Fill Out Your Patriots Act Form

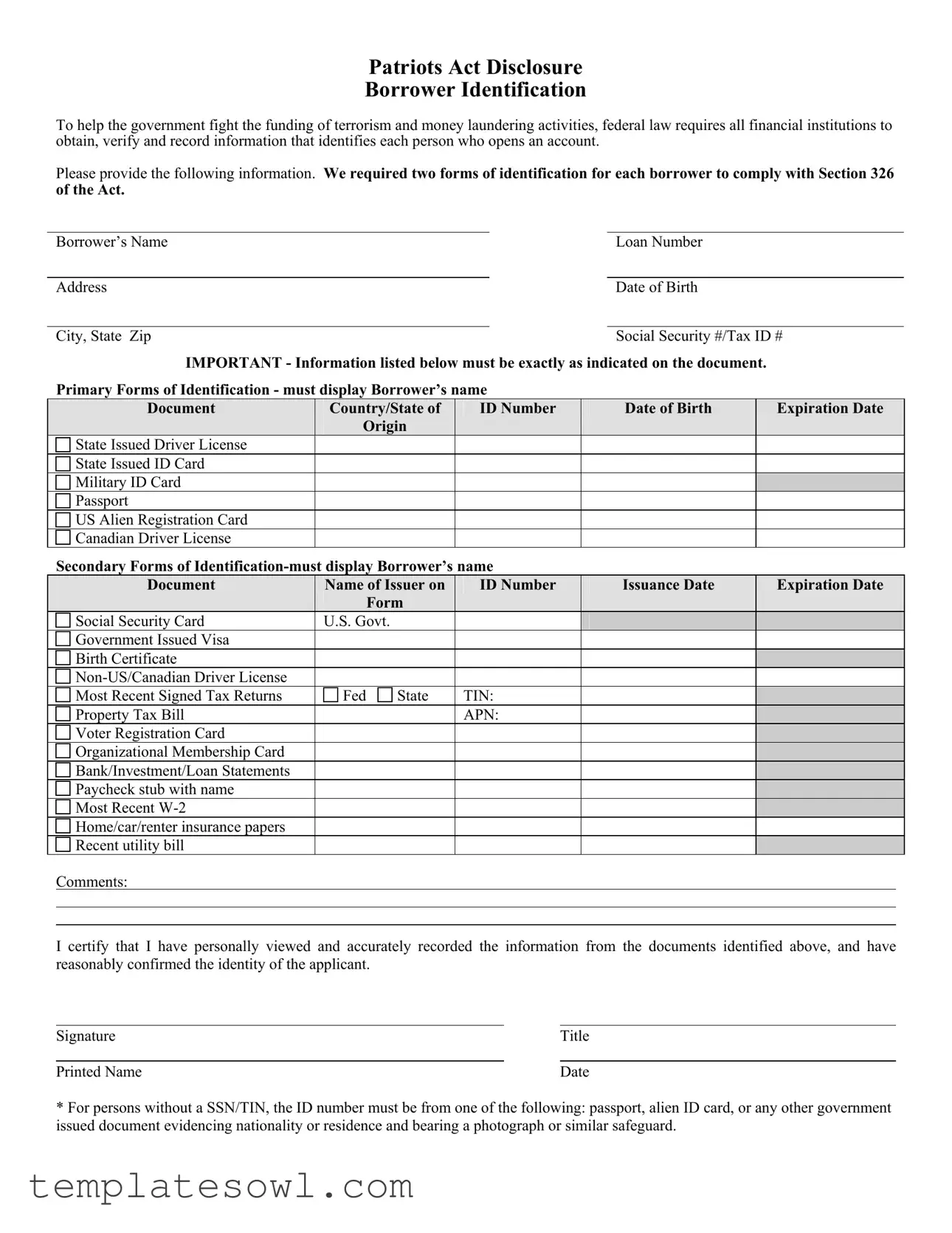

The Patriots Act form plays a crucial role in the effort to combat terrorism and money laundering activities by requiring financial institutions to gather and verify specific information about individuals opening accounts. Each borrower is asked to provide personal information, including their name, loan number, address, date of birth, city, state, zip code, and Social Security number or Tax ID number. Compliance with Section 326 of the Act necessitates the submission of two forms of identification that meet established criteria. Primary forms of identification, such as a driver’s license, military ID, or passport, must clearly display the borrower’s name along with other relevant details like document number and expiration date. Secondary forms include various documents like Social Security cards, tax returns, and utility bills, which must also verify the borrower's identity. Additionally, the form includes a certification statement, ensuring that the information provided has been accurately recorded and confirmed. This comprehensive approach helps uphold national security standards while facilitating the borrowing process.

Patriots Act Example

Patriots Act Disclosure

Borrower Identification

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account.

Please provide the following information. We required two forms of identification for each borrower to comply with Section 326 of the Act.

Borrower’s Name |

|

|

Loan Number |

|

|

|

|

Address |

|

|

Date of Birth |

|

|

|

|

City, State Zip |

|

|

Social Security #/Tax ID # |

|

IMPORTANT - Information listed below must be exactly as indicated on the document. |

||

Primary Forms of Identification - must display Borrower’s name

|

Document |

Country/State of |

ID Number |

Date of Birth |

Expiration Date |

|

|

|

|

Origin |

|

|

|

|

|

|

State Issued Driver License |

|

|

|

|

|

|

|

State Issued ID Card |

|

|

|

|

|

|

|

Military ID Card |

|

|

|

|

|

|

|

Passport |

|

|

|

|

|

|

|

US Alien Registration Card |

|

|

|

|

|

|

|

Canadian Driver License |

|

|

|

|

|

|

|

Secondary Forms of |

|

|

|

|||

|

Document |

Name of Issuer on |

ID Number |

Issuance Date |

Expiration Date |

|

|

|

|

|

Form |

|

|

|

|

|

Social Security Card |

U.S. Govt. |

|

|

|

|

|

|

Government Issued Visa |

|

|

|

|

|

|

|

Birth Certificate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Most Recent Signed Tax Returns |

Fed |

State |

TIN: |

|

|

|

|

Property Tax Bill |

|

|

APN: |

|

|

|

|

Voter Registration Card |

|

|

|

|

|

|

|

Organizational Membership Card |

|

|

|

|

|

|

|

Bank/Investment/Loan Statements |

|

|

|

|

|

|

|

Paycheck stub with name |

|

|

|

|

|

|

|

Most Recent |

|

|

|

|

|

|

|

Home/car/renter insurance papers |

|

|

|

|

|

|

|

Recent utility bill |

|

|

|

|

|

|

|

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that I have personally viewed and accurately recorded the information from the documents identified above, and have reasonably confirmed the identity of the applicant.

Signature |

|

Title |

|

|

|

Printed Name |

|

Date |

*For persons without a SSN/TIN, the ID number must be from one of the following: passport, alien ID card, or any other government issued document evidencing nationality or residence and bearing a photograph or similar safeguard.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Patriot Act aims to help combat terrorism and money laundering by requiring financial institutions to verify a borrower's identity before opening an account. |

| Identification Requirement | Financial institutions must obtain two forms of identification for each borrower, as mandated by Section 326 of the Patriot Act. |

| Primary Identification | Acceptable forms of primary identification include a driver's license, state-issued ID card, military ID, passport, and other government-issued documents that display the borrower's name and date of birth. |

| Secondary Identification | Secondary forms of identification may include documents like Social Security cards, recent utility bills, bank statements, or paycheck stubs, all of which must also display the borrower's name. |

| Governing Laws | The Patriot Act follows federal law, but specific states may have additional requirements based on local regulations. |

| Certification | Individuals providing this form must certify that they have personally verified the information and confirmed the borrower's identity through the presented documents. |

Guidelines on Utilizing Patriots Act

Completing the Patriots Act form requires accurate information and attention to detail to ensure compliance with federal regulations. Follow the steps carefully to provide the required details and submit the form correctly.

- Begin by obtaining the form. Ensure you have the latest version available from your financial institution.

- Locate the section titled Borrower Identification.

- Fill in the borrower’s full name as it appears on official identification documents.

- Enter the loan number associated with your transaction.

- Provide your current residential address, including street, city, state, and zip code.

- Input your date of birth.

- Insert your Social Security number or Tax ID number accurately.

- Identify the primary form of identification. Choose from the listed options (e.g., Driver License, Passport) and fill in all required fields: document type, issuing state or country, ID number, date of birth, expiration date, and state of issuance.

- Complete the secondary form of identification section. Again, choose an appropriate document and list the name of the issuer, ID number, issuance date, and expiration date.

- Include any additional relevant comments or notes if necessary.

- Sign the form in the designated area, confirming that the information is accurate and complete.

- Print your name and title as required.

- Add the date of signing to finalize the form.

- Review the entire form for any errors or omissions before submitting it.

Once filled out, ensure that the form is submitted according to the procedures provided by your financial institution. This may involve returning it in person or sending it via secure electronic means. Keep a copy for your records.

What You Should Know About This Form

What is the purpose of the Patriots Act form?

The Patriots Act form is designed to help the government combat terrorism financing and money laundering. By collecting specific information from individuals who open financial accounts, the form assists in verifying identities and documenting transactions accurately.

Who is required to complete the form?

Anyone looking to open a financial account is required to fill out the Patriots Act form. This includes borrowers applying for loans, opening bank accounts, or any other financial transactions that fall under the federal regulations outlined in the Patriots Act.

What information is needed to complete the form?

You will need to provide your name, address, date of birth, Social Security number or Tax ID number, and other identifying details. The form also requests two forms of identification to ensure compliance with federal law.

What types of identification are acceptable?

Acceptable primary forms include government-issued IDs like driver licenses, military IDs, or passports. Secondary forms can be things like Social Security cards, birth certificates, or recent utility bills. Ensure the IDs display your name, and make use of the complete list provided in the form to avoid errors.

What should I do if I don't have a Social Security Number?

If you do not have a Social Security number or Tax ID number, you can provide identification from other government-issued documents. These must include a photograph and evidence of your nationality or residence, such as a passport or an alien ID card.

How is the information on the form used?

The information gathered is used primarily for identity verification and compliance purposes. Financial institutions must keep accurate records as part of their obligation under the law, which also helps in preventing illegal financial activities.

Is my information secure?

Your information will be handled with care and confidentiality. Financial institutions are required to protect your data and use it strictly for compliance with federal laws. Always make sure that you're providing your information to trusted entities.

What happens if I fail to provide the required information?

If you do not provide the required information or identification, your application for a financial product or service may be denied. Compliance with the Patriots Act is mandatory for all financial institutions, so it’s essential to follow the guidelines carefully.

Can I update my information later?

Yes, you can update your information as needed. If there are any changes to your personal details or identification, make sure to inform your financial institution promptly to keep your records current and accurate.

Common mistakes

When filling out the Patriot Act form, individuals often make certain mistakes that can lead to delays or complications in the identification process. One common mistake is providing incorrect or incomplete personal information. For instance, if a borrower’s name or date of birth does not match the identification documents exactly, it can result in rejection of the form. This matches the requirements outlined in the Patriot Act, which emphasizes the need for precise information.

Another frequent error involves the selection of identification documents. Borrowers might not realize that certain forms of ID are required to be primary and others secondary. Failing to provide the correct type or an insufficient number of identification documents can complicate the matter significantly. The form clearly states the importance of listing all information "exactly as indicated on the document," and neglecting this can lead to further issues.

Additionally, individuals may overlook the expiration dates of their identification. If the primary identification has expired, it cannot be accepted. This is a crucial point because the Patriot Act emphasizes the verification of current, valid identification. Borrowers should always check the expiration dates before submitting their forms to avoid unnecessary setbacks.

Many people also miss the requirement for two forms of identification. This requirement can lead to confusion, especially if borrowers believe that providing one form would suffice. It is essential to remember that both primary and secondary identifications must be submitted together to fulfill the obligations set forth by the Act.

Finally, some borrowers neglect to sign and date the form. The certification statement at the end of the form is not just a formality; it confirms the accuracy of the information provided. Failing to sign or date the form can cause submission issues, ultimately slowing the process down. Careful attention to each detail on the form is critical to ensure compliance with the law and facilitate a smoother experience.

Documents used along the form

The USA PATRIOT Act requires financial institutions to establish and verify the identities of individuals opening accounts. Alongside the PATRIOT Act form, there are several other important documents often required. Below is a list of these forms, each serving a specific purpose in the verification process.

- Personal Identification Form: This form collects vital information from the individual, including full name, address, date of birth, and contact information. It ensures that the institution has accurate personal details on file.

- Identification Verification Certificate: This document affirms that the verifying officer has confirmed the identity of the individual through proper documentation. It serves as a record of compliance with identification verification requirements.

- Account Application Form: This form outlines the type of account being requested. It includes necessary disclosures and agreements the borrower must understand and sign prior to account opening.

- Consent for Background Check: This document gives the financial institution permission to conduct a background check. It may include checks for fraud, credit history, or criminal background as part of a comprehensive risk assessment.

- Tax Identification Number Form: This form is used to gather tax identification information. Individuals provide their Social Security Number (SSN) or Employer Identification Number (EIN) for tax reporting purposes.

- Anti-Money Laundering (AML) Policy Acknowledgment: This form confirms that the individual has received and understood the institution’s AML policies. It underscores the importance of preventing illegal financial activities.

- Privacy Notice: This document informs the account holder about their rights concerning personal information. It outlines how the institution will use and protect their private data.

- State and Federal Disclosure Forms: Various forms may be required in accordance with state and federal laws. These documents detail additional rights, responsibilities, and information regarding financial transactions.

These documents work together to create a secure environment. It is important for everyone involved to complete them accurately. Ensuring compliance with the PATRIOT Act helps protect individuals and institutions from the risks of financial crime.

Similar forms

- USA PATRIOT Act Section 326 Compliance Form - Similar in function, this document requires banks to verify the identity of individuals engaging in financial transactions to prevent money laundering and terrorism financing.

- Financial Institutions Customer Identification Program (CIP) - Related to the Patriot Act, this program mandates that financial institutions gather basic information about their customers, ensuring their identities are confirmed before accounts are opened.

- Know Your Customer (KYC) Documentation - This practice involves collecting specific data to understand a client's financial dealings. Like the Patriot Act form, it focuses on identifying potential risks related to money laundering.

- Form W-9 - Used by individuals to provide their taxpayer identification number to a financial institution. Similar to the Patriot Act form, it verifies identity and tax information.

- IRS Form 4506 - Requests for copies of tax returns engage the same need for verification. Individuals must provide specific identification to obtain documentation proving their financial status.

- Credit Application Forms - When applying for a loan or credit, applicants must furnish identification, similar to the requirements outlined in the Patriot Act form to ensure identity verification.

- State Voter Registration Forms - These forms collect personal information to verify eligibility to vote. They also require identification details to substantiate the identity of registrants.

- Social Security Administration Identification Forms - Application for a Social Security card involves providing proof of identity, paralleling the dual identification requirements of the Patriot Act.

- Bank Account Opening Forms - When opening a new bank account, customers are asked to submit identification. This practice mirrors the document requirements outlined in the Patriot Act for verifying identity.

- Lease Agreement Applications - Similar to the Patriot Act form, these applications require identification to confirm the identity of prospective tenants before formal agreements are established.

Dos and Don'ts

When filling out the Patriots Act form, it is essential to ensure accuracy and compliance with federal regulations. The following guidelines help streamline the process while safeguarding personal information.

- Do: Provide accurate personal information, such as the borrower’s name and address, as it appears on official documents.

- Do: Submit two forms of identification; one must be a primary form while the other should be a secondary form.

- Do: Ensure that all identification documents display the borrower’s name clearly.

- Do: Verify that the expiration dates on forms of identification have not passed.

- Don’t: Use any identification that does not match the information provided in the form.

- Don’t: Forget to sign and date the form to confirm the accuracy of the information provided.

- Don’t: Leave any required fields blank, as this can lead to processing delays.

Misconceptions

Here are six common misconceptions about the Patriot Act that can lead to confusion for borrowers and financial institutions alike:

- The Patriot Act only applies to banks. Many believe that the Act is limited to traditional banks. In reality, it applies to a wide range of financial institutions, including credit unions, insurance companies, and securities dealers.

- Only foreign individuals need to provide identification. Some think that identification requirements are only for foreign nationals. However, all borrowers, regardless of their nationality, must provide proper identification to comply with the Act.

- There is no requirement for the type of identification needed. Many people assume that any form of ID is acceptable. The Act specifies certain documents as primary and secondary forms of identification that must be provided, ensuring a standardized process.

- The Patriot Act is only about national security. While national security is a significant focus, the Act also addresses money laundering and financial fraud. Its provisions aim to protect the integrity of the financial system as a whole.

- Once identification is provided, it is never checked again. Some borrowers may think that their identity verification is a one-time event. Financial institutions must continually comply with monitoring and verification processes to ensure ongoing compliance.

- The identification process is overly burdensome. Although collecting identification is necessary, many lenders strive to make the process efficient and straightforward. Providing clear documentation helps expedite account openings and loan applications.

Key takeaways

Understanding how to fill out and use the Patriot Act form is crucial for compliance with federal regulations. Here are key takeaways to guide you:

- Identification Requirement: Financial institutions must collect specific identification details from individuals opening accounts. This is essential to help combat money laundering and terrorism funding.

- Two Forms of ID: Each borrower is required to provide two forms of identification. One must be a primary form, displaying the borrower's name and other vital information.

- Accuracy is Essential: It is important that the information provided matches exactly with the documents presented. Any discrepancies could lead to complications.

- Signature Certification: Borrowers need to certify that they have witnessed and accurately recorded the required information. This step is important for maintaining the integrity of the identification process.

- Alternative ID for Missing SSN: If an individual does not possess a Social Security Number or Tax Identification Number, identification must come from government-issued documents that verify nationality or residence.

Using this form properly ensures that all parties are protected and reinforces the commitment to national security. Each step plays a vital role in the identification process.

Browse Other Templates

W-4 Example - Document all relevant financial information carefully.

What Is a Usps Form 1583 - Periodic verification against USPS-provided versions of the form is a recommended best practice.