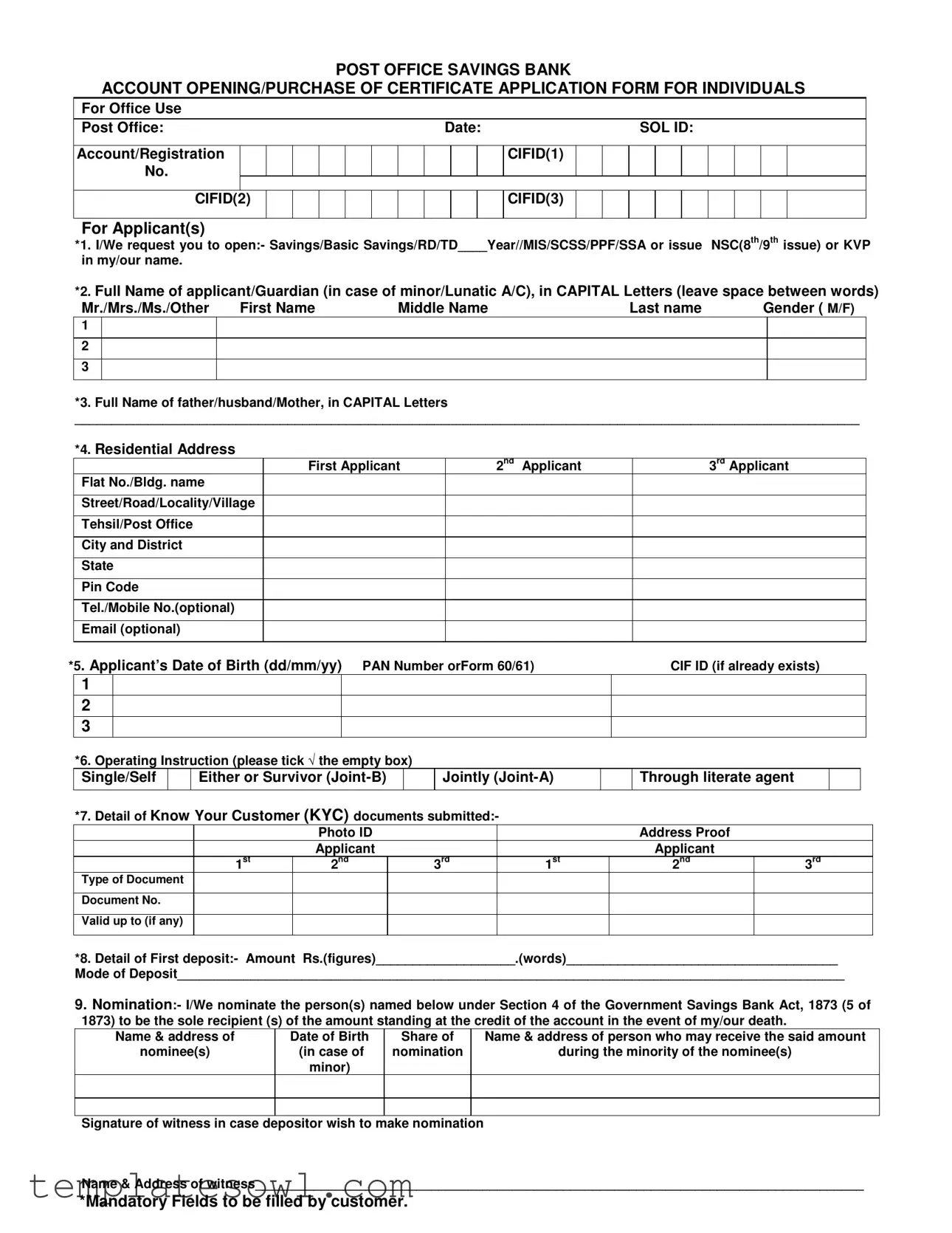

Fill Out Your Post Office Saving Bank Form

The Post Office Saving Bank form is a crucial document for individuals looking to open a savings account or purchase government-backed savings certificates. This form collects essential information from applicants, such as their full names, residential addresses, and contact details, while ensuring compliance with Know Your Customer (KYC) regulations. Applicants can choose different types of accounts, including Basic Savings, Recurring Deposit, or Monthly Income accounts, based on their financial needs. The form also allows for the designation of nominees, helping to simplify the transfer of funds in the unfortunate event of the applicant's death. Moreover, it includes spaces for the details of the first deposit and various operating instructions, which clarify how the account will be managed. Mandatory fields ensure that critical information is not overlooked, while optional fields allow for flexibility in providing additional details, such as Aadhar numbers or contact information for an agent who may handle transactions on the applicant’s behalf. Overall, the form serves as a comprehensive tool for individuals to secure their financial future while adhering to necessary regulations.

Post Office Saving Bank Example

POST OFFICE SAVINGS BANK

ACCOUNT OPENING/PURCHASE OF CERTIFICATE APPLICATION FORM FOR INDIVIDUALS

For Office Use

Post Office: |

|

|

|

|

|

|

Date: |

|

|

|

SOL ID: |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account/Registration |

|

|

|

|

|

|

|

|

|

|

CIFID(1) |

|

|

|

|

|

|

|

|

|

No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

CIFID(2) |

|

|

|

|

|

|

|

|

|

CIFID(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Applicant(s)

*1. I/We request you to open:- Savings/Basic Savings/RD/TD____Year//MIS/SCSS/PPF/SSA or issue NSC(8th/9th issue) or KVP

in my/our name.

*2. Full Name of applicant/Guardian (in case of minor/Lunatic A/C), in CAPITAL Letters (leave space between words)

Mr./Mrs./Ms./Other |

First Name |

Middle Name |

Last name |

Gender ( M/F) |

||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

*3. Full Name of father/husband/Mother, in CAPITAL Letters

___________________________________________________________________________________________________________

*4. Residential Address

|

|

First Applicant |

2nd Applicant |

3rd Applicant |

|

Flat No./Bldg. name |

|

|

|

|

|

|

|

|

|

Street/Road/Locality/Village |

|

|

|

|

|

|

|

|

|

Tehsil/Post Office |

|

|

|

|

|

|

|

|

|

City and District |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

Pin Code |

|

|

|

|

|

|

|

|

|

Tel./Mobile No.(optional) |

|

|

|

|

|

|

|

|

|

Email (optional) |

|

|

|

|

|

|

|

|

*5. Applicant’s Date of Birth (dd/mm/yy) PAN Number orForm 60/61) |

CIF ID (if already exists) |

|||

1

2

3

*6. Operating Instruction (please tick √ the empty box)

Single/Self

Either or Survivor

Jointly

Through literate agent

*7. Detail of Know Your Customer (KYC) documents submitted:-

|

|

Photo ID |

|

|

Address Proof |

|

|

|

Applicant |

|

|

Applicant |

|

|

1st |

2nd |

3rd |

1st |

2nd |

3rd |

Type of Document |

|

|

|

|

|

|

|

|

|

|

|

|

|

Document No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Valid up to (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

*8. Detail of First deposit:- Amount Rs.(figures)___________________.(words)_____________________________________

Mode of Deposit___________________________________________________________________________________________

9.Nomination:- I/We nominate the person(s) named below under Section 4 of the Government Savings Bank Act, 1873 (5 of 1873) to be the sole recipient (s) of the amount standing at the credit of the account in the event of my/our death.

Name & address of |

Date of Birth |

Share of |

Name & address of person who may receive the said amount |

nominee(s) |

(in case of |

nomination |

during the minority of the nominee(s) |

|

minor) |

|

|

|

|

|

|

|

|

|

|

Signature of witness in case depositor wish to make nomination

Name & Address of witness___________________________________________________________________________________

*Mandatory Fields to be filled by customer.

10.AADHAR

11.Please open Minor A/C through Guardian/Lunatic Account through Guardian/Blind/Physically Handicapped/Illiterate through Agent/Pensioner/BPL/SB Basic Savings Account/Sanchayaka Account/Others_________________________________

12.In case of minor/Lunatic Account, please fill Name of Guardian, his Residential Address and Relationship with Minor______________________________________________________________________________________________________

___________________________________________________________________________________________________________

13.In case of other than Minor/Lunatic, please enter Name of Sanchayka/Government Welfare Scheme and PPO/BPL/Registration/Enrollment number:- ___________________________________________________________________

14.Amount of Monthly Installment (In case of RD

15.In case of NSC/KVP:- Please issue (No. of NSC/KVP & Den.)__________________________________________

___________________________________________________________________________________________________________

16.In case services of SAS/PPF/MPKBY Agent are taken:- Name of Agent________________________Authority No._________________________Valid Up to____________________________________.

17.Standing Instructions if

18.I/We authorize Agent (name)_______________________________________________________________ to receive Passbook/Certificates on my/our behalf.

Declarations

I/We hereby declare that I/We have clearly understood POSB General Rules 1981 and Post Office Savings Account Rules 1981/ Post Office Recurring Deposit Rules 1981/ Post Office Time Deposit Rules 1981/ Monthly Income Account Rules 1987/ Senior Citizens Savings Scheme Rules, 2004 and Sukanya Samriddhi Account Rules 2014, PPF Rules 1968, NSC(VIII) and (XI) issue Rules, KVP Rules (amended from time to time) governing the accounts/Certificates under this scheme and to abide by such rules framed by the Central Government as may be applicable to the account from time to time. I hereby declare that I am not maintaining any other Public Provident Fund Account and I will not exceed maximum deposit limit fixed from time to time in self as well as my minor accounts (combining all accounts) where I am a guardian.

DATE:

Signature/Thumb Impression:- |

|

|

1st Applicant |

2nd Applicant |

3rd Applicant |

Space for affixing photo of applicants

All Fields to be entered into system by Counter PA.

******************************************************************************************************************************************************

For Office Use only

Certified that I have verified the documents submitted with this application form and confirm that KYC norms are fully complied with. Following numbers of NSC/KVP issued (in case of NSC/KVP

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

Signature of BPM |

Signature of SPM |

Signature of Postmaster |

Date Stamp |

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This application form facilitates the opening of various types of accounts, such as savings, recurring deposits, and the purchase of certificates at the Post Office Savings Bank. |

| Mandatory Fields | The form contains several fields that must be completed by the applicant, including personal identification details and contact information. These sections are marked with an asterisk (*) to indicate their importance. |

| KYC Compliance | It requires the submission of Know Your Customer (KYC) documents. This ensures that the identity of the applicant is verified, promoting transparency and security within the banking system. |

| Nomination Section | An essential part of the form, the nomination section allows the applicant to designate individuals who will receive the account funds in case of their death. This offers peace of mind regarding the benefits of the account. |

| Governing Laws | The activities related to this form are governed by the Government Savings Bank Act, 1873, and various associated rules and regulations that ensure account management follows legal standards. |

| Signature Requirement | Applicants must provide signatures or thumb impressions to authenticate the application. Additionally, a signature from a witness is required if nominations are made on behalf of minors. |

Guidelines on Utilizing Post Office Saving Bank

Filling out the Post Office Saving Bank form is an essential step to establishing your account or purchasing specific certificates. This process requires attention to detail to ensure accurate submission. Incorrect or incomplete information can lead to delays or complications in opening your account. Follow the steps below to complete the form with clarity.

- Begin by identifying the type of account you wish to open. Check the appropriate box for Savings, Basic Savings, Recurring Deposit (RD), Time Deposit (TD), Monthly Income Scheme (MIS), Senior Citizens Savings Scheme (SCSS), Public Provident Fund (PPF), Sukanya Samriddhi Account (SSA), or a National Savings Certificate (NSC).

- In the section for the applicant's full name, write your full name in capital letters, leaving spaces between words. Select your title: Mr., Mrs., Ms., or Other. Indicate your gender.

- Provide the full name of the father, husband, or mother in capital letters.

- Fill in the residential address. Provide details such as flat number, building name, street, locality, city, district, state, and pin code. Include your telephone or mobile number and email address, if desired.

- Record your date of birth in the specified format (dd/mm/yy). If applicable, include your PAN number or Form 60/61.

- Choose your operating instruction. Tick the applicable box for Single/Self, Either or Survivor (Joint-B), Jointly (Joint-A), or Through a literate agent.

- List the Know Your Customer (KYC) documents you are submitting. Note the type of documentation and its validity period, if applicable.

- Indicate the detail of your first deposit. Write the amount in both figures and words. Specify the mode of deposit.

- For nominations, provide the name and address of the nominee(s) along with their date of birth and the share of the amount. If applicable, include a witness's signature.

- If you have an AADHAR number, please enter it in the designated field.

- Indicate if you require a minor account, and provide the guardian's name, residential address, and relationship to the minor.

- Complete information regarding any welfare scheme enrollment number if applicable.

- For a Recurring Deposit (RD) account, mention the amount of the monthly installment in both figures and words.

- Detail any requests for the issuance of NSC or KVP, stating the quantity and denomination.

- If using an agent's services, provide the agent's name and authority number.

- State any standing instructions if desired.

- Authorize your agent to receive passbooks or certificates on your behalf if applicable.

- Confirm that you understand and agree to abide by the relevant rules regarding your account. Sign where indicated.

- Affix your photograph in the designated area on the form.

What You Should Know About This Form

What is the purpose of the Post Office Savings Bank form?

The Post Office Savings Bank form is used to open various types of savings accounts or to purchase certificates, such as National Savings Certificates (NSC) and Kisan Vikas Patra (KVP). This form is essential for individuals looking to secure their savings in a government-backed scheme offered by the postal department. The applicant can choose from options like Savings, Recurring Deposit (RD), Time Deposit (TD), Monthly Income Scheme (MIS), Senior Citizens Savings Scheme (SCSS), Public Provident Fund (PPF), and Sukanya Samriddhi Account (SSA).

What information do I need to provide in the application?

Applicants must provide a variety of personal details. This includes the full name, gender, and residential address. The form also requires the applicant’s date of birth, PAN number, contact information, and the amount of the initial deposit. It is important to complete all mandatory fields correctly to ensure a smooth processing of the application.

Are there any specific documents required for submission?

Yes, applicants need to submit Know Your Customer (KYC) documents. These may include a photo ID and proof of address. Depending on the applicant's status, such as minor or lunatic, additional documents may be required. All submitted documents must be valid and in accordance with KYC norms to comply with regulatory requirements.

Can I nominate someone for my account?

Yes, the form allows you to nominate one or more individuals who will receive the account balance in the event of your death. You must provide the nominee's name, address, and date of birth. It is crucial to include this information to ensure a clear succession process and to avoid disputes later on.

What should I do if I want to open an account for a minor?

For minor accounts, a guardian needs to fill out the application. The form will require the guardian's details, including their relation to the minor. The guardian will also be responsible for operating the account until the minor reaches the designated age. It's important to provide accurate information to facilitate the account opening process.

What happens after I submit the application?

Once submitted, the application will be processed by the Post Office staff. They will verify the documents and information provided. If everything is in order, a confirmation will be issued, and the account or certificates will be opened. Applicants will receive a passbook or certificate as proof of account initiation, while further communication may happen through the registered contact details.

Common mistakes

When filling out the Post Office Saving Bank form, many individuals encounter common pitfalls that can lead to delays in processing or even rejection of their application. One important mistake is omitting mandatory fields. Each field marked with an asterisk (*) must be filled out completely. Failing to do so could result in the form being returned for correction, wasting time and effort.

Another frequent error involves incorrect name formatting. The instructions clearly state that names should be written in capital letters with spaces between words. Applicants sometimes overlook this detail, leading to names being rejected due to improper formatting. This could necessitate further verification, thus extending the application process.

Many applicants also make mistakes in their addresses. Ensuring that the full residential address is entered accurately is crucial. Missing information, or providing an incomplete address, can complicate communication and hinder the ability to contact the applicant if needed.

Providing the wrong date of birth is another prevalent mistake. It’s essential to double-check that the format used is consistent with the one requested (dd/mm/yy). Inaccurate dates may raise red flags during the verification process, resulting in additional scrutiny.

The selection of the operating instructions can also be problematic. Applicants often fail to tick the appropriate box, leading to confusion about how the account will be operated. Clear instructions regarding whether the account is a single operating account or involves joint ownership are vital to ensure the account functions as intended.

Another area where mistakes can occur is in document submissions. Many applicants do not provide the necessary Know Your Customer (KYC) documents. Completing this section accurately—specifying the type of documents and their validity dates—is essential for compliance with legal requirements. Lack of proper documentation can result in immediate rejection.

The detail surrounding the first deposit can also present challenges. Applicants might either forget to include this information or might miscalculate the amount. Clear figures and corresponding words must match to avoid confusion and ensure the correct deposit is made.

While filling out the nomination section, some people neglect to provide the required information about their preferred nominee. Failing to indicate the correct name and relationship can delay access to funds in case of unforeseen circumstances. Clear communication in this area is crucial for effective management of the account.

Error in PAN number entry is common as well. The form requires a PAN number, and any discrepancies in this number could lead to complications down the line. It's advised to cross-verify the PAN details against official documents before final submission.

Lastly, neglecting to read the declaration and familiarize oneself with the rules associated with the various accounts can be detrimental. Applicants may inadvertently agree to conditions without fully understanding them, which could lead to future issues. Reading all relevant information thoroughly ensures a smooth and compliant application process.

Documents used along the form

The Post Office Savings Bank form is just one step in the process of opening or managing a savings account. Alongside this form, several other documents and forms may be required to ensure all necessary information is properly captured and verified. Below is a list of commonly used forms and documents that often accompany the Post Office Savings Bank application.

- Proof of Identity: A document verifying the applicant's identity, such as a driver’s license, passport, or state-issued ID. This is essential for compliance with KYC regulations.

- Proof of Address: Documents that confirm the applicant's residential address. Common examples include utility bills, lease agreements, or bank statements.

- PAN Card: The Permanent Account Number card serves as a key identity document for tax purposes in India. It may be required for large transactions.

- Aadhaar Card: This card provides a unique identification number issued by the Indian government, often used for KYC procedures.

- Minor Account Guardian Declaration: A form completed by guardians when opening an account for a minor, detailing their relationship to the child.

- Nomination Form: Used to specify one or more beneficiaries who will receive the account balance in the event of the account holder's death.

- Joint Account Agreement: A document defining the terms of operation and ownership between multiple account holders in a joint account setup.

- Withdrawal Application Form: A written request to withdraw funds from the savings account, often required for large withdrawals.

- Fixed Deposit Application Form: If also opening a fixed deposit account, this form outlines the deposit terms and amount.

- Circular or Guidelines from the Post Office: Official communications detailing policies or changes that may affect account holders. These may need to be read and acknowledged.

It’s important to ensure that all relevant documents are accurately filled out and submitted to avoid delays in processing. Familiarizing yourself with these forms can streamline your banking experience and help maintain compliance with necessary regulations.

Similar forms

-

Bank Account Opening Form: Similar to the Post Office Saving Bank form, a bank account opening form collects personal information like the applicant's name and address, along with required identification and KYC documents. Both forms also include details about the type of account being opened.

-

Investment Application Form: This document is used for various investment products and shares similarities with the Post Office Saving Bank form in that it requires personal details, investment choices, and sometimes nomination details for beneficiaries.

-

Certificate Application Form: Often used for applying for government bonds or savings certificates, this form requires similar information about the applicant, the investment amount, and nomination provisions, much like the Post Office Saving Bank form.

-

Loan Application Form: This form also gathers essential applicant information, including contact details and identification numbers. Moreover, both forms might require the disclosure of financial status and the purpose of the application.

-

Mutual Fund Investment Form: Like the Post Office Saving Bank form, this document requests personal identification, investment preferences, and KYC documentation to ensure compliance with financial regulations.

Dos and Don'ts

When filling out the Post Office Savings Bank form, following certain guidelines can make the process smoother. Here’s a handy list of dos and don’ts to keep in mind:

- Do ensure all mandatory fields are filled accurately.

- Do write names in capital letters, leaving spaces between words.

- Do provide all required identification and KYC documents.

- Do double-check the amounts written in both figures and words.

- Do sign where indicated and ensure your signature matches the ID submitted.

- Don't leave any mandatory field blank.

- Don't use abbreviations or nicknames for your name.

- Don't overwrite or use correction fluid on the form.

- Don't forget to include your date of birth in the correct format.

- Don't submit incomplete documents or invalid ID.

Misconceptions

When it comes to the Post Office Saving Bank form, several misconceptions can lead to confusion for applicants. Understanding these misconceptions is crucial for a smoother application process. Here’s a look at some of these common misunderstandings:

- All applicants must have a PAN number. This is not entirely accurate. While a PAN number is often required, individuals who do not have one can submit Form 60 or Form 61 as alternatives.

- Opening a joint account is complicated. Many believe that the process of opening a joint account is intricate. However, the form clearly allows for options, and instructions are straightforward, making it relatively simple.

- KYC documents are unnecessary. This is misleading. Know Your Customer (KYC) documentation is a mandatory requirement to comply with regulations and ensures security for all account holders.

- Nominations are optional. While it is true that nominations can be made later, completing this section at the time of application provides peace of mind in case of unforeseen circumstances.

- There are hidden fees associated with accounts. Many believe there are secret charges. In reality, the Post Office is transparent about its fees, and all charges are outlined in the relevant rules and regulations.

- Only Indian citizens can open an account. This is a common misconception. While most accounts are designed for Indian citizens, foreign nationals may also be eligible, depending on specific regulations.

- The application form is too lengthy to complete. Though the form contains many fields, not all sections may apply to every applicant. Take your time to fill out only the necessary parts based on your situation.

- You cannot close or transfer accounts easily. Some think account closure is a lengthy process. In fact, closing or transferring accounts is relatively straightforward, provided all requirements are met.

Addressing these misconceptions can pave the way for a better understanding of the Post Office Saving Bank form and its requirements. With accurate information, applicants can navigate the process with confidence and clarity.

Key takeaways

Filling out and using the Post Office Savings Bank form requires attention to detail. Here are key takeaways to ensure a smooth process:

- Complete required fields: Make sure to fill in all mandatory fields, such as names, addresses, and account types. Incomplete information can delay processing.

- Select correct account type: Clearly indicate whether you want to open a Savings, Recurring Deposit, or another type of account. Confusion can lead to errors.

- Provide accurate KYC documents: Submit necessary Know Your Customer documents. These may include a photo ID and proof of address; ensure they are valid and not expired.

- Choose your operating instructions carefully: Decide whether the account will be single, joint, or managed by an agent. This impacts account access and decisions.

- Nomination is crucial: Consider nominating someone to receive the funds in case of death. This assists in the smooth transfer of account ownership.

- Review before submission: Before handing in the form, double-check for accuracy. A final review helps minimize mistakes and speeds up processing time.

Following these guidelines will enhance your experience with the Post Office Savings Bank and ensure compliance with requirements.

Browse Other Templates

Academy of Art University Transcript - A section is provided for students to indicate any maiden or former names.

How to Add Availability in Resume - Please ensure all information is accurate and up to date.

Milburn Printing - The form indicates whether the shipper waives the right to a re-weigh.