Fill Out Your Pc 583 Form

The PC 583 form is an essential document utilized within Michigan's Probate Court system, specifically designed for fiduciaries managing guardianships or conservatorships. Its primary purpose is to provide a clear and concise account of the financial activities concerning a ward or protected individual's estate over a specified period, which may not exceed twelve months. When preparing this form, fiduciaries must report all income, gains, expenses, losses, and other disbursements, ensuring a transparent record that adheres to the court's requirements. The form delineates specific categories where financial information must be provided, including a detailed breakdown of the balance on hand, calculations reflecting the total income and disbursements, and a summarization of assets remaining at the end of the accounting period. Important instructions clarify that financial account numbers should not be included directly on the form; instead, a separate document is recommended for such details. Additionally, a section is dedicated to tracking fiduciary and attorney fees incurred during the accounting period, necessitating attached descriptions of services rendered, which underpin the document's reliability. Adherence to guidelines set forth by the Michigan Compiled Laws (MCL) and Michigan Court Rules (MCR) is paramount, as it ensures that all interested parties are duly notified and afforded the opportunity to challenge the account if they have concerns. Thus, the PC 583 form serves not only as a financial statement but also as a tool to foster accountability and transparency within the probate process.

Pc 583 Example

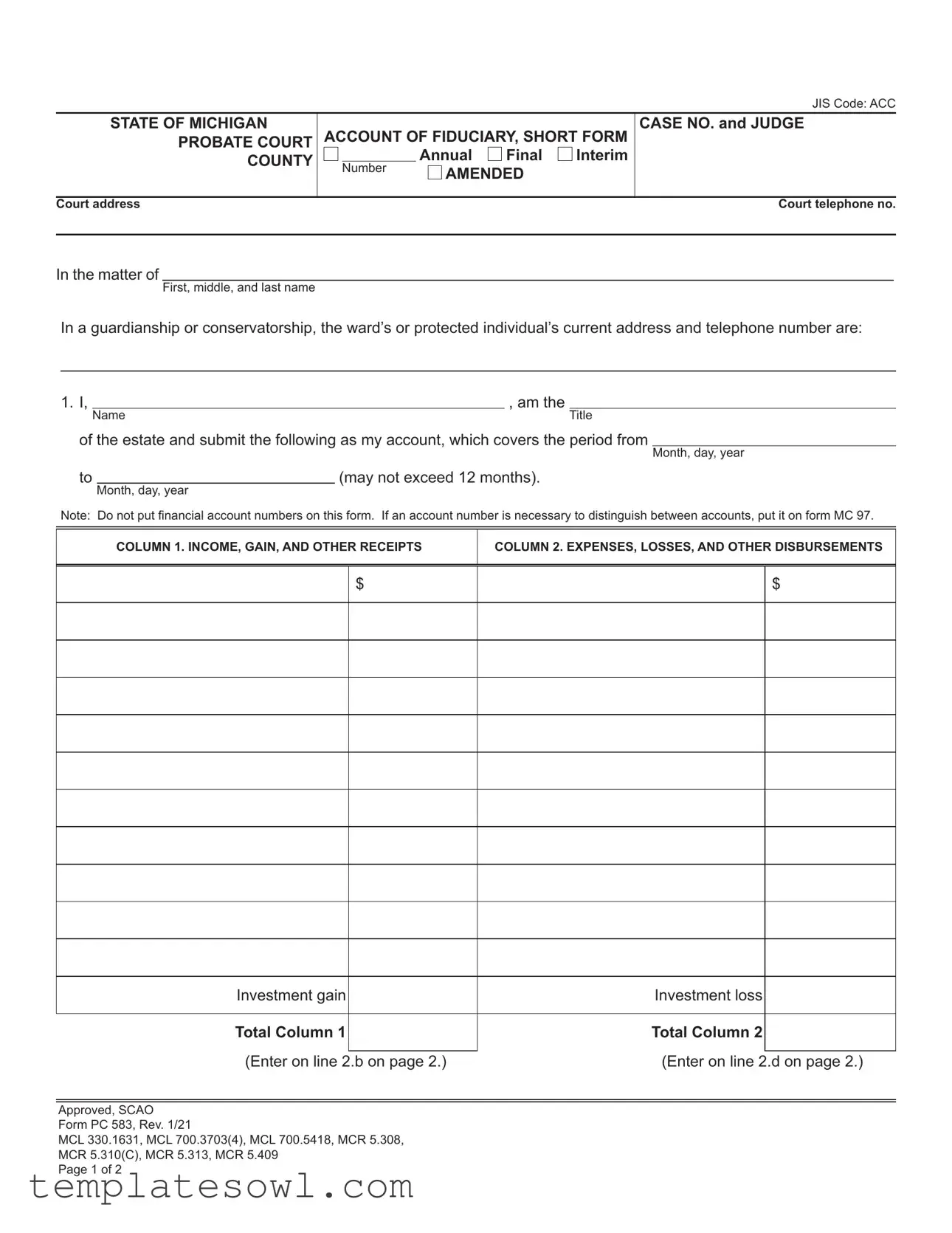

JIS Code: ACC

STATE OF MICHIGAN PROBATE COURT

COUNTY

Court address

ACCOUNT OF FIDUCIARY, SHORT FORM

Annual Final Interim

Number  AMENDED

AMENDED

CASE NO. and JUDGE

Court telephone no.

In the matter of

First, middle, and last name

In a guardianship or conservatorship, the ward’s or protected individual’s current address and telephone number are:

1. I, Name, am the Title

of the estate and submit the following as my account, which covers the period from Month, day, year

to |

|

(may not exceed 12 months). |

Month, day, year |

Note: Do not put financial account numbers on this form. If an account number is necessary to distinguish between accounts, put it on form MC 97.

COLUMN 1. INCOME, GAIN, AND OTHER RECEIPTS

COLUMN 2. EXPENSES, LOSSES, AND OTHER DISBURSEMENTS

$

$

Investment gain |

Investment loss |

||

|

|

|

|

Total Column 1 |

Total Column 2 |

||

|

|

|

|

(Enter on line 2.b on page 2.) |

(Enter on line 2.d on page 2.) |

||

Approved, SCAO

Form PC 583, Rev. 1/21

MCL 330.1631, MCL 700.3703(4), MCL 700.5418, MCR 5.308,

MCR 5.310(C), MCR 5.313, MCR 5.409

Page 1 of 2

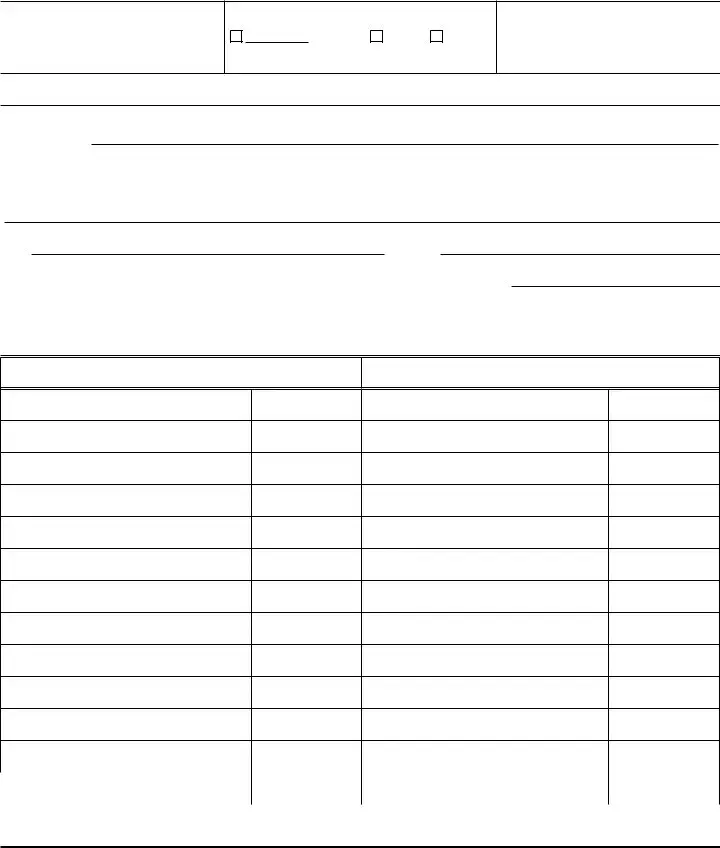

Account of Fiduciary, Short Form (1/21) |

Case No. |

Page 2 of 2 |

|

2. |

a. Balance on hand from last account, or value of inventory, if first account |

$ |

|

|

b. Enter Total Column 1, Income, Gain, and Other Receipts, from page 1 of this form |

$ |

|

|

c. Subtotal (Add line 2.a to line 2.b and enter the amount here) |

$ |

|

|

..........d. Enter Total Column 2, Expenses, Losses, and Other Disbursements, from page 1 of this form |

$ |

|

|

e. Balance of assets on hand (Subtract line 2.d from line 2.c and enter the amount here.) |

$ |

|

|

This line must equal the last line in item 3. (Itemize assets below.) |

|

|

3. |

The balance of assets on hand are as follows: |

|

|

ITEMIZED ASSETS REMAINING AT END OF ACCOUNTING PERIOD

$

Total balance on hand. This line must equal the last line in item 2. $

NOTE: In guardianships and conservatorships, except as provided by MCR 5.409(C)(4), you must present to the court copies of corresponding financial institution statements or you must file with the court a verification of funds on deposit, either of which must reflect the value of all liquid assets held by a financial institution dated within 30 days after the end of the accounting period.

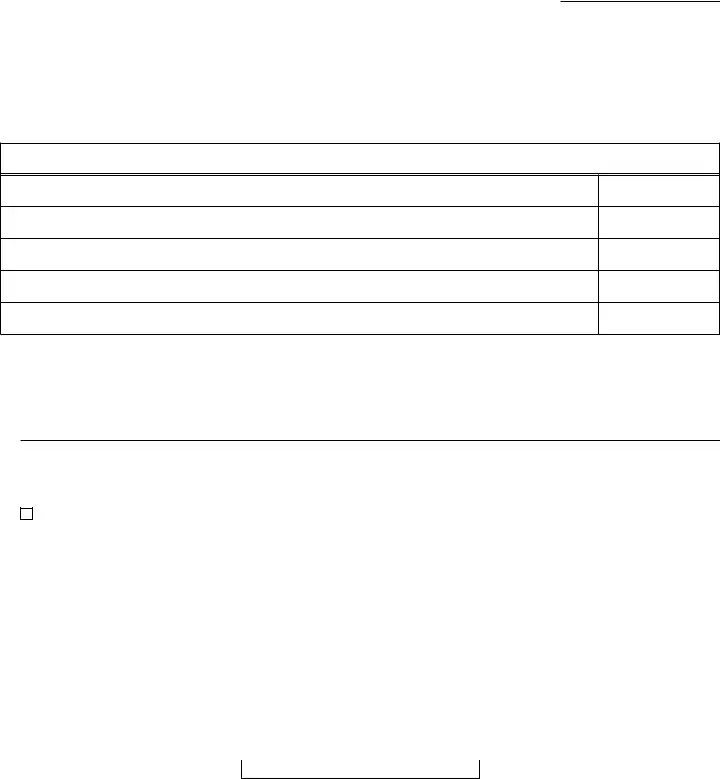

4.The interested persons, addresses, and their representatives are identical to those appearing on the initial application/ petition, except as follows: (For each person whose address changed, list the name and new address; attach separate sheet if necessary.)

5.This account lists all income and other receipts and expenses and other disbursements that have come to my knowledge.

6. This account is not being filed with the court.

This account is not being filed with the court.

7. My fiduciary fees incurred during this accounting period (including fees that have already been approved and/or paid

My fiduciary fees incurred during this accounting period (including fees that have already been approved and/or paid

|

for this accounting period) are $ |

|

|

. Attached is a written description of the services performed. |

|

8. |

Attorney fees incurred during this accounting period (including fees that have already been approved and/or paid for |

||||

|

this accounting period) are $ |

|

|

. Attached is a written description of the services performed. |

|

I declare under the penalties of perjury that this account has been examined by me and that its contents are true to the best of my information, knowledge, and belief.

|

|

|

Date |

|

|

|

|

|

|

|

|

Attorney signature |

|

|

Fiduciary signature |

|

|

|

|

|

|

|

|

Attorney name (type or print) |

Bar no. |

|

|||

|

Fiduciary name (type or print) |

|

|||

|

|

|

|

|

|

Address |

|

|

Address |

|

|

|

|

|

|

|

|

City, state, zip |

Telephone no. |

City, state, zip |

Telephone no. |

||

|

|

|

|||

(For accounts that must be filed with the court.) |

NOTICE TO INTERESTED PERSONS |

|

|

||

1.You must bring to the court’s attention any objection you have to this account. Except in guardianships and conservatorships, the court does not normally review the account without an objection.

2.You have the right to review proofs of income and disbursements at a time reasonably convenient to the fiduciary and yourself.

3.You may object to all or part of an accounting by filing a written objection with the court before the court allows the account. You must pay a $20.00 filing fee to the court when you file the objection. (See MCR 5.310[C].)

4.If an objection is filed and is not otherwise resolved, the court will conduct a hearing on the objection.

5.You must serve the objection on the fiduciary or his/her attorney.

Form Characteristics

| Fact Name | Detail |

|---|---|

| JIS Code | ACC |

| Governing Law | MCL 330.1631, MCL 700.3703(4), MCL 700.5418, MCR 5.308, MCR 5.310(C), MCR 5.313, MCR 5.409 |

| Purpose | This form is used to provide an account of a fiduciary’s financial activities in a guardianship or conservatorship. |

| Types of Accounting | Options include Annual, Final, Interim, and Amended accounting. |

| Required Information | The form requires personal details, including the fiduciary's name and the protected individual's address. |

| Financial Disclosure | No financial account numbers should be included on the form; they should be on form MC 97 if necessary. |

| Income and Expenses | The form includes columns for listing income, gains, expenses, and losses in detail. |

| Verification of Assets | Fiduciaries must present financial institution statements or verification of funds dated within 30 days of the accounting period’s end. |

| Fiduciary and Attorney Fees | Any fees incurred by the fiduciary or attorney need to be disclosed along with descriptions of services rendered. |

| Objection Process | Interested persons must file objections to the account for the court to review it; a $20.00 filing fee applies. |

Guidelines on Utilizing Pc 583

Filling out the PC 583 form is an important step for fiduciaries reporting on their management of an estate. This form ensures transparency and accountability regarding financial activities during a specified accounting period. After completing the form, you may need to submit it to the court, depending on the specifics of your case.

- Obtain the PC 583 form. You can download it from the Michigan Probate Court website or get a physical copy from the court.

- Enter the case information at the top. Fill in the Case No., County, and Judge's name.

- Provide the full name of the ward or protected individual, including first, middle, and last names.

- Input the current address and telephone number of the ward or protected individual.

- In section 1, write your name and title, indicating your role as the fiduciary. Specify the accounting period clearly, including start and end dates.

- In Column 1, list all income, gains, and other receipts during the period. Write amounts in the appropriate fields.

- In Column 2, enter all expenses, losses, and disbursements incurred. Ensure all amounts are recorded accurately.

- Calculate the total for both columns and enter those totals on page 2 in the appropriate fields.

- In section 2, provide the balance on hand from the last account or the value of inventory, if this is the first account. Follow this by entering the totals from Column 1 and Column 2 as directed.

- Calculate the subtotal by adding the last balance to the total income. Subtract the expense total from this subtotal to determine the balance of assets.

- List itemized assets remaining at the end of the accounting period. Ensure this total matches the end balance calculated previously.

- If there are changes in interested persons’ addresses, clearly list their new information. Attach a separate sheet if needed.

- Confirm that this account includes all income and expenses that you are aware of.

- Complete any sections regarding fiduciary and attorney fees. Specify the amounts and attach descriptions of services performed.

- Sign and date the account, including the required attorney and fiduciary information. Ensure both parties print their names and provide addresses and contact details.

What You Should Know About This Form

What is the PC 583 form used for?

The PC 583 form, also known as the Account of Fiduciary, Short Form, is used in the State of Michigan for fiduciaries managing a guardianship or conservatorship. This form allows fiduciaries to report the financial activity of the estate, including income, expenses, and the balance of assets during a specified period. It is essential for maintaining transparency and accountability in the management of assets that belong to a protected individual or ward.

How often do I need to file the PC 583 form?

The PC 583 form must be filed at least annually, or whenever an interim or final accounting is needed. Each accounting period reported cannot exceed 12 months. Ensuring timely and accurate submissions is crucial for fulfilling fiduciary responsibilities and complying with legal requirements.

What information do I need when filling out the PC 583 form?

You will need to gather financial information for the reporting period, including all income, receipts, expenses, and disbursements. Specifically, the form requires details about gains and losses, itemized assets at the end of the accounting period, and any fees incurred during that time. Be sure to avoid including financial account numbers on the form itself; if necessary, those details should be recorded on a separate form.

Is there a fee for filing the PC 583 form?

There is no filing fee for submitting the PC 583 form itself. However, if you are an interested party wishing to file an objection to the account, a $20.00 filing fee is required at that time. Keep in mind that this fee is separate from any potential costs associated with legal representation or other professional services.

What happens if I do not file the PC 583 form?

Failing to file the PC 583 form can lead to significant consequences. This action may leave the fiduciary open to legal challenges or accusations of mismanagement and could jeopardize the well-being of the ward or protected individual. To maintain compliance with probate court requirements, it is essential to submit the form on time.

How do I handle objections to the PC 583 form?

If you have objections to the account presented in the PC 583 form, you should file a written objection with the court. Make sure to do this before the court allows the account. Remember, the objection must be served to the fiduciary or their attorney to ensure that all parties are informed. The court will then typically schedule a hearing to address any unresolved objections.

Are there specific documentation requirements associated with the PC 583 form?

Yes, along with the PC 583 form, fiduciaries must present corresponding financial institution statements or file a verification of funds, which reflects the value of all liquid assets. These documents need to be dated within 30 days after the accounting period ends. This requirement helps ensure that the reported figures are accurate and verifiable.

Can I seek help when filling out the PC 583 form?

Absolutely. If you find the process overwhelming or have questions about specific aspects of the form, seeking assistance from a legal professional is advisable. They can provide valuable guidance to help ensure that all required information is accurately reported and that your obligations as a fiduciary are met. You are not alone in this process, and support is available.

Common mistakes

Filling out the PC 583 form can be a straightforward process, but there are several common mistakes that individuals often make. Avoiding these errors ensures that the submission is accurate and complete. Here are nine mistakes to watch out for.

1. Missing Case Number and Judge Information: It's important to include the case number and the name of the judge on the form. Omitting this information can delay processing and create confusion in court records.

2. Incorrect Dates: Always ensure that the dates covering the accounting period are entered correctly. Many people overlook the requirement that the period may not exceed 12 months. Double-check these entries to avoid discrepancies.

3. Not Itemizing Assets: Some individuals fail to provide a complete list of assets remaining at the end of the accounting period. Itemizing these assets is essential for clarity and accuracy. Remember, this must match the total balance calculated earlier.

4. Failing to Attach Required Documentation: In guardianships and conservatorships, it is necessary to attach copies of financial institution statements or a verification of funds statement. Without this documentation, the account may not be accepted.

5. Leaving Out Fiduciary and Attorney Fee Details: It's critical to list any fiduciary and attorney fees incurred during the accounting period. Failing to include these figures could result in questions about the account.

6. Not Providing Updated Addresses: If there are changes in the addresses of interested persons, be sure to provide the latest information. This can prevent issues in communication and notifications regarding the account.

7. Misunderstanding the Filing Process: Some people erroneously believe that all accounts must be filed with the court. Clarify whether yours is one that requires filing, as this can vary based on the type of guardianship or conservatorship.

8. Ignoring Signature Requirements: Remember that both the fiduciary and the attorney must sign the form. Incomplete signatures can lead to rejections or delays in processing.

9. Neglecting to Read the Instructions Carefully: Lastly, many individuals overlook the instructions that accompany the form. Taking the time to read these guidelines can prevent unintentional mistakes that lead to complications.

By being aware of these common pitfalls, you can fill out the PC 583 form accurately and efficiently, helping to ensure a smooth process in the guardianship or conservatorship accounting.

Documents used along the form

The PC 583 form is used in Michigan's probate court to report the financial activities of a fiduciary in guardianships or conservatorships. There are several other forms and documents that may accompany this form to provide necessary information and documentation concerning the financial status and activities of the ward or protected individual. Below is a brief overview of other forms frequently utilized in conjunction with the PC 583 form.

- MC 97: This form is used to provide financial account numbers without listing them directly on the PC 583 form. It helps maintain the confidentiality of specific account details while ensuring clarity in the reporting process.

- Affidavit of Service: This document verifies that the fiduciary has properly notified all interested parties about the account. It is critical for ensuring that all relevant parties are aware and have had the opportunity to respond.

- Certification of Trust: This form certifies the existence of a trust and provides essential information about the trust's terms. It may be necessary to establish the fiduciary's authority to manage assets on behalf of the ward.

- Form PC 585: Often used alongside the PC 583, the PC 585 is an account of fiduciary expenses. It details the expenses incurred during the accounting period and provides necessary information for financial transparency.

- Inventory of Estate Assets: This document lists all assets owned by the ward or protected individual at the time of the accounting. It is essential for establishing the initial financial condition of the estate.

- Notice of Hearing: If a hearing is scheduled to address any objections to the account, this document provides notice to the interested parties regarding the hearing date, time, and purpose.

- Account Review and Approval Form: This form may be utilized when seeking approval from the court for the submitted account and any expenses claimed during the reporting period.

- Financial Institution Statements: Copies of statements from financial institutions showing the account balances and transactions for the reporting period. These must reflect values dated within 30 days after the accounting period ends.

These additional documents serve important functions in supporting the fiduciary's financial disclosures and ensuring compliance with legal requirements. Proper usage of all relevant forms aids in maintaining transparency and accountability in managing the affairs of the ward or protected individual.

Similar forms

-

Form PC 580: Known as the "Account of Fiduciary, Long Form," it serves a similar purpose as the PC 583 by detailing the financial transactions of the fiduciary. However, it includes more extensive reporting requirements, making it suitable for more complex estates.

-

Form PC 584: This is the "Account of Fiduciary, Annual Report." Like PC 583, it is also used to report on income and expenses but is specifically designed for annual reporting, often covering a longer timeframe.

-

Form MC 97: This form allows for the verification of bank account balances when submitting accounts to the court. Just like PC 583, it ensures accuracy in reporting financial details, particularly focusing on income and expenses.

-

Form PC 587: This "Ex Parte Petition to Approve Accounts" is used to request court approval for accounts, similar to the PC 583. However, it specifically emphasizes the need for judicial review and approval.

-

Form PC 583a: The "Account of Fiduciary, Short Form - Supplemental" is intended to amend or update information provided in the PC 583. It follows a similar format but adds flexibility for reporting additional changes or transactions.

-

Form MC 49: This is a "Notice of Motion." It is similar in that it involves court proceedings regarding account approvals. However, it serves as a formal notification to involved parties about the intent to address financial issues before the court.

-

Form PC 580a: This "Account of Fiduciary, Long Form - Supplemental" is designed for additional information that may need to be reported post-filing. It shares similarities with the PC 583 in its reporting responsibilities but focuses on supplementary data.

Dos and Don'ts

Filling out the PC 583 form correctly is crucial for the successful management of an estate. Below are nine points to keep in mind, including what to do and what to avoid.

- Do ensure all names and titles are accurate and match court documents.

- Don't include any financial account numbers on this form.

- Do list all income, gains, and other receipts in Column 1 clearly.

- Don't leave any relevant financial information out; provide a complete record of all transactions.

- Do attach necessary financial institution statements dated within 30 days after the accounting period ends.

- Don't fail to include a written description of any fiduciary or attorney fees incurred during the accounting period.

- Do check that your totals in the accounting sections match; discrepancies can lead to issues.

- Don't neglect to notify the court of any objections to the account submitted.

- Do review the completed form for errors before submission to ensure all information is accurate.

Misconceptions

There are several misconceptions surrounding the PC 583 form. Below are eight common misunderstandings, along with clarifying information.

- The PC 583 form is only for final accounts. This is not true. The form can also be used for annual or interim accounts, enabling fiduciaries to report financial information at different intervals.

- You must include financial account numbers on the form. This is incorrect. The form explicitly advises against including account numbers. If necessary, fiduciaries should use form MC 97 for identification.

- All expenses and income must be documented with receipts. While it is beneficial to have receipts, the form allows for reporting all income and expenses that have come to the fiduciary's knowledge, which does not always include receipts.

- The court automatically reviews the account submitted. This is a misconception. In many cases, the court only reviews accounts if an objection has been raised by an interested party.

- You cannot object to the accounting after it is filed. Not true. Interested persons have the right to file a written objection with the court even after the account is submitted, but it must be before the court allows the account.

- Fiduciary fees do not need to be described in detail. This is misleading. The form requires a written description of the services performed that justify any fiduciary fees incurred during the accounting period.

- The form must always be filed with the court. This is incorrect. Depending on the situation, the account may not be filed with the court, although certain conditions must be met, especially in guardianships and conservatorships.

- There are no consequences for not following the instructions. This can lead to serious issues. Not adhering to the form’s guidelines could result in the account being rejected by the court, or could create legal complications down the line.

Understanding these aspects of the PC 583 form can help individuals navigate the process more effectively. Always review the specific requirements and consult a professional if needed.

Key takeaways

Filling out and using the PC 583 form, which is the Account of Fiduciary, Short Form, is a critical process for fiduciaries managing a guardianship or conservatorship. Here are some key takeaways to consider:

- Comprehensive Documentation: Ensure that all income, gains, expenses, and disbursements are accurately listed. Every financial detail should be accounted for to provide a clear picture of the estate during the accounting period.

- Adhere to Limitations: Since the form covers a specific period (not exceeding 12 months), be careful to follow this guideline. Ensure that the beginning and ending dates of the accounting period are appropriately filled out.

- Verify Liquid Assets: If managing a guardianship or conservatorship, remember that you must provide copies of financial institution statements or a verification of funds dated within 30 days after the end of the accounting period. This is essential to demonstrate the value of liquid assets.

- Attention to Objections: Interested parties must bring any objections to the court’s attention promptly. If an objection is filed, a hearing will be held unless resolved beforehand. Participants should be aware of their rights to review financial documentation and the process for filing objections.

This form is crucial for ensuring transparency and accountability in the management of an estate. By following these takeaways, fiduciaries can navigate the requirements smoothly while safeguarding the interests of the protected individuals.

Browse Other Templates

Quest Order Form - This form also accommodates variations in testing protocols based on each patient's specific health profile.

Academic Record Request,Official Transcript Application,Student Transcript Inquiry,CAP Transcript Order Form,Transcripts for Former Students,Alumni Transcript Request,Transcript Retrieval Form,Registrar's Transcript Request,Educational Record Release - Check the box if you are a College Acceleration Program (CAP) student.