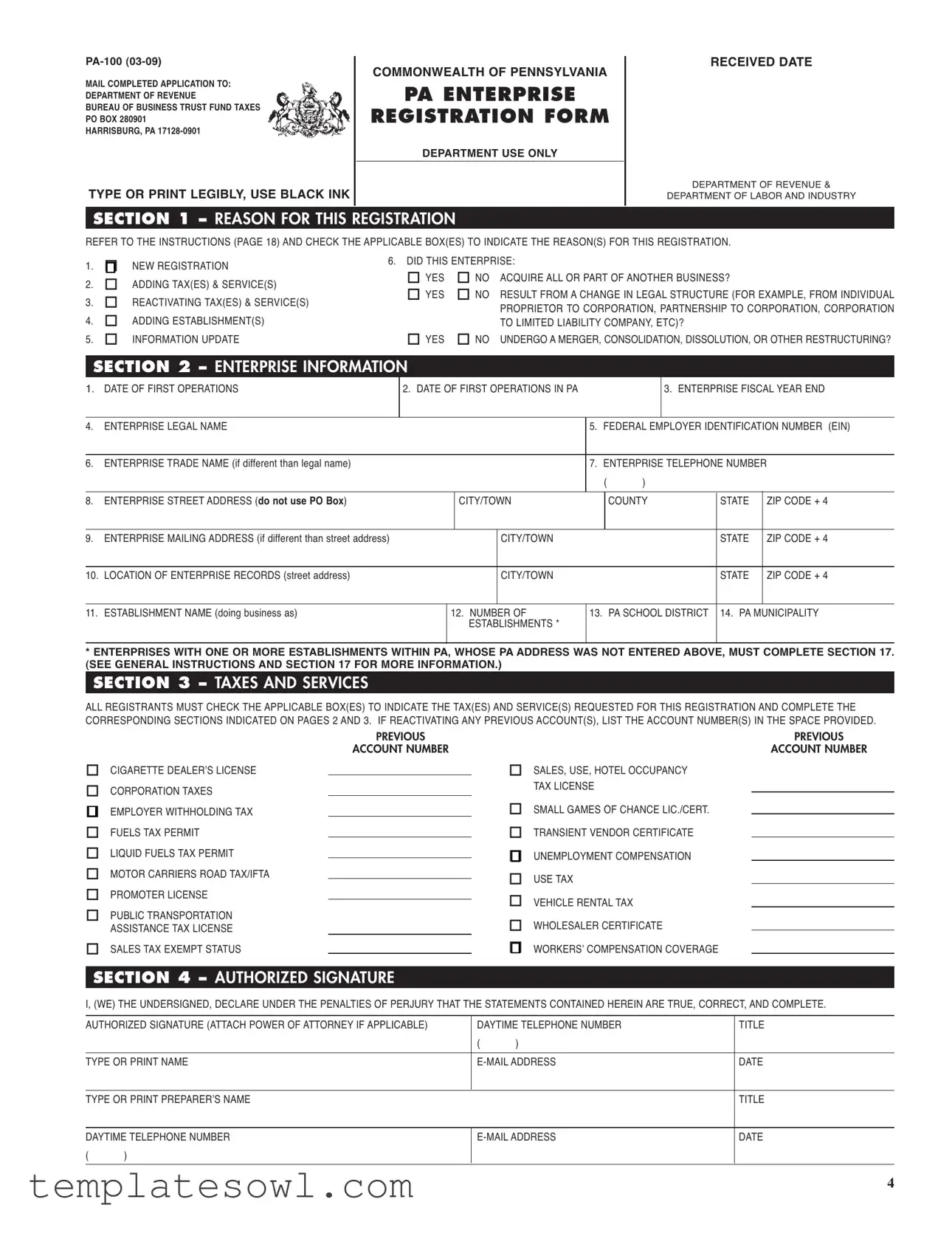

Fill Out Your Pennsylvania Pa 100 Form

The Pennsylvania PA-100 form is an essential document for businesses seeking to register with the state's Department of Revenue. This form serves several important purposes, including registering new businesses, updating existing registrations, and notifying the department of changes in ownership or business structure. The process of completing the PA-100 involves several sections that capture key information about the enterprise, such as its name, address, and type of business structure, whether it be a sole proprietorship, partnership, or corporation. Additionally, the form requests details about the business's operations within Pennsylvania, including its start date, tax identifiers, and contact information. It also asks whether the business will relate to any previous registrations or if there are multiple establishments involved. Thorough completion and accurate documentation are crucial, as the information provided is used for tax purposes and ensures compliance with state regulations. The PA-100 must be submitted to the Department of Revenue for processing, whereupon the business will receive its necessary identification and tax credentials, allowing it to operate legally within Pennsylvania.

Pennsylvania Pa 100 Example

MAIL COMPLETED APPLICATION TO:

DEPARTMENT OF REVENUE

BUREAU OF BUSINESS TRUST FUND TAXES

PO BOX 280901

HARRISBURG, PA

TYPE OR PRINT LEGIBLY, USE BLACK INK

COMMONWEALTH OF PENNSYLVANIA

PA ENTERPRISE

REGISTRATION FORM

DEPARTMENT USE ONLY

RECEIVED DATE

DEPRTMENT OF REVENUE & DEPRTMENT OF LR D INDUSTRY

SECTION 1 – REASON FOR THIS REGISTRATION

REFER TO THE INSTRUCTIONS E D CHECK THE ICE BOXTO INDI |

CTE THE RENFOR THIS REGISTRTION. |

. |

NEW REGISTRTION |

|

. |

DING T& SERVICE |

|

. |

RETIVTING T& SERVICE |

|

4. DING ESTISHMENT

5. INFORMTION UPDTE

6. DID THIS ENTERPRISE: |

|

||

YES |

NO |

QUIRE L OR PRT OF OTHER BUSINESS? |

|

YES |

NO |

RESULT FROM CHGE IN LEG STRUCTURE OR EXE FROM INDIVIDU |

|

|

|

PROPRIETOR TO CORPORTION PRTNERSHIP TO CORPORTION COR |

PORTION |

|

|

TO LIMITED LILITY COMPYETC |

|

YES |

NO |

UNDERGO MERGER CONSOLIDTION DISSOLUTION OR OTHER REST |

RUCTURING? |

SECTION 2 – ENTERPRISE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

||

. |

DTE OF FIRST OPERTIONS |

|

. DTE OF FIRST OPERTIONS IN P |

. |

ENTERPRISE FISC YE END |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

ENTERPRISE LEG N |

|

|

|

|

|

|

5. FEDER EMPLOYER IDENTIFICTION NUMBER N |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

6. ENTERPRISE TRE Nf different than legal name |

|

|

|

|

|

. ENTERPRISE TELEPHONE NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

ENTERPRISE STREETDRESS |

do ot use PO Box |

|

|

CITY/TOWN |

|

|

|

COUNTY |

|

STTE |

ZIP CODE + 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

. ENTERPRISE MLING DRESS f different than street address |

|

|

CITY/TO |

WN |

|

|

|

|

|

STTE |

ZIP CODE + 4 |

||

|

|

|

|

|

|

|

|

|

|

|

|

||

. LOCTION OF ENTERPRISE RECORDS reet address |

|

|

CITY/TOWN |

|

|

|

|

|

|

STTE |

ZIP CODE + 4 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. ESTISHMENT Noing business as |

|

|

. NUMBER OF |

|

. |

PSCHOOL DISTRICT |

4. P |

MUNICIPLITY |

|||||

|

|

|

|

|

ESTISHMENTS * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*ENTERPRISES WITH ONE OR MORE ESTABLISHMENTS WITHIN PA, WHOSE PA ADDRESS WAS NOT ENTERED ABOVE, MUST COMPLETE SECTION 17 (SEE GENERAL INSTRUCTIONS AND SECTION 17 FOR MORE INFORMATION)

SECTION 3 – TAXES AND SERVICES

LL REGISTRTS MUST CHECK THE ICE BOXTO INDICTE THE TD SERVIC |

EREQUESTED FOR THIS REGISTRTION D CO |

MPLETE THE |

CORRESPONDING SECTIONS INDICTED ON PES D . IF RETIVT |

ING Y PREVIOUS COUNT LIST THE COUNT NUMBERIN THE SPE PROVID |

ED. |

|

PREVIOUS |

|

|

ACCOUNT NUMBER |

|

CIGETTE DEERʼS LICENSE |

|

|

CORPORTION T |

|

|

EMPLOYER WITHHOLDING TX |

|

|

FUELS TPERMIT |

|

|

LIQUID FUELS TPERMIT |

|

|

|

||

MOTOR CRIERS RO TIFT |

|

|

PROMOTER LICENSE |

|

|

|

||

PUBLIC TRSPORTTION |

|

|

|

||

STCE TLICENSE |

|

|

|

|

|

SES TEXEMPT STTUS |

|

|

SECTION 4 – AUTHORIZED SIGNATURE

PREVIOUS

ACCOUNT NUMBER

SES USE HOTEL OCCUPCY

TLICENSE

SML GOF CHCE LIC./CERT.

TRSIENT VENDOR CERTIFICTE

UNEMPLOYMENT COMPENSTION

USE TX

VEHICLE RENTTX

WHOLESER CERTIFICTE

WORKERSʼ COMPENSTION COVERE

I ETHE UNDERSIGNED DECLE UNDER THE PENTIES OF PERJURY THT TH |

E STTEMENTS CONTNED HEREIN E TRUE CORRECTD COM |

PLETE. |

||

|

|

|

|

|

THORIZED SIGNTURETTH POWER OFTTORNEY IF ICE |

DYTIME |

TELEPHONE NUMBER |

TITLE |

|

TYPE OR PRINT N

ELDRESS

DTE

TYPE OR PRINT PREPERʼS N

TITLE

DYTIME TELEPHONE NUMBER

ELDRESS

DTE

4

|

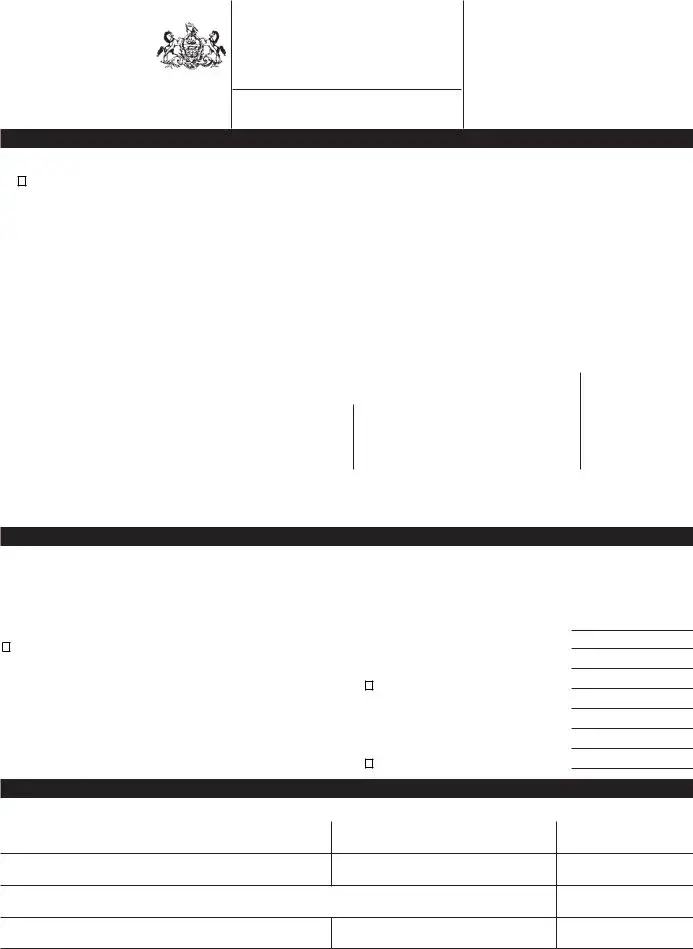

DEPRTMENT USE ONLY |

|

|

|

|

ENTERPRISE N |

|

|

SECTION 5 – BUSINESS STRUCTURE

CHECK THE OPRITE BOX FOR QUESTIONS & . IN DITION TO SEC |

TIONS THROUGH COMPLETE THE SECTIONINDICTED. |

. SOLE PROPRIETORSHIP NDIVIDU |

GENER PRTNERSHIP |

CITION |

|

CORPORTION c. |

LIMITED PRTNERSHIP |

BUSINESS TRUST |

|

GOVERNMENT c. |

LIMITED LILITY PRTNERSHIP |

ESTTE |

|

|

JOINT VENTURE PRTNERSHIP |

|

|

LIMITED LILITY COMPY

STTE WHERE CHTERED

RESTRICTED PROFESSION COMPY

STTE WHERE CHTERED

. |

PROFIT |

|

. |

YES |

NONOFIT |

IS THE ENTERPRISE ORGIZED FOR PROFIT OR NONOFIT? |

|

NO |

IS THE ENTERPRISE EXEMPT FROM TTION UNDER INTERN REVENUE CODE RCSEC |

TION 5 IF YES |

|

PROVIDE COPY OF THE ENTERPRISE'S EXEMPTION THORIZTION LETTER FROM T |

HE INTERN REVENUE SERVICE. |

SECTION 6 – OWNERS, PARTNERS, SHAREHOLDERS, OFFICERS, AND RESPONSIBLE PARTY INFORMATION

|

PROVIDE THE FOLLOWING FOR ALL INDIVIDUD/OR ENTERPRISE OWNERS PRTNERS SHEHOLDERS OFFICERS |

|

D RESPONSIBLE PRTIES. IF STOCK IS PUBLICLY |

|

||||||||||||||

|

TRED PROVIDE THE FOLLOWING FOR ANY SHAREHOLDER WITH AN EQUITY POSITION OF 5% OR MORE ADDITIONAL SPACE IS AVAILABLE IN SECTION 6A, PAGE 11 |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

N |

|

|

|

|

. SOCI SECURITY NUMBER |

. |

DTE OF BIRTH * |

4. FEDER EIN |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

OWNER |

OFFICER |

|

6. TITLE |

|

|

|

. EFFECTIVE DTE |

. |

PERCENTE OF |

. EFFECTI |

VE DTE OF |

|

|

||||

|

|

PRTNER |

SHEHOLDER |

|

|

|

|

|

OF TITLE |

|

OWNERSHIP |

|

OWNERSHIP |

|

|

|||

|

|

RESPONSIBLE PRTY |

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

. HOME DRESS reet |

|

|

|

|

CITY/TOWN |

|

|

COUNTY |

|

|

STTE |

ZIP CODE + 4 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

. THIS PERSON IS RESPONSIBLE TO REMIT/MNTN: |

SES T |

EMPLOYER WITHHOLDING TX |

MOTOR FUEL T |

|

|

|

||||||||||||

|

|

|

|

|

|

WORKERSʼ COMPENSTION COVERE |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

* DTE OF BIRTH REQUIRED ONLY IFYING FOR CIGETTE WHOL |

ESE DEERʼS LICENSE SML GOF CHCE DISTRIBUTOR LICENSE OR SML |

|

G |

|

|||||||||||||

|

OF CHCE MUFTURER CERTIFICTE. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

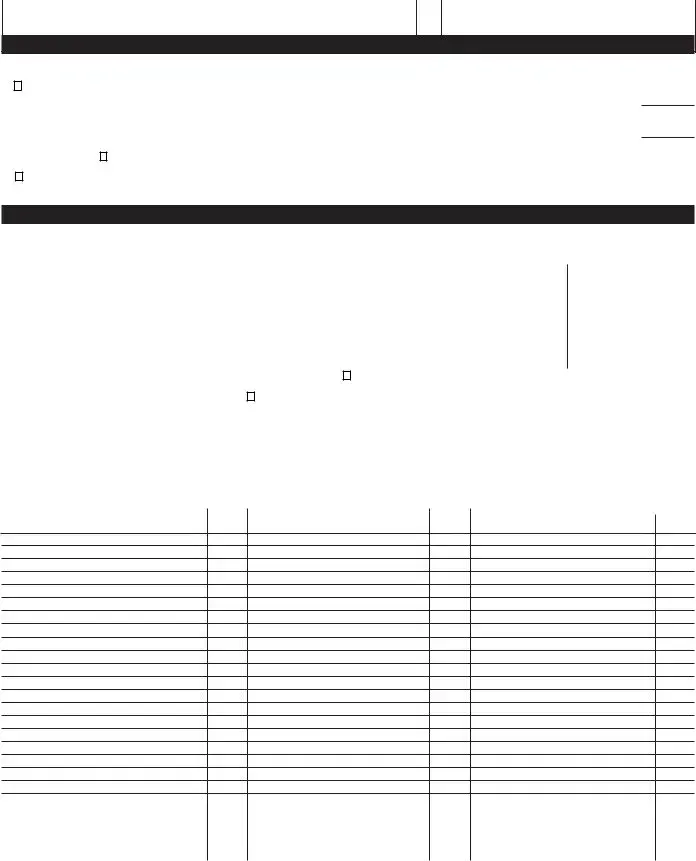

SECTION 7 – ESTABLISHMENT BUSINESS ACTIVITY INFORMATION |

|

|

|

|

|

|

|

|

|||||||||

|

REFER TO THE INSTRUCTIONS ON PAGES 20 & 21 TO COMPLETE THIS SECTION COMPLETE SECTION 17 FOR MULTIPLE ESTABLISHMENTS |

|

|

|||||||||||||||

. ENTER THE PERCENTE THT EH |

PABUSINESS ACTIVITY REPRESENTS OF THE TOTL RECEIPTS OR REVENUEST |

THIS ESTISHMENT. LIST |

PRODUCTS OR |

|

||||||||||||||

|

|

SERVICES CITED WITH EH BUSINESS TIVITY D THE PERCENTE REPRESENTING THE TO |

TL RECEIPTS OR REVENUES. |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PA BUSINESS ACTIVITY |

% |

|

PRODUCTS OR SERVICES |

% |

|

ADDITIONAL |

|

% |

|

|||||||

|

|

|

PRODUCTS OR SERVICES |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

mmodation & Food Services

riculture Forestry Fishing & Hunting

Entertainment & Recreation Services

Communications/Information

Construction st complete question

Domestics vate Households

Educational Services

Finance

Health Care Services

Insurance

Management Support & Remediation Services

Manufacturing

Mining Quarrying & Oil/Gas Extraction

Other Services

Professional Scientific & Technical Services

Public ministration

Real Estate

Retail Trade

Sanitary Service

Social stance Services

|

Transportation |

|

|

|

|

|

|

|

|

|

|

|

|

Utilities |

|

|

|

|

|

|

|

|

|

|

|

|

Warehousing |

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale Trade |

|

|

|

|

|

|

|

|

|

|

|

|

TOTL |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

. ENTER THE PERCENTE THT |

THIS ESTABLISHMENTS RECEIPTS OR REVENUES REPRESENT OF THE TOTAL PARECEIPTS OR REVENUES OF THE ENTERPRISE. |

|

|

||||||||

|

______________%. SINGLE ESTBLISHMENT ENTERPRI SES ENTER %. MULTIPLE ESTISHMENT ENTERPRISES ENTER PERCENTE OF ENTERPRISE SEC |

TION |

||||||||||

|

. ESTISHMENTS ENGED IN CONSTRUCTION |

MUST ENTER THE PERCENTE OF CONSTRUCTION TIVITY THT IS NEW D/OR |

RENOVTIVE D THE PERCENT |

|||||||||

|

E OF CONSTRUCTION TIVITY THT IS RESIDENTID/OR COMMERCI |

|

. |

|

|

|

|

|

|

|||

|

|

|

___________________% NEW |

+ |

__________________% RENOVTIVE |

= |

% |

|

|

|

||

|

|

|

___________________% RESIDENTIL |

+ |

__________________% COMMERCIL |

= |

% |

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

4. YES NO |

DOES THIS ENTERPRISE WNT TO BECOME PENNSYLVNILOTTERY |

RETLER? |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

5

|

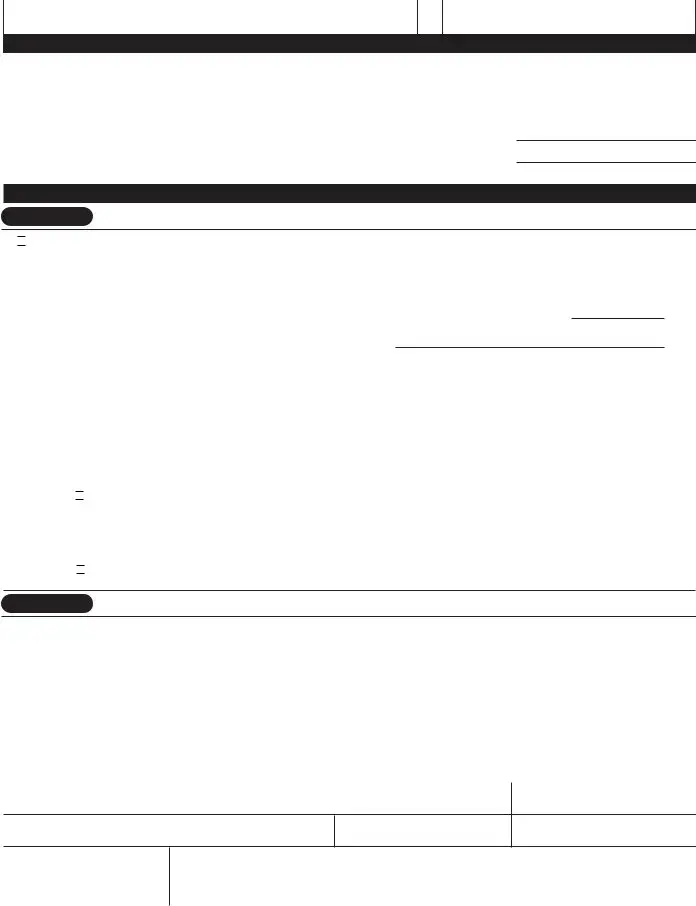

DEPRTMENT USE ONLY |

|

|

|

|

ENTERPRISE N |

|

|

SECTION 8 – ESTABLISHMENT SALES INFORMATION

. |

YES |

NO |

IS THIS ESTISHMENT SELLING TE PRODUCTS OR OFFERING TE SERVICES TO |

CONSUMERS FROM LOCTION |

|

|

|

|

IN PENNSYLVANIA? IF YES COMPLETE SECTION . |

|

|

. |

YES |

NO |

IS THIS ESTISHMENT SELLING CIGETTES |

IN PENNSYLVANIA? IF YES COMPLETE SECTIONS D . |

|

. LIST EH COUNTY |

IN PENNSYLVANIA WHERE THIS ESTISHMENT IS CONDUCTING TE SES TIVITYES |

|

||||

COUNTY |

|

|

COUNTY |

|

|

COUNTY |

COUNTY |

|

|

COUNTY |

|

|

COUNTY |

|

|

|

ATTACH ADDITIONAL 8 1/2 X 11 SHEETS IF NECESSARY. |

|

||

SECTION 9 – ESTABLISHMENT EMPLOYMENT INFORMATION

PART 1

.

YES

YES

. YES

. YES

NO |

DOES THIS ESTISHMENT EMPLOY INDIVIDUS WHO |

WORK IN PENNSYLVANIA? IF YES INDICTE: |

|||||

|

a. |

DTE WES FIRST |

PAID DD/YYYY |

. . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

|

|

|

|

|

|||

|

b. |

DTE WGES RESUMED FOLLOWING BREIN EMPLOYMENT |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||||

|

|

|

|

|

|||

|

c. |

TOTL NUMBER OF EMPLOYEES |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . |

||||

|

|

|

|

|

|||

|

d. |

NUMBER OF EMPLOYEES PRIMILY WORKING IN NEW BUILDING OR INFRRUC |

TURE |

||||

|

|

|

|

|

|

|

|

e.NUMBER OF EMPLOYEES PRIMILY WORKING IN REMODELING CONSTRUCTION . . . . . . . . . . . . . . . . . . . . . .

f. ESTIMTED GROSS WGES PER QUTER |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . .$ |

. |

g.NOF WORKERSʼ COMPENSTION INSURCE COMPY

. |

POLICY NUMBER _________________________________E FFECTIVE STRT DTE __________________END DTE __ |

_________________ |

||||||

. |

GENCY NME _____________________________________ _________________DYTIME TELEPHONE NU MBER ______________________ |

|||||||

|

MLING DRESS |

_____________________________________CITY/TOWN ______________________STTE _____ZIP CODE + 4_ _______ |

||||||

. |

IF THIS ENTERPRISE DOES NOT HVE WORKERSʼ COMPENSTIONINSURCE CHECK |

ONE: |

|

|

||||

|

a. |

THIS ESTISHMENT EMPLOYSONLY EXCLUDED WORKERS . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|||

|

b. |

. . . . . . . . . . . . . .THIS ESTISHMENT HZERO EMPLOYEES |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|||

c.THIS ESTISHMENT RECEIVED OVTO SELFNSURE BY THE PBURE OF

|

|

WORKERSʼ COMPENSTION |

. . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|||||||

|

|

IF ITEM c. IS CHECKED PROVIDE PWORKERSʼ COMPENSTION BURE CODE |

|

|

|

||||||

NO |

DOES THIS ESTISHMENT EMPLOY PRESIDENTS WHO |

|

WORK OUTSIDE OF PENNSYLVANIA? |

|

|

||||||

|

IF YES INDICTE: |

|

|

|

|

|

|

|

|

|

|

|

a. |

DTE WES FIRST |

PAID DD/YYYY . . . |

. |

. . . . . . . . . . . . . . . . . . |

. |

. . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

b. |

. . . . . . . .DTE WGES RESUMED FOLLOWING BREIN EMPLOYMENT |

. . . . . . . . . . . . . . . . . |

|

|

|

|||||

|

c. |

ESTIMTED GROSS WGES PER QUTER. |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . .$ |

|

. |

|

||||

NO |

DOES THIS ESTISHMENT PY REMUNERTION FOR SERVICES TO PERSONS YOU DO |

NOT CONSIDER EMPLOYEES? |

|

|

|||||||

|

IF YES EXPLN THE SERVICES PERFORMED |

|

|

|

|

|

|

|

|

||

PART 2

. YES |

NO |

IS THIS REGISTRTION |

RESULT OF TE DISTRIBUTION FROM |

BENEFIT TRUST DEFERRED PYMENT OR RETIREMENT PL |

||||

|

|

FOR PRESIDENTS? |

|

|

|

|

|

|

|

|

IF YES INDICTE: |

a. |

DTE BENEFITS FIRST PAID DD/YYYY |

. . . . . . . . . . . |

|

|

|

|

|

|

b. ESTIMTED BENEFITS PID PER QUTER |

. . . . . . . . . . . . . . . . . . . . . .$ |

|

. |

|

|

|

|

|

|

|

|

|||

|

SECTION 10 – BULK SALE/TRANSFER INFORMATION |

|

|

|

|

|||

IF S WERE QUIRED IN BULK FROM MORE TH ONE ENTERPRISE PHOTOCOPY T |

HIS SECTION D PROVIDE THE FOLLOWING INFORMTION |

UT EH |

||||||

SELLER/TRSFEROR. |

|

|

|

|

|

|

||

. |

YES |

NO |

DID THE ENTERPRISE QUIRE 5% OR MORE OF |

ANY CLASS OF THE PA ASSETS OF OTHER ENTERPRISE? SEE THE CLOF S |

|

|

||

|

|

|

LISTED BELOW. |

|

|

|

|

|

. |

YES |

NO |

DID THE ENTERPRISE QUIRE 5% OR MORE OF THE |

TOTALASSETS OF OTHER ENTERPRISE? |

|

|

||

IF THE SWER TO EITHER QUESTION IS YES PROVIDE THE FOLLOWING INFO RMTION UT THE |

SELLER/TRANSFEROR |

|

|

|||||

|

|

|

|

|

|

|||

. SELLER/TRSFEROR N |

|

|

4. FEDER EIN |

|

|

|||

5. SELLER/TRSFEROR STREETDRESS

CITY/TOWN

STTE |

ZIP CODE + 4 |

|

|

6. DTE S QUIRED |

. S QUIRED: |

|

|

|

|

|

|

COUNTS RECEIVE |

EQUIPMENT |

INVENTORY |

ND/OR GOODWILL |

|

|

|

CONTRTS |

FIXTURES |

LE |

RE ESTTE |

|

|

|

CUSTOMERS/CLIENTS |

FURNITURE |

MHINERY |

OTHER |

|

|

|

|

|

|

|

|

|

IMPORTANT: IF, IN ADDITION TO ACQUIRING ASSETS IN BULK, THE ENTERPRISE ALSO ACQUIRED ALL OR PART OF A PREDECESSOR'S BUSINESS, SECTION 14 MUST BE COMPLETED.

IF THE ENTERPRISE IS ACQUIRING 51% OR MORE OF ANY CLASS OF PA ASSETS AND/OR 51% OF THE TOTAL ASSETS OF ANOTHER ENTERPRISE THE SELLER MUST OBTAIN A BULK SALE CLEARANCE CERTIFICATE. REFER TO INSTRUCTIONS ON PAGE 22.

6

|

DEPRTMENT USE ONLY |

|

|

|

|

ENTERPRISE N |

|

|

SECTION 11 – CORPORATION INFORMATION

. DTE OF INCORPORTION |

. |

STTE OF INCORPORTION |

. CERTIFIC |

TE OF THORITY DTE |

|

|

|

ONCORP. |

|

|

|

|

|

|

4. COUNTRY OF INCORPORTION

5. |

YES |

NO |

IS THIS CORPORTION'S STOCK PUBLICLY TRED? |

|

|

|

|

||

6. |

CHECK THE OPRITE BOX TO DESCRIBE THIS CORPORTION: |

|

|

|

|

|

|

||

|

CORPORTION: |

STOCK |

PROFESSION |

BK: |

STTE |

MUTU |

THRIFT: STTE |

INSURCE |

P |

|

|

NONOCK |

COOPERTIVE |

|

FEDER |

|

FEDER |

COMPNY: |

NON |

|

|

MEMENT |

STTUTORY CLOSE |

|

|

|

|

|

|

. S CORPORTION: |

FEDER |

INCORDCE WITHT NO.6 OF 6 CORPORTION WITH |

|

FEDER SUBHER S STTUS IS CONSIDERED PS COR |

|||||

|

|

|

PORTION. IN ORDER |

NOT TO BE T P S CORPORTION REV6 |

MUST BE FILED. THE FORM C BE CESSED T |

||||

|

|

|

WWWREVENUESTATEPAUS FORMS D PUBLICTIONS CORPORTION T |

|

|

||||

COMPLETING THIS FORM WILL NOT FULFILL THE REQUIREMENT TO REGISTER FOR CORPORATE TAXES REGISTERING CORPORATIONS MUST CONTACT THE PA DEPART- MENT OF STATE TO SECURE CORPORATE NAME CLEARANCE AND REGISTER FOR CORPORATION TAX PURPOSES CONTACT THE PA DEPARTMENT OF STATE AT (717) 787- 1057, OR VISIT wwwaoeforbusiessstateaus

SECTION 12 – REPORTING & PAYMENT METHODS

. THE DEPRTMENT OF REVENUE REQUIRES THTY ENTERPRISEMNG PYMENTS EQ |

U TO OR GRETER TH $ REMIT PYMENTS VI ONE |

OF THE FOL |

LOWING ELECTRONIC METHODS: ELECTRONIC FUNDS TRSFER T ELECTRO |

NIC TINFORMTION D DTEXCHGE SYSTEM IDES TELEFILE SYSTEM OR |

|

CREDIT CD. ENTERPRISE REGDLESS OF UNTIS ENCOURED TO REMIT |

TPYMENTS ELECTRONICLY. |

|

a. YES |

|

b. YES |

|

. YES |

NO |

DOES THIS ENTERPRISE MEET THE DEPRTMENT OF REVENUEʼS REQUIREMENTS FOR ELECT RONIC PYMENTS? |

|

NO |

DOES THIS ENTERPRISE WNT TO PRTICIPTE IN THE DEPRTMENT OF |

REVENUEʼS ELECTRONIC PROGR |

NO |

IF THIS ENTERPRISE IS NONOFIT ORGIZTION THT IS EXEMPT UN |

DER IRC 5 OR POLITIC SUBIVISIONS IS IT |

|

INTERESTED IN RECEIVING INFORMTION UT THE DEPRTMENT OF LR & |

INDUSTRYʼS OPTION OF FINCING UC COSTS |

|

UNDER THE REIMBURSEMENT METHOD IN LIEU OF THE CONTRIBUTORY METHOD? FOR MORE DETILS REFER TO SECTION |

|

|

INSTRUCTIONS. |

|

THE DEPRTMENT OF LR & INDUSTRY REQUIRES THTY ENTERPRISE WITH |

5 OR MORE WGE ENTRIES PER QUTERLY REPORTFILE THE W |

GE INFORMTION VI |

|||

MNETIC MEDIY MNETIC REPORTING FILE MUST BE SUBMITTED FOR COMPTI |

BILITY WITH THE DEPRTMENT OF LR & INDUSTRYʼS FORMT. CONTT |

THE M |

|||

NETIC MEDI REPORTING UNITT FOR MORE INFORMT |

ION. |

|

|

|

|

THE COMMONWETH STRONGLY RECOMMENDS THT ENTERPRISES USE ELECTRONIC FIL |

ING D PYMENT OPTIONS FOR CERTN PENNSYLVNI TD SERVICES. |

|

|||

INFORMTION UT INTERNET FILING OPTIONS C BE FOUND ON THE |

eIDES WEB SITET |

wwwetidesstateaus |

|

|

|

SECTION 13 – GOVERNMENT STRUCTURE

. IS THE ENTERPRISE |

|

|

|

|

GOVERNMENT BODY |

GOVERNMENT OWNED ENTERPRISE |

GOVERNMENT & PRIVTE SECTOR |

||

|

|

|

OWNED ENTERPRISE |

|

. IS THE GOVERNMENT: |

|

|

|

|

DOMESTIC/US |

FOREIGN/NONS |

MULTITION |

||

. IF DOMESTIC IS THE GOVERNMENT: |

|

|

|

|

FEDER |

LOC: |

COUNTY |

BOROUGH |

|

STTE GOVERNOR'S JURISDICTION |

|

CITY |

SCHOOL DISTRICT |

|

STTE NONOVERNOR'S JURISDICTION |

|

TOWN |

OTHER |

|

|

|

TOWNSHIP |

|

|

7

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Pennsylvania PA-100 form is used for enterprise registration, allowing businesses to register for various tax services within the state. |

| Governing Laws | This form operates under Pennsylvania state laws, specifically the Tax Reform Code of 1971, along with regulations from the Department of Revenue. |

| Application Submission | Completed applications must be mailed to the Department of Revenue, Bureau of Business Trust Fund Taxes, at the specified PO Box in Harrisburg, PA. |

| Filing Requirements | Businesses must include their Federal Employer Identification Number (EIN) and any previous account numbers when filing the PA-100 form to ensure proper processing. |

| Signature Requirement | An authorized signature is mandatory on the PA-100 form, affirming that all provided information is true and complete under penalty of perjury. |

Guidelines on Utilizing Pennsylvania Pa 100

After gathering all the necessary information, you're ready to complete the Pennsylvania PA-100 form. This form is essential for registering your business and provides the state with key details about your enterprise. Follow these steps to ensure you fill it out correctly.

- Begin by selecting the reason for registration in Section 1. Check the appropriate box to indicate if this is a new registration, update, or other reason.

- In Section 2, provide the enterprise information. Enter the date of your first operations and the Enterprise’s legal name, along with the Federal Employer Identification Number (EIN).

- Complete Section 3 by indicating the taxes and services your business will be requesting. Be sure to check the relevant boxes for the services required.

- In Section 4, provide the authorized signature. This person must declare that the information provided is true, correct, and complete. Include their title and daytime contact information.

- Move to Section 5 to check your business structure. Choose the types that apply to your enterprise, such as sole proprietorship, corporation, or partnership.

- In Section 6, list the information for all owners, partners, shareholders, officers, and responsible parties. Include names, social security numbers, and contact details.

- Section 7 requires you to provide detailed business activity information. Specify the percentages of the business activities and list the products or services provided.

- Complete Section 8, which addresses establishment sales information. Indicate whether your establishment will be selling products or services directly to consumers.

- In Section 9, fill out employment information, including total number of employees and their wage details.

- For Section 10, provide information related to bulk sale/transfer if applicable. Confirm whether you acquired any assets from other enterprises.

- If you're a corporation, fill out Section 11 with your corporation information, including the date and state of incorporation.

- Section 12 addresses reporting and payment methods. Indicate how you plan to make payments to the Department of Revenue.

- In Section 13, declare your government structure. Specify if your enterprise is government-owned or a private sector entity.

- Lastly, review all sections and make sure all information is accurate before submitting.

Once you've completed the form, mail it to the Department of Revenue as indicated. Keeping a copy for your records is also a good idea.

What You Should Know About This Form

What is the Pennsylvania PA-100 form used for?

The Pennsylvania PA-100 form is an Enterprise Registration Form used to register a business with the Pennsylvania Department of Revenue. This form is necessary for different types of businesses, including corporations, partnerships, and sole proprietorships, to establish their legal presence and tax obligations within the state. The information provided on the form helps the Department of Revenue track and manage tax accounts for businesses operating in Pennsylvania.

How do I complete the PA-100 form?

To successfully complete the PA-100 form, fill out each section clearly, using black ink or typing the information. The form requires details about the business structure, including the date of operations, enterprise name, address, and federal employer identification number. Make sure to check the appropriate boxes that apply to your case, such as the reason for registration and types of services your enterprise will provide. After filling out the required sections, sign the form and ensure all information is accurate before submitting it to the Pennsylvania Department of Revenue.

Where do I send the completed PA-100 form?

Once the PA-100 form is completely filled out and signed, it should be mailed to the Pennsylvania Department of Revenue, Bureau of Business Trust Fund Taxes, at the following address: PO Box 280901, Harrisburg, PA 17128-0901. Make sure to send the form to this address to ensure it is processed correctly and timely.

What should I do if I make a mistake on the PA-100 form?

If you realize that you have made a mistake on the PA-100 form after submitting it, contact the Pennsylvania Department of Revenue as soon as possible. Provide them with your business details and explain the error. If necessary, you may need to submit a corrected form or provide additional documentation. Keeping a copy of all submissions can help resolve any issues that may arise during the registration process.

Common mistakes

Filling out the Pennsylvania PA-100 form is a vital step for businesses engaging with state revenue systems. However, mistakes made in this process can lead to unnecessary delays and complications. Here are eight common errors individuals make on the form.

1. Incomplete or Illegible Information: One of the most frequent mistakes is failing to provide complete details or submitting illegible responses. The form explicitly states to use black ink and print legibly. Writing that is difficult to read can result in miscommunication and processing errors.

2. Incorrect Business Structure Selection: Many applicants do not accurately indicate their business structure in Section 5. This can cause significant issues, especially regarding tax obligations. Ensure you carefully select the appropriate structure, whether it is a corporation, partnership, or sole proprietorship.

3. Missing Dates: Dates are crucial in various parts of the form—especially in Section 2 where the date of first operations is required. Omitting these dates can lead to incorrect assessments of business timelines and responsibilities.

4. Ignoring Previous Account Number Sections: If the business has an existing account with the Pennsylvania Department of Revenue, it is important to accurately provide the previous account number. Failing to do so can complicate the registration process and may hinder accessing necessary tax information.

5. Failing to Identify All Establishments: If the business operates multiple establishments, Section 17 must be completed. Many applicants overlook this requirement, which can lead to penalties for non-compliance.

6. Not Providing Accurate Owner Information: In Section 6, the form requests detailed information about owners and responsible parties. Missing or incorrect personal details, such as Social Security numbers or dates of birth, can complicate registrations and should be completed with careful attention.

7. Incorrect Response to Tax Exempt Status: Misunderstanding eligibility for tax exemption can result in incorrect completion of the form. An applicant must provide all necessary documentation if the business claims to be exempt under Section 5.

8. Failing to Review Before Submission: Common oversight arises from not reviewing the form before sending it to the Department of Revenue. This can appear trivial, but taking the time to carefully check for errors or missing information can prevent significant headaches later.

Being aware of these common mistakes can simplify the process of completing the PA-100 form. Correctly filling out this registration form ensures that businesses are compliant and can focus on growth and operations without unnecessary regulatory issues.

Documents used along the form

In conjunction with the Pennsylvania PA-100 form, several other documents are commonly required. These forms help clarify various aspects of business registration and taxation. Each document plays a critical role in ensuring compliance with Pennsylvania's state regulations.

- PA-1000: Pennsylvania Business Registration Form - This form is often used for registering different types of businesses with the Pennsylvania Department of Revenue. It collects essential information about the business, including structure and ownership details.

- Form REV-1605: Pennsylvania Sales and Use Tax Exemption Certificate - This certificate is used by businesses to purchase goods tax-free if they are for resale or if the buyer qualifies for an exemption category. Proper use of this form can prevent businesses from incurring unnecessary tax liabilities.

- Form PCA-1: Pennsylvania Corporation Registration Statement - Required for businesses wishing to incorporate in Pennsylvania, this document lays out the foundational information about the corporation, including management structure and state of incorporation.

- Form REV-856: Pennsylvania Exempt Use Certificate - This form is utilized by not-for-profit organizations to assert their exemption from certain taxes. It is crucial for maintaining compliance with state regulations regarding tax exemptions.

- Form PA-15: Application for Business License - This document is necessary for obtaining a business operating license within specific municipalities in Pennsylvania. It evidences that the business meets local regulatory requirements.

These forms work collaboratively with the PA-100 to ensure that businesses in Pennsylvania operate within the legal framework. Completing all required documents accurately can facilitate a smoother registration process, enabling business owners to focus more on their enterprise and less on compliance issues.

Similar forms

-

Form SS-4 - This is used to apply for an Employer Identification Number (EIN) from the IRS. Similar to the PA-100, it requires information about business structure and ownership.

-

Form PA-1 - The Pennsylvania Application for Sales Tax Exemption Certificate. Like the PA-100, it requires details about the nature of the business and its owners.

-

Form W-9 - Request for Taxpayer Identification Number and Certification. Both documents demand accurate identification and basic information about the business entity.

-

Form 1120 - Corporate Income Tax Return. Much like the PA-100, this form focuses on registration and taxation information for corporate entities.

-

Form 1065 - Partnership Return of Income. This document shares the purpose of detailing the structure and activities of a business, similar to the PA-100.

-

Form 941 - Employer’s Quarterly Federal Tax Return. This form, like the PA-100, tracks employment status and business tax obligations.

-

Form 8802 - Application for United States Residency Certification. Both this and the PA-100 require extensive background details pertaining to the business operations.

-

Form R-1 - Pennsylvania Employer Registration Form. This form directly parallels the PA-100 in that it registers employers for state tax purposes.

-

Form 720 - Quarterly Federal Excise Tax Return. Similar to the PA-100, it is essential for businesses that deal with specific types of products and services.

-

Form PA-40 - Pennsylvania Personal Income Tax Form. Like the PA-100, this form gathers information that is critical for proper tax assessments.

Dos and Don'ts

When filling out the Pennsylvania PA-100 form, there are important guidelines to follow. The choices you make can significantly impact your registration process. Here’s a list of what you should and shouldn’t do:

- DO: Type or print legibly using black ink. Clarity is vital to avoid misunderstandings.

- DO: Double-check all information before submitting. Errors can lead to delays in processing your application.

- DO: Ensure that you provide a valid telephone number. This allows the department to contact you if additional information is needed.

- DO: Keep a copy of your completed form for your records. This will be helpful for future reference.

- DO: Submit the form to the correct address. It should be sent to the Department of Revenue, Bureau of Business Trust Fund Taxes, PO Box 280901, Harrisburg, PA 17128-0901.

- DON'T: Use a P.O. Box as the street address. The form specifically requires a physical location.

- DON'T: Leave any required fields blank. Incomplete applications can cause delays or be rejected entirely.

- DON'T: Submit photocopies of IDs or verification documents unless specified. Original documents are often required.

- DON'T: Forget to sign the form. An unsigned application is not valid and will be returned.

- DON'T: Assume your previous registration details are still valid. Any changes in your business structure or address must be updated.

Misconceptions

1. The PA-100 form is only for new businesses. It's a common misconception that the Pennsylvania PA-100 form is solely for new companies. In reality, existing businesses use this form to update information, acquire permits, or change their business structure.

2. Submission of the form is optional. Many people believe that filing the PA-100 is not mandatory. However, the form is essential for registering a business, and failure to submit it can lead to penalties and issues with compliance.

3. All business types need to fill out the same sections. Some think that every business completes identical sections of the PA-100. In fact, the form allows for varied sections based on the business structure (like corporations or partnerships), making it tailored for different businesses.

4. You don’t need supporting documents. It's a misconception that providing additional documentation isn't necessary. In many cases, supporting documents, such as an Employer Identification Number (EIN) and other relevant licenses, are crucial for a complete application.

5. Filing is only done once and never needs to be repeated. Some individuals assume that after filing the PA-100, they never have to do it again. However, any significant change in the business, such as a change in address or structure, may require a new submission.

6. The form can be submitted via email. There’s a belief that the PA-100 can be sent electronically. This is incorrect; the form must be physically mailed to the Department of Revenue in Harrisburg, PA.

7. Businesses can choose any date when they first operated. Some think they can specify any arbitrary date on the form for when they began operations. However, the date must align accurately with when business activities truly began, as discrepancies could raise red flags during audits.

8. There is no deadline for submitting the PA-100. Many people also believe there are no time limits on filing this form, but it is crucial to complete it promptly to prevent potential fines or legal complications associated with delayed filings.

Key takeaways

Key Takeaways for Filling Out the Pennsylvania PA-100 Form:

- The PA-100 form must be completed and mailed to the Department of Revenue, Bureau of Business Trust Fund Taxes, Harrisburg, PA.

- It is important to type or print legibly in black ink to ensure clarity and avoid processing errors.

- Indicate the reason for registration clearly in Section 1, selecting the appropriate checkbox.

- Provide accurate enterprise information in Section 2, including the date of first operation and all contact details.

- All tax services required must be checked in Section 3 to ensure proper coverage and compliance.

- A signature from an authorized individual is required in Section 4 to validate the information provided.

- Section 5 allows you to specify the business structure; choosing the correct classification is crucial for legal purposes.

- Ensure that all owners and responsible parties are accurately listed in Section 6, as this information is vital for accountability.

- Section 12 outlines payment methods, with electronic payments being the preferred and often required method for transactions exceeding a specific amount.

Browse Other Templates

Optum Rx Appeal Form - Check the box if a brand medication is specifically requested.

What's a Beneficiary - Minor beneficiaries’ assets can be managed in a custodial account for their benefit.