Fill Out Your Pnc Direct Deposit Form

The PNC Direct Deposit form simplifies the process of receiving payments directly into your PNC Bank account. This essential document allows you to notify your employer or any other non-governmental organization of your decision to switch to direct deposit or update your existing direct deposit information. It includes several key components, starting with your personal information, such as your name, Social Security Number, and address, which ensures that your payments are accurately directed to your designated account. You will be required to select a primary account at PNC Bank where your funds will be deposited, specifying the account type and providing relevant details like the account number and routing number. If you wish, the form also accommodates an optional secondary account, allowing for partial deposits to another PNC account. It's important to note that this authorization remains in effect until you provide written notice of its termination to your employer, providing them a reasonable time to process your request. With the convenience of direct deposit, you eliminate concerns about checks being lost or delayed, ensuring that your payments are received promptly and securely.

Pnc Direct Deposit Example

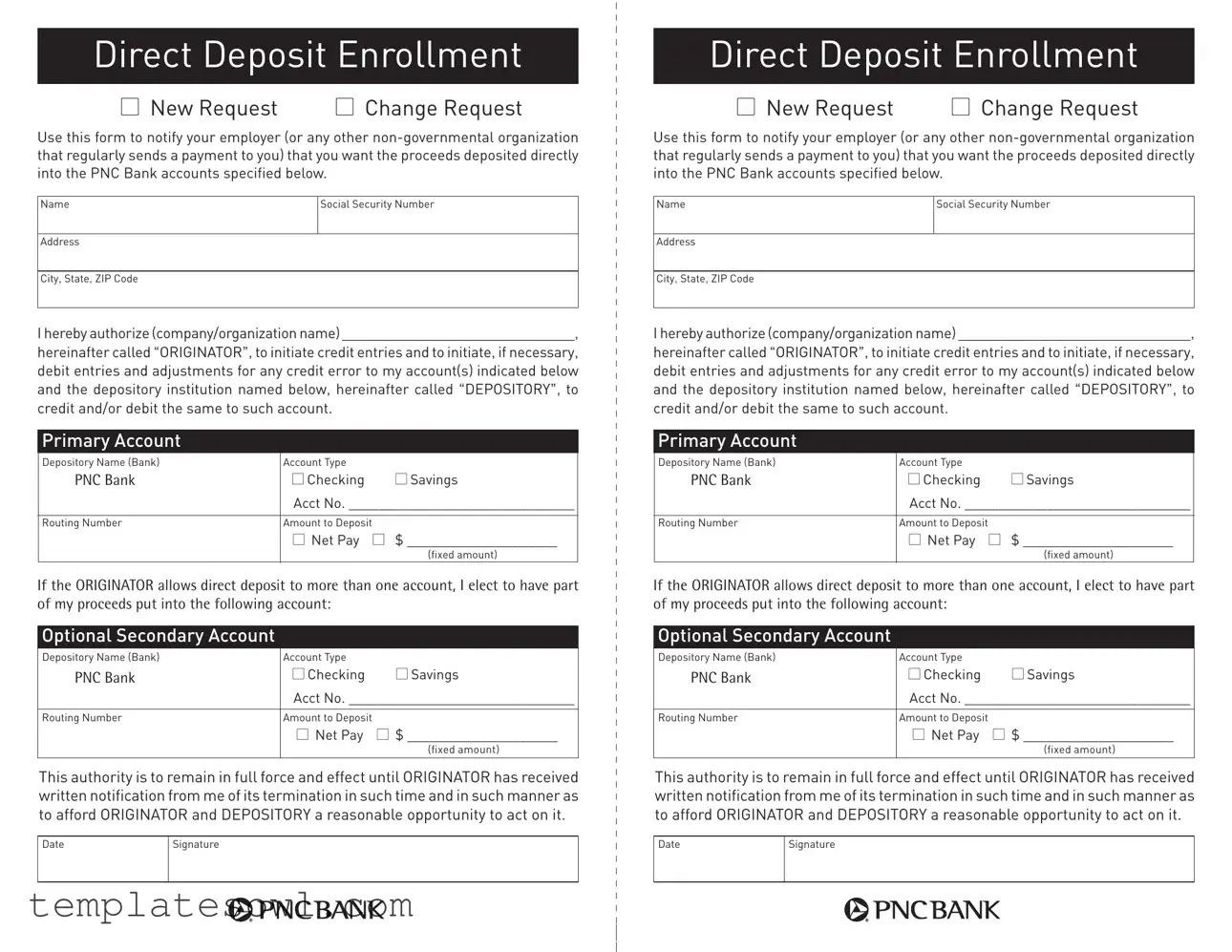

Direct Deposit Enrollment

|

|

|

|

New Request |

Change Request |

Use this form to notify your employer (or any other

Name |

Social Security Number |

|

|

Address

City, State, ZIP Code

Iherebyauthorize(company/organizationname)______________________________,

hereinafter called “ORIGINATOR”, to initiate credit entries and to initiate, if necessary, debit entries and adjustments for any credit error to my account(s) indicated below and the depository institution named below, hereinafter called “DEPOSITORY”, to credit and/or debit the same to such account.

Primary Account

Depository Name (Bank) |

Account Type |

Savings |

PNC Bank |

Checking |

|

|

Acct No. ______________________________ |

|

|

|

|

Routing Number |

Amount to Deposit |

$ ____________________ |

|

Net Pay |

|

|

|

(fixed amount) |

If the ORIGINATOR allows direct deposit to more than one account, I elect to have part of my proceeds put into the following account:

Optional Secondary Account

Depository Name (Bank) |

Account Type |

Savings |

PNC Bank |

Checking |

|

|

Acct No. ______________________________ |

|

|

|

|

Routing Number |

Amount to Deposit |

$ ____________________ |

|

Net Pay |

|

|

|

(fixed amount) |

This authority is to remain in full force and effect until ORIGINATOR has received written notification from me of its termination in such time and in such manner as to afford ORIGINATOR and DEPOSITORY a reasonable opportunity to act on it.

Date |

Signature |

|

|

Direct Deposit Enrollment

|

|

|

|

New Request |

Change Request |

Use this form to notify your employer (or any other

Name |

Social Security Number |

|

|

Address

City, State, ZIP Code

Iherebyauthorize(company/organizationname)______________________________,

hereinafter called “ORIGINATOR”, to initiate credit entries and to initiate, if necessary, debit entries and adjustments for any credit error to my account(s) indicated below and the depository institution named below, hereinafter called “DEPOSITORY”, to credit and/or debit the same to such account.

Primary Account

Depository Name (Bank) |

Account Type |

Savings |

PNC Bank |

Checking |

|

|

Acct No. ______________________________ |

|

|

|

|

Routing Number |

Amount to Deposit |

$ ____________________ |

|

Net Pay |

|

|

|

(fixed amount) |

If the ORIGINATOR allows direct deposit to more than one account, I elect to have part of my proceeds put into the following account:

Optional Secondary Account

Depository Name (Bank) |

Account Type |

Savings |

PNC Bank |

Checking |

|

|

Acct No. ______________________________ |

|

|

|

|

Routing Number |

Amount to Deposit |

$ ____________________ |

|

Net Pay |

|

|

|

(fixed amount) |

This authority is to remain in full force and effect until ORIGINATOR has received written notification from me of its termination in such time and in such manner as to afford ORIGINATOR and DEPOSITORY a reasonable opportunity to act on it.

Date |

Signature |

|

|

Direct Deposit...

Direct Deposit...

as easy as...

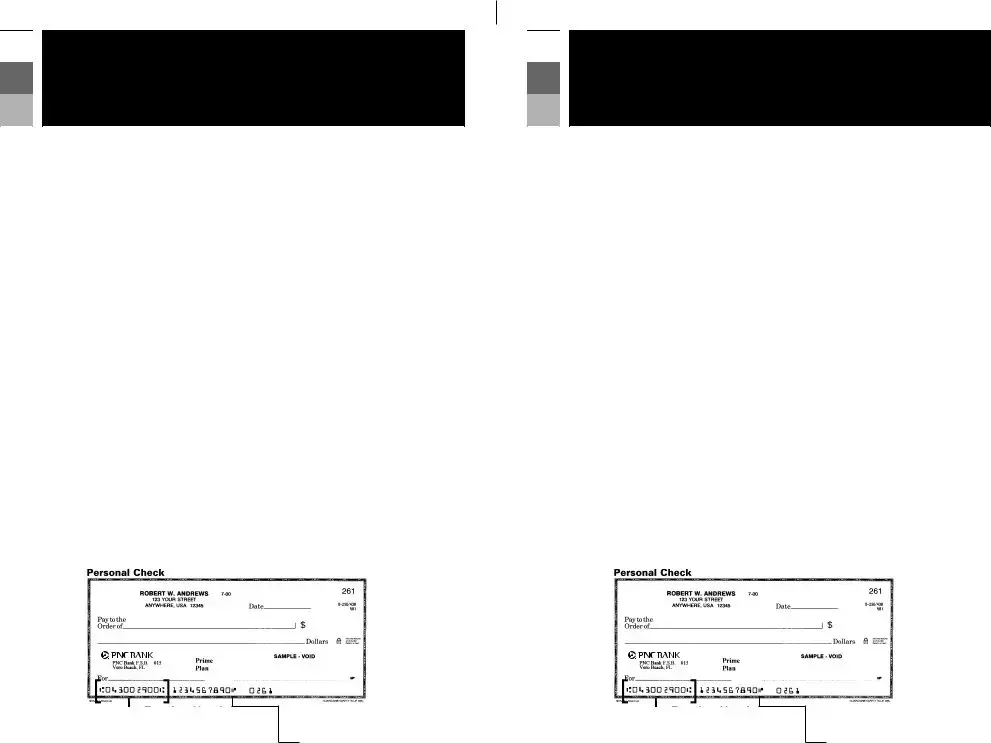

The quickest way to sign up for direct deposit – or

1change it – is to ask your employer for their direct deposit form, then fill it out using your new account numberandroutingnumber(seeillustrationbelow).You may be able to use this form for any

2You can even use this form to have dividend or insurance payments directly deposited to your account.

No more wondering if the check will

3 get to you on time or whether you’ll have time to get to the bank. With Direct Deposit, it’s conveniently and automatically done for you.

Sample Routing Number

Sample Routing Number

Sample Account Number

Direct Deposit...

Direct Deposit...

as easy as...

The quickest way to sign up for direct deposit – or

1change it – is to ask your employer for their direct deposit form, then fill it out using your new account numberandroutingnumber(seeillustrationbelow).You may be able to use this form for any

2You can even use this form to have dividend or insurance payments directly deposited to your account.

No more wondering if the check will

3 get to you on time or whether you’ll have time to get to the bank. With Direct Deposit, it’s conveniently and automatically done for you.

Sample Routing Number

Sample Routing Number

Sample Account Number

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form is used to set up or change direct deposit for payments into a PNC Bank account. |

| Eligibility | This form can be used by employees or individuals receiving payments from non-governmental organizations. |

| Accounts | Deposits can be made into either a checking or savings account at PNC Bank. |

| Authorization | Signing the form authorizes the company or organization to deposit funds and make adjustments to your account. |

| Terminating the Agreement | You must provide written notification to terminate direct deposit, allowing enough time for processing. |

Guidelines on Utilizing Pnc Direct Deposit

Filling out the PNC Direct Deposit form is an important step toward managing your finances conveniently. Once you complete the form, it should be submitted to your employer or organization responsible for issuing your payments. They will process your request and ensure that your funds are transferred directly to your specified PNC Bank account without delay.

- Start by marking whether this is a New Request or a Change Request.

- In the first section, provide your Name, Social Security Number, and Address, including City, State, and ZIP Code.

- Write the name of your employer or the organization making the payments in the space after “I hereby authorize (company/organization name).”

- Fill in your Primary Account Depository Name, selecting either Savings or Checking.

- Provide your Account Number and Routing Number.

- Indicate the Amount to Deposit by selecting either a specific dollar amount or Net Pay.

- If applicable, complete the Optional Secondary Account section with the same details as above for any additional account receiving funds.

- Review the declaration regarding the authority of the Originator, confirming that it remains effective until you notify them otherwise.

- Finally, sign and date the form to complete it.

What You Should Know About This Form

What is the PNC Direct Deposit form used for?

The PNC Direct Deposit form is used to request that an employer or any other organization deposits payments directly into a specified PNC Bank account. This form can be used for both new requests and changes to existing direct deposit arrangements.

How do I fill out the PNC Direct Deposit form?

To complete the form, provide your personal details including your name, Social Security number, address, and the name of the organization making the deposits. Indicate whether this is a new request or a change request. Include the account type (savings or checking), account number, and the routing number for your specified PNC Bank account. If you wish to deposit part of your earnings into a secondary account, complete that section as well.

Can I use the PNC Direct Deposit form for any organization?

This form can generally be used for non-governmental organizations that regularly send payments. However, it is advisable to check with your employer or the organization in question to confirm if they accept this form for direct deposit.

What happens after I submit the PNC Direct Deposit form?

Once you submit the form to the designated organization, they will initiate an electronic process to start depositing your payments directly into your specified PNC Bank accounts. You should allow some time for the organization to process your request and implement the direct deposit.

Can I make changes to my direct deposit arrangement?

Yes, you can make changes by filling out the PNC Direct Deposit form again. Mark the appropriate box indicating this is a change request, and provide updated account details as necessary. It's important to submit the changes to your employer or the organization making the payments in a timely manner to avoid any disruption in your deposits.

Is there a deadline for submitting the PNC Direct Deposit form?

There is no universal deadline set by PNC Bank, as timelines depend on the policies of the originating organization. It is advisable to submit your request as early as possible to ensure that your direct deposits begin on the desired date. Each organization may have its own processing time, so check in advance.

What should I do if I want to stop direct deposit?

If you wish to terminate your direct deposit arrangement, you must notify the originating organization in writing. The authority you granted will remain in effect until the organization receives your termination notice and has time to process it. Check with your organization to confirm their specific requirements for discontinuing the direct deposit.

Common mistakes

Filling out the PNC Direct Deposit form is straightforward, but several common mistakes can lead to complications. One of the most frequent errors is failing to provide accurate personal information. Individuals often overlook or miswrite their name, Social Security number, or address. Such inaccuracies can cause delays in the direct deposit process or even lead to missed payments.

Another common mistake is neglecting to include the correct account information. This includes the account number and routing number of the designated bank accounts. If either of these numbers is entered incorrectly, the funds may not be deposited as intended. It is advisable to double-check these details against bank statements to ensure they are correct.

Some people make the mistake of not specifying how much of their paycheck they want deposited into the primary account. They may either leave the field blank or misunderstand the options. Choosing between a fixed amount and net pay requires careful consideration. Failing to provide this information can result in funds not being deposited at all or being split incorrectly.

When multiple accounts are involved, errors often arise in designating an optional secondary account. If this section is used, individuals must ensure that both account and routing numbers are included. Omitting this information or mistakenly filling it in can lead to confusion over where the remaining funds will go.

A common oversight is not signing and dating the form. Without a signature or date, the form may not be considered valid by the employer or organization. This lack of formal acknowledgment could delay the direct deposit process significantly.

Lastly, individuals sometimes fail to notify the originator when they want to terminate the direct deposit authorization. The form explicitly states that written notification is necessary. Ignoring this requirement may result in ongoing deposits to an account, even after the individual has decided to stop receiving them.

Documents used along the form

When enrolling in direct deposit with PNC Bank, several additional forms and documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose in facilitating direct deposit arrangements with employers or other organizations.

- Employer’s Direct Deposit Form: This form is typically provided by your employer to formally request enrollment in their direct deposit program. It often requires similar information to the PNC Direct Deposit form, such as account details.

- Change of Address Form: If you have recently moved, this form notifies your employer or organization of your new address, ensuring that they have the correct information on file for communication and tax reporting purposes.

- W-4 Form: This form helps employers determine the correct amount of federal income tax to withhold from your pay. It may need to be updated alongside your direct deposit information if your withholding status changes.

- Payroll Deduction Authorization Form: If you wish to deduct specific amounts from your paycheck for savings, insurance, or other expenses, this form is necessary to outline those deductions and ensure they are processed accurately.

- Account Verification Letter: Sometimes requested by employers, this letter from your bank verifies your account information, ensuring accuracy in direct deposit transactions.

- Tax Forms (e.g., 1099, W-2): These forms report income and taxes paid. While they are not directly related to direct deposit, having accurate tax forms is crucial for your financial records and can affect future deposits.

- Employer Change Notice: This form informs relevant parties about changes in your employment status, which may impact your direct deposit setup, especially if switching jobs.

These forms collectively support the direct deposit process, allowing for timely and accurate transfers of funds. Ensuring each document is correctly completed and submitted will help maintain a smooth banking experience.

Similar forms

- W-4 Form: The W-4 form is used by employees to indicate their tax withholding preferences to their employer. Similar to the PNC Direct Deposit form, it provides necessary information such as name and social security number to ensure accurate processing of financial transactions.

- Direct Payment Authorization Form: This document allows individuals to authorize a company or organization to withdraw funds directly from their bank account for services like utilities or loans. Both forms require banking details and establish a framework for automatic financial transactions.

- Payroll Deduction Authorization Form: This form allows employees to authorize deductions from their paycheck for various benefits, such as retirement contributions or health insurance premiums. Like the PNC Direct Deposit form, it requires explicit consent and details about how funds will be allocated.

- Bank Account Information Form: Usually required to set up automatic payments or direct deposits, this document collects essential details, including account numbers and routing information. It shares the purpose of ensuring that funds flow seamlessly into the specified account, just like the PNC Direct Deposit form.

Dos and Don'ts

When filling out the PNC Direct Deposit form, consider the following helpful tips to ensure a smooth process.

- Make sure your information is accurate. Double-check your name, Social Security number, and account details to avoid any delays.

- Choose the correct account type. Specify whether your direct deposit will go to a checking or savings account.

- Keep a copy of the completed form. Retaining a personal record will help in case any issues arise in the future.

- Sign and date the form. Ensure that your authorization is clearly established with your signature and the current date.

- Don’t rush through the process. Take your time to fill out the form carefully to prevent mistakes.

- Don’t use incorrect routing or account numbers. Providing the wrong details can cause your deposit to be misdirected.

- Don’t forget to inform your employer. Make sure they receive the form promptly to avoid delays in payments.

- Don’t hesitate to ask for help. If you're unsure about any section of the form, seek clarification from your employer or bank.

Misconceptions

- Direct deposit only works for government payments. This is a common misunderstanding. Direct deposit can actually be set up for various types of payments, including wages from employers and dividends from investments, as well as insurance payments.

- Once set up, direct deposit cannot be changed. On the contrary, you can easily change your direct deposit information. Just fill out a new PNC Direct Deposit form with your updated details.

- I need to provide my full Social Security number. While it might seem necessary, typically, you only need to provide the last four digits for most forms. However, always check specific requirements from your employer.

- Direct deposit guarantees my payment will arrive on time. Although direct deposit is generally reliable, delays can still happen due to banking errors or if your employer processes payroll late. It’s not a complete guarantee.

- I can only deposit my full paycheck into one account. This is not true. The PNC Direct Deposit form allows you to split your deposit between a primary and a secondary account, which can help with budgeting.

- Once I sign the form, I have no control over it. Actually, you have the right to revoke your authorization at any time. Just notify your employer in writing and allow time for them to process your cancellation.

- Direct deposit doesn’t work for all banks. As long as the receiving bank accepts direct deposits, you shouldn't face issues. PNC Bank supports direct deposits from multiple types of organizations.

- There is no impact on my tax withholdings with direct deposit. The method of payment does not affect your tax withholdings. They are determined based on your paycheck settings, regardless of whether you choose direct deposit or paper checks.

Key takeaways

The PNC Direct Deposit form is an important tool for managing your finances efficiently. Here are five key takeaways to consider when filling it out and using it.

- Authorization is Key: By signing the form, you grant your employer or organization permission to deposit funds directly into your specified PNC Bank account. This means they can also correct any errors related to deposits.

- Multiple Accounts: The form allows for deposits into more than one account. You can allocate a portion of your pay to a primary account and the remainder to a secondary account.

- Fixed Amounts or Net Pay: You have the option to choose between a fixed dollar amount or depositing your full net pay. Be clear about your preference when filling out the form.

- Important Information: Double-check that your account number and routing number are correct to prevent delays in receiving your funds. Also, ensure that your personal information, such as name and Social Security number, is accurately filled out.

- Notification of Change: Once submitted, this authorization remains effective until you provide written notice to your employer or organization to terminate it. Always keep track of your submissions and any necessary updates.

Using the PNC Direct Deposit form can simplify how you receive payments, ensuring funds go directly to your chosen account without the need for you to manually deposit checks. Enjoy the peace of mind that comes with reliable, automatic deposits.

Browse Other Templates

Prc Application Form - The licensing body may contact applicants for further clarification if needed.

Trailer Check List - Count the number of chains and binders used in securing the load.