Fill Out Your Prudential Change Beneficiary Form

The Prudential Change Beneficiary form is a crucial document for policyholders seeking to modify their beneficiary designations on life insurance policies. It facilitates the updating of individual beneficiaries, including primary, contingent, and tertiary classifications, which determine the order in which benefits are paid upon the insured's death. Each section of the form requires careful attention, as it includes essential details such as the beneficiaries’ names, relationships to the insured, and contact information. There’s also space for special requests and additional designations, accommodating unique arrangements like children's groups or testamentary trusts. Understanding how to accurately fill out this form is vital, as any errors or omissions could delay the payment process or invalidate the intended beneficiary arrangements. For instance, the form emphasizes the importance of confirming the correctness of pre-filled information and acknowledging any corrections to ensure the request is valid. Moreover, beneficiaries are categorized to clarify the distribution of funds, highlighting the differences between primary and contingent claims. Additionally, the form addresses important considerations for Kentucky residents and state-specific requirements, further underscoring the need for adherence to local regulations. Overall, the Prudential Change Beneficiary form simplifies the management of life insurance benefits, making it accessible for policyholders to secure their family's financial future.

Prudential Change Beneficiary Example

Request to Change Beneficiary on Life Insurance Policies

The Prudential Insurance Company of America

Pruco Life Insurance Company of New Jersey

Pruco Life Insurance Company

All are Prudential Financial companies.

General Information and Instructions (Read the instructions about the change(s) you wish to make)

•Review the accuracy of any

•Return the completed form in its entirety. Do not send us your policy.

•We will record the change(s) and send a confirmation.

•On these pages, me, my, you, your, and I refer to the owner(s). We, us, and our refer to the Prudential company that issued the policy.

•This form does not provide for every arrangement. If the arrangement you want is not on this form, please contact our Customer Service Office.

Changing Your Beneficiary (Complete the Request to Change Beneficiary section)

1.To help facilitate payment when a claim is made, we need to have certain information about each beneficiary. The information we request for each beneficiary helps us identify and locate the beneficiary for payment. We recognize the confidential nature of the information requested, and we assure you that this information is for our internal use only and will not be shared.

2.Proceeds will be paid in a lump sum unless indicated otherwise in the Additional/Special Beneficiary Requests section. If information about a different method of payment was requested, we have enclosed A Word About Settlement Options. If you have not received it, contact our Customer Service Office.

3.It is important to understand the difference between primary (class 1), contingent (class 2), and tertiary (class 3) categories of beneficiaries.

•Primary beneficiaries will receive any proceeds payable at the insured’s death.

•If no primary beneficiary survives the insured, the contingent beneficiaries will receive any proceeds.

•If neither primary nor contingent beneficiaries survive the insured, tertiary beneficiaries will receive any proceeds.

4.If there is more than one beneficiary in the same class, they will be paid in equal shares or to the survivor(s) of them, unless specified otherwise.

5.Testamentary Trust (i.e., a trust that is established under a will) – A Testamentary Trust should only be named as a beneficiary if the insured’s last will and testament provides for the establishment of a trust. The death benefit can only be paid to a Testamentary Trust if the trust is named in the will and the will is probated. If the Insured’s last will and testament is not admitted to probate, under the terms of the beneficiary arrangement, we will not be able to pay the claim to the contingent beneficiary (or the insured’s estate if no contingent is named) until 18 months after the Insured’s death (or if permitted by law, a shorter period as requested in the Additional/Special Beneficiary Requests section.)

6.Our responsibility for the payment of the proceeds to a Trust ends with payment made to the Trustee(s); we have no responsibility regarding any subsequent distribution made by the Trustee(s).

Special Beneficiary Designations (Use the Additional/Special Beneficiary Requests section)

For the following designations, include the information shown in the quotations (as well as any other identifying information described in this section).

1. Children as a group. (This would include any legally adopted children.) Write“Children of the insured.”

2.Children by representation. (We do not use the term “per stirpes” in our beneficiary designations.)

If a child is not living and therefore not eligible to receive payment, and if any such child’s share is to be distributed equally to his or her surviving children, then write: “his (or her) children by representation” next to any beneficiary this will apply to.

For children as a group write “children of the Insured, their children by representation.”

3. Creditor Beneficiary or Funeral Home.

a.“(Business Name), of (city, state), its successors or assigns, creditor, as its interest may appear.” For entities other than a corporation omit ‘its successors or assigns’. or

b.“(Individual’s name), his/her estate, creditor of the Insured, as his/her interest may appear.”

For any creditor arrangement, be sure to indicate who is to receive any balance. “Pay balance, if any, to Jane Smith, wife.”

(continued)

COMB 98992

Ed. 4/2014

Page A of Instructions

Customer keeps this page

Special Beneficiary Designations (Use the Additional/Special Beneficiary Requests section) (continued)

4. Dollars and Balance Arrangements. Note: Only one dollar amount can be shown.

•“Pay $80,000, or the proceeds, if less, to Jane Doe, wife, and the balance, if any, to John Doe, son.”

5. Percentages and Fractions.

•Percentage arrangement: “Pay 75% to Jane Doe, wife, and 25% to John Doe, son.”

•Fraction arrangement: “Pay ¾ to Jane Doe, wife, and ¼ to John Doe, son.”

In the examples above, if Jane Doe is not living when the insured dies, her share will not be payable to John Doe. If you want that share to be paid to the other beneficiary (or to someone else), then write:

“Pay 75% to Jane Doe, wife, if living, otherwise to John Doe, son; and 25% to John Doe, son, if living, otherwise Jane Doe, wife.”

6.Short Term Survivorship Provision.

If this provision is chosen, any beneficiary who dies after the insured (but within the period of days you specify) will be considered to have died before the insured. The specified period (from 1 to 30 days) must be indicated, as follows: “Include Short Term Survivorship Provision of (1 to 30) days.”

For Kentucky Residents – Additional Information Regarding the Beneficiary Change

The State of Kentucky prohibits a beneficiary from collecting benefits under an insurance policy if convicted of taking the life of the decedent or of certain felonies involving abuse, neglect or financial exploitation of the decedent resulting in a loss to the decedent of more than $300 in financial or other resources, or both.

The forfeiture will not occur if:

•The insurance policy was executed prior to January 1, 2012.

•The felony was committed prior to January 1, 2012.

•The decedent, knowing of that person’s conviction, reaffirms that person’s right to receive the policy benefits by executing a new policy, or requesting a beneficiary change on an existing policy, which names that person as a beneficiary.

If a forfeiture occurs, and there are no other beneficiaries, the forfeited interest shall be paid to the State for deposit into the elder and vulnerable adult victims trust fund.

Important Notice – Civil Union Act

If your state has enacted a Civil Union Act or similar legislation, which provides that parties treat civil unions and marriages equally in all aspects, we are providing this notice to confirm that we comply with all states Civil Union Acts or similar legislation.

COMB 98992

Ed. 4/2014

Page B of Instructions

Customer keeps this page

Request to Change Beneficiary on Life Insurance Policies

Please print using blue or black ink. |

Initial any corrections or deletions that you make to the preprinted text. |

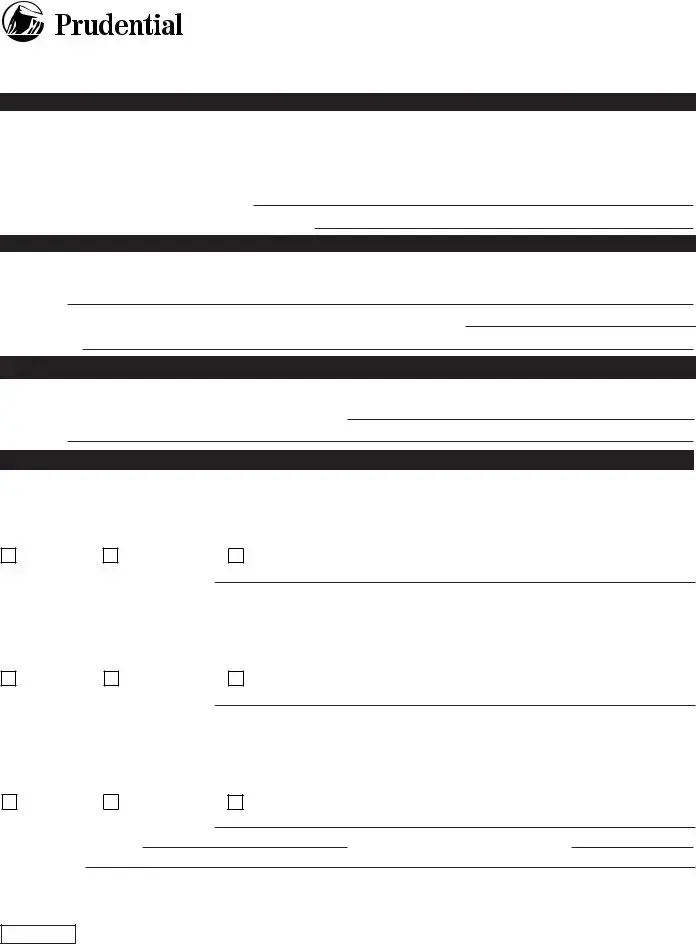

About Your Policy

You can use this form to make changes to more than one policy as long as each policy insures the same person(s) and has the same owner, and you are requesting the same changes for each policy.

Policy number(s) (eight or nine characters)

_______________________ _______________________ _______________________ _______________________

Name of insured (first, middle initial, last name)

Name of joint insured, if any (first, middle initial, last name)

Has your mailing address, telephone number(s), or

Complete this section only if you are requesting a permanent change in your mailing address, have a new telephone number(s), or

Full address

Telephone number: Home |

|

Mobile (Cell) |

Mailing Instructions

Unless otherwise indicated in this section, confirmation of the change(s) will be mailed to the owner at the address in our records.

Name of Recipient of confirmation (first, middle initial, last name)

Full address

Request to Change Beneficiary (This revokes all prior beneficiary designations)

All beneficiaries need to be restated even if they are not being changed. For example, if you are changing only the contingent beneficiary, you must restate the primary beneficiary. If more space is needed for additional beneficiaries, use the Additional/Special Beneficiary Requests section.

A. To name individual beneficiary(ies), complete the following:

Primary |

Contingent |

Name (first, middle initial, last name)

Tertiary

Relationship to insured |

|

Date of birth |

|

Soc. Sec. no. |

|

|

|||||

Full address |

|

|

|

|

|

|

|

|

|||

Telephone number: Home |

|

|

Mobile (Cell) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||

Primary |

Contingent |

Name (first, middle initial, last name)

Tertiary

Relationship to insured |

|

Date of birth |

|

Soc. Sec. no. |

|

|

|||||

Full address |

|

|

|

|

|

|

|

|

|||

Telephone number: Home |

|

|

Mobile (Cell) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||

Primary |

Contingent |

Name (first, middle initial, last name)

Relationship to insured

Full address

Tertiary

Date of birth |

|

Soc. Sec. no. |

Telephone number: Home |

|

Mobile (Cell) |

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

COMB 98992

Ed. 4/2014 |

Page 1 of 3 |

(continued) |

|

Return this page to Prudential

Initial any corrections or deletions that you make to the preprinted text.

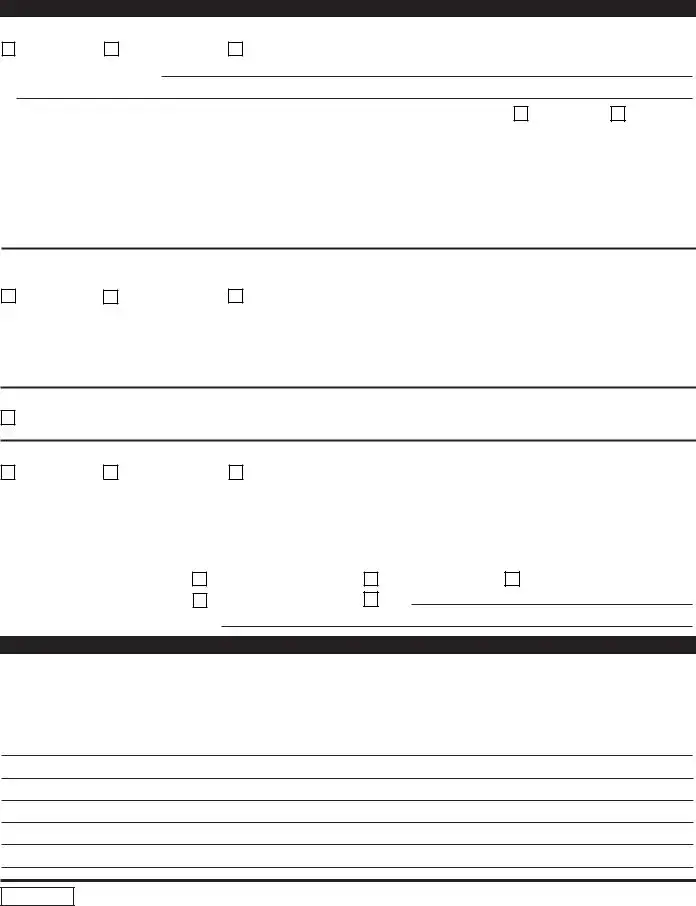

Request to Change Beneficiary (continued)

B. To name a trustee under a living

Primary |

Contingent |

Name of current trustee(s)

Tertiary

Date of trust agreement |

|

/ |

/ |

|

Trust is (check one) Irrevocable Revocable |

|||||||||

Name of trust |

|

|

|

|

|

|

|

|

|

|

|

|||

Full address |

|

|

|

|

|

|

|

|

|

|

||||

Telephone # |

|

|

|

|

|

|

||||||||

Trust taxpayer identification # |

|

|

|

|

|

|

|

|

|

|

||||

Note: Whenever possible, include confirmation of the trust information by providing a copy of those pages of the trust documentation that show the name of the trust, name(s) of the trustee(s) and date of the trust.

C. To name a trust that will be established under the Insured’s Last Will and Testament (i.e. Testamentary Trust), check one of the following:

Primary

Contingent

Tertiary

Note: You may wish to consult legal counsel before choosing this arrangement. Only choose this arrangement if the insured’s will provides for the establishment of a trust. Trusts that are established prior to the insured’s death are not testamentary trusts. To name a trust that has already been established as a beneficiary, complete B above. Please refer to #5 in the Changing Your Beneficiary section on Page A of Instructions for additional information.

D. To name the insured’s estate as your sole beneficiary, check the following:

The insured’s estate. If choosing the insured’s estate, no other beneficiary can be selected.

E. To name a business/organization, complete the following:

Primary |

|

Contingent |

Tertiary |

|||||

Name of business/organization |

|

|

|

|

|

|||

Full address |

|

|

|

|

|

|

|

|

Telephone # |

|

|

|

|

|

|

||

Employer taxpayer identification # |

|

|

|

|

|

|||

Type of business/organization |

Corporation |

|

Limited Liability Company |

Name of sole proprietor (if applicable)

Partnership

Other

Sole Proprietorship

Additional/Special Beneficiary Requests

Use this section to name an additional beneficiary, a class or group not shown in the Request to Change Beneficiary section, or to select a payment option for your beneficiary.

For each additional individual beneficiary or member of a class or group (i.e. Children of the Insured), please provide the class (primary, contingent, tertiary), their full name, relationship to the insured, date of birth, social security number, address, home and/or mobile (cell) telephone number(s) and

COMB 98992

Ed. 4/2014Page 2 of 3

Return this page to Prudential

Initial any corrections or deletions that you make to the preprinted text.

Signature(s)/Signature Requirements (Always complete)

Your request cannot be processed without the correct signature(s), date, and applicable documentation.

•For individual policyowner(s), the person (or persons if there are joint owners) that owns the policy must sign.

•For corporations, an authorized officer must sign. Be sure to include the title of the officer and the company name.

•If president – no additional requirements

•If vice president – for policies over $1,000,000, provide a Corporate Secretary’s statement reflecting the vice president’s authority to sign

•If any other officer – provide a corporate resolution

•For limited liability companies (LLC), a copy of the document that identifies who is authorized to act on behalf of the LLC (e.g. operating agreement) must be submitted. The individual(s) authorized to act should sign and include his/her title and the company name.

•For partnerships (LP, LLP, and LLLP), the form should be signed by at least two general partners, followed by the title “general partner” after each signature. If the company only has one general partner, then the sole general partner should sign followed by the title “sole general partner”. Also, include the company name.

•For sole proprietorships, submit the signature of the owner, followed by “doing business as (company name), a sole proprietorship.“

•For trusts, the trustee(s) must sign and include the title “trustee” after their signature. The name of the trust must also be indicated in the space provided for Business/Trust name. All trustees must sign unless the trust itself or state law provides otherwise.

•A holder of a power of attorney for the policyowner must sign the form and include the title

•For guardian (conservator) of the estate - sign as “guardian of the estate of (name of ward)”. A copy of the guardianship papers must also be submitted. Depending on the rights granted by the guardianship papers or the state, a court order authorizing the change may also be required.

•For a policy containing a limitation of rights, the person or entity in whose favor the rights have been limited must also sign.

By signing this form, I:

•certify that I am authorized to sign this form,

•certify that the change(s) being requested are not subject to, or in conflict with, any prior agreement, legal proceeding, or court/administrative order, which restrict, limit, or otherwise prohibit such change(s), including, but not limited to divorce or bankruptcy proceedings,

•authorize all request(s) made on this form, both preprinted and handwritten, which are subject to the terms and conditions of the policy,

•request a waiver of any policy provision that requires me to send Prudential the policy for endorsement of the change(s),

•certify that the policy(ies) is/are in my possession and that no other person has any claim or interest in it/them, except for a collateral assignee under any assignment now on record with Prudential,

•certify that if the owner is a corporation or partnership, that it is not under receivership, trusteeship, or conservatorship, and/or has not been dissolved, and if a partnership, that no notice of disassociation has been filed by any partner, and

•understand that any endorsement that Prudential may issue will conform to its rules and practices.

X

Current owner’s signatureDate signed month/day/year

X

Current joint owner’s signature(s) (if applicable) |

|

Date signed month/day/year |

|

|

|

Signer’s title (for business/trust owned only) |

|

Business/Trust name (if applicable) |

For Massachusetts residents only

State law requires that a disinterested adult, who is not a party to the policy, witness any request to change the beneficiary arrangement. Your Prudential representative may sign as a witness.

X

Witness’ signature (Massachusetts only)

COMB 98992

Ed. 4/2014Page 3 of 3

Return this page to Prudential

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of the Form | The Prudential Change Beneficiary form allows policyholders to designate or change beneficiaries for life insurance policies. |

| Pre-filled Information | It is essential to review any pre-filled information on the form for accuracy, and any corrections must be initialed to avoid delays. |

| Payment Proceeds | Life insurance proceeds are typically paid in a lump sum, unless otherwise indicated in the form’s Additional/Special Beneficiary Requests section. |

| Types of Beneficiaries | Beneficiaries are categorized as primary (class 1), contingent (class 2), or tertiary (class 3), each receiving benefits under specific circumstances. |

| Children as Beneficiaries | Children can be designated as a group or by representation; specific wording is required to ensure clarity in distribution. |

| Testamentary Trusts | A Testamentary Trust may only be named as a beneficiary if it is provided for in the insured’s will and is subject to probate. |

| Massachusetts Witness Requirement | In Massachusetts, a disinterested adult witness is required to sign when changing beneficiary arrangements. |

| Kentucky Forfeiture Policy | In Kentucky, a beneficiary may forfeit their right to benefits if they are convicted of certain crimes against the decedent, unless exceptions apply. |

| Customer Service Contact | For any arrangements not outlined on the form, policyholders are encouraged to contact Prudential’s Customer Service Office for assistance. |

| Submission Guidelines | After completing, the entire form must be returned to Prudential. The policy itself should not be sent along with the form. |

Guidelines on Utilizing Prudential Change Beneficiary

Filling out the Prudential Change Beneficiary form is a straightforward process, but it requires attention to detail. Following the instructions carefully will ensure that your beneficiary designations are accurately recorded. After submitting this form, Prudential will process your request and send you a confirmation of the changes made. This confirmation is crucial for your records and peace of mind.

- Obtain the Prudential Change Beneficiary form and ensure you have a blue or black ink pen for completion.

- Begin by reviewing any pre-filled information on the form. Initial any corrections or deletions that you need to make.

- Fill in the policy number(s) associated with the insurance policy you are updating.

- Provide the name of the insured, as well as any joint insured, if applicable.

- If there are any changes to your mailing address, telephone numbers, or email address, fill in that information in the designated section.

- Name the recipients for confirmation of the changes and provide their full address if necessary.

- In the Request to Change Beneficiary section, restate all beneficiaries, whether or not they are being changed. Select whether they are primary, contingent, or tertiary beneficiaries.

- Complete all required details for each beneficiary, including their full name, relationship to the insured, date of birth, social security number, address, and contact information.

- If you are naming a trustee or trust, provide the appropriate information and details about the trust, including the date of the trust agreement.

- For additional or special beneficiary requests, thoroughly fill out that section with the relevant details.

- Sign the form where indicated, ensuring you enter the date of your signature as well.

- If required, have the form witnessed, especially for Massachusetts residents, by a disinterested adult.

- Submit the completed form to Prudential without sending your policy document.

What You Should Know About This Form

What is the Prudential Change Beneficiary form used for?

This form is used to update or change the beneficiaries listed on life insurance policies issued by Prudential. Beneficiaries are the individuals or entities that will receive the proceeds from the insurance policy upon the insured person's death. It's crucial to ensure that the right people are listed as beneficiaries, as this helps facilitate smooth claim payments and avoid potential delays during a difficult time.

How do I fill out the form correctly?

Begin by reviewing any pre-filled information on the form. If any details are incorrect, make the necessary corrections and initial beside each change. After you complete the form, return it in its entirety to Prudential; do not include your policy. Make sure to provide all necessary information about the beneficiaries, including their name, relationship to the insured, date of birth, and contact details. Remember, if you’re only changing one beneficiary, you must still restate all the others.

Are there different types of beneficiaries I can designate?

Yes, beneficiaries can be designated as primary, contingent, or tertiary. Primary beneficiaries receive the proceeds first. If no primary beneficiaries survive the insured, the contingent beneficiaries will get the proceeds. Lastly, if neither primary nor contingent beneficiaries are alive, the tertiary beneficiaries will receive the proceeds. This hierarchy helps ensure that the proceeds are distributed according to your preferences.

What if I want to create special arrangements for my beneficiaries?

The form includes sections for additional or special beneficiary requests. For example, you can designate "Children of the Insured" as a group, specify payment amounts, or use percentages for distributions among beneficiaries. Be careful to provide clear instructions to avoid confusion or disputes later. If your arrangement is complex, consider consulting with a legal professional for guidance.

Is there anything specific I need to know if I live in Kentucky?

Yes, Kentucky state law has specific rules regarding beneficiaries. If a beneficiary is convicted of taking the life of the insured or certain felonies affecting the insured, they may be prevented from collecting benefits. However, if the insurance policy was executed or the felony committed before specific dates, exceptions may apply. It's essential to understand these rules to ensure your beneficiaries are eligible to receive benefits.

Do I need a witness to make changes to my beneficiary in Massachusetts?

Yes, if you reside in Massachusetts, state law requires that a disinterested adult who is not involved in the policy must witness the request to change beneficiaries. Your Prudential representative can serve as a witness for this purpose. Having a witness helps confirm the legitimacy of your request and meets legal requirements.

Common mistakes

Filling out the Prudential Change Beneficiary form can be straightforward, but mistakes can occur that might delay the processing of your request. One common mistake is not reviewing the pre-filled information carefully. The form often contains pre-printed data, which may not always be accurate. If any details are incorrect, it's crucial to initial those corrections. Forgetting to do this can lead to potential roadblocks, as Prudential may be unable to process your request if they have conflicting information.

Another frequent error involves misunderstanding beneficiary classifications. Individuals often confuse primary, contingent, and tertiary beneficiaries or overlook the importance of specifying them. Primary beneficiaries are entitled to payouts first; if they do not survive the insured, contingent beneficiaries will receive the proceeds. Failing to indicate these classifications accurately can complicate payout distribution and cause delays when claims are made.

Additionally, many people neglect to restate all beneficiaries. When changing a beneficiary, the form requires that all beneficiaries, even those not being altered, be included again. This means that if you are only updating a contingent beneficiary, the primary beneficiary still needs to be restated. Leaving this step out can lead to confusion and result in improper beneficiary designation.

Finally, a critical oversight is failing to sign the form correctly. The signatures must come from the individual owners of the policy, and any corporate entity or trust needs specific individuals to sign on its behalf. Different entities have different requirements for signing, so it’s important to ensure the right person is signing in the correct position. Without the proper signatures and dates, your request may be rejected, leaving your intended changes unprocessed.

Documents used along the form

The Prudential Change Beneficiary form is critical for anyone wishing to alter the designated beneficiaries of their life insurance policy. However, several other documents and forms often accompany this process to ensure validity, proper representation, and compliance with legal regulations. Below is a list of common documents used along with the Prudential Change Beneficiary form, each serving a unique purpose.

- Life Insurance Policy Document: This document outlines the terms and conditions of the insurance policy, including coverage details, premium amounts, and the original beneficiary designations.

- Beneficiary Designation Form: Similar to the Change Beneficiary form, this document establishes the initial beneficiaries for the policy before any changes are made.

- Trust Documentation: If a trust is named as a beneficiary, copies of relevant trust documents may be required to confirm the trust's existence and terms.

- Power of Attorney: If someone is changing the beneficiary on behalf of the policyowner, a power of attorney document will need to be included to demonstrate authorized decision-making.

- Death Certificate: A certified copy of the policyholder’s death certificate may be necessary for processing claims once the designated beneficiaries need to receive proceeds.

- Wills and Testamentary Documents: If a Testamentary Trust is named as a beneficiary, the will must be provided to verify its provisions and the trust’s establishment.

- Trustee Acknowledgment Form: This form confirms that the selected trustee has agreed to manage the trust if it is designated as a beneficiary.

- Change of Address Form: If there has been a change in the policyowner's contact information, a separate form may be needed to update this data.

- Validation of Relationship Form: This may be required to establish the legitimacy of the relationship between the policyowner and the beneficiary, especially for non-family beneficiaries.

- Medical Release Form: Occasionally, this may be necessary, particularly if any modifications to health-related benefits are involved.

Having the appropriate documentation ready can significantly streamline the process of updating beneficiaries for life insurance policies. Ensuring that all necessary forms are filled out accurately and submitted can prevent delays and complications following the policyholder’s passing. Consulting a financial advisor or attorney may also be beneficial when managing significant changes to insurance policies.

Similar forms

- Designation of Beneficiary Form: Like the Prudential Change Beneficiary form, this document is used to specify who will receive the benefits of a policy or account upon the owner's death. Both require clear identification of the beneficiaries to ensure proper distribution of funds.

- Life Insurance Application: This form, while used for applying for coverage, also contains sections where beneficiaries can be named. Both documents serve to communicate the owner's wishes regarding who receives benefits.

- Trust Beneficiary Designation: Similar to the Prudential form, this document designates a trust as the beneficiary. It underscores the importance of ensuring that the trust is legal and has been established correctly to receive benefits.

- Will: A Last Will often includes instructions for beneficiary designations, particularly regarding how to handle life insurance or other accounts. Both documents ensure the individual's assets are distributed according to their wishes.

- Power of Attorney: When appointing someone to make decisions on your behalf, this document can include provisions for managing benefits and accounts. Like the Prudential form, it is crucial for specifying how assets will be managed or distributed.

- Revocable Living Trust Document: It allows for the transfer of assets during a person's lifetime and specifies beneficiaries post-death. Both documents focus on the distribution of assets and providing clarity on the intentions of the owner.

- Transfer on Death Deed: This document allows for real property to pass directly to a beneficiary upon death, much like the Prudential form facilitates the transfer of life insurance benefits.

- Beneficiary Change Request for Retirement Accounts: Just like the Prudential form, this document lets account owners change who will receive their funds upon their death, making it vital for proper financial planning.

- State-Specific Beneficiary Designation Forms: Many states have their own forms that allow individuals to designate beneficiaries for specific types of accounts. Similar to the Prudential form, these documents help ensure that the owner’s wishes are respected in accordance with state laws.

Dos and Don'ts

When filling out the Prudential Change Beneficiary form, certain practices can help ensure a smooth process. Here are ten things to consider doing and not doing.

- Do: Carefully review all pre-filled information on the form to ensure it is accurate.

- Do: Initial any corrections you make to the preprinted text. This confirms your changes are noted.

- Do: Provide complete information for each beneficiary, including relationship to the insured.

- Do: Use blue or black ink for better clarity on the form.

- Do: Include all beneficiaries, even those you are not changing, as they need to be restated.

- Don't: Forget to sign the form, as it cannot be processed without your signature.

- Don't: Use pencil; it may not be accepted, and forms should be legible.

- Don't: Skip the additional/special requests section if you have unique arrangements for your beneficiaries.

- Don't: Send your life insurance policy with the form; just submit the completed form.

- Don't: Assume that changes will take effect immediately; you will receive confirmation after processing.

Misconceptions

Misconceptions about the Prudential Change Beneficiary Form

- Misconception 1: Once a beneficiary is named, it cannot be changed.

- Misconception 2: The form allows for unlimited beneficiary arrangements without restrictions.

- Misconception 3: Only primary beneficiaries receive payouts from a life insurance policy.

- Misconception 4: You can submit the form without verifying the accuracy of pre-filled information.

- Misconception 5: Testamentary Trusts do not have specific requirements for naming beneficiaries.

This is incorrect. Policyowners can change their beneficiaries at any time using the Prudential Change Beneficiary form. However, previous beneficiary designations must be revoked during this process, and all beneficiaries, even those not being changed, need to be restated.

This is not true. The form has specific requirements regarding how beneficiaries can be designated. Misunderstanding this can lead to incomplete or improperly structured beneficiary arrangements, which may complicate claims later.

This misunderstanding overlooks the roles of contingent and tertiary beneficiaries. If no primary beneficiary survives the insured, contingent beneficiaries will receive the proceeds, followed by tertiary beneficiaries if necessary.

This is a significant error. Policyowners must review any pre-filled information and initial any corrections or deletions. Failure to do so may result in delays or denial of the request.

In reality, a Testamentary Trust can only be named if the insured’s will establishes it. The will must also be probated for the death benefit to be disbursed properly. This requirement is crucial and should not be overlooked.

Key takeaways

7 Key Takeaways about Filling Out and Using the Prudential Change Beneficiary Form:

- Carefully check the pre-filled information. Any corrections or deletions should be initialed to ensure your request is processed accurately.

- Submit the completed form in its entirety; do not send your life insurance policy with it.

- Understand the roles of beneficiaries: primary, contingent, and tertiary categories determine who gets paid first in case of a claim.

- If you choose multiple beneficiaries, they will share the proceeds equally unless stated otherwise.

- If naming a testamentary trust as a beneficiary, ensure it is covered in the insured's will and that the will has been probated to avoid payment delays.

- Be aware of special designations, such as specifying percentages or dollar amounts for multiple beneficiaries in the appropriate format.

- Ensure all required signatures are present, including additional documentation for partnerships, LLCs, trusts, or power of attorney situations to validate the request.

Browse Other Templates

How Do I Get a Direct Deposit Form - Use this slip to instruct the bank how to categorize your deposit accurately.

Forbarance - All borrowers listed on the mortgage must contribute information to the hardship form to aid in the evaluation process.

Tronox Trust Payout 2022 - Your claim may be categorized differently based on the information you provide.