Fill Out Your Pay Period Calendar Form

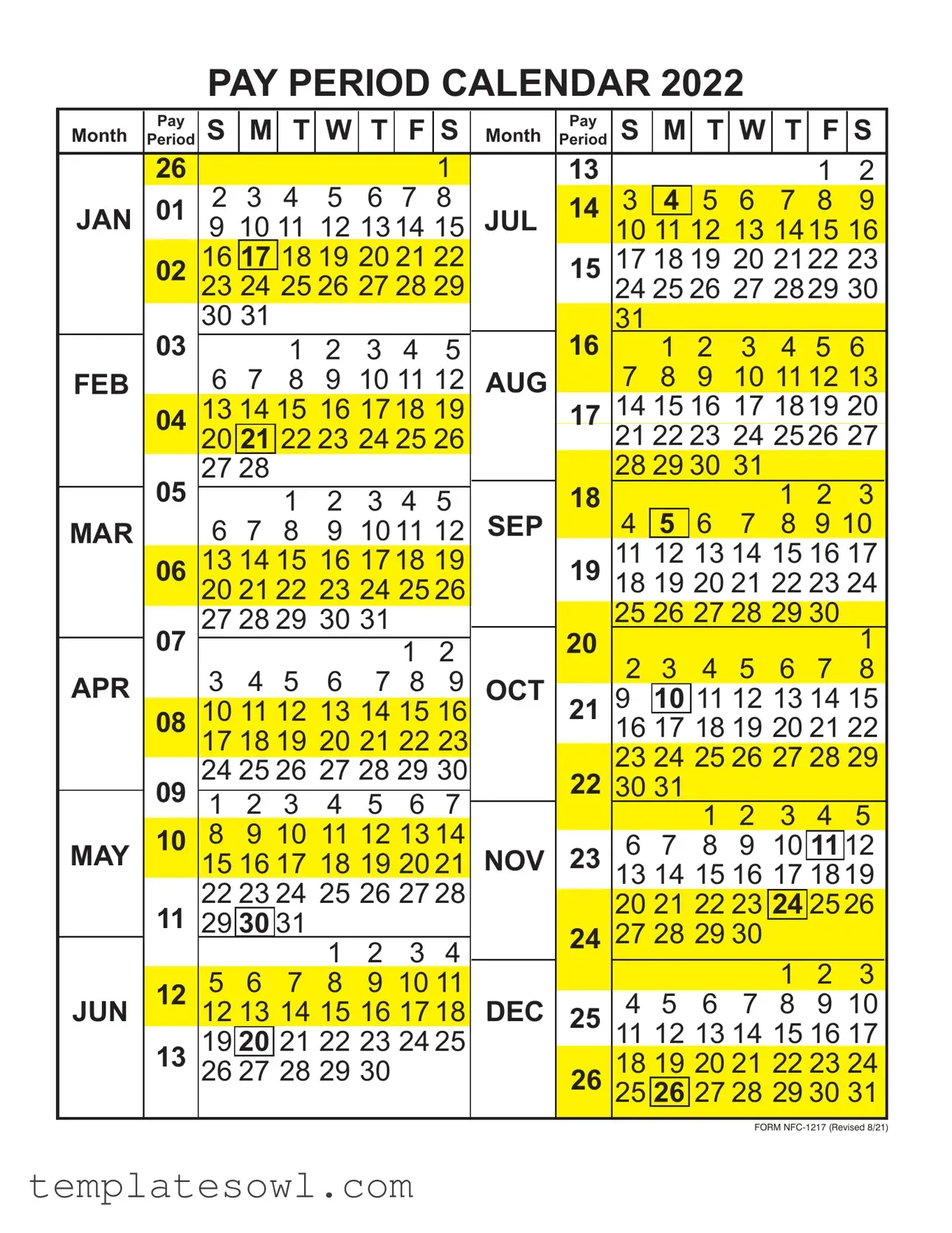

The Pay Period Calendar is an essential tool for both employers and employees, providing a clear overview of payroll periods throughout the year. This calendar outlines specific pay periods, detailing the start and end dates for each, which aids in wage calculations and helps ensure everyone is paid accurately and on time. Covering a complete year, the calendar is divided by months, making it easy to track important payroll dates at a glance. Each month features a straightforward layout, listing the days of the week and corresponding dates, which assists payroll departments in planning processes. For instance, whether it’s January or December, employees can reference this form to understand when they can expect their payments, while employers can align their accounting practices accordingly. Furthermore, this calendar is crucial for compliance with labor regulations, ensuring that all employees receive their due compensation based on their work hours. Understanding its structure and purpose can help streamline payroll operations, promoting transparency and trust within the workplace.

Pay Period Calendar Example

PAY PERIOD CALENDAR 2022

Month |

PeriodPay |

S |

M |

T |

W |

T |

F |

S |

Month |

PeriodPay |

S |

|

M |

T |

W |

T |

F |

S |

||||

|

26 |

|

|

|

|

|

|

1 |

|

13 |

|

|

|

|

|

|

|

1 |

2 |

|||

JAN |

01 |

2 3 4 5 6 7 8 |

JUL |

14 |

3 |

4 |

5 6 7 8 9 |

|||||||||||||||

9 10 11 12 13 14 15 |

10 |

|

11 |

12 13 14 15 16 |

||||||||||||||||||

|

02 |

16 |

17 |

18 19 20 21 22 |

|

15 |

17 18 19 20 21 22 23 |

|||||||||||||||

|

23 |

24 |

25 26 27 28 29 |

|

24 25 26 27 28 29 30 |

|||||||||||||||||

|

03 |

30 31 |

|

|

|

|

|

|

16 |

31 |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

1 |

2 |

3 |

4 |

5 |

6 |

|||||||

|

|

|

1 |

2 |

3 |

4 |

5 |

|

||||||||||||||

FEB |

|

6 |

7 |

8 |

9 |

10 11 12 |

AUG |

|

7 |

8 |

9 |

10 11 12 13 |

||||||||||

|

|

14 15 16 17 18 19 20 |

||||||||||||||||||||

04 |

13 14 15 16 17 18 19 |

17 |

||||||||||||||||||||

|

|

|||||||||||||||||||||

|

20 |

21 |

22 23 24 25 26 |

|

|

21 22 23 24 25 26 27 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

28 29 30 31 |

|

|

|

|

|||||||

|

05 |

27 28 |

|

|

|

|

|

|

18 |

|

|

|||||||||||

|

|

|

|

|

|

|

1 |

2 |

3 |

|||||||||||||

|

|

|

1 |

2 |

3 |

4 |

5 |

|

||||||||||||||

MAR |

|

6 |

7 |

8 |

9 |

10 11 12 |

SEP |

|

4 |

5 |

6 |

7 |

8 |

9 10 |

||||||||

|

|

11 12 13 14 15 16 17 |

||||||||||||||||||||

|

06 |

13 14 15 16 17 18 19 |

|

19 |

||||||||||||||||||

|

20 21 22 23 24 25 26 |

|

18 19 20 21 22 23 24 |

|||||||||||||||||||

|

07 |

27 28 29 30 31 |

|

|

|

20 |

25 26 27 28 29 30 |

|

||||||||||||||

|

|

|

|

|

|

|

|

1 |

||||||||||||||

|

|

|

|

|

|

1 |

2 |

|

2 |

3 |

4 |

5 |

6 |

7 |

||||||||

APR |

|

3 |

4 |

5 |

6 |

7 |

8 |

9 |

OCT |

|

8 |

|||||||||||

|

21 |

9 |

|

10 |

11 12 13 14 15 |

|||||||||||||||||

08 |

10 11 12 13 14 15 16 |

|

||||||||||||||||||||

|

|

|||||||||||||||||||||

|

|

|

|

|||||||||||||||||||

|

17 18 19 20 21 22 23 |

|

|

16 17 18 19 20 21 22 |

||||||||||||||||||

|

|

|

|

23 24 25 26 27 28 29 |

||||||||||||||||||

|

|

24 25 26 27 28 29 30 |

|

22 |

||||||||||||||||||

|

09 |

|

30 31 |

|

|

|

|

|

|

|

|

|||||||||||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

1 |

2 |

3 |

4 |

5 |

|||||||||||||

|

10 |

8 |

9 10 11 12 13 14 |

|

|

|

|

|

||||||||||||||

MAY |

NOV |

23 |

6 |

7 |

8 |

9 |

10 |

|

11 |

12 |

||||||||||||

15 16 17 18 19 20 21 |

|

|||||||||||||||||||||

|

|

|||||||||||||||||||||

|

|

22 23 24 25 26 27 28 |

|

|

13 14 15 16 17 18 19 |

|||||||||||||||||

|

11 |

|

|

20 21 22 23 |

24 |

|

25 26 |

|||||||||||||||

|

29 |

30 |

31 |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

24 |

27 28 29 30 |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

1 |

2 |

3 |

4 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

3 |

||||||||

|

12 |

5 |

6 |

7 |

8 |

9 10 11 |

|

|

|

|

|

|

|

|||||||||

JUN |

DEC |

25 |

4 |

5 |

6 |

7 |

8 |

9 10 |

||||||||||||||

12 13 14 15 16 17 18 |

||||||||||||||||||||||

|

13 |

19 |

20 |

21 22 23 24 25 |

|

|

11 12 13 14 15 16 17 |

|||||||||||||||

|

|

|

18 |

19 |

20 21 22 23 24 |

|||||||||||||||||

|

26 |

|

28 29 30 |

|

|

|

|

|||||||||||||||

|

27 |

|

|

|

26 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

25 |

|

26 |

27 28 29 30 31 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Pay Period Calendar is designed to clearly outline the pay periods for employees, ensuring everyone understands when payments will be issued. |

| Frequency | Typically, pay periods can occur weekly, bi-weekly, or monthly, depending on company policy. |

| Yearly Coverage | This specific calendar covers the entire year of 2022, detailing each month’s corresponding pay periods. |

| Employee Communication | Having a Pay Period Calendar helps in fostering better communication between employees and payroll departments regarding payment schedules. |

| State Compliance | Employers must adhere to state labor laws regarding pay frequency, which can vary across jurisdictions, influencing the use of the calendar. |

| Visual Format | The calendar presents dates in a grid format, allowing for easy reference to specific pay dates and corresponding weeks. |

| Document Version | This calendar is a revised version (NFC-1217) dated 8/21, reflecting updated payroll practices and considerations. |

Guidelines on Utilizing Pay Period Calendar

Once you have the Pay Period Calendar form in hand, carefully follow the steps outlined below to ensure accurate completion. Making sure every detail is correctly filled out is essential for proper payroll processing. Whether you're an employee reviewing your pay periods or a payroll professional preparing the calendar, this guide will facilitate the process.

- Begin with identifying the year indicated at the top of the form, confirming it is for 2022.

- Locate the calendar grid that displays the months from January to December.

- In the first column, you will see period numbers. Verify the corresponding dates for each pay period listed next to these numbers.

- As you check each month, make note of the days of the week (S M T W T F S) and their alignment with pay period dates.

- Double-check the rows for accuracy, ensuring all dates fall correctly within their respective months.

- If filling out for personal use, enter any relevant notes or reminders alongside the corresponding pay periods.

- Once all information appears accurate, ensure to keep a copy for your records or submit it as required.

What You Should Know About This Form

What is a Pay Period Calendar?

A Pay Period Calendar outlines the specific dates when employees will be paid. It shows the start and end dates of each pay period and helps organizations manage payroll schedules efficiently.

Why is it important to have a Pay Period Calendar?

A Pay Period Calendar plays a crucial role in payroll processing. It ensures employees know when they can expect payment. Additionally, it aids employers in budgeting and tracking payroll expenses over a defined timeline.

What information is included in the Pay Period Calendar form?

The Pay Period Calendar form includes month names, the specific pay periods for each month, and the corresponding weekdays. This organized layout enables both employees and employers to quickly reference pay dates throughout the year.

How do I use the Pay Period Calendar?

To use the Pay Period Calendar, simply locate the month you are interested in, and check for the designated pay period. Mark these dates in your personal calendar to stay updated on when you will receive your paycheck.

Can the Pay Period Calendar change?

Yes, a Pay Period Calendar can change based on the organization’s policies or external factors, such as holidays. Employers typically communicate any changes well in advance to ensure employees are aware of the updated schedule.

What happens if I miss a payroll date?

If you miss a payroll date, it’s recommended to communicate with your HR or payroll department as soon as possible. They can provide guidance on the next steps, which may include processing a manual check or adjusting the next payroll cycle.

Is the Pay Period Calendar the same for every employee?

Most organizations implement the same Pay Period Calendar for all employees to maintain consistency. However, some companies may have different calendars for different staff categories, such as part-time vs. full-time employees.

Where can I obtain the Pay Period Calendar form?

The Pay Period Calendar form is often available through your company's HR department or internal resources, such as an employee portal. For a physical copy, check with your HR representative.

How can I access previous years’ Pay Period Calendars?

To access previous years’ Pay Period Calendars, you should inquire with your HR department or look for archived documents on your company’s intranet. They may provide access to historical payroll information for planning purposes.

Common mistakes

Filling out the Pay Period Calendar form can carry some tricky details. One common mistake is not double-checking the entries for each day. Missing out on a date or incorrectly filling out a shift can lead to significant payroll complications, affecting not just individuals but entire teams. Every single entry counts.

Another issue arises when people forget to include all necessary signatures. By overlooking this step, they risk delays in processing their paperwork. Timely submission is crucial, and signatures are vital. Without them, forms may be rejected or set aside.

Some individuals also fail to indicate the correct pay period. Each month has specific periods, and placing an employee in the wrong timeframe can create unnecessary confusion. Always verify the start and end dates before submitting.

A frequent error is mislabeling the days of the week. This might seem minor but a simple slip can cause hours to be recorded incorrectly. Make sure the week starts on the proper day, and label correctly to avoid issues with payment.

Another mistake happens when people do not follow the formatting guidelines outlined in the form. Writing down dates or periods in the wrong style can lead to misunderstandings and complications. Adhering to the prescribed format ensures clarity and professional presentation.

Additionally, failing to keep copies of the filled-out form is often overlooked. It is essential to retain personal copies for reference in case any questions arise later. Without these records, clarifying discrepancies may become challenging.

Lastly, forgetting to update any changes in employee status can lead to incorrect pay. If someone’s role or hours shift, reflecting those updates in the calendar is critical. Neglect here could impact how payroll handles funding and allocations.

By being mindful of these common errors, anyone completing the Pay Period Calendar can help ensure a smoother payroll process. Attention to detail is key. Each of these mistakes can affect the efficiency of handling payroll, so take care to follow the guidelines closely.

Documents used along the form

The Pay Period Calendar form is essential for tracking payroll dates, but several other documents are frequently used in conjunction with it. Each document serves a specific purpose and contributes to a cohesive payroll management process. Below is a list of commonly associated forms and documents.

- Employee Time Sheet: This document records the hours worked by an employee during a specific pay period. It includes start and end times, breaks, and total hours worked, facilitating accurate payroll processing.

- Payroll Summary Report: This report consolidates all payroll data for a particular pay period, outlining total wages, deductions, and benefits paid. It helps ensure accuracy before funds are disbursed.

- W-4 Form: Employees complete this form to indicate their tax withholding preferences. It is an essential part of calculating federal income tax deductions from each paycheck.

- Direct Deposit Authorization Form: This document allows employees to authorize the direct deposit of their paychecks into designated bank accounts, simplifying payroll disbursement.

- Benefit Enrollment Form: Employees utilize this form to enroll in company-sponsored benefits during open enrollment periods, updating their status as necessary throughout the year.

- Payroll Change Form: This form records changes to an employee's payroll details, such as raises, promotions, or changes in deductions, ensuring that all changes are documented and processed correctly.

- Timesheet Approval Form: Supervisors or managers sign this form to verify that the reported hours on an employee’s timesheet are accurate, serving as a safeguard against discrepancies.

Using these forms and reports in tandem with the Pay Period Calendar improves the efficiency of payroll processing and ensures compliance with federal and state regulations. Proper documentation supports the needs of both employees and the organization.

Similar forms

- Employee Schedule: Similar to the Pay Period Calendar, an employee schedule outlines the specific days and times employees are expected to work within a designated period. Both provide clarity and help in planning staff availability.

- Time Off Request Form: This document allows employees to request time away from work. Like the Pay Period Calendar, it requires attention to the dates, ensuring that time off aligns with the pay periods and does not disrupt operations.

- Timesheet: A timesheet records the hours worked by an employee during a pay period. It directly corresponds to the Pay Period Calendar by tracking attendance and ensuring accurate compensation for hours worked.

- Payroll Register: This document summarizes the salary and wages of employees for each pay period. It uses the Pay Period Calendar to organize payment schedules and ensure employees are paid accurately on time.

- Benefits Enrollment Form: This form allows employees to enroll in benefits during specified enrollment periods, often aligned with pay periods. Both documents serve to clarify timelines and deadlines for important employee actions.

- Year-End Tax Document: Year-end tax documents compile income and tax withheld over the year, often reflecting information from the Pay Period Calendar. Understanding the pay periods helps employees accurately prepare their taxes.

Dos and Don'ts

When filling out the Pay Period Calendar form, consider the following guidelines to ensure accuracy and compliance:

- Do double-check your entries for accuracy before submission.

- Do use clear and legible handwriting or type for all entries.

- Do ensure that all necessary fields are fully completed.

- Do keep a copy of the completed form for your records.

- Do familiarize yourself with the pay periods relevant to your employment.

- Don't leave any required fields blank.

- Don't submit the form after the specified deadline.

- Don't use correction fluid on the form; it can cause confusion.

- Don't ignore updates or changes to the Pay Period Calendar.

Misconceptions

Understanding the Pay Period Calendar can eliminate confusion. However, several misconceptions persist. Below are nine common misunderstandings regarding the Pay Period Calendar form:

- It only applies to salaried employees: The Pay Period Calendar is relevant for both hourly and salaried employees, detailing payment schedules for all workers.

- All months have the same number of pay periods: Some months have three pay periods while others have two. Employees should refer to the calendar for specific details.

- Changes in pay periods affect tax calculations: Pay periods do not directly affect tax withholdings; rather, it is the employee's total earnings that determine tax obligations.

- This calendar is only for federal employees: The Pay Period Calendar is utilized by various employers, including state and private sector organizations.

- Pay dates are fixed and unchangeable: While most organizations strive for consistency, pay dates can shift due to holidays or other operational considerations.

- Only one format of the calendar exists: Different employers may adopt different formats for the Pay Period Calendar. Always check with your HR department for the correct version.

- Weekends and holidays are not considered: The calendar includes weekends and holidays. Pay dates may be adjusted if they fall on a non-business day.

- Missing a pay period means losing wages: Employees typically receive their total earnings over time. Missing one pay period simply defers payment to the next scheduled date.

- Annual pay dates cannot be planned in advance: The calendar allows employees to review pay dates for the entire year, enabling better financial planning.

Clarifying these misconceptions can assist employees in better managing their financial expectations and understanding their compensation structure.

Key takeaways

The Pay Period Calendar form is an essential tool for managing your work schedule and understanding your pay. Below are key takeaways to keep in mind when filling out and utilizing this form.

- Understand the Structure: The calendar displays both weekdays and weekends, clearly delineating each pay period month.

- Verify Dates: Double-check that all dates are correct before submission to avoid any discrepancies in pay.

- Identify Pay Periods: Familiarize yourself with the specific dates that define each pay period for accurate time tracking.

- Monitor Pay Period Changes: Be aware of any changes in schedule as they may vary due to holidays or other factors.

- Document Time Accurately: Ensure to document your hours accurately within the designated pay periods for proper compensation.

- Keep a Copy: Retain a copy of the submitted calendar for your records and future reference.

- Clarify Questions: Do not hesitate to reach out to your supervisor or HR department if you have questions regarding the calendar.

- Be Proactive: Use the calendar to plan your workload and anticipate busy periods in advance.

- Adhere to Deadlines: Submit your completed calendar by the deadline to ensure timely processing of your pay.

- Stay Informed: Regularly check for updates or revisions to the calendar form to stay up-to-date.

By following these key points, you can ensure a smooth and efficient pay process while managing your schedule effectively.

Browse Other Templates

Checklist of Labor Law Requirements - This checklist serves as a reference for all legal obligations in construction contracts.

Abc 227 - Each section of the application is designed to capture specific details about the event.

3rd Party Subpoena - This response is not an attempt to hinder legal proceedings but to uphold the law governing patient privacy.