Fill Out Your Payoff Quote Mortgage Form

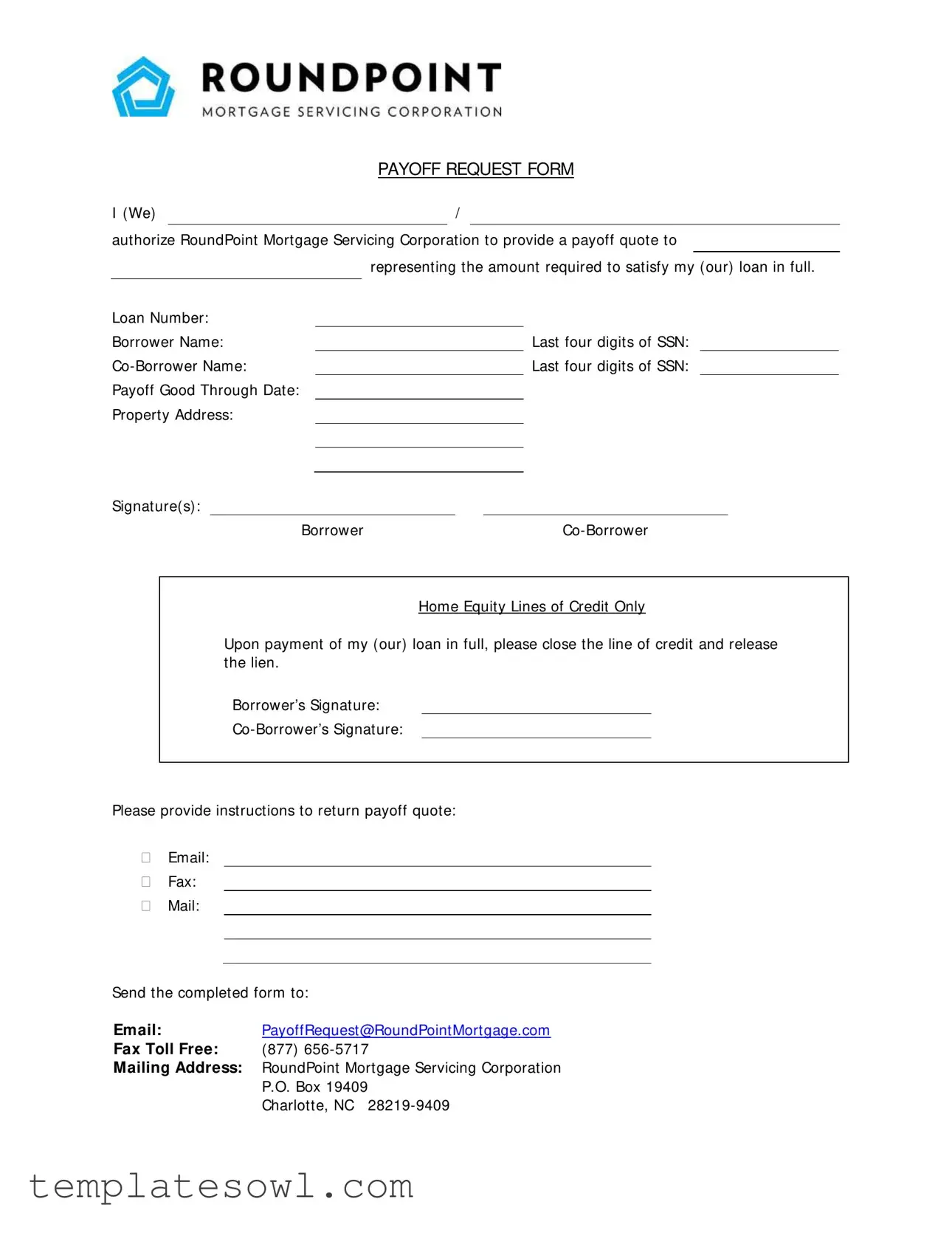

When navigating the process of paying off a mortgage, one important step is obtaining a Payoff Quote Mortgage form. This form serves as a key document allowing borrowers to request the exact amount needed to pay off their loan in full. It includes essential details such as the loan number, names of both the borrower and co-borrower, and the last four digits of their Social Security numbers, ensuring accurate identification. Additionally, borrowers will need to indicate their property address and specify a “payoff good through” date, as this information is crucial for processing the request in a timely manner. The form also includes sections for signatures, which are vital for authorizing the payoff and instructing the lender to close any associated home equity lines of credit upon payment. A choice of communication for receiving the payoff quote—via email, fax, or traditional mail—provides flexibility to meet the borrower’s needs. Finally, an organized submission process is laid out, directing borrowers to send their completed forms to RoundPoint Mortgage Servicing Corporation through designated email, fax, or mailing channels.

Payoff Quote Mortgage Example

|

|

|

PAYOFF REQUEST FORM |

|||||

I (We) |

/ |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

authorize RoundPoint Mortgage Servicing Corporation to provide a payoff quote to |

||||||||

|

|

|

|

|

|

|

||

|

|

|

representing the amount required to satisfy my (our) loan in full. |

|||||

|

|

|

|

|

|

|

|

|

Loan Number: |

|

|

|

|

|

|

|

|

Borrower Name: |

|

|

|

|

Last four digits of SSN: |

|

||

|

|

|

|

Last four digits of SSN: |

|

|||

Payoff Good Through Date: |

|

|

|

|

|

|

|

|

Property Address: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature(s):

Borrower |

Home Equity Lines of Credit Only

Upon payment of my (our) loan in full, please close the line of credit and release the lien.

Borrower’s Signature:

Please provide instructions to return payoff quote:

Email:

Fax:

Mail:

Send the completed form to:

Email:PayoffRequest@RoundPointMortgage.com

Fax Toll Free: (877)

Mailing Address: RoundPoint Mortgage Servicing Corporation

P.O. Box 19409

Charlotte, NC

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form allows borrowers to request a payoff quote from RoundPoint Mortgage Servicing Corporation. |

| Borrower Information | It requires the borrower’s name and the last four digits of their Social Security Number. |

| Co-Borrower Details | Co-borrower information is also necessary, including their name and the last four digits of their Social Security Number. |

| Loan Number | The loan number related to the mortgage must be provided to identify the account. |

| Payoff Good Through Date | The form includes a field for the date through which the payoff amount is valid. |

| Mailing Instructions | Borrowers can specify how they would like to receive the payoff quote: via email, fax, or mail. |

| Return Contact Information | There are designated fields for the borrower to provide their preferred method of receiving the payoff information. |

| Signature Requirement | Both the borrower and co-borrower must sign the form to authorize the request. |

| Regulatory Compliance | This form is governed by laws applicable in the state where the mortgage was granted. |

Guidelines on Utilizing Payoff Quote Mortgage

To complete the Payoff Quote Mortgage form, you will need specific information to accurately convey your loan payoff request. This process ensures that the mortgage servicing company can quickly respond with the necessary details regarding your loan payoff. Follow these steps carefully to fill out the form correctly.

- Fill in your authorization: Write “I (We) authorize RoundPoint Mortgage Servicing Corporation to provide a payoff quote representing the amount required to satisfy my (our) loan in full.”

- Enter your loan number: Locate and write down your loan number in the designated space.

- Provide borrower details: Write your full name as the primary borrower.

- Last four digits of your SSN: Enter the last four digits of your Social Security Number.

- Co-borrower details: If applicable, fill in the name of the co-borrower.

- Last four digits of co-borrower’s SSN: Enter the last four digits of the co-borrower’s Social Security Number.

- Payoff good through date: Specify the date until which the payoff quote will be valid.

- Property address: Provide the address of the property associated with the loan.

- Signatures: Both borrower and co-borrower must sign the form to authorize the request.

- For Home Equity Lines of Credit: If applicable, indicate your request to close the line of credit and release the lien upon payment of the loan in full, along with respective signatures.

- Return instructions: Choose how you want the payoff quote sent. Fill out the email, fax, or mail options accordingly.

Once you have completed the form, send it to RoundPoint Mortgage Servicing Corporation using the provided contact methods. This will help expedite the process of receiving your payoff quote.

What You Should Know About This Form

What is the purpose of the Payoff Quote Mortgage form?

The Payoff Quote Mortgage form is designed to authorize RoundPoint Mortgage Servicing Corporation to provide a payoff quote. This quote shows the exact amount needed to pay off the mortgage loan in full. By completing this form, you ensure that you receive the correct figures related to your outstanding mortgage balance.

What information do I need to provide on the form?

You will need to supply several key pieces of information. This includes your loan number, the names of the borrower and co-borrower, the last four digits of each Social Security Number, the desired payoff good-through date, and the property address associated with the loan. Additionally, both borrowers are required to sign the form at the bottom, indicating their consent for the payoff request.

How do I submit the Payoff Quote Mortgage form?

You can submit the completed form in several ways: via email, fax, or snail mail. If you choose to email, send it to PayoffRequest@RoundPointMortgage.com. You can also fax the form toll-free to (877) 656-5717. For those preferring traditional mail, send it to RoundPoint Mortgage Servicing Corporation, P.O. Box 19409, Charlotte, NC 28219-9409.

What if I have a Home Equity Line of Credit (HELOC)?

If you have a Home Equity Line of Credit, it's important to note that the form allows you to specify that you want the line of credit closed upon full payment of the loan. Be sure to indicate your wishes clearly by signing both that you are requesting the payoff quote and that you would like the lien to be released after payment.

How will I receive the payoff quote?

The form provides you with options for receiving your payoff quote. You can choose to have it sent via email, fax, or by postal service. Make sure to fill out the appropriate section of the form with your preferred method of receiving this important document.

Is there a deadline for the payoff quote?

Yes, the form requires you to specify a "Payoff Good Through Date." This date indicates how long the quote is valid. It's crucial to act within this timeframe, as your loan balance may change if payments are made or fees accrue after the specified date.

Can I request a payoff quote for someone else's mortgage?

Common mistakes

Filling out a Payoff Quote Mortgage form can be a daunting task. Unfortunately, many people make mistakes that can delay processing or even lead to complications. Here are seven common errors to avoid when completing this form.

One frequent mistake involves missing signatures. Both the borrower and co-borrower must sign the form for it to be processed. Neglecting this step can result in the request being returned, wasting time and causing frustration.

Another common issue arises from incomplete personal information. Along with the loan number, there are essential fields, such as names and the last four digits of Social Security numbers, that must be accurately filled out. Omitting details or providing incorrect information can hinder the ability of the mortgage company to locate the account swiftly.

Failing to specify a payoff good through date is also a typical oversight. This date informs the lender of when the payoff amount should be calculated up to. Without it, borrowers might receive an inaccurate quote that could lead to complications in the payoff process.

Addressing the problem of return instructions is another crucial area where errors often occur. It is essential to choose a method for receiving the payoff quote—whether via email, fax, or regular mail—and ensure that the corresponding contact information is correctly provided. A missing or incorrect email address could delay receipt of the payoff quote significantly.

Moreover, some individuals fail to indicate the type of loan accurately. For instance, if the form applies to a Home Equity Line of Credit (HELOC), borrowers must clarify this. Misclassifying the loan type can cause confusion and potentially affect the request outcome.

Finally, it is vital to check the final review of the completed form. Rushing through this step may lead to errors that could have been easily corrected. Ensuring all information is accurate will facilitate a smoother process and reduce the risk of delays or misunderstandings.

By being mindful of these common mistakes, individuals completing the Payoff Quote Mortgage form can enhance their chances of a successful and timely request. Attention to detail is key in navigating such important financial paperwork.

Documents used along the form

When you request a payoff quote for your mortgage, several other forms and documents may be necessary to facilitate the process. Each of these documents serves a unique purpose in ensuring a smooth transition and accurate record-keeping. Understanding their roles can help you navigate the complexities of mortgage payoff efficiently.

- Authorization to Release Information: This document allows your mortgage servicer to share your loan information with authorized third parties, such as buyers or real estate agents. It ensures that sensitive data is handled appropriately.

- Loan Payoff Estimator: Often utilized to provide an initial estimate of your loan balance, this form helps you gauge the amount needed to fully satisfy your mortgage obligations. It can aid in budgeting and financial planning.

- Final Payment Letter: This letter is provided by the lender once the loan is paid off. It serves as proof of payment and should be kept for your records; it may be needed for tax purposes or future credit references.

- Release of Lien: After the loan is satisfied, this document is issued to indicate that the lender relinquishes its claim on the property. It is crucial for clearing title for future transactions.

- Statement of Account: This account summary details your loan activity, including payments made, interest accrued, and outstanding fees. It’s beneficial for tracking your financial history with the lender.

- Closing Disclosure: Provided during the mortgage closing process, this document outlines the final terms of the loan agreement. While it primarily serves new homeowners, it may also provide context for payoff calculations.

- Deed of Trust: This document secures the loan with the property as collateral. Understanding this can clarify rights and responsibilities in the mortgage contract and is necessary when drafting a payoff request.

- Buyer’s Affidavit: In some cases, buyers acquiring a property may be required to confirm that they are aware of contingent liabilities related to the mortgage payoff. This affidavit formalizes their acknowledgment.

- Transfer of Ownership Form: This document is used when ownership of the property changes hands. It ensures that all parties are legally documented, and the new owner can assume the property free and clear.

By familiarizing yourself with these forms and their purposes, you can streamline the mortgage payoff process, ensuring that everything is correctly processed and documented. This diligence not only protects your interests but also provides peace of mind during a significant financial transaction.

Similar forms

The Payoff Quote Mortgage form serves a specific purpose within the mortgage industry. However, there are several other documents that share similar functions or features. Here are five documents that are comparable to the Payoff Quote Mortgage form:

- Loan Payoff Statement: This document provides a breakdown of the total amount needed to pay off a mortgage. It typically includes details like the remaining balance, interest accrued, and any fees associated with the payoff, similar to the payoff quote’s intent.

- Settlement Statement (HUD-1): Similar to the Payoff Quote form, the Settlement Statement outlines the financial details of a real estate transaction. It details the amounts owed and received at closing, ensuring all parties recognize the complete financial picture.

- Mortgage Satisfaction Document: After a mortgage is fully paid off, this document verifies that the lender has released their claim on the property. It parallels the Payoff Quote’s function by confirming that the loan has been satisfied and the lien removed.

- Cancellation of Lien Document: This document formally removes a lien on a property. It is similar in that it reflects the conclusion of a borrower's obligation, akin to what is requested in the Payoff Quote form.

- Home Equity Payoff Request: Like the Payoff Quote, this form is used specifically for home equity lines of credit. It requests a specific amount needed to pay off the line of credit, ensuring clarity and precision in the payoff process.

Dos and Don'ts

When filling out the Payoff Quote Mortgage form, keep these important tips in mind:

- Double-check your loan number. Ensure you enter the correct loan number to avoid any delays.

- Provide complete borrower information. Include full names and the last four digits of Social Security Numbers for both borrower and co-borrower.

- Specify the payoff good through date. Clearly state the date by which the payoff amount is valid.

- Use clear handwriting or type the information. This reduces the chances of errors in processing your request.

- Sign the form. Make sure both borrower and co-borrower sign where indicated.

Avoid these common mistakes:

- Don’t leave any fields blank. Incomplete information can lead to processing delays.

- Never forget to provide contact instructions. Specify how you wish to receive the payoff quote (email, fax, or mail).

- Don’t use an unofficial email address. Use a secure and personal email for confidential information.

- Avoid submitting the form without reviewing it. Errors can complicate the process, so always check your entries.

- Don’t neglect to send the form to the correct address. Ensure all submissions go to the provided email, fax, or mailing address.

Misconceptions

There are several misconceptions regarding the Payoff Quote Mortgage form. Understanding these can help ensure borrowers are adequately informed about the payoff process. Below are nine common misconceptions explained:

- It is not necessary to submit a Payoff Quote Request form. Many borrowers mistakenly assume that a payoff quote can be obtained without submitting the official form. However, providing this form is essential to receive an accurate quote for paying off the mortgage.

- The payoff amount will remain the same until the loan is actually paid off. Borrowers often believe that the quoted amount is fixed. In reality, interest accrues daily, meaning the payoff amount can change until payment is made in full.

- A payoff quote includes additional fees. Some borrowers think the payoff quote reflects all possible fees, including prepayment penalties. However, the quote generally only includes the principal and interest owed; additional fees may apply and should be confirmed separately.

- Payoff quotes can be obtained instantly. Many borrowers expect to receive their payoff quote immediately. Typically, however, processing this request may take a few business days due to the necessary verification steps.

- Only the primary borrower needs to sign the form. Some individuals believe that only the primary borrower needs to authorize the request. Both the borrower and any co-borrower must sign the form for it to be valid.

- All lenders provide the same payoff quote options. Borrowers may think that every lender offers uniform methods for obtaining a payoff quote. In fact, specific requirements, processing times, and available options can vary significantly from lender to lender.

- A Payoff Quote Mortgage form cannot be completed online. There is a misconception that this form must be mailed or faxed. Many lenders now offer electronic submission options, which can expedite the process.

- Payoff quotes are only necessary for traditional mortgages. Some borrowers believe that only traditional mortgage loans require a payoff quote. In truth, this is also essential for home equity lines of credit and other types of loans.

- The form doesn’t require a specific payoff good through date. Borrowers may overlook the importance of specifying a "payoff good through date." This date indicates until when the quoted amount is valid, making it crucial for planning the payment.

Understanding these misconceptions can streamline the mortgage payoff process and help borrowers avoid delays or complications.

Key takeaways

Filling out the Payoff Quote Mortgage form is an important step for borrowers who wish to understand how much is needed to pay off their mortgage. Here are key takeaways to consider:

- Authorization: You must authorize RoundPoint Mortgage Servicing Corporation to provide the payoff quote. This signifies that you agree to their terms and request.

- Personal Information: Accurate completion of personal information is essential. Include your name, loan number, and the last four digits of your Social Security Number.

- Co-Borrower Details: If applicable, provide information for the co-borrower as well, ensuring that all required data is entered correctly.

- Payoff Good Through Date: Make sure to specify the “Payoff Good Through Date.” This date indicates how long the quoted amount will remain valid.

- Property Address: Clearly state the property address linked to the mortgage. This helps identify the loan in question.

- Signature Requirement: Both borrower and co-borrower should sign the form to validate the request. This is a crucial step in ensuring the request is processed.

- Return Instructions: Indicate how you would like to receive the payoff quote. Options include email, fax, or mail; choose the method that works best for you.

Submitting the form correctly will help you get a clear understanding of the payoff amount needed to settle your mortgage. Ensure all information is complete and accurate to avoid delays in processing your request.

Browse Other Templates

Tax Clearance Certificate Nj - The C-9600 is more than just a form; it represents legal compliance in business dealings.

Louisiana Standardized Credentialing Application - Continue consistent documentation across all practice locations for clarity.