Fill Out Your Bc 100 Form

The BC-100 form is an essential document for businesses in Indiana wishing to officially close their tax accounts. This form, titled the Indiana Business Tax Closure Request, must be completed by organizations that have ceased operations or no longer need to maintain registration for certain tax types, including sales tax, withholding tax, and more. Within the form, business owners must provide basic information such as their tax identification number (TID), location number, and federal identification number (FID). A declaration is required to certify that they have either gone out of business or are no longer obligated to be registered for the indicated tax types. By filling out the BC-100, the owner acknowledges that they remain responsible for filing tax returns and remitting taxes due for any outstanding periods up to the date of closure. It’s vital that the form reflects no tax has been collected following the closure date. Additionally, if a business has undergone a change in its legal mailing address, that information can also be updated in this form. Contact information and resources for further assistance with completing the BC-100 are readily available, ensuring that businesses can navigate this process smoothly.

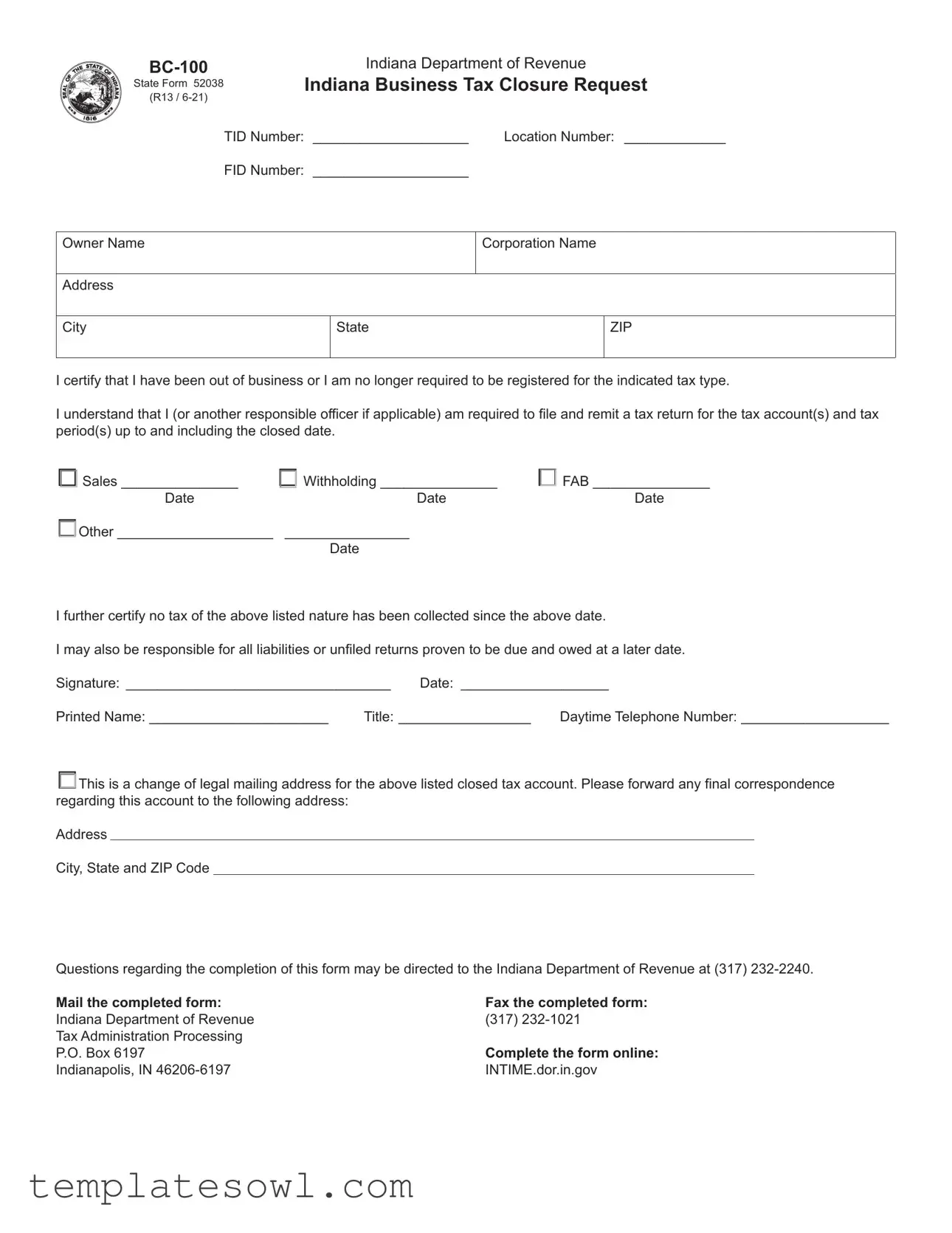

Bc 100 Example

Indiana Department of Revenue |

||

State Form 52038 |

Indiana Business Tax Closure Request |

|

|

|

|

(R13 / |

|

|

|

TID Number: _____________________ |

Location Number: _ _____________ |

|

FID Number: _____________________ |

|

Owner Name

Address

City

Corporation Name

State |

ZIP |

|

|

I certify that I have been out of business or I am no longer required to be registered for the indicated tax type.

I understand that I (or another responsible officer if applicable) am required to file and remit a tax return for the tax account(s) and tax period(s) up to and including the closed date.

□ Sales _______________ |

□ Withholding _______________ |

□ FAB _______________ |

Date |

Date |

Date |

□Other ____________________ |

________________ |

|

|

Date |

|

I further certify no tax of the above listed nature has been collected since the above date.

I may also be responsible for all liabilities or unfiled returns proven to be due and owed at a later date.

Signature:_ __________________________________ |

Date:_ ___________________ |

||

Printed Name:________________________ |

Title:__________________ |

Daytime Telephone Number:____________________ |

|

□This is a change of legal mailing address for the above listed closed tax account. Please forward any final correspondence regarding this account to the following address:

Address

City, State and ZIP Code

Questions regarding the completion of this form may be directed to the Indiana Department of Revenue at (317)

Mail the completed form: |

Fax the completed form: |

Indiana Department of Revenue |

(317) |

Tax Administration Processing |

Complete the form online: |

P.O. Box 6197 |

|

Indianapolis, IN |

INTIME.dor.in.gov |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The BC-100 form serves as a request for closure of a business tax account in Indiana. |

| Governing Law | This form is governed by Indiana Code Title 6, Article 2.2 regarding the Indiana Business Tax. |

| Certification Requirement | The signer must certify that they are out of business or no longer required to register for the indicated tax type. |

| Submission Details | The completed BC-100 form can be mailed or faxed to the Indiana Department of Revenue, ensuring to include all required information. |

Guidelines on Utilizing Bc 100

Filling out the BC-100 form is a necessary process for businesses in Indiana that need to close their tax accounts. Once you complete the form correctly, it will be submitted to the Indiana Department of Revenue for processing.

- Begin with the TID Number and Location Number at the top of the form.

- Fill in the FID Number.

- Input the Owner Name and Address.

- Add the City, State, and ZIP code for the business.

- If applicable, include the Corporation Name.

- Certification: Indicate that you have been out of business or that you no longer need to be registered for the indicated tax type. Select the tax type(s) related to your account (Sales, Withholding, FAB, or Other) and include the relevant dates.

- Sign the form, providing the date of your signature.

- Print your name and title below your signature.

- Provide your daytime telephone number.

- If this is a change of legal mailing address, fill in the new address, city, state, and ZIP code.

- Review the form for accuracy and completeness.

- Submit the completed form by mailing it to the address provided or faxing it to the designated number.

For any questions or assistance, the Indiana Department of Revenue is available at (317) 232-2240. Completing this form accurately is essential for closing your tax accounts efficiently.

What You Should Know About This Form

What is the BC-100 form used for?

The BC-100 form is a tax closure request submitted to the Indiana Department of Revenue. Merchants and businesses use this form to notify the state that they have ceased operations or no longer need to be registered for specific tax types. This includes sales tax, withholding tax, and others. Completing this form is an important step to officially close out your business tax accounts.

Who needs to fill out the BC-100 form?

Any business or individual who has been registered for state taxes in Indiana and has ceased operations should complete the BC-100 form. This may include sole proprietors, partnerships, corporations, or any entity that has stopped collecting taxes or no longer conducts business. It is essential to make sure that this form is submitted to avoid future tax liabilities.

What information is required on the BC-100 form?

To complete the BC-100 form, you will need to provide specific information including your TID Number, Location Number, FID Number, and the owner's name and address. Additionally, you must indicate which tax types you are closing, sign the form, and provide a daytime telephone number. Correctly filling out this information is crucial for processing your request efficiently.

What happens after I submit the BC-100 form?

Once you submit the BC-100 form, the Indiana Department of Revenue will process your request. You may still be responsible for filing any outstanding tax returns for the periods leading up to your closure date. If there are any questions or issues, the Department may contact you for clarification. It is also vital to keep records of your submission and follow up on any correspondence regarding your account.

Where do I send the completed BC-100 form?

You can mail the completed form to the Indiana Department of Revenue at P.O. Box 6197, Indianapolis, IN 46206-6197. Alternatively, if you prefer to fax the form, you can send it to (317) 232-1021. Make sure to double-check that all required information is accurate before you send the form to prevent any delays in processing.

Common mistakes

Filling out the BC-100 form can seem straightforward, but many individuals and businesses make common mistakes that delay their closure request. One of the most frequent errors is failing to provide all necessary identification numbers, such as the TID or FID number. These numbers are essential for the Indiana Department of Revenue to correctly process the request, so double-checking that they are filled out accurately is crucial.

Another mistake involves the completion of the owner and corporation name fields. Insufficient detail or typos can lead to confusion or miscommunication. Ensuring that names are spelled correctly and match the official records will streamline the processing of the form.

Many people neglect to indicate the correct tax types they are closing. The BC-100 requires applicants to specify if they are ceasing operations in sales, withholding, or other tax categories. Skipping this step can result in delays as the Department seeks clarification. The importance of good record-keeping becomes evident here.

It’s also common for individuals to forget to confirm that they have not collected any taxes since their declared closure date. This clause safeguards against future tax liabilities, so overlooking this certification could lead to complications down the line.

Signing the form is another critical area where mistakes occur. A missing signature can halt the entire process. It is essential for the responsible officer to sign the form and date it, ensuring that the request is officially recognized.

Providing an incorrect daytime telephone number can slow down communications related to any questions about the form or its processing. If the Indiana Department of Revenue needs to reach out for clarification, an accurate number is vital.

Sometimes, individuals forget to mention a change of address if applicable. If the mailing address has changed, it is important to indicate this on the form. Otherwise, vital correspondence may get lost in the shuffle.

Lastly, failing to review the form thoroughly before submission can lead to minor mistakes that may cause significant delays. Taking the time to double-check all entries can make a substantial difference in how swiftly the request is handled.

Documents used along the form

The BC-100 form is an essential document used for business tax closure in Indiana. When filing this form, it is often accompanied by various other forms and documents that assist in the tax closure process. Each of these documents serves a specific purpose and helps streamline the reporting or closure of tax accounts. Understanding these forms can facilitate a smoother experience for business owners navigating the tax landscape.

- BC-101: Business Closure Notification - This form notifies the Indiana Department of Revenue that a business has officially ceased operations. It provides important details such as the effective closure date and final tax obligations.

- BC-102: Final Sales Tax Return - Required for businesses that collected sales tax up until the closure date, this form reports the final sales made. It ensures that all collected sales taxes are properly remitted to the state.

- BC-103: Final Withholding Tax Return - Employers must complete this form to settle any remaining withholding taxes. It reflects the final wages paid and the corresponding withholding amounts before the business shutdown.

- BC-104: Request for Tax Account Review - This form requests a formal review of the business’s tax accounts to ensure all obligations have been met. Businesses may submit this to clear up any outstanding liabilities.

- BC-105: Certificate of No Tax Due - This certificate verifies that no outstanding taxes are owed by the business at the time of closure. It can be requested by businesses needing to prove compliance for licensing or other purposes.

- Form W-2: Wage and Tax Statement - Employers must issue this form to report wages paid and taxes withheld for employees. It is essential for final reporting to ensure all payroll obligations are satisfied.

- Form 941: Employer's Quarterly Federal Tax Return - If applicable, this form is important for employers to report income taxes, Social Security tax, or Medicare tax withheld from employee paychecks, along with employer contributions.

- State and Local Business License Closure Form - Many municipalities require a form to officially notify them of business closure. This is often necessary to avoid future licensing fees or penalties.

- Final Personal Property Tax Return - This return is used to declare any business personal property taxes owed on assets held until closure. It ensures that all property taxes are accounted for before dissolution.

- Certificate of Dissolution - If the business is a corporation or LLC, this document officially terminates its legal existence. It is often filed with the state and serves as a final step in the closure process.

Each of these forms and documents plays a critical role in ensuring that a business can properly and legally close its operations. Understanding their functions can help business owners fulfill their responsibilities and avoid potential issues with tax compliance.

Similar forms

- BC-101 Indiana Business Tax Registration Form: Similar in purpose, the BC-101 form registers businesses for various tax types with the Indiana Department of Revenue. Both forms ensure proper documentation for business tax obligations.

- BC-102 Indiana Business Tax Modification Form: This form allows businesses to modify their tax registration or liabilities. Like the BC-100, it is a formal request related to business tax status.

- BC-103 Indiana Sales Tax Exemption Certificate: While the BC-100 focuses on closure, the BC-103 certifies an organization’s intent not to charge sales tax due to qualifying reasons. Both document tax-related details.

- BC-104 Indiana Withholding Tax Reinstatement Form: Businesses use this form to reinstates their withholding account after a closure. Similar to the BC-100, it addresses changes in tax status.

- BC-150 Indiana Tax Clearance Certificate Request: A request for a tax clearance serves to confirm that a business has no outstanding tax obligations. It is directly related to the closure process initiated by the BC-100.

- BC-105 Indiana Business Tax Change of Ownership Form: This form is submitted when ownership of a business changes. Both it and the BC-100 signify important transitions affecting tax responsibilities.

- BC-106 Indiana Business Closing Statement: This statement outlines the details of business closure for tax purposes. It parallels the BC-100 in confirming the end of business operations and associated tax accounts.

Dos and Don'ts

When filling out the BC-100 form, there are important guidelines to ensure accuracy and compliance. Here are eight things to keep in mind:

- Do: Make sure to fill in all required fields completely; missing information can lead to processing delays.

- Do: Double-check your TID, FID, and location numbers for accuracy before submitting.

- Do: Specify the correct tax types you are closing to avoid confusion.

- Do: Ensure the signature is from the owner or an authorized officer to validate the request.

- Don't: Submit the form without reviewing it; mistakes can cause unnecessary complications.

- Don't: Ignore the certification statements; these are essential for compliance.

- Don't: Forget to indicate if there is a change of mailing address for correspondence.

- Don't: Use outdated forms; always ensure you have the latest version of the BC-100.

By carefully following these tips, you can help ensure a smoother process for your business tax closure request.

Misconceptions

The BC-100 form, used for Indiana Business Tax Closure Requests, is often misunderstood. Below are ten common misconceptions about this form and clarifications to help address them.

- Misconception 1: The BC-100 form can be submitted after the business has closed.

- Misconception 2: Completing this form eliminates all tax responsibilities.

- Misconception 3: All business owners must file the form, even if they do not have outstanding taxes.

- Misconception 4: The form can be submitted without providing a reason for closure.

- Misconception 5: The BC-100 does not require a signature for submission.

- Misconception 6: Businesses can submit the form online without any issues.

- Misconception 7: There is no deadline for submitting the BC-100 form.

- Misconception 8: The BC-100 form requires financial statements to be included.

- Misconception 9: The Department of Revenue does not review the form after submission.

- Misconception 10: A change of address on the form means closure of the business.

While it is true that this form is for businesses that have ceased operations, it must be submitted in a timely manner to avoid penalties or complications.

Filing the BC-100 does not absolve a business of liabilities or unfiled returns that may be due at a later date.

The form is only necessary if a business has been out of operation or is no longer required to be registered for a specific tax type.

Clearly indicating the business closure is vital. The form requires the certification of ceasing operations for compliance purposes.

A signature from the owner or responsible officer is essential for the form to be valid and processed.

While the form can be completed online, it still needs to be mailed or faxed to the Indiana Department of Revenue; it cannot be submitted electronically.

Timely submission is important. Delaying may lead to penalties or complications regarding tax obligations.

No financial statements are required. The form itself contains all necessary information about the closure.

The state reviews the form to ensure compliance and may follow up if there are discrepancies or outstanding issues.

A change of legal mailing address does not indicate closure. The form can be used to update records without affecting business status.

Understanding the BC-100 form correctly can facilitate a smoother closure process for businesses, ensuring all obligations are met efficiently.

Key takeaways

Here are some key takeaways for filling out and using the BC 100 form:

- Ensure you have the correct TID number, location number, and FID number before starting the form.

- Provide the owner’s name and address, as well as the corporation name if applicable.

- Confirm that you have actually been out of business or no longer need to be registered for the indicated tax type.

- Understand that you must file and remit any tax returns for up to the date your business closed.

- Indicate all applicable tax types, including Sales, Withholding, and FAB, and provide the corresponding dates.

- Recognize that you may still be held responsible for any unfiled returns or liabilities that arise later.

- If your mailing address has changed, clearly mark the appropriate checkbox and provide the new address for final correspondence.

If you have questions, reach out to the Indiana Department of Revenue at (317) 232-2240 for assistance. Follow the mailing instructions carefully when submitting the completed form.

Browse Other Templates

Florida Notice of Commencement Form - The notice must include detailed contact information for responsible parties.

Sample Car Lease Agreement - The document outlines the importance of training for vehicle operators to prevent accidents.