Fill Out Your Pd7A Spreadsheet Form

The Pd7A Spreadsheet form is a crucial tool for businesses in managing payroll and remittances efficiently. Designed to summarize financial information related to employee compensation, it includes fields for essential details such as gross earnings, deductions for Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) taxes. This form facilitates transparency in payroll processing by requiring the business name, the specific period, and the remittance frequency, thereby keeping employers organized and compliant with regulations. It allows for the systematic listing of each employee’s payroll data, ensuring accurate calculations of net earnings after all deductions. Furthermore, the form includes sections for employer contributions to both CPP and EI, as well as spaces for recording vital transaction details like the date remitted and check numbers. By capturing all these components in one place, the Pd7A Spreadsheet form simplifies payroll management while promoting accountability through a signature line that signifies completeness and approval. Each entry plays a pivotal role in ensuring that all financial obligations are met timely and accurately.

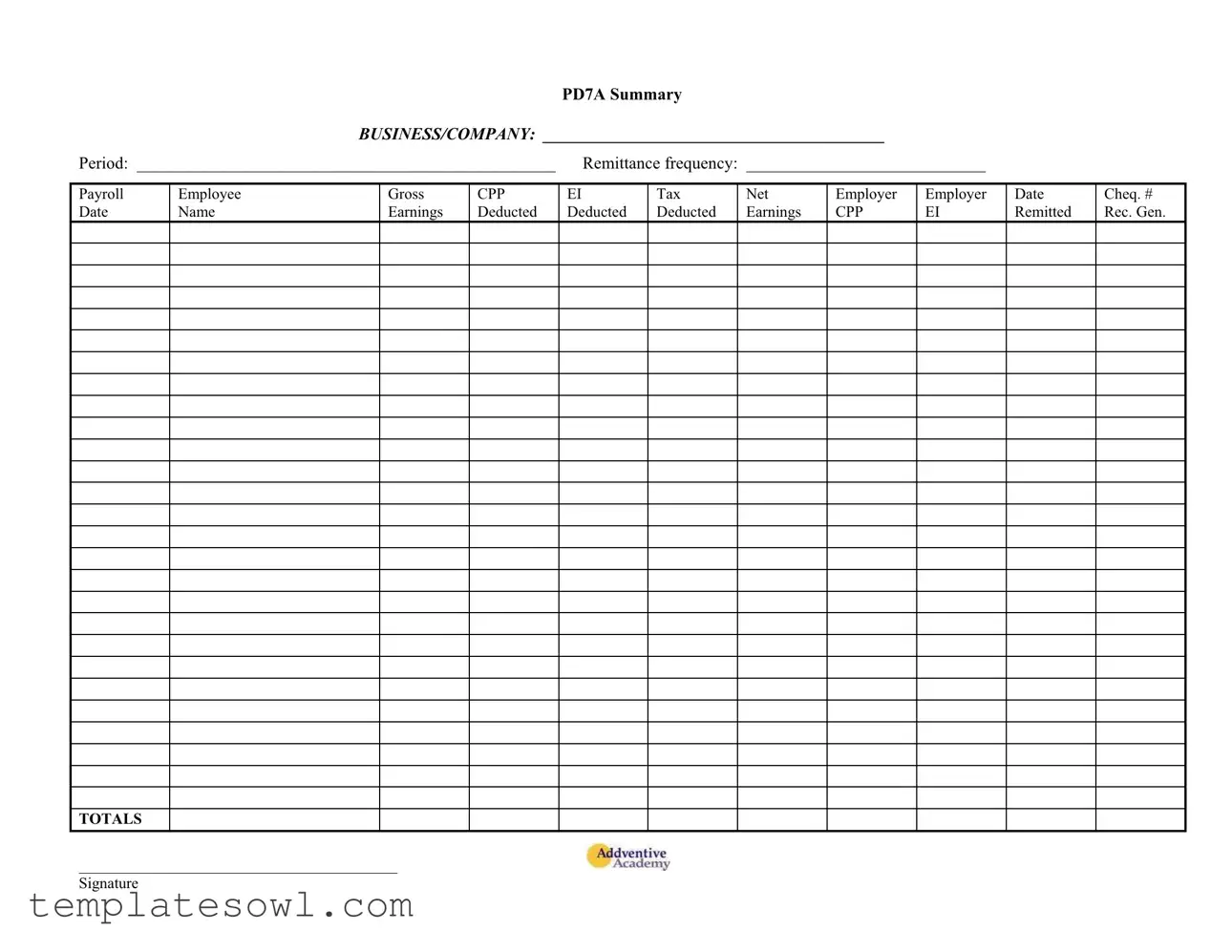

Pd7A Spreadsheet Example

PD7A SUMMARY

BUSINESS/COMPANY: ________________________________________

Period: _________________________________________________ Remittance frequency: ____________________________

Payroll

Date

Employee Name

Gross

Earnings

CPP Deducted

EI |

Tax |

Net |

Deducted |

Deducted |

Earnings |

Employer

CPP

Employer

EI

Date Remitted

Cheq. # Rec. Gen.

TOTALS

_________________________________________

Signature

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The PD7A form is used for reporting payroll deductions for employees in Canada. |

| Governing Body | This form is governed by the Canada Revenue Agency (CRA) guidelines on payroll and employee deductions. |

| Reporting Period | Employers must specify the period for which they are reporting payroll deductions using the form. |

| Remittance Frequency | The form requires employers to indicate their remittance frequency, which can vary based on total payroll. |

| Required Employee Information | Information such as employee name, gross earnings, and deductions (CPP and EI) must be entered for each employee. |

| Total Calculation | Employers must provide total figures for gross earnings, deductions, and net earnings at the bottom of the form. |

| Signature Requirement | A signature is required to validate the accuracy and truthfulness of the information presented on the form. |

| Submission Timing | The completed PD7A form must be submitted by the deadline set by the CRA for timely reporting and remittance. |

Guidelines on Utilizing Pd7A Spreadsheet

To effectively complete the Pd7A Spreadsheet form, it is essential to gather all required information beforehand. This form is used for payroll and tax deduction reporting purposes. Follow the steps outlined below to ensure all necessary sections are filled accurately.

- Begin by entering the business or company name in the designated area at the top of the form.

- Fill in the period during which the payroll applies.

- Indicate the remittance frequency (e.g., monthly, quarterly) by writing it in the available space.

- List each payroll date in the corresponding column for each employee.

- Under the employee section, write the employee names next to their respective payroll dates.

- Input each employee’s gross earnings in the column provided.

- Calculate and enter the Canada Pension Plan (CPP) deducted for each employee.

- Fill in the amount for Employment Insurance (EI) deducted for each employee.

- Calculate the total taxes deducted for each employee and enter it in the respective column.

- After deductions, calculate each employee’s net earnings and input this amount.

- For employer contributions, record the employer CPP in the designated column.

- Fill in the employer EI totals in the corresponding area.

- Record the date remitted for each payment.

- Document the cheque number associated with each remittance, if applicable.

- List the general totals for all fields at the end of the form.

- Lastly, ensure to sign the form to certify that all information is accurate.

Once completed, review the form for any errors or omissions. It is critical that all information is precise to comply with regulatory requirements. After confirming that everything is correct, the form can be submitted as required.

What You Should Know About This Form

What is the purpose of the PD7A Spreadsheet form?

The PD7A Spreadsheet form is used by businesses in Canada to report and summarize payroll information. It helps employers track employee earnings, deductions for Canada Pension Plan (CPP) and Employment Insurance (EI), and ensure accurate remittance of payroll taxes. It serves as an essential tool for maintaining compliance with tax regulations.

What information must be included on the PD7A form?

Employers need to complete several fields on the PD7A form. Key details include the business or company name, the reporting period, and the remittance frequency. Additionally, employers must input payroll details for each employee, including their names, gross earnings, deductions for CPP and EI, net earnings, and amounts remitted to the government. This data is paramount for accurate reporting and tax compliance.

How is the remittance frequency determined?

The remittance frequency for payroll taxes can be influenced by the size of the employer's payroll. Employers are typically classified as regular or quarterly remitters based on their average monthly withholding amount. Their classification should align with the rules set by the Canada Revenue Agency (CRA) to ensure compliance with remittance schedules.

What are the possible remittance frequencies?

There are three main remittance frequencies: monthly, quarterly, and annually. Monthly remitters must submit payroll deductions by the 15th of the following month. Quarterly remitters have a schedule that aligns with the end of each fiscal quarter, while annual remitters must remit by the due date specified by the CRA for their specific business circumstances.

Are there penalties for late remittance reported on the PD7A form?

Late remittance can result in penalties imposed by the Canada Revenue Agency. These penalties can include a percentage of the overdue amount. It is essential for businesses to adhere to the remittance deadlines specified to avoid incurring financial penalties or interest on late payments.

How can I obtain a copy of the PD7A Spreadsheet form?

The PD7A Spreadsheet form can be downloaded from the official Canada Revenue Agency (CRA) website. Employers can access it easily by searching for "PD7A Spreadsheet form" on the CRA site. Additionally, local accounting firms and business resources may also provide access to a fillable version of this important payroll document.

Common mistakes

The Pd7A Spreadsheet form is crucial for businesses when reporting payroll taxes. However, several common mistakes can lead to incorrect submissions and potential penalties. Awareness of these errors helps ensure compliance and accuracy.

One frequent mistake is failing to complete the business or company name section. Without this information, tax authorities cannot associate the submission with a specific entity, leading to delays or misallocations of payments.

Another error involves neglecting to specify the remittance frequency. Payroll periods can vary, and clearly indicating the frequency ensures that the proper timing for submissions is understood by all parties involved.

Many individuals mistakenly overlook entering all employee names or only list partial names. This omission can create confusion and mislead tax authorities when trying to verify records. Every employee paid should be accurately named to avoid discrepancies.

The gross earnings section often contains errors. Employers sometimes enter incorrect amounts, either due to simple miscalculations or failure to account for bonuses and overtime. Accurate reporting of gross earnings is essential for calculating appropriate deductions.

CPP and EI deductions can also be miscalculated. Some people fail to apply the correct rates or reference tables, leading to under or over deducting from employees’ paychecks. Ensuring the most current rates are applied helps maintain compliance.

Additionally, individuals may forget to account for net earnings after all deductions. This oversight affects not only employee pay but also reporting accuracy. Each deduction must be considered to arrive at the correct net amount.

When completing the form, it’s vital that the date remitted is clearly noted. Omitting this can create confusion regarding payment timelines, which may affect the company’s standing with tax authorities.

Some individuals misplace or fail to include supporting documentation. This documentation is required for verification, and lacking it may lead to inquiries or penalties from tax offices.

The cheque number should also be included. Forgetting this detail can complicate record-keeping and make tracking payments more difficult, possibly resulting in payment disputes.

Lastly, neglecting to obtain a signature on the form raises validity issues. A missing signature can lead to questions regarding accountability and intent, undermining the integrity of the submission.

Documents used along the form

The PD7A Spreadsheet form is essential for businesses managing payroll. It provides a clear overview of employee earnings and the deductions made for Canada Pension Plan (CPP) and Employment Insurance (EI). However, it is often accompanied by other important documents that help streamline payroll processes and ensure compliance. Below are some commonly used forms that complement the PD7A Spreadsheet.

- PD7A Summary Report: This document summarizes the total deductions for CPP and EI for all employees in a given period. It is a crucial comparison tool, ensuring that the amounts deducted and remitted align with the figures reported in the PD7A Spreadsheet.

- T4 Slip: Issued at the end of the year, the T4 slip details the total earnings and deductions for each employee. It is an important document for tax reporting, helping employees report their income accurately on their tax returns.

- Employers’ Payroll Remittance Voucher (Form PD7A): This form is used to remit the total deductions collected from employees to the government. It contains all necessary details regarding the payment period, employer information, and the amounts being remitted.

- Record of Employment (ROE): This document is issued to employees when they leave a job. It outlines their earnings and the reasons for their employment ending, which is critical for determining their eligibility for EI benefits.

Utilizing these forms alongside the PD7A Spreadsheet can help ensure accuracy and compliance in payroll management. Staying organized and keeping thorough records fosters a smoother payroll process and supports both employer and employee needs.

Similar forms

The Pd7A Spreadsheet form is often used in employment and payroll processing. Here are seven other documents that are similar to the Pd7A form in their purpose or structure:

- PD7A Summary Report: Like the Pd7A Spreadsheet, this report summarizes payroll deductions for the employer. It provides a clear overview of what was withheld from employees' earnings.

- T4 Statement of Remuneration Paid: This document shows how much an employee was paid in a tax year and the deductions made. Both forms track payroll information but serve different reporting needs.

- ROE (Record of Employment): This record provides details about an employee's work history and earnings. It can be seen as complementary to the Pd7A, as it may reference earnings and deductions.

- Payroll Register: Similar to the Pd7A, the payroll register includes details on each employee's pay, deductions, and net pay for each pay period. It is vital for record-keeping.

- Remittance Voucher: This document accompanies remittance payments to the government. It shares similarities with the Pd7A in that both involve documenting deductions and payments due.

- Employee Pay Stub: The pay stub informs employees of their earnings and deductions per pay period, much like the details presented in the Pd7A Spreadsheet.

- Annual Tax Returns: While broader in scope, annual tax returns summarize an individual's income and deductions over a year, paralleling the cumulative data on the Pd7A form.

Dos and Don'ts

When completing the Pd7A Spreadsheet form, there are important guidelines to follow to ensure accuracy and compliance. Here are key do's and don'ts to keep in mind:

- Do double-check the business or company name for spelling errors.

- Do ensure the payroll date is clearly marked and correctly formatted.

- Do include all necessary employee names and their corresponding earnings.

- Do calculate deductions accurately for CPP, EI, and taxes.

- Don't leave any fields blank; every section needs to be filled out completely.

- Don't use abbreviations or shorthand that might confuse the information provided.

- Don't forget to sign the summary before submission; it validates the form.

- Don't submit the form late; adhere to remittance deadlines to avoid penalties.

By following these guidelines, you can streamline the process and ensure that your submissions are clear and accurate.

Misconceptions

Misconceptions about the Pd7A Spreadsheet form can lead to confusion for businesses and employers. Here are ten common misunderstandings:

- It’s only for large businesses. Many believe that the Pd7A form is exclusive to large companies, but small businesses must also use it if they have employees.

- Only accountants can fill it out. While accountants can help, any business owner or payroll manager can complete the form, provided they understand the payroll process.

- It is primarily for monthly reporting. Some think the Pd7A is only for monthly remittances. In reality, it is used for various remittance frequencies, depending on the company’s size and payroll frequency.

- All fields are optional. While some fields may not be strictly necessary, completing as many relevant sections as possible ensures accurate payroll reporting.

- You can submit the form anytime. Many believe they can submit the form whenever they want, but there are strict deadlines associated with remittance periods that must be adhered to.

- The form doesn't require a signature. The Pd7A must be signed by an authorized representative to confirm the accuracy of the reported information.

- You don't need to keep copies. Some think that once they submit the form, they can discard it. However, businesses should retain copies for their records in case of audits.

- The Pd7A only tracks employee earnings. While it does detail employee earnings, it also includes payroll deductions such as CPP and EI, crucial for accurate remittances.

- It's the same as other payroll documents. The Pd7A form is unique in its specific purpose for remitting payroll deductions. Other forms may have different functions.

- Submitting late is acceptable. Many believe that late submissions won’t impact the business, but delays can result in penalties and increased liabilities.

Understanding these misconceptions ensures that employers can properly manage their payroll processes and comply with regulations effectively.

Key takeaways

When filling out the PD7A Spreadsheet form, keep these key takeaways in mind:

- Accurate Information: Ensure all entries, especially employee names and earnings, are correct to avoid issues later.

- Remittance Frequency: Clearly specify how often you will remit payments, as this will affect deadlines.

- Regular Updates: Gather and update employee payroll data promptly to keep the form relevant.

- Total Calculation: Double-check the total calculations to confirm that all deductions are accurately reflected.

- Sign and Date: Don’t forget to sign and date the form before submission; this confirms your accountability.

- Retention: Keep a copy of the completed form for your records, as it may be needed for future reference.

- Submission Timeliness: Submit the form on time to avoid penalties or interest on overdue remittances.

Browse Other Templates

Fannie Mae Form - Payments are made monthly, starting on a specified date, promoting consistency in payment schedules.

Integrated Brand Promotion - The Integrated Brand Promotion form serves as a toolkit for developing potent advertising strategies.