Fill Out Your Patriot Act Cip Form

The Patriot Act CIP form serves as a crucial compliance tool for financial institutions in their effort to combat terrorism financing and money laundering activities. When you apply to open a new mortgage loan account, you may be surprised to find that the process involves more than just filling out a standard application. You'll be required to provide important information such as your name, address, date of birth, and identification documents like a driver’s license. This thorough identification process is mandated by federal law under Section 326 of the USA Patriot Act, which aims to ensure that institutions verify and record personal information for every individual seeking a mortgage. It’s essential to note that the details collected during this process will not influence your credit decision; instead, they are solely for regulatory compliance. A loan officer will usually review this disclosure with you, whether in person, by mail, via telephone, or through the internet. Understanding this form and its requirements can help streamline your mortgage application experience.

Patriot Act Cip Example

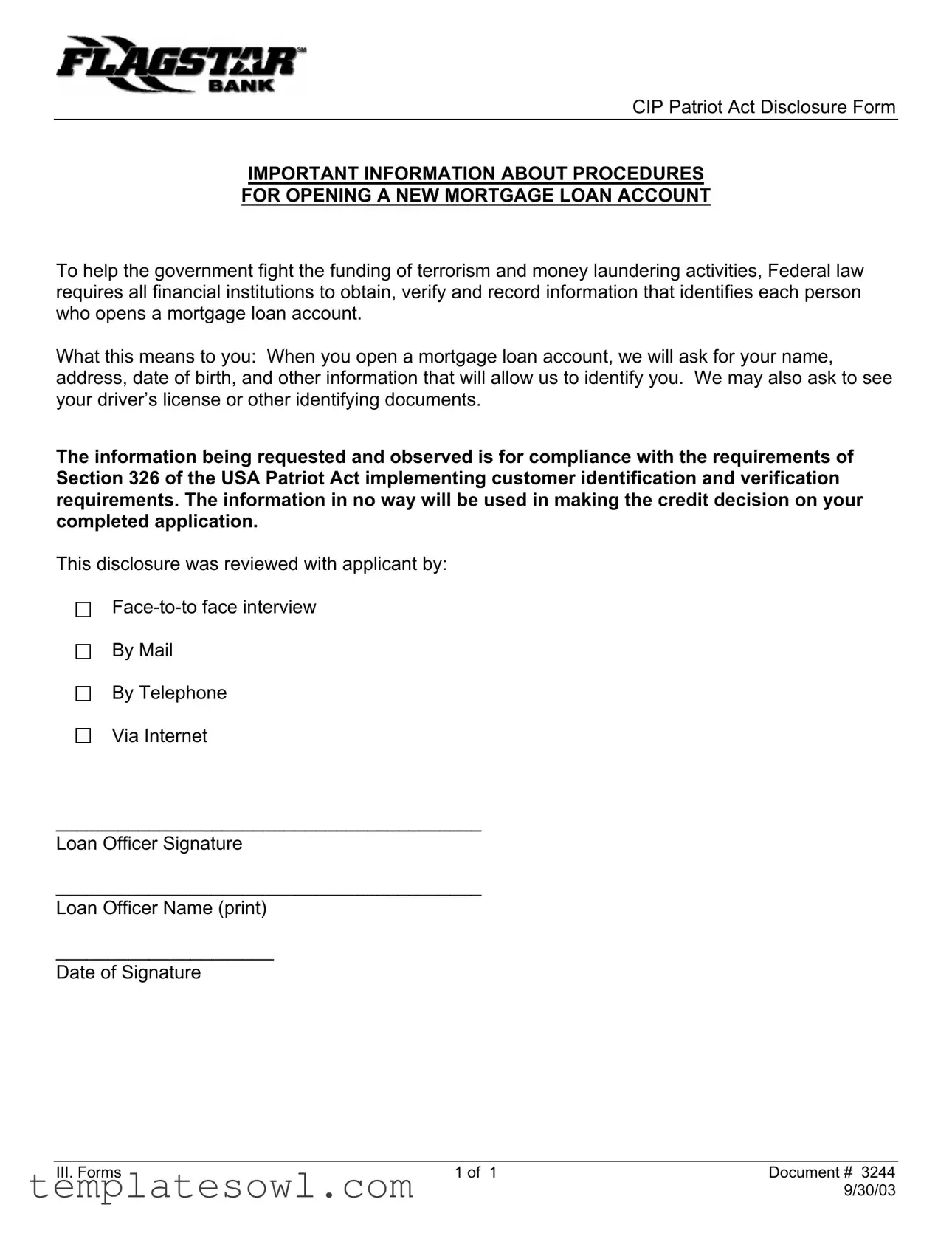

CIP Patriot Act Disclosure Form

IMPORTANT INFORMATION ABOUT PROCEDURES

FOR OPENING A NEW MORTGAGE LOAN ACCOUNT

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens a mortgage loan account.

What this means to you: When you open a mortgage loan account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

The information being requested and observed is for compliance with the requirements of Section 326 of the USA Patriot Act implementing customer identification and verification requirements. The information in no way will be used in making the credit decision on your completed application.

This disclosure was reviewed with applicant by:

By Mail

By Telephone

Via Internet

_________________________________________

Loan Officer Signature

_________________________________________

Loan Officer Name (print)

_____________________

Date of Signature

III. Forms |

1 of 1 |

Document # 3244 |

|

|

9/30/03 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the CIP Form | The form is designed to comply with federal law aimed at combating terrorism and money laundering by identifying individuals opening mortgage loan accounts. |

| Required Information | Applicants must provide their full name, address, date of birth, and other identifying details when opening a mortgage loan account. |

| Identification Verification | The financial institution may request to see a driver’s license or other documents to verify the applicant's identity. |

| Legal Basis | This form adheres to Section 326 of the USA Patriot Act, which mandates identity verification for financial transactions. |

| Impact on Credit Decisions | Information collected through the CIP form will not influence the credit decision regarding the mortgage application. |

| Review of the Disclosure | The disclosure must be reviewed with the applicant either face-to-face, by mail, by telephone, or online. |

| Loan Officer Requirements | The loan officer is required to sign and print their name on the form, confirming the face-to-face review or method of disclosure. |

| Document Identification | This document is identified as Document #3244 and was issued on September 30, 2003. |

| State-Specific Laws | States may have additional laws governing customer identification, which should be reviewed alongside this federal requirement. |

Guidelines on Utilizing Patriot Act Cip

Your next steps involve gathering the required information and filling out the Patriot Act CIP form accurately and completely. This is an essential part of the mortgage loan application process. A few minutes dedicated to this task can significantly streamline the opening of your account.

- Gather Required Information: Collect your name, address, date of birth, and any other information needed for identification.

- Prepare Identification Documents: Have your driver’s license or other forms of identification ready for review.

- Fill Out Your Name and Address: Clearly write your full name and current residential address in the designated fields.

- Provide Date of Birth: Enter your date of birth following the requested format.

- Additional Identification: If prompted, include any other details that may aid in identifying you, such as a Social Security number.

- Review the Form: Before submitting, check all entries for accuracy and completeness.

- Submit to Loan Officer: Hand the completed form and identification documents to your loan officer for verification.

Completing the form correctly is crucial to prevent delays in your mortgage application. Ensuring that all details are accurate will facilitate a smoother process and help meet necessary regulatory requirements.

What You Should Know About This Form

What is the purpose of the Patriot Act CIP form?

The Patriot Act CIP form is designed to help the government curb terrorism financing and money laundering. It requires financial institutions to identify and verify the identity of individuals opening mortgage loan accounts. This ensures that institutions know who they are doing business with and that they comply with federal laws.

What information do I need to provide when completing the form?

You will need to provide your name, address, date of birth, and other details that establish your identity. Additionally, financial institutions may ask to see your driver’s license or other official identifying documents to further verify your identity.

Does the information I provide affect my credit decision?

No, the information collected on the Patriot Act CIP form will not influence the credit decision regarding your mortgage loan application. The purpose of this form is strictly for identity verification and compliance with federal law.

What happens if I don’t complete the Patriot Act CIP form?

If you do not complete the form, the financial institution will be unable to process your mortgage loan application. Compliance with this requirement is mandatory for all applicants to ensure legal adherence and secure transactions.

How is my personal information protected?

Your personal information is treated with utmost confidentiality. Financial institutions are obligated to implement strict security measures to safeguard the data you provide. They must comply with privacy laws that dictate how your information can be used and shared.

Who will review the information collected on this form?

Can I complete the form through multiple methods?

Yes, the form can be reviewed and completed through various methods—face-to-face interviews, mail, telephone, or even online. The method you choose typically depends on the financial institution’s policies and your personal convenience.

What should I do if I have questions about the Patriot Act CIP form?

If you have questions, it's best to reach out directly to the loan officer or customer service representative of the financial institution. They can provide clarification and assist you in understanding your obligations and rights under the law.

Common mistakes

Filling out the Patriot Act Customer Identification Program (CIP) form may seem straightforward, but many applicants make common mistakes that can delay their mortgage loan application. One frequent error occurs when individuals fail to provide complete and accurate identifying information. This means omitting details like your address or date of birth, which are crucial for identification purposes. Missing even one piece of information can lead to unnecessary delays in processing your loan.

Another mistake involves not presenting the appropriate identification documents. The form clearly states that you may be asked to show a driver’s license or other forms of ID. Many people neglect this step or bring documents that do not meet the requirements. Without the correct identification, the financial institution may not be able to verify your identity, ultimately hindering the approval process for your mortgage loan.

Some applicants also make the mistake of assuming that the information requested on the CIP form is irrelevant to their credit decision. In reality, the collection of this data is mandated by federal law but does not play a role in determining your creditworthiness. Misunderstanding this might lead applicants to provide incomplete information, thinking it is unnecessary.

Failing to review the form before submission is another common pitfall. A rushed or careless approach can lead to typographical errors or incorrect information. This can not only cause delays but could also necessitate further communication with the loan officer to clarify the errors, prolonging the entire process.

Lastly, it’s essential to communicate with your loan officer during this process. Some people overlook the significance of noting how the disclosure was reviewed, whether in person, by mail, or via the internet. This information plays an important role in the application process, and failing to address it can complicate things down the line. Always ensure every section of the CIP form is complete and accurate, as this will foster a smoother experience when opening your mortgage loan account.

Documents used along the form

The USA PATRIOT Act was enacted to enhance law enforcement’s ability to combat terrorism and financial crimes. When you open a new mortgage loan account, several other forms and documents may be required, in addition to the CIP Patriot Act Disclosure Form. These documents help ensure compliance with federal regulations and assure that identity verification processes are correctly followed. Below is a list of commonly used forms alongside the CIP Patriot Act form:

- Loan Application (Form 1003): This standardized application collects essential information from the borrower, including financial details, employment history, and the purpose of the loan. It serves as the primary document for evaluating a borrower’s eligibility and gathering relevant background information.

- Credit Report Authorization: This document allows the lender to obtain the applicant's credit report, which provides insight into borrowing history, outstanding debts, and payment habits. Assessing creditworthiness is crucial for decision-making in mortgage lending.

- Right to Receive Copies of Appraisal: This form informs borrowers of their rights regarding the appraisal process. It guarantees that they will receive copies of any appraisals or valuation reports upon request, fostering transparency in the lending process.

- Fair Lending Disclosure: This document assures applicants that the lender is committed to fair lending practices. It outlines the borrower’s rights and helps ensure that lending decisions are made equitably without discrimination.

- Privacy Policy Notice: This notice outlines how the lender collects, uses, and protects personal information. Borrowers must be informed about their privacy rights and how their data will be handled throughout the loan process.

Understanding these additional documents can demystify the loan application process. Being prepared with the required information can help make your mortgage experience smoother and more efficient, while also ensuring compliance with important legal standards.

Similar forms

- Know Your Customer (KYC) Form: This document is designed to identify and verify the identity of customers in the banking sector. Like the Patriot Act CIP form, it collects personal information to comply with federal regulations aimed at preventing fraud and money laundering.

- Bank Secrecy Act (BSA) Compliance Form: Similar to the CIP form, this form requires financial institutions to maintain records and file reports on financial transactions. Both forms serve to support the identification and reporting of suspicious activities related to money laundering.

- Credit Authorization Form: When opening a loan account, applicants must fill out this form, which collects personal information. While it mainly focuses on creditworthiness, it also emphasizes the verification of identity, much like the requirements of the Patriot Act CIP form.

- Mortgage Application Form: This form contains detailed information about the applicant, including personal and financial data. It’s similar because it requires the applicant to provide information that assists in identity verification as part of the mortgage approval process.

- Identity Verification Certificate: This document serves to confirm a person's identity through various means of identification. It parallels the CIP form by ensuring compliance with regulations that protect against identity theft and fraud.

Dos and Don'ts

When filling out the Patriot Act CIP form, there are several important do's and don'ts to consider. This will ensure a smooth process and compliance with federal requirements.

- Do provide accurate and up-to-date information about your identity.

- Do include all requested details, such as your name, address, and date of birth.

- Do be prepared to show a form of identification, like a driver’s license.

- Do communicate openly with your loan officer if you have questions.

- Do ensure your form is signed and dated appropriately.

- Don't leave any fields blank that require information.

- Don't use false information; this could lead to legal issues.

- Don't ignore requests for additional documentation.

- Don't assume your credit decision will be based on this information.

- Don't hesitate to ask for clarification on the process or requirements.

Misconceptions

Many misunderstandings surround the Patriot Act CIP form. Here are seven common misconceptions:

- Misconception 1: The form is for credit scoring.

- Misconception 2: You can refuse to provide your identification.

- Misconception 3: The information is shared with unauthorized parties.

- Misconception 4: Only certain types of loans require the CIP form.

- Misconception 5: You can provide outdated identification.

- Misconception 6: The form is only required for U.S. citizens.

- Misconception 7: The process is quick and requires minimal information.

This is inaccurate. The information collected is solely for identity verification and has no impact on your credit decision.

While you can refuse, doing so means you cannot open a mortgage loan account. Identification is a legal requirement.

Your data is protected. Financial institutions are obligated to keep your information secure and confidential.

All mortgage loan accounts require this form, regardless of the loan type. This measure applies universally to ensure compliance.

Current and valid identification is necessary. This ensures accurate verification of your identity at the time of account opening.

Non-U.S. citizens must also complete this form. Everyone opening a loan account must be verified, regardless of their citizenship status.

While the process aims to be efficient, it does involve gathering accurate and thorough information to comply with federal regulations.

Key takeaways

When filling out and using the Patriot Act CIP form, keep these key takeaways in mind:

- Identification Requirement: You must provide personal information like your name, address, and date of birth to open a mortgage loan account.

- Additional Documentation: Be prepared to show your driver’s license or other forms of ID. This is important for verifying your identity.

- No Impact on Credit Decisions: The information collected will not affect the credit decision on your mortgage loan application.

- Compliance with Federal Law: The form is necessary to comply with Section 326 of the USA Patriot Act, aimed at preventing terrorism financing and money laundering.

- Review Process: The disclosure must be reviewed with you by your loan officer, confirming the method of communication used.

These points will help ensure a smooth process when you are providing information for your mortgage loan account.

Browse Other Templates

Form 77 - Benefit rights explanations provided alongside the LWC 77 can equip workers with necessary information about their claims.

Eft Authorization - Personal and business insurance compensation can be managed via this service.

Maryland Workers Compensation Commission - The completed form must be submitted to the Maryland Workers’ Compensation Commission.