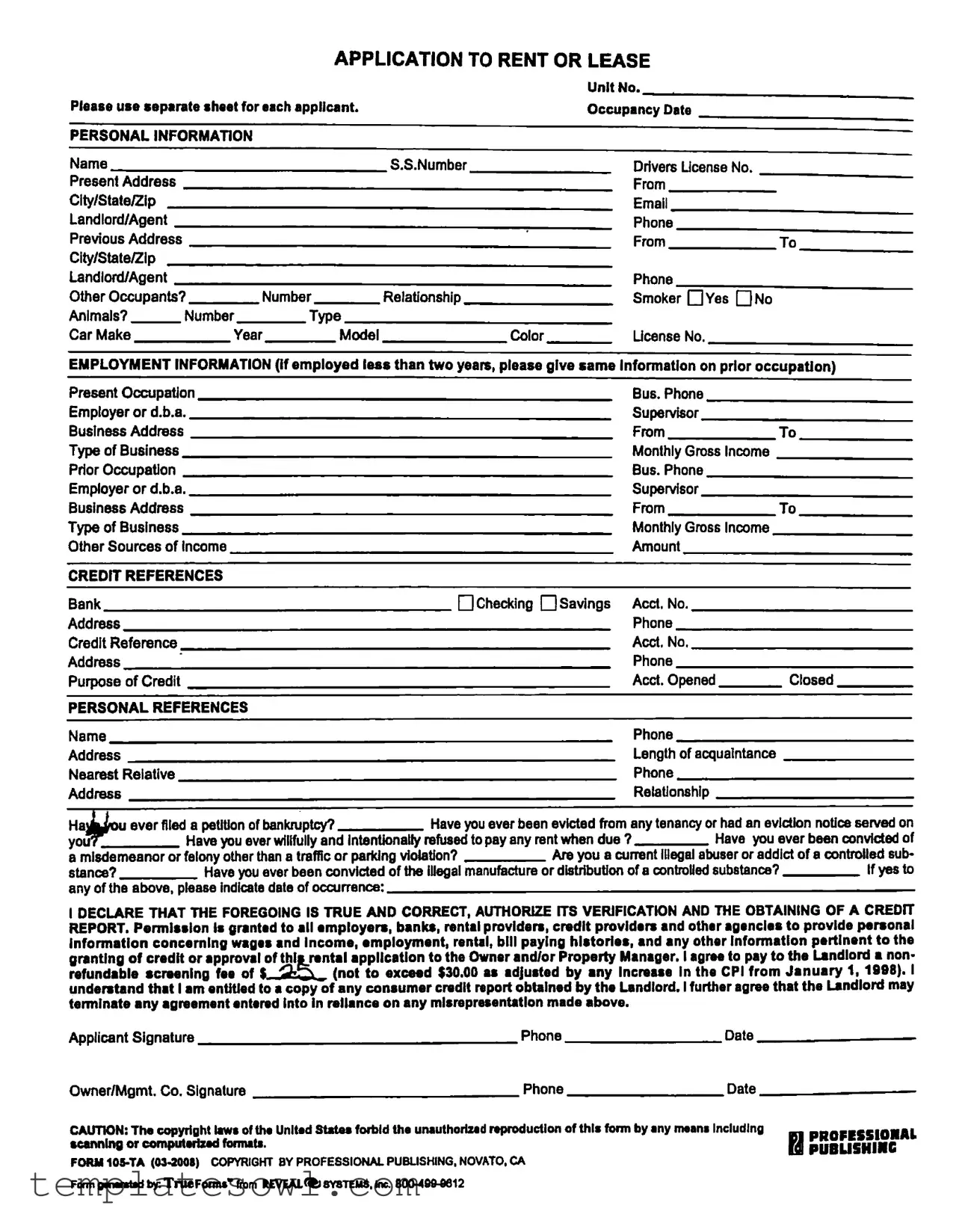

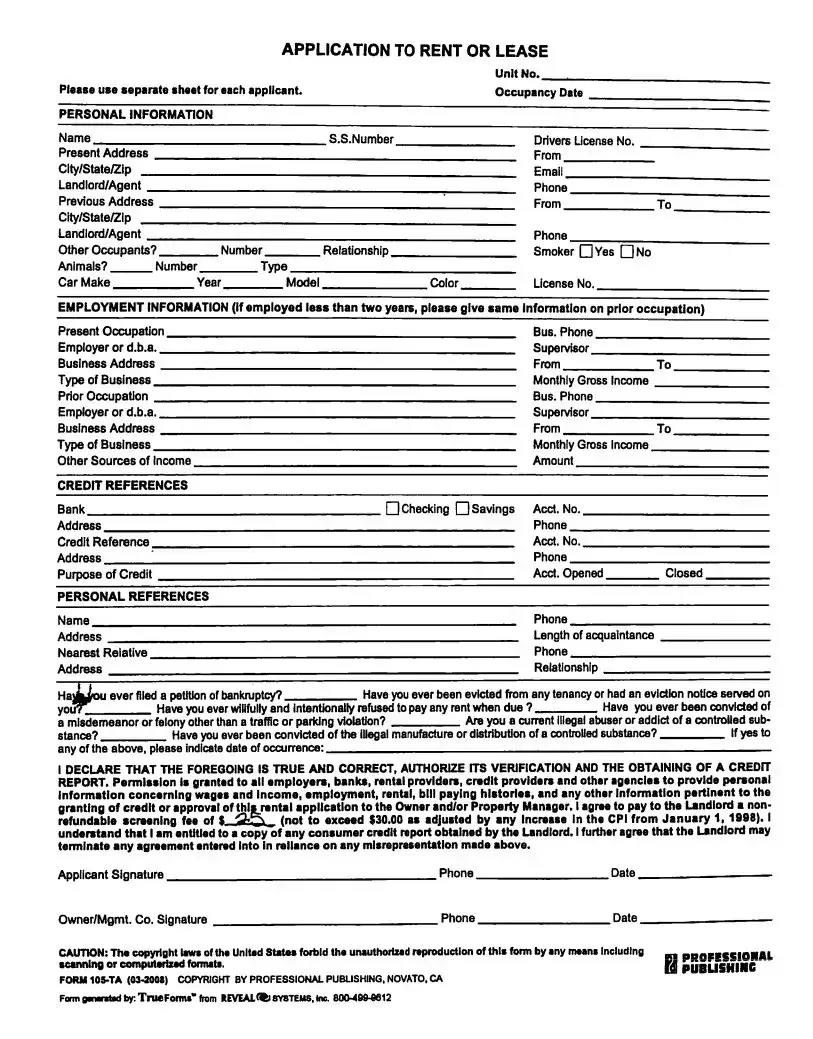

Fill Out Your Professional Publishing 105 Ta Form

The Professional Publishing 105 Ta form serves as a crucial application tool for individuals seeking to rent or lease a property. It collects essential personal information, including the applicant's name, current and previous addresses, Social Security number, and employment details. The form also queries about household members, pets, vehicles, and smoking habits, ensuring that landlords or property managers can assess potential tenants comprehensively. Employment history, credit references, and personal references are detailed sections that help gauge an applicant’s reliability and financial stability. Important questions regarding past bankruptcies, evictions, and criminal convictions provide further insight into an individual's rental history. Additionally, the form includes a signed declaration that grants permission for verification of the provided information, along with a non-refundable screening fee. This thorough approach aids landlords in making informed decisions while maintaining compliance with necessary legal protections.

Professional Publishing 105 Ta Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Professional Publishing 105 TA form is an application for individuals seeking to rent or lease a property. |

| Personal Information Required | Applicants must provide personal details, including name, current address, occupation, and references. |

| Credit and Employment Verification | Authorization is granted to verify employment and obtain credit reports for rental approval. |

| Non-refundable Fee | Applicants agree to pay a non-refundable screening fee, capped at $30, which can be adjusted by CPI increases. |

Guidelines on Utilizing Professional Publishing 105 Ta

Filling out the Professional Publishing 105 Ta form is a straightforward process. This form gathers essential information from applicants seeking to rent or lease a property. Make sure all the details you provide are accurate and complete. Here’s how to tackle it step by step.

- Gather necessary information: Before you start, collect your personal details, employment history, and credit references.

- Fill in personal information: Start with your name, current address, city, state, and zip code. Include your previous address and related landlord or agent information.

- List other occupants: If anyone else will be living with you, state their names and relationship to you.

- Provide your identification: Enter your Social Security number and driver's license number or state ID.

- Include contact information: Fill in your email and phone numbers. Make sure these are up-to-date for easy communication.

- Complete employment information: Write your current job title, employer’s name, business address, and type of business. If you’ve been there less than two years, include details of your prior employment.

- Disclose other sources of income: Mention any additional income sources, making sure to provide details like gross monthly income.

- List your credit references: Provide the names and contact information for your bank and any other credit references, including account details and supervisor names.

- Fill in personal references: List at least one personal reference, their address, and phone number.

- Answer background questions: Be honest when responding to questions about bankruptcy, rental history, convictions, and substance abuse.

- Sign and date the form: A signature is required, confirming all information is accurate. Include the date next to your signature.

Double-check all entries for accuracy before submission. This ensures a smoother application process. Keep a copy for your records and submit the form to the appropriate party, along with any required fees.

What You Should Know About This Form

What is the Professional Publishing 105 Ta form used for?

The Professional Publishing 105 Ta form is designed for individuals applying to rent or lease a residential unit. This form collects essential information from the applicant, including personal details, employment history, and credit references. It assists landlords and property managers in assessing the eligibility of applicants for tenancy.

What information do I need to provide on the form?

Applicants must provide their personal information, including name, address, and contact details. Employment information is needed, such as current occupation and employer details. Additionally, applicants should list credit and personal references, include any prior eviction history, and disclose any criminal convictions if applicable. This comprehensive data helps a landlord evaluate the potential tenant's reliability.

Do I need to provide a background check authorization?

Yes, by signing the form, you authorize the landlord to verify the information provided. This includes obtaining credit reports and contacting your employers or rental references to confirm your rental history and financial stability.

What is the non-refundable screening fee mentioned in the form?

The non-refundable screening fee, which does not exceed $30, is paid to cover the costs associated with processing your rental application. This fee may be adjusted based on the Consumer Price Index (CPI) changes. It is important to note that this fee is non-refundable regardless of whether your application is approved or denied.

Am I entitled to receive a copy of the credit report?

Yes, you are entitled to receive a copy of any consumer credit report that the landlord obtains as part of the screening process. This is your right under the Fair Credit Reporting Act, allowing you to review any information that may affect your application.

What happens if I provide false information on the application?

If any misrepresentations are found in your application, the landlord has the right to terminate any rental agreement made based on the incorrect information. It is crucial to provide truthful and accurate data to avoid any issues with your application or potential rental agreement.

Is it necessary to complete the entire form?

Yes, it is imperative to complete all applicable sections of the form. If any sections are left blank or unanswered, the landlord may consider your application incomplete, potentially delaying or denying your rental request. Each part of the form is designed to give the landlord a full picture of your rental qualifications.

Common mistakes

Many applicants make common mistakes when filling out the Professional Publishing 105 Ta form, which can lead to delays or issues with their rental application. Understanding these pitfalls is crucial for a smooth process.

One frequent error is omitting personal information. Applicants sometimes forget to include crucial details such as their Social Security Number or current phone number. Missing information can stall the application as landlords cannot complete the necessary background checks.

Another mistake involves inaccurate employment details. When listing present and prior occupations, applicants may provide incomplete information about their employers or fail to include the type of business. It is vital to offer full company names and relevant addresses, as vague or missing employment history raises red flags for landlords.

Some applicants inaccurately report their monthly gross income. It's essential to ensure that the income stated reflects all sources accurately. Landlords assess income to gauge an applicant's ability to pay rent, so presenting falsified or unclear figures can lead to immediate disqualification.

Additionally, people often forget to check the references section thoroughly. Failing to provide complete addresses or phone numbers of personal and credit references can create difficulties for landlords attempting to verify an applicant's background. All information provided needs to be valid and current to expedite the process.

Another common oversight is misrepresenting occupants. If applicants are living with others, they should accurately list all additional occupants. Leaving out information regarding household members can be viewed unfavorably and may result in further scrutiny or rejection.

Many applicants do not fully understand the legal implications of the form's statements. For instance, some might neglect to disclose bankruptcy or eviction history truthfully. This lack of transparency can lead to future disputes. Honesty is vital to building trust with landlords.

Lastly, an incomplete declaration of employment history is a common mistake. Applicants often fail to provide comprehensive details for jobs held for less than two years, resulting in incomplete profiles. It's important to give a complete employment history for accurate assessment.

By addressing these mistakes, applicants can improve their chances of a successful rental application. Review and double-checking all entries can make a significant difference.

Documents used along the form

The Professional Publishing 105 Ta form is often accompanied by various other documents that help facilitate the rental application process. Each document plays an essential role in providing additional information that landlords or property managers may need to make an informed decision. Here’s a list of some common documents that may be submitted along with the 105 Ta form.

- Credit Report Authorization Form: This document allows landlords to obtain a tenant's credit history. It gives written consent for reviewing any credit applications and payment behavior, crucial for assessing financial responsibility.

- Income Verification Document: This can include recent pay stubs, bank statements, or tax returns. It provides proof of income, helping landlords determine if the applicant can afford the rent.

- Rental History Verification Form: This form is filled out by previous landlords to affirm an applicant’s history of rental payments. It often includes details about the applicant’s behavior as a tenant, which can be important for the approval process.

- Background Check Consent Form: This allows the landlord to conduct a background check, which may include criminal history. It helps ensure the safety and security of current tenants and the property itself.

- Co-Signer Agreement: If the applicant has a limited credit history or income, a co-signer may be required. This document binds the co-signer to assume responsibility for the lease should the primary tenant fail to meet obligations.

- Pet Agreement Form: If the applicant has pets, this document outlines the terms and responsibilities related to having animals on the property. It typically includes fees, deposits, and rules regarding pet behavior.

- Security Deposit Receipt: Once the applicant has paid a deposit, this receipt serves as proof of payment. It details the amount received and any specific terms regarding the return of the deposit after tenancy ends.

By submitting these additional documents along with the Professional Publishing 105 Ta form, applicants can present a more complete picture of their background and reliability as potential tenants. This thorough approach aids landlords in making well-informed decisions regarding tenant selection.

Similar forms

- Rental Application Form: Similar to the Professional Publishing 105 Ta form, a rental application form collects personal and financial information from prospective tenants. It typically includes sections on employment, references, and consent for background checks.

- Lease Agreement: A lease agreement outlines the terms and conditions of renting a property. It complements the Professional Publishing 105 Ta form by formalizing the rental relationship after approval.

- Credit Application: Like the 105 Ta form, a credit application gathers detailed financial information. It assesses the applicant's creditworthiness and ability to pay, often including similar inquiries about income and debts.

- Background Check Authorization Form: This document authorizes landlords to conduct background checks on applicants. It parallels the 105 Ta form, as both require consent for the verification of personal and financial history.

- Employment Verification Form: An employment verification form confirms a tenant's job status and income. Like the 105 Ta form, it seeks to provide assurance to landlords regarding the applicant's ability to meet rental obligations.

- Rental History Verification Form: This form verifies previous rental agreements and payment histories from past landlords. It shares similarities with the 105 Ta form by validating an applicant’s reliability in rental agreements.

- Guarantor Application Form: A guarantor application form is completed by someone willing to cover the rent if the tenant fails to pay. It reflects similar information gathering as the 105 Ta form regarding income and obligations.

- Pet Agreement Form: This document outlines the terms for having pets in rental properties. It relates to the 105 Ta form, which asks about animals and addresses potential issues for landlords concerned about pet-related matters.

Dos and Don'ts

When filling out the Professional Publishing 105 Ta form, it’s essential to keep certain best practices in mind. Here is a list of things to do and avoid to ensure the form is completed accurately and efficiently.

- Do: Review all instructions carefully before starting to fill out the form.

- Do: Use clear and legible handwriting or type the information if possible.

- Do: Provide complete and honest answers to every question.

- Do: Double-check for any typos or errors after completion.

- Don’t: Leave any sections blank; if something doesn’t apply, write “N/A.”

- Don’t: Provide misleading or false information, as this could jeopardize your application.

- Don’t: Forget to sign and date the form, as your agreement is vital for processing.

Staying attentive to these pointers can make a significant difference in the application process. Good luck!

Misconceptions

Many people have misunderstandings about the Professional Publishing 105 TA form. Here are some common misconceptions explained:

- It's only for new tenants. This form can be used by anyone applying to rent a property, regardless of their rental history.

- My application will be automatically approved. Approval depends on multiple factors such as credit history and references.

- Providing my Social Security number is optional. To verify identity and run background checks, submitting this number is often required.

- I cannot see my credit report. You have the right to a copy of any consumer credit report obtained by the landlord.

- All landlords use this form. Not every landlord uses the Professional Publishing 105 TA. Some may have their own applications.

- Past issues won't affect my application. Issues like evictions or bankruptcies can influence the landlord's decision.

- I don’t need to sign this form. Your signature is important. It authorizes checks on your financial history and confirms accuracy.

Key takeaways

Filling out the Professional Publishing 105 Ta form requires careful attention to detail. Here are nine key points to consider:

- Separate Submissions: Use a separate sheet for each applicant to avoid confusion during processing.

- Accurate Personal Information: Ensure that your personal details, including your current and previous addresses, are accurate.

- Animal Information: If applicable, disclose any pets you have. Include the number of animals in the designated section.

- Employment History: Provide details of your current and prior occupation, especially if you haven’t been employed for two years.

- Credit References: List credit references that can validate your financial behavior. Include the supervision contact details.

- Banking Details: Accurately list your checking and savings accounts, ensuring to include the bank’s address.

- Honesty is Imperative: Answer inquiries about bankruptcy, eviction, and legal convictions honestly, as misrepresentation can lead to application denial.

- Review the Declaration: Before signing, read through your declaration to confirm the information provided is true and correct.

- Non-Refundable Fee: Be prepared to pay a non-refundable screening fee, which is capped at $30, to cover processing costs.

Understanding these points will help streamline your application process and improve your chances of success.

Browse Other Templates

How to Submit Medical Redetermination Form - Contact your caseworker if you have questions about the form.

Conditional Lien Release - Emergency medical treatment received does not create liability for URRLS according to this form.