Fill Out Your Prudential 401K Loan Form

The Prudential 401(k) Loan form serves as a crucial tool for participants looking to access their retirement savings during times of financial hardship. It lays out clear instructions for requesting a hardship loan withdrawal and outlines specific eligibility requirements, including the need for appropriate documentation to substantiate the claim. The form is designed to ensure all relevant details are captured efficiently, from personal information to the reason behind the request. The application process emphasizes the importance of completeness; any missing information could lead to delays or denials. Furthermore, the form makes provisions for necessary signatures and consent, reinforcing the significance of accurate disclosures. Prudential offers customer support during standard business hours for those needing assistance, appearing to be both user-friendly and accessible. Understanding the terms, which include associated fees and repayment conditions, is vital for applicants, as it can directly impact their financial status. Finally, participants are advised to review the accompanying documents carefully to ensure that their requests meet all requirements. Overall, the Prudential 401(k) Loan form embodies a structured approach to accessing essential funds while preserving the integrity of retirement savings.

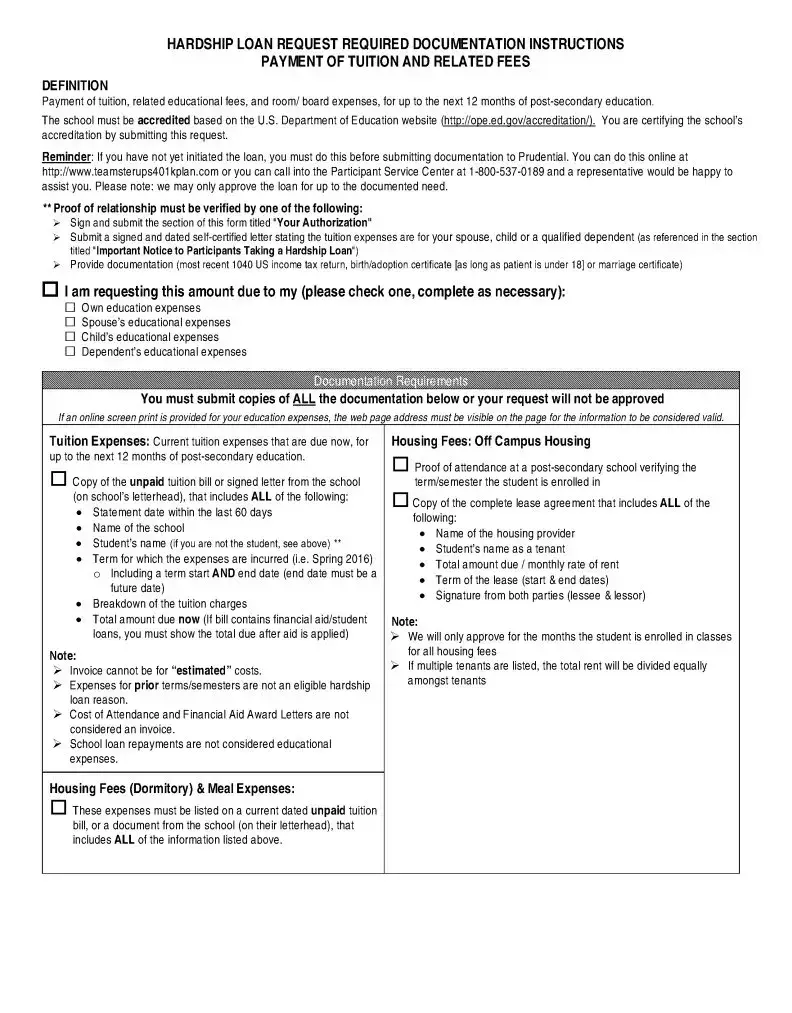

Prudential 401K Loan Example

|

|

|

Instructions for Requesting a Hardship Loan |

|

|

|

|

|

|

|

|

|

|

1. |

Obtain and submit all required documentation that pertains to the reason for your request. |

|

|

||

Instructions |

|

Please refer to the Hardship Loan Request Required Documentation Instructions (located at the end |

|

|

|

|

of this document) for the documents you need to submit. |

|

|

|

Important: Requests received with documentation that is incomplete or does not meet the requirements |

|

|

|

described will not be processed until they are in good order, which could cause a substantial delay in |

|

|

|

receiving your funds. |

|

|

|

It is your responsibility to obtain and verify the documents you submit meet the stated requirements. |

|

|

4. Please be sure to update your 'Notification Preference' in the About You section, to be notified of the |

|

|

|

|

status of your request (if applicable). |

|

|

5. |

Mail or fax all forms and documentation, including the About You page, to: |

|

|

|

Prudential Retirement |

|

|

|

|

|

|

|

PO Box 5640 |

|

|

|

Scranton, PA 18505 |

|

|

|

OR |

|

|

|

Fax it to |

|

|

|

|

|

|

Upon receipt of your hardship loan request, all documents will be reviewed by Prudential. |

|

|

|

||

Approval/ |

• |

If your paperwork is not in good order, the hardship loan request will be denied. We will notify you of |

|

Denial of |

|

our findings. Please note that the documents submitted will not be returned to you, therefore, please |

|

Hardship |

|

make copies for your records. |

|

|

|

||

Loan |

• |

If it is determined that you qualify for a hardship loan based on current Internal Revenue Code |

|

Request |

|

regulations and Plan provisions, Prudential will process your request. |

|

οIn the event of an audit you must retain documentation to support your claim of financial hardship and to demonstrate compliance. Tax or legal counsel should be consulted regarding the permissibility of any loan.

Customer Service representatives are available to answer general questions you may have about your loan or about your Plan. Call

Personal assistance with a Customer Service representative is available Monday through Friday, 8 a.m. to 9 p.m. Eastern Time, except on holidays.

Our representatives look forward to providing you with information in English, Spanish, or many other languages through an interpreter service.

Account information is available for the hearing impaired by calling us at

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 1 of 22

771

Hardship Loan Information

|

|

|

Plan number |

|

|

|

|

|

|

|

|

||||||||

About You |

|

|

|

0 |

|

6 |

|

0 |

|

0 |

|

|

9 |

|

|

||||

|

0 |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|||||||||||||

Social Security number |

|||||||||||||||||||

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

First name

|

|

Sub Plan number |

|

|

|

|||||||||

|

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

1 |

||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

MI |

Last name |

||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||

Address

City |

State |

ZIP code |

-

Date of birth |

|

|

|

|

|

|

|

|

|

|

Gender |

|

|

|

|

Fax Number |

|

|

|

||||||||||||

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

F |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

month |

|

day |

|

year |

|

|

|

|

|

|

|

|

|

|

|

|

|

area code |

|

|

|

||||||||||

Preferred Email address (how Prudential Retirement will contact you, if needed)

-

Daytime telephone number

- |

|

|

|

|

|

- |

|

|

area code

Mobile telephone number

- |

|

|

|

|

|

- |

|

|

area code

Notification Preference (how you prefer Prudential to contact you for this request, choose one): ___ Email ___SMS Text

Please note: If neither email or text are selected (or both), we will default to email if provided.

Please review all the enclosed information before proceeding.

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 2 of 22

I hereby request a Hardship Loan for the following reason(s). I agree to provide the applicable documentation as described in the Hardship Loan Request Required Documentation Instructions.

Reason(s) |

**Please refer to Important Notice to Participants Taking a Hardship Loan for additional information on |

|||

for |

||||

definition of dependent in IRC Section 152. |

||||

Hardship |

||||

Please Note: |

||||

Loan |

||||

|

• The minimum amount for a loan is $1,000.00. |

|||

|

• The minimum amount for Immediate and Heavy Financial Need Loan is $2500.00. |

|||

|

|

Exception: if under $2500.00, you can be approved for the maximum available loan amount, as long: |

||

|

|

o The available loan amount meets the $1000.00 minimum |

||

|

|

o Your documentation supports $2500.00 or more |

||

|

• We can only approve loan funds for up to the documented financial need. |

|||

|

• Multiple reasons can be used for one loan (minimums must still be met). |

|||

|

|

|

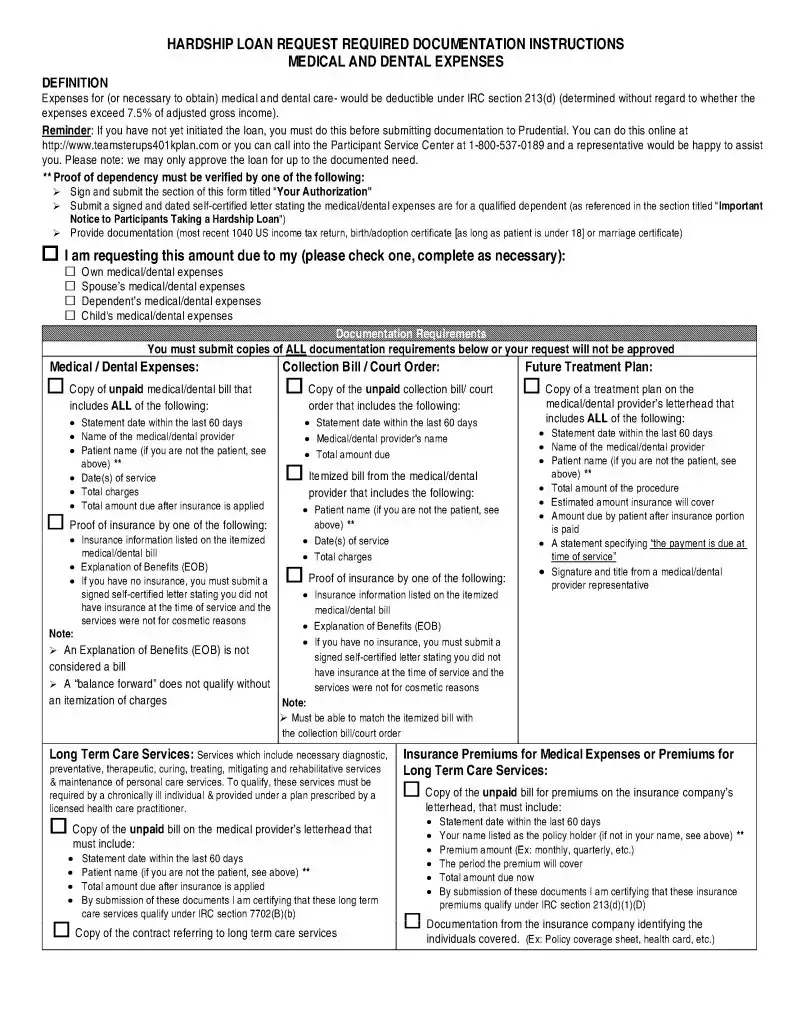

Medical/Dental expenses incurred by me, my spouse, or any of my dependents. |

|

|

|

|

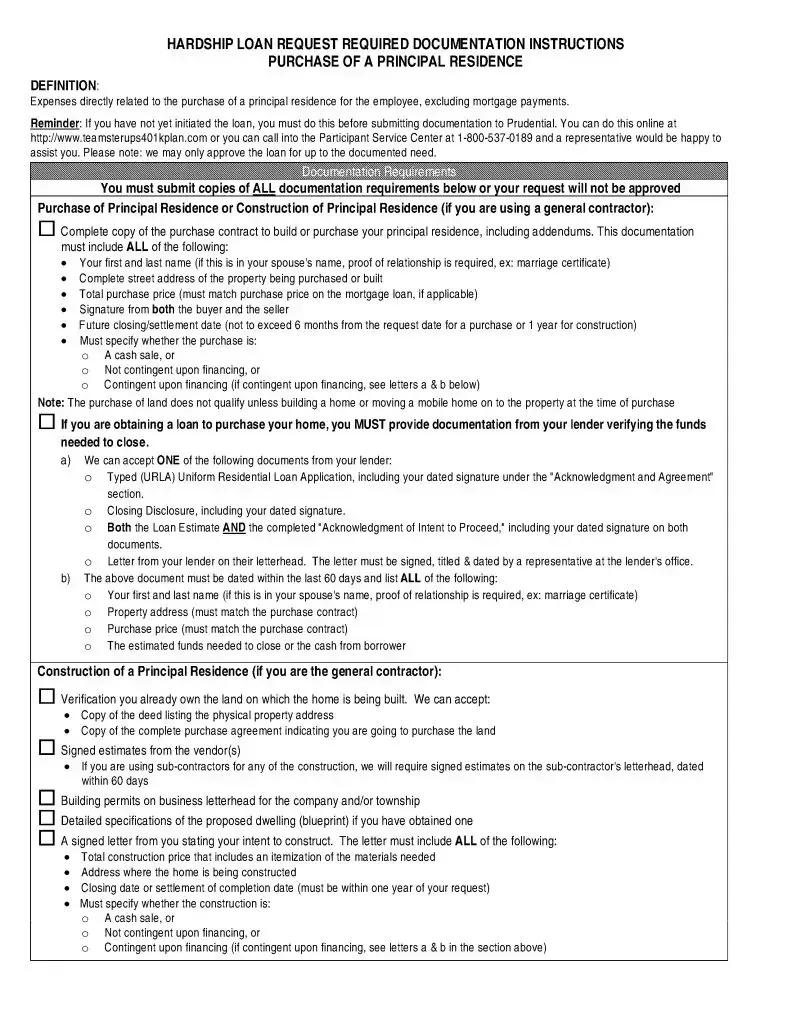

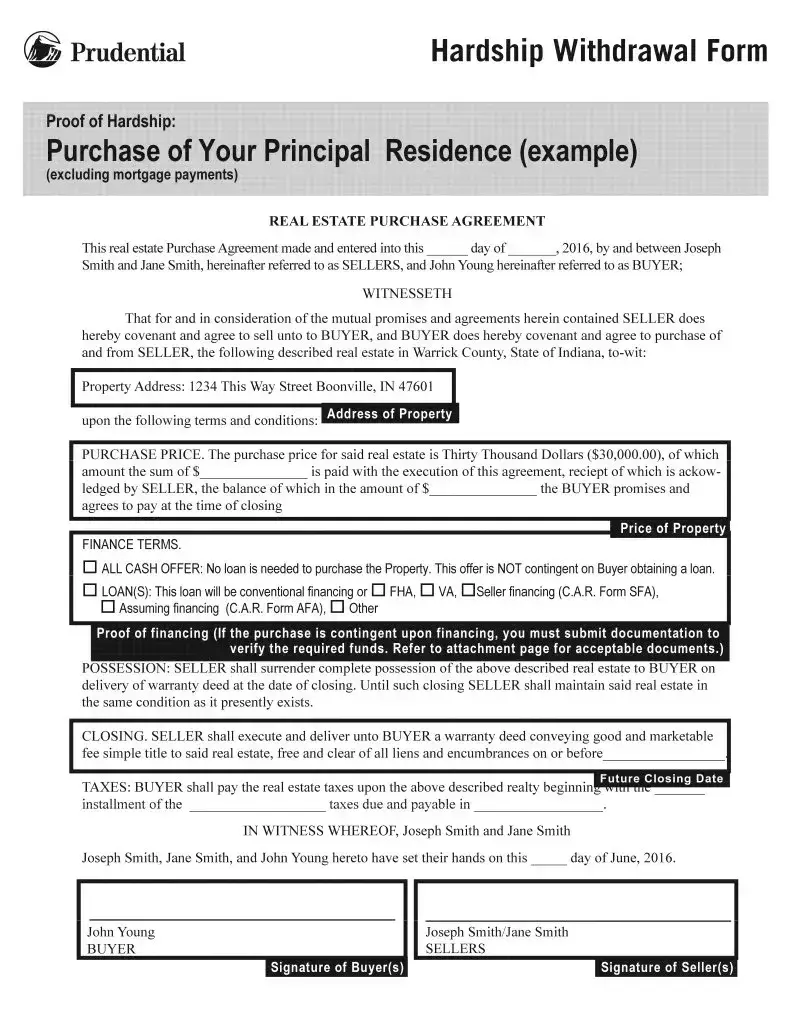

Purchase (excluding mortgage payments) of my principal residence. |

|

|

|

|

||

|

|

|

Payment of tuition for the next 12 months of |

|

|

|

|

any of my children or dependents. You are certifying the schools' accreditation by submitting |

|

|

|

|

this request. |

|

|

|

|

Payments needed to prevent eviction or imminent foreclosure from my principal residence. |

|

|

|

|

Payment of burial or funeral expenses for my deceased parent, spouse, child or dependent. |

|

|

|

|

||

|

|

|

Expenses for the repair of damage to my principal residence that qualifies for a casualty |

|

|

|

|

||

|

|

|

deduction. |

|

|

|

|

Costs directly related to the placement of a child with the Participant in connection with the |

|

|

|

|

adoption of such child by the participant or by the participant and his or her spouse. |

|

|

|

|

Costs or expenses creating an immediate and heavy financial need that cannot reasonably be |

|

|

|

|

||

|

|

|

satisfied through any other means. Expense must be due to an unforeseen event. |

|

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 3 of 22

|

|

• |

The processing fee is $75.00 and will be automatically charged to your account. The processing fee is |

|

|

|

|||

Fees |

• |

|||

A $25.00 annual maintenance fee will be charged to your account in the amount of $6.25 per quarter for |

||||

|

|

|||

|

|

|

the duration of the hardship loan. |

|

Your

I certify that the information I have provided is true and correct and will be relied upon in processing my request and the tax implications regarding this disbursement. I understand that any failure in this regard,

inaccurate assertion or misrepresentation may jeopardize the ability of my employer to offer a plan and may Authorizationsubject me to disciplinary action, including severance from employment. I will be responsible for its accuracy

in the event any dispute arises with respect to the transaction. I certify all other distributions (other than hardship distributions) and

Privacy Act Notice:

Since your Plan engages the services of Prudential Retirement to qualify hardships on their behalf, this information is to be used by Prudential Retirement in determining whether you qualify for a financial hardship under your retirement Plan. It will not be disclosed outside Prudential Retirement except as required by your Plan and permitted by law for regulatory audits. You do not have to provide this information, but if you do not, your application for a hardship may be delayed or rejected.

Consent:

By signing below, I consent to allow Prudential Retirement to request and obtain information for the purposes of verifying my eligibility for a financial hardship under this Plan.

The Plan will assess a 2 percent

By signing the Consent section of this form, I am certifying that this request is for me or a qualified dependent as defined on the following page titled "Important Notice to Participants Taking a Hardship

Loan."

If you are requesting an Immediate and Heavy Financial Need Loan, by signing this form, you certify that this need cannot be reasonably satisfied by any other means.

X |

Date |

Participant’s signature

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 4 of 22

Important Notice to Participants Taking a Hardship Loan

Terms and Conditions

Important: Loan initiations for the Teamster UPS 401k plan are automated. There are two steps to completing a loan initiation.

1.You must initiate the loan by either: Logging onto your account at www.teamsterups401kplan.com or by calling

2.You must submit the required back up documentation for the loan to process.

•The minimum amount for a loan is $1,000.00 ($2,500.00 for Immediate and Heavy Financial Need Loan).

•The maximum amount for a loan is 50% of the account balance (excluding SMA and not to exceed $50,000 in a

•Maximum duration for hardship loan is 5 years.

•Maximum duration for a primary residence hardship loan is 20 years.

•No more than 2 loans may be outstanding at any one time.

•If a loan defaults, it will not affect your credit, but will be reported as a distribution and you will be responsible for any applicable taxes or penalties. You will not be permitted to take another loan until the defaulted loan is repaid.

Dependent

The definition of "dependent" is important in the application of the "deemed hardship loan" standards that pertain to 401(k) plans. Unless a specific exception applies, a dependent must either be a "qualifying child" or a "qualifying relative". These terms are defined as follows:

Qualifying Child

A qualifying child is a child or descendant of a child of the taxpayer. A child is a son, daughter, stepson, stepdaughter, adopted child or eligible foster child of the taxpayer. A qualifying child also includes a brother, sister, stepbrother or stepsister of the taxpayer or a descendant of any such relative. In addition, the individual must have the same principal place of abode as the participant for more than half of the taxable year, the individual must not have provided over half of his own support for the calendar year, and the individual must not have attained age 19 by the end of the calendar year. An individual who has attained age 19 but is a student who will not be 24 as of the end of the calendar year and otherwise meets the requirements above is also considered a qualifying child. Special rules apply to situations such as divorced parents, disabled individuals, citizens or nationals of other countries, etc. Please see your tax advisor for further details regarding special situations.

Qualifying Relative

A qualifying relative is an individual who is not the participant's "qualifying child", but is the participant's: child, descendant of a child, brother, sister, stepbrother, stepsister, father, mother, ancestor of the father or mother, stepfather, stepmother, niece, nephew, aunt, uncle,

Ed. 05/18/2020 |

Important information and signatures required on the following pages |

Plan number: 006009

Page 5 of 22

Page 6 of 22

Page 7 of 22

Page 8 of 22

Page 9 of 22

Page 10 of 22

Form Characteristics

| Fact Name | Details |

|---|---|

| Customer Service Availability | Customer service representatives are available Monday through Friday, from 8 a.m. to 9 p.m. Eastern Time, excluding holidays. |

| Loan Amount Limits | The minimum loan amount is $1,000, and the maximum is 50% of your account balance, not exceeding $50,000 within a 12-month period. |

| Processing Fees | A $75 processing fee is charged to your account, even if your loan is not approved. Additionally, a $25 annual maintenance fee applies. |

| Required Documentation | You must provide appropriate documentation supporting your financial need. A lack of necessary documents will result in your request being rejected. |

| Hearing Impaired Assistance | Assistance for hearing-impaired individuals is available by calling 1-877-760-5166. |

| Language Support | Support is offered in multiple languages through an interpreter service, including Spanish and English. |

Guidelines on Utilizing Prudential 401K Loan

Filling out the Prudential 401K Loan form may seem overwhelming, but it can be straightforward if you follow these steps. Completing the form correctly will help ensure a smooth processing of your request. Be sure to use blue or black ink for clarity.

- Begin by carefully reading all the information in the Hardship Loan Withdrawal package.

- Complete all relevant sections of the Hardship Loan Request Form, ensuring you provide accurate details.

- Indicate the reason for your hardship loan request on the form. Choose one reason only.

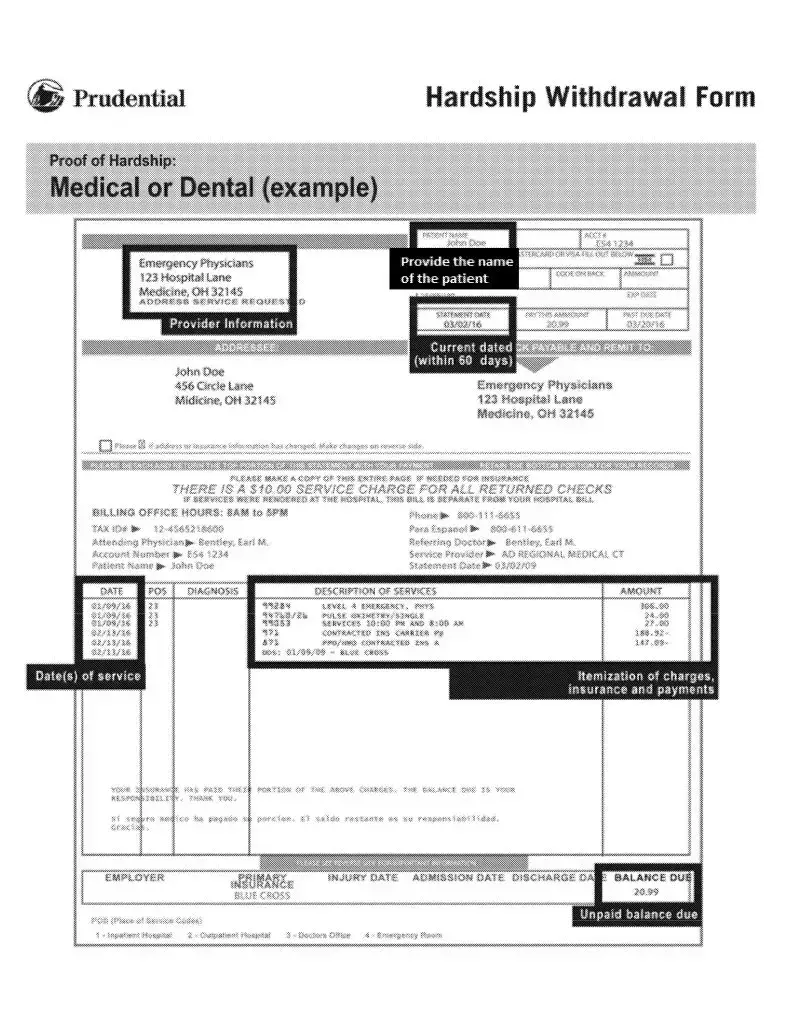

- Gather the appropriate documentation to support your financial need as specified in the instructions.

- Sign and date the form at the designated area on the last page.

- Attach the required documents and ensure everything is included, as incomplete requests may be denied.

- Mail the completed form and attachments to the provided address or fax it to the specified number.

Once your request is submitted, Prudential will review everything. They will notify you about the approval or denial of your loan. Support is available if you have questions or need help during this process.

What You Should Know About This Form

What is the Prudential 401K Loan form?

The Prudential 401K Loan form is a document used by participants of the Teamster-UPS National 401(k) Tax Deferred Savings Plan to request a hardship loan withdrawal from their retirement savings. This form includes sections for personal information, the reason for the loan, required documentation, and the participant's signature. Proper completion of this form is essential to process the loan request effectively.

How can I obtain the Prudential 401K Loan form?

You can obtain the Prudential 401K Loan form by visiting the Prudential website or by contacting their Customer Service at 1-800-537-0189. The form is typically included in the hardship loan withdrawal package, which also provides instructions on how to complete the loan request process.

What information is required to complete the form?

You will need to provide personal information such as your name, Social Security number, address, and contact details. Additionally, you must indicate the reason for your loan request. Supporting documentation that substantiates your reason for requesting a hardship loan must also accompany your submission.

What are the acceptable reasons for requesting a hardship loan?

Acceptable reasons for a hardship loan request include un-reimbursed medical expenses, the purchase of your principal residence, payment of tuition for education, payments to prevent eviction or foreclosure, burial or funeral expenses, and costs related to the placement of a child for adoption. Each reason has specific documentation requirements outlined in the loan package.

What happens if my loan request is denied?

If your loan request is denied, Prudential will notify you regarding the findings. The documents you submitted will not be returned, so it is advised to keep copies for your records. You may also contact Customer Service for further clarification and assistance.

Are there any fees associated with the hardship loan?

Yes, there is a processing fee of $75.00, which is non-refundable and will be deducted from your account even if the loan is not processed. Additionally, there is a $25.00 annual maintenance fee charged quarterly at a rate of $6.25 while the loan is active.

What is the maximum amount I can borrow?

The maximum amount you can borrow through a hardship loan is 50% of your account balance, with a cap of $50,000 in any 12-month period. The minimum loan amount you can request is $1,000. Note that outstanding loans may affect your eligibility for additional borrowing.

How long do I have to repay the loan?

The maximum repayment period for a hardship loan is five years. However, if the loan is for the purchase of a primary residence, the repayment period can be extended to 15 years. Be mindful of the terms for repayment to avoid default.

What if I default on my loan?

If you default on your loan, it will not affect your credit rating; however, it will be reported as a distribution. You will then be responsible for any applicable taxes or penalties. Additionally, you will not be able to take out another loan until the defaulted loan is repaid.

Common mistakes

When filling out the Prudential 401K Loan form, several common mistakes can lead to unnecessary delays or outright denials. One frequent error is failing to complete all relevant sections. Each section of the form requires specific information. If any section is left blank, especially those concerning your personal details and loan request, the request may be deemed incomplete.

Another common mistake involves not providing the necessary documentation to substantiate your financial hardship. This can include crucial proof that demonstrates your need for the loan. Without this supporting documentation, your application will not proceed. Ensure that you attach all required documents as listed, keeping in mind that incomplete submissions can lead to rejections.

A lot of people overlook the requirement to indicate the specific reason for their hardship loan request. The form specifies that you must select only one reason per request. If you select more than one, the request may be invalidated. Be clear and concise in your selection to avoid confusion.

Incorrectly calculating the loan amount is another hurdle applicants face. The maximum amount you can borrow is 50% of your account balance, not exceeding $50,000 in any 12-month period. Double-check the figures in your submission to ensure compliance with these limits.

Signing and dating the form may seem trivial, but it's vital. Submitting without a signature or a missing date can result in immediate rejection. Always remember to sign the document before sending it back, as this confirms your agreement with the provided information.

Many individuals neglect to review all attachments before mailing their forms. Submissions that include the Loan Request Form but lack the necessary supporting documents will not be processed. It’s essential to perform a thorough check before sending in your paperwork to ensure that all components are included.

Lastly, ignoring the processing fees can lead to unexpected surprises. A $75 processing fee is automatically charged to your account, regardless of the outcome of your loan request. Always account for these fees to understand the full implications of your application. Being proactive about these details can streamline your experience with the Prudential 401K Loan process.

Documents used along the form

When applying for a hardship loan through the Prudential 401k plan, several additional forms and documents may be necessary to support your request. These documents help to verify your financial needs and ensure that your application is processed efficiently.

- Hardship Loan Request Form: This is the primary form used to request a hardship loan. It includes sections to identify your personal information, the reason for the loan, and necessary disclosures regarding your situation.

- Attachments to Hardship Loan Request: This includes various documents that demonstrate your financial hardship. Documentation could include bills, eviction notices, or any other proof related to your claim.

- Authorization Form: This document provides consent for Prudential to request and obtain information necessary to verify your eligibility for a loan. It must be signed and dated to process your application.

- Processing Fee Notification: Information about fees associated with your application is outlined here. Generally, a processing fee is charged even if the loan is not approved.

- Plan Summary Document: This outlines the details of your retirement plan. It provides additional information about loan limits, repayment terms, and other important policies.

- Tax Implications Disclosure: This document explains potential tax consequences of taking a hardship loan, including penalties or tax liabilities you might incur.

- Proof of Identity: A form of identification, such as a recent tax return or a government-issued ID, may be required to confirm your identity and execute the loan process.

Ensure you have all required documents ready when submitting your hardship loan request. Missing or incomplete attachments can result in delays or denial of your loan application.

Similar forms

- Hardship Withdrawal Request Form: Similar to the Prudential 401K Loan form, this document allows individuals to request funds from their retirement plans due to financial hardship. It typically requires documentation of the financial need and a signature affirming the details provided.

- Loan Application for 403(b) Plans: This form serves a similar purpose for participants in 403(b) plans. Applicants must complete specific sections and provide supporting documentation related to the loan request.

- Pension Plan Loan Request Form: Participants of pension plans utilize this document to request loans. Similar requirements include specifying the reason for the loan and attaching relevant supporting documents.

- Withdrawal Request Form for IRA: This form is used to withdraw funds from an Individual Retirement Account (IRA). Like the Prudential form, it may involve the disclosure of reasons for withdrawal and necessary documentation to justify the request.

- Health Savings Account (HSA) Withdrawal Form: Requesting funds from an HSA is similar in nature. Individuals must provide a valid reason for withdrawal, often related to qualifying medical expenses.

- Disability Claim Application: While primarily focused on short-term or long-term disabilities, this document requires proof of eligibility, making it similar in terms of providing necessary documentation and justifying financial need.

- Emergency Fund Access Request Form: In situations where individuals need immediate access to emergency funds, this form allows them to outline their circumstances and submit related documentation, mirroring the approach taken in the Prudential form.

- Temporary Financial Assistance Application: This document is utilized for applying for temporary financial assistance from organizations. A detailed explanation is required regarding the financial hardship, akin to what is requested in the Prudential form.

- Student Loan Deferment Request Form: This form requires individuals to explain their financial situation related to education costs and provide documentation to support their requests for deferment, similar to the documentation requirements for a hardship loan.

- Long-Term Care Insurance Claim Form: This document enables policyholders to claim benefits related to long-term care expenses. A thorough explanation of care needs and supporting documentation must be provided, paralleling the process involved in the Prudential 401K Loan form.

Dos and Don'ts

When filling out the Prudential 401K Loan form, it's important to carefully follow guidelines to ensure your request is processed smoothly. Here are six things to do and not do:

- Do: Ensure you print using blue or black ink for readability.

- Do: Complete all relevant sections of the request form after thoroughly reviewing the information provided.

- Do: Indicate the reason for your hardship loan clearly on the form.

- Do: Include all required documentation that shows financial need.

- Don't: Forget to sign and date the form before submission.

- Don't: Submit your application without making copies of your documents for your records.

Misconceptions

Misconceptions about the Prudential 401K Loan form can lead to confusion and frustration. Understanding the reality behind these misconceptions can help you navigate the process more effectively.

- One can borrow any amount from their 401(k) without limits. Many believe they can take out any sum they desire. However, the maximum amount for a loan is capped at 50% of the account balance, not exceeding $50,000 within a 12-month period.

- Submitting the loan request is the only requirement. A common assumption is that simply completing the form suffices. In reality, necessary documentation that proves financial hardship must accompany the request for it to be processed.

- Hardship loans affect your credit score. Some think that taking a hardship loan will hurt their credit. This is not true; while defaults on loans are reported as distributions, they do not directly impact your credit score.

- All dependents automatically qualify for financial hardship. Many believe that all relatives qualify without scrutiny. Yet, the IRS has defined criteria for what constitutes a "qualifying child" or "qualifying relative," which applicants must adhere to.

- The loan can be used for any personal expense. Some view hardship loans as a source of quick cash for any reason. This is misleading; loans must be tied to specific, qualifying hardships outlined in the guidelines.

- Once a loan is initiated, paperwork is returned. There's a misconception that submitted documents will be returned after processing. In fact, the submitted paperwork will not be returned, so it is crucial to make copies for your records.

Key takeaways

- Ensure Accuracy: Carefully fill out all sections of the Prudential 401K Loan form, paying close attention to details. An incomplete or incorrect submission may lead to delays or denials in processing.

- Include Documentation: Attach all required documents that substantiate your financial need. Missing documentation will result in rejection of your hardship loan request.

- Processing Fees: Be aware that there is a $75 processing fee which is non-refundable. This fee will be deducted from your account regardless of whether your loan is approved.

- Customer Service Availability: Utilize customer service for assistance. Representatives are available Monday through Friday from 8 a.m. to 9 p.m. ET and can help with forms or any questions about your plan.

- Loan Limits: The minimum loan amount is $1,000, while the maximum is 50% of your account balance, up to $50,000 within a 12-month period. Ensure you verify these limits to avoid any unexpected issues.

Browse Other Templates

Aarp Claim Form - This form serves to meet the needs of beneficiaries while remaining compassionate to their circumstances.

File Articles of Incorporation California - Delayed filings may complicate the dissolution process, so act promptly.

Service Member Loan Reimbursement Form - The form is a critical tool for servicemembers seeking financial relief from student loans while serving.