Fill Out Your Proof Of Claim Attachment Form

The Proof of Claim Attachment form, officially recognized as Form 410A, plays a crucial role in the bankruptcy process, particularly for individual debtors. It is specifically designed to accompany a Proof of Claim submission (Official Form B410) when secured debts, such as mortgages, are involved. Essential for compliance with bankruptcy rules, this form requires a detailed breakdown of the claim, including all associated costs like interest, fees, and expenses, thereby ensuring transparency in the debtor’s financial obligations. The form must contain vital information such as the case number, names of the debtors, last four digits of the loan account number, and calculations reflecting the total debt. Specifically, it necessitates an itemization of the principal balance, any overdue interest, and additional fees as of the bankruptcy filing date. Additionally, if there are any arrears, these must also be outlined, providing clarity on the amount necessary to cure defaults. Sections within the form facilitate a comprehensive loan payment history from the initial date of default up to the filing date, reflecting all financial transactions. It also includes directives for calculating future monthly payments and projections regarding escrow accounts, ensuring that all parties are fully informed of the financial landscape. By adhering to the instructions and requirements delineated in this form, creditors can maintain their claims effectively while complying with the legal standards mandated by the Federal Rules of Bankruptcy Procedure.

Proof Of Claim Attachment Example

Official Form 410A

Instructions for Mortgage Proof of Claim Attachment

United States Bankruptcy Court |

10/20 |

Introduction

This form is used only in individual debtor cases. When required to be filed, it must be attached to Proof of Claim (Official Form B410) with other documentation required under the Federal Rules of Bankruptcy Procedure.

Applicable Law and Rules

Rule 3001(c)(2)(A) of the Federal Rules of Bankruptcy Procedure requires for the bankruptcy case of an individual that any proof of claim be accompanied by a statement itemizing any interest, fees, expenses, and charges that are included in the claim.

Rule 3001(c)(2)(B) requires that a statement of the amount necessary to cure any default be filed with the claim if a security interest is claimed in the debtor’s property.

If a security interest is claimed in property that is the debtor’s principal residence,

Rule 3001(c)(2)(C) requires this form to be filed with the proof of claim. The form implements the requirements of Rule 3001(c)(2)(A) and (B).

If an escrow account has been established in connection with the claim, Rule 3001(c)(2)(C) also requires an escrow statement to be filed with the proof of claim. The statement must be prepared as of the date of the petition and in a form consistent with applicable nonbankruptcy law.

Directions

Definition

This form must list all transactions on the claim from the first date of default to the petition date. The first date of default is the first date on which the borrower failed to make a payment in accordance with the terms of the note and mortgage, unless the note was subsequently brought current with no principal, interest, fees, escrow payments, or other charges immediately payable.

Information required in Part 1: Mortgage and Case Information

Insert on the appropriate lines:

the case number;

the names of Debtor 1 and Debtor 2;

the last 4 digits of the loan account number or any other number used to identify the account;

the creditor’s name;

the servicer’s name, if applicable; and

the method used to calculate interest on the debt (i.e., fixed accrual, daily simple interest, or other method).

Official Form 410A |

Mortgage Proof of Claim Attachment |

page 1 |

Information required in Part 2: Total Debt Calculation

Insert:

the principal balance on the debt;

the interest due and owing;

any fees or costs owed under the note or mortgage and outstanding as of the date of the bankruptcy filing; and

any Escrow deficiency for funds advanced— that is, the amount of any prepetition payments for taxes and insurance that the servicer or mortgagee made out of its own funds and for which it has not been reimbursed.

If the secured debt has merged into a prepetition judgment, the principal balance on the debt is the remaining amount of the judgment. Any post- judgment interest due and owing, fees and costs, and escrow deficiency for funds advanced shall be the amounts that are collectible under applicable law.

Also disclose the Total amount of funds on hand. This amount is the total of the following, if applicable:

a positive escrow balance,

unapplied funds, and

amounts held in suspense accounts.

Total the amounts

Insert this amount under Total debt. The amount should be the same as the claim amount that you report on line 7 of Official Form 410.

Information required in the Part 3: Arrearage as of the Date of Petition

Insert the amount of the principal and interest portion of all prepetition monthly installments that remain outstanding as of the petition date. The escrow portion of prepetition monthly

installment payments should not be included in this figure.

Insert the amount of fees and costs outstanding as of the petition date. This amount should equal the Fees/Charges balance as shown in the last entry in Part 5, Column P.

Insert any escrow deficiency for funds advanced. This amount should be the same as the amount of escrow deficiency stated in Part 2.

Insert the Projected escrow shortage as of the date the bankruptcy petition was filed. The projected escrow shortage is the amount the claimant asserts should exist in the escrow account as of the petition date, less the amount actually held. The amount actually held should equal the amount of a positive escrow account balance as shown in the last entry in Part 5, Column O.

This calculation should result in the amount necessary to cure any prepetition default on the note or mortgage that arises from the failure of the borrower to satisfy the amounts required under the Real Estate Settlement Practices Act (RESPA). The amount necessary to cure should include 1/6 of the anticipated annual charges against the escrow account or 2 months of the monthly pro rata installments due by the borrower as calculated under RESPA guidelines. The amount of the projected escrow shortage should be consistent with the escrow account statement attached to the Proof of Claim, as required by Rule 3001(c)(2)(C).

Insert the amount of funds on hand that are unapplied or held in a suspense account as of the petition date.

Total the amounts due listed in Part 3, subtracting the funds on hand, and insert the calculated amount in Total prepetition arrearage. This should be the same amount as “Amount necessary to cure any default as of the date of the petition” that your report on line 9 of Official Form 410.

Official Form 410A |

Mortgage Proof of Claim Attachment |

page 2 |

Information required in Part 4: Monthly Mortgage Payment

Insert the principal and interest amount of the first postpetition payment.

Insert the monthly escrow portion of the monthly payment. This amount should take into account the receipt of any amounts claimed in Part 3 as escrow deficiency and projected escrow shortage. Therefore, a claimant should assume that the escrow deficiency and shortage will be paid through a plan of reorganization and provide for a credit of a like amount when calculating postpetition escrow installment payments.

Claimants should also add any monthly private mortgage insurance amount.

Insert the sum of these amounts in Total monthly payment.

Information required in Part 5: Loan Payment History from the First Date of Default

Beginning with the First Date of Default, enter:

the date of the default in Column A;

amount incurred in Column D;

description of the charge in Column E;

principal balance, escrow balance, and unapplied or suspense funds balance as of that date in Columns M, O, and Q, respectively.

For (1) all subsequently accruing installment payments; (2) any subsequent payment received;

(3)any fee, charge, or amount incurred; and

(4)any escrow charge satisfied since the date of first default, enter the information in date order, showing:

the amount paid, accrued, or incurred;

a description of the transaction;

the contractual due date, if applicable;

how the amount was applied or assessed; and

the resulting principal balance, accrued interest balance, escrow balance, outstanding fees or charges balance, and the total unapplied funds held or in suspense.

If more space is needed, fill out and attach as many copies of Mortgage Proof of Claim Attachment: Additional Page as necessary.

Official Form 410A |

Mortgage Proof of Claim Attachment |

page 3 |

Mortgage Proof of Claim Attachment |

(12/15) |

|

|

If you file a claim secured by a security interest in the debtor’s principal residence, you must use this form as an attachment to your proof of claim. See separate instructions.

|

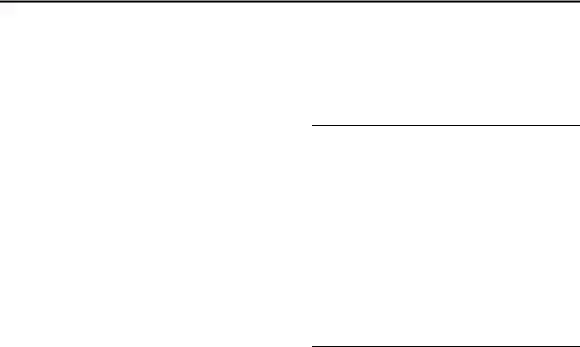

Part 1: Mortgage and Case Information |

|

|

|

Part 2: Total Debt Calculation |

|

|

|

Part 3: Arrearage as of Date of the Petition |

|

|

|

Part 4: Monthly Mortgage Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Case number: |

____________________ |

Principal balance: |

|

Debtor 1: |

____________________ |

Interest due: |

|

Debtor 2: |

____________________ |

Fees, costs due: |

|

Last 4 digits to identify: |

___ ___ ___ ___ |

Escrow deficiency for |

|

funds advanced: |

|||

|

|

__________ |

Principal & interest due: |

____________ |

Principal & interest: |

_____________ |

__________ |

Prepetition fees due: |

____________ |

Monthly escrow: |

_____________ |

|

Escrow deficiency for funds |

|

Private mortgage |

_____________ |

__________ |

advanced: |

____________ |

insurance: |

|

|

|

|

Total monthly |

|

|

Projected escrow shortage: |

|

_____________ |

|

__________ |

____________ |

payment: |

||

|

|

|

|

|

Creditor: |

____________________ |

Less total funds on hand: |

– __________ |

Less funds on hand: |

|

|

|

|

|

Servicer: |

____________________ |

Total debt: |

__________ |

Total prepetition arrearage: |

Fixed accrual/daily |

|

|

|

|

|

|

|

|

|

simple interest/other: |

____________________ |

|

|

|

–____________

____________

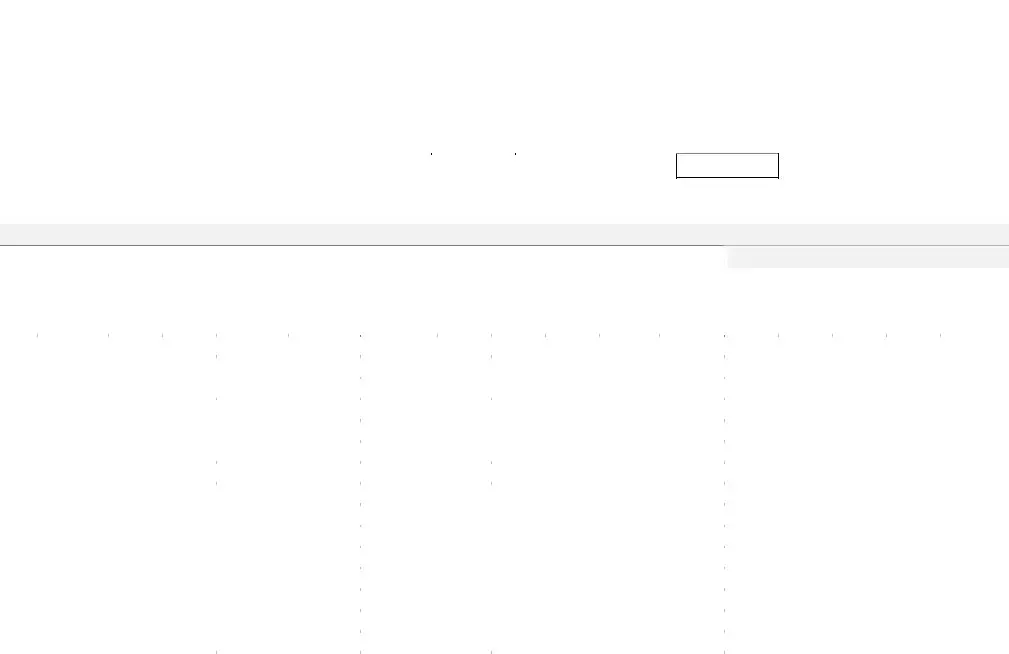

Part 5 : Loan Payment History from First Date of Default

Account Activity |

|

How Funds Were Applied/Amount Incurred |

|

|

|

|

|

Balance After Amount Received or Incurred

A. |

B. |

C. |

D. |

E. |

F. |

G. |

H. |

I. |

J. |

K. |

L. |

M. |

N. |

O. |

P. |

Q. |

Date |

Contractual |

Funds |

Amount |

Description |

Contractual |

Prin, int & |

Amount |

Amount |

Amount |

Amount |

Unapplied |

Principal |

Accrued |

Escrow |

Fees / |

Unapplied |

|

payment |

received |

incurred |

|

due date |

esc past due |

to |

to |

to |

to fees or |

funds |

balance |

interest |

balance |

Charges |

funds |

|

amount |

|

|

|

|

balance |

principal |

interest |

escrow |

charges |

|

|

balance |

|

balance |

balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Official Form 410A |

Mortgage Proof of Claim Attachment |

page 1 of __ |

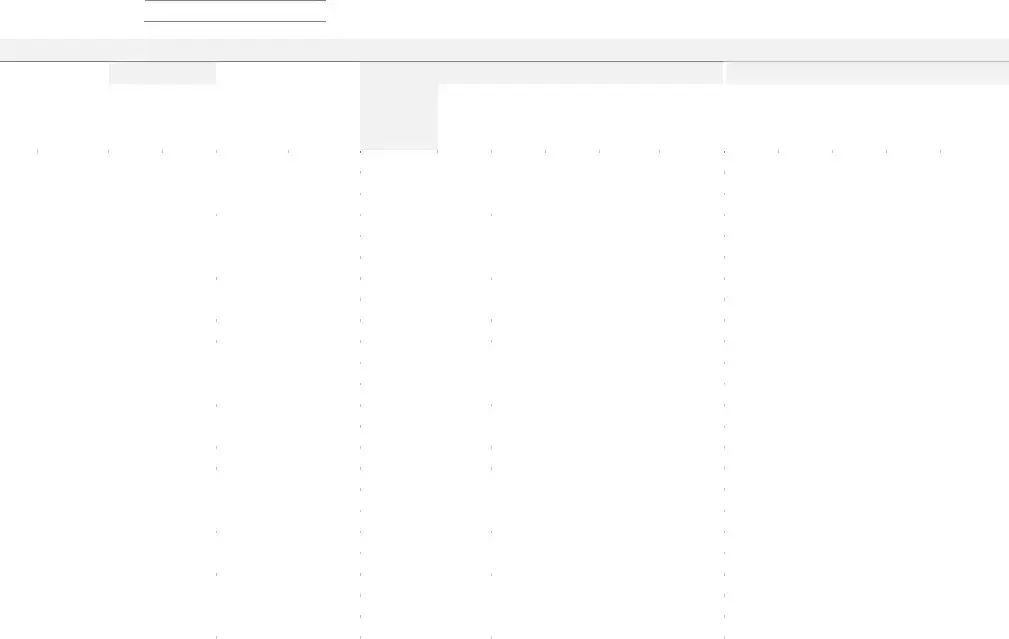

Mortgage Proof of Claim Attachment: Additional Page |

(12/15) |

|

|

Case number:

Debtor 1:

Part 5 : Loan Payment History from First Date of Default

Account Activity |

|

How Funds Were Applied/Amount Incurred |

A. |

B. |

C. |

D. |

E. |

F. |

G. |

H. |

I. |

J. |

K. |

L. |

Balance After Amount Received or Incurred

M. N. O. P. Q.

Date Contractual |

Funds |

Amount |

Description Contractual |

Prin, int & |

|

Amount |

Amount |

Amount |

Amount |

Unapplied |

Principal |

Accrued |

Escrow |

Fees / |

Unapplied |

|||

|

payment |

received |

incurred |

|

due date |

esc past due |

|

to |

to |

to |

to fees or |

funds |

balance |

interest |

balance |

Charges |

funds |

|

|

amount |

|

|

|

|

|

balance |

|

principal |

interest |

escrow |

charges |

|

|

balance |

|

balance |

balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Official Form 410A |

Mortgage Proof of Claim Attachment |

page __ of __ |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Proof of Claim Attachment form (Official Form 410A) is specifically designed for individual debtor cases to substantiate a claim against a debtor's property. |

| Governing Rules | This form follows Federal Rules of Bankruptcy Procedure, particularly Rule 3001(c)(2)(A), (B), and (C), mandating supportive documentation for mortgage claims. |

| Itemization Requirement | Rule 3001(c)(2)(A) necessitates that any proof of claim is accompanied by an itemized statement that details interest, fees, expenses, and charges included in the claim. |

| Default Information | It is essential to report all transactions related to the claim from the first date of default up to the bankruptcy petition date. |

| Escrow Account Details | If applicable, an escrow statement must also be submitted along with the Proof of Claim, as per Rule 3001(c)(2)(C). |

| Debt Calculation | Part 2 of the form requires total debt calculations, including principal balance, interest due, and any fees or costs outstanding as of the filing date. |

| Monthly Payment Breakdown | Claimants must provide details of the monthly mortgage payment structure in Part 4, outlining both principal and interest amounts as well as any escrow components. |

| Loan Payment History | Part 5 mandates a detailed loan payment history from the first date of default, outlining all payments made and charges incurred since that date. |

Guidelines on Utilizing Proof Of Claim Attachment

Completing the Proof of Claim Attachment form may feel daunting, but breaking it down step-by-step can make the process more manageable. After you've gathered the necessary information about the mortgage and financial details, you can begin to fill out the form accurately. Make sure every piece of information is filled in; omitting crucial details may delay processing.

- Start with Part 1: Mortgage and Case Information. Enter the case number, names of Debtor 1 and Debtor 2, the last four digits of the loan account number, the creditor’s name, the servicer’s name (if applicable), and the method used to calculate interest.

- Move to Part 2: Total Debt Calculation. Input the principal balance, interest due, any outstanding fees or costs, and the escrow deficiency. Calculate the total amount of funds on hand, and subtract this from the total amounts owed to derive the total debt.

- In Part 3: Arrearage as of the Date of Petition, enter the amounts for principal, interest, fees, escrow deficiency, and projected escrow shortage. Sum these values and ensure they match the figures needed to show the amount necessary to cure any default.

- Next, complete Part 4: Monthly Mortgage Payment. Fill in the principal and interest amount for the first postpetition payment, the monthly escrow portion, and include any private mortgage insurance, before calculating the total monthly payment.

- Finally, address Part 5: Loan Payment History from the First Date of Default. For each entry, add the date of default, amounts incurred, a description of charges, and the remaining balances for principal, interest, escrow, and any fees. Follow this pattern for each transaction in the timeline, and if necessary, attach more pages for additional entries.

Once the form is complete, ensure it is attached to your Proof of Claim, along with any required documentation. This thoroughness helps facilitate a smoother process as your claim moves forward.

What You Should Know About This Form

What is the purpose of the Proof Of Claim Attachment form?

The Proof Of Claim Attachment form (Official Form 410A) is specifically designed for individual debtor cases in bankruptcy. It serves to provide detailed information regarding a mortgage claim. When you file a proof of claim (using Official Form B410), this attachment is necessary to itemize any interest, fees, expenses, and charges associated with the claim as mandated by federal rules. It ensures transparency and thorough documentation for both the claimant and the court during bankruptcy proceedings.

When is the Proof Of Claim Attachment form required?

This form is required whenever a debtor is involved in bankruptcy proceedings and the claim involves a security interest in the debtor's principal residence. Specifically, if a proof of claim is submitted and includes any interest in the property, the Proof Of Claim Attachment form must accompany it. This ensures compliance with the Bankruptcy Rule 3001, which stipulates the need for detailed disclosures regarding debts and any associated escrow accounts.

What information must be included in the form?

The attachment requires several critical pieces of information. In Part 1, you must include the mortgage and case information, such as the case number, names of debtors, and the creditor’s name. Part 2 focuses on total debt calculations, including the principal balance and outstanding fees. Part 3 lists any arrearages by the petition date, while Part 4 covers monthly mortgage payment details. Lastly, Part 5 chronicles the loan payment history from the first date of default, providing a comprehensive view of all transactions.

How do I determine the first date of default?

The first date of default is identified as the first instance when the borrower failed to make a payment as per the terms of the mortgage agreement. If a borrower later brings the mortgage current without any outstanding principal, interest, fees, or escrow payments, that date will still serve as the starting point for the calculation of all subsequent debt activities recorded within the form.

What happens if I fail to attach the Proof Of Claim Attachment form?

If the Proof Of Claim Attachment form is not included with the proof of claim, it may result in complications in the bankruptcy process. The court could dismiss or deny your claim due to insufficient documentation. It is crucial to complete and submit this form accurately to ensure your claim is processed without delay and complies with bankruptcy rules.

Common mistakes

Filling out the Proof of Claim Attachment form can be intricate, and many individuals make mistakes that can complicate their bankruptcy cases. Understanding these common pitfalls can help ensure that the form is filled out accurately and efficiently.

One common error is failing to include all required information in Part 1, the Mortgage and Case Information section. Many people neglect to fill in essential details, such as the case number or the last four digits of the loan account. Omissions like these can lead to delays or even rejection of the claim.

Another mistake occurs in Part 2, where individuals often miscalculate the total debt. Some may forget to include certain fees or costs owed under the note, or fail to disclose escrow deficiencies. To accurately report the total debt, it is crucial to double-check all figures and ensure that every applicable amount is included.

In Part 3, many claimants mistakenly include the escrow portion of prepetition monthly installments when reporting arrearages. It’s essential to remember that only the principal and interest should be counted here. This misunderstanding can skew the figures and lead to potential disputes later on.

Additionally, there are individuals who do not properly calculate the projected escrow shortage. This figure should reflect the amount believed to be necessary for a functioning escrow account as of the petition date. Failing to accurately assess this can lead to further issues when trying to cure any defaults associated with the mortgage.

Part 4 of the form requires specific calculations of the monthly mortgage payment. Some affiliates make the mistake of overlooking the monthly private mortgage insurance. This oversight can result in an incomplete picture of the required monthly payments, leading to confusion for all parties involved.

Another frequent issue arises in Part 5, where individuals fail to maintain a clear and chronological loan payment history. Some claimants make entries out of order, which can disrupt clarity and make it difficult for reviewers to assess the payment history. Accurately documenting these transactions is essential.

In many cases, claimants forget to attach vital supporting documents outlined in the form’s instructions. This flaw can delay processing and hinder the ability to properly evaluate the claim. Every required document should accompany the Proof of Claim to avoid potential complications.

Finally, individuals often ignore or misinterpret the requirements surrounding the escrow account. The rules state that an escrow statement must be included if one exists. Not paying attention to this detail can undermine the integrity of the claim filed.

By avoiding these common mistakes, individuals can improve their chances of a smooth bankruptcy process. Attention to detail is crucial, and taking time to thoroughly review each section before submission can make a significant difference.

Documents used along the form

When filing a Proof of Claim Attachment form, several other documents are typically required to support the claim. Each of these documents plays a crucial role in ensuring that the process is smooth and that all necessary information is presented clearly.

- Official Form B410: This is the main Proof of Claim form that creditors must file in bankruptcy cases. It outlines the details of the debt owed and must be completed correctly for the claim to be valid.

- Escrow Account Statement: Required when there's an escrow account, this document details all transactions, current balances, and any deficiencies present in the account as of the bankruptcy filing date.

- Loan Payment History: This provides a detailed record of the borrower's payment history, including dates, amounts, and how funds were applied to the balance due.

- Default Notice: A notification that outlines the default on payments. This is important for establishing the timeline and circumstances regarding the borrower's default.

- Promissory Note: This document is a signed agreement between the lender and borrower detailing the terms of the loan. It is crucial in proving the legitimacy of the debt being claimed.

- Mortgage Document: This legal document outlines the terms and conditions of the mortgage agreement under which the claim is filed. It demonstrates the lender's right to the secured property.

- Cure Amount Statement: This statement details the amount necessary to cure any defaults as of the petition date, allowing for a better understanding of the payments required to bring the loan current.

- Recent Account Statements: Providing the latest statements can help show the current status of the loan, including any recent payments made by the borrower.

- Proof of Service: This document verifies that all necessary parties have been properly informed of the filed claim and accompanying documents, ensuring compliance with procedural rules.

Submitting these documents along with the Proof of Claim Attachment form is essential in a bankruptcy case. Each piece of documentation supports the claim and helps facilitate a clearer view of the debtor's financial situation. Proper preparation and organization of these materials can make a significant difference in the outcome of the case.

Similar forms

The Proof Of Claim Attachment form has similarities to several other documents commonly used in bankruptcy-related contexts. Here’s a list of five of these documents:

- Proof of Claim (Official Form B410): This is the primary form that individuals or businesses file to assert a claim against the debtor in bankruptcy. Like the Proof Of Claim Attachment, it requires detailed information about the claim, including the amount owed and the basis for the claim.

- Escrow Statement: Required under Rule 3001, the escrow statement must detail any amounts held in escrow related to the claim. Both documents must be filed together in situations involving a debtor’s principal residence, ensuring transparency regarding funds held for taxes and insurance.

- Itemized Statement of Fees and Charges: This document breaks down fees, interest, and other charges associated with the mortgage, similar to the itemization required in the Proof Of Claim Attachment. Both require a clear representation of the financial obligations outstanding as of the bankruptcy filing.

- Monthly Mortgage Statement: This provides a detailed breakdown of monthly payments due, including principal and interest. Like the Proof Of Claim Attachment, it documents payment history and any outstanding balances owed at the time of bankruptcy.

- Summary of Loan Payment History: Often included with proof of claim documentation, this summarizes the history of payments made, missed payments, and fees incurred. It parallels the loan payment history required in the Proof Of Claim Attachment, offering a clear view of the debtor's financial history regarding the loan.

Dos and Don'ts

When filling out the Proof of Claim Attachment form, understanding the correct procedures can greatly enhance accuracy and compliance. Below are key dos and don'ts to consider during the process.

- Do ensure all entries are precise, especially the case number and debtor information.

- Do attach any necessary documentation that supports your claim, including interest calculations and escrow statements.

- Do adhere to the format and structure outlined in the form instructions to avoid rejection.

- Do double-check your total debt calculations to confirm they align with the amounts reported on the main Proof of Claim form.

- Don't leave any required fields blank; incomplete information can lead to delays or denial of your claim.

- Don't submit the form without a thorough review, as errors can significantly impact the outcome of the bankruptcy process.

Misconceptions

There are several misconceptions surrounding the Proof Of Claim Attachment form (Official Form 410A). Understanding these can help ensure accurate and timely completion of this important document.

- This form is only for creditors. Many believe that only creditors need to file this form. However, the form is specifically designed for individual debtors in bankruptcy cases. It provides a structured way for debtors to disclose claims related to mortgages, ensuring all relevant details are addressed.

- All claims must be filed using this form. Some think that a Proof of Claim must always use the Official Form 410A. While this form is necessary for claims involving a security interest in the debtor's principal residence, not all creditors utilize it. Only those claiming a security interest need to attach it to their proofs of claim.

- Escrow statements are optional. A misconception exists that including an escrow statement is optional. In fact, if there is an escrow account related to the claim, Rule 3001 mandates that an escrow statement must accompany the Proof of Claim. This ensures all necessary financial details are presented transparently.

- The form is straightforward and requires little documentation. It is a common belief that filling out the form is simple and can be done with minimal preparation. However, accurately completing the form requires detailed information, including itemized calculations of debt, fees, and payment history. Proper documentation is key to avoid delays in processing the claim.

Key takeaways

The Proof Of Claim Attachment form (Official Form 410A) is an essential document for debtors in bankruptcy cases involving individual claims. Here are some key takeaways regarding its completion and use:

- Attachment Requirement: This form must be attached to the Proof of Claim (Official Form 410) when filing for bankruptcy. It is specifically needed when making a claim against an individual debtor's property, particularly if a security interest in their principal residence is asserted.

- Detailed Documentation: Information provided on this form needs to be thorough. It should include all transactions from the first date of default until the date of filing the petition. This includes the principal balance, interest due, any fees, costs, and an escrow deficiency if applicable.

- Total Debt Calculation: Claimants must calculate and report the total debt accurately. This requires deducting any funds on hand from the total amounts owed to arrive at the correct total debt due. It is crucial that this total aligns with what is reported on line 7 of Official Form 410.

- Cure Default Amount: When determining the amount necessary to cure any prepetition default, specific calculations need to take place. This involves considering projected escrow shortages and ensuring compliance with applicable regulations, including the Real Estate Settlement Procedures Act (RESPA).

Browse Other Templates

How to Transfer Transcript From College to College - You may check the status of your request by contacting the Registrar's office.

Lee College Admissions - Accurate information submission reduces the risk of delays in transcript retrieval.

Types of Advance Directives - Your health care agent's decisions carry the same weight as your own regarding your treatment.