Fill Out Your Provider Information Update Form

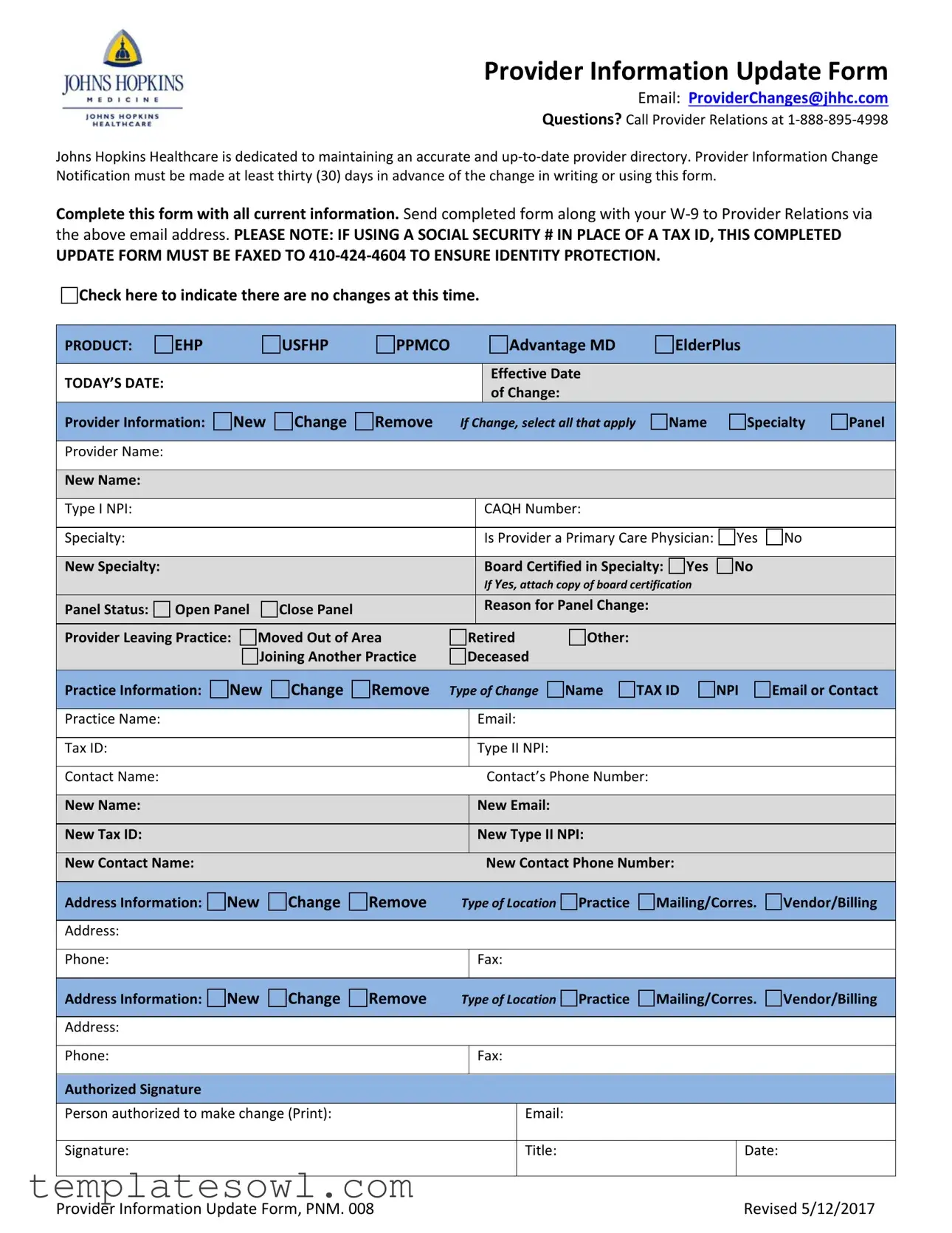

The Provider Information Update form is a crucial tool designed to ensure that Johns Hopkins Healthcare maintains an accurate and comprehensive provider directory. It serves several purposes, including facilitating the notification of changes to provider information, which must be reported at least thirty days in advance, whether in writing or via this specific form. To effectively implement these updates, providers are required to fill out the form with their latest details and submit it alongside their W-9. For added security, if a provider opts to use a Social Security number instead of a Tax ID, the completed form must be sent via fax rather than email to protect their identity. The form covers a range of areas including changes in provider's name, specialty, panel status, and the associated practice information. Additionally, it contains sections for both current information and new updates, ensuring that a comprehensive record is maintained. Providers can select various options to indicate whether they are making changes, joining another practice, or if no changes are necessary at this time. To facilitate communication, questions can be directed to Provider Relations through a dedicated phone line or email, reflecting the organization’s commitment to a responsive and collaborative environment.

Provider Information Update Example

Provider Information Update Form

Email: ProviderChanges@jhhc.com

Questions? Call Provider Relations at

Johns Hopkins Healthcare is dedicated to maintaining an accurate and

Complete this form with all current information. Send completed form along with your

UPDATE FORM MUST BE FAXED TO

Check here to indicate there are no changes at this time.

Check here to indicate there are no changes at this time.

|

PRODUCT: |

EHP |

|

USFHP |

PPMCO |

|

|

|

|

Advantage MD |

ElderPlus |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TODAY’S DATE: |

|

|

|

|

|

|

|

|

|

Effective Date |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

of Change: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Provider Information: |

New |

Change |

Remove |

|

If Change, select all that apply |

Name |

|

Specialty |

Panel |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provider Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type I NPI: |

|

|

|

|

|

|

|

|

CAQH Number: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Specialty: |

|

|

|

|

|

|

|

|

Is Provider a Primary Care Physician: |

|

Yes |

No |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

New Specialty: |

|

|

|

|

|

|

|

|

Board Certified in Specialty: Yes |

No |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

If Yes, attach copy of board certification |

|

|

|

|

||||

|

Panel Status: |

Open Panel |

Close Panel |

|

|

|

|

|

Reason for Panel Change: |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Provider Leaving Practice: Moved Out of Area |

|

Retired |

Other: |

|

|

|

|

|

|||||||||

|

|

|

Joining Another Practice |

|

Deceased |

|

|

|

|

|

|

|||||||

|

Practice Information: |

New |

Change |

Remove |

Type of Change |

Name |

TAX ID |

NPI |

Email or Contact |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Practice Name: |

|

|

|

|

|

|

|

Email: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Tax ID: |

|

|

|

|

|

|

|

Type II NPI: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Contact Name: |

|

|

|

|

|

|

|

|

Contact’s Phone Number: |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

New Name: |

|

|

|

|

|

|

|

New Email: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Tax ID: |

|

|

|

|

|

|

|

New Type II NPI: |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Contact Name: |

|

|

|

|

|

|

|

New Contact Phone Number: |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Information: |

New |

Change |

Remove |

|

Type of Location |

Practice |

Mailing/Corres. |

Vendor/Billing |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Phone: |

|

|

|

|

|

|

|

Fax: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Address Information: |

New |

Change |

Remove |

|

Type of Location |

Practice |

Mailing/Corres. |

Vendor/Billing |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Phone: |

|

|

|

|

|

|

|

Fax: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Person authorized to make change (Print): |

|

|

|

|

|

|

|

Email: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

Title: |

|

|

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provider Information Update Form, PNM. 008 |

Revised 5/12/2017 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Email Contact | Providers can send updates to ProviderChanges@jhhc.com. |

| Advance Notification Requirement | Changes must be notified at least 30 days in advance in writing or through this form. |

| Identity Protection Procedure | If using a Social Security Number instead of a Tax ID, fax the completed form to 410-424-4604. |

| Governance | This form adheres to state regulations under [specific state law, if applicable]. |

Guidelines on Utilizing Provider Information Update

Once the Provider Information Update form is completed, it should be submitted to ensure that your provider information remains accurate. This is important for maintaining a reliable provider directory. Following are the steps to fill out the form correctly.

- Provide your email address at the top of the form.

- If you have questions, you can call Provider Relations at 1-888-895-4998.

- Check the box if there are no changes to report at this time.

- Fill in today’s date and the effective date of the change, if applicable.

- Indicate if you are adding, changing, or removing provider information.

- Enter the provider's name, specialty, and indicate if the provider is a Primary Care Physician.

- If there are changes, enter the new information where indicated, including New Name, Type I NPI, CAQH Number, and more as needed.

- Complete the panel status section by selecting Open or Closed, and state the reason for the change if applicable.

- For practice information, repeat the steps to indicate any new changes, including practice name, contact name, and email.

- Provide the address information and mark the type of location it refers to, such as practice or mailing address.

- Ensure the Authorized Signature section is filled out, including the printed name, email, title, and date.

After completing the form, ensure that your W-9 is included. Send the document to Provider Relations via the provided email. If using a Social Security number instead of a tax ID, fax the form to the specified number for identity protection.

What You Should Know About This Form

What is the purpose of the Provider Information Update form?

The form is designed to help maintain an accurate and up-to-date provider directory for Johns Hopkins Healthcare. It allows providers to inform the organization about changes in their information, ensuring that records remain current.

How can I submit the completed form?

You can submit the completed Provider Information Update form via email to ProviderRelations@jhhc.com. If you are using a Social Security Number instead of a Tax ID, the completed form must be faxed to 410-424-4604 for identity protection.

What information is required on the form?

The form requires detailed information including your current name, specialties, NPI numbers, contact details, and any changes to your panel status. Be sure to attach your W-9 with the form as well.

How far in advance should I notify about my changes?

Changes must be communicated at least thirty (30) days in advance. This notice period allows for proper updates to be made in the provider directory.

What should I do if there are no changes to my information?

If there are no changes at this time, simply check the designated box on the form to indicate that your information remains the same.

Who should I contact if I have questions about the form?

If you have any questions or need assistance while filling out the form, you can call Provider Relations at 1-888-895-4998 for support.

Is board certification information necessary?

If you have board certification in your specialty, you should attach a copy of your certification to the form. This documentation is essential for updating your records accurately.

What should I do if I am leaving practice or relocating?

In such cases, you are required to indicate the reason for the panel change on the form. Choose the relevant option, such as "Provider Leaving Practice" or "Moved Out of Area," to ensure proper documentation of your status.

Can I modify different categories of information on the same form?

Yes, the form allows you to change various categories of information, including provider details, practice information, and address specifics. Just mark each section clearly to indicate what needs to be updated.

Common mistakes

Filling out the Provider Information Update form is a crucial task that requires attention to detail. A common mistake people make is failing to provide complete and current information. Omitting essential details can lead to delays in processing the update. Ensure that every section is filled out accurately.

Another frequent error is neglecting to attach the W-9 form. This form is vital for verification and tax purposes. Without it, updates may not be accepted. Double-check to confirm all necessary documents are included before submitting.

People often forget to indicate whether there are no changes at the time of submission. This oversight can create confusion about the provider's current status. If there are no updates, make sure to check the designated box on the form.

Incorrectly filling out the date fields is another issue. Both the current date and the effective date of change must be clearly stated. If these dates are not correct, it may cause problems with implementation and updates.

Many individuals fail to include all applicable changes in the section regarding the provider's information. Each relevant change should be marked clearly, whether it’s a new name, a change in specialty, or an adjusted contact method. This helps ensure that the provider directory remains accurate.

Using a Social Security number instead of a tax ID number without following the specific instructions can lead to serious identity protection issues. If opting for the social security number, remember that the completed form must be faxed to the designated number, which is crucial for security.

It’s easy to overlook the panel status section. This part must be clearly marked as either open or closed. Failing to do this may lead to miscommunication regarding the provider's availability, affecting patient referrals and access to care.

In some cases, individuals forget to provide a valid contact number. This information is important for follow-up questions or clarifications. Always include a phone number where you can be reached easily.

Lastly, people sometimes neglect to have the form signed by an authorized person. Without a signature, the submitted form may not be valid. Ensure that all required signatures are in place before sending the form for processing.

Documents used along the form

The Provider Information Update Form is essential for healthcare providers to notify Johns Hopkins Healthcare of any changes in their information. This form is often accompanied by several other documents to ensure that all necessary updates and verifications are made effectively. Below is a list of related forms and documents that may be required during this process.

- W-9 Form: This form provides the requester with the correct Taxpayer Identification Number (TIN) and certification. It is necessary for tax reporting and is submitted alongside the Provider Information Update Form.

- CAQH Application: Completed by healthcare providers to create a universal credentialing database, the CAQH application allows providers to share their credentials with multiple insurers and facilitates smoother updates.

- Credentialing Application: This document is used by healthcare providers to formally apply for credentialing with a specific healthcare plan. It includes detailed information about qualifications and practice history.

- Board Certification Verification: This document serves as proof of a provider's specialty qualifications. A copy of this certification must be attached if the provider indicates they are board certified in their specialty.

- Notice of Practice Closure: Providers must submit this notice when they plan to close their practice. It formally informs healthcare plans and patients of the upcoming closure.

- Provider Termination Form: If a provider leaves a network, this form is needed to formally notify the healthcare plan about the provider's departure and to update directory information accordingly.

- Change of Ownership Form: Used when there is a change in ownership of a practice, this form ensures that the new owners are recognized and that all relevant information is updated in the provider directory.

- Address Change Form: Specifically designed for reporting a change in the provider's practice location, this form ensures that all correspondence is directed to the correct address.

Completing these documents diligently will help maintain an accurate provider directory. It is crucial for every healthcare provider to ensure that their information is current for the benefit of their practice and the patients they serve.

Similar forms

The Provider Information Update form shares similarities with several other documents commonly used in healthcare settings. Here’s a comparison of the eight documents:

- Change of Address Form: Similar to the Provider Information Update form, this document is specifically used to notify healthcare organizations of a provider's new address. Both require detailed current information and are often submitted in advance of the actual change.

- Provider Enrollment Application: Much like the Provider Information Update form, this application collects essential details about a healthcare provider. It is typically used for getting a provider enrolled in a new network or plan.

- W-9 Tax Form: The W-9 is essential for confirming a provider’s tax ID and payee information. Like the Provider Information Update form, it requires accurate and up-to-date information for financial transactions.

- Credentialing Application: This document, similar in intent to the Provider Information Update form, gathers data to verify that a provider meets certain professional standards, including qualifications and practice details.

- Practice Name Change Notification: This notification serves a similar purpose as the Provider Information Update form by informing relevant parties of a change to a practice's name, ensuring current records are maintained.

- Insurance Credentialing Application: Similar to the Provider Information Update form, this application is designed to collect provider information necessary for credentialing with various insurance companies.

- Provider Termination Notice: This document informs of a provider’s departure from a healthcare network. It functions similarly to the updates regarding changes, ensuring that records reflect current provider status.

- Medicare/Medicaid Enrollment Form: This form, like the Provider Information Update form, is used to submit or update information needed for enrollment in government programs, requiring comprehensive provider details.

Dos and Don'ts

When filling out the Provider Information Update form, it’s crucial to follow specific guidelines to ensure accuracy and compliance. Here you'll find five important do's and don'ts to keep in mind.

- Do complete the form using all current and accurate information.

- Do send the completed form along with your W-9 to Provider Relations via the provided email address: ProviderChanges@jhhc.com.

- Do check the box if there are no changes to report at this time.

- Do ensure that changes are communicated at least thirty days in advance of the actual change.

- Do fax the form to 410-424-4604 if using a Social Security number instead of a tax ID for identity protection.

- Don't forget to include the effective date of change; this is crucial for processing.

- Don't leave any required sections empty, as this may delay the update process.

- Don't use the form for changes that are not related to the provider’s information.

- Don't neglect to sign the form before submission; an authorized signature is mandatory.

- Don't assume that phone calls alone will suffice; a written notification is required for all changes.

Following these guidelines will help ensure a smooth and efficient update process. If there are any questions, reach out to Provider Relations for clarification.

Misconceptions

The Provider Information Update form is crucial for keeping provider directories accurate. However, several misconceptions surround its use. Here are six common misunderstandings:

- Faxes are no longer accepted. Many people believe that all submissions must be sent via email. In fact, if a Social Security number is used, the completed form must be faxed for identity protection.

- The update must be submitted immediately. Some providers think they need to notify of changes instantly. However, notification is required at least thirty days in advance.

- The form is only for major changes. It is a misconception that the form is necessary only for significant alterations. Even minor updates, like a new phone number or email address, should be reported.

- Only changes to provider information are necessary. Some individuals believe the form exclusively pertains to changes in personal provider details. In reality, it also covers changes in practice information and billing addresses.

- W-9 forms are optional. There is a belief that submitting a W-9 is not required. It is essential to include this document along with the Provider Information Update form.

- The update can be verbal. People often think they can verbally notify the provider relations team. However, all changes must be documented in writing using the form to be processed.

Understanding these misconceptions can help providers ensure they meet all requirements for maintaining their directory listings.

Key takeaways

When filling out and using the Provider Information Update form, keep these key takeaways in mind:

- Timely Notification: Submit change notifications at least thirty (30) days before the effective date.

- Complete Information: Ensure all sections of the form are filled out with current and accurate details.

- Email and Fax Processes: Send the completed form and W-9 to ProviderChanges@jhhc.com. If using a Social Security number instead of a Tax ID, fax the form to 410-424-4604.

- Confirm Changes: If there are no changes at the time, check the designated box to indicate this.

Browse Other Templates

Subpoena Duces Tecum California - Witnesses are advised to contact the subpoenaing party for clarification on details.

Setting Up an Llc in Illinois - Amendments are a routine part of maintaining an LLC's legal standing.

Church Connect Card - Let us know if you're visiting but might want to join later.