Fill Out Your Paychekplus Epaystub Form

The Paychekplus Epaystub form serves as an essential online tool for accessing paycheck information conveniently and securely. This system allows employees to view and print their paycheck stubs whenever needed, significantly enhancing accessibility while promoting environmental responsibility by reducing paper usage. By having a digital record of up to 13 months of paycheck stubs, individuals can better manage their financial documentation without the fear of losing important papers. Accessing your ePayStub is straightforward and involves simple steps: visit the designated website, log in using your personal information, and select the pay period you wish to view. For those without internet access, a phone option provides an alternative to hear a summary of paycheck details. This streamlined process not only offers convenience but also ensures that personal data remains encrypted and private, contributing to both user peace of mind and the company's commitment to reducing operational costs linked to traditional paycheck stub distribution.

Paychekplus Epaystub Example

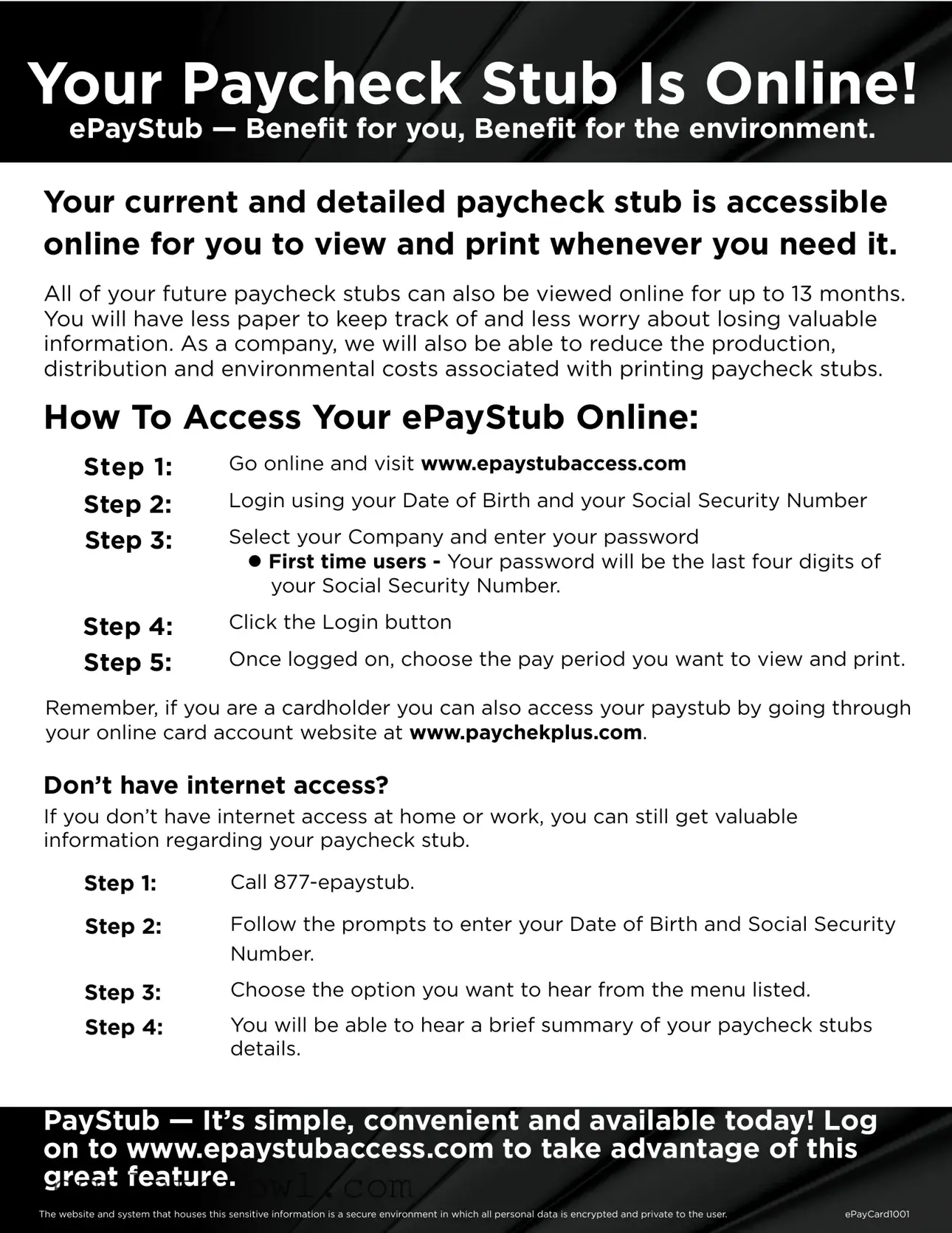

Your Paycheck Stub Is Online!

ePayStub — Benefit for you, Benefit for the environment.

Your current and detailed paycheck stub is accessible online for you to view and print whenever you need it.

All of your future paycheck stubs can also be viewed online for up to 13 months. You will have less paper to keep track of and less worry about losing valuable information. As a company, we will also be able to reduce the production, distribution and environmental costs associated with printing paycheck stubs.

How To Access Your ePayStub Online:

Step 1:

Step 2:

Step 3:

Step 4: Step 5:

Go online and visit www.epaystubaccess.com

Login using your Date of Birth and your Social Security Number

Select your Company and enter your password

l First time users - Your password will be the last four digits of your Social Security Number.

Click the Login button

Once logged on, choose the pay period you want to view and print.

Remember, if you are a cardholder you can also access your paystub by going through your online card account website at www.paychekplus.com.

Don’t have internet access?

If you don’t have internet access at home or work, you can still get valuable information regarding your paycheck stub.

Step 1:

Step 2:

Step 3: Step 4:

Call

Follow the prompts to enter your Date of Birth and Social Security Number.

Choose the option you want to hear from the menu listed.

You will be able to hear a brief summary of your paycheck stubs details.

PayStub — It’s simple, convenient and available today! Log on to www.epaystubaccess.com to take advantage of this great feature.

The website and system that houses this sensitive information is a secure environment in which all personal data is encrypted and private to the user. |

ePayCard1001 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Online Access | Your paycheck stub is accessible online, allowing you to view and print it anytime you need. |

| 13-Month Storage | You can access your future paycheck stubs online for up to 13 months. |

| Environmental Benefit | The ePayStub system reduces paper usage and environmental costs associated with traditional printing. |

| Secure Environment | Your personal data is stored in a secure environment, ensuring that all information is encrypted and private. |

| Access Without Internet | If you lack internet access, you can call 877-epaystub to hear a summary of your paycheck stub details. |

| First-Time Password | For first-time users, the password will be the last four digits of your Social Security Number. |

Guidelines on Utilizing Paychekplus Epaystub

Accessing your Paychekplus ePayStub is straightforward and beneficial for managing your paycheck information efficiently. With online access, you can view and print your paycheck stubs whenever needed. This system simplifies your financial records by reducing paper use and enhancing privacy. Follow these steps to fill out the online form correctly.

- Go online and visit www.epaystubaccess.com.

- Login using your Date of Birth and your Social Security Number.

- Select your Company and enter your password. If you are a first-time user, your password will be the last four digits of your Social Security Number.

- Click the Login button.

- Once logged on, choose the pay period you want to view and print.

If you are a cardholder, you can also access your paystub through your online card account at www.paychekplus.com. In case you lack internet access, you can retrieve paycheck details by following these steps:

- Call 877-epaystub.

- Follow the prompts to enter your Date of Birth and Social Security Number.

- Choose the option you want to hear from the menu listed.

- You will be able to hear a brief summary of your paycheck stub's details.

Remember, this online system is secure, ensuring your personal data remains private and protected.

What You Should Know About This Form

What is the Paychekplus ePaystub form?

The Paychekplus ePaystub form is an online tool that allows you to view and print your paycheck stubs. By accessing this form, you benefit from having your paycheck information available at your convenience, eliminating the clutter of physical paperwork. It ensures that your information is accessible for up to 13 months.

How do I access my ePaystub online?

To access your ePaystub, follow these simple steps: First, go to www.epaystubaccess.com. Next, log in using your Date of Birth and your Social Security Number. Select your company and enter your password, which for first-time users will be the last four digits of your Social Security Number. After logging in, choose the pay period you want to review or print. If you're a cardholder, you can also check your paystub through your online card account at www.paychekplus.com.

What if I don't have internet access?

If you lack internet access, you can still obtain valuable paycheck stub information. Simply call 877-epaystub. You'll need to follow the prompts to input your Date of Birth and Social Security Number. Once you've done that, you can select from a menu of options to hear a brief summary of your paycheck stub details.

How secure is my personal data on the ePaystub system?

Your privacy and security are taken seriously. The website and system where your sensitive information is stored are secure environments. All personal data is encrypted, ensuring that only you have access to your information.

How long can I access my previous paycheck stubs?

You will be able to view and print your paycheck stubs online for up to 13 months. This feature not only helps in keeping track of your earnings but also minimizes the worry of losing important documents.

What are the environmental benefits of using ePaystub?

Using ePaystub helps reduce paper waste since all your paycheck stubs are stored digitally. As a company, this shift also decreases the resources spent on printing and distributing paper stubs, contributing positively to the environment.

What should I do if I encounter issues accessing my ePaystub?

If you face any problems while trying to access your ePaystub, verify that you are entering your Date of Birth and Social Security Number correctly. If issues persist, consider reaching out to your HR department or the designated support team for assistance to ensure you can access your important information without delay.

Common mistakes

Filling out the Paychekplus Epaystub form can seem straightforward; however, individuals often make common mistakes that can prevent them from accessing their information smoothly. One frequent error occurs when users enter their Date of Birth. It is essential to ensure that the date is formatted correctly to avoid login issues. Incorrect entries may lead to an inability to access the paystub, resulting in frustration.

Another mistake people often make is entering an incorrect Social Security Number. Double-checking this number is crucial, as even a single digit off can prevent successful login. It is advisable for users to have this number readily available for reference when completing the online form.

Many individuals overlook their company selection during the login process. Selecting the wrong company can cause delays in accessing the paycheck stub. Users should confirm that they have chosen the correct employer from the provided list to avoid this pitfall.

Using the default password can also lead to mistakes. For first-time users, the password is the last four digits of the Social Security Number. However, some individuals may forget or misremember these digits. Taking a moment to verify this information can help alleviate access problems.

Another common mistake involves neglecting to click the Login button after inputting the required information. Users may mistakenly believe that their information is automatically submitted. Ensuring that this step is completed is necessary to access the information correctly.

Some users may not be aware that they can also view their paystubs through their online card account at www.paychekplus.com. Ignoring this option can lead to unnecessary complications when trying to access important financial documents.

For those without internet access, there is a viable alternative option. People sometimes forget to call the provided phone number, which serves as another way to obtain paycheck details. Following the prompts on the phone service is a valid option when online access is not available.

Simplifying the access method is often beneficial. Individuals may forget that they can hear a brief summary of their paycheck stubs by selecting the appropriate options during their call. Understanding these options fully can result in a smoother experience.

It is also important to remember that personal data is sensitive and needs to be protected. Not familiarizing oneself with the security features of the website can lead to misunderstandings about data encryption and privacy, potentially causing concern about using an online platform.

Lastly, failing to take advantage of the easy features available can hinder access. Users should recognize the simplicity and convenience of the ePayStub system, as logging in is designed to be straightforward. Taking a few moments to review these steps can help ensure a successful login and access to important paycheck information.

Documents used along the form

When utilizing the Paychekplus ePaystub form, several other forms and documents are commonly associated with payroll and payment processes. Understanding these can simplify your financial record-keeping and ensure you are well-informed about your income and benefits.

- W-2 Form: This document provides an annual summary of your earnings and taxes withheld. Employers must send W-2 forms to employees by January 31st each year for tax reporting purposes.

- 1099 Form: For independent contractors and freelancers, a 1099 form outlines income received from different clients. Unlike the W-2, it does not include tax withholdings, which makes it essential for self-reporting taxes.

- I-9 Form: Required for verification of employment eligibility, the I-9 form includes information about your identity and eligibility to work in the U.S. Employers must keep this form on file for each employee.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit wages directly into their bank account, reducing the need for paper checks and simplifying the payroll process.

- Vacation/Sick Leave Request Form: Use this form to formally request time off due to vacation or illness. It documents your request and provides a paper trail for both employer and employee to reference.

- Payroll Change Form: When there are changes to your payroll information—like an address change, updated tax withholdings, or direct deposit adjustments—this form enables you to communicate those changes to your employer officially.

- Employee Handbook: While not a form, the employee handbook outlines company policies that govern payroll, benefits, and employee rights. It's a valuable resource for understanding your entitlements and responsibilities.

- Health Benefits Enrollment Form: If your employer offers health benefits, this form is crucial for enrolling in a plan and selecting coverage options that meet your needs.

- Retirement Plan Enrollment Form: To participate in an employer-sponsored retirement savings plan, employees must complete this form, which details their contribution preferences and investment choices.

Being familiar with these documents enhances your overall understanding of your employment and financial rights. Keeping them organized can lead to a smoother communication process with your employer while ensuring you remain informed about your income and benefits.

Similar forms

- Traditional Pay Stub - A document given to employees that outlines their earnings for a pay period, along with deductions and tax withholdings. Like the ePayStub, it provides a breakdown of gross pay, net pay, and various deductions.

- W-2 Form - Issued at the end of the tax year, this document summarizes an employee's annual wages and taxes withheld. Both forms serve as important records of income, but the W-2 is used for tax filing purposes.

- 1040 Tax Return - This form is used by individuals to report their annual income and calculate their tax liability. Similar to the ePayStub, it includes income details, yet it encompasses a wider range of financial information for tax purposes.

- Direct Deposit Authorization Form - This document allows employees to receive their wages directly into their bank accounts. While the form does not provide paycheck details, it is connected by facilitating a streamlined payroll process.

- Payroll Register - A summary report maintained by employers that lists all employees’ earnings and deductions for a specific pay period. This document works in conjunction with the ePayStub for internal record-keeping.

- Employee Earnings Record - A cumulative record tracking an employee's earnings over time. Like the ePayStub, it offers historical data but is typically kept as an internal document by the employer.

- Tax Withholding Allowance Certificate (W-4) - This form helps employers determine the amount of tax to withhold from an employee's paycheck. The W-4 impacts the information seen on the ePayStub by influencing tax deductions.

- Benefits Statement - This document outlines an employee's eligibility and information regarding benefits, such as health insurance and retirement plans. Both documents provide critical information for financial planning but focus on different aspects of compensation.

- Payment Settlement Document - Similar in function to an ePayStub, this document summarizes payments made for services rendered, especially for contractors or freelancers. It is a record of payment, although generally less detailed than a pay stub.

Dos and Don'ts

When filling out the Paychekplus ePaystub form, there are various practices that can help ensure a smooth experience. Below is a list of things you should and shouldn’t do:

- Do: Visit the official ePaystub website at www.epaystubaccess.com.

- Do: Use your Date of Birth and Social Security Number to log in.

- Do: Select your company accurately before entering your password.

- Do: Remember your password is the last four digits of your Social Security Number for first-time users.

- Do: Choose the correct pay period to view or print your paycheck stub.

- Don’t: Share your Social Security Number or password with anyone else.

- Don’t: Use public or unsecured Wi-Fi networks to access your information.

- Don’t: Try to access the system from outdated or unverified devices.

- Don’t: Ignore prompts if you're calling for help instead of accessing online.

- Don’t: Forget to secure your personal information and log out after each session.

Misconceptions

There are several misconceptions about the Paychekplus ePaystub form that can lead to confusion. It's essential to clarify these points to ensure users understand how to access their pay information accurately.

- Misconception 1: Accessing the ePaystub requires a work email.

- Misconception 2: ePaystubs cannot be printed.

- Misconception 3: Information is not secure online.

- Misconception 4: You can only access your ePaystub if you have internet at home.

This is incorrect. Users do not need a work email to access their ePaystub. All necessary steps can be completed using personal information such as a date of birth and Social Security number.

Many believe they cannot print their ePaystubs. In reality, once logged in, users can view and print their paycheck stubs whenever they need them, providing convenience and easy record-keeping.

Some individuals worry about the safety of their personal data. The platform uses encryption, ensuring that all user information remains private and secure while being accessed online.

This is not true. Users can still obtain their paycheck stub information by calling customer service. By following a simple phone menu, they can hear a summary of their paycheck stub details without needing internet access.

Key takeaways

Here are key takeaways on filling out and using the Paychekplus ePaystub form:

- Your paycheck stub is available online, allowing easy access and print options whenever needed.

- Future paycheck stubs can be viewed online for up to 13 months, reducing paper clutter and loss of information.

- Access your ePaystub by visiting www.epaystubaccess.com and logging in with your Date of Birth and Social Security Number.

- First-time users have a simple login process, using the last four digits of their Social Security Number as the password.

- If internet access is unavailable, you can still retrieve paycheck stub information by calling 877-epaystub.

- The website provides a secure environment where all personal data is encrypted, ensuring your information remains private.

Taking advantage of this online feature is simple and enhances your convenience.

Browse Other Templates

What Is a P11 - Follow all provided instructions to ensure compliance.

Form 886-h-eic - Taxpayers should maintain organized records of all documentation related to dependent claims.