Fill Out Your Paychex Paystub Form

Understanding your Paychex Paystub is crucial for managing your finances effectively and ensuring that you're properly compensated for your work. This document contains essential payroll information that aids in providing clarity regarding your income. Personal details such as your name, address, and tax filing status are prominently featured, making it easy to verify that your information is correct. If your employer offers paid time off, this is also where you’ll find a summary of any used and remaining days available to you.

The Paychex Paystub highlights how your earnings are distributed. Look for the “Check Amount” to see the value of your live payroll check, while those utilizing Direct Deposit will find detailed account distributions to their checking and savings accounts. This layout ensures you have a transparent view of your financial picture. In addition, messages from your employer can provide insights regarding upcoming changes or important reminders. Other key components include an overview of your total earnings, deductions, and tax withholdings, alongside details of both the current pay period and year-to-date totals. With all these sections combined, this paystub serves as a vital tool for tracking your income and understanding your financial obligations.

Paychex Paystub Example

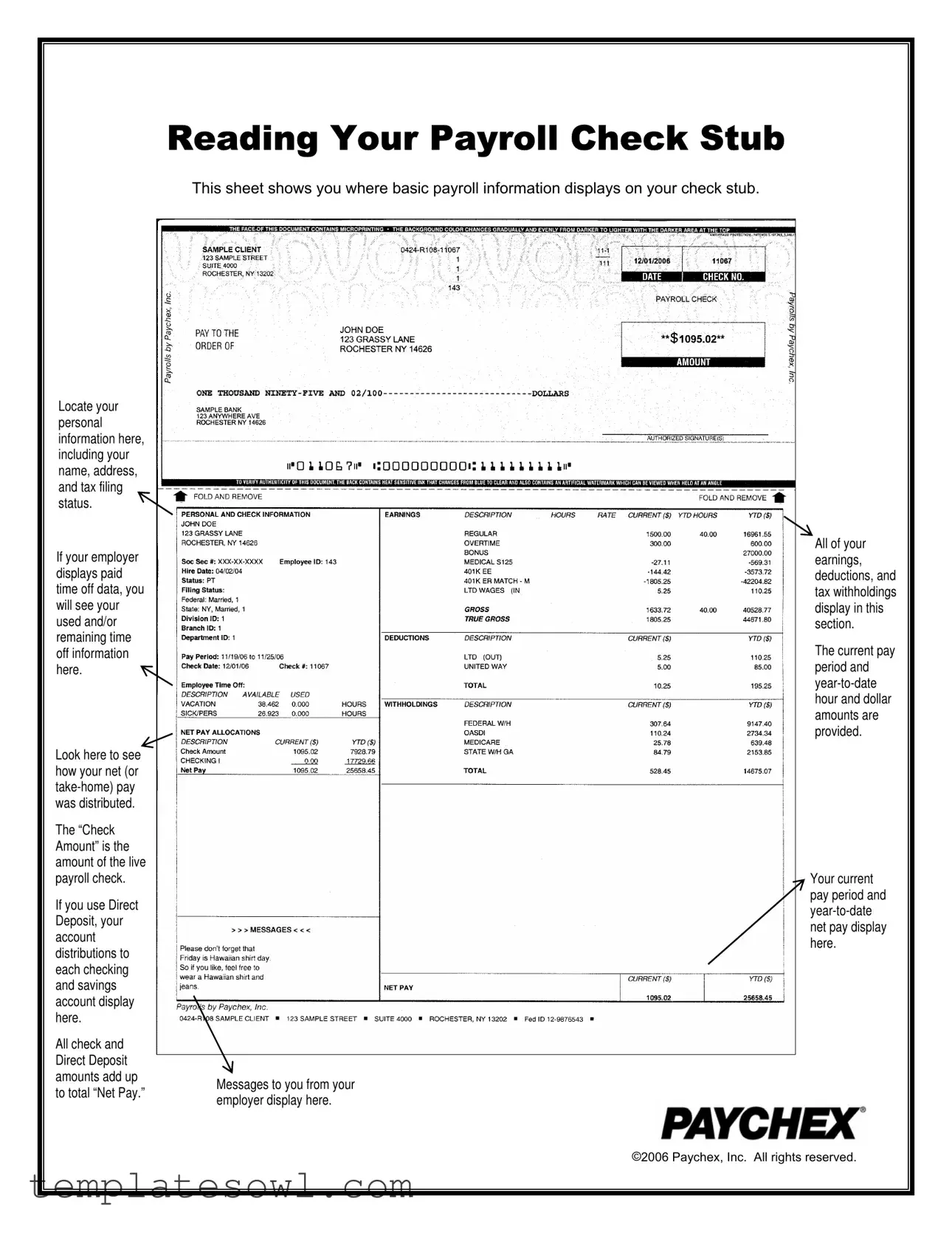

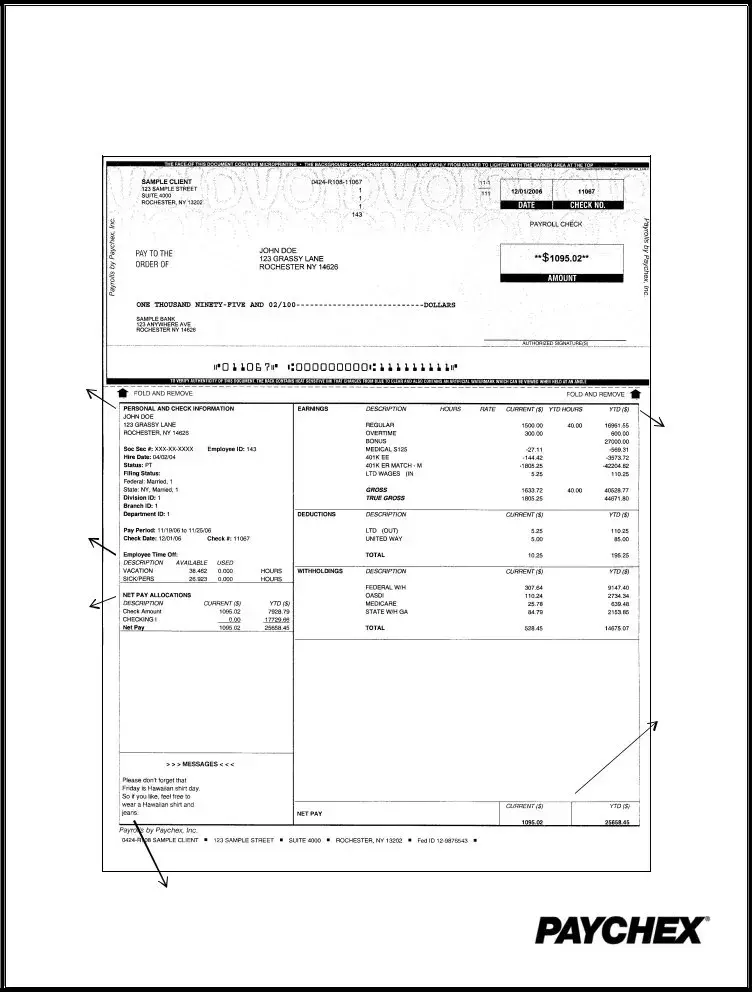

Reading Your Payroll Check Stub

This sheet shows you where basic payroll information displays on your check stub.

Locate your personal information here, including your name, address, and tax filing status.

If your employer displays paid time off data, you will see your used and/or remaining time off information here.

Look here to see how your net (or

The “Check Amount” is the amount of the live payroll check.

If you use Direct Deposit, your account distributions to each checking and savings account display here.

All check and |

|

|

Direct Deposit |

|

|

amounts add up |

Messages to you from your |

|

to total “Net Pay.” |

||

employer display here. |

||

|

All of your earnings, deductions, and tax withholdings display in this section.

The current pay period and

Your current pay period and

©2006 Paychex, Inc. All rights reserved.

Form Characteristics

| Fact Name | Description |

|---|---|

| Personal Information | Your payroll check stub includes critical personal details like your name, address, and tax filing status. |

| Paid Time Off | If applicable, the stub displays information on your used and remaining paid time off, allowing you to track your leave effectively. |

| Net Pay Distribution | The net pay section reveals how your take-home pay is allocated, either as a check amount or through direct deposits. |

| Direct Deposit Details | For employees using direct deposit, the stub shows how funds are distributed among various checking and saving accounts. |

| Employer Messages | Your employer may communicate important messages related to your pay or benefits, which will appear on the check stub. |

| Earnings and Deductions | All earnings, deductions, and tax withholdings are itemized, providing you with detailed insights into your payroll deductions. |

| Pay Period Information | Both the current pay period and year-to-date totals for hours worked and pay earned are clearly listed to aid your financial planning. |

Guidelines on Utilizing Paychex Paystub

Filling out the Paychex Paystub form requires attention to specific personal and financial details. To ensure accuracy, follow the steps outlined below. Proper completion will facilitate a clear understanding of your payroll information.

- Begin by entering your name at the top section of the form.

- Next, provide your address, ensuring that it is current and complete.

- Indicate your tax filing status accurately to avoid any discrepancies.

- If applicable, add information regarding your paid time off, including any used or remaining hours.

- Locate the area for your net pay amount. Enter the total after deductions.

- If you prefer Direct Deposit, fill in the details for your checking and savings account distributions.

- Check that all amounts, including earnings, deductions, and tax withholdings, are clearly displayed in the designated sections.

- Ensure that both your current pay period and year-to-date amounts are accurate and reflect the correct figures.

Once you have completed all sections, verify that all entries are correct to prevent any issues. Reviewing the information thoroughly will help maintain accurate records and reduce the likelihood of errors.

What You Should Know About This Form

What information is included on my Paychex paystub?

Your Paychex paystub includes several important pieces of information. First, it will display your personal details such as your name, address, and tax filing status. You will also see your paid time off information, showing both used and remaining time off. Additionally, your earnings, deductions, and tax withholdings are clearly outlined. The current pay period and year-to-date amounts for hours worked and dollars earned are provided to give you a complete overview of your pay.

How can I find my net pay on the paystub?

Your net pay, also known as take-home pay, is indicated prominently on the paystub. This amount is listed as the “Check Amount” if you received a physical payroll check. If you utilize Direct Deposit, the paystub will show how your net pay is distributed across your checking and savings accounts. The total net pay is the sum of all the check and Direct Deposit amounts combined.

What should I do if I notice an error on my paystub?

If you find any discrepancies on your paystub, such as incorrect earnings or deductions, it's important to address them promptly. Start by contacting your employer's payroll department. They can assist you in reviewing the payroll calculations and making any necessary corrections. Record any discrepancies and keep a copy for your records, as this can aid in resolving the issue.

Can I access my Paychex paystub online?

Yes, many employers offer online access to paystubs through the Paychex system. To access your paystub, you will typically need to log into the employee portal provided by your employer. If you're unsure how to do this, reach out to your HR department for detailed instructions on accessing your information online.

What is the significance of the year-to-date amounts on my paystub?

The year-to-date (YTD) amounts displayed on your paystub provide a cumulative summary of your earnings, deductions, and tax withholdings from the beginning of the calendar year up to the current pay period. This information is crucial for understanding your overall financial situation and can help you with tax planning and budgeting.

Are there messages from my employer included on my paystub?

Yes, your paystub may include messages from your employer. These messages can range from important updates about company policies to reminders regarding benefits enrollment and deadlines. It’s a good practice to read these messages as they may contain valuable information relevant to you.

What happens if my employer does not use Paychex for payroll?

If your employer does not use Paychex for payroll, then you will receive a paystub from whichever payroll provider they use. The format may differ, but the key information—such as your earnings, deductions, and net pay—should still be present. If you have questions about your paystub, it’s best to seek guidance from your HR department or payroll provider.

How is paid time off calculated on my paystub?

Paid time off (PTO) is calculated based on the policy set by your employer. Your paystub will show the amount of PTO you have used during the current pay period and the remaining balance. Keep in mind that the calculation of PTO can vary by company, including factors like accrual rates, carryover rules, and usage policies. Review your employer's PTO policy for further clarity.

Common mistakes

Filling out the Paychex Paystub form can be straightforward, but many people still encounter common pitfalls. One of the most frequent mistakes is not double-checking personal information. When individuals neglect to confirm their name, address, and tax filing status, it can lead to significant complications down the line. Any errors in these sections might delay tax processing or misdirect important financial information.

Another mistake occurs when people fail to accurately report their paid time off (PTO). If your employer provides updates on PTO usage, make sure to verify how much time you have taken versus what remains. Misunderstanding these figures can lead to confusion about available leave, especially during critical times like holidays or personal emergencies.

Many individuals also overlook the importance of reviewing their net pay distribution. It's crucial to ensure that the amounts listed under "Check Amount" and the Direct Deposit breakdown align with your expectations. Failing to do this can result in financial strain if there’s an error in how much you actually receive.

It's not uncommon for people to ignore the deductions and tax withholdings section. Understanding what is being deducted from your paycheck is vital. Individuals should take the time to review these amounts carefully to ensure accuracy and prevent unexpected tax liabilities when the tax season arrives.

Lastly, many forget to keep an eye on the year-to-date totals. Regularly checking these figures can provide insight into your earnings and deductions over time. Without this practice, you might miss important trends that could impact your financial planning and tax filing.

Documents used along the form

The Paychex Paystub form is an essential document that provides employees with detailed information about their earnings and deductions for a specific pay period. Several other forms and documents complement the Paystub, enhancing understanding and management of payroll information. Below are five commonly used documents that often accompany the Paychex Paystub.

- W-2 Form: This form summarizes an employee's annual earnings and the taxes withheld. Employers must provide a W-2 to employees by the end of January each year, allowing workers to file their income tax returns accurately.

- Direct Deposit Authorization Form: Employees complete this form to instruct their employer to deposit their pay directly into their bank account. It typically requires the employee's banking information for processing payments securely.

- Employee Time Sheet: A record of hours worked by an employee, this document tracks attendance and ensures proper compensation. It is crucial for accurate payroll calculations and can include various details like overtime hours and shift times.

- Payroll Deduction Authorization Form: This form allows employees to authorize deductions from their paycheck for specific purposes, such as health insurance premiums or retirement savings plans. It outlines the deductions an employee agrees to and their amounts.

- Pay Schedule: This document provides employees with information about when they will be paid, whether weekly, bi-weekly, or monthly. It is vital for helping employees plan their finances and understand the payroll cycle.

These forms and documents play significant roles in the payroll process, providing essential information and ensuring employees are compensated accurately and on time. Understanding each of these documents can help employees navigate their financial responsibilities more effectively.

Similar forms

- W-2 Form: Similar to a Paychex paystub, the W-2 form summarizes an employee's annual earnings and tax withholdings. Both documents display personal information such as name and employer details, but the W-2 provides a year-end summary instead of a pay period breakdown.

- 1099 Form: Independent contractors receive a 1099 form, which shows their earnings for the year. Like the Paychex stub, it outlines how much was earned and any tax withholdings. However, the 1099 is specifically for non-employee compensation.

- Paycheck: The physical paycheck itself is similar in that it reflects the same amounts as the Paychex paystub. It includes net pay and often provides a breakdown of deductions, but it is a tangible payment rather than a record of payroll details.

- Payroll Register: This document details all payroll information for multiple employees in a given pay period. Both the payroll register and Paychex paystub display earnings, deductions, and tax information, yet the register encompasses data for an entire workforce.

- Summary of Earnings: An earnings summary provides a concise overview of pay periods, hours worked, and total compensation. Much like the Paychex paystub, it summarizes essential payroll information but lacks the detailed breakdown of deductions.

- Direct Deposit Statement: This document is similar in that it details payments made via direct deposit, including the amount deposited and where the funds were allocated. It focuses on distribution rather than an overall summary of pay and deductions.

- Tax Withholding Statement: This statement outlines how much tax has been withheld from each paycheck. Like the Paychex stub, it provides clarity about deductions, particularly for taxes, although it may not include other payroll details such as net pay.

- State Unemployment Insurance Notice: This notice indicates the unemployment insurance contributions made on an employee's behalf. While it details deductions similar to the Paychex stub, it serves a specific purpose related to unemployment benefits.

- PTO Balance Statement: This document informs employees of their paid time off balances. Similar to the Paychex paystub, it tracks leave used and accrued but focuses solely on leave rather than total earnings or deductions.

- Employee Benefits Statement: This statement outlines an employee's benefits and contributions, akin to the deductions listed on a paystub. It helps employees understand their total compensation package beyond just salary.

Dos and Don'ts

When filling out the Paychex Paystub form, it’s essential to ensure accuracy and completeness. Here’s a helpful list of things to do and avoid for a smoother experience.

- Do verify your personal information, such as your name and address.

- Do check your tax filing status to ensure it reflects your current situation.

- Do review the paid time off data, noting any used or remaining time off.

- Do ensure that your net pay distributed amounts are correct, especially if you use Direct Deposit.

- Do confirm that all earnings, deductions, and tax withholdings are accurately listed.

- Don't ignore any discrepancies; address them as soon as possible.

- Don't forget to keep a copy of your completed form for your records.

- Don't overlook verifying your current pay period information against your previous records.

- Don't rush through the form; take your time to ensure everything is accurate.

Taking a moment to carefully fill out this form can save you time and hassle later. It’s all about setting yourself up for success!

Misconceptions

Understanding the Paychex Paystub form is essential for employees. However, misconceptions often lead to confusion. Here are four common misunderstandings about the form.

- Misconception 1: The paystub only shows gross pay.

- Misconception 2: The “Check Amount” is the same as the net pay.

- Misconception 3: Paid time off information is always shown.

- Misconception 4: Year-to-date amounts are always accurate.

Many believe that the only important figure on the paystub is the gross pay, or total earnings before deductions. In reality, the paystub details several elements, including deductions for taxes, insurance, and retirement contributions, which are critical for understanding the net pay you receive.

Some employees think the “Check Amount” directly equals their net pay. While the “Check Amount” indicates the total you will receive for that paycheck, it may not reflect additional funds deposited through Direct Deposit, which can lead to confusion about overall compensation.

Employees often expect to see a detailed breakdown of their paid time off on every paystub. However, this information only appears if the employer chooses to include it. Checking with your employer regarding what details are added can clarify your leave balance.

Some might assume that the year-to-date amounts presented on the paystub are always reliable. Discrepancies can occur, especially if there were payroll adjustments or changes in employment status. Regularly reviewing these figures against your records ensures you maintain accuracy.

Key takeaways

Here are some key takeaways for effectively filling out and using the Paychex Paystub form:

- Personal Information: Your check stub contains essential personal details such as your name, address, and tax filing status. Always verify this information for accuracy.

- Paid Time Off: If applicable, your used and remaining paid time off balances will be indicated on the stub. Check this section to stay informed about your leave status.

- Net Pay Breakdown: Look for the "Check Amount" to see the total of your live payroll check. For direct deposit users, this section will explain how your pay is distributed across your accounts.

- Earnings and Deductions: All of your earnings, deductions, and tax withholdings are detailed on the stub. It’s crucial to review these figures for any discrepancies.

- Pay Period Information: The stub shows both current pay period and year-to-date amounts for hours worked and dollars earned. Use this information to track your overall earnings throughout the year.

Browse Other Templates

Costco Zyn - Submit your order via email, fax, or phone for convenience.

Daf Form 988 - Update your Adobe Reader for optimal document viewing experience.

Average Child Support in Illinois - This procedure aims to support the child's welfare financially.