Fill Out Your Prudential 1099 Int Form

The Prudential 1099-INT form plays an essential role in reporting interest income throughout the United States. Taxpayers may receive this form when they earn interest income from various sources, including delayed annuity payments or accrued interest from dividend accumulations. If the sum of this interest exceeds a specific reporting threshold, the issuance of a 1099-INT becomes necessary. Individuals may also get this form for interest earned on conventional savings accounts, certificates of deposit (CDs), or other financial tools. Key details found on the form include the recipient's identification number, the total interest earned, and any taxes withheld. For instance, Box 1 highlights the taxable interest amount, while Box 4 indicates any federal income tax withheld under backup withholding regulations. This withholding typically applies to individuals who have not met reporting requirements regarding taxpayer identification or have been specifically notified by the IRS. Understanding the contents of the 1099-INT is crucial for accurate tax reporting, as the information affects both Form 1040 and potential tax liabilities. Those who receive this form should pay close attention to instructions provided and consider consulting a tax advisor for personalized guidance.

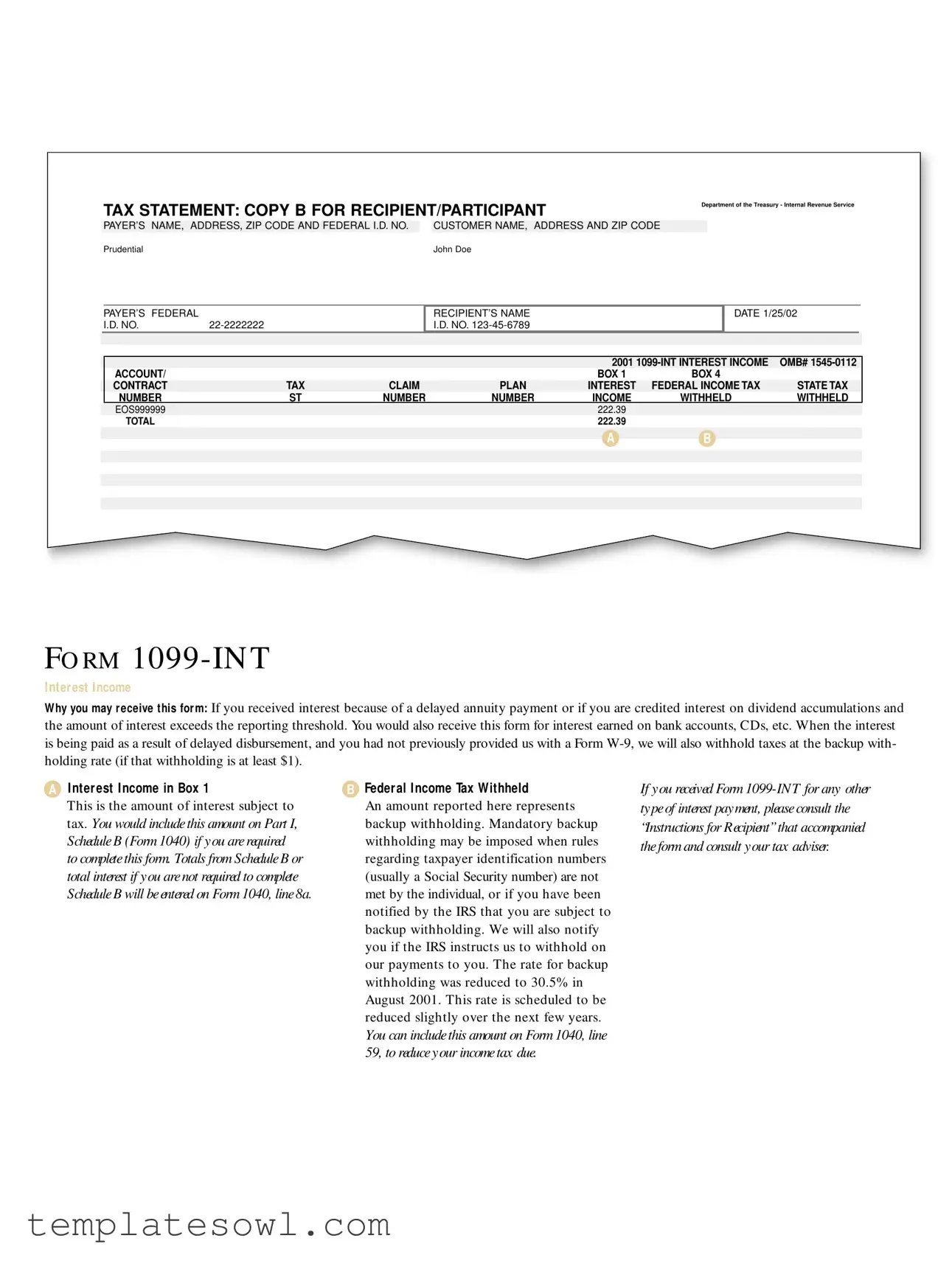

Prudential 1099 Int Example

TAX STATEMENT: COPY B FOR RECIPIENT/PARTICIPANT

PAYER’S NAME, ADDRESS, ZIP CODE AND FEDERAL I.D. NO. |

CUSTOMER NAME, ADDRESS AND ZIP CODE |

Department of the Treasury - Internal Revenue Service

PRUDENTIAL |

JOHN DOE |

PAYER’S FEDERAL |

|

I.D. NO. |

RECIPIENT’S NAME I.D. NO.

DATE 1/25/02

|

|

|

|

|

2001 |

OMB# |

|

|

ACCOUNT/ |

|

|

|

BOX 1 |

BOX 4 |

|

|

CONTRACT |

TAX |

CLAIM |

PLAN |

INTEREST |

FEDERAL INCOME TAX |

STATE TAX |

|

NUMBER |

ST |

NUMBER |

NUMBER |

INCOME |

WITHHELD |

WITHHELD |

|

EOS999999 |

|

|

|

222.39 |

|

|

|

TOTAL |

|

|

|

222.39 |

|

|

|

|

|

|

|

A |

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FO RM

I nt er est I ncome

W hy you may r eceive t his for m: If you received interest because of a delayed annuity payment or if you are credited interest on dividend accumulations and the amount of interest exceeds the reporting threshold. You would also receive this form for interest earned on bank accounts, CDs, etc. When the interest is being paid as a result of delayed disbursement, and you had not previously provided us with a Form

AI nt er est I ncome in Box 1

This is the amount of interest subject to tax. You would include this amount on Part I, Schedule B (Form 1040) if y ou are required to complete this form. Totals from Schedule B or total interest if y ou are not required to complete Schedule B will be entered on Form 1040, line 8a.

BFeder al I ncome Tax W it hheld

An amount reported here represents backup withholding. Mandatory backup withholding may be imposed when rules regarding taxpayer identification numbers (usually a Social Security number) are not met by the individual, or if you have been notified by the IRS that you are subject to backup withholding. We will also notify you if the IRS instructs us to withhold on our payments to you. The rate for backup withholding was reduced to 30.5% in August 2001. This rate is scheduled to be reduced slightly over the next few years. You can include this amount on Form 1040, line

If y ou received Form

59, to reduce y our income tax due.

Form Characteristics

| Fact Name | Description |

|---|---|

| Payer's Information | The form contains the payer's name, address, zip code, and Federal I.D. number, essential for identifying who issued the 1099-INT. |

| Recipient's Details | It lists the recipient's name, address, and I.D. number, which are necessary for the IRS to track income received by individuals. |

| Interest Income Reporting | The 1099-INT form is used to report interest income, specifically the amount of interest earned throughout the tax year. |

| Backup Withholding | If applicable, backup withholding amounts are reported on this form when taxpayer identification rules are not followed. |

| Form Use Cases | Recipients may receive this form if they earn interest from various sources, including delayed annuities or bank accounts. |

| Filing Requirements | For those who must complete Schedule B (Form 1040), the interest amount shown is included in the total taxable income. |

| Federal Income Tax Withheld | The form specifies the federal income tax withheld as part of backup withholding, usually triggered by missing identification details. |

| State-Specific Considerations | State tax withholding is also reported. Consult state laws for specifics on how to handle this income. |

| Instructions for Recipients | Important accompanying instructions guide recipients on how to report the income and any withholding properly on their tax return. |

Guidelines on Utilizing Prudential 1099 Int

Filling out the Prudential 1099-INT form requires careful attention to detail. This form is crucial for reporting interest income you earned over the year. Follow these steps to ensure you complete the form accurately and efficiently.

- Locate the form. You can find the Prudential 1099-INT form in your tax documents.

- In the top section, fill in your name and address where it asks for the recipient’s name and address.

- Find the Payer’s Name section. Fill in "Prudential" along with their address and federal I.D. number (22-2222222).

- In the Recipient’s I.D. No. section, enter your Social Security number (123-45-6789).

- Enter the date of the interest income. The date should be 1/25/02.

- In Box 1, input the total interest income you received, which in this case is 222.39.

- If any federal income tax was withheld, report that amount in Box 4. For this form, it’s 0.00.

- Check if state taxes were withheld. If yes, enter that amount in the appropriate box.

- Double-check all the information for accuracy before signing the form.

- Retain a copy for your records. Send the completed form to the IRS and attach it to your tax return.

Once you've filled out the form, it will be essential to include the reported figures on your tax return. Ensure you keep track of all documentation related to your interest income, as this may be required for future reference or in case of any inquiries from the IRS.

What You Should Know About This Form

What is the Prudential 1099 INT form?

The Prudential 1099 INT form is a tax statement that reports interest income earned by an individual during the tax year. This form is issued by Prudential to recipients who have received interest payments from products such as delayed annuities or bank accounts. The information included helps individuals accurately report their income to the IRS.

Why would I receive a Prudential 1099 INT form?

You may receive a Prudential 1099 INT form if you earned interest from a delayed annuity payment, or if you were credited interest from dividend accumulations, with the total amount exceeding the reporting threshold. Interest from bank accounts or CDs may also trigger the issuance of this form. Additionally, if taxes must be withheld due to the absence of a Form W-9, you will receive a 1099 INT.

What information is reported in Box 1 of the form?

Box 1 of the Prudential 1099 INT form contains the total amount of interest income you earned during the year. This amount is subject to taxation. It should be included on Part I of Schedule B (Form 1040) if applicable. If not required to complete Schedule B, you can report the total interest on Form 1040, line 8a.

What does the federal income tax withheld mean on the form?

The amount labeled as federal income tax withheld indicates that backup withholding has been applied to your interest income. Such withholding occurs when taxpayer identification number rules are not followed, or if the IRS mandates backup withholding. This withheld amount can be claimed on Form 1040, line 59, potentially reducing your overall income tax liability.

What is backup withholding, and who might be subject to it?

Backup withholding is a form of tax collection where a portion of payments is withheld by the payer and sent to the IRS. It may apply to individuals who have not provided a valid taxpayer identification number, such as a Social Security number, or those who have received notification from the IRS regarding their status. If you are subject to backup withholding, it will be specified on your Prudential 1099 INT form.

What should I do if I receive a Prudential 1099 INT for other types of interest payments?

If you receive a Prudential 1099 INT for other types of interest income, you should refer to the “Instructions for Recipient” that accompanied the form. This document will provide additional guidance on how to report the interest on your tax return. Consulting with a tax adviser may also be beneficial for personalized assistance.

Where can I find additional help regarding my 1099 INT form?

For further assistance regarding your Prudential 1099 INT form, reviewing the IRS website or seeking advice from a tax professional can be helpful. They can provide explanations on tax reporting, potential deductions, and guide you through the process of completing your tax returns accurately.

Common mistakes

Filling out the Prudential 1099-INT form can be a straightforward process, but several common mistakes often lead to confusion or errors. First, neglecting to include all required information can create significant problems. It is crucial that the recipient’s name, address, and identification number align correctly with the information provided on the form. Discrepancies can raise flags with the IRS, potentially complicating tax filing.

Another frequent error occurs when people fail to understand the importance of Box 1, which reports the total amount of interest income for the tax year. Many individuals overlook this important figure, which directly impacts the completion of their Schedule B and, ultimately, Form 1040. Ensure that you accurately report this amount to avoid underreporting income.

Some recipients mistakenly assume they do not need to report interest income if they receive a small amount. This is incorrect. Regardless of the amount, if you receive a 1099-INT form, you are required to report it. Failing to do so can draw unwanted attention from the IRS, leading to potential fines.

Understanding the purpose of backup withholding is another area of confusion. Many people do not realize that if the IRS requires backup withholding due to identification number issues, this must also be reported on Form 1040. Not including this amount could lead to miscalculation of your tax obligations.

Some individuals forget to provide Form W-9, resulting in automatic backup withholding. It's important to understand that submitting this form when necessary can prevent unnecessary deductions from interest payments.

In their haste, many people do not double-check for math errors. Simple arithmetic mistakes can lead to inaccurate reporting. Always review the figures entered on the form, especially sums in Box 1 and amounts withheld.

Additionally, the filing deadline can be overlooked. Those completing the form should be aware of the timeline to provide it to the IRS and the recipient. Missing deadlines can result in penalties that could have been avoided with timely submission.

Misclassifying income is also a common error. It is critical to understand that certain types of interest might be classified differently, affecting how you report them on your tax return. If unsure, seeking advice can be invaluable.

Some individuals fail to consult the “Instructions for Recipient” included with their 1099-INT form. This document contains essential information on how to accurately complete the form. Ignoring it can lead to misinterpretation of the data presented.

Lastly, forgetting to retain copies of filed forms is a misstep that can hinder your ability to provide proof of income in the future. Keep copies for your records and future reference, especially in case of audits or discrepancies.

Documents used along the form

The Prudential 1099-INT form reports interest income that individuals receive. This form is part of necessary documentation when filing tax returns. Other forms and documents may be needed alongside the 1099-INT to provide a complete financial picture. Here are some commonly used documents.

- Form W-9: This form provides taxpayer identification information to a payer. It is often requested so that the payer can report income to the IRS accurately. Individuals use this form to certify their taxpayer status and provide their Social Security number or Employer Identification Number.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. Taxpayers report their annual earnings, including any interest income from the 1099-INT, on this form. It includes various sections for income, deductions, and credits.

- Schedule B (Form 1040): This schedule is used to report interest and ordinary dividends. If a taxpayer has more than $1,500 of interest income, they must complete this form and attach it to their Form 1040. It helps the IRS verify the accuracy of reported income.

- Form 1099-DIV: This form reports dividends and distributions from investments. Individuals who receive dividends from stock investments will get this form. It may impact the reporting of total income when filing taxes.

These forms and documents, along with the Prudential 1099-INT, are important for individuals to consider during tax season. Properly completing and submitting these documents helps ensure compliance with tax laws.

Similar forms

-

Form 1099-MISC: This form reports various types of income other than wages, salaries, or tips. Like the 1099-INT, it provides a summary of income earned that may be taxable. Both forms require the recipient to report received amounts on their tax returns, helping the IRS track income earners.

-

Form 1099-NEC: This form is used to report non-employee compensation, such as payments made to independent contractors. Similar to the 1099-INT, it ensures that recipients report their earnings. Both documents provide critical information for accurate tax filings.

-

Form W-2: Employers use this form to report wages and taxes withheld for employees. While it focuses on earned income, both W-2 and 1099 forms inform recipients of taxable income received in a specific year, ensuring transparency and compliance with tax laws.

-

Form 1098: This form is generally used to report mortgage interest paid by a borrower. Like the 1099-INT, it can aid in tax deductions, providing recipients with essential information related to potential tax benefits on their returns.

Dos and Don'ts

When filling out the Prudential 1099 Int form, consider the following dos and don'ts:

- Do double-check all personal information for accuracy, such as your name, address, and Social Security number.

- Do report the total interest income accurately on your tax return. This amount is important for calculating your taxes.

- Don’t ignore any backup withholding listed on the form. It may affect your tax obligations.

- Don’t hesitate to consult a tax professional if you have questions about how to report the information.

Misconceptions

Understanding the Prudential 1099-INT form can be challenging. Here are six common misconceptions surrounding this tax document, along with explanations to clarify each one.

- The 1099-INT form is only for bank interest. Many individuals believe this form is exclusively for interest earned from bank accounts. In reality, it applies to various sources, including delayed annuity payments and credit interest on dividend accumulations.

- If I receive a 1099-INT, I owe taxes immediately. Receiving this form indicates interest income that may be taxable, but it does not automatically mean taxes are due at the time of receipt. Actual tax liability is determined when you file your tax return.

- Backup withholding is optional if I do not provide a W-9. Quite the opposite. If the IRS requires backup withholding and you fail to submit the necessary taxpayer identification details, a mandatory withholding will automatically occur on payments, which you will see reflected on your 1099-INT.

- Only high-income earners receive this form. There is a misconception that only those with substantial earnings receive a 1099-INT. However, anyone who meets the reporting threshold, regardless of income level, may receive this document.

- The interest reported in Box 1 is the only amount I should report. While Box 1 shows the taxable interest income, taxpayers may also need to consider totals from Schedule B or other sources when completing their Form 1040.

- All amounts withheld are refundable during tax filing. Although some withheld amounts can be claimed as a credit, failure to meet IRS requirements may mean that certain withheld funds are not fully refundable. Always consult a tax advisor for clarity regarding your specific situation.

Key takeaways

Key Takeaways for Prudential 1099 INT Form

- The Prudential 1099 INT form is used to report interest income received on various types of accounts, including delayed annuity payments and interest from bank accounts.

- Box 1 indicates the total interest income that is subject to federal taxation. This amount should be reported on Form 1040, line 8a, or on Part I of Schedule B if applicable.

- Backup withholding may be applied if a taxpayer identification number is not provided or if certain IRS notifications have been issued. This amount will be reported in the federal income tax withheld section of the form.

- It is crucial to consult the accompanying instructions and consider seeking advice from a tax professional if the form pertains to interest payments beyond the primary income sources.

Browse Other Templates

How to Address a Certified Letter - The form is essential for proving mailing and tracking registered items.

Military Housing Request Form,CG Housing Assignment Application,U.S. Coast Guard Housing Application,Application for Military Housing Assignment,Coast Guard Housing Eligibility Form,Military Accommodation Request,Coast Guard Housing Application Sheet - The form helps military families find housing that meets their needs.

Certificate Content - This certificate recognizes your positive impact on the veteran community.