Fill Out Your Probate 13101 Form

The Probate 13101 form is a critical tool for anyone seeking to claim unclaimed property from a deceased individual's estate in California. This form allows eligible individuals to collect the decedent's assets without the lengthy process of probate or obtaining letters of administration. To utilize it, at least 40 days must have passed since the decedent's death, as evidenced by a certified death certificate. The form requires accurate details regarding the decedent, including their name, date of death, and location. Users must indicate whether any probate proceedings are currently ongoing or have previously occurred. Additionally, the gross fair market value of the decedent's property must fall below a specific threshold, which varies depending on the date of death. The form also requires the listing of any relevant unclaimed property identification numbers. Finally, signers must attest to their entitlement to the decedent's assets, ensuring no conflicting claims exist. Following these guidelines will facilitate a smoother path to reclaiming owed property.

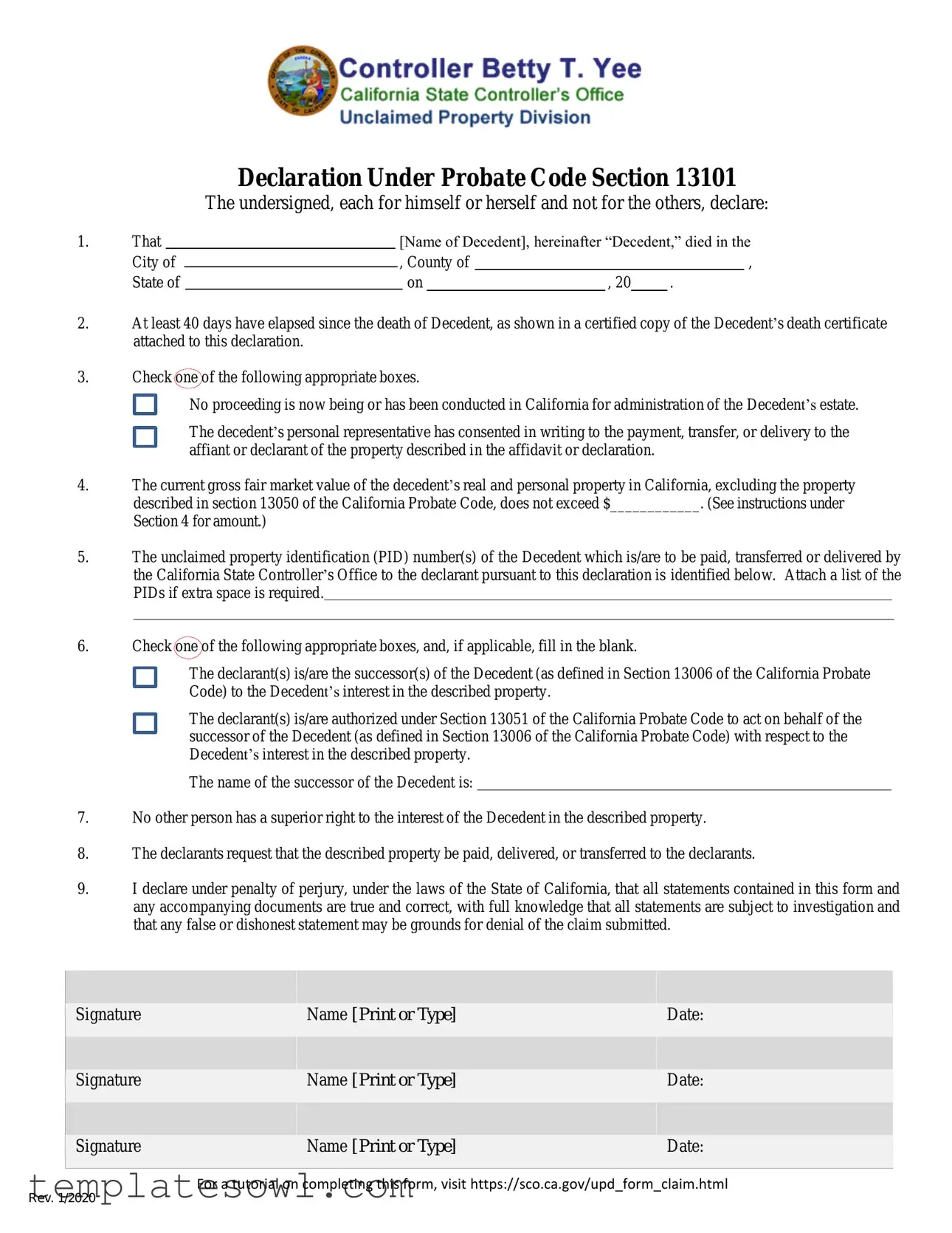

Probate 13101 Example

|

|

|

Declaration Under Probate Code Section 13101 |

|||||||||

|

|

|

The undersigned, each for himself or herself and not for the others, declare: |

|||||||||

1. |

That |

|

|

|

[Name of Decedent], hereinafter “Decedent,” died in the |

|||||||

|

City of |

|

|

, County of |

|

|

, |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of |

|

|

|

on |

|

|

, 20 |

|

. |

|

|

2.At least 40 days have elapsed since the death of Decedent, as shown in a certified copy of the Decedent’s death certificate attached to this declaration.

3.Check one of the following appropriate boxes.

No proceeding is now being or has been conducted in California for administration of the Decedent’s estate.

The decedent’s personal representative has consented in writing to the payment, transfer, or delivery to the affiant or declarant of the property described in the affidavit or declaration.

4.The current gross fair market value of the decedent’s real and personal property in California, excluding the property described in section 13050 of the California Probate Code, does not exceed $____________. (See instructions under Section 4 for amount.)

5.The unclaimed property identification (PID) number(s) of the Decedent which is/are to be paid, transferred or delivered by the California State Controller’s Office to the declarant pursuant to this declaration is identified below. Attach a list of the PIDs if extra space is required.

6.Check one of the following appropriate boxes, and, if applicable, fill in the blank.

The declarant(s) is/are the successor(s) of the Decedent (as defined in Section 13006 of the California Probate Code) to the Decedent’s interest in the described property.

The declarant(s) is/are authorized under Section 13051 of the California Probate Code to act on behalf of the successor of the Decedent (as defined in Section 13006 of the California Probate Code) with respect to the Decedent’s interest in the described property.

The name of the successor of the Decedent is:

7.No other person has a superior right to the interest of the Decedent in the described property.

8.The declarants request that the described property be paid, delivered, or transferred to the declarants.

9.I declare under penalty of perjury, under the laws of the State of California, that all statements contained in this form and any accompanying documents are true and correct, with full knowledge that all statements are subject to investigation and that any false or dishonest statement may be grounds for denial of the claim submitted.

|

|

|

Signature |

Name [Print or Type] |

Date: |

|

|

|

|

|

|

Signature |

Name [Print or Type] |

Date: |

|

|

|

|

|

|

Signature |

Name [Print or Type] |

Date: |

|

|

|

For a tutorial on completing this form, visit https://sco.ca.gov/upd_form_claim.html

Rev. 1/2020

Instructions for Completing

Declaration Under Probate Code Section 13101

This form may be used to collect the unclaimed property of a decedent without procuring letters of administration or awaiting probate of the decedent’s will if you are entitled to the decedent’s property under Section 13101 of the California Probate Code. In order for the Unclaimed Property Division to determine if you are entitled to collect the unclaimed property of the decedent, please complete this form and submit it along with your Claim Affirmation Form and all other required documents.

Section 1: Fill out name, location, and date of death for decedent which can be found on the decedent’s death certificate.

Section 2: In signing the form, you declare the statement in Section 2 is true.

Section 3: Check the applicable box. Only one of the boxes shall apply:

Check the first box if there are no court proceedings pending, nor have any been conducted to administer the decedent’s estate, and that no personal representative or special administrator has been appointed by the court to administer the decedent’s estate.

Check the second box if there is written consent from the decedent’s personal representative providing for you to receive payment, transfer or delivery of the properties listed in Section 5.

Section 4: By signing the form, you attest that the statement in Section 4 is true. Please refer to Section 13050 of the

California Probate Code to identify properties that may be excluded from the value of the decedent’s estate. Please insert the amount that corresponds with the decedent’s date of death as set forth in the below table:

If the decedent died on or before December 31, 2019 |

$150,000 |

If the decedent died on or between January 1, 2020, and March 31, 2022 |

$166,250 |

Section 5: In the space provided, list all of the State Controller's Office’s (SCO) property identification numbers (PID) you are claiming. Attach a separate sheet if extra space is needed. Please note that the claim identification number (CID) will not be accepted in lieu of listing each property identification number. Please refer to the information on your Claim Form, if

you received it from our office, or to the property detail pages you were instructed to print from the SCO’s website for the PID numbers.

Section 6: Check the applicable box. Only one of the boxes shall apply:

Check the first box if one of the following applies:

The claimant is a beneficiary listed in the decedent’s will; or,

The decedent did not leave a will, but the claimant is the decedent’s successor as defined in Section 13006 of the California Probate Code.

Check the second box if one of the following applies:

The claimant is the guardian or conservator of the estate of the person entitled to any of the decedent’s property.

The claimant is the trustee of the decedent’s trust.

The claimant is a personal representative of beneficiary(ies) of the decedent’s estate.

The claimant is an

Fill in the name of the person or the name of the trust entitled to the decedent’s property, whichever is applicable. Please refer to the California Probate Code section 13051 and 13006 for more information.

Section 7, 8 and 9: In signing the form, you declare the statements in Sections 7, 8 and 9 are true.

Signature and Date: All claimants must print their name, sign, and date this form.

For a tutorial on completing this form, visit https://sco.ca.gov/upd_form_claim.html

Rev. 1/2020

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Probate 13101 form allows individuals to claim unclaimed property of a deceased person without going through formal probate proceedings. |

| Eligibility | Claimants must be entitled to the decedent's property as defined by California Probate Code Section 13101. |

| Waiting Period | A minimum of 40 days must have passed since the decedent's death, verified by an attached death certificate. |

| Value Limit | The total current gross fair market value of the decedent's property in California cannot exceed a specified amount, based on the decedent’s date of death. |

| Identification Numbers | The form requires listing of the property identification numbers (PIDs) associated with the unclaimed property the claimant is seeking. |

| Successors | Claimants must confirm their status as successors or authorized persons under California Probate Code Sections 13006 and 13051. |

| Penalties for False Information | Submitting false information can result in denial of the claim and potential legal consequences under California law. |

Guidelines on Utilizing Probate 13101

Completing the Probate 13101 form is an essential step in claiming unclaimed property from a decedent. After you've filled out the form correctly, you'll need to submit it alongside your Claim Affirmation Form and other necessary documents. Make sure to double-check all information for accuracy to avoid any delays.

- Start with the name of the decedent. Fill in the field for the decedent's name, location, and date of death.

- In Section 2, confirm the statement is true by signing the form.

- In Section 3, check the appropriate box. Choose the first box if no court proceedings are pending for the decedent's estate. Use the second box if you have written consent from the decedent's personal representative.

- Section 4 requires you to attest that the gross fair market value of the decedent's property does not exceed the specified amount. Use the table to find the correct amount based on the decedent's date of death.

- List the property identification numbers (PIDs) you are claiming in Section 5. Attach an additional sheet if more space is needed, ensuring you do not use the claim identification number.

- Check the appropriate box in Section 6. If you're a beneficiary or successor of the decedent, select the first box. If you fall under the second category (guardian, trustee, etc.), check the second box and provide the relevant name.

- Sections 7, 8, and 9 require your declaration that these statements are true. Take your time to read them carefully.

- Finally, print your name, sign, and date the form at the bottom. Make sure each claimant does this if there are multiple signers.

What You Should Know About This Form

What is the Probate 13101 form?

The Probate 13101 form is a declaration that allows individuals to claim unclaimed property of a deceased person without going through probate. The form is filed in accordance with California Probate Code Section 13101, which enables successors to collect worth from the decedent's estate without needing letters of administration.

Who can use the Probate 13101 form?

Anyone who is entitled to the decedent's property can use this form. This includes beneficiaries named in the will, successors if there is no will, guardians or conservators of the estate, trustees of the decedent’s trust, and individuals with a Durable Power of Attorney for the decedent.

What information do I need to complete the form?

You will need the decedent's name, date of death, and the location of death. This information can be found on the decedent's death certificate. Furthermore, you need to provide the gross fair market value of the decedent's property while ensuring it does not exceed the maximum allowable amount according to the instructions for the form.

How is the gross fair market value calculated?

The gross fair market value of the decedent's property is the total worth of both real and personal property in California, excluding specific assets described in Section 13050 of the California Probate Code. Check the table in the instructions to find the maximum amounts based on the date of death.

What are the necessary supporting documents?

You need to attach a certified copy of the decedent’s death certificate, as well as any required documentation proving your right to claim the property. This often includes the Claim Affirmation Form and any additional identification numbers for the property being claimed.

What happens if I submit false information on the form?

Including false or misleading information on the Probate 13101 form can have serious consequences. It may result in the denial of your claim and could lead to legal action against you for perjury, as the form contains a declaration made under penalty of perjury.

How do I submit the Probate 13101 form?

Completion of the form can be done either by hand or electronically. Once the form is fully filled out and signed, it should be submitted to the California State Controller’s Office along with all required documentation. Check the office's website for options regarding online submissions or mailing instructions.

Is there a tutorial available for completing the form?

Yes, the California State Controller’s Office provides a tutorial to help individuals complete the Probate 13101 form correctly. A link to this tutorial can be found on their official website at https://sco.ca.gov/upd_form_claim.html.

What if I need further assistance with the Probate 13101 form?

If you have additional questions or need help with the form, consider reaching out to the California State Controller's Office, or consult an attorney who specializes in probate law. They can provide the necessary guidance specific to your situation.

Common mistakes

Filling out the Probate 13101 form can seem straightforward, but mistakes easily happen. One common error is failing to provide accurate details about the decedent and their death. It's important to ensure the name, location, and date of death match the death certificate. If this information is incorrect, it could slow down the process or even lead to denial of the claim.

Another frequent mistake involves the gross fair market value of the decedent’s estate. Many individuals overlook important guidelines when entering this amount. It's crucial to ensure the value does not exceed the limits set by California law, and it’s also essential to correctly interpret which property should be included or excluded from this calculation. Incorrect valuations can result in complications down the line.

Improperly checking the boxes in Section 3 can also lead to issues. Only one box should be checked, either indicating no proceedings are in progress or that there is written consent from a personal representative. Misunderstandings about which situation applies can cause delays or even rejections of the application.

Section 5 requires specific property identification numbers (PIDs), and failing to provide them accurately is another pitfall. Claimants sometimes confuse the PIDs with claim identification numbers (CIDs), which are not acceptable. A separate attachment for the PIDs should be included if there are multiple numbers, and missing this part can hinder the processing of the claim.

Lastly, claimants often neglect to sign and date the form properly. This is a simple yet crucial step. All declarants must print their names, sign, and date the form to confirm that all statements are true. Without these signatures, the form may be considered incomplete, delaying the entire process and creating unnecessary complications.

Documents used along the form

The Probate 13101 form is significant for individuals seeking to claim unclaimed property from a deceased person's estate without going through formal probate proceedings. It's essential to have the right accompanying documents to ensure a smooth process. Below are some forms and documents often used in conjunction with the Probate 13101.

- Claim Affirmation Form: This document confirms the identity of the claimant and their right to collect the unclaimed property. The affirmations require specific details about the decedent and the claimant's relationship to the estate.

- Death Certificate: A certified copy of the decedent's death certificate must accompany the Probate 13101 form. This document serves as proof of the decedent's passing and may also provide relevant information about their estate.

- List of Property Identification Numbers (PIDs): If multiple properties are claimed, a comprehensive list of the PID numbers must be submitted. This facilitates a clear identification of all assets that are being claimed from the California State Controller’s Office.

- Power of Attorney (if applicable): In cases where another individual is acting on behalf of the claimant, a legally executed Power of Attorney is necessary. This document grants the designated person authority to manage the property claims on behalf of the claimant.

Having these documents prepared and organized can make the claim process more efficient. It’s always wise to ensure that you have correctly filled out the forms and included all necessary attachments before submission. Doing so will help reduce the likelihood of delays or issues arising during the claims process.

Similar forms

- Affidavit of Heirship: Similar to the Probate 13101 form, this document is used to establish the heirs of a decedent when there is no formal probate. It identifies heirs and their relationship to the deceased, facilitating the transfer of property without probate proceedings.

- Small Estate Affidavit: This affidavit serves a similar purpose by allowing heirs to claim a decedent’s assets without going through probate if the estate meets specific value requirements. It simplifies the process for certain small estates.

- Claim Affirmation Form: This form accompanies the Probate 13101, helping to affirm the claim to unclaimed property. It provides additional details about the claimant’s entitlement and is necessary for processing the overall claim.

- Declaration of Personal Representative: In cases where a personal representative is appointed, this document declares their authority to act on behalf of the estate. It functions similarly by facilitating asset distribution, albeit after formal probate proceedings.

- Notice of Death: This document notifies relevant parties of a decedent's passing. While not specifically for property claims, it creates a legal record crucial for determining who may claim the estate.

- Trustee's Authorization Letter: For estates held in trust, this letter gives a trustee the authority to manage and distribute estate assets, paralleling the authority granted through the Probate 13101 form for heirs or claimants.

- Will: A last will and testament outlines how a decedent wishes to distribute their assets. While it requires probate, it serves the same ultimate goal of asset distribution as the 13101 form in situations with or without a will.

- Beneficiary Designation Form: This form is used to dictate who receives certain assets like retirement accounts or life insurance. Like the Probate 13101, it allows direct transfer of specified assets upon a person’s death.

- Petition for Probate: This document initiates formal probate proceedings, allowing a court to oversee asset distribution. While the Probate 13101 form avoids probate, both serve to resolve the decedent’s estate in different contexts.

Dos and Don'ts

When filling out the Probate 13101 form, there are important dos and don’ts to keep in mind to ensure your submission is accurate and accepted. Here’s a helpful list:

- Do ensure that you have waited at least 40 days since the decedent's death before submitting the form.

- Do check the correct box in Section 3. Only one box can be selected, so be sure to choose the one that accurately reflects the situation regarding court proceedings.

- Do attach a certified copy of the decedent’s death certificate as required in Section 2.

- Do double-check all the PIDs listed in Section 5 to confirm their accuracy, as missing or incorrect numbers can delay your claim.

- Don't forget to sign and date the form. Unsigned forms will not be considered.

- Don't leave any sections blank. Filling in all requested information prevents unnecessary rejections.

- Don't use the Claim Identification Number (CID) instead of the Property Identification Numbers (PID). Each must be listed accurately.

- Don't assume that any claims will be accepted without full compliance with the detailed instructions provided.

By following these guidelines, you can increase the chances that your Probate 13101 form will be processed smoothly and efficiently.

Misconceptions

Understanding the nuances of the Probate 13101 form is crucial for navigating the process of claiming unclaimed property. Here are seven common misconceptions regarding this form:

- The form can be used immediately after the decedent’s death. Many believe they can file the form right away. In reality, you must wait at least 40 days after the death of the decedent.

- It's necessary to have a personal representative to file the form. Some think a personal representative is needed. The form can actually be filed without one, provided there are no ongoing probate proceedings.

- Completing the form guarantees unclaimed property will be received. People may assume that just because they fill out the form, the property is automatically theirs. The Unclaimed Property Division still needs to verify eligibility before any property is transferred.

- All properties of the decedent can be claimed. It's a misconception that all of a decedent's property qualifies. The form specifically addresses only properties not exceeding certain values as specified in the Probate Code.

- Only immediate family can file the form. Some individuals believe that only family members are eligible to file. However, others, such as designated beneficiaries or legal representatives, may also qualify.

- The information on the form can be approximate. It's often thought that estimates are acceptable. In reality, accurate and verifiable information is essential when completing the form.

- Signature from one person is enough. It's a common belief that just one signature is required. If multiple people are claiming, all must sign the form.

Being informed about these misconceptions can save you time and stress in the claims process. Always ensure you have all the right details before proceeding with the Probate 13101 form.

Key takeaways

Filling out the Probate 13101 form is an important step in securing a decedent's unclaimed property. Here are key points to keep in mind:

- Eligibility: This form can be utilized to claim unclaimed property without needing letters of administration or waiting for probate.

- Information Requirements: Ensure the decedent's name, location, and date of death, as found on the death certificate, are correctly filled out.

- Timeframe: At least 40 days must pass since the decedent's death before filing this form.

- Current Property Valuation: The total gross fair market value of the estate must not exceed specified amounts. Be attentive to the valuation limits based on the decedent's date of death.

- Property Identification: Provide all property identification numbers (PIDs) for the unclaimed property you are claiming, and attach additional sheets if necessary.

- Claimant Status: Clearly indicate whether you are a successor, beneficiary, or authorized representative, ensuring you meet the qualifications set forth in the form.

- Verification: By signing, you declare that all statements are true, with an understanding that false claims could lead to denial or legal consequences.

Always verify the instructions accompanying the form to ensure compliance with the California Probate Code.

Browse Other Templates

Chp 362 Form - This form reflects the California Highway Patrol’s commitment to accountability and transparency in hiring.

Printable Voluntary Resignation Form - Remember to thank your supervisor as you complete your resignation process.

How to File Unemployment in Montana - Submitting the report on time reinforces good standing with the unemployment insurance program.