Fill Out Your Processor Certification Form

The Processor Certification form plays a crucial role in the home loan process, ensuring that all documentation provided during the application is authentic and reliable. This form is intended for loan processors, who serve as the intermediaries between borrowers and lending institutions. By completing the form, the loan processor asserts that the documents, such as pay stubs, W-2s, tax returns, and bank statements, are true and correct copies of the originals received from the borrower. The certification further entails a commitment that these documents have remained unaltered and have been received through secure means, whether by USPS mail, courier, email, or other methods. Additionally, the form encompasses the verification of employment, deposits, and rent or mortgage agreements, establishing a comprehensive framework for supporting the loan application. Thus, the Processor Certification form is more than just a document; it represents a vital step in validating the legitimacy of the information that lenders depend on to make informed decisions.

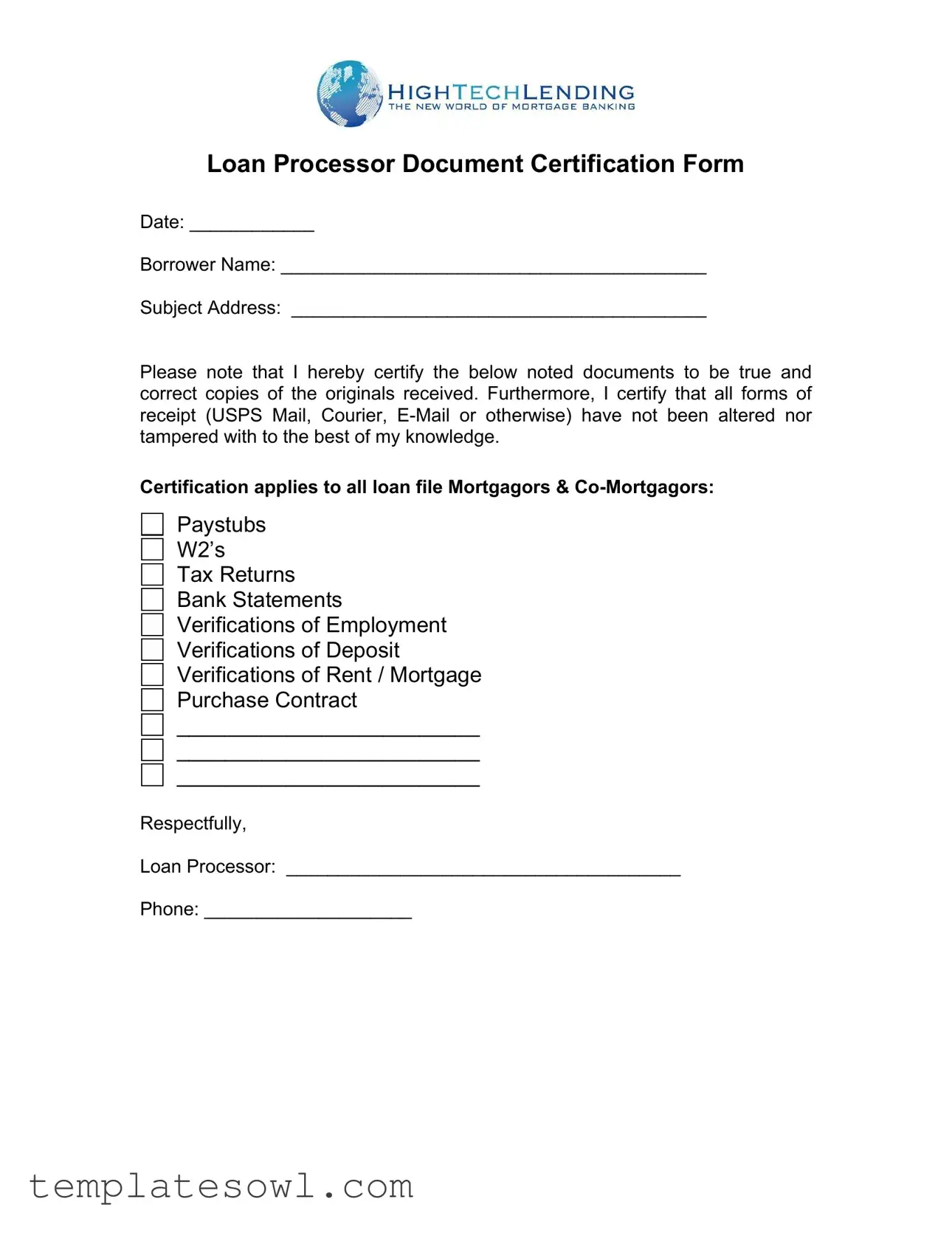

Processor Certification Example

Loan Processor Document Certification Form

Date: ____________

Borrower Name: _________________________________________

Subject Address: ________________________________________

Please note that I hereby certify the below noted documents to be true and correct copies of the originals received. Furthermore, I certify that all forms of receipt (USPS Mail, Courier,

Certification applies to all loan file Mortgagors &

Paystubs W2’s

Tax Returns Bank Statements Verifications of Employment Verifications of Deposit Verifications of Rent / Mortgage Purchase Contract

_________________________

_________________________

_________________________

Respectfully,

Loan Processor: ______________________________________

Phone: ____________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Processor Certification form certifies that certain loan documents are true and correct copies of the originals received. |

| Documents Verified | This certification applies to documents such as paystubs, W2s, tax returns, bank statements, and verifications related to employment or deposits. |

| Borrower Identification | It requires the borrower's name and subject address to clearly identify who the form pertains to. |

| Certification Statement | The signer certifies that all communication methods used, whether USPS Mail, Courier, or Email, have not been altered or tampered with. |

| Signature Requirement | The loan processor must sign the form, confirming their involvement in the document verification process. |

| Governing Law | State laws applicable to this form can vary; consult specific state regulations to determine local governing laws for document verification processes. |

Guidelines on Utilizing Processor Certification

Filling out the Processor Certification form is a straightforward process that requires accurate and complete information. Once submitted, this form will help ensure that all documentation related to a loan is certified as true and unaltered. Follow the steps below to fill out the form correctly.

- Enter the date at the top of the form in the space provided.

- Write the full name of the borrower in the designated area.

- Fill in the subject address where the loan is related.

- In the certification section, list all required documents (Paystubs, W2s, Tax Returns, etc.) and ensure that each item is accurately noted.

- Sign and date the line where it says “Loan Processor.”

- Provide a contact phone number in the space provided.

What You Should Know About This Form

What is the purpose of the Processor Certification form?

The Processor Certification form serves to certify that various financial documents related to a loan application are accurate and true copies of the originals. This provides assurance to lenders that the information has not been altered or tampered with, facilitating the evaluation and approval of loan applications.

Who needs to fill out the Processor Certification form?

This form is typically filled out by the loan processor, who is responsible for gathering and verifying the required financial documents for loan applicants. It is essential that this person has access to all necessary documentation to ensure accuracy and compliance.

What kind of documents are included in the certification?

The Processor Certification form certifies several key documents, including paystubs, W-2s, tax returns, bank statements, and verifications of employment, deposit, and rent or mortgage. Additionally, it may cover any purchase contracts related to the loan.

How does the certification benefit the loan process?

The certification helps streamline the loan approval process by providing lenders with a reliable assurance that the documents presented are authentic and have been reviewed for accuracy. This confidence can help speed up decision-making and reduce the likelihood of delays caused by document discrepancies.

Is the Processor Certification form required for all loan applications?

While many lenders require the Processor Certification form as part of the loan processing procedure, it may not be universally required for every application. The need for this form can vary based on the lender's specific guidelines and the type of loan being applied for.

What should I do if I find an error after submitting the form?

If an error is discovered after submitting the Processor Certification form, it is crucial to address the issue promptly. The loan processor should notify the lender and provide corrected information or documentation, ensuring that all records are accurate moving forward.

Can the certification be done electronically?

Yes, in many cases, the Processor Certification form can be completed and submitted electronically. This practice often simplifies the process and enhances efficiency. However, it is essential to check with the specific lender for their requirements regarding electronic submissions.

How do I fill out the date and borrower information?

When completing the Processor Certification form, the date is typically filled out first, indicating when the certification is being provided. Then, the borrower’s name and the subject property address must be accurately entered to correspond with the loan application and relevant documentation.

Common mistakes

Filling out the Processor Certification form requires attention to detail. One of the most common mistakes is failing to provide the date. Without this crucial piece of information, the certification lacks legitimacy. Ensure that the date is clearly entered at the top of the form to avoid complications later.

Another frequent error is neglecting to include the borrower’s name. The form must clearly state who the certification pertains to. Omitting the borrower’s name can lead to confusion and delays in processing.

Inaccuracies in the subject address often arise as well. Many individuals mistakenly leave this field blank or enter incorrect information. This address is vital for identifying the property in question, so it’s essential to double-check it before submission.

When certifying documents, some people fail to adequately list all relevant documents. The form explicitly requests specific items like paystubs, W2s, and tax returns. Skipping any of these documents can result in a lack of verification and could jeopardize the loan application.

It’s equally important to avoid altering any forms of receipt. Document tampering is a serious issue. Certification must state that all receipts have not been altered to maintain integrity. Ensure this statement is clear and precise.

Some processors mistakenly think that a signature is optional. In reality, the signature is mandatory for validation. Always ensure that the form includes a signature to affirm the documentation’s authenticity.

Another common mistake is the incomplete contact details. It’s critical to provide a phone number so that lenders can reach the loan processor if any issues arise. Missing contact information can slow down processing times significantly.

People often forget to check for inconsistent information throughout the form. Ensure that all details such as names, addresses, and document types match across different sections. Inconsistencies can lead to questions and potentially reject the application.

Many individuals skip over the importance of reviewing the entire form before submission. Conducting a final check can catch small mistakes that might otherwise derail the certification process.

Lastly, not keeping a copy of the submitted form is a significant oversight. Retaining a copy can provide valuable reference information if there are questions or discrepancies later. Always make sure to keep a record for your files.

Documents used along the form

When engaging in loan processing, several essential documents complement the Processor Certification form. Each of these forms serves a unique purpose in the verification and documentation process. Below is a list of commonly used forms along with brief descriptions of their functions.

- Verification of Employment (VOE): This document is used to confirm a borrower’s employment status. It typically includes details such as the borrower’s job title, salary, and length of employment, which are vital for assessing the borrower’s ability to repay the loan.

- Paystubs: Recent paystubs play a crucial role in the loan assessment process. They provide evidence of a borrower’s income and employment history, helping lenders evaluate the financial stability of the applicant.

- W-2 Forms: These forms report an employee's annual wages and the taxes withheld from their paycheck. Lenders utilize W-2s to analyze a borrower’s income over a specific period, which is important for making informed lending decisions.

- Bank Statements: Bank statements illustrate the borrower’s financial behavior and account balance over time. Lenders examine these statements to assess savings, spending habits, and overall financial health.

Understanding these related documents can greatly enhance the efficiency of the loan processing experience. Each form contributes crucial information, promoting transparency and accuracy throughout the lending process.

Similar forms

The Processor Certification form shares similarities with several important documents used in financial and legal transactions. Each document plays a critical role in verifying the accuracy and legitimacy of information. Below is a list outlining these similarities:

- Acknowledgment of Receipt Form: This document confirms that a party has received certain documents. Like the Processor Certification form, it ensures that information has been received without alteration.

- Affidavit of Identity: Often used to verify a person's identity, this document similarly verifies the authenticity of information. Both provide a legal assertion of accuracy and truth.

- Loan Application Form: This form gathers information for a loan request. Both documents require certification that the information presented is complete and correct, supporting the loan process.

- Due Diligence Checklist: Used during the loan approval process, this checklist reviews necessary documents. Similar to the Processor Certification form, it ensures that all required documentation has been received and is legitimate.

- Certification of Funds: This document certifies that adequate financial resources exist for a transaction. Like the Processor Certification form, it asserts the truthfulness of the information provided.

- Lease Agreement: A lease agreement outlines the terms of property rental. It also requires verification of the terms and conditions, similar to the certification process in the Processor Certification form.

Dos and Don'ts

When filling out the Processor Certification form, following some guidelines can help ensure accuracy and compliance. Here are seven important things to keep in mind:

- Double-check your entries. Ensure all information, particularly names and addresses, is correct.

- Use clear handwriting. If you're filling out the form by hand, legibility is crucial.

- Include all required documents. Ensure that you list every document that has been certified.

- Sign and date the form. Your certification isn't valid without your signature and the date.

- Keep copies for your records. Always retain a copy of the submitted form for your own files.

- Review confidentiality policies. Make sure you understand and comply with any privacy regulations.

- Submit by the deadline. Make sure the form is submitted within the required timeframe to avoid delays.

On the other hand, avoid these common pitfalls:

- Don't omit any information. Leaving blank spaces can lead to delays or rejection of your form.

- Don't submit unclear or altered documents. Ensure all documents are true and unmodified copies.

- Don't use abbreviations. Write out terms fully to avoid confusion.

- Don’t forget to follow submission guidelines. Adhering to the specified method of submission is important.

- Don't rush through the process. Take your time to review your entries to avoid mistakes.

- Don’t sign the form without reviewing it first. Every detail should be checked before you certify.

- Don’t ignore requests for additional documentation. If further information is needed, provide it promptly.

Misconceptions

Understanding the Processor Certification form is crucial for anyone involved in the loan process. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about this important document.

- It's just a formality. Many people believe that the Processor Certification form is a mere formality without real consequences. In reality, it serves as a legal affirmation that all documents submitted are accurate and unaltered.

- All documents must be originals. Some individuals think that only original documents can be certified. However, certified copies are acceptable, provided they accurately represent the original files.

- Only the loan processor can fill it out. While the loan processor typically completes the form, anyone authorized can certify the documents, including assistants or supervisors, as long as they have the proper knowledge.

- It guarantees loan approval. Certifying documents is not a guarantee that a loan will be approved. It merely affirms the accuracy of the documents presented.

- The form is unnecessary if all documents are submitted. Even if all documents appear accurate and complete, the Processor Certification form is essential, as it officially verifies their authenticity.

- It can be signed without verification. There’s a misconception that processors can certify documents without thorough checks. In fact, they must carefully review each document to ensure they are true and correct.

- Submitting the form is the final step in the process. Many believe that submitting the Processor Certification form concludes their role. Instead, it is just one step in a more extensive process, which continues until the loan closes.

- Certification applies only to certain documents. It is often misunderstood that certification only concerns specific paperwork. However, the form can apply to various documents, including paystubs, tax returns, and bank statements.

- There’s no accountability after signing. Some people assume that after certification, the processor has no further responsibility. On the contrary, processors remain accountable for the accuracy of the documents throughout the loan process.

By clearing up these misconceptions, everyone involved in the loan process can better understand the significance of the Processor Certification form, leading to a smoother transaction for all parties.

Key takeaways

When filling out the Processor Certification form, several key points ensure accuracy and proper use. Understanding these aspects can help streamline the documentation process significantly.

- Document Verification: The processor must verify that all documents listed on the form, such as paystubs, W-2s, and tax returns, are true and correct copies of the originals. This step is crucial for maintaining the integrity of the loan file.

- Attention to Detail: Each field in the form requires careful completion. Omissions or inaccuracies can result in delays or complications in the loan processing cycle.

- Chain of Custody: The certification includes an affirmation that the documents have not been altered or tampered with during their receipt. This helps establish a clear chain of custody, which is important for the integrity of the loan file.

- Contact Information: Including accurate and current contact information for the loan processor is essential. This allows for any necessary follow-up or clarification regarding the documents submitted.

By keeping these key takeaways in mind, you can ensure that the Processor Certification form is completed correctly and utilized effectively in the loan processing workflow.

Browse Other Templates

Knock Out Tournament - The winners’ bracket consists of teams that have won their matches.

Total Number of Allowances - The DE 35 form includes important information both in English and Spanish for accessibility.