Fill Out Your Paycor Direct Deposit Form

The Paycor Direct Deposit form is a crucial document for employees wishing to receive their payroll directly into their bank accounts. It simplifies the payment process, ensuring timely and secure access to funds. The form accommodates multiple accounts—up to three—allowing employees to allocate percentages or specific amounts to each account, whether they choose a savings or checking option. For full net deposits, employees simply indicate 100%. Each account requires essential details such as the bank name, account number, and routing number, which must be accurate to avoid any disruption in payment. Additionally, attaching a voided check or deposit slip is necessary for verification. Signing the form authorizes Paycor to initiate electronic transfers, complying with the National Automated Clearing House Association's regulations. This authorization stays active until a written termination notice is given, granting both Paycor and the bank ample time to process the request. Retaining this form in employee files is key, as it ensures easy access and reference for both employees and the employer.

Paycor Direct Deposit Example

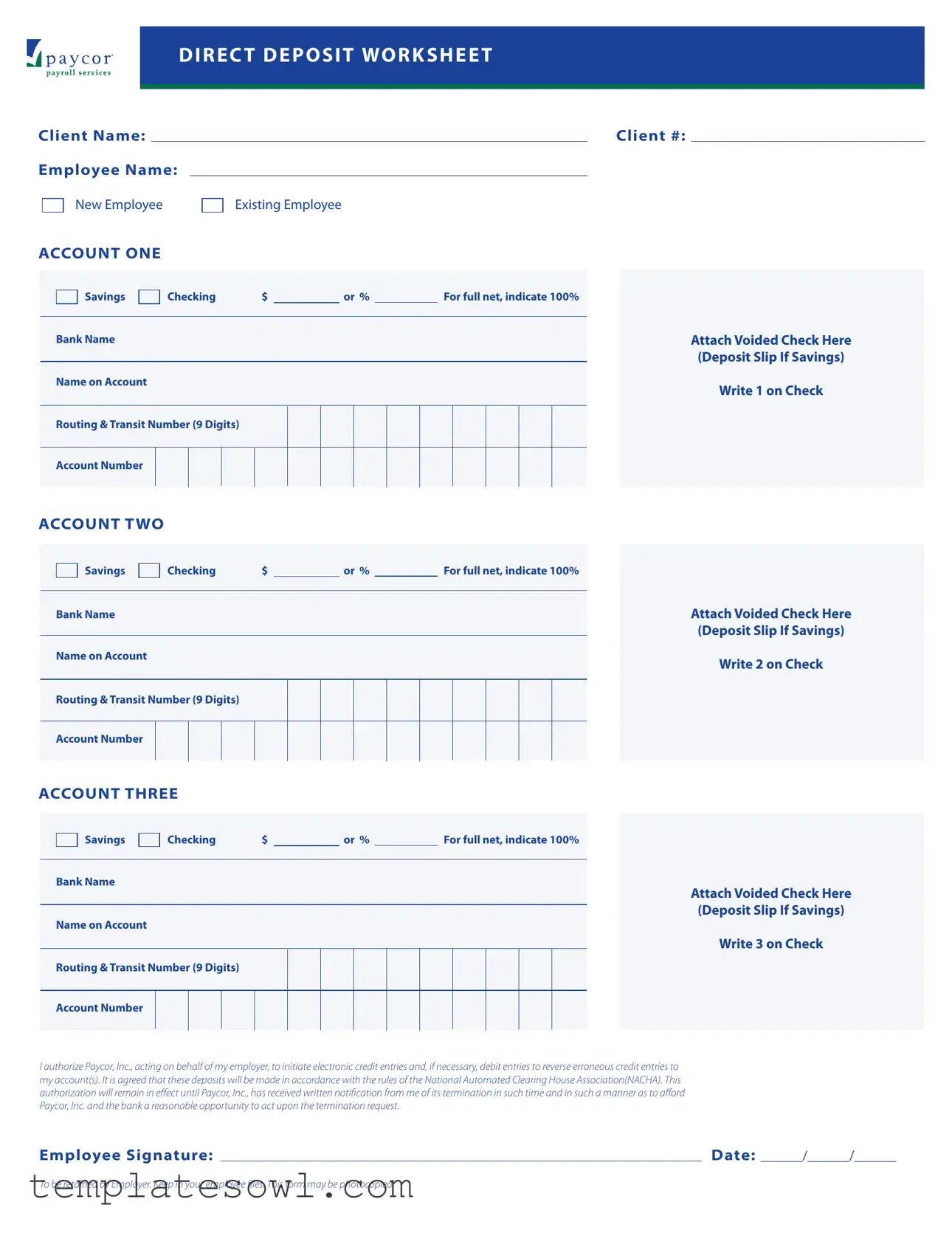

DIRECT DEPOSIT WORKSHEET

payroll services

Client Name: |

|

Client #: |

Employee Name:

New Employee

Existing Employee

ACCOUNT ONE

|

|

Savings |

|

Checking |

$ |

|

or % |

|

For full net, indicate 100% |

|

|

|

|

|

|

|

|

|

|

Bank Name |

Attach Voided Check Here |

|

(Deposit Slip If Savings) |

Name on Account |

Write 1 on Check |

|

Routing & Transit Number (9 Digits)

Account Number

ACCOUNT TWO

Savings

Checking |

$ |

|

or % |

|

For full net, indicate 100% |

Bank Name

Name on Account

Routing & Transit Number (9 Digits)

Account Number

Attach Voided Check Here (Deposit Slip If Savings)

Write 2 on Check

ACCOUNT THREE

|

|

Savings |

|

Checking |

$ |

|

or % |

|

For full net, indicate 100% |

|

|

|

|

|

|

|

|

|

|

Bank Name

Attach Voided Check Here

(Deposit Slip If Savings)

Name on Account

Routing & Transit Number (9 Digits)

Write 3 on Check

Account Number

I authorize Paycor, Inc., acting on behalf of my employer, to initiate electronic credit entries and, if necessary, debit entries to reverse erroneous credit entries to my account(s). It is agreed that these deposits will be made in accordance with the rules of the National Automated Clearing House Association(NACHA). This authorization will remain in efect until Paycor, Inc., has received written notiication from me of its termination in such time and in such a manner as to aford Paycor, Inc. and the bank a reasonable opportunity to act upon the termination request.

Employee Signature: |

|

Date: ______/______/______ |

To be retained by Employer. Keep in your employee iles. This form may be photocopied.

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Client Information | The form requires the client name and client number to ensure accurate processing. |

| Employee Status | It distinguishes between new and existing employees to manage account details effectively. |

| Bank Account Options | Employees can elect up to three bank accounts for direct deposit, allowing flexibility in fund allocation. |

| Authorization | By signing the form, employees authorize Paycor, Inc. to process electronic deposits and, when necessary, reversals. |

| NACHA Compliance | The direct deposits follow the rules set by the National Automated Clearing House Association (NACHA), ensuring financial security. |

| Termination of Authorization | The authorization remains effective until written notice is provided by the employee, giving Paycor time to act on requests. |

Guidelines on Utilizing Paycor Direct Deposit

Once you've completed the Paycor Direct Deposit form, your information will be submitted for processing. This step is crucial as it enables your payroll department to direct your salary or wages straight to your bank account. Make sure all details are accurate to avoid any delays in your payroll deposits.

- Begin by filling in the section labeled Client Name and Client # with the relevant information for your employer.

- Next, provide your Employee Name and indicate whether you are a New Employee or an Existing Employee.

- For Account One, select whether it’s a Savings or Checking account.

- Next, indicate the amount or percentage you wish to deposit into this account. To have your full net pay deposited, write 100%.

- List your Bank Name and attach a voided check or deposit slip, if it’s a savings account.

- Enter the Name on Account.

- Write the Routing & Transit Number (9 digits). This is crucial for directing your funds correctly.

- Fill in your Account Number.

- Repeat the process for Account Two and Account Three, if applicable, filling in all required fields and attaching necessary documentation for each.

- At the end of the form, read the authorization statement carefully. This gives Paycor permission to handle electronic deposits and possible reversals.

- Finally, sign and date the form in the spaces provided.

What You Should Know About This Form

What is the purpose of the Paycor Direct Deposit form?

The Paycor Direct Deposit form is designed to facilitate the direct deposit of your payroll checks into your bank account. By completing this form, you authorize your employer to deposit your wages electronically, which can ensure that you receive your funds quickly and securely. It eliminates the need for paper checks, making the payment process more efficient for both you and your employer.

How do I complete the form correctly?

To complete the Paycor Direct Deposit form, you will need to provide specific information for each account you wish to use for direct deposits. For each account, indicate whether it is a savings or checking account. You should also include the bank name, your name on the account, and attach a voided check or deposit slip. Make sure to write the account number and routing number (nine digits) accurately. If you wish to allocate a specific percentage of your paycheck to multiple accounts, clearly specify that as well.

What do I need to attach to the form?

You will need to attach a voided check for each checking account, or a deposit slip for each savings account that you are using for direct deposit. This attachment is crucial as it provides your bank’s routing number and account number, ensuring that funds are deposited into the correct accounts without any errors.

How long does it take for direct deposit to start?

The timeframe for setting up direct deposit can vary. Generally, it may take one to two pay cycles after your employer receives and processes your completed Paycor Direct Deposit form. However, this can depend on your employer's payroll schedule and their internal processing times. During this period, it is a good idea to continue monitoring your bank account for any deposits.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information. If you need to alter the accounts or bank details you provided previously, you simply need to fill out a new Paycor Direct Deposit form and submit it to your employer. Just ensure that you do this in a timely manner, allowing your employer sufficient time to process your request before your next payroll date.

Common mistakes

Filling out the Paycor Direct Deposit form requires careful attention to detail. One common mistake is leaving out the routing and transit number. This nine-digit number is crucial for directing funds to the correct bank. Without it, your direct deposit may be delayed or misdirected. Always double-check that this number is accurate before submitting the form.

Another frequent error involves incorrectly specifying the type of account. Employees may select either savings or checking but forget to mark the corresponding box clearly. Any ambiguity can lead to complications in processing your direct deposit. Make sure to indicate your choice clearly by checking the appropriate box next to each account.

Also, some individuals fail to attach a voided check or deposit slip. This attachment is essential for validating your account information. Without this documentation, Paycor cannot verify your account details, which can lead to further delays. Remember to include this attachment with the form to ensure a smooth process.

Finally, neglecting to fill in personal information, such as your full name or signature, can be problematic. Incomplete forms can be rejected, causing unnecessary delays in receiving your pay. Always review the entire form to confirm that all required fields are completed and that the form is signed and dated.

Documents used along the form

When setting up direct deposit with Paycor, several other documents may come into play to ensure a smooth and accurate process. Together, these forms create a comprehensive framework for managing payroll efficiently. Below is a list of commonly used documents that often accompany the Paycor Direct Deposit form.

- W-4 Form: This form, officially known as the Employee's Withholding Certificate, allows employees to inform their employer about their tax situation. It determines the amount of federal income tax to withhold from an employee's paycheck. By accurately completing this form, employees can avoid under-withholding or over-withholding taxes.

- Employee Information Form: New employees typically complete this form to provide essential information to their employer. This may include personal details, contact information, emergency contacts, and information pertinent to employment eligibility. It ensures that the employer has accurate records for communication and compliance purposes.

- Voided Check: This document is often required to set up direct deposit. By providing a blank check with "VOID" written across it, employees can verify their bank account details. This step helps prevent errors in depositing funds and ensures that payments are directed to the correct account.

- Authorization Agreement for Direct Deposit: This agreement formalizes the employee's request to receive their wages via direct deposit. It outlines the terms under which the employer, through Paycor, will deposit funds into the employee's bank account. The agreement may also contain information about the employee's rights regarding termination of the direct deposit setup.

Collectively, these documents support the direct deposit process and help maintain accuracy and efficiency in payroll services. Ensuring all necessary paperwork is completed can lead to a seamless financial experience for both employees and employers.

Similar forms

- W-4 Form: The W-4 form is used by employees to indicate their tax withholding preferences. Like the Paycor Direct Deposit form, it requires personal information and is essential for payroll processing.

- Direct Deposit Authorization Form: This form grants permission to an employer to deposit wages directly into an employee's bank account, similar to the Paycor Direct Deposit form, which also seeks authorization for direct deposits.

- Payroll Authorization Form: Employees use this document to authorize specific payroll actions. It shares similarities with the Paycor form in that both are aimed at initiating payroll processes.

- Bank Account Information Form: Used to collect details about an employee's bank account for payroll or reimbursement reasons, this form holds the same purpose as the Paycor form regarding account verification.

- Employment Application: This document collects pertinent personal and financial information from job candidates. Like the Paycor Direct Deposit form, it requires basic identifying details crucial for employee records.

- Direct Deposit Change Form: When an employee changes bank accounts, this form facilitates updating payroll information. Its function is akin to that of the Paycor Direct Deposit form in maintaining accurate banking details.

- Time Sheet: Employees submit time sheets to track hours worked for payroll purposes. While the primary function differs, both are integral to the payroll process and require employee input.

- Employee Information Form: This form collects essential details about employees and is used similarly to the Paycor Direct Deposit form to maintain accurate records for payroll and other administrative functions.

- Expense Reimbursement Form: Employees use this document to request reimbursement for work-related expenses. It captures financial information similar to the Paycor form, which is essential for managing employee finances.

Dos and Don'ts

When filling out the Paycor Direct Deposit form, it is essential to pay attention to detail to ensure a smooth and accurate process. Consider the following guidelines:

- Do provide your correct account number to avoid delays in receiving payments.

- Do attach a voided check or deposit slip, especially for savings accounts, to confirm account details.

- Do clearly indicate the percentage or amount you want deposited in each account.

- Do sign and date the authorization to ensure it is valid.

- Don't forget to include the routing and transit number, as it is critical for direct deposits.

- Don't leave any required fields blank; incomplete forms can lead to processing errors.

- Don't write on the checks or attach anything other than the required documents.

- Don't submit the form without reviewing it for accuracy; mistakes can cause payment delays.

Misconceptions

- Direct Deposit is only for full-time employees. This is a common misconception. Both part-time and full-time employees can use direct deposit for their paychecks.

- You can only have one bank account for direct deposit. In fact, employees can set up multiple accounts for direct deposit, distributing their pay as they wish.

- A voided check is not necessary if you have a deposit slip. While a deposit slip is acceptable for savings accounts, it is still crucial to provide a voided check for checking accounts to ensure accuracy.

- Changing your direct deposit information is complicated. The process is usually straightforward. Simply complete the Direct Deposit form with updated information and submit it to your employer.

- Your employer can access your bank account information. Employers do not have direct access to your bank account details. They only receive confirmations about deposit transactions.

- It takes a long time for direct deposit to become active. Typically, once the form is processed, direct deposit can start within one payroll cycle, making it a quick solution for receiving pay.

- If you change banks, you need to reapply for direct deposit. You don't need to reapply, but you do need to update your account information on the Direct Deposit form.

- You will not receive a paper paycheck if you sign up for direct deposit. It's possible to receive a pay statement even with direct deposit, as some companies still provide documentation of earnings.

- Direct deposits are not secure. Direct deposit is typically considered secure and efficient. It reduces the risk of lost or stolen checks, offering enhanced safety for your earnings.

Key takeaways

Filling out the Paycor Direct Deposit form is an essential task for employees looking to streamline their payroll process. Here's what you need to know:

- Choose Your Accounts Wisely: You can specify multiple accounts for direct deposit. If you want your entire paycheck in one account, indicate 100% in the appropriate box.

- Provide Accurate Banking Details: Double-check that your bank name, routing number, and account number are correct. Any mistakes could delay your deposit.

- Attach Required Documents: Don’t forget to attach a voided check for each checking account or a deposit slip for savings accounts. This helps to verify your account information and makes the process smoother.

- Understand Your Authorization: By signing the form, you’re allowing Paycor to deposit your funds and, if needed, reverse any errors. It’s a straightforward process, but take a moment to read the authorization details.

- Keep Records: Remember, this form will be kept on file by your employer. It’s a good idea to keep a personal copy for your records, just in case.

- Notify for Changes: If you ever want to change your direct deposit settings or stop them altogether, you need to notify Paycor in writing. Make sure to give them enough time to process your request.

By paying attention to these key points, you can ensure that your direct deposit experience is as smooth as possible. Happy banking!

Browse Other Templates

Long Term Personal Care Services Louisiana - Evaluate behavioral issues exhibited over the past week to understand support requirements.

Due Diligence Money - It is designed to protect both parties and outline responsibilities during the purchasing process.