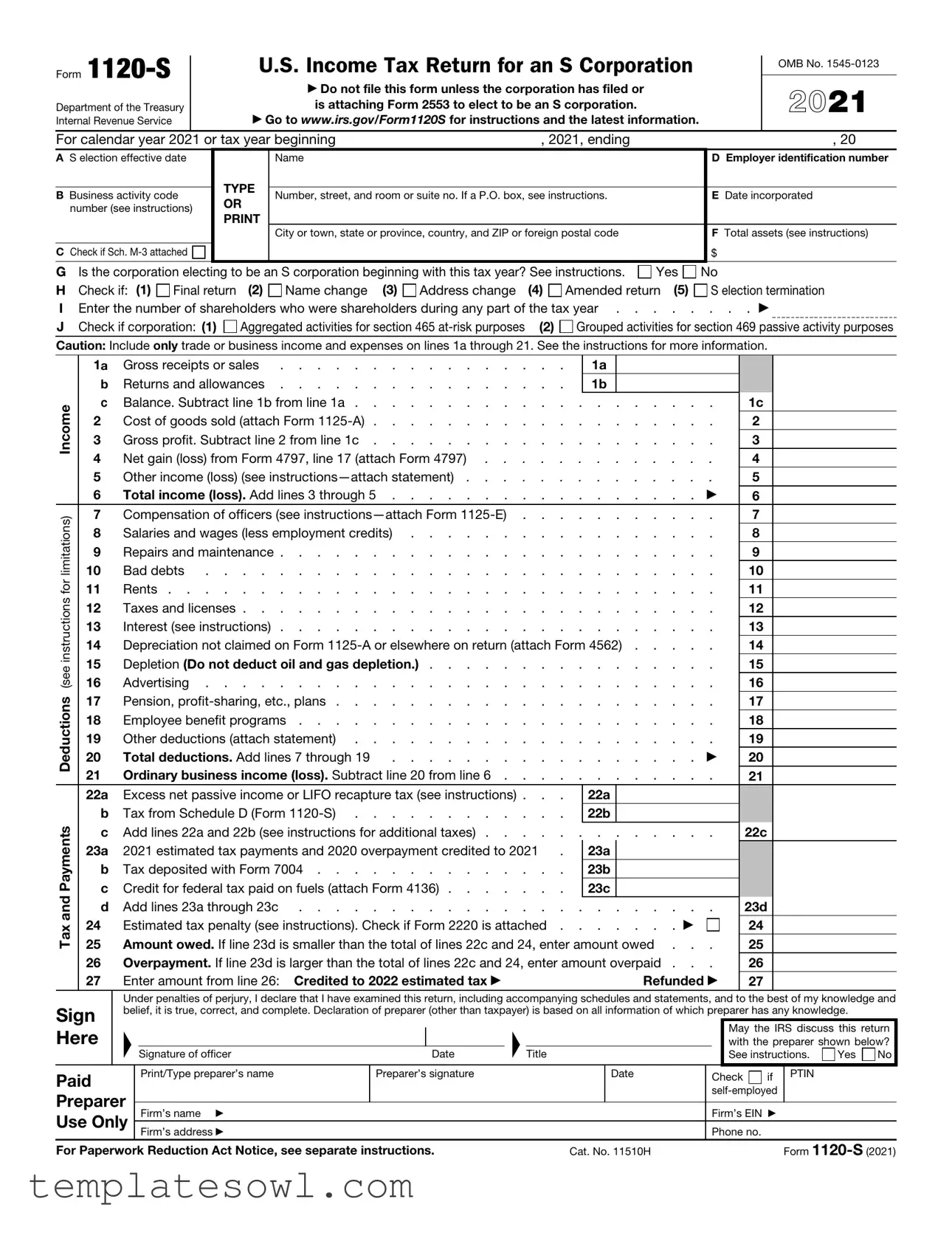

Fill Out Your Federal Supporting Form

The Federal Supporting Form 1120-S is a crucial document for S corporations that wish to report their income and associated tax obligations accurately. Designed specifically for S corporations, the form must only be filed by qualifying entities that have already submitted Form 2553 to establish their S status. This comprehensive tax return collects vital information, including the corporation's gross receipts, deductions, and net income or loss. Taxpayers must also disclose the total number of shareholders, assets, and any changes in corporate status, such as name or address modifications. Additionally, the form requires information about any attached schedules that address complex tax situations, such as passive activity limits or tax credits. S corporations must ensure they meet the requirements for any special elections or statuses, thoroughly filling out sections that pertain to their specific circumstances. The warning against filing without the necessary prior elections underscores the importance of understanding the requirements before submitting this form. Supporting schedules may include detailed financial data crucial for completing the return accurately, making it essential to adhere to the instructions provided by the IRS.

Federal Supporting Example

Form |

|

|

|

|

|

U.S. Income Tax Return for an S Corporation |

|

|

OMB No. |

||||

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ Do not file this form unless the corporation has filed or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

||

Department of the Treasury |

|

|

|

|

|

|

is attaching Form 2553 to elect to be an S corporation. |

|

|

|

|||

Internal Revenue Service |

|

|

|

|

|

▶ Go to www.irs.gov/Form1120S for instructions and the latest information. |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

For calendar year 2021 or tax year beginning |

, 2021, ending |

|

, 20 |

||||||||||

A S election effective date |

|

|

|

|

Name |

|

|

|

D Employer identification number |

||||

|

|

|

|

|

TYPE |

|

|

|

|

|

|

||

B |

Business activity code |

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

E Date incorporated |

|||||||

|

OR |

|

|

|

|||||||||

|

number (see instructions) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

F Total assets (see instructions) |

||

|

|

|

|

|

|

|

|

|

|

|

|||

C Check if Sch. |

|

|

|

|

|

|

|

|

$ |

|

|||

G Is the corporation electing to be an S corporation beginning with this tax year? See instructions. |

Yes |

No |

|||||||||||

H |

Check if: (1) Final return |

|

(2) Name change (3) Address change |

(4) Amended return (5) |

|

S election termination |

|||||||

I |

Enter the number of shareholders who were shareholders during any part of the tax year |

|

. . . ▶ |

||||||||||

J |

Check if corporation: (1) |

|

Aggregated activities for section 465 |

(2) Grouped activities for section 469 passive activity purposes |

|||||||||

Caution: Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information.

Tax and Payments Deductions (see instructions for limitations) Income

1a |

Gross receipts or sales |

|

1a |

|

|

|

|

|

|

b |

Returns and allowances |

|

1b |

|

|

|

|

|

|

c |

Balance. Subtract line 1b from line 1a |

. . . . . . . . |

1c |

|

|||||

2 |

Cost of goods sold (attach Form |

. . . . . . . . |

2 |

|

|||||

3 |

Gross profit. Subtract line 2 from line 1c |

. . . . . . . . |

3 |

|

|||||

4 |

Net gain (loss) from Form 4797, line 17 (attach Form 4797) |

. . . . . . . . |

4 |

|

|||||

5 |

Other income (loss) (see |

. . . . . . . . |

5 |

|

|||||

6 |

Total income (loss). Add lines 3 through 5 |

. . . . |

. |

. . |

▶ |

6 |

|

||

7 |

Compensation of officers (see |

. . . . . . . . |

7 |

|

|||||

8 |

Salaries and wages (less employment credits) |

. . . . . . . . |

8 |

|

|||||

9 |

Repairs and maintenance |

. . . . . . . . |

9 |

|

|||||

10 |

Bad debts |

. . . . . . . . |

10 |

|

|||||

11 |

Rents |

. . . . . . . . |

11 |

|

|||||

12 |

Taxes and licenses |

. . . . . . . . |

12 |

|

|||||

13 |

Interest (see instructions) |

. . . . . . . . |

13 |

|

|||||

14 |

Depreciation not claimed on Form |

14 |

|

||||||

15 |

Depletion (Do not deduct oil and gas depletion.) |

. . . . . . . . |

15 |

|

|||||

16 |

Advertising |

. . . . . . . . |

16 |

|

|||||

17 |

Pension, |

. . . . . . . . |

17 |

|

|||||

18 |

Employee benefit programs |

. . . . . . . . |

18 |

|

|||||

19 |

Other deductions (attach statement) |

. . . . . . . . |

19 |

|

|||||

20 |

Total deductions. Add lines 7 through 19 |

. . . . |

. |

. . |

▶ |

20 |

|

||

21 |

Ordinary business income (loss). Subtract line 20 from line 6 . . . . |

. . . . . . . . |

21 |

|

|||||

22a |

Excess net passive income or LIFO recapture tax (see instructions) . . . |

|

22a |

|

|

|

|

|

|

b |

Tax from Schedule D (Form |

|

22b |

|

|

|

|

|

|

c |

Add lines 22a and 22b (see instructions for additional taxes) |

. . . . . . . . |

22c |

|

|||||

23a |

2021 estimated tax payments and 2020 overpayment credited to 2021 . |

|

23a |

|

|

|

|

|

|

b |

Tax deposited with Form 7004 |

|

23b |

|

|

|

|

|

|

c |

Credit for federal tax paid on fuels (attach Form 4136) |

|

23c |

|

|

|

|

|

|

d |

Add lines 23a through 23c |

. . . . . . . . |

23d |

|

|||||

24 |

Estimated tax penalty (see instructions). Check if Form 2220 is attached . |

. . . . |

. |

. ▶ |

|

24 |

|

||

25 |

Amount owed. If line 23d is smaller than the total of lines 22c and 24, enter amount owed . . . |

25 |

|

||||||

26 |

Overpayment. If line 23d is larger than the total of lines 22c and 24, enter amount overpaid . . . |

26 |

|

||||||

27 |

Enter amount from line 26: Credited to 2022 estimated tax ▶ |

|

|

|

Refunded ▶ |

27 |

|

||

|

|

|

|

|

|

|

|

|

|

Sign Here

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▲ |

|

|

▲ |

|

|

May the IRS discuss this return |

||

|

|

|

||||||

|

|

|

|

with the preparer shown below? |

||||

Signature of officer |

Date |

Title |

|

See instructions. |

Yes |

No |

||

|

|

|

|

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

Check |

if |

PTIN |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

Preparer |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

Firm’s EIN ▶ |

|

|

||

Use Only |

|

|

|

|

|

|||

Firm’s address ▶ |

|

|

|

Phone no. |

|

|

|

|

|

|

|

|

|

|

|

||

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 11510H |

|

|

Form |

|

|||

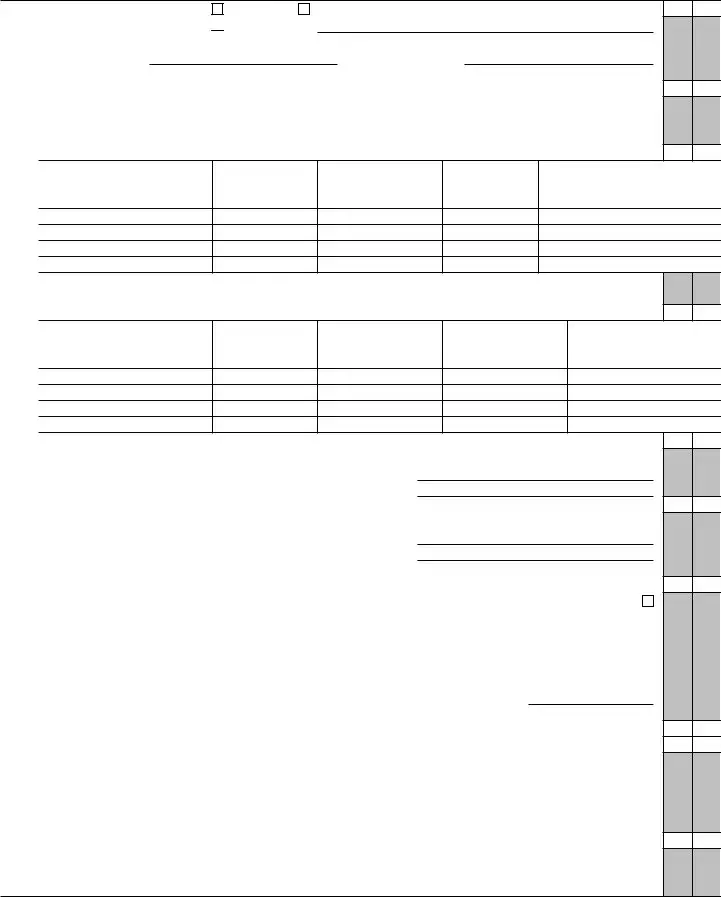

Form |

Page 2 |

|

Schedule B |

|

Other Information (see instructions) |

1 Check accounting method: a |

Cash |

b |

Accrual |

c

Other (specify) ▶

Other (specify) ▶

2 See the instructions and enter the:

a Business activity ▶ |

b Product or service ▶ |

3At any time during the tax year, was any shareholder of the corporation a disregarded entity, a trust, an estate, or a nominee or similar person? If “Yes,” attach Schedule

4At the end of the tax year, did the corporation:

aOwn directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any foreign or domestic corporation? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v)

below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

(i)Name of Corporation

(ii)Employer Identification

Number (if any)

(iii)Country of Incorporation

(iv)Percentage of Stock Owned

(v)If Percentage in (iv) Is 100%, Enter the Date (if applicable) a Qualified Subchapter

S Subsidiary Election Was Made

bOwn directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v) below . . . . . . .

(i)Name of Entity

(ii)Employer Identification

Number (if any)

(iii)Type of Entity

(iv)Country of Organization

(v)Maximum Percentage Owned in Profit, Loss, or Capital

5a At the end of the tax year, did the corporation have any outstanding shares of restricted stock? . . . . . . . .

If “Yes,” complete lines (i) and (ii) below.

(i) |

Total shares of restricted stock |

▶ |

(ii) |

Total shares of |

▶ |

bAt the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? . If “Yes,” complete lines (i) and (ii) below.

(i) |

Total shares of stock outstanding at the end of the tax year |

. ▶ |

(ii)Total shares of stock outstanding if all instruments were executed ▶

6Has this corporation filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide

|

information on any reportable transaction? |

. . . . . . . . . . . . . . . . . . . . . . . . |

7 |

Check this box if the corporation issued publicly offered debt instruments with original issue discount . . . . ▶ |

|

|

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount |

|

|

Instruments. |

|

8If the corporation (a) was a C corporation before it elected to be an S corporation or the corporation acquired an asset with a basis determined by reference to the basis of the asset (or the basis of any other property) in the hands of a C corporation, and

(b) has net unrealized

gain reduced by net recognized

9Did the corporation have an election under section 163(j) for any real property trade or business or any farming business

in effect during the tax year? See instructions . . . . . . . . . . . . . . . . . . . . . . . .

10 Does the corporation satisfy one or more of the following? See instructions . . . . . . . . . . . . . .

aThe corporation owns a

bThe corporation’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense.

cThe corporation is a tax shelter and the corporation has business interest expense.

If “Yes,” complete and attach Form 8990.

11 Does the corporation satisfy both of the following conditions? . . . . . . . . . . . . . . . . . .

aThe corporation’s total receipts (see instructions) for the tax year were less than $250,000.

bThe corporation’s total assets at the end of the tax year were less than $250,000. If “Yes,” the corporation is not required to complete Schedules L and

Form

Form |

Page 3 |

|

Schedule B |

Other Information (see instructions) (continued) |

Yes No |

12During the tax year, did the corporation have any

terms modified so as to reduce the principal amount of the debt? . . . . . . . . . . . . . . . . .

If “Yes,” enter the amount of principal reduction . . . . . . . . . . . . . . ▶ $

13During the tax year, was a qualified subchapter S subsidiary election terminated or revoked? If “Yes,” see instructions .

14a Did the corporation make any payments in 2021 that would require it to file Form(s) 1099? |

|

|||||||||||

b |

If “Yes,” did the corporation file or will it file required Form(s) 1099? |

|

||||||||||

15 |

Is the corporation attaching Form 8996 to certify as a Qualified Opportunity Fund? |

|||||||||||

|

If “Yes,” enter the amount from Form 8996, line 15 |

. . . . ▶ $ |

|

|

|

|

||||||

Schedule K |

Shareholders’ Pro Rata Share Items |

|

|

|

|

|

|

|

Total amount |

|||

|

|

1 |

Ordinary business income (loss) (page 1, line 21) |

. . . . . . |

. . |

1 |

|

|

||||

|

|

2 |

Net rental real estate income (loss) (attach Form 8825) |

. . . . . . |

. . |

2 |

|

|

||||

|

|

3a |

Other gross rental income (loss) |

|

3a |

|

|

|

|

|

||

|

|

b |

Expenses from other rental activities (attach statement) |

. . . . |

|

3b |

|

|

|

|

|

|

|

|

c |

Other net rental income (loss). Subtract line 3b from line 3a . . . |

. . . . . . |

. . |

3c |

|

|||||

(Loss) |

|

4 |

Interest income |

. . . . . . |

. . |

4 |

|

|

||||

|

5 |

Dividends: a Ordinary dividends |

. . . . . . |

. . |

5a |

|

|

|||||

|

|

|

||||||||||

Income |

|

|

b Qualified dividends |

|

5b |

|

|

|

|

|

||

|

6 |

Royalties |

. . . . . . |

. . |

6 |

|

|

|||||

|

|

|

|

|||||||||

|

|

7 |

Net |

. . . . . . |

. . |

7 |

|

|

||||

|

|

8a |

Net |

. . . . . . |

. . |

8a |

|

|||||

|

|

b |

Collectibles (28%) gain (loss) |

|

8b |

|

|

|

|

|

||

|

|

c |

Unrecaptured section 1250 gain (attach statement) |

|

8c |

|

|

|

|

|

||

|

|

9 |

Net section 1231 gain (loss) (attach Form 4797) |

. . . . . . |

. . |

9 |

|

|

||||

|

|

10 |

Other income (loss) (see instructions) . . . |

Type ▶ |

|

|

|

|

|

10 |

|

|

Deductions |

|

11 |

Section 179 deduction (attach Form 4562) |

. . . . . . |

. . |

11 |

|

|

||||

|

12a |

Charitable contributions |

. . . . . . |

. . |

12a |

|

|

|||||

|

|

|

||||||||||

|

|

b |

Investment interest expense |

. . . . . . |

. . |

12b |

|

|||||

|

|

c |

Section 59(e)(2) expenditures |

Type ▶ |

|

|

|

|

|

12c |

|

|

|

|

d |

Other deductions (see instructions) . . . . |

Type ▶ |

|

|

|

|

|

12d |

|

|

|

|

13a |

. . . . . . |

. . |

13a |

|

||||||

|

|

b |

. . . . . . |

. . |

13b |

|

||||||

Credits |

|

c |

Qualified rehabilitation expenditures (rental real estate) (attach Form 3468, if applicable) |

. . |

13c |

|

||||||

|

d |

Other rental real estate credits (see instructions) |

Type ▶ |

|

|

|

|

|

13d |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

e |

Other rental credits (see instructions) . . . |

Type ▶ |

|

|

|

|

|

13e |

|

|

|

|

f |

Biofuel producer credit (attach Form 6478) |

. . . . . . |

. . |

13f |

|

|||||

|

|

g |

Other credits (see instructions) |

Type ▶ |

|

|

|

|

|

13g |

|

|

International Transactions |

|

14 |

Attach Schedule |

|

|

|

||||||

|

|

|

|

|

||||||||

|

|

|

check this box to indicate you are reporting items of international tax relevance . . . |

▶ |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

Alternative MinimumTax Items(AMT) |

15a |

. . . . . . |

. . |

15a |

|

|||||||

b |

Adjusted gain or loss |

. . . . . . |

. . |

15b |

|

|||||||

c |

Depletion (other than oil and gas) |

. . . . . . |

. . |

15c |

|

|

||||||

|

|

|

||||||||||

|

|

d |

Oil, gas, and geothermal |

. . . . . . |

. . |

15d |

|

|||||

|

|

e |

Oil, gas, and geothermal |

. . . . . . |

. . |

15e |

|

|||||

|

|

f |

Other AMT items (attach statement) |

. . . . . . |

. . |

15f |

|

|||||

ItemsAffecting ShareholderBasis |

|

16a |

. . . . . . |

. . |

16a |

|

||||||

|

f |

Foreign taxes paid or accrued |

. . . . . . |

. . |

16f |

|

||||||

|

|

b |

Other |

. . . . . . |

. . |

16b |

|

|||||

|

|

c |

Nondeductible expenses |

. . . . . . |

. . |

16c |

|

|||||

|

|

d |

Distributions (attach statement if required) (see instructions) . . . |

. . . . . . |

. . |

16d |

|

|||||

|

|

e |

Repayment of loans from shareholders |

. . . . . . |

. . |

16e |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

|

Form |

|

|

Page 4 |

|||

Schedule K |

|

Shareholders’ Pro Rata Share Items (continued) |

|

Total amount |

||

|

Information |

17a |

Investment income |

17a |

||

Other |

d |

Other items and amounts (attach statement) |

|

|

||

|

|

b |

Investment expenses |

17b |

||

|

|

c |

Dividend distributions paid from accumulated earnings and profits |

17c |

||

|

|

|

|

|

|

|

Recon- |

ciliation |

18 |

|

Income (loss) reconciliation. Combine the amounts on lines 1 through 10 in the far right |

|

|

|

|

|

|

|

||

|

|

|

|

column. From the result, subtract the sum of the amounts on lines 11 through 12d and 16f . |

18 |

|

Schedule L |

Balance Sheets per Books |

|

Beginning of tax year |

|

|

End of tax year |

|||||

|

|

Assets |

|

(a) |

|

(b) |

|

(c) |

|

|

(d) |

1 |

Cash |

|

|

|

|

|

|

|

|

|

|

2a |

Trade notes and accounts receivable . . . |

|

|

|

|

|

|

|

|

|

|

b |

Less allowance for bad debts |

( |

|

) |

|

|

( |

) |

|

|

|

3 |

Inventories |

|

|

|

|

|

|

|

|

|

|

4 |

U.S. government obligations |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

||

6 |

Other current assets (attach statement) . . . |

|

|

|

|

|

|

|

|

|

|

7 |

Loans to shareholders |

|

|

|

|

|

|

|

|

|

|

8 |

Mortgage and real estate loans |

|

|

|

|

|

|

|

|

|

|

9 |

Other investments (attach statement) . . . |

|

|

|

|

|

|

|

|

|

|

10a |

Buildings and other depreciable assets . . . |

|

|

|

|

|

|

|

|

|

|

b |

Less accumulated depreciation |

( |

|

) |

|

|

( |

) |

|

|

|

11a |

Depletable assets |

|

|

|

|

|

|

|

|

|

|

b |

Less accumulated depletion |

( |

|

) |

|

|

( |

) |

|

|

|

12 |

Land (net of any amortization) |

|

|

|

|

|

|

|

|

|

|

13a |

Intangible assets (amortizable only) . . . . |

|

|

|

|

|

|

|

|

|

|

b |

Less accumulated amortization |

( |

|

) |

|

|

( |

) |

|

|

|

14 |

Other assets (attach statement) |

|

|

|

|

|

|

|

|

|

|

15 |

Total assets |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

16 |

Accounts payable |

|

|

|

|

|

|

|

|

|

|

17 |

Mortgages, notes, bonds payable in less than 1 year |

|

|

|

|

|

|

|

|

|

|

18 |

Other current liabilities (attach statement) . . |

|

|

|

|

|

|

|

|

|

|

19 |

Loans from shareholders |

|

|

|

|

|

|

|

|

|

|

20 |

Mortgages, notes, bonds payable in 1 year or more |

|

|

|

|

|

|

|

|

|

|

21 |

Other liabilities (attach statement) . . . . |

|

|

|

|

|

|

|

|

|

|

22 |

Capital stock |

|

|

|

|

|

|

|

|

|

|

23 |

Additional |

|

|

|

|

|

|

|

|

|

|

24 |

Retained earnings |

|

|

|

|

|

|

|

|

|

|

25 |

Adjustments to shareholders’ equity (attach statement) |

|

|

|

|

|

|

|

|

|

|

26 |

Less cost of treasury stock |

|

|

|

( |

) |

|

|

( |

) |

|

27 |

Total liabilities and shareholders’ equity . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

Form |

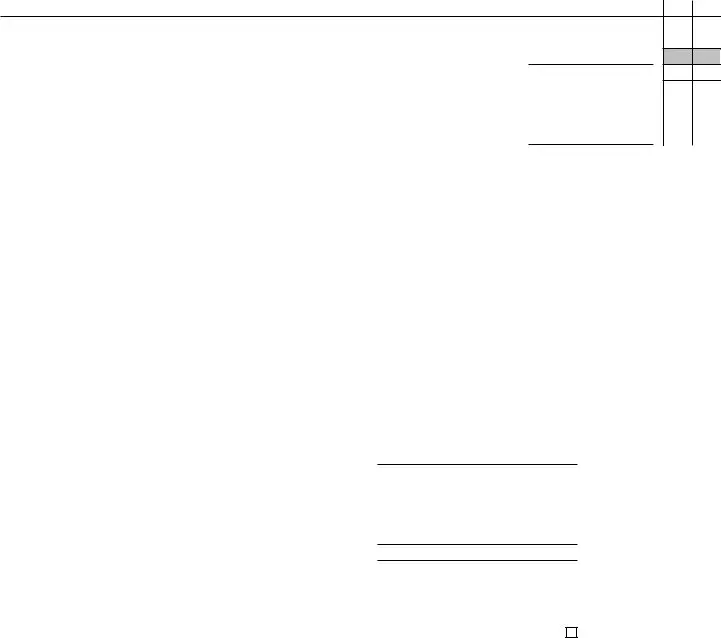

Page 5 |

|

Schedule |

Reconciliation of Income (Loss) per Books With Income (Loss) per Return |

|

Note: The corporation may be required to file Schedule

1 |

Net income (loss) per books . . . . |

|

|

5 |

|

Income recorded on books this year |

|

|

|||

2 |

Income included on Schedule K, lines 1, 2, |

|

|

|

|

not included on Schedule K, lines 1 |

|

|

|||

|

|

|

|

through 10 (itemize): |

|

|

|

||||

|

3c, 4, 5a, 6, 7, 8a, 9, and 10, not recorded |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

|

on books this year (itemize) |

|

|

a |

|

|

|

|

|||

3 |

Expenses recorded on books this year |

|

|

6 |

|

Deductions included on Schedule K, |

|

|

|||

|

|

|

|

|

|||||||

|

not included on Schedule K, lines 1 |

|

|

|

|

lines 1 through 12 and 16f, not charged |

|

|

|||

|

through 12 and 16f (itemize): |

|

|

|

|

against book income this year (itemize): |

|

|

|||

a |

Depreciation $ |

|

|

a |

|

Depreciation $ |

|

|

|

||

b |

Travel and entertainment $ |

|

|

7 |

|

Add lines 5 and 6 |

|

|

|||

|

|

|

|

|

|||||||

|

|

|

|

|

8 Income (loss) (Schedule K, line 18). |

|

|

||||

4 |

Add lines 1 through 3 |

|

|

|

|

Subtract line 7 from line 4 . . . . |

|

|

|||

Schedule |

Analysis of Accumulated Adjustments Account, Shareholders’ Undistributed Taxable Income |

|

|||||||||

|

|

Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account |

|

||||||||

|

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Accumulated |

|

(b) Shareholders’ |

|

(c) Accumulated |

(d) Other adjustments |

|

|

|

|

|

|

adjustments account |

|

undistributed taxable |

|

earnings and profits |

account |

|

|

|

|

|

|

|

|

|

income previously taxed |

|

|

|

|

1 |

Balance at beginning of tax year |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

2 |

Ordinary income from page 1, line 21 . . . |

|

|

|

|

|

|

|

|

||

3 |

Other additions |

|

|

|

|

|

|

|

|

||

4 |

Loss from page 1, line 21 |

( |

|

) |

|

|

|

|

|

||

5 |

Other reductions |

( |

|

) |

|

|

|

( |

) |

||

6 |

Combine lines 1 through 5 |

|

|

|

|

|

|

|

|

||

7 |

Distributions |

|

|

|

|

|

|

|

|

||

8 |

Balance at end of tax year. Subtract line 7 from |

|

|

|

|

|

|

|

|

||

|

line 6 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Form |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Name of the Form | Form 1120-S is the U.S. Income Tax Return specifically for S Corporations. |

| Governing Agency | This form is filed with the Internal Revenue Service (IRS). |

| Election Requirement | The corporation must file Form 2553 to elect its status as an S Corporation before using Form 1120-S. |

| Assets Reporting | Corporations must report total assets and attach necessary schedules if applicable. |

| Shareholder Information | The form requires the number of shareholders during the tax year, which is crucial for tax calculations. |

| Tax Years Covered | Form 1120-S is used for calendar years or tax years starting and ending in 2021. |

| Significant Changes | Checkboxes are available for indicating significant changes such as name change or final return. |

| Income and Deductions | This form includes a section for reporting income and various deductions associated with the business's operations. |

| Estimated Tax Payments | There are specific lines to report the estimated tax payments made for the current and previous years. |

Guidelines on Utilizing Federal Supporting

Filling out the Federal Supporting form can seem overwhelming, but by following these straightforward steps, you can ensure you provide the necessary information. It's important to gather all required documents and understand the form's various sections before you begin. With your information in hand, the process will be smoother.

- Start with your corporation's details. Enter the name, employer identification number, and business activity code in the specified areas.

- For the address section, input the corporation's number, street name, and, if applicable, the suite number. Ensure the city, state, and ZIP code are accurate.

- Indicate the date of incorporation and check whether you are using the form for the final return, name change, address change, amended return, or S election termination.

- Count the number of shareholders during the tax year and enter that number. Mark whether the corporation is aggregating or grouping activities.

- Move to the Income section. Fill in the gross receipts or sales and the returns and allowances, then calculate the balance by subtracting returns from gross receipts.

- Complete the cost of goods sold by attaching Form 1125-A, and then calculate the gross profit by subtracting the cost from the balance.

- List other income sources as necessary, following the instructions provided in the form.

- In the Deductions section, record details such as compensation for officers, salaries, and any other relevant expenses. Ensure to attach any required forms or statements.

- Once all income and deductions are populated, calculate the ordinary business income or loss by subtracting total deductions from total income.

- Proceed to the tax payments section. If applicable, enter estimated tax payments and any amounts owed or overpaid.

- Sign and date the form, making sure that the declaration is fully filled out, acknowledging the accuracy of the provided information.

- If using a preparer, enter their details in the designated area, ensuring compliance with all required signatures.

After you complete your form, make copies for your records. Verify all entries for accuracy, and consider consulting a tax professional if you have any uncertainties. You can then proceed to file the form as required. Be aware of deadlines to avoid any penalties.

What You Should Know About This Form

What is the Federal Supporting Form 1120-S?

The Federal Supporting Form 1120-S is the U.S. Income Tax Return specifically for S Corporations. This form must be filed by corporations that have elected to be treated as S Corporations for tax purposes, which allows income to be passed through to shareholders without being taxed at the corporate level. It's crucial to file this form only if the corporation has previously filed or is attaching Form 2553, which is the election form for S Corporation status.

Who needs to file Form 1120-S?

Any corporation that has made an S Corporation election needs to complete and submit Form 1120-S. This includes corporations with multiple shareholders. The form must encapsulate the business's financial activities for the year, itemizing income, deductions, and tax credits. It ensures that shareholders accurately report their share of the corporation's income on their personal tax returns.

What should I include when filing Form 1120-S?

When filing Form 1120-S, expect to provide information on the corporation’s income, including gross receipts and sales, along with any applicable deductions such as compensation of officers, salaries, wages, and various operating expenses. Ensure to include accurate data for items such as total assets, number of shareholders, and any relevant tax credits. If applicable, attach necessary schedules and supporting documentation, like Form 4797 for sales of business property or Form 1125-A pertaining to the cost of goods sold.

Are there penalties for failing to file Form 1120-S?

Yes, there are penalties for failing to timely file Form 1120-S. If a corporation does not file, it may be subject to a penalty that can accumulate the longer the filing is delayed. Shareholders could also be impacted because their personal tax returns would lack necessary information regarding the corporation's income distribution. To avoid such consequences, it’s advisable to submit the form on time and ensure that all required details are accurately completed.

Common mistakes

Completing the Federal Supporting Form 1120-S can be a challenging task. Many people unknowingly make mistakes that could lead to complications with the IRS. One common mistake is failing to properly identify the corporation's tax year. When completing this form, it's crucial to indicate the start and end dates of the tax year accurately. Inadvertent errors in this area can cause the filing to be rejected or processed incorrectly.

Another significant error occurs with the shareholder information. Some filers neglect to list all shareholders who were in place at any time during the tax year. This oversight can create confusion about ownership and distribution of income or loss, possibly leading to penalties. The IRS requires full transparency about every shareholder's portion.

Miscalculating deductions also poses a problem for many. People often do not realize that certain expenses may have limitations, which are clearly outlined in the instructions. For instance, cost of goods sold is a common area where inaccuracies creep in. Incorrect calculations can arise from misunderstanding the specific requirements for what can be included in this section.

Furthermore, incorrectly checking boxes on the form can lead to further complications. Failing to mark whether the corporation is electing to be an S corporation or neglecting to check necessary additional boxes can cause issues. Each checkmark matters since it informs the IRS of crucial aspects of the corporation's filing status. A simple oversight can delay processing and trigger additional inquiries from the IRS.

Finally, not signing the form properly is a frequent mistake that many make. The signature line isn't just a formality. Without an authorized signature, the IRS treats the form as unfiled, which can result in penalties and interest. Always ensure that the appropriate officer's signature is present, along with the date and title.

Documents used along the form

The Federal Supporting Form, specifically Form 1120-S, accompanies several other important documents that are often necessary for tax reporting and compliance for S corporations. Each of these forms and documents serves a particular purpose in the overall tax filing process. Below is a list of additional forms and documents that are commonly utilized alongside Form 1120-S.

- Form 2553: This form is used to make the election to be taxed as an S corporation. It must be submitted to the IRS to officially change a corporation’s tax status.

- Form 1125-A: This document outlines the cost of goods sold and is required if you have inventory or sales of products during the tax year.

- Form 1125-E: This form provides information regarding officer compensation and must be included if officers are compensated.

- Form 4562: Use this form to claim deductions for depreciation and amortization. It also provides information on section 179 expensing.

- Form 4797: For reporting the sale of business property, this form details gains and losses from transactions involving such assets.

- Schedule K-1 (Form 1120-S): This schedule reports each shareholder's share of the income, deductions, and credits of the S corporation. Each shareholder receives a K-1 for their own tax reporting.

- Form 8990: This form is used to calculate and report business interest expense limitations, especially relevant for corporations with high levels of business interest expense.

- Schedule B: Included as part of Form 1120-S, this schedule details any additional specific information about the S corporation, such as accounting methods and ownership interests.

- Form 1099: Required if the corporation made payments to independent contractors or other specific payments that meet reporting thresholds. This ensures IRS compliance regarding miscellaneous income reporting.

Understanding the purpose of these documents ensures that S corporations fulfill their tax obligations accurately and comprehensively. Each form aligns with specific reporting requirements, which helps streamline the overall tax filing process.

Similar forms

- Form 1120: This form is the U.S. Income Tax Return for C Corporations. Like Form 1120-S, it reports income, gains, deductions, and losses. However, Form 1120 is used for corporations that do not elect S Corporation status.

- Form 1065: This is the U.S. Return of Partnership Income. Similar to Form 1120-S, it reports income and expenses, but it is specifically designed for partnerships rather than corporations. Both forms allow for the distribution of income or losses to owners or shareholders.

- Form 990: This form is the Return of Organization Exempt From Income Tax. It shares similarities in financial reporting with Form 1120-S, particularly for non-profit organizations. Both require detailed reporting of income, expenses, and assets.

- Form 2553: This form is used to elect S Corporation status. It is directly related to Form 1120-S as it must be filed before Form 1120-S if a corporation wants to be treated as an S Corporation for tax purposes.

- Schedule C (Form 1040): This is the Profit or Loss from Business form. Like Form 1120-S, it details income and expenses. It is used by sole proprietors, while Form 1120-S is for S Corporations. Both forms ultimately help determine taxable income.

Dos and Don'ts

When filling out the Federal Supporting Form 1120-S for an S Corporation, adhering to certain guidelines can help streamline the process and minimize errors. Here are five key things to consider doing and avoiding.

- DO: Ensure that the corporation has filed Form 2553 to elect S corporation status.

- DO: Use accurate and complete information, including employer identification numbers and asset totals.

- DO: Double-check the calculations for each income and deduction line to avoid mistakes.

- DO: Attach all required schedules and additional forms to support your entries.

- DO: Sign and date the return, confirming that the information is true and correct.

- DON'T: File the form if the S corporation election has not been made.

- DON'T: Leave any fields blank; if a question does not apply, indicate it accordingly.

- DON'T: Forget to include schedules if you checked the boxes indicating they are required.

- DON'T: Rely on previous years' information without verifying if it remains accurate.

- DON'T: Wait until the last minute to file; extensions are available but have deadlines.

Misconceptions

Understanding the Federal Supporting Form, specifically Form 1120-S for S Corporations, can be challenging. Here are five common misconceptions that people have about this form.

- My corporation doesn't need to file Form 1120-S if it has losses. This is incorrect. Any S Corporation that has elected for S status must file Form 1120-S regardless of whether it has a profit or a loss. The form is necessary to report the corporation’s income, deductions, and other tax-related information.

- The Form 1120-S is only for corporations with large profits. This is a common misunderstanding. All S Corporations, regardless of their financial performance, must file this form. Even if a corporation operates at a loss, it must still comply with this requirement.

- Filing Form 1120-S is the same as filing personal tax returns. While S Corporation income is passed through to shareholders’ personal tax returns, the filing process for Form 1120-S is distinct. The corporation must record its income and deductions separately before passing this information to its shareholders.

- I can submit Form 1120-S at any time. This is misleading. S Corporations typically must file Form 1120-S by March 15 of each year to comply with IRS deadlines. Late filings can result in penalties.

- All income from an S Corporation is tax-exempt. This is not true. While S Corporations do enjoy certain tax benefits, income is generally subject to taxation. Shareholders must report their share of the S Corporation's income on their personal tax returns, which may be taxable depending on their individual tax situations.

Key takeaways

Filling out the Federal Supporting form, specifically Form 1120-S for S Corporations, requires careful attention to detail and understanding of the guidelines provided by the IRS. Below are key takeaways that can aid in successfully navigating the process.

- Eligibility Requirements: Corporations must ensure they are eligible to file Form 1120-S. This includes having previously filed Form 2553 to make the S corporation election.

- Accurate Information: All sections of the form must be completed accurately. This includes the corporation's name, address, Employer Identification Number (EIN), and relevant financial data.

- Income and Deductions: Properly report all income and deductions. The form emphasizes the need to include trade or business income and expenses only. Be mindful of limits and attach necessary schedules as specified in the instructions.

- Signatures and Declarations: The form must be signed by an authorized officer of the corporation. This declaration affirms the accuracy of the information provided, which is crucial for compliance with tax laws.

Browse Other Templates

Va Form 21-0845 Fillable - The form is a crucial tool in enabling veterans to receive help without compromising their privacy.

Ch-100 Form - Explain whether the person will still access their home or workplace if you get a stay-away order.