Fill Out Your Policy Loan Request Form

The Policy Loan Request form is a vital document for policyholders looking to borrow against their life insurance. It simplifies the process of accessing cash value from a policy, providing essential details that must be filled out accurately. Key information required includes the policy number, owner's information, and any changes to addresses or contact details, which are crucial for effective communication. The form details the terms and conditions of the loan, specifying that the amount borrowed cannot exceed 90% of the cash value and outlining the minimum loan amount of $500. It also highlights how requested loans are processed, including the transfer of funds, potential fees, and the impact of loans on death benefits and surrender values. Additionally, borrowers need to be mindful of the tax implications and risks associated with policy loans. Signature requirements are clear, with additional steps for significant withdrawals and specific disbursement methods, everything working together to ensure that policyholders are well-informed before proceeding with a loan request.

Policy Loan Request Example

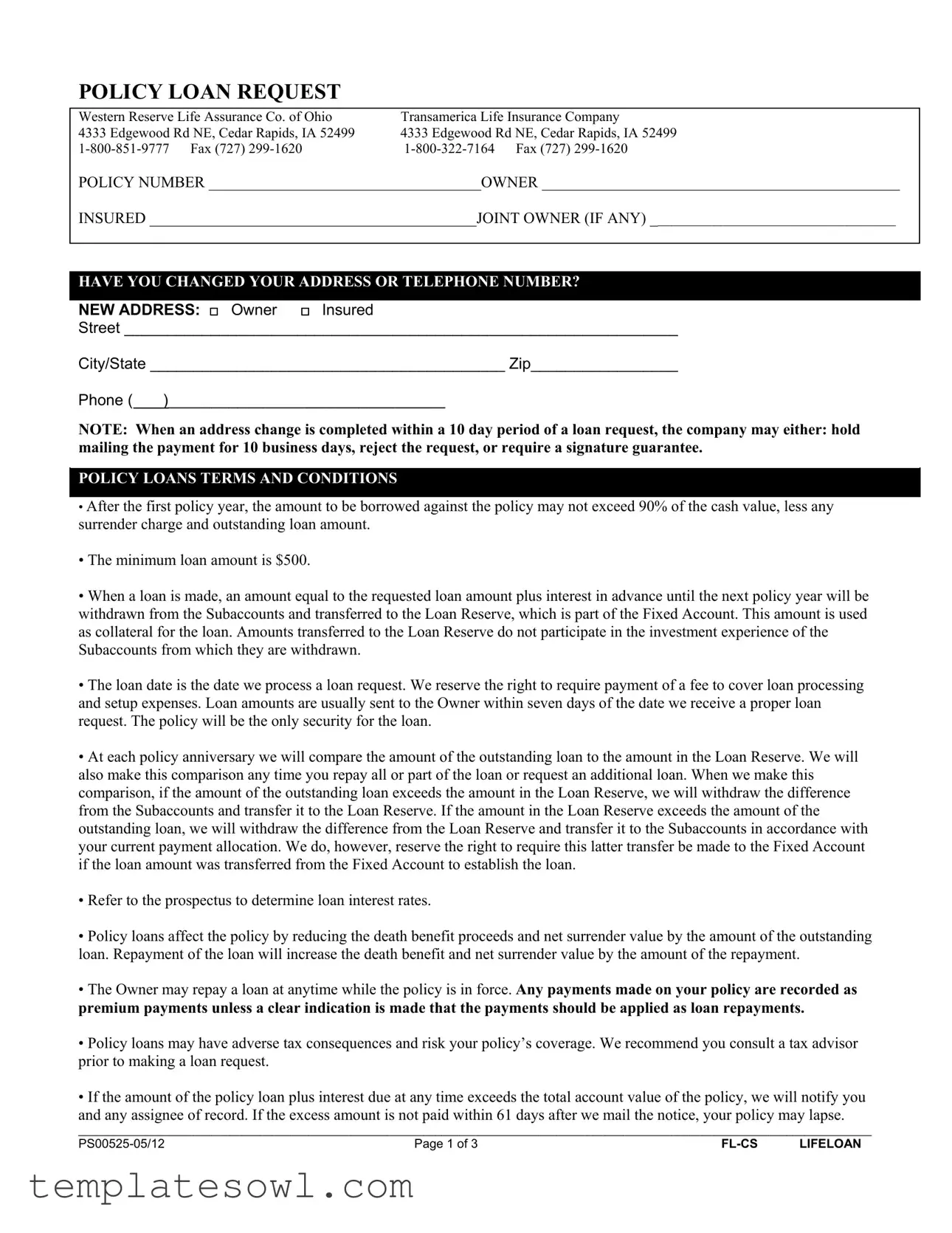

POLICY LOAN REQUEST

|

Western Reserve Life Assurance Co. of Ohio |

Transamerica Life Insurance Company |

||

|

4333 Edgewood Rd NE, Cedar Rapids, IA 52499 |

4333 Edgewood Rd NE, Cedar Rapids, IA 52499 |

||

|

|

|||

|

POLICY NUMBER ___________________________________OWNER ______________________________________________ |

|||

|

INSURED __________________________________________JOINT OWNER (IF ANY) ___________________________________ |

|||

|

|

|

||

|

|

|

||

|

HAVE YOU CHANGED YOUR ADDRESS OR TELEPHONE NUMBER? |

|

||

|

|

|

|

|

|

NEW ADDRESS: Owner |

Insured |

|

|

Street ________________________________________________________________

City/State _________________________________________ Zip_________________

Phone ( )________________________________

NOTE: When an address change is completed within a 10 day period of a loan request, the company may either: hold mailing the payment for 10 business days, reject the request, or require a signature guarantee.

POLICY LOANS TERMS AND CONDITIONS

•After the first policy year, the amount to be borrowed against the policy may not exceed 90% of the cash value, less any surrender charge and outstanding loan amount.

•The minimum loan amount is $500.

•When a loan is made, an amount equal to the requested loan amount plus interest in advance until the next policy year will be withdrawn from the Subaccounts and transferred to the Loan Reserve, which is part of the Fixed Account. This amount is used as collateral for the loan. Amounts transferred to the Loan Reserve do not participate in the investment experience of the Subaccounts from which they are withdrawn.

•The loan date is the date we process a loan request. We reserve the right to require payment of a fee to cover loan processing and setup expenses. Loan amounts are usually sent to the Owner within seven days of the date we receive a proper loan request. The policy will be the only security for the loan.

•At each policy anniversary we will compare the amount of the outstanding loan to the amount in the Loan Reserve. We will also make this comparison any time you repay all or part of the loan or request an additional loan. When we make this comparison, if the amount of the outstanding loan exceeds the amount in the Loan Reserve, we will withdraw the difference from the Subaccounts and transfer it to the Loan Reserve. If the amount in the Loan Reserve exceeds the amount of the outstanding loan, we will withdraw the difference from the Loan Reserve and transfer it to the Subaccounts in accordance with your current payment allocation. We do, however, reserve the right to require this latter transfer be made to the Fixed Account if the loan amount was transferred from the Fixed Account to establish the loan.

•Refer to the prospectus to determine loan interest rates.

•Policy loans affect the policy by reducing the death benefit proceeds and net surrender value by the amount of the outstanding loan. Repayment of the loan will increase the death benefit and net surrender value by the amount of the repayment.

•The Owner may repay a loan at anytime while the policy is in force. Any payments made on your policy are recorded as premium payments unless a clear indication is made that the payments should be applied as loan repayments.

•Policy loans may have adverse tax consequences and risk your policy’s coverage. We recommend you consult a tax advisor prior to making a loan request.

•If the amount of the policy loan plus interest due at any time exceeds the total account value of the policy, we will notify you

and any assignee of record. If the excess amount is not paid within 61 days after we mail the notice, your policy may lapse.

___________________________________________________________________________________________________________________________________

Page 1 of 3 |

LIFELOAN |

REQUEST INFORMATION

Partial Loan Net Amount $ _______________________ Gross Amount $_____________________

Maximum Available Note: WRL will hold recent payments for 15 days.

Is the Policy on Monthly Draft? □ Yes □ No

If YES, would you like your Payments to go towards Loan Repayment? □ Yes □ No

DISBURSEMENT METHOD INFORMATION

I would like to receive my disbursement sent: (Please select only one option)

By Regular Mail

Overnight (fee applies)

Wire Transfer (fee applies) Trust bank accounts must be titled with the name of the Trust and NOT the Trustee’s name.

________________________________________ ___________________________________________________________

Bank Name |

Bank Address |

|

_________________________ |

___________________________________ |

___________________________________ |

Bank Phone Number |

Bank Routing Number |

Bank Account Number |

___________________________________________________________________________________________________________________________________

Page 2 of 3 |

LIFELOAN |

SIGNATURES

Signature of Policy Owner __________________________________________________________ Date ________________

_______________________________________________________________________

Print Name / Title (POA, Trustee, Guardian, etc.)

Signature of Power of Attorney ______________________________________________________ Date _________________

Signature of Joint Owner or Spouse___________________________________________________ Date ________________

Signature is required for jointly owned policies

Signature of Assignee______________________________________________________________ Date ________________

Request must contain the owner’s signature.

NOTE: Medallion Signature Guarantee required for withdrawal of $500,000 or more. A Medallion Signature Guarantee will also be required where proceeds are to be sent to an address other than the address of record. Signatures must be guaranteed by a national or state bank or a member of a national stock exchange or any other institution which is an eligible guarantor institution as defined by the rules and regulations of the Securities and Exchange Commission. A Notarization is not acceptable.

MEDALLION SIGNATURE GUARANTEE

Signature: ____________________________________

Please Note: Unless we have been notified of a community or marital property interest in this contract, we will rely on our good faith belief that no such interest exists and will assume no responsibility for inquiry. The contract owner agrees to indemnify and hold the Insurance Company harmless from the consequences of accepting this transaction.

Faxes may be accepted up to $499,999.

___________________________________________________________________________________________________________________________________

Page 3 of 3 |

LIFELOAN |

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility for Loans | After the first year of the policy, one can borrow up to 90% of the cash value, minus any applicable surrender charges and existing loan amounts. |

| Minimum Loan Amount | The form stipulates that the minimum amount for a loan request is set at $500, ensuring that only significant borrowing is facilitated. |

| Repayment Conditions | Policyholders can repay their loans at any time while the policy remains active. Payments must be clearly indicated to avoid confusion with premium payments. |

| Tax Implications | Taking a loan against the policy may lead to adverse tax consequences. Seeking advice from a tax advisor is advisable before proceeding with a loan request. |

| Signature Requirements | A Medallion Signature Guarantee is necessary for withdrawals of $500,000 or more, ensuring the security of the transaction. Joint ownership requires signatures from all parties involved. |

Guidelines on Utilizing Policy Loan Request

After you complete the Policy Loan Request form, it will be submitted for processing. The insurance company usually reviews the request promptly, and you can typically expect to receive the requested loan amount within a week, provided all information is accurate and complete.

- Write the policy number in the designated space.

- Enter the owner's name as it appears on the policy.

- Fill in the insured's name as listed in the policy.

- If applicable, include the joint owner's name.

- Indicate whether you have changed your address or telephone number. If yes, provide the new address and phone number.

- Complete the sections regarding the loan amount. Specify both the net amount and the gross amount you are requesting.

- Indicate if the policy is on a monthly draft and if payments should go towards loan repayment.

- Select your preferred disbursement method: Regular Mail, Overnight, or Wire Transfer.

- Fill in the bank details required for the disbursement method you chose, including the bank name, address, phone number, routing number, and account number.

- Sign the form as policy owner and date it.

- If applicable, have the Power of Attorney or joint owner/spouse sign and date as needed.

- If applicable, include the assignee's signature and date.

- If the loan request involves $500,000 or more, ensure a Medallion Signature Guarantee is included.

What You Should Know About This Form

What is the Policy Loan Request form and who can use it?

The Policy Loan Request form allows policy owners to request a loan against their life insurance policy. This form can be completed by the owner of the policy, and if the policy has a joint owner or an assignee, those individuals must also provide their signatures. It is important for policy owners to understand the terms and conditions related to policy loans before submitting the form.

What are the conditions for borrowing against my policy?

You can borrow up to 90% of the cash value of your policy after the first year, minus any surrender charges and outstanding loans. The minimum loan amount is set at $500. When you request a loan, the funds will be taken from your policy's subaccounts and moved to the Loan Reserve, which acts as collateral for the loan. This collateral does not participate in the subaccounts' investment experience.

How long does it take to receive the loan funds?

Generally, you can expect to receive your loan funds within seven days of the completed request, provided all required information is included. The company reserves the right to charge a fee for processing the loan, which might affect when you get your money.

What happens to my policy if I do not pay back the loan?

If the total amount of the loan plus interest surpasses the total account value of the policy, the insurance company will notify you and any assignees. If you do not repay the excess within 61 days after the notification, your policy risks lapsing. It is crucial to stay informed about the outstanding loan balance to maintain your policy’s coverage.

Can I repay my loan at any time?

Yes, you may repay your loan at any time while the policy is active. Any repayments will generally be recorded as premium payments unless you specify that they are to be applied toward the loan balance. Keeping clear records of your payments can help prevent any confusion.

What are the tax implications of a policy loan?

Taking out a loan against your policy may have adverse tax consequences. It's advisable to consult with a tax advisor before proceeding with a loan request. Understanding these implications can help you make informed decisions about the impact on your financial situation.

What types of disbursements are available for loan funds?

You can choose how you wish to receive your loan funds. Options include regular mail, overnight delivery (which incurs a fee), or wire transfer (also incurring a fee). Make sure to indicate your preferred method clearly on the request form to ensure timely processing of your loan funds.

Common mistakes

When filling out the Policy Loan Request form, it's important to avoid common mistakes that can delay processing. One mistake people often make is forgetting to include their policy number. This number is essential for identifying your account and ensuring that your request is processed correctly. Without it, your application may get delayed or even rejected.

Another frequent error is neglecting to update their address or telephone number. If you have changed either recently, it is crucial to provide the new information. The company may hold your payment for up to 10 business days or require additional verification if there have been changes within that period. Failing to report these changes can slow down the loan application process.

Some individuals overlook the disbursement method choices when completing the form. Selecting how you would like to receive your funds is vital. Failure to choose one option could lead to confusion about how to deliver your loan amount. Always indicate whether you prefer regular mail, overnight service, or a wire transfer.

Additionally, signing the form can be a stumbling block. Many applicants forget to provide all necessary signatures, especially in cases of joint ownership or when a Power of Attorney is involved. Ensure that all required parties have signed to avoid processing delays and confirm that you have included your signature as the policy owner.

Another common mistake is assuming that any payments made are automatically applied as loan repayments. It’s essential to clearly indicate if you intend for payments to count as loan repayment rather than regular premium payments. Miscommunication here could lead to complications when you intend to repay your loan.

Lastly, some people do not consider the potential tax consequences of taking out a policy loan. This decision could impact your policy's coverage in the long term. It is advisable to consult with a tax advisor before making your request. Being informed can help you avoid unexpected problems in the future.

Documents used along the form

When submitting a Policy Loan Request form, there are several other documents and forms that may also be needed to streamline the process. Here are five important ones that you might encounter:

- Authorization for Release of Information: This form allows the insurance company to obtain necessary information regarding the policy owner's financial or personal details from third parties. It ensures transparency and allows for accurate processing of the loan request.

- Medallion Signature Guarantee: Required for withdrawals of $500,000 or more, this document verifies that the signatures on the Policy Loan Request form match the ones on file and are legitimate. It must be provided by an authorized financial institution.

- Loan Repayment Agreement: This outline details the terms and conditions related to loan repayment, including interest rates and repayment schedules. It helps the policy owner understand their obligations after taking the loan.

- Policy Change Request Form: If there are recent changes to the policy, such as an address change, this form notifies the insurer of these adjustments. It ensures that all communications reach the correct location and parties involved.

- Power of Attorney (POA): If someone is acting on behalf of the policy owner, a POA document must be provided, authorizing them to make decisions related to the policy. This is critical for ensuring that the request is handled appropriately.

Having these documents completed and ready can greatly enhance the efficiency of processing your Policy Loan Request. It is always advisable to double-check that all necessary paperwork is submitted to avoid delays.

Similar forms

Loan Agreement: Similar to the Policy Loan Request form, a Loan Agreement outlines the terms and conditions under which a borrower may access funds. Both documents clarify payment obligations and consequences of non-payment, helping to manage expectations.

Mortgage Application: Much like the Policy Loan Request, a Mortgage Application requires detailed personal and financial information. Both forms aim to assess the borrower's ability to repay, ensuring proper documentation is in place to secure the loan.

Credit Application: A Credit Application is comparable as it also evaluates an individual's creditworthiness and collects relevant personal data. Both documents facilitate the lending process by gathering essential background information.

Withdrawal Request Form: Similar in function, a Withdrawal Request Form is used to access funds from accounts like retirement plans. Each form outlines the procedure for accessing funds and specifies any limitations or conditions.

Refinance Application: Like the Policy Loan Request, a Refinance Application seeks to adjust the terms of an existing loan. Both documents require a review of the current financial situation and may affect the overall debt commitment.

Payment Authorization Form: This form is similar, as it allows individuals to authorize automatic payments for loans. Both forms deal with the management of loan payments, ensuring proper handling of the borrower’s accounts.

Insurance Claim Form: Just as the Policy Loan Request deals with using a policy for financial assistance, an Insurance Claim Form seeks to access benefits under an insurance policy. Both processes ensure that policyholders understand their rights and obligations.

Power of Attorney Document: Much like the Policy Loan Request, having a Power of Attorney allows someone to act on behalf of another. Both forms require signatures and can significantly affect decisions regarding financial matters.

Account Change Request: An Account Change Request can be seen as similar, focusing on updating personal information with a financial institution. Both forms emphasize the importance of keeping records current and accurate to protect financial interests.

Release of Information Form: This form is comparable in that it grants permission for institutions to share personal information. Both documents ensure that the individual maintains control over who can access their sensitive data.

Dos and Don'ts

When filling out the Policy Loan Request form, it is important to follow certain guidelines to ensure a smooth process. Here are eight essential do's and don'ts:

- Do provide accurate and complete information in all fields.

- Do ensure your signature matches the name on the policy.

- Do verify if the correct disbursement method is selected.

- Do consult a tax advisor before requesting a loan.

- Don't leave any required sections blank; this may delay processing.

- Don't request a loan amount exceeding 90% of the cash value minus charges.

- Don't ignore the necessary signatures needed for joint policies.

- Don't assume that payments will automatically apply to loan repayment unless indicated.

Following these guidelines can help prevent issues and ensure a timely response to your loan request.

Misconceptions

- Policy loans are free money. Many believe that taking out a policy loan means accessing funds without any repercussions. However, loans accrue interest and must be repaid; otherwise, they can reduce the death benefit and surrender value of the policy.

- All loan requests are processed instantly. Another common misconception is that once the request is made, funds will be received immediately. In reality, it often takes up to seven days for the owner to receive the loan amount after the request is properly submitted.

- Policy loans do not affect the overall policy. Some individuals think that borrowing against their policy would have no effect on their coverage. Unfortunately, loans decrease the death benefit and net surrender value proportionally to the outstanding amount.

- You can borrow 100% of your policy’s cash value. Many policyholders assume they can take out any amount up to their cash value. In truth, the maximum loan amount is capped at 90% of the cash value, minus any surrender charges and outstanding loans.

- You cannot repay a loan once it is taken. Some feel that once a loan is secured, they cannot make repayments until the policy is canceled. On the contrary, repayments can be made at any time while the policy remains active.

- Tax consequences of policy loans are negligible. A frequent belief is that loans won't lead to any tax implications. This is misleading, as policy loans may create adverse tax consequences, which can jeopardize the policy’s coverage. Consulting a tax advisor is strongly recommended before proceeding.

- Address changes do not affect loan processing. Many don’t realize that updating an address could delay a loan request. If an address change occurs within ten days of making a loan request, the company might hold payment for an extended period or reject the request entirely.

- A notary is enough for signature verification. Some think that notarizing signatures suffices for the withdrawal process. However, a Medallion Signature Guarantee is necessary for certain withdrawals, particularly amounts exceeding $500,000 or for different payee addresses.

Key takeaways

Here are key takeaways for filling out and using the Policy Loan Request form:

- Policy Information: Clearly write your policy number and the names of the owner and insured on the form.

- Address Changes: If there’s been a change of address within 10 days of the loan request, the company may delay processing.

- Loan Amount: You can borrow up to 90% of the cash value after the first policy year, with a minimum loan amount of $500.

- Loan Setting: The requested loan amount will be deducted from your subaccounts and placed in the Loan Reserve as collateral.

- Processing Time: Typically, loan amounts are sent to the owner within seven days after a proper request is received.

- Loan Repayment: You can repay the loan at any time, which will increase both your death benefit and net surrender value.

- Tax Considerations: Policy loans can have adverse tax consequences. It's advisable to consult a tax advisor.

- Lapse Risk: If the loan plus interest exceeds the total account value, notice will be sent. If unpaid after 61 days, your policy may lapse.

Browse Other Templates

Dme Form - It is essential for compliance with Texas Department of Aging regulations.

Arizona Health Care - The form includes rights and responsibilities for applicants and recipients.