Fill Out Your Personal Loan Application Form

When it comes to securing a personal loan, completing the Personal Loan Application form is one of the most crucial steps in the process. This form plays an essential role in determining your eligibility and the terms of any loan you may be offered. The very first aspect you’ll notice is the need to identify whether you are applying for individual or joint credit. The choices made here guide what sections are required. Sections A through D delve into your personal details, employment history, and current financial status. You'll provide information such as your full name, contact details, loan amount requested, and the purpose for which you need the loan. It’s vital to disclose your assets and liabilities accurately. This includes everything from income sources, such as salary and any additional income, to listing debts like mortgages and credit card obligations. There is also a special section for joint applicants, where you can include details about a co-applicant or guarantor, should you choose to apply together. Lastly, signatures at the end affirm that the information you have provided is accurate and complete, making it clear that you understand the implications of your application. By understanding each part of the form, you pave the way for a smoother application process and increase your chances of obtaining the financial support you seek.

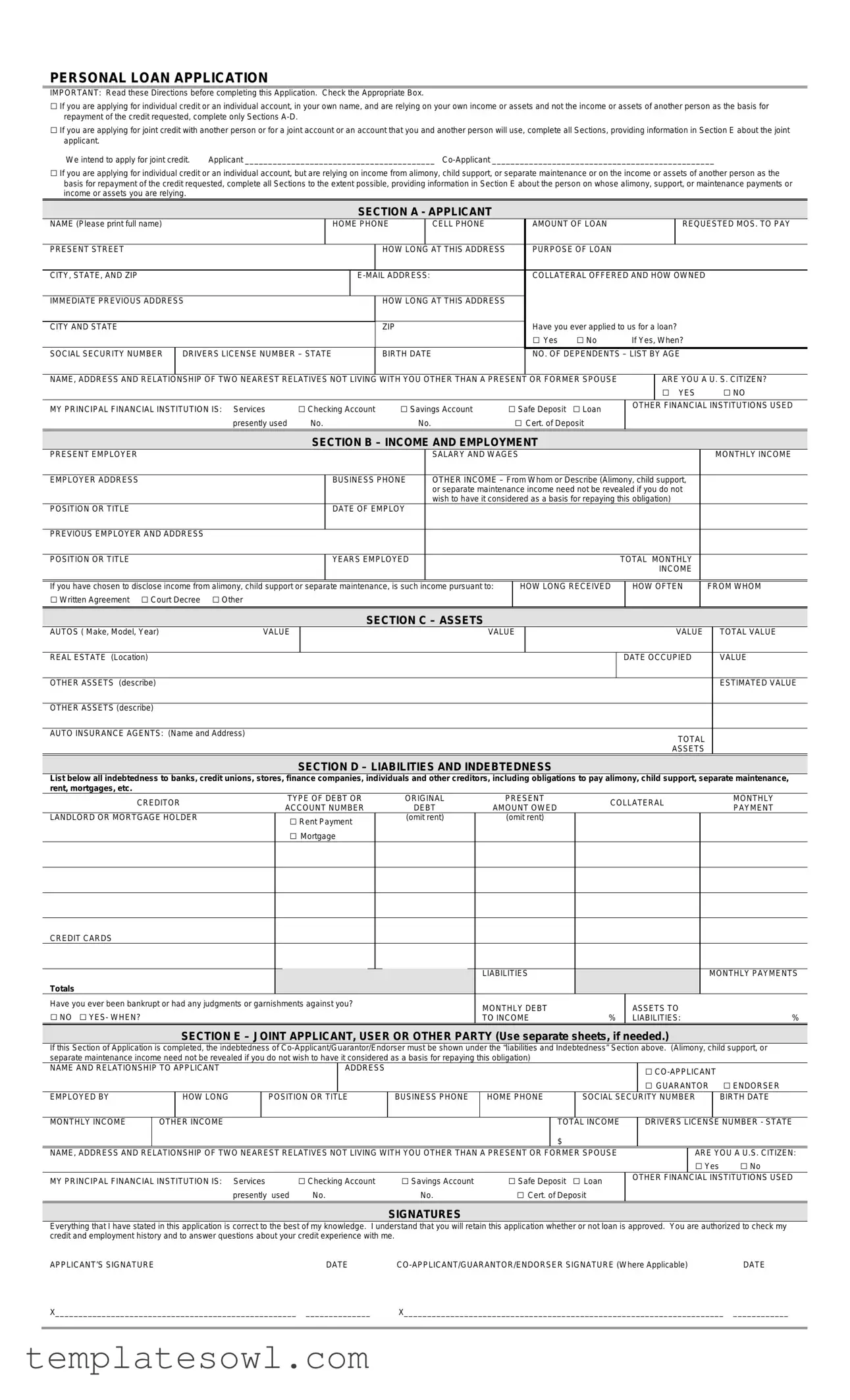

Personal Loan Application Example

PERSONAL LOAN APPLICATION

IMPORTANT: Read these Directions before completing this Application. Check the Appropriate Box.

□If you are applying for individual credit or an individual account, in your own name, and are relying on your own income or assets and not the income or assets of another person as the basis for repayment of the credit requested, complete only Sections

□If you are applying for joint credit with another person or for a joint account or an account that you and another person will use, complete all Sections, providing information in Section E about the joint applicant.

We intend to apply for joint credit. |

Applicant _________________________________________ |

□If you are applying for individual credit or an individual account, but are relying on income from alimony, child support, or separate maintenance or on the income or assets of another person as the basis for repayment of the credit requested, complete all Sections to the extent possible, providing information in Section E about the person on whose alimony, support, or maintenance payments or income or assets you are relying.

SECTION A - APPLICANT

NAME (Please print full name) |

|

|

|

IHOME PHONE |

|

ICELL PHONE |

|

|

|

|

AMOUNT OF LOAN |

|

|

|

|

|

IREQUESTED MOS. TO PAY |

|||||||

PRESENT STREET |

|

|

|

|

|

HOW LONG |

AT THIS ADDRESS |

|

|

|

|

PURPOSE OF LOAN |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

CITY, STATE, AND ZIP |

|

|

|

|

|

|

|

|

COLLATERAL OFFERED AND HOW OWNED |

|

|

|||||||||||||

IMMEDIATE PREVIOUS ADDRESS |

|

|

|

|

|

HOW LONG AT THIS ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you ever applied to us for a loan? |

|

|

||||||||

CITY AND STATE |

|

|

|

|

|

ZIP |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ Yes |

□ No |

|

|

|

If Yes, When? |

|

|

|||

SOCIAL SECURITY NUMBER |

IDRIVERS LICENSE NUMBER – STATE |

BIRTH DATE |

|

|

|

|

NO. OF DEPENDENTS – LIST BY AGE |

|

|

|||||||||||||||

NAME, ADDRESS AND RELATIONSHIP OF TWO NEAREST RELATIVES NOT LIVING WITH YOU OTHER THAN A PRESENT OR FORMER SPOUSE |

|

|

|

|

ARE YOU A U. S. CITIZEN? |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I□ YES |

|

□ NO |

||

MY PRINCIPAL FINANCIAL INSTITUTION IS: |

Services |

□ Checking Account |

□ Savings Account |

□ Safe Deposit |

□ Loan |

|

I |

OTHER |

FINANCIAL INSTITUTIONS USED |

|||||||||||||||

|

|

presently used |

|

No. |

|

No. |

|

|

□ Cert. of Deposit |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

SECTION B – INCOME AND EMPLOYMENT |

|

|

|

|

|

|

|

|

|

|

||||||||||

PRESENT EMPLOYER |

|

|

|

|

|

|

|

SALARY AND WAGES |

|

|

|

|

|

|

|

|

|

|

|

MONTHLY INCOME |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

EMPLOYER ADDRESS |

|

|

|

BUSINESS PHONE |

|

OTHER INCOME – From Whom or Describe (Alimony, child support, |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

or separate maintenance income need not be revealed if you do not |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

wish to have it considered as a basis for repaying this obligation) |

|

|

|

||||||||||||

POSITION OR TITLE |

|

|

|

DATE OF EMPLOY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREVIOUS EMPLOYER AND ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

POSITION OR TITLE |

|

|

|

YEARS EMPLOYED |

|

|

|

|

|

|

|

|

TOTAL MONTHLY |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

If you have chosen to disclose income from alimony, child support or separate maintenance, is such income pursuant to: |

|

I |

HOW LONG RECEIVED |

|

I |

HOW OFTEN |

|

FROM WHOM |

||||||||||||||||

□ Written Agreement □ Court Decree □ Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

SECTION C – ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

AUTOS ( Make, Model, Year) |

VALUE |

|

I |

|

|

VALUE |

|

I |

|

|

|

|

|

|

VALUE |

|

TOTAL VALUE |

|||||||

REAL ESTATE (Location) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OCCUPIED |

|

VALUE |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|||

OTHER ASSETS (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTIMATED VALUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

AUTO INSURANCE AGENTS: (Name and Address) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

||

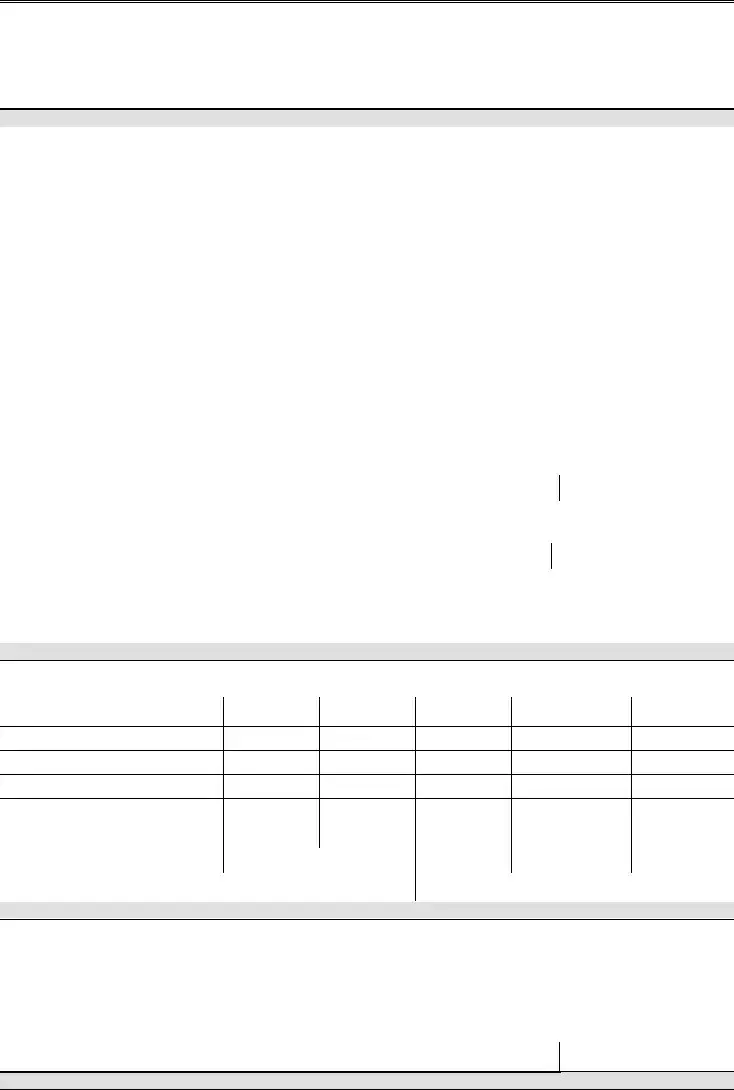

SECTION D – LIABILITIES AND INDEBTEDNESS

List below all indebtedness to banks, credit unions, stores, finance companies, individuals and other creditors, including obligations to pay alimony, child support, separate maintenance, rent, mortgages, etc.

CREDITOR |

TYPE OF DEBT OR |

ORIGINAL |

PRESENT |

COLLATERAL |

MONTHLY |

|

ACCOUNT NUMBER |

DEBT |

AMOUNT OWED |

PAYMENT |

|||

|

|

|||||

LANDLORD OR MORTGAGE HOLDER |

□ Rent Payment |

(omit rent) |

(omit rent) |

|

|

|

|

□ Mortgage |

|

|

|

|

CREDIT CARDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

MONTHLY PAYMENTS |

Totals |

|

|

|

|

|

|

|

|

Have you ever been bankrupt or had any judgments or garnishments against you? |

|

|

MONTHLY DEBT |

|

ASSETS TO |

|

|

|

□ NO □ YES- WHEN? |

|

|

|

|

|

|||

|

|

TO INCOME |

% |

ILIABILITIES: |

% |

|||

SECTION E – JOINT APPLICANT, USER OR OTHER PARTY (Use separate sheets, if needed.)

If this Section of Application is completed, the indebtedness of

NAME AND RELATIONSHIP TO APPLICANT |

|

ADDRESS |

|

|

|

|

□ |

|

||||

|

|

|

|

|

|

|

|

|

□ GUARANTOR |

□ ENDORSER |

||

EMPLOYED BY |

|

HOW LONG |

POSITION OR TITLE |

BUSINESS PHONE |

HOME PHONE |

|

SOCIAL SECURITY NUMBER |

|

BIRTH DATE |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTHLY INCOME |

OTHER INCOME |

|

|

|

|

TOTAL INCOME |

DRIVERS LICENSE NUMBER - STATE |

|||||

|

|

|

|

|

|

|

$ |

|

|

|

|

|

NAME, ADDRESS AND RELATIONSHIP OF TWO NEAREST RELATIVES NOT LIVING WITH YOU OTHER THAN A PRESENT OR FORMER SPOUSE |

|

ARE YOU A U.S. CITIZEN: |

||||||||||

|

|

|

|

|

|

|

|

|

|

□ Yes |

□ No |

|

MY PRINCIPAL FINANCIAL INSTITUTION IS: Services |

□ Checking Account |

□ Savings Account |

□ Safe Deposit □ Loan |

presently used |

No. |

No. |

□ Cert. of Deposit |

OTHER FINANCIAL INSTITUTIONS USED

SIGNATURES

Everything that I have stated in this application is correct to the best of my knowledge. I understand that you will retain this application whether or not loan is approved. You are authorized to check my credit and employment history and to answer questions about your credit experience with me.

APPLICANT’S SIGNATURE |

DATE |

DATE |

|

X____________________________________________________ |

______________ |

X_____________________________________________________________________ |

____________ |

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Application Purpose | The Personal Loan Application is used to apply for either individual or joint credit. Specific sections must be completed based on the applicant's financial situation. |

| Sections to Complete | Applicants seeking individual credit should fill out Sections A-D. For joint credit applicants, all sections must be completed, including Section E for the joint party. |

| Income Verification | Applicants can include income sources such as alimony or child support based on their discretion. However, declaring such income is not mandatory for loan consideration. |

| Required Information | Essential information like name, contact details, income, and liabilities must be provided. This helps lenders assess the applicant’s financial stability. |

| Citizenship Status | Applicants need to confirm if they are U.S. citizens, which may influence eligibility. This is an important consideration for many lenders. |

| Retention of Application | The lender will retain the application, regardless of whether the loan is approved. This policy ensures that all applicants are treated consistently. |

| Legal Considerations | Depending on the state, laws governing personal loans may vary. It’s essential to check specific state regulations to understand your rights and obligations. |

Guidelines on Utilizing Personal Loan Application

Completing the Personal Loan Application can be a streamlined process if you follow these steps carefully. Once you have the form in front of you, gather all necessary information to ensure your application is filled out completely and accurately. Missing details could delay your application or lead to its rejection.

- Check the appropriate box at the top of the form to indicate whether you are applying for individual credit or joint credit.

- Fill out Section A with the applicant's full name, home and cell phone numbers, requested loan amount, and additional personal information including current address, Social Security number, and employment details.

- Answer the question about previous applications by marking "Yes" or "No" and noting the date if applicable.

- Provide details about your income in Section B, including your present employer, salary, and any other sources of income.

- Document your assets in Section C, listing vehicles, real estate, and any additional assets alongside their values.

- List all liabilities and any debts you owe in Section D, including credit cards, mortgages, and rent obligations.

- If applicable, complete Section E for joint applicants with their personal and financial details.

- Review the signatures section to sign and date the application, confirming that all information is correct.

After completing the form, double-check all sections to ensure accuracy. This not only aids the lender in processing your application but also highlights your attention to detail—an essential quality in financial matters. Once satisfied, submit the application according to the lender's instructions.

What You Should Know About This Form

What information is required on the Personal Loan Application form?

The application requires personal information such as your name, address, contact numbers, social security number, and birth date. Additionally, you will need to provide details about your employment, monthly income, assets, and liabilities. If you are applying with a co-applicant, similar information will be required for them as well.

What are the different application options available?

Depending on your financial situation, you have several options. You can apply for individual credit, where you solely rely on your own income, or joint credit with another person. If you are counting on income from alimony or child support, you must complete all sections, stating your reliance on that income to repay the loan.

Is it necessary to provide information about other income?

While it is not mandatory to disclose alimony or child support if you do not want them considered for repayment, you must provide other income sources if they contribute to your overall financial picture. This includes income from investments or secondary jobs, among other sources.

How do I fill out the income section?

In the income section, list your current employment details, including your employer’s name, your position, and how long you have been with the company. Include your monthly salary and any additional income sources. If you have income from alimony or child support, indicate how much you receive and the frequency of those payments.

What should I include when detailing my assets?

When detailing your assets, include items such as vehicles, real estate, and other valuable possessions. For each asset, provide the make, model, and year for vehicles or the location and value for real estate. Estimating the value of other assets, like jewelry or collectibles, can also be helpful.

What if I have outstanding debts?

If you have debts, you must list all obligations in the liabilities section. This includes loans, credit card debts, and any rent or mortgage payments. You should indicate the creditor, original debt amount, current amount owed, and monthly payment amounts. This information helps lenders assess your financial health.

What if I have a history of bankruptcy?

The application will ask if you have ever filed for bankruptcy or had any judgments against you. It's crucial to answer truthfully, as this history could affect your loan eligibility. If applicable, provide the date of the bankruptcy or judgment.

Do I need to provide information about joint applicants?

Yes, if you are applying for joint credit, you must complete the section specific to the co-applicant or guarantor. This includes details similar to your own, such as personal information, income, and liabilities. Both applicants must sign the application, acknowledging the information shared.

What happens after I submit my application?

Upon submission, the lender will review your application for completeness and accuracy. They may conduct background checks on your credit history and employment. It’s important to know that regardless of the application outcome, the lender retains the application for their records.

Common mistakes

When filling out a Personal Loan Application form, mistakes can lead to delays or even denials. Below are ten common errors that applicants often make.

One of the most frequent mistakes is incomplete information. Failing to fill in all required sections or leaving essential fields blank can result in automatic rejection. Each section must be completed in full, whether applying for individual or joint credit.

Another error is the use of illegible handwriting. If the forms are difficult to read, lenders may misinterpret the provided information. Always print clearly to ensure accurate processing.

Many applicants also neglect to list all sources of income accurately. This includes not only salaries but also alimony, child support, or any other relevant earnings. Providing a comprehensive picture of your finances can improve your chances of approval.

Misstating financial obligations is another common issue. It’s crucial to accurately report all debts, including credit card balances, loans, and monthly payments. Lenders assess your ability to repay based on this information.

A lack of documentation can also hinder the application process. Supporting materials, such as proof of income or identification, must accompany the application. Ensure that all necessary documents are attached before submission.

Some applicants fail to check their credit history beforehand. Knowing your credit score is essential as it can influence the loan terms offered. If there are inaccuracies, address them prior to applying.

Another common mistake is not specifying the purpose of the loan. Clearly stating how you intend to use the funds can help lenders understand your situation better and might positively affect their decision.

Many also forget to identify their principal financial institution. This section provides insight into your banking history. It’s advisable to include the names of banks or credit unions where you maintain accounts.

Some applicants overlook the importance of relationships with co-applicants. If applying jointly, providing accurate information about your co-applicant, including relationship and financial details, is essential.

Lastly, a lack of signatures and dates can invalidate an application. Ensure that all required parties sign the document and that each signature is accompanied by the date to avoid processing delays.

By avoiding these common mistakes, applicants can streamline the process and improve the chances of obtaining the necessary funds.

Documents used along the form

When applying for a personal loan, several additional documents enhance your application. These documents provide lenders with a more complete picture of your financial situation, helping them make informed decisions. Below is a list of common forms you may need to include along with your Personal Loan Application.

- Proof of Income: This can include recent pay stubs, tax returns, or W-2 forms. Lenders use this to verify your income and assess your ability to repay the loan.

- Credit Report: Some lenders may request a recent credit report to evaluate your credit history. This report provides insight into your credit score, payment history, and existing debts.

- Identification Documents: A government-issued ID, like a driver's license or passport, is typically required to confirm your identity and verify your residency.

- Bank Statements: Current bank statements for your checking and savings accounts demonstrate your liquidity and financial habits. They can indicate how well you manage money.

- Collateral Documentation: If you are using collateral to secure the loan, you may need to provide documentation proving ownership and value of the asset, such as vehicle titles or property deeds.

- Completed Loan Agreement: After approval, a loan agreement may need to be signed. This document outlines the loan terms, interest rates, and payment schedule.

Having these documents ready when you apply for a personal loan can streamline the process and improve your chances of approval. Being prepared demonstrates financial responsibility and helps build trust with your lender.

Similar forms

The Personal Loan Application form shares similarities with several other documents typically used in financial transactions. Each of these documents serves a specific purpose but follows a common structure in gathering relevant information. Below is a list of eight documents that are akin to the Personal Loan Application form, along with brief descriptions of how they relate.

- Mortgage Application - Like the personal loan application, this document requests detailed information about the applicant's financial situation, including income, assets, and liabilities, to assess the ability to repay the loan.

- Credit Card Application - This form similarly requires personal identification, income details, and credit history to evaluate the applicant's creditworthiness before granting a credit line.

- Student Loan Application - Much like a personal loan application, this document collects financial information, including income and expenses, to determine eligibility for financial aid based on the applicant's need.

- Rental Application - This form asks for personal and financial details to assess whether the applicant can meet rental obligations, echoing the information requested in a loan application.

- Auto Loan Application - Similar to a personal loan application, this document gathers information regarding employment, income, and existing debts to evaluate whether the applicant can afford to finance a vehicle.

- Business Loan Application - This form requires detailed financial disclosures about the business and its owners, reflecting the personal and financial data collection seen in personal loan applications.

- Home Equity Line of Credit Application - Like a personal loan application, this document reviews the homeowner's financial standing and the value of their property to determine eligibility for borrowing against home equity.

- Insurance Application - This form collects personal and financial information, including income and existing debts, to evaluate the risk and eligibility for coverage, similar to the loan assessment process.

By understanding these similarities, applicants can navigate the process more effectively and gather the necessary information beforehand.

Dos and Don'ts

Things to Do When Filling Out a Personal Loan Application:

- Read all directions carefully before starting to fill out the form.

- Provide accurate and up-to-date information regarding income, assets, and debts.

- Complete all sections that apply to your situation, especially if you are using another person's income for support.

- Check your application for any errors or missing information before submitting it.

Things Not to Do When Filling Out a Personal Loan Application:

- Do not leave any sections blank that are relevant to your situation.

- Avoid submitting false information or omitting significant financial details.

- Do not rush through the application; take your time to ensure everything is correct.

- Do not forget to sign and date the application before submission.

Misconceptions

Understanding the personal loan application process can often be challenging. Here are some common misconceptions that individuals may have about the application form.

- Only individuals with perfect credit can apply. Many lenders consider applications from individuals with varying credit scores. They may take into account other factors, such as income and employment stability, when making their decision.

- You cannot apply for a loan if you're unemployed. While employment status is important, some lenders may consider other forms of income, such as alimony or investment income, which can support repayment.

- The application form does not require my Social Security number. Providing your Social Security number is usually necessary for lenders to verify your identity and check your credit history.

- Joint applicants must have equal creditworthiness. While both applicants' financial situations are considered, one applicant’s good credit may compensate for the other’s poor credit in certain cases.

- All sources of income must be disclosed. You are not required to disclose alimony or child support income if you do not want it to be considered in your application.

- Providing false information will not affect my application. Misrepresentation can lead to denial of the application or even legal consequences. Honesty is crucial.

- The loan amount is fixed and cannot be negotiated. Many lenders allow borrowers to discuss the amount they are requesting based on their financial situation.

- The application is solely for personal use loans. Some lenders offer various types of loans, including business loans or home equity loans, depending on your needs.

- Once submitted, I cannot change my application. Most lenders allow applicants to make adjustments to their application prior to final approval, especially if circumstances change.

Awareness of these misconceptions can help individuals navigate the personal loan application process with a clearer understanding. Approaching this process informed can mitigate anxiety and empower applicants.

Key takeaways

When completing the Personal Loan Application form, it is important to remember several key points to ensure a smooth application process.

- Choose the correct application type. Indicate whether you are applying for individual or joint credit. This determination influences which sections of the form to complete.

- Provide accurate personal information. Fill in your full name, address, contact information, Social Security number, and any required financial details to avoid delays.

- Disclose all relevant income sources. Report all income, including alimony or child support if applicable, even if you choose not to have it considered for loan approval.

- List all assets and liabilities. Include detailed information about your assets, debts, and monthly payments. This will help the lender assess your financial situation effectively.

- Review before submission. Ensure all sections are complete and accurate. Inaccuracies may lead to denial or rejection of the application.

Browse Other Templates

Pa License Plate Peeling - When applying for a replacement due to non-receipt, both parts of Section E must be completed.

Ct Security Guard Card Renewal - Indicate if you have changed your residence address since your last application.

Grand Rapids City Taxes - Taxpayer records should reflect the submitted payment voucher information.