Fill Out Your Paychex Direct Deposit Form

The Paychex Direct Deposit form serves as an essential tool for employees seeking to ensure seamless and efficient payment processing through bank account deposits. This form simplifies the direct deposit setup, allowing individuals to add, update, or replace their existing bank account details with clarity and precision. It requires basic information such as the employee's name, unique worker number, and the company name or client number to facilitate proper identification. Within the form, employees specify whether they wish to direct their entire net pay to a particular account or designate a specific dollar amount or percentage, providing flexibility tailored to their financial needs. Additionally, employees must acknowledge their authority over the specified bank accounts and confirm the accuracy of their information; therefore, only original signatures are permissible—a crucial point ensuring security and authenticity. After completion, it's vital for employees to retain a copy for their records and submit the original to their employer, who likewise needs to keep a copy for compliance purposes. This thorough documentation procedure plays a significant role in safeguarding the interests of both parties involved.

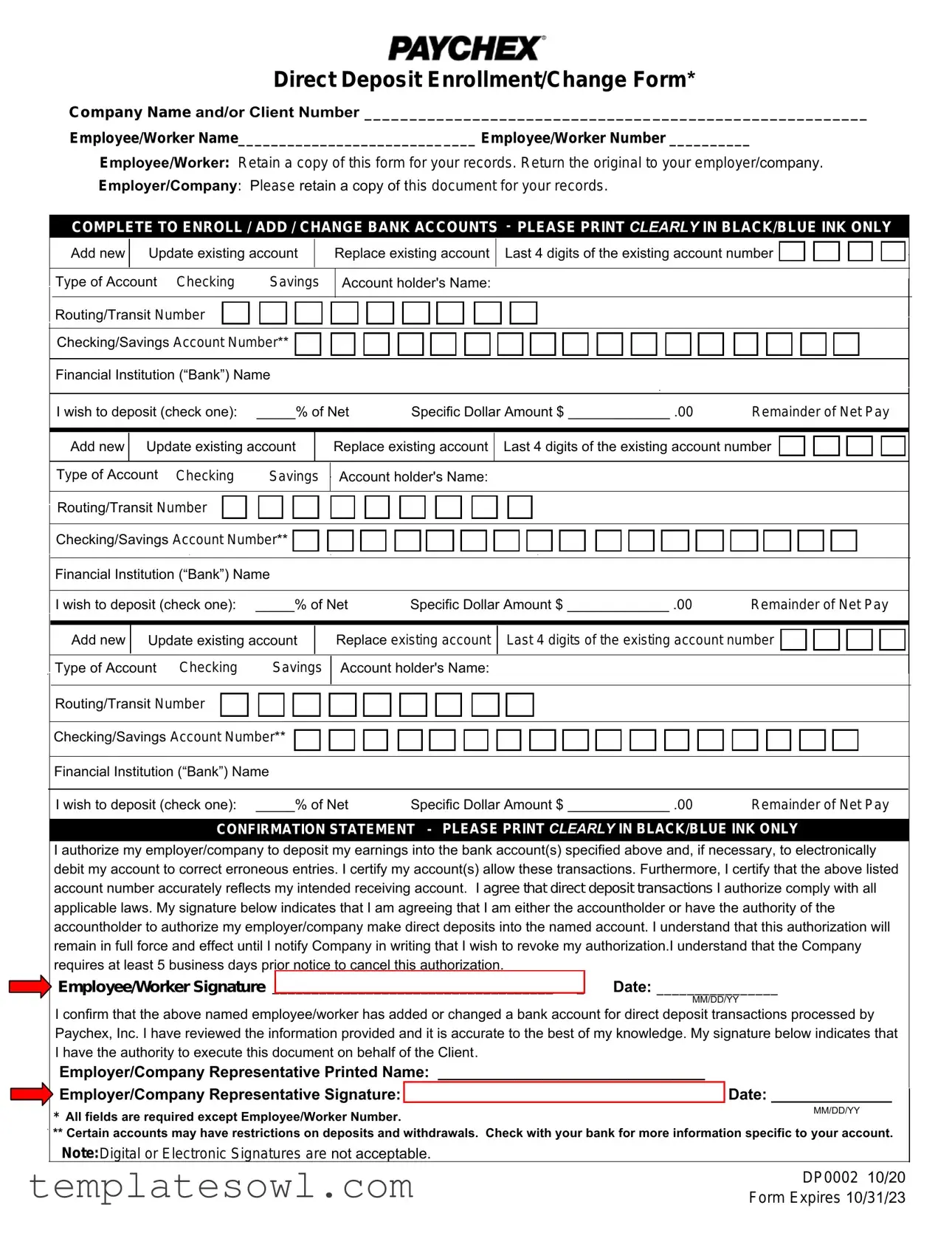

Paychex Direct Deposit Example

Direct Deposit Enrollment/Change Form*

Company Name and/or Client Number ________________________________________________________

Employee/Worker Name_____________________________ Employee/Worker Number __________

Employee/Worker: Retain a copy of this form for your records. Return the original to your employer/company.

Employer/Company: Please retain a copy of this document for your records.

COMPLETE TO ENROLL / ADD / CHANGE BANK ACCOUNTS

–

PLEASE PRINT CLEARLY IN BLACK/BLUE INK ONLY

Add new

Update existing account

Replace existing account

Last 4 digits of the existing account number

Type of Account Checking |

Savings |

Account holder's Name:

Routing/Transit Number

Checking/Savings Account Number**

Financial Institution (“Bank”) Name

I wish to deposit (check one): _____% of Net |

Specific Dollar Amount $ _____________ .00 |

Remainder of Net Pay |

Add new

Update existing account

Replace existing account

Last 4 digits of the existing account number

Type of Account Checking |

Savings |

Account holder's Name:

Routing/Transit Number

Checking/Savings Account Number**

Financial Institution (“Bank”) Name

I wish to deposit (check one): _____% of Net |

Specific Dollar Amount $ _____________ .00 |

Remainder of Net Pay |

Add new

Update existing account

Replace existing account

Last 4 digits of the existing account number

Type of Account Checking |

Savings |

Account holder's Name:

Routing/Transit Number

Checking/Savings Account Number**

Financial Institution (“Bank”) Name

I wish to deposit (check one): _____% of Net |

Specific Dollar Amount $ _____________ .00 |

Remainder of Net Pay |

CONFIRMATION STATEMENT

–

PLEASE PRINT CLEARLY IN BLACK/BLUE INK ONLY

I authorize my employer/company to deposit my earnings into the bank account(s) specified above and, if necessary, to electronically debit my account to correct erroneous entries. I certify my account(s) allow these transactions. Furthermore, I certify that the above listed account number accurately reflects my intended receiving account. I agree that direct deposit transactions I authorize comply with all applicable laws. My signature below indicates that I am agreeing that I am either the accountholder or have the authority of the accountholder to authorize my employer/company make direct deposits into the named account. I understand that this authorization will remain in full force and effect until I notify Company in writing that I wish to revoke my authorization.I understand that the Company requires at least 5 business days prior notice to cancel this authorization.

Employee/Worker Signature ________________________________________ |

Date: ________________ |

|

MM/DD/YY |

I confirm that the above named employee/worker has added or changed a bank account for direct deposit transactions processed by Paychex, Inc. I have reviewed the information provided and it is accurate to the best of my knowledge. My signature below indicates that I have the authority to execute this document on behalf of the Client.

Employer/Company Representative Printed Name: _______________________________

Employer/Company Representative Signature: _____________________________________ Date: ______________

* All fields are required except Employee/Worker Number. |

MM/DD/YY |

|

** Certain accounts may have restrictions on deposits and withdrawals. Check with your bank for more information specific to your account.

Note:Digital or Electronic Signatures are not acceptable.

DP0002 10/20

Form Expires 10/31/23

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Paychex Direct Deposit form allows employees to enroll, add, or change their direct deposit banking information. |

| Required Information | Employees must provide their name, employer information, and banking details, including account and routing numbers. |

| Account Types | Employees can indicate whether they want funds deposited into a checking or savings account. |

| Deposit Options | Employees can choose to deposit a percentage of net pay, a specific dollar amount, or the remainder of their net pay. |

| Authorization | By signing the form, employees authorize their employer to deposit earnings into specified accounts and to correct errors. |

| Record Keeping | Both employees and employers must retain copies of the completed form for their records. |

| Signature Requirement | A handwritten signature from the employee is required to validate the authorization; digital signatures are not accepted. |

| Revocation Notice | Employees must provide at least 5 business days' notice in writing to revoke their authorization for direct deposit. |

| Compliance | Direct deposit transactions must comply with applicable laws and regulations, including those specific to each state. |

| Expiration | The form is valid until the expiration date indicated at the bottom, which is 10/31/23 for the current version. |

Guidelines on Utilizing Paychex Direct Deposit

Once you have the Paychex Direct Deposit form in hand, you’re ready to fill it out. This form allows you to enroll, add, or change your bank account details for direct deposit. Make sure to print clearly in black or blue ink throughout the process. After completing this form, you must return the original to your employer while keeping a copy for your records.

- Enter the Company Name and/or Client Number at the top of the form.

- Fill in your Employee/Worker Name.

- Write your Employee/Worker Number. This field is optional.

- Decide whether you are adding a new account, updating an existing one, or replacing an existing account, and check the appropriate box.

- If you are updating or replacing, provide the last 4 digits of the existing account number.

- Select the Type of Account: Checking or Savings.

- Fill in the Account Holder's Name.

- Provide the Routing/Transit Number for your bank.

- Input your Checking/Savings Account Number.

- Write the name of your Financial Institution (Bank).

- Choose how you want your deposits: specify either a percentage of your net pay or a specific dollar amount. Indicate your preference by checking the box and entering the amount if applicable.

- Repeat steps 4-10 for any additional accounts you wish to add or modify.

- Sign and date the form in the designated area, confirming your authorization for direct deposits.

- Have an employer/company representative sign the form, confirming the accuracy of the provided information.

What You Should Know About This Form

What is the Paychex Direct Deposit form used for?

The Paychex Direct Deposit form is used to enroll in or make changes to direct deposit payments for employees or workers. By completing this form, individuals can specify the bank account where their earnings should be deposited, ensuring a smooth and efficient payment process.

How do I fill out the Direct Deposit form?

To fill out the Direct Deposit form, print clearly in black or blue ink only. You will need to provide your company name or client number, your name, and employee or worker number. Then, indicate if you want to add a new account, update an existing one, or replace an account. Fill in the details of your bank account, including the account holder's name, account number, and routing number.

Can I use this form for multiple bank accounts?

Yes, the form allows you to set up direct deposit for multiple bank accounts. You can specify the percentage of your net pay or a specific dollar amount to be deposited into each account. Just complete the relevant sections for each bank account you wish to include.

What should I do with the completed form?

After filling out the form, keep a copy for your records. Then, return the original form to your employer or the relevant company representative. It’s important that both you and your employer retain a copy for future reference.

How long does it take for the direct deposit to start after submitting the form?

Once you submit the completed Direct Deposit form, your employer typically requires at least 5 business days to process the request. After this period, you should see the direct deposit in your designated account. However, be sure to check with your employer for their specific processing timeline.

What if I want to change or cancel my direct deposit?

If you wish to change or cancel your direct deposit, you must provide written notification to your employer. It is essential to give at least 5 business days’ notice for any changes or cancellations to take effect. This notice ensures that your employer can make the necessary adjustments in a timely manner.

What happens if I provide incorrect banking information?

Providing incorrect banking information can cause delays in your direct deposit. If there are any errors, your employer has the authority to electronically debit your account to correct erroneous entries. Always double-check your account details before submitting the form to avoid issues.

Are digital signatures accepted on this form?

No, digital or electronic signatures are not acceptable on the Paychex Direct Deposit form. Both employee and company signatures must be handwritten to validate the document properly.

What should I check with my bank before using this form?

Before submitting the Paychex Direct Deposit form, it’s advisable to check with your bank regarding any restrictions on deposits and withdrawals associated with your accounts. Each bank may have specific policies that could affect your direct deposit setup.

Common mistakes

Completing the Paychex Direct Deposit form can be simple, but there are common mistakes that people often make. These errors can lead to delays in receiving payments or complications with bank accounts. Being aware of these mistakes is essential for a smooth process.

One frequent issue is failing to fill in the Company Name and/or Client Number. This information is crucial as it links the employee to the correct employer. Omitting it can cause confusion and may result in processing delays. Always double-check that this field is completed accurately.

Another common error involves account numbers. Many individuals write down the wrong account or routing numbers. It's important to ensure that these numbers are entered correctly. Even a single digit off can lead to funds being deposited in the wrong account. Taking a moment to verify this information with bank documents can prevent headaches later.

People often overlook the need to clearly indicate the type of account. Whether it's a checking or savings account should be confirmed. If left blank, this could lead to misprocessing and delays. Always ensure this information is clearly marked.

Additionally, a frequent oversight is the percentage or dollar amount to be deposited. Some individuals may forget to fill in this section or leave it ambiguity. Clearly specifying the amount or percentage ensures that the right funds go into the right accounts as intended.

Lastly, many individuals neglect to sign and date the form. Without a signature, the form is incomplete and may not be processed. Be sure to sign and date the form to confirm that all the information provided is correct and that you authorize the transactions as stated.

Documents used along the form

The process of managing direct deposits often involves several important forms and documents. Each of these forms serves a distinct purpose and helps ensure that both employees and employers fulfill their roles effectively. Understanding these documents can offer clarity and reassurance during payroll processing. Below is a list of commonly used forms that are essential alongside the Paychex Direct Deposit form.

- Employee Information Form: This document gathers essential personal details about the employee, including their name, address, Social Security number, and emergency contact information. It helps employers maintain accurate records and ensure that communication channels are open.

- W-4 Form: The W-4 is used by employees to indicate their tax withholding preferences. Proper completion of this form allows the employer to deduct the correct amount of federal income tax from each paycheck, thereby preventing any tax-related discrepancies for the employee.

- Bank Verification Letter: Some employers may require a letter from the employee's bank confirming account details. This document is critical for verifying that the bank account is valid and that the employee is authorized to receive deposits into that account.

- Authorization for Payroll Deductions: This form allows employees to consent to any deductions from their paychecks apart from taxes. Examples include contributions to retirement plans, health insurance premiums, or flexible spending accounts that the employee opts into.

- Employment Agreement: This contract outlines the terms and expectations of the employment relationship, including salary, benefits, and responsibilities. Having a clear agreement ensures both parties have aligned expectations regarding compensation and job duties.

Familiarizing oneself with these documents enhances understanding and helps streamline the administrative processes associated with payroll. Employees should take the time to fill them out accurately and retain copies for their personal records. By doing so, clarity is maintained for both the employee and employer in regard to financial transactions and responsibilities.

Similar forms

- W-4 Form: Much like the Paychex Direct Deposit form, the W-4 form helps ensure that employees provide accurate information regarding their finances. Both documents are crucial for determining the correct handling of employee earnings and account details.

- Direct Deposit Authorization Form: This document serves the same purpose as the Paychex form, enabling employees to authorize deposits into their bank accounts. Its structure includes details about the employee, the bank, and account preferences.

- Bank Account Application: Similar to the Paychex Direct Deposit form, a bank account application requires personal and financial information to facilitate transactions. Both involve confirming account details for error prevention.

- Employee Change of Information Form: Both forms allow employees to update critical information related to their employment status. Employees rely on each to ensure that financial and personal records remain current and accurate.

- Payroll Registration Form: This form collects necessary details for processing payroll, sharing similarities with the Paychex Direct Deposit form by focusing on account numbers and payment preferences.

- Payment Authorization Form: Similar in purpose, this form enables individuals to authorize payments through various methods. It contains essential account information to ensure payments are processed correctly.

- Tax Eligibility Form: This document gathers information relevant for tax purposes, paralleling the Paychex Direct Deposit form in that it supports correct handling of earnings and ensures compliance with applicable laws.

Dos and Don'ts

Filling out the Paychex Direct Deposit form accurately is essential for ensuring that employees receive their pay without any issues. Here are some important guidelines to follow:

- Do print clearly using blue or black ink. This ensures your information is readable and reduces the chance of errors.

- Don’t leave any required fields blank. Completing every section is crucial for the processing of your direct deposit.

- Do double-check your bank account numbers, routing numbers, and any dollar amounts. Mistakes here can lead to delays in receiving your funds.

- Don’t use digital or electronic signatures. A handwritten signature is necessary for the authorization to be valid.

- Do keep a copy of the completed form for your records. This helps in maintaining your own documentation should any issues arise.

- Don’t ignore the requirement for at least five business days' notice if you wish to revoke your authorization. Planning ahead is important.

- Do confirm that the financial institution allows direct deposit. Some banks have specific restrictions that could affect your account.

- Don’t submit the form without ensuring that your employer has the latest version. Using an outdated form may cause processing issues.

Following these dos and don'ts will help facilitate a smooth direct deposit enrollment or change process, ensuring that you receive your payments promptly and accurately.

Misconceptions

Understanding the Paychex Direct Deposit form can help avoid confusion. Below are five misconceptions about this form, along with clarifications for each:

- Direct deposit is mandatory for all employees. Many believe that direct deposit is a requirement. In reality, it is often optional. Employees can choose whether or not to participate based on their preferences.

- Filling out the form incorrectly will lead to penalties. Some individuals fear that mistakes will result in financial repercussions. Generally, errors can be corrected when reported promptly, and there are no punitive measures just for submitting an inaccurate form.

- All banks can process direct deposits without issue. A common misconception is that every financial institution is the same. However, some banks have specific policies regarding direct deposits. It is wise to check with the bank to confirm that they can handle such transactions.

- Once submitted, the form cannot be changed. Many think that submitting the form is a permanent decision. In truth, employees can update their direct deposit information whenever necessary, following the appropriate procedures outlined by their employer.

- The company will always notify you of a successful deposit. There is a belief that employees will receive confirmation from their employer every time a deposit is made. While some companies provide notifications, it is not a universal practice. Employees should keep track of their bank statements to confirm deposits.

Key takeaways

When considering the Paychex Direct Deposit form, there are several key points to keep in mind to ensure a smooth experience. Below are important details that each employee and employer should understand.

- Retain a Copy: Employees are encouraged to keep a copy of the form for their records after submission. Employers should also maintain a copy for their documentation.

- Clear Printing: It is crucial to fill out the form using clear, legible handwriting in black or blue ink. This minimizes the risk of errors in processing.

- Multiple Accounts: The form allows for the addition, updating, or replacement of multiple bank accounts. Each account should be completed separately as instructed.

- Deposit Options: Employees can choose to deposit a specific percentage of their net pay, a specific dollar amount, or the remainder of their net pay into their chosen accounts.

- Include Accurate Information: Providing accurate details, such as routing numbers and account numbers, is essential for ensuring that the payment is directed to the correct financial institution.

- Authorization: Employees must sign the form to authorize their employer to deposit earnings into the specified bank accounts and, if necessary, debit for corrections.

- Ongoing Authorization: The completed authorization remains effective until the employee submits a written request to revoke it. Notice of at least 5 business days is required for cancellations.

- Restrictions: It is important to note that some bank accounts may have restrictions regarding deposits. Employees should verify with their bank to understand any limitations.

- Signature Requirements: Digital or electronic signatures are not acceptable. Employees must provide a handwritten signature to validate the form.

By understanding these points, employees can navigate the Paychex Direct Deposit process with greater ease, while employers can ensure compliance and accuracy in handling direct deposit requests.

Browse Other Templates

Llc Fees Illinois - The form includes a section to provide the name of the limited liability company and its Secretary of State file number.

What Is Hepatitis B Virus - Participation in training is crucial before making your decision.