Fill Out Your Proof Of Funds Letter Sample Form

In financial transactions, particularly in real estate and large purchases, demonstrating the ability to pay is critical. One effective way to provide assurance to sellers or service providers is through a Proof of Funds (POF) letter. This document serves as an official verification from a bank or financial institution, confirming a client's financial status and the availability of funds. Typically printed on the bank's letterhead, the POF letter includes essential details such as the banking institution’s name and address, as well as the account holder's information. It states the length of the banking relationship, which can be an indicator of trust and reliability, and specifies the total current cash deposits or credit available to the account holder. The letter may also highlight the value the client brings to the bank, reinforcing their credibility as a borrower or buyer. Additionally, the contact information of a bank representative ensures that any inquiries can be directly addressed. Understanding these elements is crucial for anyone preparing to engage in significant financial negotiations, as the POF letter not only affirms financial capability but also establishes a foundation for trust in the transaction.

Proof Of Funds Letter Sample Example

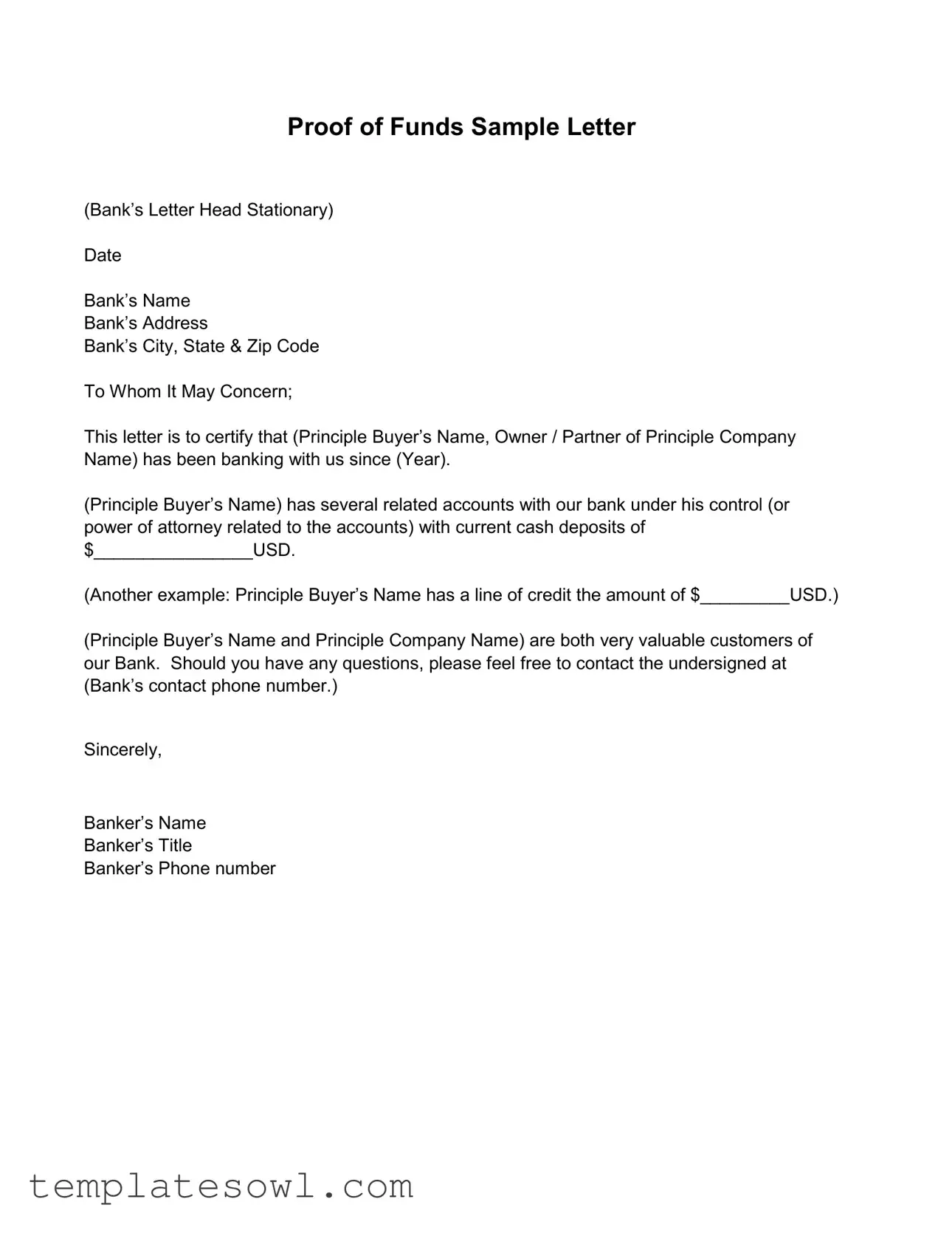

Proof of Funds Sample Letter

(Bank’s Letter Head Stationary)

Date

Bank’s Name

Bank’s Address

Bank’s City, State & Zip Code

To Whom It May Concern;

This letter is to certify that (Principle Buyer’s Name, Owner / Partner of Principle Company Name) has been banking with us since (Year).

(Principle Buyer’s Name) has several related accounts with our bank under his control (or power of attorney related to the accounts) with current cash deposits of $________________USD.

(Another example: Principle Buyer’s Name has a line of credit the amount of $_________USD.)

(Principle Buyer’s Name and Principle Company Name) are both very valuable customers of

our Bank. Should you have any questions, please feel free to contact the undersigned at (Bank’s contact phone number.)

Sincerely,

Banker’s Name

Banker’s Title

Banker’s Phone number

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Proof of Funds Letter serves to certify the financial position of a buyer, demonstrating available funds for transactions. |

| Structure | The letter is typically formatted on the bank's letterhead and includes the bank's contact information, the date, and the names of the involved parties. |

| State-Specific Forms | Each state may have specific regulations governing the use of Proof of Funds Letters, referencing state banking laws and practices. |

| Customer Relationship | The letter emphasizes the bank's client relationship with the buyer, indicating their status as a valuable customer. |

Guidelines on Utilizing Proof Of Funds Letter Sample

Once you have gathered your information, filling out the Proof of Funds Letter is straightforward. This letter is important for confirming the financial capability of the buyer in various transactions. Follow the steps below carefully to ensure all necessary details are included.

- Use Bank's Letterhead: Start the letter on the official letterhead of the bank.

- Date: Write the date at the top of the letter.

- Bank's Information: Include the bank’s name, address, city, state, and zip code below the date.

- Salutation: Address the letter with “To Whom It May Concern.”

- Certification Statement: State that this letter certifies the named buyer's banking relationship. Include the buyer’s full name and their role (e.g., Owner/Partner) along with the name of their company.

- Account Information: Mention how long the buyer has been with the bank, and then provide details about their accounts. Include the current cash deposits or the amount available on a line of credit, as applicable, in USD.

- Customer Value: State that the buyer and their company are valued customers of the bank.

- Contact Information: Offer a point of contact for any questions. Provide the contact's name, title, and phone number.

- Closing: Sign off the letter with “Sincerely,” followed by the banker’s name and title.

Now that the letter is filled out, it will serve as an official confirmation of the buyer's financial standing. Ensure that all information is accurate before sending it to the concerned party.

What You Should Know About This Form

What is a Proof of Funds Letter?

A Proof of Funds Letter is a document issued by a financial institution that verifies an individual’s or business’s financial ability to complete a transaction. It typically outlines the cash deposits or available lines of credit held by the individual or entity, and serves as assurance to third parties that the necessary funds are available for a specific purpose, such as a real estate purchase or business investment.

Who typically issues a Proof of Funds Letter?

The letter is usually issued by banks or financial institutions where the individual or business maintains accounts. Bank representatives, such as personal bankers or managers, usually prepare the letter on official bank letterhead, ensuring authenticity and validity.

What information should be included in a Proof of Funds Letter?

A comprehensive Proof of Funds Letter should include the following details: the date of issuance, the bank’s name and address, the name of the account holder or entity, the duration of the banking relationship, the current available cash deposits, any specific lines of credit, and a statement regarding the customer’s status as a valuable client of the bank. Contact information for the bank representative should also be provided for any follow-up inquiries.

How is the Proof of Funds Letter used?

This letter is primarily used in transactions requiring financial verification. Real estate agents, property sellers, and lenders often request the letter as part of the negotiation or approval process. It provides assurance that the buyer has the financial means to complete the purchase.

Is a Proof of Funds Letter the same as a bank statement?

No, a Proof of Funds Letter is not the same as a bank statement. A bank statement provides detailed account activity over a specific period, while a Proof of Funds Letter is a summary document certifying the availability of funds at the time of issuance. The latter is specifically intended for verifying financial capability for a transaction.

Can a Proof of Funds Letter expire?

Yes, a Proof of Funds Letter can have an implicit expiration based on the nature of the transaction. While the letter itself may not have a specified expiration date, its relevance diminishes as time passes, especially if the transaction involves large sums of money or if market conditions change. It is advisable to obtain a new letter if significant time has elapsed.

How can one obtain a Proof of Funds Letter?

Individuals or businesses should contact their bank to request a Proof of Funds Letter. This process may involve verifying identification and providing information about the accounts in question. It may be helpful to inform the bank of the intended use of the letter to ensure that all necessary details are included in the document.

Common mistakes

Many individuals encounter issues when completing the Proof of Funds Letter Sample form. These mistakes can create significant complications down the line. Being aware of these pitfalls can help ensure a smooth process.

One common mistake is failing to provide accurate account details. The bank must clearly identify the accounts being referenced. Omitting this information can lead to misunderstandings or questions about the financial standing of the buyer. A comprehensive overview reassures the reader.

Another frequent error is incorrect or vague financial figures. When stating the amount of cash deposits, it is critical to provide an exact dollar amount. Using vague terms like "substantial" or "a lot" does not convey the necessary information. Clarity in numbers is essential for establishing credibility.

Not including the proper date on the letter can also be an oversight. The date establishes the timeliness of the proof of funds. Without it, the letter may seem outdated or irrelevant. Always ensure that the date is current and visible at the top of the letter.

People often forget to use the bank's official letterhead. This detail is vital as it adds legitimacy to the document. Submitting a letter without the bank's branding could raise questions about its authenticity. Always ask the bank for a letter printed on official stationery.

Some individuals neglect to have the letter signed by an authorized bank representative. A signature provides verification that the information presented is accurate and trustworthy. An unsigned letter may be easily dismissed and not taken seriously.

Additionally, many leave out critical contact information for the bank. Readers may have questions, and they need to know how to reach someone at the bank for clarification. Providing a contact number adds an extra layer of transparency and accessibility.

Lastly, some individuals fail to proofread the letter before submission. Grammatical errors or typos can detract from its professionalism. A well-crafted letter reflects the seriousness of the transaction. Careful review is essential to ensure the letter meets all necessary standards.

Documents used along the form

A Proof of Funds Letter is an important document used in various transactions, especially in real estate and business deals. When preparing this letter, you might also need other forms and documents to support your application or transaction. Below is a list of these additional documents, along with brief descriptions of each.

- Bank Statements: These provide a detailed account of an individual's or business's financial activity over a specific period. They help verify the proof of funds by showing consistent cash deposits and account balances.

- Letter of Intent: This document outlines the intention of the buyer to engage in a particular transaction. It sets the stage for negotiations and can complement the proof of funds by showing seriousness.

- Pre-Approval Letter: This letter from a lender confirms a buyer's mortgage pre-approval. It assures sellers that the buyer has the financial means to purchase the property.

- Income Verification: Often in the form of pay stubs or employment letters, this document demonstrates an individual's income level. It can support the proof of funds by indicating ongoing financial stability.

- Tax Returns: These documents provide insight into an individual’s or business’s financial health over the past few years. They can serve as evidence of income and financial responsibility.

- Asset Statements: Documents that outline the value of various assets, such as investment accounts or property holdings. These statements support the proof of funds by showcasing the overall financial picture.

- Business Financial Statements: These include balance sheets and income statements of a business. They provide insight into the financial health of the business and are useful for transactions involving business purchases or investments.

- Identification Proof: This could be a driver's license or passport. It verifies the identity of the person who is providing the proof of funds, ensuring legitimacy in transactions.

Each of these documents plays a significant role in reinforcing the claims made in the Proof of Funds Letter. Together, they create a comprehensive view of an individual’s or business’s financial status, which is crucial in many financial dealings.

Similar forms

Below are nine documents similar to a Proof of Funds Letter. Each one serves to verify financial status or the availability of funds. While their specific purposes may vary, they generally provide assurances about an individual's or entity's financial capabilities.

- Bank Statement: This document provides a detailed summary of an account's activity over a specific period. It confirms the account balance and shows transactions, reinforcing the holder's financial standing.

- Letter of Credit: Issued by a bank, this document guarantees a buyer's payment to a seller, ensuring that funds are available under specified conditions. It acts as a safety net in transactions.

- Financial Statement: Companies often prepare this document to summarize their financial position. It includes balance sheets and cash flow statements, presenting a clear picture of assets, liabilities, and capital.

- Asset Verification Letter: Issued by a financial institution, this letter details the assets held by a client. It serves to verify ownership and worth, vital for loans and investment opportunities.

- Letter of Intent (LOI): Common in business transactions, an LOI outlines a party's intention to engage in a deal. It can stipulate terms, including financial commitments, establishing an early understanding between parties.

- Paystub or Salary Statement: This document confirms an individual's income through regular payments. Employers issue it, providing insight into financial health for loan applications or other financial assessments.

- Tax Returns: Personal or business tax returns can serve as proof of income or revenue. They provide a comprehensive view of earnings and can be requested by lenders to assess financial viability.

- Credit Report: This report compiles an individual’s or business’s credit history, illustrating their borrowing and repayment patterns. It is crucial for lenders to evaluate creditworthiness.

- Investment Account Statement: This document summarizes the holdings and value of investments for a given period. It assures potential stakeholders of the financial stability and resources available for future endeavors.

Dos and Don'ts

When filling out the Proof Of Funds Letter Sample form, here are some do's and don'ts to keep in mind:

- Do include accurate details. Ensure that all names, dates, and amounts are correct to avoid any confusion.

- Do use the bank's official letterhead. This adds credibility to the document.

- Do clearly state the purpose of the letter. Explain the context of the funds being certified.

- Do provide contact information. This allows the recipient to reach the bank with any questions.

- Do keep the tone professional. Maintain a formal yet approachable style in your wording.

- Don't omit any crucial information. Missing details can lead to questions and delays in processing.

- Don't use informal language. Keep the letter respectful and straightforward.

- Don't include irrelevant information. Stick to the purpose of proving funds.

- Don't forget to sign the letter. A signature validates the document.

- Don't use outdated information. Ensure all figures and account statuses are current.

Misconceptions

Understanding the Proof of Funds Letter can be crucial for various transactions. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- All banks provide the same type of POF letter. Different banks may have varying formats and requirements for issuing a Proof of Funds letter. Not all institutions follow the same procedures, so it is essential to confirm your bank's specific requirements.

- This letter guarantees funding. A Proof of Funds letter simply shows that a buyer has the necessary funds available. It does not guarantee that these funds are committed or ready for a specific transaction.

- Only liquid cash counts as proof of funds. While cash deposits are often highlighted, other assets like lines of credit can also be included. This provides a broader picture of a buyer's financial position.

- A POF letter can be used for any transaction. Some transactions, especially larger or more complex deals, may require specific wording or details in the POF letter. Always check the requirements for your particular situation.

- Anyone can request a Proof of Funds letter. Typically, only the account holder or an authorized representative can request this letter. It is not available to just anyone.

- A POF letter does not expire. Although a POF letter may not have an explicit expiration date, it is generally recommended to obtain one shortly before a transaction to ensure it's still relevant and accurate.

Being clear about these misconceptions is important. It helps ensure that the Proof of Funds letter serves its purpose effectively.

Key takeaways

When preparing and using a Proof of Funds Letter, consider the following key points:

- Shop for a Reputable Bank: Choose a bank that has a solid reputation and is recognized in the community.

- Use Official Letterhead: The letter must be on the bank’s official letterhead to ensure authenticity.

- Include Your Information: Clearly state the principal buyer’s name and the company they represent.

- Specify the Account Details: Provide current cash deposits or relevant account information, like a line of credit.

- State the Banking Relationship: Mention how long the principal buyer has been a customer to emphasize their reliability.

- Contact Information: Leave a contact number for any inquiries; this adds credibility and encourages verification.

- Be Clear and Concise: Use straightforward language to ensure the letter is easily understood.

- Request Confirmation: It’s helpful to ask the bank to confirm the letter’s validity if needed.

Following these guidelines will help create a professional and effective Proof of Funds Letter.

Browse Other Templates

Community Service Hours Template - Validate your volunteer experience with a clear record.

Seterus Mortgage Login - This form requires borrowers to declare their intentions regarding the property during the short sale process.

Papa Johns Jobs - Review the job duties before confirming your ability to perform them.