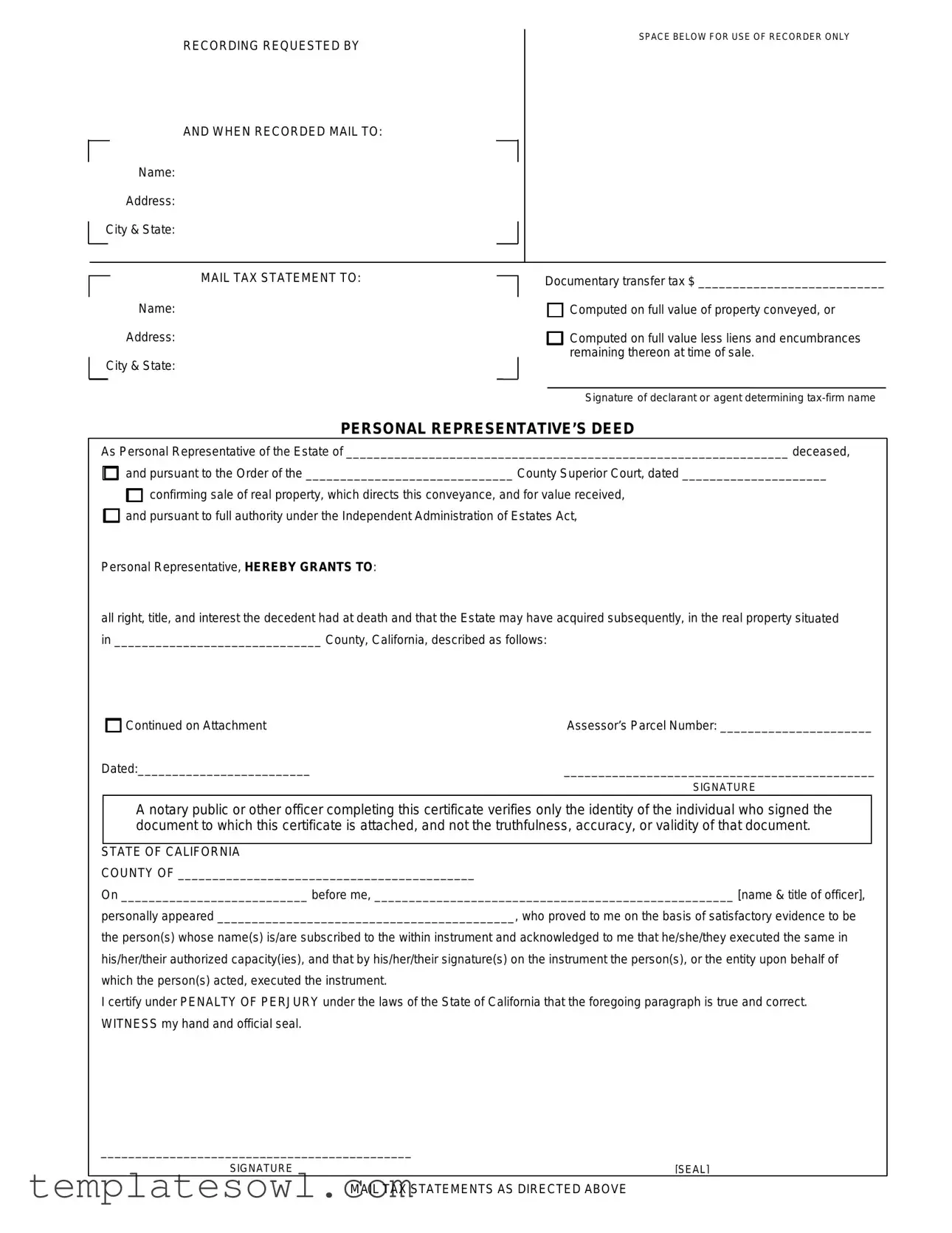

Fill Out Your Personal Deed Form

The Personal Deed form is a significant legal document that facilitates the transfer of property ownership from an estate to a designated individual or entity. This form is often utilized by a personal representative when handling the affairs of a deceased person's estate. It contains essential information such as the names and addresses of both the person requesting the recording and the recipient of the property. Additionally, it details the assessment of transfer taxes, providing options for calculating the owed amount based on the full property value or adjusted for existing liens. Crucially, the form includes a section confirming the authority under which the personal representative acts, whether through a court order or independent administration. As part of the legal process, a notary public must verify the identity of the signer. This step ensures that the document is executed properly, safeguarding against potential disputes. Overall, the Personal Deed form plays a vital role in ensuring a smooth and lawful transition of property rights during estate administration.

Personal Deed Example

RECORDING REQUESTED BY

|

|

|

|

|

AND WHEN RECORDED MAIL TO: |

|||

|

|

|

|

Name: |

|

7 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

L |

City & State: |

_J |

|

|||

|

|

|||||||

SPACE BELOW FOR USE OF RECORDER ONLY

|

|

|

MAIL TAX STATEMENT TO: |

|

|

i |

|

|

|

Name: |

|

|

|||

|

|

|

Address:

LCity & State:

7

_J

Documentary transfer tax $ ___________________________

□

Computed on full value of property conveyed, or

Computed on full value of property conveyed, or

□

Computed on full value less liens and encumbrances remaining thereon at time of sale.

Computed on full value less liens and encumbrances remaining thereon at time of sale.

Signature of declarant or agent determining

PERSONAL REPRESENTATIVE’S DEED

As Personal Representative of the Estate of ________________________________________________________________ deceased,

□

and pursuant to the Order of the ______________________________ County Superior Court, dated _____________________

and pursuant to the Order of the ______________________________ County Superior Court, dated _____________________

□

confirming sale of real property, which directs this conveyance, and for value received, □

confirming sale of real property, which directs this conveyance, and for value received, □

and pursuant to full authority under the Independent Administration of Estates Act,

and pursuant to full authority under the Independent Administration of Estates Act,

Personal Representative, HEREBY GRANTS TO:

all right, title, and interest the decedent had at death and that the Estate may have acquired subsequently, in the real property situated in ______________________________ County, California, described as follows:

□Continued on Attachment |

Assessor’s Parcel Number: ______________________ |

Dated:_________________________ |

_____________________________________________ |

|

SIGNATURE |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF ___________________________________________

On ___________________________ before me, ____________________________________________________ [name & title of officer],

personally appeared ___________________________________________, who proved to me on the basis of satisfactory evidence to be

the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct. WITNESS my hand and official seal.

_____________________________________________

SIGNATURE |

[SEAL] |

MAIL TAX STATEMENTS AS DIRECTED ABOVE

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Personal Deed form is used to transfer ownership of real property from the estate of a deceased person to a specified recipient. |

| Governing Law | In California, this deed is governed by the Independent Administration of Estates Act. |

| Grantor | The grantor is the personal representative of the estate, who holds the legal authority to make the transfer. |

| Recipient | The form specifies the recipient who will receive the deceased's interest in the property. |

| Property Description | The deed requires a description of the real property, which includes the county and assessor’s parcel number. |

| Tax Information | The form includes a section for the documentary transfer tax, which must be calculated based on the property's value. |

| Notary Requirement | A notary public must verify the identity of the individual who signs the deed, ensuring their authority. |

| Recording | The completed deed must be recorded with the county recorder’s office to make the transfer official. |

| Tax Statement Mailing | Tax statements related to the property are sent to the address provided on the form. |

Guidelines on Utilizing Personal Deed

Once the Personal Deed form is completed, it must be submitted to the appropriate recording office. Ensure all information is accurate to avoid delays. Follow the listed steps to fill out the form properly.

- Begin with the "Recording Requested By" section: Enter your name in the designated space.

- Fill in your address: Provide the complete address, including city and state.

- Complete the "Mail Tax Statement To" section: Enter the name and address where the tax statement should be sent.

- Documentary transfer tax: Indicate the amount and check the applicable box regarding how the tax is computed.

- Signature of declarant or agent: The personal representative should sign and print their name, along with the firm name, if applicable.

- Identify as Personal Representative: State that you are the Personal Representative of the Estate of the deceased individual, providing the decedent’s name.

- Authority section: Indicate if you are acting under a court order or under the Independent Administration of Estates Act. Ensure this is accurately reported.

- Describe the property: Provide details about the real property, including the county and description. Include the Assessor’s Parcel Number.

- Sign and date the document: The personal representative should date the form, and sign where indicated.

- Notary section: A notary public must complete the certification section to verify the identities of those who signed the deed.

After completing these steps, check the form for accuracy and clarity before submitting it to the recording office. It’s crucial to ensure compliance with local regulations and requirements to facilitate a smooth processing of the deed.

What You Should Know About This Form

What is a Personal Deed form?

A Personal Deed form is a legal document used to transfer ownership of real estate from a deceased individual’s estate to its designated beneficiaries. This transfer occurs under the authority granted to a personal representative, who acts on behalf of the estate. The form is crucial in formalizing the conveyance of property rights after a person's death.

Who can use a Personal Deed form?

Typically, the form can be used by the personal representative of an estate. This person is appointed to manage the deceased's affairs, which include distributing property according to the deceased's will or state law if there is no will. The personal representative might also be referred to as an executor if there was a will.

What information is required on the form?

The Personal Deed form requires several key pieces of information. This includes the name of the deceased, details of the property, and the authority under which the personal representative is acting. Other required elements include signatures from the personal representative and a notary public, which verifies the identity of those involved in the transaction.

Do I need a notary public for the Personal Deed form?

Yes, having a notary public is essential. The notary's role is to verify the identities of the individuals signing the document. This adds an extra layer of security to the transaction, ensuring that the signatures are valid and that the document can be trusted.

What is documentary transfer tax, and do I need to pay it?

The documentary transfer tax is a tax imposed on transactions involving the transfer of real property. Depending on the circumstances of the property transfer, this tax may be calculated based on the full value of the property or less any existing liens and encumbrances. It is important to review your situation to determine if you need to pay this tax and how much it will be.

Is it necessary to provide property details on the Personal Deed form?

Yes, it is necessary to provide specific property details. This typically includes the property's location and assessor’s parcel number. If more space is required, an attachment can be added to include additional property information.

What happens if the property has multiple owners?

If the property has multiple owners or beneficiaries, the Personal Deed form needs to reflect this accurately. All interested parties may need to sign the document to ensure that their rights are adequately represented and acknowledged in the transfer process.

Can I use the Personal Deed form if there was no will?

Yes, you can still use the Personal Deed form even if there was no will. In such cases, the transfer would follow state laws regarding intestate succession, which determine how the deceased’s assets should be distributed among heirs. The personal representative will ensure that the form complies with these requirements.

Where do I file the Personal Deed form once completed?

Once completed, the Personal Deed form must be filed with the county recorder's office in the county where the property is located. This filing ensures that the transfer of ownership is officially recorded and becomes part of the public record, which helps protect the rights of the new owner.

Common mistakes

Filling out the Personal Deed form correctly is vital to ensure a smooth property transfer. Unfortunately, many individuals make mistakes that can lead to delays or complications. Here are nine common errors to avoid.

One major mistake is failing to provide complete contact information. Ensure that you include full names, addresses, and all relevant details. Incomplete information may cause confusion or misdirection of important documents.

Another frequent error occurs in the tax statement section. Be careful to select the correct option for how the documentary transfer tax is computed. Missing this can result in financial repercussions later.

Many people forget to sign the form or neglect to obtain the necessary signatures from all parties involved. Signing the document is essential. Double-check to confirm that all required signatures are in place.

Inaccurate or missing property descriptions can cause significant issues. It is crucial to provide a complete and precise description of the property, including the correct Assessor’s Parcel Number. Failing to do so could prevent the deed from being recorded.

Another pitfall is not dating the document appropriately. Ensure that the date is current and reflects when the deed was executed. A missing or incorrect date can complicate the legal standing of the deed.

Sometimes, people neglect to check for notarization. A notary public must verify the identities of the signers to ensure the document's validity. Without proper notarization, your deed may not be accepted.

Mistakes in the reference to the deceased's estate, especially in the Personal Representative section, can lead to legal complications. Make sure to reference the correct estate name, as stipulated by the court.

Failing to review the entire form before submitting is a common blunder. Take the time to go through each section and correct any discrepancies. This simple step can save you a lot of time.

Lastly, keeping copies of all documents is essential. In case any disputes arise, having a record of submitted information can be invaluable. Always retain a complete copy for your records.

Documents used along the form

The Personal Deed form is just one document involved in property transactions, particularly in the context of estates. When navigating these processes, several other forms are often required to ensure legal compliance and proper record-keeping. Below is a brief overview of six commonly used documents that may accompany the Personal Deed.

- Grant Deed: This document transfers property ownership from one party to another. It offers a guarantee that the seller holds clear title to the property and has the right to sell it, safeguarding the buyer against any legal claims.

- Affidavit of Death: When dealing with estate property, this document provides proof of a person's death, helping to clarify that the property in question is indeed part of the deceased's estate.

- Intestate Succession Documents: For individuals who die without a will, these documents outline how a deceased person's assets will be distributed under state law, ensuring that heirs receive their rightful shares.

- Notice of Administration: This document informs interested parties that the estate is being probated, providing them with an opportunity to present claims or objections regarding the administration of the estate.

- Title Report: A comprehensive title report details the history of ownership and any encumbrances on the property. It helps ascertain any potential legal issues that may affect the sale or transfer.

- Wills: A will outlines how a person's assets, including real estate, should be distributed after their death. It provides clear instructions and can be crucial in the estate's administration process.

Each of these documents serves a specific purpose, contributing to the overarching goal of ensuring a smooth and legally sound property transfer process. Understanding their roles can greatly enhance the experience of dealing with real estate transactions, especially in the context of estate management.

Similar forms

- Quitclaim Deed: Similar to the Personal Deed form, a Quitclaim Deed is used to transfer interest in real property. It provides a way for individuals to release any claim they may have on a property. Unlike a warranty deed, it offers no guarantees about the title, focusing purely on the transfer of rights.

- Grant Deed: This document functions similarly to the Personal Deed by conveying property ownership from one party to another. The Grant Deed assures that the grantor has not sold the property to anyone else and that the property is free of encumbrances, unlike the more straightforward promises made in a personal deed.

- Deed of Trust: A Deed of Trust, while primarily used in financing contexts, serves a similar purpose in that it conveys an interest in property. It creates a security interest for a lender, assuring them that the borrower has an obligation connected to the property until the debt is paid off.

- Easement Agreement: Like the Personal Deed, an Easement Agreement enables the transfer of specific rights over a property. Although it does not transfer ownership, it grants permission for the use of a portion of the property, which can be necessary for access or utility installations.

- Title Transfer Document: This document also resembles the Personal Deed as it formalizes the transfer of title from one party to another. It adheres to the stipulations of state laws, ensuring that ownership is legally recognized and recorded.

Dos and Don'ts

Filling out the Personal Deed form can seem daunting, but following a clear set of guidelines will simplify the process. Below are important dos and don'ts to consider:

- Do ensure all names are spelled correctly, including the decedent's full name.

- Do include accurate addresses for both the mail recipient and the tax statement.

- Do verify that the documentary transfer tax section is completed correctly to avoid delays.

- Do provide a detailed description of the property, including the Assessor’s Parcel Number.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't use ambiguous language when describing the property.

- Don't forget to sign the form where indicated, as an unsigned deed is not valid.

- Don't neglect to have the document notarized; this is a crucial step for validity.

Misconceptions

Here are 10 common misconceptions about the Personal Deed form:

- A Personal Deed is only for transferring ownership. Many think it's solely for ownership transfers, but it also can outline rights and interests of deceased individuals.

- You don't need a notary public. Some believe that a notary is unnecessary; however, a notary helps verify the identity of the signer, which is critical for legal acceptance.

- The form is the same everywhere in the U.S. Many assume that one form works across all states. Each state has different requirements and formats for deeds.

- Anyone can fill it out. People may think they can fill it out without assistance. However, specific knowledge about estate law and property is often needed.

- No taxes are due on the transfer. Some individuals believe there's no tax obligation. In reality, documentary transfer taxes may apply, depending on the situation.

- The Personal Representative must act alone. It is a misconception that a Personal Representative cannot consult others. They can seek legal advice to ensure proper handling of estate matters.

- Once signed, the deed is final immediately. Many think that signing the deed schedules a final transfer right away, but recording it with the County Recorder is what officially finalizes the process.

- All heirs must sign the deed. Some believe all heirs need to approve the transfer. However, if the Personal Representative has proper authority, not every heir’s consent is necessary.

- A Personal Deed replaces a will. People might think that using a Personal Deed negates the need for a will. In truth, both documents serve different purposes in estate planning.

- The deed can be changed later without issue. It's a fallacy that any part of the Personal Deed can be easily altered. Changes can require re-execution and may need additional legal steps.

Key takeaways

Filling out the Personal Deed form requires careful attention to detail. Here are some key takeaways to ensure a smooth process:

- Record Keeping: Always note where the form is being recorded. Include the name and address of where the document should be mailed after recording.

- Documentary Transfer Tax: Confirm the method of calculating the documentary transfer tax. You can choose between the full value or the value less any liens or encumbrances.

- Personal Representative’s Authority: Ensure you have the proper authority as the Personal Representative of the estate. This may require a court order.

- Property Description: Accurately describe the property being conveyed, including the Assessor’s Parcel Number. Any details should be clearly documented.

- Signature Requirements: Remember to sign the form. If applicable, a notary public must acknowledge the signature to validate the document.

- Tax Statements: Clearly indicate where tax statements should be sent post-recording to avoid any future confusion.

These key points are crucial for effective and valid execution of the Personal Deed form. Take action promptly to uphold legal integrity and ensure compliance.

Browse Other Templates

NC Tax Objection Form,Request for Review of Tax Assessment,Departmental Review Request Form,Objection to Tax Notice Form,Tax Assessment Appeal Form,Notice Review Request NC-242,Form for Tax Objection Submission,Request for Tax Adjustment Review,Taxpa - The form collects information on the taxpayer and the related tax notice.

Pos-040 - The legal implications of misserving documents can render a case invalid, highlighting the importance of adherence to this form's guidelines.

Air Balance Hvac - Documentation must be reviewed for prior adjustments before initiating balancing.