Fill Out Your Print Out Applications Form

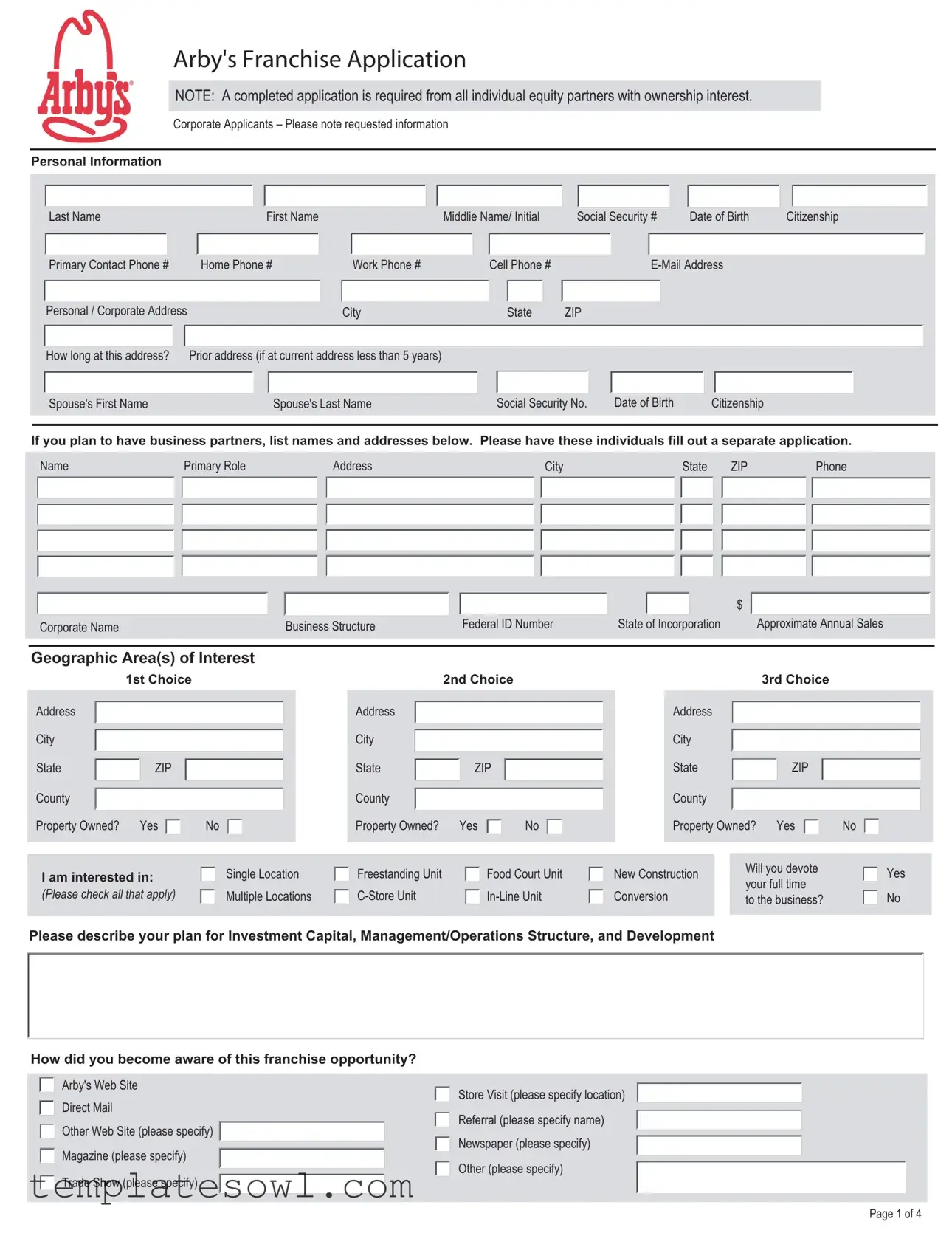

The Arby’s Franchise Application form is a pivotal document for individuals or corporations looking to establish a franchise business. It requires comprehensive information from every equity partner who holds ownership interest, ensuring that all significant stakeholders are thoroughly vetted. Included in the application are sections that capture personal details, such as names, contact information, and citizenship, which provide insights into the applicant's background. Corporate applicants must present additional data regarding their business structure, annual sales, and financial standing, including verified liquid assets of at least $500,000 along with a net worth of $1 million. The form also delves into professional history, requiring a list of previous occupations, educational qualifications, and any prior experience in the franchise or restaurant industry. Additionally, it seeks to uncover any possible impediments to franchise approval, such as financial or legal issues. For transparency and trust, applicants must consent to a background check, allowing Arby’s representatives to evaluate their creditworthiness and overall character. Finally, the submission process is clearly outlined, guiding applicants on how to properly complete and submit the application to ensure timely consideration.

Print Out Applications Example

Arby's Franchise Application

NOTE: A completed application is required from all individual equity partners with ownership interest.

Corporate Applicants – Please note requested information

Personal Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

First Name |

Middlie Name/ Initial |

Social Security # |

Date of Birth |

Citizenship |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Contact Phone # |

|

Home Phone # |

|

|

|

Work Phone # |

|

|

Cell Phone # |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal / Corporate Address |

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How long at this address? |

Prior address (if at current address less than 5 years) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's First Name |

|

|

|

|

Spouse's Last Name |

|

|

|

Social Security No. |

Date of Birth |

|

Citizenship |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you plan to have business partners, list names and addresses below. Please have these individuals fill out a separate application.

Name |

|

Primary Role |

|

Address |

|

City |

State |

|

ZIP |

Phone |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Corporate Name |

|

Business Structure |

|

Federal ID Number |

State of Incorporation |

|

Approximate Annual Sales |

||

Geographic Area(s) of Interest

1st Choice |

2nd Choice |

3rd Choice |

Address

City

State

County

ZIP

Address

City

State

County

ZIP

Address

City

State

County

ZIP

Property Owned? |

Yes |

No |

Property Owned? |

Yes |

No |

Property Owned? |

Yes |

No |

I am interested in:

(Please check all that apply)

Single Location

Multiple Locations

Freestanding Unit

Food Court Unit

New Construction |

Will you devote |

|

your full time |

||

Conversion |

||

to the business? |

||

|

Yes

No

Please describe your plan for Investment Capital, Management/Operations Structure, and Development

How did you become aware of this franchise opportunity?

Arby's Web Site

Direct Mail

Other Web Site (please specify)

Magazine (please specify)

Trade Show (please specify)

Store Visit (please specify location)

Referral (please specify name)

Newspaper (please specify)

Other (please specify)

Page 1 of 4

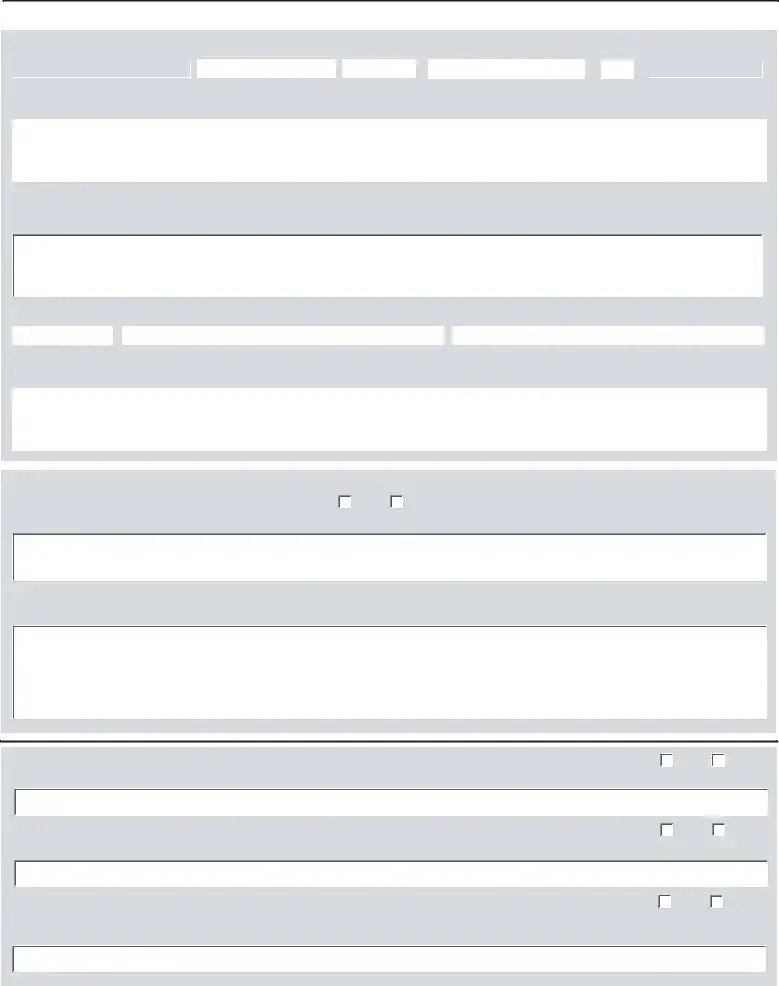

Professional Background (please attach resume if available)

Current Occupation

|

|

|

|

|

|

|

|

|

|

|

|

Company |

|

Position |

|

Start Date |

|

City |

State |

|

Current Salary |

||

Describe duties, number of employees supervised, and responsibilities: |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Previous Business Experience (list most recent first)

List company, describe duties and responsibilities and dates employed:

Education |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Year of School Completed |

Name of College/Postgraduate School(s) |

|

Degree(s) |

|

||

Describe any training in sales, management, or retailing: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchise Experience

Have you ever owned, or do you currently own a franchised business? Yes If yes, please explain:

No

Franchise Restaurant or Restaurant Experience

List concept, years of tenure, titles, principal responsibilities (please note: restaurant experience is not required for approval):

Do you have any arrangements or commitments, contractual or otherwise, that may interfere with your becoming a franchisee? |

Yes |

If yes, please explain: |

|

No

Have you or any business entity within which you have owned an interest, been involved in bankruptcy, insolvency, or proceedings with creditors? |

Yes |

If yes, please explain: |

|

No

Have you or any business entity within which you have owned an interest, ever been arrested, charged, or convicted of a felony or other criminal |

Yes |

or civil offense (except a minor traffic offense)? |

|

If yes, please explain: |

|

No

Page 2 of 4

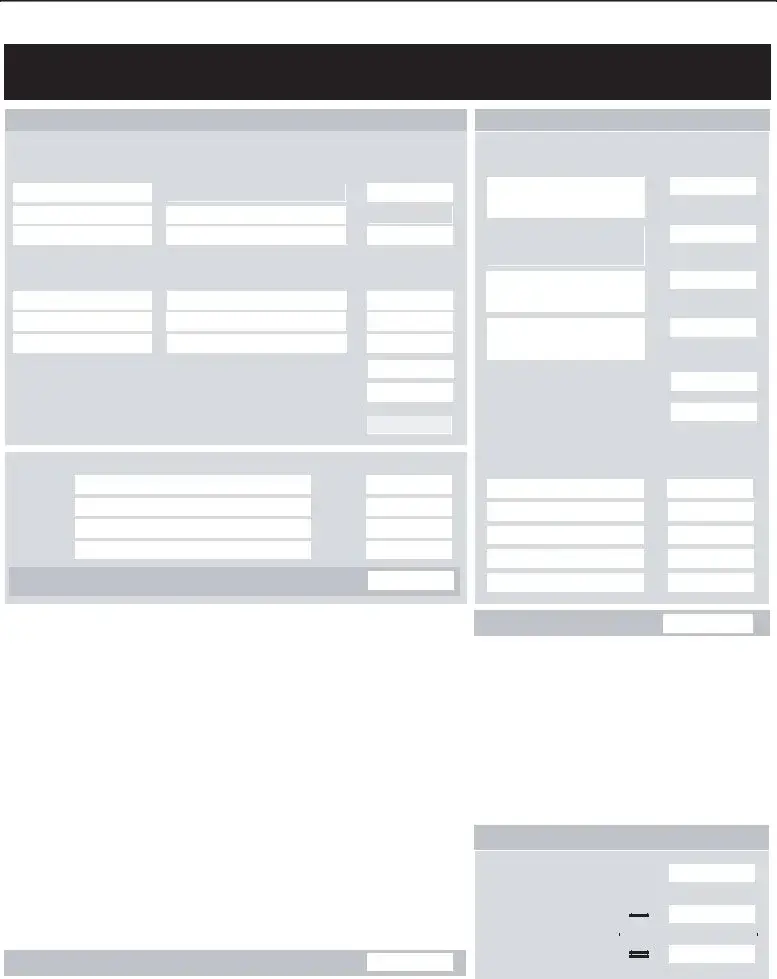

Personal Financial Information

Corporate Applicants – please attach a copy of your Organization Documents and your most recent Balance Sheet and Profit/Loss Statement

IMPORTANT: To obtain credit approval for an Arby's Franchise Agreement, you, your partnership, or your corporation must have $500,000 in verified liquid assets and a minimum net worth of $1 million. Verification includes current (90 days) bank, mutual fund, or brokerage statements. We will not be able to approve your application without proper documentation.

Assets

A.Liquid Assets Note: Net worth will be automatically calculated. In all dollar amount fields, please

|

|

|

|

|

enter numbers only; no spaces, commas, or symbols (e.g., enter $20,000 as 20000) |

||||||||||||||

|

Cash in Banks |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Bank Name |

Account Type & Account# |

|

|

|

|

|

|

|

|

Balance |

|||||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stocks, Mutual Funds, and Government Securities |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Account Name |

Account Type |

|

|

|

|

|

|

|

|

Balance |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

CASH VALUE OF LIFE INSURANCE |

|

$ |

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||

|

IRA, 401K, AND RETIREMENT FUNDS |

|

$ |

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Total Liquid Assets |

|

$ |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Real Estate Owned (Including personal residence) |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Address |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

Value |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Address |

|

|

|

|

Value |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Address |

|

|

|

|

Value |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Address |

|

|

|

|

Value |

|

|

|

|

||||||||

|

|

|

|

|

|

|

$ |

|

|

|

|

||||||||

|

|

BA. Total RealLiquidEstateAssetsValue |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Notes, Accounts, and Mortgages Receivable |

$ |

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||

|

|

Other – Automobiles / Personal Property |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Item |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

Value |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Item |

|

|

|

|

Value |

|

|

|

|||||||||

|

|

Item |

|

|

|

|

Value |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Item |

|

|

|

|

Value |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Total |

|

$ |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Net Value of Business Interests |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Business |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Value |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Business |

|

|

|

Value |

|

|

|

||||||||||

|

|

Business |

|

|

|

Value |

|

|

|||||||||||

|

|

|

|

|

|

|

|

||||||||||||

|

|

Business |

|

|

|

Value |

|

|

|||||||||||

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Total Value of Business Interests |

$ |

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||

Please include requested verification with Initial Application.

|

Liabilities |

|

|

|

|

|

Real Estate Mortgages |

|

|

|

|

||

|

Address |

|

|

|

Balance |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

Loans / Notes/Accounts Payable |

$ |

|

|

|||

|

|

|||||

Federal or State Taxes Due |

$ |

|

|

|||

|

|

|||||

|

|

|

|

|

|

|

Other Liabilities (Including Credit Cards) |

||||||

|

Item |

|

|

|

Balance |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TotalNet WorthLiabilitiesComputation |

|

$ |

|

|

|

|

|

|

|

||||

Net Worth Calculation

Total Assets |

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

Total Liabilities |

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Net Worth |

$ |

|

|

|

|

||

|

|

|

|

|

|

|

|

Page 3 of 4

Background Verification Disclosure

Arby’s Restaurant Group, Inc., or its representatives, agents or designees, may obtain a Consumer Report and/or a Background Investigative Report, to be used in processing your franchise application or updated from time to time throughout the franchise relationship. The Fair Credit Reporting Act, as amended by the Consumer Reporting Reform Act of 1996, requires us to advise you that a Consumer Report and/or Background Investigative Report may be made which may include information about your credit standing, credit capacity, character, general reputation, personal characteristics, and mode of living. Upon written request, additional information as to the nature and scope of the report(s) will be provided.

Authorization and Release

I hereby authorize Arby’s Restaurant Group, Inc., or its representatives, agents or designees, to procure a Consumer Report and/or Background Investigative Report which I understand may include information regarding my creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, and mode of living. These reports may be compiled with information from court records, departments of motor vehicles, past or present employers and educational institutions, governmental occupational licensing or registration entities, business or personal references, and any other source required to verify information that I have voluntarily supplied. I authorize any person, association, firm, company, law enforcement agency, or personnel office to furnish information, including but not limited to, my business reputation, my credit history, my references, my performance, my criminal conviction record, my civil record, and any other record. I indemnify and release all such persons, firms, organizations, or agencies from any liability or damages that may be incurred as a result of such an inquiry or the furnishing of such information.

I certify that I have read and understand all provisions of this Authorization and Release.

Applicant's Signature |

|

|

Date |

|

|

|

|

|

|

|

|

|

|

Applicant's Printed Name |

|

|

|

Social Security # |

|

|

|

|

|

|

|

|

|

|

|

|

Driver's License # |

|

State |

|

Maiden Name (if applicable) |

|

|

|

|||

|

|

|

|

|

|

|

Please complete Spouse information if joint application:

Spouse's Signature

Spouse's Printed Name

Date

Social Security #

Maiden Name (if applicable) |

Driver's License # |

State |

|

|

How to submit this application:

1.Complete all required fields.

2.Print this document and sign where indicated.

3.Attach required financial verification documents.

4.Mail to Arby’s Restaurant Group, Inc., ATTN: Franchise Development Marketing Manager, 1155 Perimeter Center West, Atlanta, GA 30338 You may return via facsimile to

Page 4 of 4

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Required for All Partners | This application must be completed by every individual equity partner holding an ownership interest in the franchise. |

| Personal Information | Applicants must provide detailed personal information, including social security numbers, dates of birth, and various contact numbers. |

| Financial Requirements | A minimum of $500,000 in verified liquid assets and a net worth of at least $1 million is required for approval. |

| Background Checks | The application process may involve a background check, which encompasses a consumer report related to credit standing and personal history. |

| Submission Instructions | Applicants need to print, sign, and mail the completed form along with necessary financial verification documents to the franchisor. |

| Governing Law | Franchise applications in Georgia are governed under Georgia’s Franchise Investment Law and related regulations. |

Guidelines on Utilizing Print Out Applications

Completing the Print Out Applications form is an essential step in your journey to potentially becoming an Arby’s franchisee. Once you have filled out the required information accurately, you will gather necessary financial verification documents before submitting the application. This ensures that your request is processed efficiently.

- Gather personal information, including your full name, Social Security number, date of birth, and contact details.

- Provide your current address and the duration at this residence. If you have lived there for less than five years, list your prior address.

- Input details about your spouse, if applicable, including their name, Social Security number, and date of birth.

- If you plan to have business partners, list their names and addresses in the designated section and ensure they complete a separate application.

- Fill out corporate information, if applicable, including the corporate name, business structure, Federal ID number, and state of incorporation.

- Indicate your preferred geographic areas of interest for the franchise. Choose up to three locations.

- Check the boxes for the type of location you are interested in, such as single location or multiple locations.

- State whether you will devote full-time to the business.

- Summarize your investment capital, management structure, and development plan in the provided space.

- Explain how you learned about this franchise opportunity.

- Document your professional background, including current and previous employment details, responsibilities, and salary.

- List your educational background, specifying the highest level of education completed.

- Answer the franchise experience questions, disclosing any relevant ownership or involvement in franchised businesses.

- Provide details regarding any bankruptcy or legal issues if applicable.

- Move on to the personal financial section and disclose your liquid assets, real estate owned, and any non-liquid assets, entering dollar amounts only, without spaces or symbols.

- Complete the liabilities section, detailing any loans or credit obligations.

- Calculate your net worth by subtracting total liabilities from total assets. Make sure the calculations are accurate.

- Authorize the background verification by signing and dating the designated section of the form.

- If submitting a joint application, include the same information for your spouse.

- Print the completed document and make sure you sign it where indicated.

- Attach the necessary financial verification documents.

- Mail the application to the specified address or send a facsimile but remember to mail the original document separately.

What You Should Know About This Form

What is the Print Out Applications form for?

The Print Out Applications form is specifically designed for individuals and corporate applicants seeking to apply for an Arby's franchise. This application collects essential personal and professional details to assess the suitability of potential franchisees.

Who needs to complete the application?

All individual equity partners with an ownership interest in the franchise must complete the application. If the applicant is a corporation, key personal details of the corporate entities involved must also be provided.

What information is required on the application?

The application requires detailed personal information, such as name, Social Security number, date of birth, and contact details. It also necessitates professional background, financial information, and details regarding any previous business or franchise experience. Applicants must provide information about their investment plan, business structure, and any potential partners.

What are the financial requirements to apply?

To gain credit approval for an Arby's Franchise Agreement, applicants must demonstrate a minimum of $500,000 in verified liquid assets and a net worth of at least $1 million. Documentation like bank statements from the last 90 days is essential to validate this information.

How should I submit the completed application?

After completing the application and signing it, applicants should print the document and submit it by mailing it to Arby’s Restaurant Group, Inc. at the specified address. It is also possible to send a fax to 678-514-5346, but the original must be mailed as well.

What happens if I have a prior bankruptcy or felony conviction?

Applicants must disclose any past bankruptcies, felony convictions, or other legal issues within the application. While these factors won't automatically disqualify an applicant, they may influence the approval process and require further explanation during review.

Can I attach my resume to the application?

Yes, attaching a resume is highly encouraged. The resume can provide additional context regarding your professional background, relevant experience, and skills that may support your application.

What information is needed regarding my business partners?

If you plan to include business partners in your franchise venture, their names and addresses must be listed in the application. Furthermore, each partner is required to fill out a separate application as part of the overall submission process.

Is there a specific way to fill out the financial sections?

When entering financial information into the application, applicants must avoid using any spaces, commas, or symbols. For example, if declaring $20,000, it should simply be entered as 20000. This ensures clarity and accuracy in assessing financial status.

Common mistakes

Filling out the Arby's Franchise Application can be a meticulous process. Many applicants, however, make common mistakes that can delay their application or lead to rejection. Here are six mistakes to avoid when completing the form.

First, not providing complete personal information is a frequent error. Each section requires accurate details, including your full name, social security number, and date of birth. Omitting any part of this information can hinder the processing of your application. Ensure that all fields are filled out completely—double-checking this can save precious time.

Another common mistake is failing to list prior addresses or neglecting to mention the length of time at your current address. If you've lived at your current residence for less than five years, you are required to provide prior addresses. This information helps assess your stability as a potential franchisee. Forgetting to include this information can lead to delays.

Many applicants also overlook the section requesting information about business partners. If you plan to bring partners into the business, you must list their names and addresses. Each partner needs to fill out a separate application too. It is essential for everyone involved to be transparent from the beginning.

Providing insufficient financial information is another pitfall. The application requires detailed documentation of your assets, including liquid and non-liquid assets. Missing or unclear financial data could result in denial of credit approval. It's important to attach all required financial documents, including bank and investment statements, to validate your financial standing.

Additionally, some applicants forget to address questions regarding previous business experiences or criminal history. Providing thorough answers to these inquiries is critical. If you've had any significant events in your professional or personal life that may impact your application, it's advisable to be upfront. Transparency is key in fostering trust with the franchise company.

Finally, not following submission instructions can lead to application rejection. Some applicants may fail to sign the document, overlook the requirement to mail the original application, or not include necessary attachments. Following all submission guidelines meticulously ensures that your application gets processed correctly without unnecessary delays.

By avoiding these common mistakes, you can enhance your chances of a swift and successful application process. Take your time to fill out the form carefully and address each section thoroughly.

Documents used along the form

When submitting the Print Out Application form for an Arby's franchise, several other important documents are typically required. Each of these documents helps to provide a comprehensive view of the applicant's qualifications and financial status. Below is a list of commonly requested documents that must accompany the application.

- Personal Financial Statement: This document outlines the applicant's financial position, including assets and liabilities. It helps the franchisor gauge the applicant's financial stability and ability to invest in the franchise.

- Resume: A resume provides an overview of the applicant's professional background, work experience, and skill set. This helps assess management capabilities and relevant industry experience.

- Credit Report Authorization: Applicants must allow the franchisor to obtain a credit report. This step is essential for verifying financial responsibility and understanding the applicant's credit history.

- Background Check Consent: This authorization allows for a background check to verify the applicant's criminal history and adherence to legal standards required for franchise ownership.

- Corporate Formation Documents: For corporate applicants, these documents establish the legal existence of the business entity, including articles of incorporation, bylaws, and operating agreements.

- Business Plan: A detailed business plan outlines the applicant’s vision for the franchise, including market analysis, operational strategy, and financial projections. This document is critical for demonstrating the applicant's preparedness and planning capabilities.

- Proof of Liquid Assets: Documentation showing the availability of liquid assets, such as bank statements or investment portfolios, is required to confirm the applicant meets the minimum financial requirements.

- Tax Returns: Most recent personal and business tax returns allow the franchisor to assess income levels and overall financial health.

- Franchise Disclosure Document (FDD): Although provided by the franchisor, the applicant should read and understand the FDD, as it contains critical information about franchise operations, fees, and obligations.

Submitting the Print Out Application form along with these additional documents creates a thorough application package. Ensuring that all information is complete and accurate is vital for a smooth process and positive evaluation by the franchisor.

Similar forms

Franchise Disclosure Document (FDD): Both the Print Out Application and the FDD require detailed personal information including financial backgrounds of applicants. The FDD serves to inform potential franchisees about the franchise system, while the application collects personal data necessary for the approval process.

Business License Application: Similar to the Print Out Application, this document collects personal information and business details about the applicant. It serves to authorize and verify the right to operate a business within a specific jurisdiction.

Partnership Agreement: Like the Print Out Application, this agreement outlines the roles and responsibilities of each partner, requiring disclosure of personal information. It formalizes the structure of business ownership, essential for franchise agreements.

Loan Application: Both documents request detailed financial information and personal history to evaluate creditworthiness. The loan application assesses the applicant's financial stability, while the franchise application requires similar disclosures for approval.

Employment Application: This form, similar to the Print Out Application, gathers personal information, work history, and references. Both documents aim to evaluate the applicant’s suitability based on their background and experiences.

Real Estate Rental Application: Much like the Print Out Application, this requires personal details and background information, especially regarding financial ability. It assesses the potential tenant's qualifications to secure a rental property.

Shareholder Agreement: This document parallels the Print Out Application in that it involves detailed disclosures of personal roles and financial interests. It governs the relationship among shareholders in a corporation.

Non-Disclosure Agreement (NDA): Although primarily focused on confidentiality, an NDA may require parties to provide personal information and business interests, similar to the information requested in the franchise application.

Consumer Credit Application: This application collects personal identification and financial information to assess credit eligibility, like the personal financial information section in the Print Out Application.

Application for a Business Identification Number (EIN): Refers to the collection of business information and personal details of owners for tax purposes, echoing requirements found in the franchise application.

Dos and Don'ts

When filling out the Print Out Applications form for an Arby's franchise, following the right steps can ensure a smoother process. Here’s a list of what you should and shouldn’t do:

- Do read each question carefully before answering it. Misunderstanding a question can lead to incorrect information.

- Do provide accurate and up-to-date personal and financial information. Your application depends on it being truthful.

- Do fill out all required fields completely. Incomplete applications will delay the processing time.

- Do double-check all numerical entries to avoid errors. Simple mistakes in figures can change your financial picture.

- Don't leave out required documents. Make sure to attach everything requested, especially financial verification materials.

- Don't rush through the application. Taking your time can reduce errors and give you peace of mind about your submission.

Misconceptions

Understanding the Print Out Applications form for Arby's Franchise is essential for potential applicants. Unfortunately, several misconceptions can lead to confusion and delays in the application process. Here are five common misconceptions along with accurate clarifications.

- Only one application is needed for corporate entities. Many believe that submitting a single application for a corporation is sufficient. However, all individual equity partners with ownership interest must also submit their own applications. This means that if you have co-owners, they need to complete separate forms.

- Previous restaurant experience is a necessity. There's a misconception that you must have owned a restaurant before applying. While experience in the restaurant industry can be beneficial, it is not a strict requirement for approval. The application places more weight on your overall business acumen and financial capacity.

- Only financial documents are necessary. Some applicants think that simply submitting financial statements will suffice. However, you must also provide a thorough background and personal information. This includes details about your past employment, education, and any legal issues that may affect your ability to operate a franchise.

- Providing liquid assets means listing only cash. Another common mistake is believing that liquid assets are restricted to cash in banks. In fact, liquid assets can also include stocks, mutual funds, and certain retirement accounts. It is critical to list all relevant assets accurately to meet the financial requirements.

- The background check is only a formality. Some individuals may assume that the background check is a minor detail. In reality, the background verification can significantly impact your approval. It’s crucial to disclose any relevant information as inaccuracies can lead to disqualification.

Clearing up these misconceptions is vital for anyone considering the franchise application process. Make sure to thoroughly complete the application and provide all necessary documentation to enhance your chances of approval.

Key takeaways

- Complete the Entire Form: Ensure that all sections of the Print Out Applications form are filled out completely. This includes personal, financial, and business information.

- Documentation is Key: Attach essential financial documents, including bank statements and proof of liquid assets, as these are required for credit approval.

- Accurate Financial Reporting: Enter monetary values without commas or symbols. For clarity, use numbers only (e.g. enter $20,000 as 20000).

- Background Authorization: Understand that by submitting the application, you authorize a background check. This may include inspection of your credit history and personal background.

- Multiple Applicants: If planning to include business partners, each individual must complete a separate application form. Gather all necessary information in advance to streamline the process.

- Submission Instructions: Follow the submission process carefully. Mail the signed form and documents to the specified address, ensuring that all components are included.

Browse Other Templates

Gcaar Residential Lease Washington Dc - There is a reminder that until a lease is fully ratified, the applicant holds no leasehold interest in the property.

30 Ceus for Dialysis Technicians - Awareness of the deadlines and requirements will ensure a smoother recertification experience for all technicians.