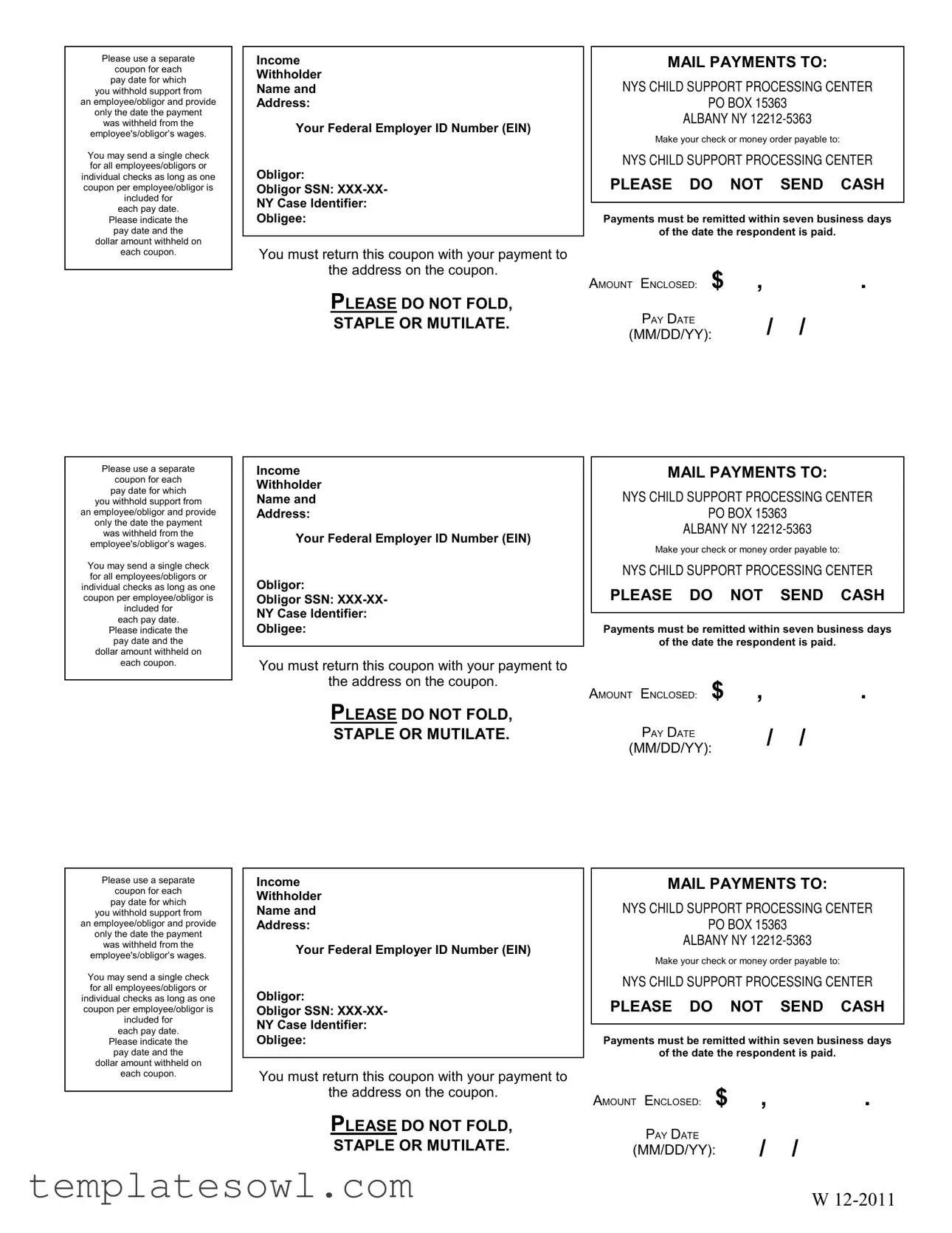

Fill Out Your Payable Coupon Form

The Payable Coupon form is a critical tool for employers and income withholders in the administration of child support payments. Proper use of this form ensures compliance with legal requirements while streamlining the payment process. To correctly fill out a coupon, each pay date for which support is withheld from an employee or obligor should have a separate coupon. This method avoids confusion and maintains accurate records. The form includes essential details such as the employee's name, their Federal Employer Identification Number (EIN), and relevant identifiers like the obligor's Social Security Number (SSN) and case identifier. Each coupon must clearly display the pay date and the dollar amount that has been withheld. While payments can be consolidated into a single check for multiple employees or obligors, it remains essential that a coupon accompanies each payment to ensure proper processing. It is important not to fold, staple, or mutilate the form, as this could hinder its processing. All forms and payments should be sent to the New York State Child Support Processing Center, with payments required to be made within seven business days following the date the respondent was paid. Ensuring all these details are correctly provided on the Payable Coupon form leads to effective communication and compliance within the child support payment system.

Payable Coupon Example

Please use a separate

coupon for each

pay date for which

you withhold support from

an employee/obligor and provide

only the date the payment

was withheld from the

employee's/obligor’s wages.

You may send a single check for all employees/obligors or individual checks as long as one

coupon per employee/obligor is

included for

each pay date.

Please indicate the

pay date and the

dollar amount withheld on

each coupon.

Please use a separate

coupon for each

pay date for which

you withhold support from

an employee/obligor and provide

only the date the payment

was withheld from the

employee's/obligor’s wages.

You may send a single check for all employees/obligors or individual checks as long as one

coupon per employee/obligor is

included for

each pay date.

Please indicate the

pay date and the

dollar amount withheld on

each coupon.

Please use a separate

coupon for each

pay date for which

you withhold support from

an employee/obligor and provide

only the date the payment

was withheld from the

employee's/obligor’s wages.

You may send a single check for all employees/obligors or individual checks as long as one

coupon per employee/obligor is

included for

each pay date.

Please indicate the

pay date and the

dollar amount withheld on

each coupon.

Income

Withholder

Name and

Address:

Your Federal Employer ID Number (EIN)

Obligor:

Obligor SSN:

NY Case Identifier:

Obligee:

You must return this coupon with your payment to

the address on the coupon.

PLEASE DO NOT FOLD,

STAPLE OR MUTILATE.

Income

Withholder

Name and

Address:

Your Federal Employer ID Number (EIN)

Obligor:

Obligor SSN:

NY Case Identifier:

Obligee:

You must return this coupon with your payment to

the address on the coupon.

PLEASE DO NOT FOLD,

STAPLE OR MUTILATE.

Income

Withholder

Name and

Address:

Your Federal Employer ID Number (EIN)

Obligor:

Obligor SSN:

NY Case Identifier:

Obligee:

You must return this coupon with your payment to

the address on the coupon.

PLEASE DO NOT FOLD,

STAPLE OR MUTILATE.

MAIL PAYMENTS TO:

NYS CHILD SUPPORT PROCESSING CENTER

PO BOX 15363

ALBANY NY

Make your check or money order payable to:

NYS CHILD SUPPORT PROCESSING CENTER

PLEASE DO NOT SEND CASH

Payments must be remitted within seven business days

of the date the respondent is paid.

AMOUNT ENCLOSED: $ |

, |

. |

PAY DATE |

/ |

/ |

(MM/DD/YY): |

MAIL PAYMENTS TO:

NYS CHILD SUPPORT PROCESSING CENTER

PO BOX 15363

ALBANY NY

Make your check or money order payable to:

NYS CHILD SUPPORT PROCESSING CENTER

PLEASE DO NOT SEND CASH

Payments must be remitted within seven business days

of the date the respondent is paid.

AMOUNT ENCLOSED: $ |

, |

. |

PAY DATE |

/ |

/ |

|

|

|

(MM/DD/YY): |

|

|

MAIL PAYMENTS TO:

NYS CHILD SUPPORT PROCESSING CENTER

PO BOX 15363

ALBANY NY

Make your check or money order payable to:

NYS CHILD SUPPORT PROCESSING CENTER

PLEASE DO NOT SEND CASH

Payments must be remitted within seven business days

of the date the respondent is paid.

AMOUNT ENCLOSED: $ |

, |

. |

PAY DATE

(MM/DD/YY): / /

W

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Payable Coupon is used to withhold support payments from an employee's or obligor's wages. |

| Individual Coupons | Each pay date requires its own separate coupon for proper tracking and accountability. |

| Payment Methods | Employers can send a single check for multiple employees or individual checks, provided each employee coupon is included for every pay date. |

| Information Required | Each coupon mandates the pay date and the exact dollar amount withheld from wages. |

| Return Instructions | Coupons must be returned with the payment to the designated address, ensuring prompt processing. |

| Payment Timeline | Payments should be submitted within seven business days after the respondent is paid. |

| Prohibition Against Cash | No cash payments are allowed; checks or money orders must be payable to the NYS Child Support Processing Center. |

| Governing Law | This form operates under New York state law, specifically related to child support enforcement. |

Guidelines on Utilizing Payable Coupon

Completing the Payable Coupon form involves entering specific information to ensure proper processing of payments withheld from employees or obligors. The form must be filled out accurately for each pay date to streamline the financial transaction. Follow these steps to fill out the Payable Coupon form correctly.

- Enter the Income Withholder Name and Address at the top of the form.

- Provide your Federal Employer ID Number (EIN).

- Fill in the Obligor section with the employee or obligor's name.

- Input the Obligor SSN in the format XXX-XX-XXXX.

- Include the NY Case Identifier relevant to the case.

- Enter the Obligee name in the designated section.

- Indicate the Pay Date in the format MM/DD/YY.

- Write the Amount Enclosed in dollars and cents (e.g., $100.00).

- Make the payment by check or money order payable to: NYS Child Support Processing Center.

- Do not send cash.

- Return the completed coupon with your payment. Ensure not to fold, staple, or mutilate the coupon.

- Mail your completed payment to: NYS Child Support Processing Center, PO Box 15363, Albany NY 12212-5363.

What You Should Know About This Form

What is the Payable Coupon form?

The Payable Coupon form is used to document withheld support payments from an employee or obligor’s wages. By completing this form, you ensure that the appropriate amounts are properly credited when reporting support payments to the state.

How many coupons should I submit?

You should use a separate coupon for each pay date from which you withhold support payments. It is essential to accurately report amounts withheld for each date to maintain clarity in your records.

Can I send a single check to cover multiple employees?

Yes, you can send a single check that combines payments for multiple employees or obligors. However, remember to include one completed Payable Coupon for each individual employee or obligor for every pay date.

What information needs to be included on each coupon?

Each coupon must indicate the pay date and the specific dollar amount withheld from the employee’s or obligor’s wages. This information is critical for accurate processing and record-keeping.

Where should I send the completed coupons and payments?

Send all completed coupons along with your payment to the NYS Child Support Processing Center at the following address: PO Box 15363, Albany, NY 12212-5363. Make sure to follow the guidelines outlined on the coupon.

What payment methods are acceptable?

When submitting payments, you may use a check or a money order made payable to the NYS Child Support Processing Center. Please do not send cash, as it cannot be accepted or processed.

How quickly do I need to make these payments?

Payments must be made within seven business days following the date on which the employee or obligor was paid. Timely remittance ensures compliance and prevents potential penalties.

What should I avoid when handling the coupons?

It is crucial not to fold, staple, or mutilate the coupons in any way. Maintaining the integrity of the coupon is important for processing and record-keeping. Always send the coupons flat and intact.

What happens if I forget to send a coupon?

If a coupon is not sent along with your payment, it may lead to delays in processing. Each coupon serves as a necessary identification tool that specifies the employee or obligor, their payment date, and the amount withheld. Always ensure that each payment corresponds with its respective coupon.

Is there any specific information required from the obligor on the coupon?

Yes, the coupon must include details such as the obligor's Social Security Number (partially masked for privacy), along with the NY Case Identifier. These details link the payment to the correct support case, ensuring accurate tracking and processing.

Common mistakes

Completing the Payable Coupon form accurately is essential for smooth processing. One common mistake is using the same coupon for multiple pay dates. Each pay date for which support is withheld should have its own separate coupon. This ensures clarity and compliance with the guidelines.

Another error occurs when individuals forget to provide the date the payment was withheld. It is crucial to include only this specific date on the coupon. Omitting this information can lead to delays in processing or issues with tracking payments.

Additionally, failing to indicate the correct dollar amount withheld on each coupon can cause misunderstandings. Each coupon must clearly display the amount being remitted for that pay date. Inaccuracies in the amount can lead to complications with future payments.

Some individuals make the mistake of folding, stapling, or mutilating the coupon. It is important to keep the form intact when submitting it alongside the payment. Follow the instruction to avoid any damages that might affect processing.

Incorrect addressing is another frequent issue. The coupon must be returned to the specified address: NYS Child Support Processing Center, PO Box 15363, Albany NY 12212-5363. Double-check the address to ensure proper delivery.

Providing an incorrect or missing Federal Employer ID Number (EIN) is yet another common mistake. This number is vital to identify the income withholder and must be included accurately.

People sometimes forget to include their name and address as the income withholder on the coupon. This detail helps identify the sender and ensures proper record-keeping, so ensure that this information is filled out completely.

Leaving the Obligor Social Security Number (SSN) section blank or filling it in inaccurately can lead to further complications. Carefully enter the correct SSN to connect the payment to the right obligor.

Some individuals fail to send the coupon with their payment or neglect to attach it at all. Remember, the coupon must accompany the payment to ensure it is credited accurately. Incomplete submissions can lead to processing delays.

Lastly, not adhering to the seven business days requirement for remittance can result in penalties. Payments must be sent promptly after the respondent is paid to remain compliant with obligations. Keep this timeframe in mind when preparing the payment.

Documents used along the form

The Payable Coupon form is essential for managing child support payments withheld from an employee's wages. However, several other documents are often used in conjunction with it to ensure compliance and proper processing. These documents serve various purposes, ranging from identity verification to payment tracking, and help streamline the entire process.

- Employee Withholding Authorization Form: This document authorizes the employer to withhold a specified amount from an employee's wages for child support obligations. It provides necessary details about the employee and the recipient of the support.

- Child Support Order: This legal document outlines the obligations of the individual responsible for child support. It specifies payment amounts, frequency, and any other relevant conditions dictated by the court.

- Payment History Record: This form tracks all payments made toward child support. It includes dates, amounts, and any adjustments. Having a clear record helps both custodial and non-custodial parents stay informed and resolve any disputes regarding payments.

- Notification of Change in Employment: Should an employee change jobs, this document informs the child support enforcement agency about the transition. It ensures that child support payments continue without interruption, safeguarding the interests of the child.

- Proof of Income Statement: Often required to verify an obligor's income, this document helps calculate appropriate child support amounts. It can be a pay stub or a tax return, depending on the situation.

- Summary of Payments Report: This report summarizes all child support payments made within a specific period. It can assist both parties in understanding their financial responsibilities and help in addressing any discrepancies.

By understanding the role of these additional forms and documents, those involved in child support cases can better navigate the process. Ensuring accurate and timely communication is key to fulfilling obligations effectively.

Similar forms

- Pay Stub: A pay stub provides employees with a detailed breakdown of their earnings for a specific pay period. Like the Payable Coupon form, it indicates amounts withheld from the employee's wages, including taxes and other deductions.

- Wage Assignment Document: This document outlines the specifics of wage garnishment, similar to how the Payable Coupon form must provide information about wages withheld for support obligations. Both serve to ensure that amounts are correctly diverted for designated payments.

- IRS Form W-2: Employers send W-2 forms to employees detailing annual wage and tax information. This is akin to the Payable Coupon because both must document payments and withholdings for reporting purposes, though the W-2 focuses on annual totals while the Payable Coupon details each specific payment.

- Direct Deposit Authorization Form: This form allows employees to have their wages directly deposited into their bank account. While it serves a different purpose, both this document and the Payable Coupon facilitate the management of wage payment flows and ensure that payments are made under specified conditions.

- Child Support Payment Record: A record maintained to track payments made for child support obligations is similar to the Payable Coupon as both document the amounts withheld from wages. Each serves as proof of compliance with legal support obligations and ensures accurate payment histories.

Dos and Don'ts

When completing the Payable Coupon form for child support withholdings, following the correct guidelines is crucial. Here’s a list of important dos and don'ts to help you navigate the process effectively:

- Do use a separate coupon for each pay date.

- Do indicate the date the payment was withheld from the employee's or obligor's wages.

- Do include the dollar amount withheld on each coupon.

- Do provide your Federal Employer ID Number (EIN) accurately.

- Do send a single check for all employees/obligors or individual checks as long as one coupon is included for each.

- Don't fold, staple, or mutilate the coupon.

- Don't send cash when making payments.

- Don't forget to mail the coupon with your payment to the correct address.

- Don't delay; payments must be made within seven business days after the respondent is paid.

- Don't make checks payable to anyone other than NYS Child Support Processing Center.

Following these guidelines will streamline your process and ensure compliance. Don’t take shortcuts; the details matter greatly in this situation!

Misconceptions

Many people have misunderstandings about the Payable Coupon form used for withholding support from an employee or obligor. Below are some common misconceptions.

- One coupon can be used for multiple pay dates. Each pay date requires a separate coupon. This ensures accurate record-keeping for each payment withheld.

- Payments can be sent without the coupon. It is essential to return the coupon with the payment. Failure to do so may result in delays or misattributed payments.

- Cash payments are acceptable. Cash is not allowed. Always make checks or money orders payable to the NYS Child Support Processing Center.

- Payments do not need to be remitted quickly. Payments must be sent within seven business days of when the respondent is paid. Timely remittance is critical for compliance.

- Folding or stapling the coupon is fine. You should not fold, staple, or otherwise mutilate the coupon. Doing so can cause processing issues.

- One coupon can be used for all employees/obligors. Each employee or obligor needs their own coupon. This maintains clarity in records and simplifies the processing for each individual case.

Understanding these aspects can help ensure that the payment process goes smoothly.

Key takeaways

Filling out the Payable Coupon form accurately is essential for ensuring timely processing of payments related to employee support withholdings. Here are key takeaways to keep in mind:

- Each pay date requires a separate coupon. Do not combine pay dates on one coupon.

- Provide only the date the payment was withheld from the employee's or obligor’s wages.

- You can send either a single check for all employees/obligors or individual checks. Ensure that one coupon is included for each employee/obligor.

- Clearly indicate the pay date and the dollar amount withheld on each coupon.

- Return the completed coupon with your payment to the address specified on the coupon. Ensure it is not folded or stapled.

- Payments must be remitted within seven business days after the date the respondent is paid to avoid delays.

By adhering to these guidelines, you can help facilitate a smoother payment process and avoid potential issues.

Browse Other Templates

What Is Transcript of Record in School - Timely submission is key to receiving transcripts when needed.

Gamestop Application Pdf - Open availability can enhance employment opportunities.

Form Ca-17 - Claimants are encouraged to keep copies of all documentation submitted for their records.