Fill Out Your Prequalification Mortgage Paper Form

When navigating the path to homeownership, understanding the Prequalification Mortgage Paper form is essential. This vital document, provided by the Virginia Housing Development Authority (VHDA), helps assess your eligibility for a mortgage loan before you formally apply. The form requires you to provide personal data, including your name, social security number, and contact information, along with comprehensive employment history for you and any co-borrower. You will need to submit copies of your recent pay stubs, W-2 forms from the past two years, and any signed commitment from your financial provider. It's crucial to clearly indicate all sources of household income, which may include alimony or child support, and disclose any outstanding debts or financial obligations. Additionally, the form prompts you to describe your current living situation and present housing status. By collecting this data, the VHDA can offer guidance tailored to your financial profile. Remember, completing this form is an initial step; it does not constitute a formal loan application. Take time to fill it out completely with accurate information, as this will facilitate a smoother process moving forward.

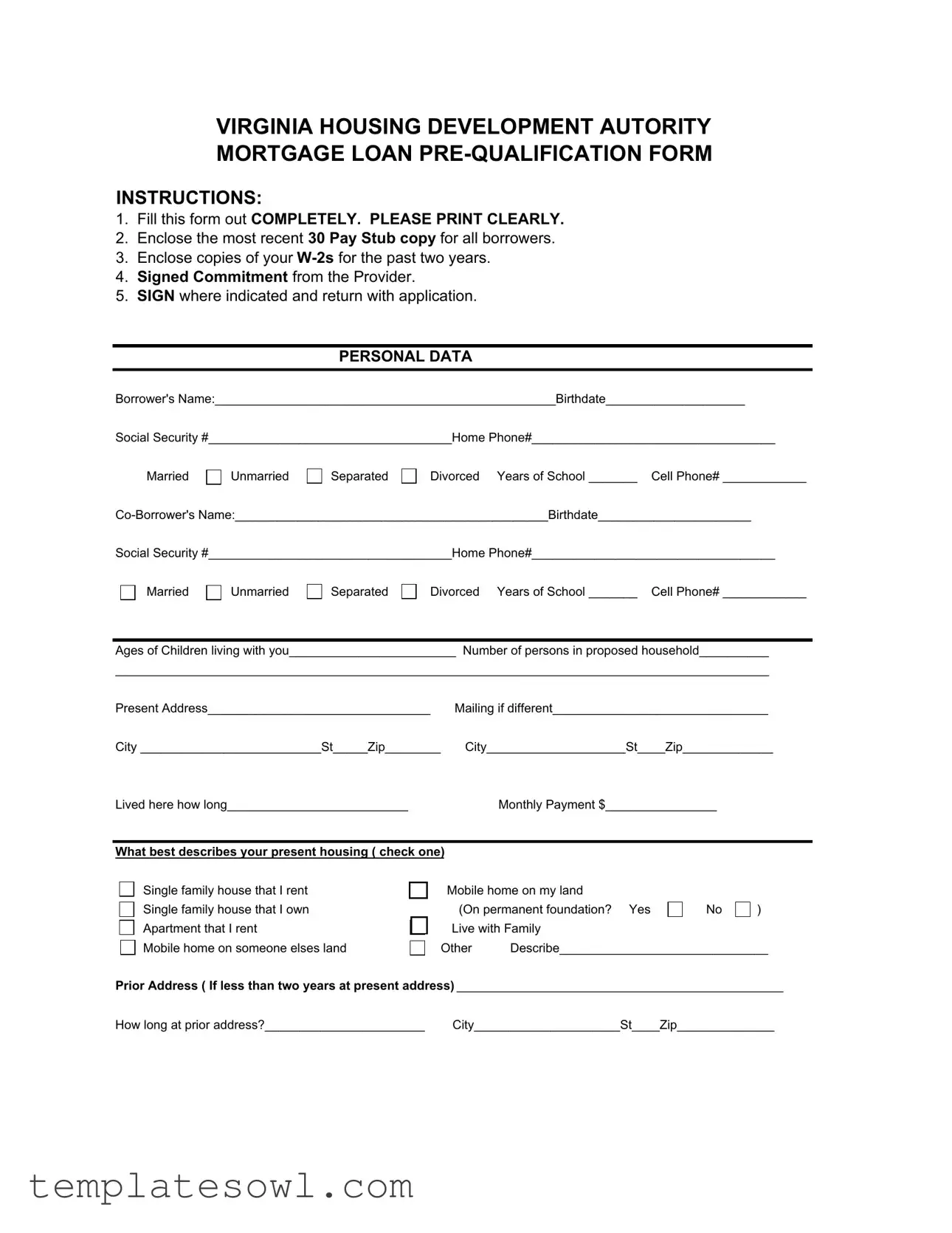

Prequalification Mortgage Paper Example

VIRGINIA HOUSING DEVELOPMENT AUTORITY

MORTGAGE LOAN

INSTRUCTIONS:

1.Fill this form out COMPLETELY. PLEASE PRINT CLEARLY.

2.Enclose the most recent 30 Pay Stub copy for all borrowers.

3.Enclose copies of your

4.Signed Commitment from the Provider.

5.SIGN where indicated and return with application.

PERSONAL DATA

Borrower's Name:_________________________________________________Birthdate____________________

Social Security #___________________________________Home Phone#___________________________________

Married |

Unmarried |

Separated |

Divorced |

Years of School _______ |

Cell Phone# ____________ |

Social Security #___________________________________Home Phone#___________________________________ |

|||||

Married |

Unmarried |

Separated |

Divorced |

Years of School _______ |

Cell Phone# ____________ |

Ages of Children living with you________________________ Number of persons in proposed household__________

______________________________________________________________________________________________

Present Address________________________________ |

Mailing if different_______________________________ |

City __________________________St_____Zip________ |

City____________________St____Zip_____________ |

Lived here how long__________________________ |

Monthly Payment $________________ |

What best describes your present housing ( check one)

Single family house that I rent Single family house that I own Apartment that I rent

Mobile home on someone elses land

Mobile home on my land |

|

|

|

(On permanent foundation? Yes |

No |

) |

|

Live with Family |

|

|

|

Other |

Describe______________________________ |

||

Prior Address ( If less than two years at present address) _______________________________________________

How long at prior address?_______________________ |

City_____________________St____Zip______________ |

Employment Borrower

Employer________________________________________________Position_________________________________

Address________________________________________________Phone___________________________________

City______________________________________St_________Zip_______________________

How long employed here________Hourly Rate__________Hours Per Week_______ or Salary____________________

Previous employment (if on current job less than 2 years).

Employer________________________________________________Position_________________________________

Address________________________________________________Phone___________________________________

City______________________________________St_________Zip_______________________

How long employed here________Hourly Rate__________Hours Per Week________or Salary___________________

Employment

Employer________________________________________________Position_________________________________

Address________________________________________________Phone__________________________________

City_______________________________________St________Zip________________________

How long employed here_______Hourly Rate__________Hours Per Week________or Salary____________________

Previous employment for

Employer_______________________________________________Position_________________________________

Address_______________________________________________Phone___________________________________

City______________________________________St__________Zip______________________

How long employed here________Hourly Rate_________Hours Per Week_________or Salary___________________

LIST ALL OTHER HOUSEHOLD INCOME (Alimony, child support, disability and etc.)

Please list who receives the income and the source.

Name |

|

Source |

|

Monthly Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower |

||||||

Yes or No |

Yes or No |

|||||

Are either of you U.S. Veterans or Reservists? |

|

|

|

|

|

|

Are there any outstanding judgments or collections against you? |

|

|

|

|

|

|

|

|

|

|

|

||

Have you been declared Bankrupt within the past 7 years? |

|

|

|

|

|

|

|

|

|

|

|

||

If yes, date of discharge:______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you had property foreclosed upon or repossessed? |

|

|

|

|

|

|

Have you owned a home during the last three years? |

|

|

|

|

|

|

Do you operate a business from your home? |

|

|

|

|

|

|

Do you have to pay Alimony, Child Support or Separate Maintenance? |

|

|

|

|

|

|

If yes, amount paid per month $________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

Name of Bank or Credit Union |

Current Balance |

|

401(K) Value |

|

$ |

|

|

|

|

|||||

__________________________________ |

$___________ |

|

|

IRA Value |

|

$ |

|

|

|

|

||||

__________________________________ |

$___________ |

|

Value of Stocks and Bonds |

$ |

|

|

|

|||||||

__________________________________ |

$___________ |

|

|

|

|

|

|

|

|

|

|

|

||

Auto: Make____________ Year______ Value $ |

Make |

|

|

|

Year______ Value $________ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Debt Payments

Note: Include payroll deducted loans and student loans, even if the payment is deferred.

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Paid to:_______________________________________Monthly Payment $_____________Balance $______________

Note: Completion of this form does not constitute a loan application. This is a preliminary screening to assist us in deter- mining your eligibility under VHDA's program guidelines. Credit and property eligibility will be determined only after a full loan application has been processed on your behalf.

BORROWER SIGNATURE AUTHORIZATION

Part 1 - General Information

Borrower |

|

Lender Name and Address |

|

|

VHDA |

|

601 S. Belvidere Street |

|

|

|

Richmond, VA 23220 |

Part II - Borrower Authorization

I hereby authorize the Lender to verify my past and present employment earning records, bank acounts, stock holdings and any other asset balances that are needed to process my mortagage loan application. I further authorize the Lender to order a consumer credit report and verify other credit information, including past and present mortgage and landlord references. It is understood that a copy of this form will also serve as authorization.

The information the Lender obtains is only to be used in the processing of my application for a mortgage loan.

Borrower Signature___________________________________________________Date _____________________

Notice to Borrowers: This is notice to you as required by the Right to Financial Privacy Act of 1978 that HUD/FHA has a right of access to financial records held by financial institutions in connection with the consideration or administration of assistance to you. Financial records involving your transaction will be available to HUD/FHA without further notice or authorization but will not be disclosed or released by this institution to another Government Agency or Department without your consent except as required or permitted by law.

**********************************************************************************************************************************************

CONSENT FOR DISCLOSURE OF PERSONAL INFORMATION

I/We hereby consent to the disclosure by the Virginia Housing Development Authority (VHDA), acting on its own be- half and any of its employees, contractors, agents and representatives to ___________________________________

_________________________________________ of all personal information, including information which may be

covered or protected by federal or state law, about me/us which they may now or hereafter have relating to my application for a loan for the financing of the residence located at__________________________________________

_______________________________________. This consent is given voluntarily and for my/our benefit.

I/We understand that VHDA is not obligated by this consent to make any disclosure of such personal information and shall not be liable for the completeness or correctness of any personal information so disclosed.

This consent:

Does include medical records and information. Does not include medical records and information.

I/We agree that this consent shall remain in effect until the receipt by VHDA of written notice from me/us that this consent has been revoked. A

and effect as the original. This consent is executed this _______________day of _______________________, 20_____.

_________________________________________ |

_____________________________________________ |

Borrower signature |

Form Characteristics

| Fact Title | Description |

|---|---|

| Governing Authority | This form is governed under the regulations of the Virginia Housing Development Authority (VHDA). |

| Purpose | The Prequalification Mortgage Paper form is designed to help assess eligibility for a mortgage loan prior to submitting a complete application. |

| Required Documentation | Applicants must submit several documents, including the most recent 30 pay stubs, two years of W-2s, and a signed commitment from the mortgage provider. |

| Personal Information Required | Applicants need to provide detailed personal information such as social security numbers, employer details, and household income sources. |

| Signatures Needed | Both borrower and co-borrower must sign the form to authorize the lender to verify personal and financial information. |

| Disclaimer | Completion of this form does not guarantee loan approval; it's a preliminary screening for eligibility under VHDA guidelines. |

Guidelines on Utilizing Prequalification Mortgage Paper

Completing the Prequalification Mortgage Paper form is essential to initiate the process for evaluating your mortgage options. Follow these steps carefully to ensure you provide all necessary information accurately. Once the form is completed, you'll need to submit it alongside required documents to proceed.

- Print your personal data clearly in the provided sections for both the borrower and co-borrower.

- Fill out all relevant sections, including employment information for both parties.

- List household income, including any alimony or child support, and specify who receives that income.

- Indicate any additional financial obligations like monthly debt payments.

- Complete the asset section, detailing balances for banks, IRAs, stock values, and vehicle information.

- Answer any questions regarding past financial events such as bankruptcy or foreclosure.

- Sign where indicated to authorize the lender to verify your information.

- Attach the required documents: recent 30 pay stubs, W-2 copies for the last two years, and a signed commitment from the provider.

- Review the form for completeness and clarity before submitting.

What You Should Know About This Form

What is the purpose of the Prequalification Mortgage Paper form?

The Prequalification Mortgage Paper form is designed to help potential homebuyers gauge their eligibility for a mortgage loan. By completing this form, individuals provide essential financial information, which assists lenders in assessing whether they meet the basic requirements for receiving a mortgage under the guidelines of the Virginia Housing Development Authority (VHDA). It is important to note that filling out this form does not constitute a formal loan application but serves as a preliminary screening tool.

What documents do I need to submit with the form?

To complete the mortgage prequalification process, you will need to gather several key documents. Firstly, a copy of your most recent 30 pay stubs is required for all borrowers involved. Additionally, you should include copies of your W-2 forms from the past two years. It is also necessary to attach a signed commitment from your lender. Finally, ensure that you sign the form where indicated before returning it along with your application.

How is my financial information used after I submit the form?

Upon submission of your Prequalification Mortgage Paper form, the lender will utilize your financial information to evaluate your mortgage eligibility. This includes verifying your employment, income, and asset information. The lender may also obtain a consumer credit report to assess your creditworthiness. Rest assured that the information you provide is kept confidential and is strictly used for processing your mortgage loan application.

Can I still apply for a mortgage if I have a bankruptcy or foreclosure in my history?

Yes, you can apply for a mortgage even if you have a bankruptcy or foreclosure in your past. However, it will be essential to disclose this information on the form. Lenders will consider various factors, including the age of the bankruptcy or foreclosure and your current financial situation. Each application is evaluated on a case-by-case basis, and some programs may have specific waiting periods after such events.

What happens after I submit the Prequalification Mortgage Paper form?

After you submit the form and the necessary documents, the lender will review your information to determine your eligibility for a mortgage loan. You may receive feedback or request for additional information during this phase. If you qualify, the lender will guide you on the next steps for moving forward with a formal loan application and processing your request for financing your new home.

Common mistakes

Completing the Prequalification Mortgage Paper form requires attention to detail, yet many individuals overlook critical components. One common mistake is failing to fill out the form completely. Each section must be addressed to provide a comprehensive overview of your financial situation. Omitting required information can lead to delays or even disqualification.

Another frequent error is not providing accurate personal details. Ensure that all names, birth dates, and Social Security numbers are entered correctly. Incorrect information can confuse lenders and complicate the approval process.

Inadequate documentation is also a major issue. Applicants often neglect to enclose all required documents, such as recent pay stubs and W-2 forms. Submitting your application without these documents will certainly slow down the process.

Many people also fail to sign where indicated. The signature is essential to validate your application. Overlooking this step can leave your application incomplete and void.

When addressing previous employment, some applicants provide insufficient details about their job history. It’s vital to include all relevant employment information, especially if you've changed jobs within the last two years. Missing job records can raise red flags during the verification process.

Another common pitfall is misreporting monthly income or expenses. Providing inaccurate information can lead to a miscalculation of your financial eligibility. Be sure to double-check figures before submission.

Many applicants are also unaware of the need to disclose certain financial obligations, such as child support or alimony. Failing to list all sources of income and debt can result in discrepancies. Full transparency is crucial for a successful application.

Lastly, applicants frequently misinterpret what is required under the consent to disclose personal information. Ensure that you understand what rights you are granting. Misunderstanding this section can lead to complications down the line regarding your financial records.

Documents used along the form

The Prequalification Mortgage Paper form is an essential first step for those looking to secure a mortgage. It helps lenders assess the eligibility of potential borrowers based on their financial information. Additionally, there are several other forms and documents that commonly accompany this application, each serving a specific purpose in the process.

- Pay Stubs: Recent copies of pay stubs are required to provide proof of income. Typically, the last 30 days of pay stubs are requested from all borrowers. This document helps lenders verify current earnings and employment status.

- W-2 Forms: Copies of W-2s for the past two years are crucial as they detail the annual income earned by the borrower and co-borrower. This information allows lenders to assess overall financial stability and income consistency.

- Signed Commitment Letter: A signed commitment from the provider indicates that the lender agrees to proceed with the application based on preliminary information. This document signals the lender’s intent to move forward with the mortgage process.

- Credit Authorization Form: This form grants permission for the lender to check the credit history of the borrower(s). It ensures that the lender has the necessary information to evaluate creditworthiness and manage risk effectively.

Understanding these additional forms and documents can make the mortgage prequalification process smoother. Being prepared with all necessary information can help streamline communication with the lender and avoid potential delays in securing financing for your new home.

Similar forms

- Loan Application Form: Similar to the Prequalification Mortgage Paper, this form collects detailed information about the borrower's financial situation and intentions for securing a loan.

- Income Verification Form: Like the Prequalification form, this document is used to confirm the borrower's income through pay stubs and tax documents.

- Credit Authorization Form: This form, similar to the authorization part of the Prequalification form, allows lenders to access a borrower's credit report.

- Property Listing Agreement: This document outlines details of the property involved, much like the Prequalification's section on present and prior addresses.

- Debt-to-Income Ratio Worksheet: This worksheet evaluates a borrower's financial stability, just as the Prequalification form includes sections about monthly debts and payments.

- Property Disclosure Statement: Similar to the Prequalification form which requires details about property ownership, this document informs buyers of a property's condition and any issues.

- Employment Verification Letter: This letter confirms a borrower's employment status, akin to the employment sections in the Prequalification form.

- Financial Statement: This statement provides an overview of a borrower's financial health, paralleling the Prequalification's sections on assets and liabilities.

- Consent to Release Information Form: Like the consent section in the Prequalification form, this document permits lenders to share the borrower’s personal information with relevant parties.

- Mortgage Broker Agreement: This agreement outlines the terms of engagement with a broker, similar to how the Prequalification form sets expectations for the loan process.

Dos and Don'ts

When filling out the Prequalification Mortgage Paper form, there are certain actions that will help ensure a smooth and efficient process. Here are ten things to keep in mind.

- Do: Fill out the form completely.

- Do: Print clearly to avoid any confusion.

- Do: Include the most recent 30 pay stubs for all borrowers.

- Do: Include copies of your W-2s for the past two years.

- Do: Provide a signed commitment from the provider.

- Do: Sign where indicated before returning with your application.

- Do: Double-check that the social security numbers are accurate.

- Do: List all sources of household income, including child support or alimony.

- Do: Provide information about any outstanding judgments, collections, or bankruptcies.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank; incomplete forms may delay processing.

- Don't: Use abbreviations or unclear handwriting, as this adds confusion.

- Don't: Forget to list all monthly debt payments; this is crucial for financial assessment.

- Don't: Provide outdated financial information; keep it current and relevant.

- Don't: Sign the form without reviewing all provided information for accuracy.

- Don't: Assume prior homeownership history is unimportant; include it as needed.

- Don't: Provide false or misleading information, as this can result in disqualification.

- Don't: Submit without confirming that all required documentation is enclosed.

- Don't: Ignore deadlines associated with the submission of the mortgage application.

- Don't: Hesitate to ask for clarification if any part of the form is confusing.

Misconceptions

Understanding the Prequalification Mortgage Paper form is essential for anyone looking to secure a mortgage. Unfortunately, there are several misconceptions surrounding this form that can lead to confusion. Here are four common misunderstandings explained:

- Filling out the form guarantees loan approval. Many people believe that completing the prequalification form means they will definitely receive a mortgage. In reality, the form is merely a preliminary step. It helps lenders gauge initial eligibility but does not guarantee that a loan will be approved.

- Only income information is required. Some individuals think that listing income is all that's needed on the form. However, lenders also evaluate other factors such as debts, assets, and credit history. This broader picture helps them accurately assess financial health.

- Employers are not contacted during the prequalification process. A common misconception is that employment verification does not occur until after a loan is formally applied for. In fact, the prequalification process typically includes verifying current employment to ensure that income levels can sustain future mortgage payments.

- The form is the same as a loan application. Many confuse the prequalification form with a full loan application. Though they are related, they are different documents. The prequalification form is used for initial assessment, while a full loan application is more detailed and is required for the final approval process.

Being aware of these misconceptions can lead to a smoother experience in the mortgage application process. It is always beneficial to seek clarity when dealing with financial documents and processes.

Key takeaways

1. Complete the Form Thoroughly: Fill out the Prequalification Mortgage Paper form completely and clearly. Incomplete forms may lead to delays or denial of prequalification.

2. Attach Necessary Documentation: To process your application, include the last 30 pay stubs for all borrowers, copies of W-2s for the past two years, and a signed commitment from the provider.

3. Provide Accurate Personal Information: Ensure all personal details, including names, birthdates, social security numbers, and contact information, are accurate to avoid any confusion during the review process.

4. Review Housing History: Be prepared to disclose your current and any prior addresses, along with how long you have lived at each location. This information helps assess your housing stability.

5. Disclose All Income: List all sources of household income, including alimony or child support, whether the income is for you or your co-borrower. Transparency is crucial for evaluating your financial situation.

6. Understand Limitations: Remember, completing this form is not a loan application. It is merely a preliminary assessment to establish your eligibility under Virginia Housing Development Authority (VHDA) guidelines.

Browse Other Templates

Computershare Investor Center - The Computershare Transfer Request form facilitates the transfer of securities between accounts.

California Temporary Seller's Permit - Contacting the Customer Service Center can provide assistance in filling out the BOE 410 D.

Marriott Explore Program - Taking advantage of available resources can streamline the process of finding the best discount card.