Fill Out Your Partial Exemption Certificate Farm Form

The Partial Exemption Certificate for Farm is an essential tool for those engaged in agricultural business in California. This certificate allows qualified purchasers to receive a partial exemption from the state general fund portion of the sales and use tax applied to farm equipment and machinery. However, it is crucial to note that this exemption does not absolve the purchaser from their responsibilities concerning local and district taxes, nor does it apply to certain specific state tax provisions outlined in the California Revenue and Taxation Code. Designed to support agricultural operations, the certificate requires the purchaser to certify their engagement in an appropriate agricultural business as defined by established industry codes. It also emphasizes that the purchased or leased equipment must be primarily utilized for producing and harvesting agricultural products. Additionally, the certificate can function as a blanket certification for future purchases if general types of property are described, making it easier for businesses to manage their transactions. Careful attention should be paid to the usage of the equipment, as improper use may necessitate the reporting and payment of applicable taxes. Completing the certificate mandates accurate disclosure of personal and business information, and once signed, it remains valid until a written revocation occurs. Such details are vital for ensuring compliance while maximizing the benefits available to farming operations.

Partial Exemption Certificate Farm Example

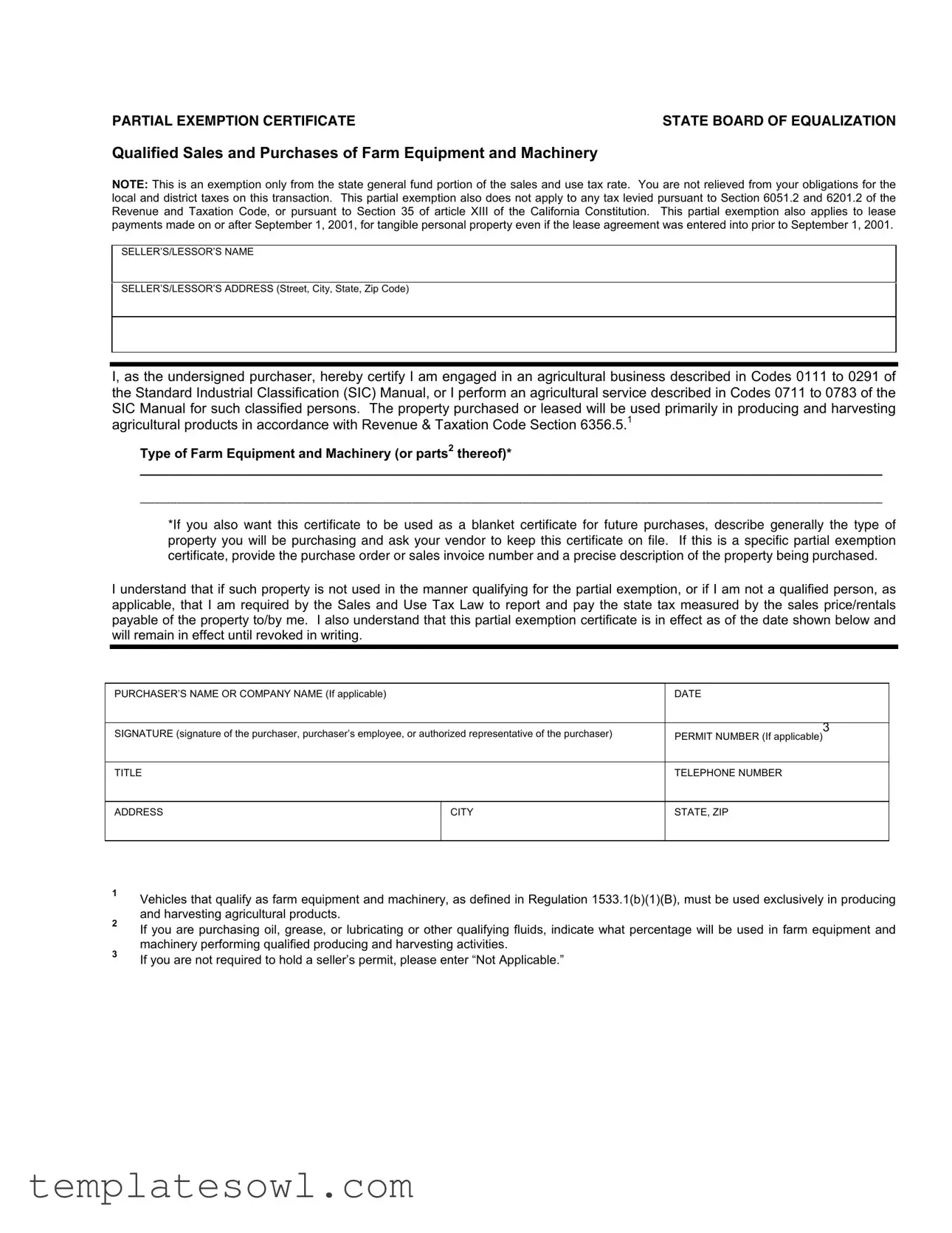

PARTIAL EXEMPTION CERTIFICATE |

STATE BOARD OF EQUALIZATION |

Qualified Sales and Purchases of Farm Equipment and Machinery

NOTE: This is an exemption only from the state general fund portion of the sales and use tax rate. You are not relieved from your obligations for the local and district taxes on this transaction. This partial exemption also does not apply to any tax levied pursuant to Section 6051.2 and 6201.2 of the Revenue and Taxation Code, or pursuant to Section 35 of article XIII of the California Constitution. This partial exemption also applies to lease payments made on or after September 1, 2001, for tangible personal property even if the lease agreement was entered into prior to September 1, 2001.

SELLER’S/LESSOR’S NAME

SELLER’S/LESSOR’S ADDRESS (Street, City, State, Zip Code)

I, as the undersigned purchaser, hereby certify I am engaged in an agricultural business described in Codes 0111 to 0291 of the Standard Industrial Classification (SIC) Manual, or I perform an agricultural service described in Codes 0711 to 0783 of the SIC Manual for such classified persons. The property purchased or leased will be used primarily in producing and harvesting agricultural products in accordance with Revenue & Taxation Code Section 6356.5.1

Type of Farm Equipment and Machinery (or parts2 thereof)*

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

*If you also want this certificate to be used as a blanket certificate for future purchases, describe generally the type of property you will be purchasing and ask your vendor to keep this certificate on file. If this is a specific partial exemption certificate, provide the purchase order or sales invoice number and a precise description of the property being purchased.

I understand that if such property is not used in the manner qualifying for the partial exemption, or if I am not a qualified person, as applicable, that I am required by the Sales and Use Tax Law to report and pay the state tax measured by the sales price/rentals payable of the property to/by me. I also understand that this partial exemption certificate is in effect as of the date shown below and will remain in effect until revoked in writing.

PURCHASER’S NAME OR COMPANY NAME (If applicable) |

DATE |

SIGNATURE (signature of the purchaser, purchaser’s employee, or authorized representative of the purchaser) |

3 |

||

PERMIT NUMBER (If applicable) |

|||

|

|

||

|

|

|

|

TITLE |

|

TELEPHONE NUMBER |

|

|

|

|

|

ADDRESS |

CITY |

STATE, ZIP |

|

|

|

|

|

1

2

3

Vehicles that qualify as farm equipment and machinery, as defined in Regulation 1533.1(b)(1)(B), must be used exclusively in producing and harvesting agricultural products.

If you are purchasing oil, grease, or lubricating or other qualifying fluids, indicate what percentage will be used in farm equipment and machinery performing qualified producing and harvesting activities.

If you are not required to hold a seller’s permit, please enter “Not Applicable.”

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose of the Certificate | This certificate allows for a partial exemption from the state general fund portion of sales and use tax applied to qualified farm equipment and machinery purchases. |

| Local Tax Obligations | While the certificate provides an exemption for state taxes, it does not relieve individuals or businesses from their responsibilities for local and district taxes related to the transaction. |

| Applicable Laws | The exemption is subject to Section 6356.5 of the Revenue and Taxation Code, along with the provisions outlined in Sections 6051.2 and 6201.2. |

| Effective Date for Leases | Leases for farm equipment and machinery entered into after September 1, 2001, may also utilize this partial exemption, regardless of when the agreement was established. |

| Eligibility Criteria | Purchasers must be engaged in agriculture or provide agricultural services, as specified by codes ranging from 0111 to 0291 and 0711 to 0783 in the SIC Manual. |

| Intended Use Requirement | The machinery or equipment acquired must be used primarily for producing and harvesting agricultural products to qualify for the exemption. |

| Revocation of Certificate | The certificate remains valid until it is revoked in writing by the purchaser, providing a clear process for discontinuation. |

| Pertinent Information | Details such as the seller's address, purchaser's information, and specific farm equipment descriptions must be included for proper certification. |

Guidelines on Utilizing Partial Exemption Certificate Farm

The Partial Exemption Certificate Farm form will help you secure benefits connected to agricultural purchases. Completing the form accurately is crucial, as it not only ensures compliance but also enables you to take advantage of applicable tax exemptions for farm equipment and machinery. Follow the steps below to fill out the form successfully.

- Begin by entering the seller’s or lessor’s name at the top of the form.

- Next, provide the seller’s or lessor’s address, including street, city, state, and zip code.

- In the certification section, confirm that you are engaged in an agricultural business. This can be done by checking the appropriate codes in the Standard Industrial Classification (SIC) Manual.

- Specify the type of farm equipment and machinery you are purchasing or leasing. This should include a detailed description.

- If you want this certification to act as a blanket certificate for future purchases, mention the general types of property you intend to buy and instruct your vendor to keep this certificate on file.

- For a specific transaction, include the purchase order or sales invoice number and give a precise description of the purchased property.

- Read and acknowledge the understanding statement regarding the usage of the property and your obligations under the Sales and Use Tax Law.

- Provide your name or the company name, if applicable.

- Enter the date the form is being completed.

- Sign the form with the signature of the purchaser, an employee, or an authorized representative.

- If applicable, enter the permit number.

- Complete the contact information section, including telephone number and address (including city, state, and zip).

What You Should Know About This Form

What is the Partial Exemption Certificate for Farm Equipment and Machinery?

The Partial Exemption Certificate allows qualified purchasers to get a break on the state sales and use tax for certain farm equipment and machinery. This exemption only applies to the portion of the tax that goes to the state general fund. It's important to note that you are still responsible for any local or district taxes on your purchases. Additionally, the exemption does not apply to specific taxes outlined in California tax laws, including those related to agricultural activities. If you lease farm equipment, you can also use this certificate for payments made after September 1, 2001, even for leases signed before that date.

Who qualifies for the Partial Exemption Certificate?

To qualify for the Partial Exemption Certificate, the purchaser must be engaged in an agricultural business recognized in certain codes of the Standard Industrial Classification (SIC) Manual, specifically Codes 0111 to 0291. Alternatively, if you provide agricultural services that fall under Codes 0711 to 0783, you may also qualify. The key requirement is that the property you buy or lease must be used mainly for producing and harvesting agricultural products, as defined by the relevant laws.

How do I use the Partial Exemption Certificate?

When using the Partial Exemption Certificate, fill out the form with necessary details, including the type of farm equipment or machinery you're purchasing. If you want the certificate to apply to future purchases, provide a general description of the types of items you will buy and ask the vendor to keep the certificate on file. If this certificate is for a specific purchase, include the purchase order or invoice number and a detailed description of the item. Remember, if you misuse this exemption or don't meet the qualifications, you will have to report and pay the applicable state tax.

Is there a time limit for using the Partial Exemption Certificate?

The Partial Exemption Certificate is effective from the date you sign it and will remain valid until you revoke it in writing. Always ensure that the information you provide is accurate and up-to-date. If your business operations change or if you no longer qualify for the exemption, you must discontinue its use to avoid any tax liabilities.

Common mistakes

Common mistakes occur when people fill out the Partial Exemption Certificate Farm form, leading to delays or denials in claiming tax exemptions. One prevalent error is incomplete information. Failing to provide all required details, such as the seller’s or lessor’s address, can result in an invalid form. Every section needs to be filled out accurately to ensure the form is processed correctly.

Another mistake is misidentifying the type of farm equipment. Applicants sometimes provide vague descriptions instead of the precise nature of the machinery being purchased. It is crucial to detail specifically what will be used, as this information directly affects eligibility for the exemption. Clear descriptions help avoid confusion and streamline the approval process.

Many people also overlook the significance of certifying their qualification as agricultural business participants. The form requires a certification that the purchaser is engaged in an agricultural business as per defined codes. Not explicitly stating this or providing inadequate proof may lead to disqualification for the exemption.

Not keeping a record of the purchase order number or sales invoice number is another common oversight. This information should be consistently documented, especially for specific exemption requests. Keeping accurate records helps validate claims and eases any future inquiries from tax authorities.

Finally, failing to update the form when necessary can result in issues down the line. If any circumstances change regarding the use of the equipment or the purchaser's qualifications, it is essential to revoke the previously submitted certificate and submit a new one. Regularly reviewing and updating records ensures compliance with tax regulations.

Documents used along the form

When engaging in agricultural business, various forms and documents facilitate compliance with tax regulations and ensure proper management of transactions. Alongside the Partial Exemption Certificate Farm form, here are some commonly used documents that may be relevant.

- Sales Tax Permit: This document permits a business to collect sales tax from customers on taxable sales. It is essential for compliance, especially for farmers selling products to consumers.

- Farm Equipment Purchase Agreement: This contract outlines the terms of sale for farm machinery. It details the price, payment terms, and any warranties concerning the equipment.

- Resale Certificate: This certificate allows a business to purchase items without paying sales tax when those items are meant for resale. It is particularly important for agricultural suppliers.

- Lease Agreement: A lease agreement details the terms and conditions under which farm equipment is rented. This document typically specifies rental periods, payment obligations, and maintenance responsibilities.

- Affidavit of Agricultural Use: This affidavit confirms that property or equipment is used for agricultural purposes. It may be required to validate tax exemption claims.

- Farm Tax Credit Application: This application is for claiming certain tax credits available to farmers. It typically requires detailed information about the agricultural business and expenses incurred.

- Invoice: An invoice records the sale of goods and services. It includes essential details such as purchase dates, item descriptions, quantities, and amounts owed, serving as proof of transaction.

- Sales and Use Tax Return: This return summarizes taxable sales and use tax collected. It is submitted periodically to report and pay the appropriate taxes to state authorities.

These documents work in conjunction with the Partial Exemption Certificate to ensure smooth operations and compliance with applicable tax laws. Understanding each of these forms is crucial for agricultural businesses to effectively navigate their financial obligations.

Similar forms

The Partial Exemption Certificate Farm form is not an isolated document. It shares similarities with a few other documents, often used in agricultural or business settings. Each document plays a specific role in tax exemptions or allowances. Below is a list highlighting four documents that are similar to the Partial Exemption Certificate Farm form:

- Sales Tax Exemption Certificate: Like the Partial Exemption Certificate Farm, this document allows buyers to claim exemptions on qualifying purchases. Specifically used for exempt organizations or resellers, it certifies that the buyer will not pay sales tax on certain transactions, akin to the equipment used in farming.

- Lease Exemption Certificate: Much like the Partial Exemption Certificate Farm form, this document applies to leased property. Both documents help businesses reduce their tax burden, allowing them to report transactions that qualify for tax exemptions based on specific uses, such as agricultural purposes in the case of the Partial Exemption Certificate.

- Manufacturer’s Exemption Certificate: This certificate offers similar benefits by providing tax relief to manufacturers on their purchases of materials used in production. Just as the Partial Exemption Certificate targets agricultural operations, the manufacturer’s document supports businesses in a different industry by facilitating tax exemptions on specific equipment and materials.

- Non-Profit Exemption Certificate: Non-profit organizations often use this certificate to avoid sales tax on purchases directly related to their missions. Similar to the Partial Exemption Certificate Farm, it signifies the non-profit's qualified status and the intended use of funds, ensuring compliance while minimizing tax liability.

Understanding these similar documents can help streamline the process of applying for and managing exemptions in various business contexts.

Dos and Don'ts

When filling out the Partial Exemption Certificate Farm form, keep these important points in mind:

- Do provide accurate information about the seller's name and address to avoid processing delays.

- Don’t forget to describe the type of farm equipment and machinery clearly if it's a specific purchase.

- Do ensure that you meet the agricultural business requirements outlined in the form.

- Don’t use the exemption for items that don’t qualify under the specified codes.

Misconceptions

There are several misconceptions surrounding the Partial Exemption Certificate Farm form. Understanding these can help ensure compliance and make the process smoother for those in the agricultural sector.

- This certificate exempts all taxes, including local taxes. This is incorrect. The partial exemption only applies to the state general fund portion of the sales and use tax. Local and district taxes remain applicable.

- Any type of farm equipment qualifies for the exemption. Not all farm equipment qualifies. The equipment must be specifically used in producing and harvesting agricultural products to meet the qualifications outlined in the law.

- This exemption applies to taxes levied under all sections of the law. This is misleading. The exemption does not apply to taxes levied under Section 6051.2 and 6201.2 of the Revenue and Taxation Code, or Section 35 of Article XIII of the California Constitution.

- Once the certificate is submitted, it never expires. This is not true. The certificate remains in effect until it is revoked in writing, so it's important to keep track of its status.

- A purchaser does not have to certify their agricultural business. This is a misunderstanding. Purchasers must certify that they are actively engaged in applicable agricultural business codes to qualify for the exemption.

- The certificate can be used for any purchase, regardless of its nature. This is incorrect. The property purchased or leased must be primarily used for agricultural purposes to qualify.

- Farmers can use this certificate for personal purchases. This is false. The exemption is strictly for commercial agricultural use and does not extend to personal purchases.

- The exemption applies to leases made before September 1, 2001. This misconception arises from misunderstanding the law. The exemption applies to lease payments made on or after this date, regardless of when the lease agreement was initiated.

- Any representative can sign the certificate for the purchaser. This is misleading. Only the purchaser themselves or an authorized representative is permitted to sign this certificate.

It is essential to address these misconceptions to ensure full understanding and compliance with the regulations associated with the Partial Exemption Certificate Farm form.

Key takeaways

Understanding the Partial Exemption Certificate Farm form is essential for anyone involved in the agricultural industry. This certificate can lead to tax savings when purchasing or leasing equipment. Here are key takeaways to keep in mind:

- The exemption applies only to the state’s general fund portion of the sales and use tax. Local and district taxes still apply.

- This certificate is relevant for purchases made on or after September 1, 2001, including lease payments for tangible personal property.

- You must be engaged in an agricultural business or providing agricultural services as defined by certain codes in the SIC Manual to qualify.

- Detail your farm equipment and machinery clearly. Provide a general description if you want the certificate to serve as a blanket for future purchases.

- If you don't use the property correctly or if you're not a qualified person, you are obligated to report and pay standard state tax.

- The certificate remains valid until you revoke it in writing. Keep it updated if your business situation changes.

- It's a good idea to keep a copy on file with your vendor, especially if you make frequent purchases.

- For vehicles, strict usage criteria apply. They must be used exclusively for agricultural production and harvesting.

The benefits of understanding and effectively utilizing the Partial Exemption Certificate Farm form can lead to significant savings. Ensure you meet all qualifications and maintain proper documentation for smooth transactions.

Browse Other Templates

Health Home Program Decline Form,Medicaid Client Health Home Opt-Out Statement,New York Medicaid Care Management Elections Form,Health Home Services Non-Participation Agreement,Medicaid Client Health Home Withdrawal Document,Opt-Out Statement for Hea - The form includes a disclaimer about alternative care management options for eligible clients.

Dd Form 282 - Requisitioning must align with DOD printing requirements.