Fill Out Your Rental Receipt Form

The Rental Receipt form serves as an essential document in the landlord-tenant relationship. It captures vital information regarding rent payments and helps ensure clarity between both parties. This form includes fields for the date of payment, tenant details, and the property address, making it easy to track transactions. A designated section allows for the amount paid, specifying the payment method—whether cash, check, or money order—along with necessary details like check or money order numbers. The form also specifies the month and year the rent covers, providing crucial context for the payment. To authenticate the transaction, the name and signature of the landlord or their agent are included, and there is an optional section for a witness to sign. Proper use of this form can protect the interests of both landlords and tenants while also fostering transparent communication regarding rental agreements.

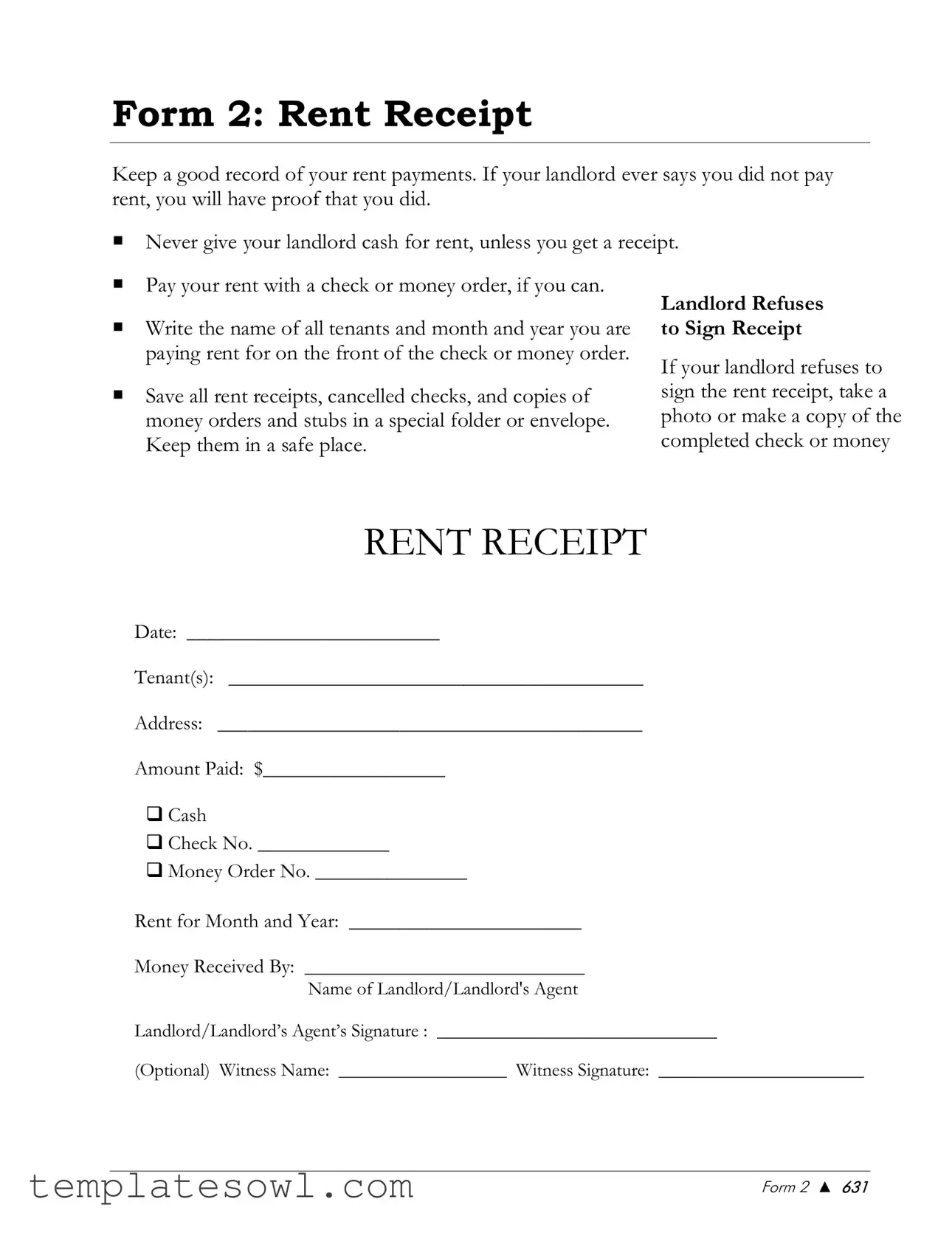

Rental Receipt Example

RENT RECEIPT

Date: _________________________

Tenant(s): _________________________________________

Address: __________________________________________

Amount Paid: $__________________

Cash

Check No. _____________

Money Order No. _______________

Rent for Month and Year: _______________________

Money Received By: ______________________________

Name of Landlord/Landlord's Agent Landlord/Landlord’s Agent’s Signature : ______________________________

(Optional) Witness Name: __________________ Witness Signature: ______________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Date | The rental receipt should include the date of payment to establish a clear record of when the transaction occurred. |

| Tenant Information | It must clearly list the tenant's name(s) to identify who is responsible for the rent payment. |

| Payment Method | The form allows for multiple payment methods, such as cash, check, or money order. Mark the method used for clarity. |

| Landlord's Details | The name and signature of the landlord or their agent are essential. This shows who is receiving the payment. |

| State-Specific Laws | In some states, rental receipts may be governed by specific laws. For example, in California, landlords are required to provide receipts for cash payments as per Civil Code Section 1947.5. |

Guidelines on Utilizing Rental Receipt

Once the Rental Receipt form is completed, it serves as a documented acknowledgment of rent received from the tenant. It is crucial to fill out each section accurately to ensure clarity for both tenants and landlords. Follow these steps to fill out the form correctly.

- Date: Write the date on which the rent is received.

- Tenant(s): Fill in the names of the tenant or tenants who are responsible for the rental payment.

- Address: Enter the complete address of the rental property being leased.

- Amount Paid: Indicate the total rent amount that has been paid. Include the dollar sign and the actual number.

- Payment Method: Check one of the boxes to specify the payment method: Cash, Check, or Money Order. If a check or money order is used, write the corresponding number in the designated space.

- Rent for Month and Year: Specify the month and year for which the rent payment applies.

- Money Received By: Provide the name of the landlord or landlord's agent who has received the payment.

- Landlord/Landlord's Agent’s Signature: Optionally, the landlord or agent can sign the receipt in the designated area.

- Witness Name: Record the name of a witness, if applicable.

- Witness Signature: The witness must sign the receipt to validate the transaction.

What You Should Know About This Form

What is the purpose of the Rental Receipt form?

The Rental Receipt form serves as proof of payment for rent. When tenants pay their monthly rent, they receive this receipt from their landlord or property manager. It details the amount paid, the method of payment, and the month and year for which the rent is applicable. This document is important for both tenants and landlords. Tenants can use it to keep track of their payments, while landlords can maintain accurate records of rent received.

What information do I need to fill out on the Rental Receipt form?

You will need to provide several key pieces of information on the Rental Receipt form. First, indicate the date of the transaction. Next, list the tenant's name(s) and the rental property's address. You must also document the amount paid. Specify the payment method by checking the appropriate box—this could be cash, check, or money order. Finally, the name of the landlord or their agent and their signature (optional) should be included. Completing these details ensures clarity and accountability for both parties.

Is the Landlord's Signature necessary on the Rental Receipt?

What should I do if I lose my Rental Receipt?

If you lose your Rental Receipt, it’s important to address it promptly. Start by communicating with your landlord or property manager. They can issue a duplicate receipt if their records indicate that rent was received. If the landlord is unresponsive, consider maintaining your own records of payments made, such as bank statements or a ledger. These can serve as proof of payment if needed down the line. Keeping organized records can save you headaches in the future.

Common mistakes

Filling out a rental receipt form correctly is crucial for both landlords and tenants. However, many individuals make mistakes that can lead to confusion or disputes later on. Understanding these common errors can help ensure that your paperwork is clear and accurate.

One frequent mistake is not entering the date on the rental receipt. The date serves as a reference point for the transaction and is essential for record-keeping. Without it, there can be uncertainty about when payments were made, which complicates any related discussions or disputes.

Another common error occurs in the tenant information section. Tenants sometimes forget to provide their names or miswrite them. It is vital to include the correct names as listed on the lease agreement. Missing or incorrect names can lead to complications if the landlord needs to refer back to the lease or if there are disagreements regarding payments.

When it comes to the payment section, people often neglect to specify the method of payment. This includes failing to check the appropriate box for whether the payment was made in cash, by check, or via money order. Clearly indicating the payment method helps maintain a transparent record for both parties and can aid in rectifying any future payment issues.

The amount paid field is another frequent source of mistakes. Tenants might forget to fill in the amount or accidentally record the wrong figure. This discrepancy can lead to disputes, especially if the landlord has accepted a different payment than what the tenant intended to document.

Signature requirements are often overlooked. Tenants may fail to provide a signature in the designated area. Likewise, landlords sometimes forget to sign as well. A signature legitimizes the receipt and ensures that both parties acknowledge the payment, reinforcing accountability.

Lastly, forgetting to designate a witness can be problematic, especially in situations where disputes arise. While it may not be mandatory for every transaction, having a witness signature can add an extra layer of security and validate the receipt. Including this detail will benefit both the landlord and the tenant in any future discussions regarding the rental payment.

Documents used along the form

A Rental Receipt form plays a crucial role in documenting the payment of rent between landlords and tenants. Alongside this essential form, there are several other documents that are commonly used to support the rental agreement and clarify responsibilities. Here is a list of these documents and a brief overview of each.

- Rental Agreement: This is a legal document that outlines the terms and conditions under which the tenant rents a property from the landlord. It typically includes details such as the rental amount, lease duration, and responsibilities of both parties.

- Move-In Inspection Checklist: This checklist is used to document the condition of the rental property before the tenant moves in. It protects both parties by ensuring that any existing damages are noted, which can prevent disputes regarding security deposits later on.

- Security Deposit Receipt: When a tenant pays a security deposit, the landlord should provide a receipt. This document outlines the amount paid and confirms that the funds are being held for possible future repairs or unpaid rent.

- Notice to Pay Rent or Quit: This notice is issued to a tenant who has missed rent payments. It serves as a formal request for the tenant to pay the overdue amount within a specific timeframe or face potential eviction proceedings.

- End of Lease Notice: This document informs the tenant that their lease is coming to an end. It can include information regarding the renewal process or details about moving out procedures, ensuring that both the landlord and tenant are aware of expectations.

Collectively, these forms and documents help maintain clarity and protect the rights of both landlords and tenants throughout the rental process. Understanding their purpose can lead to smoother interactions and a more structured leasing experience.

Similar forms

The Rental Receipt form serves as a crucial document in rental agreements. It outlines the specifics of the rent paid by the tenant, providing a clear record for both parties. There are several other documents that share similarities with the Rental Receipt form, both in function and purpose. Here are six of them:

- Lease Agreement: This document establishes the terms of the rental between the landlord and tenant. Like the Rental Receipt, it includes key details such as the amount due and payment schedule.

- Security Deposit Receipt: Similar to a Rental Receipt, this document confirms the receipt of a security deposit amount. It typically outlines how much was paid and conditions for its return.

- Payment Ledger: A comprehensive account of all payments made by a tenant over time. It records each transaction, making it akin to a collection of Rental Receipts.

- Eviction Notice: While it serves a different purpose, an eviction notice must also document rent payments and outstanding balances. Like the Rental Receipt, it ensures transparency between landlord and tenant.

- Move-In Checklist: This document helps record the condition of the property when a tenant moves in. By documenting the move-in date, it's similar to the Rental Receipt in that it marks a significant moment in a rental agreement.

- Tenancy Agreement: Similar to the lease agreement, this outlines the rights and responsibilities of both parties. It includes rental amounts, akin to the details found in a Rental Receipt.

Dos and Don'ts

When filling out the Rental Receipt form, it is important to follow certain guidelines to ensure accuracy and clarity.

- Do: Enter the date clearly at the top of the form.

- Do: Write the tenant's full name and the property address correctly.

- Do: Specify the amount paid, ensuring the numeral is accurate.

- Do: Choose the payment method by checking the appropriate box.

- Do: Sign the receipt as the landlord or landlord's agent.

- Do: Keep a copy of the receipt for your records.

- Don’t: Leave any fields blank; fill out all required sections.

- Don’t: Use a pencil; always use a pen for legibility.

- Don’t: Forget to date the receipt; this is crucial for record-keeping.

- Don’t: Alter any information after it has been completed.

- Don’t: Provide false information; ensure accuracy in all entries.

- Don’t: Skip the witness section if applicable; it adds validity to the receipt.

Misconceptions

Understanding the Rental Receipt form is crucial for both landlords and tenants. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- A rental receipt is not necessary. Some believe that a rental receipt is optional. In reality, it is important for record-keeping and can protect both parties in case of disputes.

- Only landlords need rental receipts. Tenants also benefit from receiving a receipt. It serves as proof of payment, confirming that their rent has been paid on time.

- Payment method does not need to be recorded. Recording the payment method is essential. It provides clarity and can serve as evidence of how and when the payment was made.

- The landlord's signature is mandatory on the receipt. While a signature enhances validity, it is marked as optional. A receipt without a signature can still be legitimate if all necessary information is provided.

- Rental receipts do not require a witness. Although having a witness is optional, it can add an extra layer of security. A witness can confirm that a payment was made.

- Digital copies of receipts are insufficient. While keeping digital copies is helpful, having a physical copy is often recommended. It serves as tangible evidence that both parties can retain.

- The rental receipt form is standardized across all states. Rental receipt forms can vary significantly from one jurisdiction to another. It is essential to ensure that the form complies with local laws and regulations.

- Only the first month’s rent needs a receipt. Every payment requires a receipt, including subsequent months. Continuous documentation is important for both parties’ records.

- All renters must receive a rental receipt. In informal rental arrangements, some may forgo receipts. However, everyone, regardless of the situation, should obtain a receipt to avoid future misunderstandings.

Addressing these misconceptions can help clarify the importance of the Rental Receipt form, ensuring both landlords and tenants are properly informed and protected.

Key takeaways

Filling out and utilizing the Rental Receipt form is essential for both landlords and tenants. Here are key takeaways to consider:

- Accuracy is Crucial: Ensure that all fields are filled out accurately to avoid disputes in the future.

- Date Matters: Always include the date of payment; this helps clarify the transaction timeline.

- Identify Tenants: List all tenant names clearly. This establishes who made the payment.

- Full Address: Include the full rental address; this ties the receipt directly to the correct rental property.

- Specify the Amount: Clearly state the exact amount paid. It eliminates confusion over payment amounts.

- Payment Method: Mark the method of payment. Indicating whether it was cash, check, or money order is important for record-keeping.

- Signature Verification: The signature of the landlord or landlord’s agent is optional but adds a layer of formality to the receipt.

- Witness Option: Having a witness sign the receipt can serve as an additional verification of the transaction.

- Store Receipts Securely: Both landlords and tenants should keep copies of the receipts for future reference.

This organized approach to filling out the Rental Receipt form can enhance clarity and protect the interests of all parties involved.

Browse Other Templates

Irs Publication 503 - The assumed name is declared to be used in specified counties in Texas.

Nyc Doe Hr Connect Phone Number - Employees can maintain updated records, which is critical during audits or reviews.