Fill Out Your Parent Plus Loan Form

The Parent Plus Loan form is a crucial step for parents looking to support their dependent college students with additional financial resources. To initiate this process, parents first need to complete the Free Application for Federal Student Aid (FAFSA), which establishes eligibility for federal loans. Including the school code for Blue Ridge Community College (BRCC) ensures that the financial aid office receives the necessary data to proceed with loan certification. Once the FAFSA is submitted, parents must apply for a credit check through the Federal Student Aid website, as the Parent PLUS Loan is credit-based. The next step requires filling out a Master Promissory Note (MPN), which acts as a binding agreement to repay the loan under specific terms and conditions. It is essential for parents to thoroughly understand the MPN, as it describes their rights and responsibilities as borrowers. Finally, completing the BRCC Loan Request Form allows the financial aid office to officially process the loan application. Importantly, timely submission is essential to avoid delays, and understanding the specific steps is key to ensuring that the loan can be accessed when needed.

Parent Plus Loan Example

Blue Ridge Community College

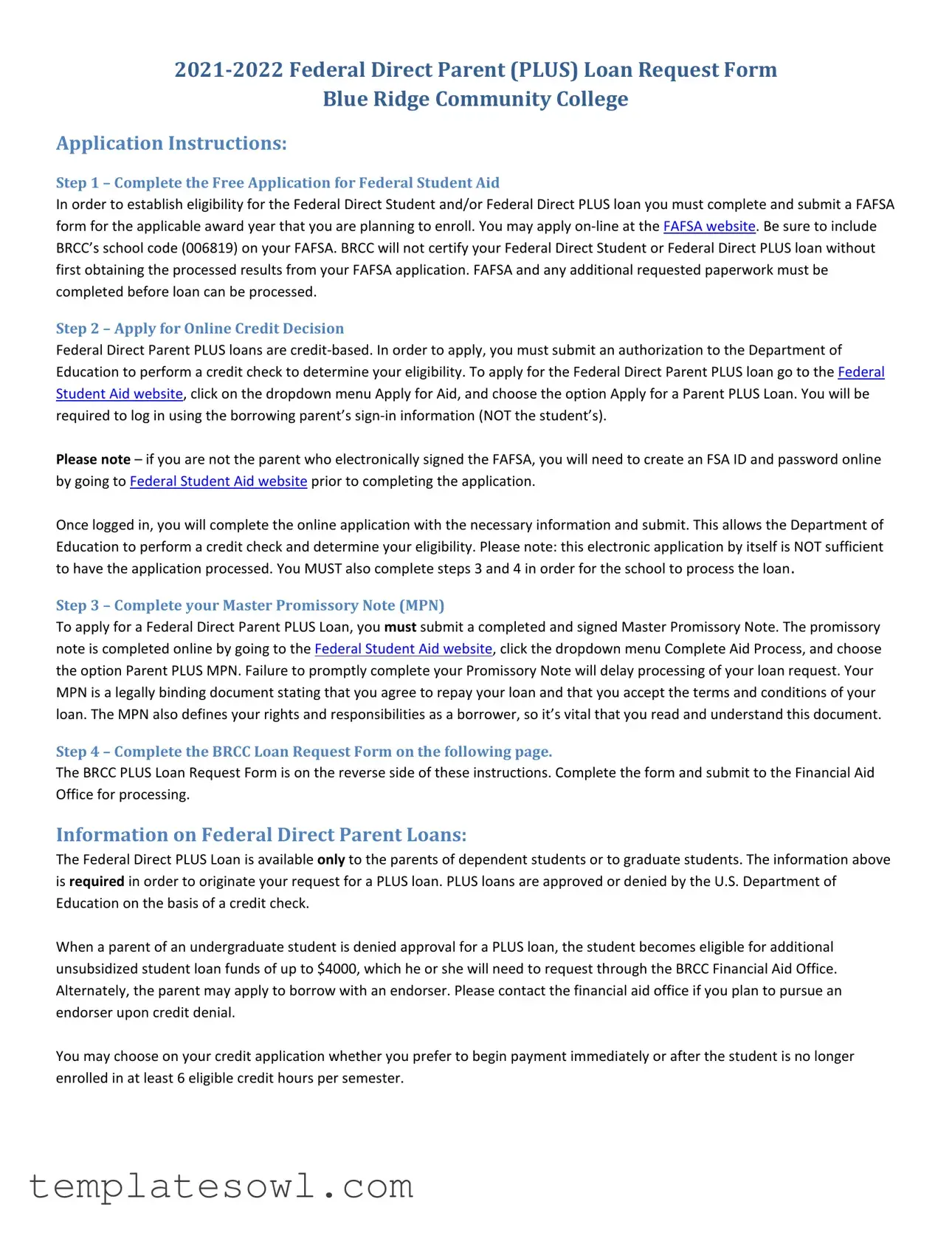

Application Instructions:

Step 1 – Complete the Free Application for Federal Student Aid

In order to establish eligibility for the Federal Direct Student and/or Federal Direct PLUS loan you must complete and submit a FAFSA form for the applicable award year that you are planning to enroll. You may apply

Step 2 – Apply for Online Credit Decision

Federal Direct Parent PLUS loans are

Please note – if you are not the parent who electronically signed the FAFSA, you will need to create an FSA ID and password online by going to Federal Student Aid website prior to completing the application.

Once logged in, you will complete the online application with the necessary information and submit. This allows the Department of Education to perform a credit check and determine your eligibility. Please note: this electronic application by itself is NOT sufficient to have the application processed. You MUST also complete steps 3 and 4 in order for the school to process the loan.

Step 3 – Complete your Master Promissory Note (MPN)

To apply for a Federal Direct Parent PLUS Loan, you must submit a completed and signed Master Promissory Note. The promissory note is completed online by going to the Federal Student Aid website, click the dropdown menu Complete Aid Process, and choose the option Parent PLUS MPN. Failure to promptly complete your Promissory Note will delay processing of your loan request. Your MPN is a legally binding document stating that you agree to repay your loan and that you accept the terms and conditions of your loan. The MPN also defines your rights and responsibilities as a borrower, so it’s vital that you read and understand this document.

Step 4 – Complete the BRCC Loan Request Form on the following page.

The BRCC PLUS Loan Request Form is on the reverse side of these instructions. Complete the form and submit to the Financial Aid Office for processing.

Information on Federal Direct Parent Loans:

The Federal Direct PLUS Loan is available only to the parents of dependent students or to graduate students. The information above is required in order to originate your request for a PLUS loan. PLUS loans are approved or denied by the U.S. Department of Education on the basis of a credit check.

When a parent of an undergraduate student is denied approval for a PLUS loan, the student becomes eligible for additional unsubsidized student loan funds of up to $4000, which he or she will need to request through the BRCC Financial Aid Office. Alternately, the parent may apply to borrow with an endorser. Please contact the financial aid office if you plan to pursue an endorser upon credit denial.

You may choose on your credit application whether you prefer to begin payment immediately or after the student is no longer enrolled in at least 6 eligible credit hours per semester.

Complete this form and submit it to the Financial Aid Office as soon as possible. Incomplete forms will be returned unprocessed. If you do not know your 7 digit Student ID number, see How to Look Up Emplid.

A. Parent Applicant Information

Last Name: ______________________________ First Name: ______________________________ Middle Initial: ______

Date of Birth: ___________________ Phone Number: ____________________________

Street Address: __________________________________________________________________________

City: __________________________________ State: ______ Zip: ______________

Email Address: _________________________________________________________________________________

Gender: ☐ Male ☐ Female ☐ Other Relationship to Student: __________________________________

Marital Status: ☐ Single |

☐ Married ☐ Divorced ☐ Separated ☐ Widowed |

Are you a U.S. Citizen? ☐ |

Yes ☐ No If not, what is your current citizenship status? ___________________________ |

*If you are the parent borrower and your SSN is not listed on the FAFSA, please contact the Financial Aid Office by telephone, mail, or in person to provide your full SSN. Never send your full SSN by email.

B. Student Information

Last Name: |

____________________________ |

First Name: ________________________ |

Middle Initial: ____ |

Student ID: |

____________________________ |

Date of Birth: ___________________ Phone Number: _________________________ |

|

C. Semester:

I am requesting to borrow for the following term(s):

☐ Fall and Spring ☐ Fall Semester Only ☐ Spring Semester Only ☐ Summer Semester Only

D. Loan Information

Loan Amount Requested: _________________________

Important Information about Loans

•Loan amount borrowed will be reduced by up to 4.2% in loan origination fees.

•Loans borrowed for a single term will be disbursed in 2 disbursements, the first of which will be at the normal time for financial aid disbursement and the second of in the final third of the semester. A fall spring loan will be divided into half, with half disbursing in the fall and half in the spring.

•Submission of request form does not guarantee loan eligibility nor does it guarantee that eligible students will receive the full amount.

C.Checklist and Certification – Check each item below once you have completed it

☐FAFSA Completed

☐Credit Check Completed *

☐Master Promissory Note Completed *

☐All fields on this form completed

☐Student enrolled in at least 6 eligible credit hours for the term you are borrowing for.

* Credit Check and Master Promissory Note must be completed electronically at the Federal Student Aid website.

BORROWER CERTIFICATION:

I authorize the Financial Aid Office at Blue Ridge Community College to forward my request for the Direct Loan indicated above. In order to complete the loan process, I understand that I must have signed the appropriate promissory note electronically at https://studentaid.gov. I authorize the College to transfer loan proceeds received by electronic funds (EFT) or Master Check to Student Financial Services to pay for ALL incurred expenses. Incurred expenses can include but are not limited to tuition, fees, books, supplies, and other miscellaneous fees.

Borrower’s Signature__________________________________________________________ Date: _____________________

Please return your completed form in one of the following ways: Electronic: Upload to

at DropSecure. Note: Forms must be physically signed with a pen or drawn using the “fill and sign” option on the PDF. TYPED SIGNATURES ARE NOT ACCEPTED. Fax to

Form Characteristics

| Fact Name | Details |

|---|---|

| Eligibility Requirement | A completed FAFSA form is necessary to start the application process for the Federal Direct Parent PLUS Loan. |

| Credit Check | The application for a Parent PLUS loan requires a credit check to determine eligibility. |

| Master Promissory Note (MPN) | Parents must complete and sign the MPN, a legally binding document indicating their agreement to repay the loan. |

| State Governing Law | Virginia’s financial aid regulations govern this loan process according to local educational laws. |

| Loan Request Submission | The completed BRCC PLUS Loan Request Form must be submitted to the Financial Aid Office. |

| Loan Disbursement | Funds are typically disbursed in multiple payments throughout the semester. |

| Loan Amount Reduction | A loan origination fee of up to 4.2% will be deducted from the total borrowed amount. |

| Supporting Documents | All relevant forms must be completed accurately; incomplete forms will be returned unprocessed. |

Guidelines on Utilizing Parent Plus Loan

Completing the Parent Plus Loan form involves several steps. It is essential to follow these instructions carefully to ensure your request is processed smoothly. After submitting the necessary documents, the Financial Aid Office will review your application and inform you of the outcome.

- Complete the FAFSA form. Make sure to include Blue Ridge Community College's school code (006819) to establish your eligibility.

- Apply for an online credit decision on the Federal Student Aid website. Use the borrowing parent’s sign-in information to log in. If necessary, create an FSA ID and password before proceeding.

- Complete the Master Promissory Note (MPN) online via the Federal Student Aid website. Thoroughly read and understand the terms and conditions before signing.

- Fill out the BRCC PLUS Loan Request Form. Provide accurate information and submit it to the Financial Aid Office for processing.

Once submitted, your application will be evaluated based on the provided information and credit check results. Be sure to follow up with the Financial Aid Office if you have any questions or need further assistance.

What You Should Know About This Form

What is the first step to apply for a Parent Plus Loan?

The first step in applying for a Parent Plus Loan is to complete the Free Application for Federal Student Aid (FAFSA). This form establishes eligibility for federal financial aid, including the Parent Plus Loan. When filling out the FAFSA, it is essential to include Blue Ridge Community College's school code (006819). Without this, the school cannot process your loan request. Ensure that all required paperwork, including any additional documents requested by the school, is submitted promptly to avoid delays in loan processing.

How do I know if I am eligible for a Parent Plus Loan?

Eligibility for a Parent Plus Loan is determined primarily through a credit check performed by the Department of Education. Parents of dependent undergraduate students or graduate students can apply. If your credit history is acceptable, you will be approved for the loan. However, if a parent is denied a Parent Plus Loan, the dependent student may then be eligible for additional unsubsidized federal student loans, which can be requested through the Financial Aid Office at Blue Ridge Community College.

What documents do I need to complete after applying for the loan?

After applying for the Parent Plus Loan electronically, you need to complete a Master Promissory Note (MPN). This legally binding document outlines your responsibility to repay the loan and its terms. The MPN must be completed online at the Federal Student Aid website. Failure to complete and sign this document promptly can cause processing delays for your loan request. Additionally, you must fill out and submit the BRCC Loan Request Form to the Financial Aid Office for processing.

Can I start repaying the loan immediately?

When applying for the Parent Plus Loan, you will have the option to choose when to begin repayment. You can decide to start making payments immediately or defer them until the student is no longer enrolled in at least six eligible credit hours per semester. This flexibility allows families to manage the financial impact of the loan based on individual circumstances.

What should I do if my Parent Plus Loan application is denied?

If your application for the Parent Plus Loan is denied due to credit issues, the dependent student can apply for additional unsubsidized student loans through the Financial Aid Office. The student may qualify for up to $4,000 in extra funds. Alternatively, the parent may consider applying with an endorser who has a stronger credit history. It is advised to reach out to the Financial Aid Office for guidance if you plan to pursue this option.

Common mistakes

Applying for a Parent Plus Loan can be a straightforward process, but many people make mistakes that can delay their loan approval or create confusion. Here are seven common errors to avoid when filling out the Parent Plus Loan form.

First, failing to complete the Free Application for Federal Student Aid (FAFSA) is a significant mistake. This application is crucial for establishing eligibility for the Parent Plus Loan. Make sure to include Blue Ridge Community College's school code on your FAFSA. If this step is overlooked, your loan request cannot be processed.

Next, be careful to use the correct login information. When accessing the loan application, it is essential to log in with the borrowing parent's credentials, not the student’s. Confusing these details may prevent you from successfully submitting your application and obtaining the loan.

Another common mistake is not completing the Master Promissory Note (MPN) on time. This document is a legally binding contract that outlines the terms and conditions of the loan. Delay in completing the MPN can disrupt the entire loan processing timeline, so prioritize this step to avoid unnecessary setbacks.

Providing incomplete information on the BRCC Loan Request Form can also be problematic. Make sure all sections of the form are filled out completely. Incomplete forms are often returned unprocessed, creating additional delays.

Missing a credit check can lead to complications as well. Remember, the Parent Plus Loan is credit-based. This means you must authorize the Department of Education to conduct a credit check. If this step is skipped, your application will not be processed.

Additionally, many applicants forget to confirm that the student is enrolled in at least six eligible credit hours when borrowing for a new term. This enrollment requirement is essential for loan eligibility and must be verified prior to submitting the application.

Finally, ensure you submit the form through the appropriate method. Using the wrong submission method may result in delays. Whether you upload the form electronically or send it by mail, make sure to follow the provided instructions carefully.

Documents used along the form

The Parent Plus Loan application process involves multiple forms and documents that ensure thorough evaluation and processing of borrowing requests. Understanding these forms can help navigate the application successfully. Here are some additional documents often used alongside the Parent Plus Loan form:

- Free Application for Federal Student Aid (FAFSA): This form is essential for determining eligibility for federal financial aid. It collects information about a student's and their family's financial situation. Completing this application is the first step in securing financial assistance for education.

- Master Promissory Note (MPN): The MPN is a legal document where the borrower agrees to repay the loan amount along with any applicable interest. It outlines the terms and conditions of the loan. Completing the MPN is crucial as it finalizes the borrowing agreement.

- Credit Authorization Form: This document grants permission to the U.S. Department of Education to perform a credit check on the borrowing parent. The outcome of this credit check impacts the approval of the Parent Plus Loan. Submitting this form is necessary to move forward with the application.

- Blue Ridge Community College (BRCC) Loan Request Form: This institution-specific form captures details such as the loan amount requested and the term for which the loan is needed. It is submitted to the Financial Aid Office after completing the FAFSA and MPN.

Being familiar with these documents ensures that the process moves along smoothly. It is advisable to complete each form accurately and submit them as soon as possible to avoid delays in obtaining financial aid.

Similar forms

The Parent Plus Loan form is similar to several other important financial documents used in the student loan and federal aid processes. Here are seven documents that share similar functions or requirements:

- Free Application for Federal Student Aid (FAFSA): Like the Parent Plus Loan form, the FAFSA is essential for determining eligibility for federal financial aid. Both require specific personal and financial information from parents and students.

- Master Promissory Note (MPN): The MPN functions similarly as it is also a legally binding document. It confirms the borrower's agreement to repay the loan and outlines the terms, much like the commitment made in the Parent Plus Loan form.

- Federal Direct Student Loan Application: This application is similar as it involves a credit check and personal information. It also ensures the borrower understands their loan obligations and rights, akin to the Parent Plus Loan form.

- Loan Exit Counseling: Information requirements in this counseling process parallel the Parent Plus Loan form as it prepares borrowers for repayment and emphasizes their rights and responsibilities, similar to how the Parent Plus Loan form outlines these details.

- Verification Worksheets: These worksheets are used during the FAFSA completion process to verify eligibility. They capture necessary financial information, just as the Parent Plus Loan form gathers details about the parent and student.

- Credit Check Authorization Form: This document is quite similar in that both require the borrower’s consent for a credit check. Creditworthiness is vital for both documents in determining loan eligibility.

- Endorser Request Form: When a borrower is denied credit for the Parent Plus Loan, they may choose to request an endorser. This form is similar as it collects necessary personal information and serves a purpose related to securing funding, similar to what is laid out in the Parent Plus Loan form.

Dos and Don'ts

Things You Should Do:

- Complete the FAFSA form before applying for the Parent PLUS Loan. This establishes eligibility for federal aid.

- Use the borrowing parent’s sign-in information when applying. Avoid using the student’s information to prevent processing issues.

- Read and understand the Master Promissory Note thoroughly. This document outlines your repayment obligations and rights.

- Submit the BRCC Loan Request Form promptly. Delays may cause processing setbacks.

- Keep a copy of all documents submitted. This ensures you have a record of your application process.

Things You Shouldn't Do:

- Don’t forget to include BRCC’s school code (006819) on your FAFSA. Missing this may lead to loan processing issues.

- Avoid making typed signatures on your forms. Forms must be physically signed or drawn using the “fill and sign” option.

- Don’t skip any required steps. Completing only part of the application will delay your loan processing.

- Don’t assume loan eligibility just because you submitted the request form. Approval is subject to a credit check and other conditions.

- Never send your full Social Security Number via email. Instead, provide it securely through alternative methods.

Misconceptions

Misconceptions about the Federal Direct Parent PLUS Loan form can lead to confusion during the application process. Below are six common misconceptions clarified:

- It’s only for parents of undergraduate students. Many believe that the Parent PLUS Loan is exclusively for undergraduate students. However, it is also available for graduate students.

- Approval is automatic once the application is submitted. Another misconception is that submitting the application guarantees loan approval. Approval depends on a credit check, and denial can occur based on credit history.

- You can apply without completing the FAFSA. Completing the FAFSA is essential for determining eligibility. The loan application cannot proceed without processed FAFSA results.

- You don’t need to know the student's ID number. Some think that the student ID is optional. In reality, it is required for the application process, and lack of it may lead to processing delays.

- Payments are due immediately after loan disbursement. It is commonly believed that payments must start right after disbursement. Parents can choose whether payments begin immediately or defer until the student is no longer enrolled in at least six credit hours.

- Forms can be signed electronically in any way. A frequent misunderstanding is that any electronic signature is acceptable. Only physical signatures or those created using specific methods on PDFs are valid; typed signatures will not be accepted.

Understanding these points can simplify the process and help applicants avoid common pitfalls.

Key takeaways

- Complete the FAFSA: Before applying for a Parent PLUS Loan, you must complete the Free Application for Federal Student Aid (FAFSA) to establish eligibility.

- Obtain School Code: When filling out the FAFSA, include Blue Ridge Community College’s school code (006819). Without this, your loan will not be processed.

- Credit Check Authorization: The application process requires authorization for a credit check to determine eligibility. This can be done on the Federal Student Aid website.

- Use Borrowing Parent's Information: Ensure you log in using the parent’s sign-in information, not the student’s, when applying for the loan.

- Complete the Master Promissory Note: After applying online, you must submit a completed and signed Master Promissory Note to finalize your loan request.

- BRCC Loan Request Form: Complete and submit the BRCC PLUS Loan Request Form to the Financial Aid Office. This is crucial for processing your loan.

- Understand Loan Terms: Read the Master Promissory Note carefully as it outlines your rights, responsibilities, and the agreement to repay the loan.

- Submit Completed Forms Early: Always submit forms as soon as possible. Incomplete submissions may be returned and delay loan processing.

Browse Other Templates

How Much Is Unemployment Taxed - Additional questions regarding the city and county of operation are included.

Steer Clear Safe Driver Discount - Compliance with the requirements is monitored regularly.