Fill Out Your Pro Invoice Form

The Pro Invoice form serves as a vital document in international trade, particularly when a commercial invoice is not available. This form facilitates the declaration of values and pricing for goods being shipped, ensuring that all necessary information is communicated clearly. Key components include details about the shipper and consignee, shipment specifics, and various identification numbers, such as the customer's purchase order number and letter of credit number. Additionally, the Pro Invoice outlines transportation terms, payment methods, and a thorough itemization of the goods, including descriptions, quantities, unit prices, and total costs. A declaration affirming the accuracy of the provided information culminates the form, requiring a signature, title, and date. Properly completing this form is essential for smooth customs clearance and compliance with regulations. By understanding the Pro Invoice's structure and requirements, traders can navigate the complexities of exporting and importing with greater ease.

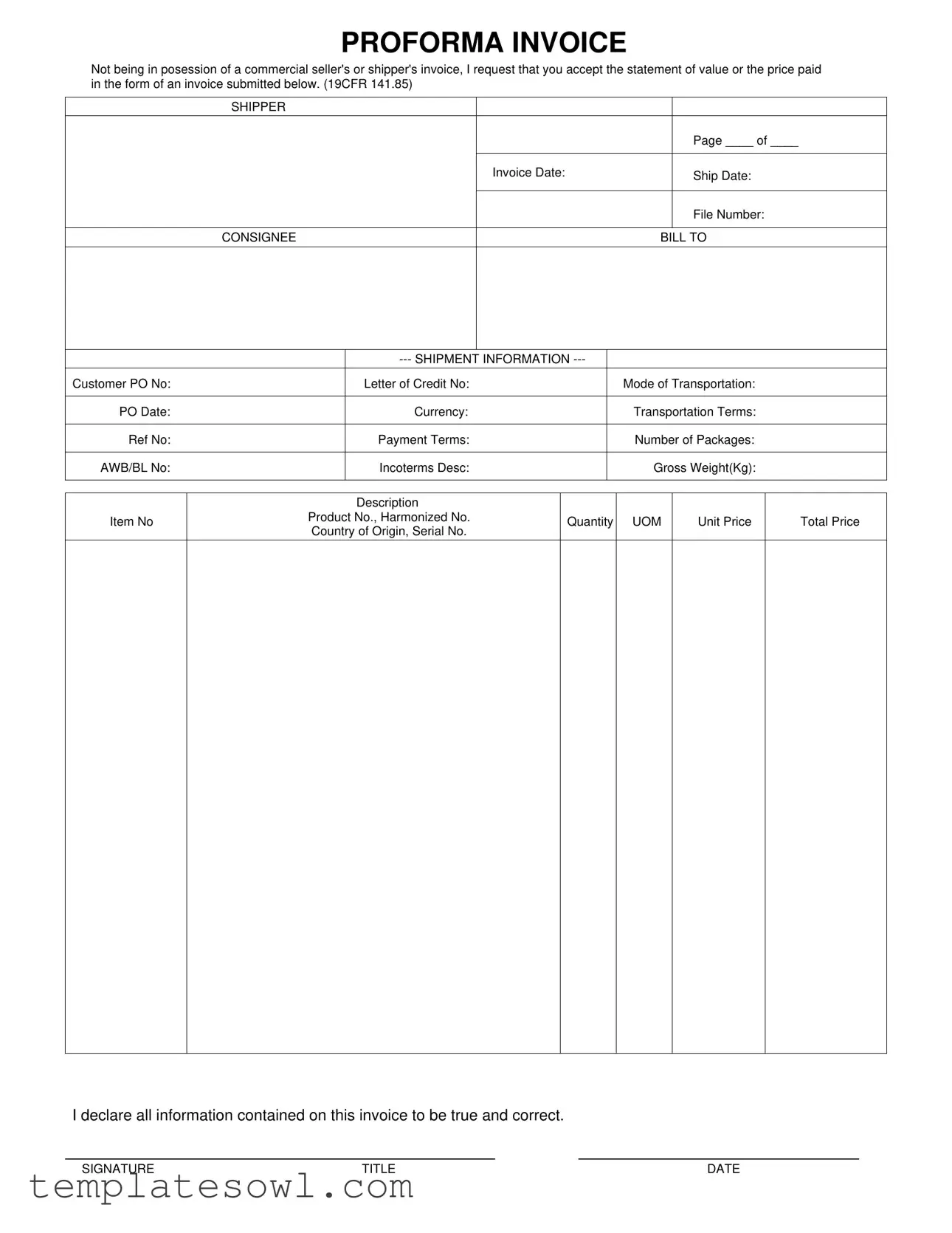

Pro Invoice Example

PROFORMA INVOICE

Not being in posession of a commercial seller's or shipper's invoice, I request that you accept the statement of value or the price paid in the form of an invoice submitted below. (19CFR 141.85)

SHIPPER |

|

|

|

|

|

|

|

|

|

|

Page ____ of ____ |

|

|

|

|

|

Invoice Date: |

|

Ship Date: |

|

|

|

|

|

|

|

|

|

|

|

File Number: |

|

|

|

|

CONSIGNEE |

|

BILL TO |

|

|

|

|

|

|

|

|

|

Customer PO No: |

Letter of Credit No: |

Mode of Transportation: |

PO Date:

Currency:

Transportation Terms:

Ref No:

Payment Terms:

Number of Packages:

AWB/BL No:

Incoterms Desc:

Gross Weight(Kg):

Item No

Description

Product No., Harmonized No.

Country of Origin, Serial No.

Quantity

UOM

Unit Price

Total Price

I declare all information contained on this invoice to be true and correct.

SIGNATURE |

TITLE |

DATE |

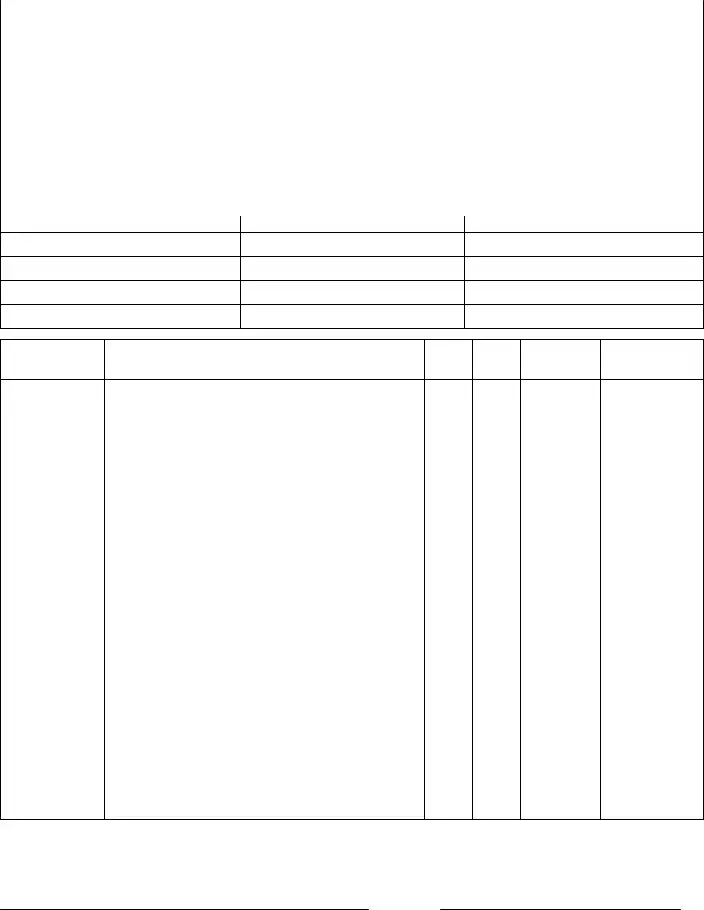

PROFORMA INVOICE CONTINUATION SHEET

Ship From:

Ship To:

Bill To:

Cust PO:

Invoice Date:

Page __________ of ______

Ship Date:

File Num:

Item No

Description

Product No., Harmonized No.

Country of Origin, Serial No.

Quantity

UOM

Unit Price

Total Price

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Proforma Invoice serves as a preliminary invoice provided to buyers before a shipment, detailing the expected costs and key transaction information. |

| Legal Basis | This invoice is governed by U.S. Customs regulations under 19 CFR 141.85. |

| Information Required | Essential details include shipper and consignee information, shipment specifics, payment terms, and itemized descriptions with pricing. |

| Declaration | The signatory must declare that all information provided in the invoice is true and correct, ensuring accountability. |

| Multiple Pages | The form may contain multiple pages, as indicated by the "Page ____ of ____" notation. |

| Currency and Terms | The invoice should specify the currency for the transaction as well as payment and transportation terms to clarify trading conditions. |

Guidelines on Utilizing Pro Invoice

Filling out the Pro Invoice form is a vital step when you lack a commercial seller’s invoice. Providing accurate information is essential to ensure smooth processing. Follow the steps below to complete the form correctly.

- Invoice Date: Enter the date you are creating the invoice.

- Ship Date: Write down the date you plan to ship the items.

- File Number: Provide any relevant file number for your records.

- Consignee Bill To: Fill in the name and address of the person or business receiving the goods.

- Customer PO No: Include the purchase order number from your customer.

- Letter of Credit No: Enter the number of any applicable letter of credit.

- Mode of Transportation: State how the items will be shipped (e.g., air, sea, road).

- PO Date: Write the date of the purchase order.

- Currency: Specify the currency in which the transaction will take place.

- Transportation Terms: Detail the terms agreed upon for the transportation of goods.

- Ref No: Include any reference number that applies.

- Payment Terms: Describe how and when payment is to be made.

- Number of Packages: Indicate how many packages will be sent.

- AWB/BL No: Provide the air waybill or bill of lading number.

- Incoterms Desc: State the applicable Incoterms for the shipment.

- Gross Weight (Kg): Enter the total weight of the shipment in kilograms.

For each item being shipped, complete the following details:

- Item No: Assign a unique number for each item.

- Description: Briefly describe the item being shipped.

- Product No., Harmonized No: Note the product number along with its harmonized code.

- Country of Origin: State where the item was manufactured.

- Serial No: If applicable, provide the item’s serial number.

- Quantity: Indicate how many units are being shipped.

- UOM: Specify the unit of measure (e.g., pieces, kilograms).

- Unit Price: Enter the price per unit.

- Total Price: Calculate and write the total cost for that item.

Finally, declare the accuracy of the information by signing and dating the invoice.

- Signature: Sign your name.

- Title: Include your job title.

- Date: Write the date of signing.

If you have more items, continue using the Proforma Invoice Continuation Sheet, providing the same details as necessary.

What You Should Know About This Form

What is a Pro Invoice form?

A Pro Invoice form is a preliminary invoice used when a seller does not possess a traditional commercial invoice. This document typically states the value of goods or the price paid for them. It helps facilitate shipping and customs processes, especially for international transactions.

When should I use a Pro Invoice?

You should use a Pro Invoice when you are shipping goods without a standard commercial invoice. This might occur if you are sending samples, goods for exhibitions, or if you’re working with a new supplier who hasn’t provided a formal invoice yet.

What information do I need to complete on a Pro Invoice?

Gather key details before filling out the form. You’ll need information about the shipper and consignee, shipment details, item descriptions, quantities, unit prices, and total costs. Be sure to accurately declare the values to prevent customs issues.

Is there a specific format I must follow?

While there's no strict format, the Pro Invoice should be clear and contain all required fields. Ensure that all necessary information is presented logically and straightforwardly to avoid confusion during the shipping process.

Do I need to sign the Pro Invoice?

Yes, signing the Pro Invoice is crucial. By signing, you declare all information provided is true and correct. This signature often carries significant weight in legal and customs proceedings.

Can I use a Pro Invoice to replace a commercial invoice?

No, a Pro Invoice is not a replacement for a commercial invoice. It serves a different purpose and is typically used for specific situations where a commercial invoice is unavailable.

How do I handle corrections on a Pro Invoice?

If you need to make corrections on the Pro Invoice, cross out the errors and provide the correct information nearby. Ensure that the corrections are clear. You should also initial any changes to confirm their accuracy.

Do I need to submit a Pro Invoice for customs?

Yes, submitting a Pro Invoice is often necessary for customs clearance if a commercial invoice is not available. Customs officials use it to assess duties and ensure compliance with relevant regulations.

Where can I find a template for a Pro Invoice?

You can find Pro Invoice templates online through various legal form websites or business resources. It's helpful to choose one that meets your specific needs and complies with your local regulations.

Common mistakes

Filling out the Pro Invoice form can seem straightforward, but many people make common mistakes that can lead to delays or complications. One prevalent issue is failing to provide complete and accurate shipment information. Details such as the Invoice Date, Ship Date, and Fill Number need careful attention. Omitting any of these can cause confusion and potential compliance issues with customs.

An additional error often encountered is not including the Customer PO No and Letter of Credit No. These identifiers are crucial for tracking and ensuring the shipment aligns with the purchase order. If these numbers are overlooked, it may complicate the transaction and hinder payment processing.

Some individuals neglect to specify the Mode of Transportation and Transportation Terms. These factors are vital for understanding how the goods will be moved and who holds responsibility during transit. Incomplete information in these sections can result in misunderstandings or liability issues down the line.

Another frequent mistake is not verifying the Currency for the transaction. Failing to state the currency used can lead to financial discrepancies and complicate the invoicing process. It is essential to be specific about whether the payment will be in USD or another currency to avoid confusion.

People also sometimes forget to fill out the Incoterms, which define the responsibilities of both buyer and seller. Not including these terms can create disputes about shipping costs and risk during transport. Clear communication around these terms can prevent many misunderstandings.

Inaccurate product information is another common mistake. Each item must have correct descriptions and codes, including the Harmonized No. and Country of Origin. Errors here can lead to logistical issues and customs penalties. Proper categorization ensures that products clear customs smoothly.

Additionally, failing to complete the total pricing section accurately can also derail an otherwise meticulous and complete form. Each item must have a corresponding Unit Price and Total Price. Inaccuracies in this area can affect financial reporting and payment schedules.

Finally, forgetting to sign and date the invoice is a mistake that seems simple but is often overlooked. This final step is crucial, as it affirms that the information provided is true and complete. Without a signature, the invoice may not be considered valid, leading to complications or refusal of payment.

Documents used along the form

The Pro Invoice form is an essential document used in international trade and shipping. It serves as a preliminary invoice to indicate the value of goods being shipped. In addition to the Pro Invoice, there are other documents that are frequently used to support various transactions and requirements. Below is a list of these important forms.

- Commercial Invoice: This document provides a detailed description of the items being sold, including quantities, prices, and terms of sale. It's usually requested for tax and customs purposes.

- Packing List: This lists all the items included in a shipment. It provides details like dimensions, weight, and packaging type, helping both the sender and recipient verify contents.

- Bill of Lading: This is a contract between the shipper and carrier, serving as the receipt for the goods. It can also be used to transfer ownership of the shipment during transit.

- Export License: Required for certain goods, this document proves that the exporter has permission from the government to ship specified items out of the country.

- Certificate of Origin: This document certifies the country where the goods are manufactured. It may be needed to comply with trade agreements or duty rates.

- Insurance Certificate: This shows that the shipment is insured and details the coverage. It protects the financial interests of both the seller and buyer in case of damage or loss during transit.

- Customs Declaration: Required by customs authorities, this form outlines the details of the shipment to assess duties and taxes and ensure compliance with local laws.

Using the right combination of these documents can greatly simplify the shipping process and ensure smooth transactions. It's important for everyone involved to understand these documents and their significance in international trade.

Similar forms

When considering various documents that are similar to the Pro Invoice form, it is important to recognize how they serve similar purposes in transactions and international shipping. Below are nine documents that share characteristics with the Pro Invoice form:

- Commercial Invoice: This document provides detailed information about goods sold, including item descriptions, quantity, and pricing. Like a Pro Invoice, it is used for customs declaration and cross-border trade.

- Proforma Invoice: Although it shares a name, the Proforma Invoice is issued before goods are shipped, serving as a preliminary bill. It outlines an estimated price and terms, similar to the Pro Invoice's purpose in absence of a seller’s invoice.

- Bill of Lading: This document acts as a receipt for cargo received by a carrier. It details shipment contents and is crucial for transportation, much like the Pro Invoice which also contains shipment information.

- Packing List: A packing list itemizes the contents of a shipment. It is often accompanied by an invoice, like the Pro Invoice, assisting with inventory management and customs clearance.

- Export Declaration: Required by government authorities, this document provides information about goods being exported. Both the Export Declaration and the Pro Invoice are essential for compliance with export regulations.

- Sales Order: This document confirms the sale of goods or services, detailing customer orders and prices. The Sales Order is similar to the Pro Invoice in that it captures transaction details and terms.

- Receipt: A receipt serves as proof of payment and can be linked to invoices. Both documents reflect transaction details, although typically a receipt is issued after payment, while a Pro Invoice is provided beforehand.

- Letter of Credit: This document guarantees payment to a seller, as long as the conditions are met. Similar to the Pro Invoice, it helps ensure that transactions proceed smoothly in international trade.

- Customs Declaration Form: A form used to declare items being imported or exported, it provides values and descriptions akin to the information contained in a Pro Invoice, which aids in customs processing.

Dos and Don'ts

When filling out the Proforma Invoice form, attention to detail is crucial. Here are seven important do's and don'ts to consider.

- Do ensure that all information is accurate and complete.

- Do use clear and understandable language for descriptions.

- Do double-check dates, including the invoice date and ship date.

- Do fill in the currency in which the transaction is made.

- Don't leave any fields blank. Every section is necessary.

- Don't forget to include your signature and date at the end.

- Don't use abbreviations that might confuse the reader.

Following these guidelines will help ensure that the Proforma Invoice is processed smoothly and without unnecessary delays.

Misconceptions

There are several misconceptions about the Pro Invoice form. Understanding the realities can help you avoid potential issues. Here are four common misunderstandings:

- 1. A Pro Invoice is the same as a Commercial Invoice. Many people believe that the Pro Invoice is equivalent to a commercial invoice. In reality, the Pro Invoice is used when a formal commercial invoice is not available. It provides a statement of value or price but does not serve as a legally binding confirmation of sale.

- 2. It does not require accurate information. Some think that because a Pro Invoice is temporary, they can provide inaccurate details. This is incorrect. Any information on the Pro Invoice must be true and correct, as the form is often used for customs and shipping purposes.

- 3. Pro Invoices are only for international shipments. People may assume that this form is exclusively for international transactions. While it is commonly used in that context, Pro Invoices can also be applicable for domestic shipments, especially when formal invoices are not available.

- 4. No signature is needed. There is a misconception that a Pro Invoice can be submitted without a signature. However, the declaration of the truthfulness of the document requires a signature, establishing accountability for the information provided.

It’s crucial to be aware of these misconceptions to ensure compliance and accuracy when using the Pro Invoice form.

Key takeaways

When completing and utilizing the Pro Invoice form, it is important to keep the following key takeaways in mind:

- The Pro Invoice should accurately reflect the value or price of the items being shipped, as it may be required by customs.

- Ensure all fields, including the shipment information and consignee details, are filled out completely to avoid delays.

- Double-check the currency and payment terms for clarity, as this can impact the acceptance of the invoice.

- Remember to include any necessary signatures and titles to validate the document.

- Retain a copy of the completed Pro Invoice for record-keeping and potential future reference.

Browse Other Templates

Change Llc Name Missouri - Indicate if your business is affected by local tax districts using the 126 form.

Dps Forms - Failure to follow guidelines may delay the processing of your application.

Heb Community Investment - Each submission will be reviewed based on specific criteria.