Fill Out Your Pay For Deletion Form

Navigating the complexities of credit reporting can be daunting, especially when you find yourself dealing with collections that can significantly impact your credit score. One effective strategy in this arena is utilizing the Pay For Deletion form, a tool that empowers consumers to negotiate the removal of negative entries from their credit reports. The essence of the Pay For Deletion letter lies in its straightforward approach; it outlines your willingness to settle a debt in exchange for the deletion of the associated collection account from your credit history. It’s essential to keep your letter concise and focused, but equally important is the inclusion of specific rights you possess under the Fair Debt Collection Practices Act (FDCPA). By demonstrating knowledge of your rights and approaching collection agencies with a firm yet respectful tone, you not only enhance your negotiating position but also potentially increase the likelihood of compliance on their part. The letter should clearly specify important details, including the name of the collection agency, the account number, the amount owed, and the settlement amount you're proposing. Furthermore, emphasizing that this correspondence is not an admission of liability can protect your interests while facilitating a resolution. For individuals facing medical collections, there’s additional context provided by pending legislation that could alter the landscape, making strategic negotiations even more critical. This article will delve deeper into the mechanism of the Pay For Deletion process, offering insights and tips on how to craft a compelling letter that effectively communicates your intentions while safeguarding your rights.

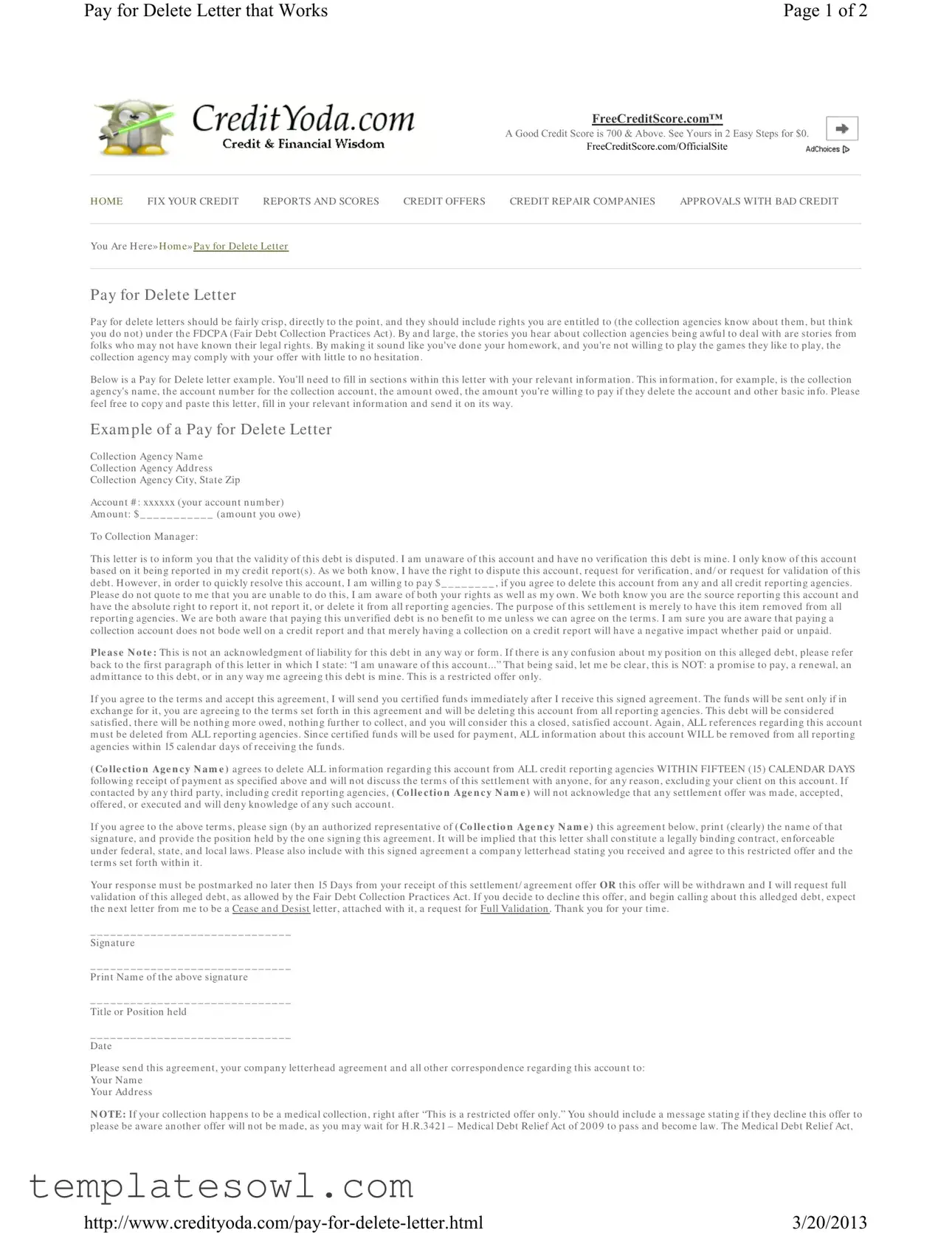

Pay For Deletion Example

Pay for Delete Letter that Works |

Page 1 of 2 |

FreeCreditScore.com™

A Good Credit Score is 700 & Above. See Yours in 2 Easy Steps for $0.

FreeCreditScore.com/OfficialSite

H OME |

FIX YOUR CREDIT |

REPORTS AND SCORES |

CREDIT OFFERS |

CREDIT REPAIR COMPANIES |

APPROVALS WITH BAD CREDIT |

|

|

|

|

|

|

You Are H ere» Hom e» Pay for Delete Letter

Pay for Delete Letter

Pay for delete letters should be fairly crisp, directly to the poin t, and they should include rights you are entitled to (the collection agencies kn ow about them , but think you do not) under the FDCPA (Fair Debt Collection Practices Act). By an d large, the stories you hear about collection agencies bein g awful to deal with are stories from folks who m ay not have kn own their legal rights. By m aking it soun d like you've done your hom ework, and you're not willing to play the gam es they like to play, the collection agency m ay com ply with your offer with little to n o hesitation .

Below is a Pay for Delete letter exam ple. You'll n eed to fill in section s within this letter with your relevant inform ation . This in form ation, for exam ple, is the collection agency's nam e, the account num ber for the collection accoun t, the am ount owed, the am ount you're willing to pay if they delete the account an d other basic info. Please feel free to copy and paste this letter, fill in your relevant inform ation and send it on its way.

Exam ple of a Pay for Delete Letter

Collection Agen cy Nam e

Collection Agen cy Address

Collection Agen cy City, State Zip

Account # : xxxxxx (your account num ber)

Am ount: $ _ _ _ _ _ _ _ _ _ _ _ (am ount you owe)

To Collection Manager:

This letter is to inform you that the validity of this debt is disputed . I am un aware of this account and have n o verification this debt is m ine. I only know of this account based on it bein g reported in m y credit report(s). As we both know, I have the right to dispute this accoun t, request for verification , an d/ or request for validation of this debt. H owever, in order to quickly resolve this account, I am willin g to pay $ _ _ _ _ _ _ _ _ , if you agree to delete this account from any and all credit reporting agencies.

Please do not quote to m e that you are unable to do this, I am aware of both your rights as well as m y own . We both know you are the source reportin g this accoun t and have the absolute right to report it, not report it, or delete it from all reporting agen cies. The purpose of this settlem ent is m erely to have this item rem oved from all reporting agencies. We are both aware that paying this unverified debt is no benefit to m e unless we can agree on the term s. I am sure you are aware that paying a collection account does n ot bode well on a credit report an d that m erely having a collection on a credit report will have a negative im pact whether paid or unpaid.

P le a s e N o te : This is n ot an acknowledgm ent of liability for this debt in an y way or form . If there is any confusion about m y position on this alleged debt, please refer

back to the first paragraph of this letter in which I state: “I am unaware of this account...” That being said, let m e be clear, this is NOT: a prom ise to pay, a renewal, an adm ittan ce to this debt, or in an y way m e agreeing this debt is m ine. This is a restricted offer only.

If you agree to the term s and accept this agreem ent, I will sen d you certified fun ds im m ediately after I receive this signed agreem en t. The fun ds will be sent only if in exchan ge for it, you are agreeing to the term s set forth in this agreem ent and will be deletin g this account from all reporting agencies. This debt will be con sidered satisfied, there will be nothin g m ore owed, nothin g further to collect, and you will consider this a closed, satisfied account. Again, ALL references regarding this accoun t m ust be deleted from ALL reporting agencies. Sin ce certified funds will be used for paym en t, ALL in form ation about this accoun t WILL be rem oved from all reporting agencies within 15 calendar days of receiving the fun ds.

( Co lle c ti o n Ag e n c y N a m e ) agrees to delete ALL inform ation regardin g this accoun t from ALL credit reporting agencies WITHIN FIFTEEN (15) CALENDAR DAYS following receipt of paym ent as specified above and will not discuss the term s of this settlem ent with anyone, for any reason, excludin g your clien t on this account. If con tacted by an y third party, includin g credit reporting agencies, ( Co lle c tio n Ag e n c y N a m e ) will not acknowledge that any settlem en t offer was m ade, accepted, offered, or executed and will deny knowledge of any such account.

If you agree to the above term s, please sign (by an authorized representative of ( Co lle c ti o n Ag e n c y N a m e ) this agreem ent below, print (clearly) the nam e of that sign ature, and provide the position held by the one signing this agreem ent. It will be im plied that this letter shall constitute a legally bin ding contract, enforceable un der federal, state, an d local laws. Please also include with this signed agreem ent a com pany letterhead stating you received and agree to this restricted offer an d the term s set forth within it.

Your response m ust be postm arked no later then 15 Days from your receipt of this settlem en t/ agreem en t offer OR this offer will be withdrawn an d I will request full validation of this alleged debt, as allowed by the Fair Debt Collection Practices Act. If you decide to declin e this offer, and begin callin g about this alledged debt, expect the n ext letter from m e to be a Cease an d Desist letter, attached with it, a request for Full Validation . Thank you for your tim e.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Signature

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Prin t Nam e of the above signature

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Title or Position held

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Date

Please sen d this agreem ent, your com pany letterhead agreem en t and all other correspondence regarding this account to:

Your Nam e

Your Address

N OTE: If your collection happens to be a m edical collection , right after “This is a restricted offer on ly.” You should include a m essage stating if they decline this offer to please be aware another offer will not be m ade, as you m ay wait for H .R.3421 – Medical Debt Relief Act of 20 0 9 to pass and becom e law. The Medical Debt Relief Act,

3/20/2013 |

Pay for Delete Letter that Works |

Page 2 of 2 |

in a nutshell, would force collection agencies to delete m edical collection accounts from all credit reporting agencies once it was paid in full or settled for less than owed .

Also: In the Pay for delete letter above, there's m en tion of a Cease and Desist letter and Validation Letter, to view exam ples of them visit:

•Cease and Desist Letter

•Debt Validation Letter

If you're wondering how m uch you should offer, a good first offer is around 50 % of what's owed. The collection agency will usually either accept the offer or they could counter

Credit Knowledge |

Credit Resources |

Yoda Credit Offers |

Fix Your Credit |

Credit Repair Services |

Your Credit Report |

Pay for Delete Letter |

Credit Cards |

Repair Your Credit Step 1 |

Free Trial with DebtGoal |

Understanding Credit Scores |

Cease and Desist Letter |

Person al Loans |

Repair Your Credit Step 2 |

Lexington Law Firm |

Quick Score Boost |

Debt Validation Letter |

Mortgage Loans |

Repair Your Credit Step 3 |

Loan Modification s |

Various Credit Laws |

Credit Reporting Agencies |

Auto Loan s |

Repair Your Credit Step 4 |

FREE Credit Repair |

State Security Freeze Guide |

Info on Credit Card Act |

Payday Loans |

Repair Your Credit Step 5 |

Con sultation |

|

||||

State Statutes of Lim itation |

Credit Finance Directory |

Credit Reports and Scores |

Dealing with Collections |

Veracity Credit Repair |

|

||||

|

|

|

|

|

|

|

|

Sh ar e | |

Feed Bu r n er |

Blog |

||

|

|

|

|

|

|

|

|

Copyright © 20 10 - All Rights Reserved - CreditYoda.com |

|

Tem plate by OS Tem plates |

|

Con tact Us | Privacy Policy | Term s | Advertise on CreditYoda.com |

|

Yoda Icon by Wyvern |

|

|

|

|

|

3/20/2013 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Pay for Delete | The Pay for Delete letter aims to settle a debt while requesting the removal of the collection account from credit reports. |

| Disputing the Debt | This letter asserts that the validity of the debt is disputed, emphasizing the consumer's rights under the Fair Debt Collection Practices Act (FDCPA). |

| Settlement Offer | Consumers can propose a specific amount they are willing to pay in exchange for the deletion of the collection account. |

| Collection Agency Obligations | The collection agency has the right to delete the debt from reports and must comply with the agreement if accepted. |

| Timeframe for Deletion | Agreements specify that information must be deleted from reporting agencies within 15 calendar days after payment. |

| Cease and Desist Potential | If the collection agency declines the offer, the consumer may send a Cease and Desist letter to halt all communications. |

| Legal Binding | The letter constitutes a legally binding contract, enforceable under federal, state, and local laws. |

| State-Specific Variations | Different states may have specific laws governing debt collection practices, potentially affecting negotiations and outcomes. |

| Medical Debt Relief Act | Pending legislation may mandate the deletion of medical debt from credit reports once paid, impacting negotiation strategies for medical collections. |

Guidelines on Utilizing Pay For Deletion

After completing the Pay for Deletion form, it is essential to send it to the collection agency promptly. The agency will review the offer you present and may either accept it or propose alternative terms. In either case, maintaining a record of all correspondence is vital to ensure clarity and accountability throughout the process.

- Start by gathering necessary information: You will need the name and address of the collection agency, your account number, and the amount owed.

- Open a blank document or letter template to draft your Pay for Deletion letter.

- Address the letter to the "Collection Manager" of the agency you are contacting.

- Clearly state your dispute in the opening paragraph, explaining that you are unaware of the debt and are seeking verification.

- Indicate the amount you are willing to pay in exchange for the deletion of the account from all reporting agencies.

- Make sure to express your awareness of your rights under the Fair Debt Collection Practices Act (FDCPA).

- Include a clear statement that this offer does not acknowledge your liability for the debt.

- Specify that, upon their acceptance of the terms, you will send certified funds immediately after receiving a signed agreement.

- Insert a request for a response within 15 calendar days to indicate your timeline.

- Sign the letter and print your name beneath your signature.

- Include your title or position if applicable and the date of writing the letter.

- Address the envelope to yourself and include your full name and address for clarity.

- Make a copy of the letter for your own records before sending it to the collection agency.

What You Should Know About This Form

What is a Pay For Deletion letter?

A Pay For Deletion letter is a request you send to a collection agency, proposing to pay a debt in exchange for the removal of that debt from your credit report. Essentially, you offer a specific amount to settle the debt and request that the collection agency delete any negative reporting associated with that account from all credit reporting agencies once they receive your payment. This approach aims to help improve your credit score by eliminating harmful entries from your credit history.

How do I fill out a Pay For Deletion letter?

Filling out a Pay For Deletion letter is straightforward. You'll need to include important details such as the collection agency's name and address, your account number, and the amount owed. In the letter, clearly state your intention to pay a specific amount if they agree to delete the account from your credit report. Remember to emphasize that this is not an admission of liability for the debt. You can use the provided template as a guide—just personalize it with your information and ensure that it's concise and direct.

What should I do if the collection agency refuses my offer?

If the collection agency declines your offer, do not become discouraged. They may counter-offer or simply reject the proposal altogether. It's important to approach the situation calmly. Consider waiting a bit before reaching out again; some collectors are more willing to negotiate after some time has passed. If further attempts do not yield results, you might want to request a validation of the debt, which can sometimes encourage them to cooperate. You could also explore other debt resolution options or consult a credit repair service for assistance.

Is a Pay For Deletion letter legally binding?

While a Pay For Deletion letter is not a legally binding contract in the traditional sense, it serves as a written record of your negotiation and agreement with the collection agency. If both parties agree to the terms and sign the letter, it can become enforceable under applicable federal and state laws. This underscores the importance of making the terms clear and obtaining a signature from the collection agency. Ensure you keep copies of all correspondence for your records. This way, you can reference the agreement should any issues arise later.

Common mistakes

When individuals decide to fill out a Pay For Deletion form, they often overlook key details that can hinder their efforts to have derogatory marks removed from their credit reports. One common mistake is failing to clearly identify the debt and the collection agency involved. Providing the wrong collection agency name or account number can lead to confusion and frustration. It is essential to double-check that all information entered is accurate and up-to-date to ensure effective communication.

Another frequent error revolves around the lack of specificity regarding the payment offer. A vague offer may not persuade the collection agency to consider deleting the account from the credit report. It is recommended to state the exact amount you are willing to pay, ideally around 50% of what you owe. This sets clear expectations and encourages the agency to engage in negotiation.

Moreover, many people neglect to reference their rights under the Fair Debt Collection Practices Act. By understanding and including these rights in the Pay For Deletion letter, individuals can demonstrate their knowledge and assertiveness. Acknowledging legal entitlements can prompt the collection agency to take your request more seriously, thus increasing the chances of a favorable outcome.

Lastly, some individuals fail to establish a clear deadline for the collection agency's response. Without a defined timeline, there is a higher likelihood of the offer being forgotten or ignored. Including a specific date for response not only emphasizes the urgency of the matter but also creates a structured approach that the agency must follow. By avoiding these common pitfalls, individuals can improve their chances of successfully removing negative collections from their credit reports.

Documents used along the form

The Pay for Deletion form is an important document in credit repair, often accompanied by several other key documents that can support your efforts. Understanding these forms can enhance your chances of successfully negotiating with collection agencies and improving your credit report.

- Cease and Desist Letter: This letter requests a collection agency to stop all communication regarding a debt. It serves as a formal notice of your intention to limit unwanted contact.

- Debt Validation Letter: Use this letter to request proof of the debt from a collection agency. It obligates them to provide evidence that the debt is valid and that they have the right to collect it.

- Settlement Agreement: A written agreement detailing the terms under which a debt will be settled. This document can outline the amount to be paid and the conditions for releasing the debt from your credit report.

- Payment Receipt: After payment of a settlement, retain this receipt as proof of payment. This documentation can help to verify that a debt has been resolved.

- Credit Report Dispute Letter: If inaccuracies are found in your credit report, this letter can be sent to credit bureaus disputing the entries. It formally notifies them to review and correct the inaccuracies.

- Hardship Letter: If you face financial difficulties, a hardship letter may explain your situation to a collection agency. This can sometimes lead to more favorable payment arrangements.

Utilizing these documents alongside the Pay for Deletion form can streamline the process of addressing debts and enhance your position in negotiations. Taking the necessary steps today can help in eventually boosting your credit profile.

Similar forms

- Cease and Desist Letter: This document instructs a collector to stop all communication regarding the debt. It expresses a similar intent to take control over the communication and negotiation process, much like a Pay For Deletion letter. It demonstrates the sender’s knowledge of their rights and establishes a boundary when dealing with collection agencies.

- Debt Validation Letter: This letter requests proof that the debt is owed. It is similar to the Pay For Deletion form in that both involve asserting consumer rights under the Fair Debt Collection Practices Act. They stress the importance of verifying the legitimacy of a debt before making any payments.

- Settlement Agreement: This document outlines terms for settling a debt for less than the full amount owed. Like the Pay For Deletion letter, it hinges on negotiating terms for payment and debt resolution, with an agreement to remove negative reporting from credit agencies as a key component.

- Payment Plan Agreement: This document outlines an agreement to pay off a debt in installments. Similar to the Pay For Deletion letter, it requires clear terms outlining the obligations of both parties. However, the goal of a payment plan is different; it seeks to manage debt repayment rather than negotiating a deletion of the derogatory mark on a credit report.

Dos and Don'ts

When filling out the Pay For Deletion form, there are certain practices that can enhance your chances of success and others that may hinder your efforts. Below is a helpful list of dos and don’ts:

- Do provide accurate and complete personal information, such as your name and address.

- Do clearly state the amount you are willing to pay in exchange for deletion.

- Do reference your rights under the Fair Debt Collection Practices Act (FDCPA).

- Do keep your tone professional and respectful throughout the letter.

- Do follow up if you do not receive a response within a reasonable time frame.

- Don’t admit liability for the debt in any form.

- Don’t threaten or use aggressive language towards the collection agency.

- Don’t send cash or untraceable payment methods; opt for certified funds instead.

- Don’t forget to keep a copy of the letter and any correspondence for your records.

Misconceptions

- Pay for Deletion Guarantees Credit Score Improvement

- Collection Agencies Are Obligated to Accept Pay for Deletion Offers

- Paying the Debt Removes It From Your Credit Report

- A Pay for Deletion Agreement is Legally Enforceable

Many people believe that submitting a Pay for Deletion letter will automatically improve their credit score. However, this is not true. While deleting a negative item can positively impact your score, there is no guarantee the collection agency will agree to the terms or that other negative items won't continuously affect your score.

Another misconception is that collection agencies must accept any Pay for Deletion offer made to them. In reality, these agencies are not required by law to accept such offers. They have the discretion to refuse and may choose to collect the debt in other ways.

Some believe that paying off a debt will automatically lead to its removal from the credit report. However, this is misleading. Even if the debt is paid off, it may still remain listed as a collection account unless a specific agreement, like Pay for Deletion, is reached.

Many individuals think that a Pay for Deletion agreement is a legally binding contract. However, while it may be taken seriously, enforcing it can be complicated. Collection agencies might not adhere to the terms, and proving that they violated the agreement can be challenging.

Key takeaways

Understanding the Pay for Deletion Form is essential when addressing debt collections. Here are four key points to remember when filling out and using this form:

- Be Direct and Clear: Your letter should get straight to the point. Be clear about your intentions and the debt being discussed.

- Know Your Rights: Familiarize yourself with your rights under the Fair Debt Collection Practices Act (FDCPA). This knowledge can empower you when communicating with collection agencies.

- Include Relevant Information: Fill in all necessary parts of the letter, such as the collection agency's name, your account number, and the amounts involved. This helps prevent any confusion about the debt you are addressing.

- Set Your Offer Carefully: A good starting point for your payment offer is around 50% of the owed amount. Be prepared for possible negotiations, as collection agencies may counter your offer.

Following these takeaways will improve your chances of successfully negotiating the deletion of the debt from your credit report.

Browse Other Templates

Tc 96 - The Kentucky TC 96-187 ensures that security interests are formally recorded.

Guest Registration Card - Include the exact date of your check-in and check-out.