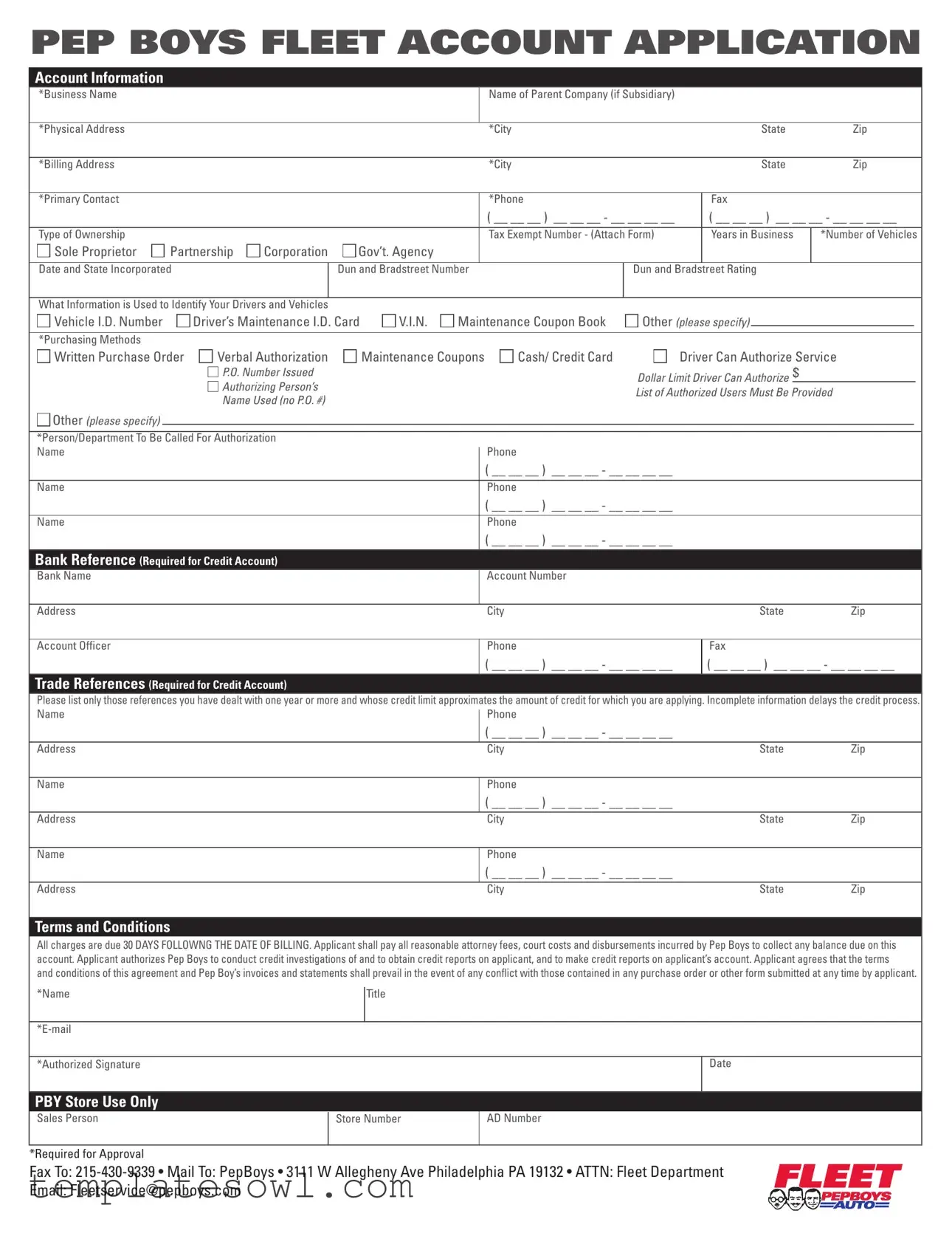

Fill Out Your Pep Boys Application Form

Applying for a Pep Boys Fleet Account involves filling out a comprehensive application form that requires important details regarding your business and its operations. Essential information include the name of the business and parent company, physical and billing addresses, and primary contact details, ensuring that Pep Boys can easily reach out if needed. The form also asks about the type of ownership—whether your business operates as a sole proprietor, partnership, corporation, or government agency. Specific inquiries about your company's history, including how long it has been in business and the number of vehicles you manage, help assess your eligibility for credit. Furthermore, you must provide your tax-exempt number, Dun and Bradstreet data, and identification details pertaining to your drivers and vehicles. With purchasing methods clearly outlined, applicants can specify how they intend to authorize purchases, whether through written purchase orders, verbal authorizations, or cash. Moreover, the form requests bank and trade references, essential for establishing creditworthiness. Finally, various terms and conditions govern the account, ensuring that all parties understand their responsibilities and the implications of breaches. Completing this application accurately is crucial since missing information can delay approval and limit your business capabilities with Pep Boys.

Pep Boys Application Example

PEP BOYS FLEET ACCOUNT APPLICATION

Account Information

*Business Name |

|

|

|

|

|

|

|

Name of Parent Company (if Subsidiary) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Physical Address |

|

|

|

|

|

|

|

*City |

|

|

|

State |

Zip |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Billing Address |

|

|

|

|

|

|

|

*City |

|

|

|

State |

Zip |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Primary Contact |

|

|

|

|

|

|

|

*Phone |

|

|

Fax |

|

|

|

|||

|

|

|

|

|

|

|

|

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

||||

Type of Ownership |

|

|

|

|

|

|

|

Tax Exempt Number - (Attach Form) |

|

Years in Business |

*Number of Vehicles |

||||||

Sole Proprietor |

Partnership |

Corporation |

Gov’t. Agency |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Date and State Incorporated |

|

|

Dun and Bradstreet Number |

|

Dun and Bradstreet Rating |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

What Information is Used to Identify Your Drivers and Vehicles |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Vehicle I.D. Number |

|

Driver’s Maintenance I.D. Card |

V.I.N. |

Maintenance Coupon Book |

Other (please specify) |

|

|

|

|

||||||||

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Purchasing Methods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Written Purchase Order |

Verbal Authorization |

|

Maintenance Coupons |

Cash/ Credit Card |

|

Driver Can Authorize Service |

|||||||||||

|

|

|

P.O. Number Issued |

|

|

|

|

|

Dollar Limit Driver Can Authorize |

$ |

|

|

|

||||

|

|

|

Authorizing Person’s |

|

|

|

|

|

List of Authorized Users Must Be Provided |

||||||||

|

|

|

Name Used (no P.O. #) |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Other (please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

*Person/Department To Be Called For Authorization |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name |

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

|

|

|

|

|

|

Bank Reference (Required for Credit Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Bank Name |

|

|

|

|

|

|

|

Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

City |

|

|

|

State |

Zip |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Officer |

|

|

|

|

|

|

|

Phone |

|

|

Fax |

|

|

|

|||

|

|

|

|

|

|

|

|

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade References (Required for Credit Account)

Please list only those references you have dealt with one year or more and whose credit limit approximates the amount of credit for which you are applying. Incomplete information delays the credit process.

Name |

Phone |

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

Address |

City |

State |

Zip |

|

|

|

|

Name |

Phone |

|

|

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

Address |

City |

State |

Zip |

|

|

|

|

Name |

Phone |

|

|

|

( __ __ __ ) __ __ __ - __ __ __ __ |

|

|

Address |

City |

State |

Zip |

Terms and Conditions

All charges are due 30 DAYS FOLLOWNG THE DATE OF BILLING. Applicant shall pay all reasonable attorney fees, court costs and disbursements incurred by Pep Boys to collect any balance due on this account. Applicant authorizes Pep Boys to conduct credit investigations of and to obtain credit reports on applicant, and to make credit reports on applicant’s account. Applicant agrees that the terms

and conditions of this agreement and Pep Boy’s invoices and statements shall prevail in the event of any conflict with those contained in any purchase order or other form submitted at any time by applicant.

*Name |

Title |

|

|

|

|

|

|

|

|

|

|

*Authorized Signature |

|

Date |

|

|

|

PBY Store Use Only

Sales Person |

Store Number |

AD Number |

|

|

|

*Required for Approval

Fax To:

Email: Fleetservice@pepboys.com

Pep Boys Fleet Credit Account Agreement

In this Agreement, the words “you” and “your” mean the person(s) who sign the Pep Boys commercial credit account agreement. The words “we,” “us” and “our” means Pep Boys.

1. Terms

All charges are due net 30 days following the date of the invoices. Once a month a statement will be forwarded to you to help you reconcile your account.

2. Promise to Pay

You promise to pay us for all charges made to your Account and for all finance charges and fees described in this Agreement. If there is more than one of you, you are jointly and severely liable for all required payments, regardless of who made or benefited from any particular charge. If you allow someone else to use your Account, you will be responsible for their charges whether or not they charge more than you intended. Unless you notify us of a billing error within 30 days after we sent the first statement on which it appears, you agree that your monthly statement is valid evidence of your obligation to pay the amount shown thereon.

3. Payment Requirements

Payments must be made to the address shown on your statement and be accompanied by the payment stub from your statement. Failure to make payments in accordance with these requirements may result in delay in crediting your Account. We may accept partial payments and payments marked with “paid in full” or similar language without waiving our rights. Payment checks should be made out to “Pep Boys.”

4. Finance Charges

A finance charge will be assessed at 1.5% per month, which is 18% per annum, on the balance that is past due.

5. Minimum Finance Charge

If a billed finance charge amount is computed for any billing cycle and if the amount of that finance charge as figured above would be less than $.50, the minimum billed finance charge will be $.50.

6. Fees

Our current fee for returned checks will be charged if any check you send us for payment on your Account is returned unpaid.

7. Your Credit Limit Authorization

We will establish your initial credit limit and may change that limit at any time, with or without notice. You agree not to exceed your credit limit (and if you do, immedi- ately pay any balance in excess of that limit). If there is more than one of you, any of you may request a change in your credit limit. Each charge that you make may be subject to our authorization. We may decline to grant such authorizations for any reason, and may impose various limits on those authorizations.

8. Default

If you default in making any required payment, we can declare the unpaid balance to be due and payable immediately, and may continue to assess a finance charge until full payment is received. If your Account is referred for collections to an attorney who is not a salaried employee of Pep Boys, you agree to pay, in a addition to your outstanding balance and finance charges thereon, all court or other collection costs actually incurred and reasonable attorney’s fees, subject to any applicable law.

9. Termination

We may, at any time, with or without cause and without notice, terminate this Agreement and your privilege to use your Account and to make further charges to your Account. You will continue to be responsible to pay all unpaid balances existing at termination, and all finance charges and fees accruing after termination.

10. Credit Investigation and Reporting

You agree that we may obtain a credit report and make inquiries to your bank and/or creditors for any lawful purpose related to your Account such as reviewing it, changing the credit limit and collecting. If you request, we will tell you whether or not a credit report was requested and the name and address of any credit reporting agency that furnished the report. You agree that we may release information to others, including but not limited to credit bureaus, about the status and history of your Account.

11. Transferability

Your Account, your rights and privileges under this Agreement cannot be transferred or assigned by you. We may transfer or assign your Account, your Account balance or any portion thereof, or any of our rights under this Agreement to a third party, with or without notice to you.

12. Waiver and Severability

We can delay in enforcing our rights or waive any of our rights on one or more occasions without losing those rights. If any part of this Agreement is determined to be invalid or unenforceable, the remaining parts shall continue to be effective.

13. Security Interest

You grant to us a purchase money security interest in all merchandise purchased on your Account until such merchandise is paid in full.

14. Authorized User(s)

We have the right to rely upon all reasonable representations of persons representing themselves to be agents of you with the authority to make purchases on behalf of you unless Pep Boys receives prior written notification limiting agents authorized to make purchases.

15. Commercial Credit Agreement

This Agreement embodies the entire commercial account agreement. There are no other promises, terms, conditions or obligations other than those contained herein.

16. Governing Law

You understand and agree that any credit extended to you is strictly commercial credit and does not arise out of a consumer transaction and is therefore not governed by applicable federal or state consumer credit regulations.

To find out changes in the information in this application, write to:

Credit Department

3111 West Allegheny Avenue • Philadelphia, PA 19132

Form Characteristics

| Fact Name | Details |

|---|---|

| Application Structure | The Pep Boys Fleet Account Application consists of essential sections including account information, contact details, ownership type, vehicle details, purchasing methods, bank and trade references, and authorization signatures. |

| Required Information | Key fields marked with an asterisk (*) must be filled out to process the application. This includes business name, physical address, primary contact information, and signature. |

| Credit Account Review | The application requires the submission of bank and trade references, which are necessary for assessing creditworthiness. Only references that have been engaged for one year or more should be listed. |

| Authorization Process | Applicants must designate individuals authorized to make purchases. This designation requires names and contact numbers for each authorized user to streamline the approval process. |

| Terms and Conditions | Payments for charges are due within 30 days after the billing date. The applicant is liable for all charges made to the account, including those made by unauthorized users if the account holder fails to notify Pep Boys of such usage. |

| Governing Law | This application operates under commercial credit regulations and does not partake in the consumer transaction guidelines due to its business-focused nature, ensuring applicability to appropriate credit laws. |

Guidelines on Utilizing Pep Boys Application

Completing the Pep Boys Fleet Account Application form is a straightforward process, but attention to detail is crucial. You will need to provide specific information about your business, including ownership details, bank references, and authorized contacts. By following the steps outlined below, you can ensure a smooth completion of the application, leading to timely processing.

- Business Information: Fill in the name of your business, as well as the name of the parent company if applicable. Include the physical and billing addresses, along with the city, state, and zip codes for both.

- Contact Details: Provide the name of the primary contact, along with their phone and fax numbers. Ensure that the numbers are accurate to facilitate communication.

- Ownership Type: Indicate the type of ownership by selecting one of the options: Sole Proprietor, Partnership, Corporation, or Government Agency. Include your Tax Exempt Number if applicable, and attach any required forms.

- Business Tenure: State the number of years your business has been operational and the number of vehicles owned.

- Dun and Bradstreet Details: If you have a Dun and Bradstreet Number, please provide it along with your Dun and Bradstreet Rating.

- Identification Methods: Choose how you will identify your drivers and vehicles, selecting from: Vehicle I.D. Number, Driver’s Maintenance I.D. Card, V.I.N., Maintenance Coupon Book, or Other (if so, specify).

- Purchasing Methods: Indicate your purchasing methods by checking one or more options, such as Written Purchase Order, Verbal Authorization, or Maintenance Coupons, among others.

- Authorization: List the persons/departments to be contacted for authorization, along with their phone numbers. Provide multiple contacts if necessary.

- Bank Reference: Include the required bank reference details, such as the bank name, account number, address, and contact information for the account officer.

- Trade References: List at least three trade references you have dealt with for over a year. Include their names, phone numbers, and addresses.

- Terms and Conditions: Read and agree to the terms and conditions outlined in the application. You will need to sign and date the form to confirm your understanding.

- Store Use: Leave the section for store personnel blank as they will fill it out when processing your application.

- Submission: Fax your completed application to 215-430-9339, mail to the address provided, or email it to Fleetservice@pepboys.com.

What You Should Know About This Form

What information do I need to provide on the Pep Boys Application form?

The Pep Boys Application form requires a variety of details about your business. You will need to provide your business name, physical and billing addresses, and the contact information for a primary representative. Also required are details about your ownership structure, vehicles, and purchasing methods. Additionally, you'll need to include bank and trade references if you are applying for a credit account. Incomplete submissions can cause delays in processing your application.

How does Pep Boys use my financial information?

Pep Boys uses the financial information provided in the application to assess your creditworthiness. They may conduct credit investigations and obtain credit reports. This helps them determine your ability to manage credit and how to set your credit limit. Providing accurate and complete information improves your chances of approval and a better credit limit.

What are the payment terms once my account is approved?

If your account is approved, all charges are typically due within 30 days of the billing date. Monthly statements will be issued to help you keep track of outstanding balances. It is important to know that failure to pay on time may result in extra fees, including finance charges assessed at 1.5% per month on any past-due balances.

What if I exceed my credit limit?

Exceeding your credit limit is not ideal, and if it occurs, you are immediately responsible for paying any amount above that limit. Pep Boys may also require that you obtain prior approval for any charges beyond your limit. It is crucial to monitor your account activity to avoid going over this limit, as it can lead to additional complications in your account management.

How do I update my application or account information?

To update any information provided in your application or to inform Pep Boys of changes, you need to contact their Credit Department directly. You can write to them at the address listed on the application form. Keeping your information current is important for maintaining your account in good standing and ensuring efficient communication.

Is there a fee for returned checks?

Yes, if a check you send for payment is returned unpaid, Pep Boys applies a fee to your account. Ensuring that you have sufficient funds in your account before making payments can help prevent such fees and the ensuing complications that come with them. It’s best to track your financial situation closely to avoid any unexpected charges.

Common mistakes

When submitting a Pep Boys Application form, it’s essential to be meticulous. A small error can delay your application or even lead to denial. Here are seven common mistakes that applicants often make.

First, many people ignore the importance of providing complete contact information. Missing fields such as the primary contact's phone number or email can raise red flags. Businesses need to ensure that all required sections are filled out accurately. Leaving out even one piece of vital information could slow down the approval process.

Second, misclassifying the type of ownership is a frequent error. Whether you're a sole proprietor, partnership, or corporation, selecting the wrong option can mislead the reviewers. Accuracy in this area ensures that your business is assessed fairly.

Another mistake is failing to provide accurate trade references. It’s crucial to list suppliers you’ve worked with for a year or more. Providing incomplete or incorrect references causes unnecessary delays and can harm your chances of acquiring the credit you seek.

The fourth issue stems from inadequate financial information. Applicants sometimes forget to include required bank references or leave out critical details like account numbers. This omission can lead to requests for additional documents, extending the review period.

Fifth, many overlook the significance of specifying authorized users. Listing all individuals authorized to make purchases is vital. If someone makes a purchase without prior approval and you're liable, it can lead to complications.

Sixth, failing to read and understand the terms and conditions is a common pitfall. Ignoring the payment requirements and finance charges might result in skipped payments or unintentional debt accumulation. Being informed about these terms can prevent unexpected issues down the line.

Finally, applicants often rush their submission without thorough proofreading. Simple typos or grammatical errors can convey carelessness. Taking the time to review the application enhances its professionalism and helps avoid misunderstandings.

By being mindful of these points, applicants can streamline their submission process. Careful attention to detail leads to a smoother experience with Pep Boys. Ensure your application reflects the professionalism your business embodies.

Documents used along the form

When applying for a Pep Boys Fleet Account, several other forms and documents are often required to support your application. These documents play a crucial role in establishing your business's credibility and financial reliability. Here’s a brief overview of those documents.

- Tax Exempt Form: This document is necessary for businesses seeking tax-exempt status. It certifies that the applicant qualifies under applicable tax laws and provides any required exemptions for purchases made through the account.

- Bank Reference Form: Required for credit accounts, this form provides details about your business's banking relationship. It includes the name of the bank, account number, and contact information for a bank officer who can verify your account's standing.

- Trade References: Businesses typically need to submit a list of trade references they've done business with for over a year. This information helps Pep Boys assess the creditworthiness of the business based on prior financial relationships.

- Driver’s Maintenance I.D. Card: This card is used to identify authorized drivers responsible for procuring services. It ensures that the fleet management remains secure and services are only utilized by approved personnel.

- Maintenance Coupon Book: For businesses that use coupons for maintenance services, this document outlines the terms and conditions of the coupons and may be required to validate purchases made against the account.

Gathering these documents alongside your Pep Boys Application form can streamline the approval process. Ensuring all required documentation is accurate and complete will enhance the chances of a smooth application experience.

Similar forms

- Credit Application Form: Similar to the Pep Boys Application, a general credit application form collects detailed financial and personal information about the applicant. This document typically requests the applicant's business name, ownership type, financial references, and authorization for credit checks, similar to the creditworthiness assessments in the Pep Boys form.

- Supplier Account Application: A supplier account application serves to establish a business relationship between a supplier and a purchaser. Like the Pep Boys form, it includes sections for business identification, contact information, payment methods, and terms of service, ensuring that both parties agree on purchasing and payment conditions.

- Lease Application: A lease application is used to evaluate potential tenants for rental property. It requests personal and financial information, references, and consent for credit checks. This process mirrors the Pep Boys Application in that both documents seek to verify financial reliability and business operations.

- Business Loan Application: A business loan application gathers extensive information about the business’s financial status, purpose of the loan, and repayment plan. Both the loan application and the Pep Boys Application require disclosure of financial history, ownership details, and assets to assess creditworthiness.

- Warranty Registration Form: A warranty registration form often requests the consumer’s contact information, product details, and purchase information. This is akin to the Pep Boys Application in that both forms require identification of the business, point of contact, and agreement to terms associated with the respective services provided.

Dos and Don'ts

Things to Do:

- Fill out all required fields, marked with an asterisk (*).

- Provide accurate and up-to-date contact information.

- List trade references you have worked with for at least a year.

- Specify the names and contact information of authorized personnel.

- Attach any necessary documents, such as the Tax Exempt Number form.

- Ensure that you sign and date the application before submission.

Things to Avoid:

- Do not leave any required fields blank.

- Avoid using outdated or incorrect contact information.

- Do not list references that do not meet the one-year relationship requirement.

- Do not forge signatures or provide false information.

- Avoid submitting an application without confirming all details are complete.

- Do not forget to check all terms and conditions before signing.

Misconceptions

When it comes to the Pep Boys application form, several misconceptions often arise. Understanding these can help applicants navigate the process more efficiently.

- Only larger businesses can apply. Many believe that only large corporations are eligible for a Pep Boys account. In reality, both small and large businesses can apply, as long as they meet the criteria outlined in the application.

- Applying is a lengthy process. Some people think that the application procedure is tedious and time-consuming. However, most applications can be completed quickly, especially if all required information is readily available.

- No need for a credit check. It’s a common belief that applicants will not undergo a credit check. In fact, Pep Boys does conduct credit investigations as part of their process to establish the creditworthiness of applicants.

- You don’t need trade references. Many assume that listing trade references is optional. However, providing this information is crucial for any business seeking a credit account with Pep Boys.

- The application can be submitted anyway. Applicants often think they can submit incomplete forms. Unfortunately, missing information can delay processing times and may even lead to rejection.

- The credit limit is fixed once assigned. Some applicants mistakenly believe that their credit limit will never change. In truth, Pep Boys may modify credit limits based on their assessments and account activity.

- Authorized users aren’t necessary. There’s a misconception that applicants can use their accounts without designating authorized users. However, it’s essential to provide a list of authorized individuals to prevent unauthorized charges.

- Application approval guarantees credit. Some applicants think that filling out the application guarantees them credit. Yet, credit approvals depend on various factors, including credit history and provided information.

Key takeaways

Filling out the Pep Boys Application Form is a significant step towards establishing a fleet account. Here are six essential takeaways to keep in mind:

- Provide Accurate Information: Ensure all required fields, such as business name, physical address, and primary contact details, are completed accurately to avoid processing delays.

- Identify Ownership Structure: Clearly indicate your business type—whether sole proprietor, partnership, corporation, or government agency—as this affects your application.

- Include Trade References: List trade references with whom you have a relationship of at least one year; incomplete references may delay credit approval.

- Understand Payment Terms: Be aware that all charges are due 30 days following the billing date; familiarize yourself with the finance charges for late payments.

- Assign Authorized Users: Ensure that your application contains a list of authorized users who can make purchases. This step is crucial for streamlining your account management.

- Review Terms and Conditions: Carefully read through the terms of the credit agreement. Understanding your responsibilities can prevent potential issues down the line.

Taking these factors into account can significantly improve your experience with the Pep Boys fleet account application process. Complete your application thoughtfully to set the foundation for successful account management.

Browse Other Templates

How to Fill Out an Application - Indicate the position you are applying for clearly to streamline the hiring process.

Isef Form - Analyzed the effectiveness of different insulation materials in reducing heat loss, offering recommendations for energy-efficient home construction.