Fill Out Your Prudential Surrender Form

The Prudential Surrender form is a vital document for policyholders seeking to surrender their life insurance policies with Prudential Assurance Malaysia Berhad. This form captures essential information such as the policy number, insured member's name, and the agent's details, ensuring a straightforward process. Clear instructions for completion are provided, including the requirement to fill out the form with dark black ink. Different service types, like investment-linked plans and traditional plans, are indicated, providing clarity on what the policyholder is requesting. In Part Two, applicants must supply their bank account details for a direct credit facility, allowing for a smooth transfer of any surrender values. Additionally, the form contains a declaration section where applicants acknowledge their understanding of the terms and conditions, reinforcing the necessity of accuracy and integrity in the application process. It is crucial to submit all required documents, including identification, to prevent delays in processing the surrender request.

Prudential Surrender Example

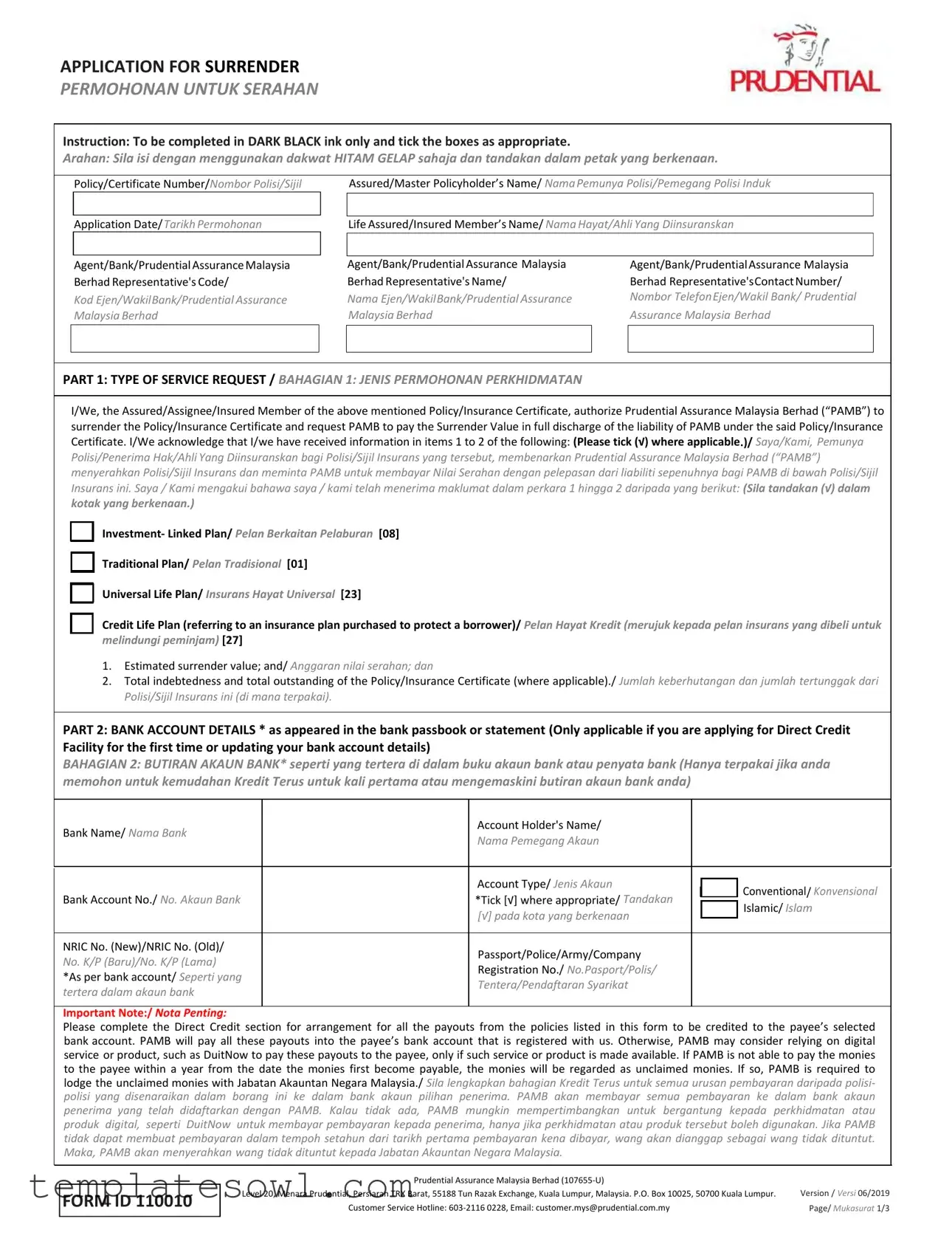

APPLICATION FOR SURRENDER

PERMOHONAN UNTUK SERAHAN

Instruction: To be completed in DARK BLACK ink only and tick the boxes as appropriate.

Arahan: Sila isi dengan menggunakan dakwat HITAM GELAP sahaja dan tandakan dalam petak yang berkenaan.

Policy/Certificate Number/Nombor Polisi/Sijil |

|

Assured/Master Policyholder’s Name/ NamaPemunya Polisi/Pemegang Polisi Induk |

||

Application Date/Tarikh Permohonan |

|

Life Assured/Insured Member’s Name/ Nama Hayat/Ahli Yang Diinsuranskan |

||

Agent/Bank/Prudential Assurance Malaysia |

|

Agent/Bank/Prudential Assurance Malaysia |

Agent/Bank/Prudential Assurance Malaysia |

|

Berhad Representative's Code/ |

|

Berhad Representative's Name/ |

Berhad Representative'sContactNumber/ |

|

Kod Ejen/WakilBank/Prudential Assurance |

|

Nama Ejen/WakilBank/Prudential Assurance |

Nombor TelefonEjen/Wakil Bank/ Prudential |

|

Malaysia Berhad |

|

Malaysia Berhad |

Assurance Malaysia Berhad |

|

|

|

|

|

|

PART 1: TYPE OF SERVICE REQUEST / BAHAGIAN 1: JENIS PERMOHONAN PERKHIDMATAN

I/We, the Assured/Assignee/Insured Member of the above mentioned Policy/Insurance Certificate, authorize Prudential Assurance Malaysia Berhad (“PAMB”) to surrender the Policy/Insurance Certificate and request PAMB to pay the Surrender Value in full discharge of the liability of PAMB under the said Policy/Insurance Certificate. I/We acknowledge that I/we have received information in items 1 to 2 of the following: (Please tick (√) where applicable.)/ Saya/Kami, Pemunya Polisi/Penerima Hak/Ahli Yang Diinsuranskan bagi Polisi/Sijil Insurans yang tersebut, membenarkan Prudential Assurance Malaysia Berhad (“PAMB”) menyerahkan Polisi/Sijil Insurans dan meminta PAMB untuk membayar Nilai Serahan dengan pelepasan dari liabiliti sepenuhnya bagi PAMB di bawah Polisi/Sijil Insurans ini. Saya / Kami mengakui bahawa saya / kami telah menerima maklumat dalam perkara 1 hingga 2 daripada yang berikut: (Sila tandakan (√) dalam kotak yang berkenaan.)

Investment- Linked Plan/ Pelan Berkaitan Pelaburan [08]

Traditional Plan/ Pelan Tradisional [01]

Universal Life Plan/ Insurans Hayat Universal [23]

Credit Life Plan (referring to an insurance plan purchased to protect a borrower)/ Pelan Hayat Kredit (merujuk kepada pelan insurans yang dibeli untuk melindungi peminjam) [27]

1.Estimated surrender value; and/ Anggaran nilai serahan; dan

2.Total indebtedness and total outstanding of the Policy/Insurance Certificate (where applicable)./ Jumlah keberhutangan dan jumlah tertunggak dari Polisi/Sijil Insurans ini (di mana terpakai).

PART 2: BANK ACCOUNT DETAILS * as appeared in the bank passbook or statement (Only applicable if you are applying for Direct Credit Facility for the first time or updating your bank account details)

BAHAGIAN 2: BUTIRAN AKAUN BANK* seperti yang tertera di dalam buku akaun bank atau penyata bank (Hanya terpakai jika anda memohon untuk kemudahan Kredit Terus untuk kali pertama atau mengemaskini butiran akaun bank anda)

Bank Name/ Nama Bank |

Account Holder's Name/ |

|

|

|

|

Nama Pemegang Akaun |

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

|

Account Type/ Jenis Akaun |

[ |

] |

Conventional/ Konvensional |

|

Bank Account No./ No. Akaun Bank |

*Tick [√] where appropriate/ Tandakan |

||||

[ |

] |

Islamic/ Islam |

|||

|

[√] pada kota yang berkenaan |

||||

|

|

|

|

||

|

|

|

|

|

|

NRIC No. (New)/NRIC No. (Old)/ |

Passport/Police/Army/Company |

|

|

|

|

No. K/P (Baru)/No. K/P (Lama) |

|

|

|

||

Registration No./ No.Pasport/Polis/ |

|

|

|

||

*As per bank account/ Seperti yang |

|

|

|

||

Tentera/Pendaftaran Syarikat |

|

|

|

||

tertera dalam akaun bank |

|

|

|

||

|

|

|

|

Important Note:/ Nota Penting:

Please complete the Direct Credit section for arrangement for all the payouts from the policies listed in this form to be credited to the payee’s selected bank account. PAMB will pay all these payouts into the payee’s bank account that is registered with us. Otherwise, PAMB may consider relying on digital service or product, such as DuitNow to pay these payouts to the payee, only if such service or product is made available. If PAMB is not able to pay the monies

to the payee within a year from the date the monies first become payable, the monies will be regarded as unclaimed monies. If so, PAMB is required to lodge the unclaimed monies with Jabatan Akauntan Negara Malaysia./ Sila lengkapkan bahagian Kredit Terus untuk semua urusan pembayaran daripada polisi- polisi yang disenaraikan dalam borang ini ke dalam bank akaun pilihan penerima. PAMB akan membayar semua pembayaran ke dalam bank akaun penerima yang telah didaftarkan dengan PAMB. Kalau tidak ada, PAMB mungkin mempertimbangkan untuk bergantung kepada perkhidmatan atau produk digital, seperti DuitNow untuk membayar pembayaran kepada penerima, hanya jika perkhidmatan atau produk tersebut boleh digunakan. Jika PAMB tidak dapat membuat pembayaran dalam tempoh setahun dari tarikh pertama pembayaran kena dibayar, wang akan dianggap sebagai wang tidak dituntut. Maka, PAMB akan menyerahkan wang tidak dituntut kepada Jabatan Akauntan Negara Malaysia.

FORM ID 110010

Prudential Assurance Malaysia Berhad |

|

Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. |

Version / Versi 06/2019 |

Customer Service Hotline: |

Page/ Mukasurat 1/3 |

Policy/Insurance Certificate Number/ Nombor Polisi/Sijil Insurans

PART 3: STATEMENT OF DECLARATION / BAHAGIAN 3: KENYATAAN PENGAKUAN

A. Surrender/ Serahan

1.I/We have read, understood and agreed to the Terms and Conditions (as set out below) for making this application./ Saya/Kami telah membaca, memahami dan bersetuju kepada Terma dan Syarat (seperti yang ternyata di bawah ini) untuk permohonan ini.

2.I/We understand that this application will not take effect until it is accepted and notified to me/us by Prudential Assurance Malaysia Berhad(“PAMB”)./ Saya/Kami memahami bahawa permohonan saya/kami tidak akan berkuatkuasa sehingga permohonan saya diterima dan dimaklumkan kepada saya/kami oleh Prudential Assurance MalaysiaBerhad (PAMB).

3.I/We declare that the information given in this form is true and complete./ Saya/Kami mengaku bahawa semua maklumat yang diberikan dalam borang ini adalah benar dan lengkap.

4.I/We understand that all requests received shall be processed based on the terms stated in the Policy/Insurance Certificate./ Saya/Kami memahami bahawa semua permohonan akan diproses mengikut terma yang tertera dalam Polisi/Sijil Insurans.

5.I/We further declare that I/we am/are not involved in any bankruptcy proceedings and that I/we have committed no act of bankruptcy in the last twelve (12) months and that no receiving order has been made against me/us nor have I/we been adjudged bankrupt during that period./ Saya/Kami selanjutnya mengaku bahawa saya/kami tidak terlibat di dalam apa‐apa prosiding kebankrapan dan saya/kami tidak melakukan perbuatan kebankrapan di dalam tempoh duabelas (12) bulan yang lalu dan tiada perintah penerimaan atau penghukuman kebankrapan telah dibuat ke atas saya/kami dalam tempoh tersebut.

B. Direct Credit (Only applicable if you are completing the Bank Account Details)/ Kredit Terus (Hanya terpakai jika anda melengkapkan Butiran Akaun Bank)

In consideration of PAMB approving this application, I/we, who am/are also the Payee, hereby agree and declare that:/ Sebagai balasan kepada PAMB membenarkan permohonan ini, saya/kami, yang mana saya/kami adalah seorang Penerima, dengan ini bersetuju dan mengisytiharkan bahawa:

1.PAMB shall pay and credit the relevant monies payable pursuant to the Proposal and Policy (“Monies”) into the Account;/ PAMB akan membayar

dan mengkreditkan wang yang relevan yang boleh dibayar menurut Cadangan dan Polisi (“Wang”) ke Akaun;

2.PAMB shall continue to pay/credit the Monies into the Account until and unless PAMB receives a written instruction from the Payee to revoke

the authority given to PAMB pursuant to this application or PAMB approves a new application to change the Account details provided in this application;/ PAMB akan terus membayar/mengkreditkan Wang tersebut ke dalam Akaun sehingga dan melainkan PAMB menerima arahan

bertulis daripada Penerima untuk menarik balik kuasa diberikan kepada PAMB menurut permohonan ini atau PAMB meluluskan permohonan yang baru untuk mengubah butiran Akaun diberikan dalam permohonan ini;

3.PAMB shall not be held liable for any losses that I/we may suffer or have suffered, whether directly or indirectly, if for any reason PAMB is unable or delayed to pay and credit the Monies into the Account through no fault of PAMB, including but not limited to, the payment being rejected by the financial institution due to incorrect Account details;/ PAMB tidak bertanggungjawab terhadap sebarang kerugian yang mungkin saya/kami tanggung atau telah tanggung, sama ada secara langsung atau tidak langsung, jika untuk sebarang sebab PAMB tidak dapat atau lewat membayar dan mengkreditkan Wang tersebut ke dalam Akaun atas sebab bukan salah PAMB, termasuk tetapi tidak terhad kepada bayaran ditolak oleh institusi kewangan kerana butiran Akaun yang tidak betul;

4.I/We agree to immediately refund to PAMB in full the Monies which is paid by mistake or which I/we am/are not entitled to receive;/ Saya/ Kami bersetuju untuk membayar balik dengan

tidak ada hak untuk menerimanya;

5. PAMB is kept harmless and fully indemnified against any and all actions, claims, proceedings, costs (including legal costs on solicitor and client basis) and damages, including any compensation paid by PAMB to settle such claim, that may howsoever arise from or be incidental to my/our instruction pursuant to this application. This authorization and indemnity contained in this application shall be binding upon my/our respective

daripada sebarang dan semua tindakan, tuntutan, prosiding, kos (termasuk kos perundangan atas dasar peguamcara dan pelanggan) serta kerugian, termasuk sebarang pampasan dibayar oleh PAMB untuk menyelesaikan tuntutan sedemikian, yang mungkin timbul dalam apa cara sekalipun daripada atau berkaitan dengan arahan saya/kami menurut permohonan ini. Pemberian kuasa dan tanggung rugi ini adalah mengikat ke atas pengganti hak milik, wasi, pentadbir dan wakil peribadi serta/atau waris saya/kami; dan

C. Data Privacy Declaration/ Pengakuan Data Peribadi

I/We understand and agree to the following Data Privacy Declaration:/ Saya/Kami faham dan bersetuju kepada Pengakuan Data Peribadi berikut:

1.Any personal data collected or held by PAMB (whether given now or subsequently to PAMB) can be processed and used to process this application, for data matching, fraud detection and prevention, discharging PAMB’s duties as an insurer, updating PAMB’s records, marketing and promotion of other financial products and services by PAMB, group of companies of PAMB and Prudential plc, as well as communicating with me/us for any of these purposes (“Purposes”);/ Sebarang data peribadi yang dikumpul dan dipegang oleh PAMB (sama ada yang diberikan sekarang atau pada masa hadapan kepada PAMB) boleh diproses dan digunakan untuk memproses permohonan ini, pemadanan data, mengesan dan mencegah frod, melaksanakan

2.To achieve these Purposes, PAMB (and any third party appointed by PAMB) can transfer and disclose the personal data to third parties such as financial institutions, reinsurers, claims investigator companies, other insurers, industry associations, PAMB’s intermediaries, individuals or entities within PAMB, group of companies of PAMB and Prudential plcs, as well as other third party service providers PAMB has appointed. As some of these third parties are not located in Malaysia, PAMB can transfer the personal data to places outside of Malaysia;/ Bagi mencapai

3.I/We understand that I/we have a right to get access and request for correction of any personal data held by PAMB. Such requests can be made at PAMB’s Customer Service Centre; and/ Saya/Kami faham bahawa saya/kami mempunyai hak untuk akses dan memohon pembetulan dibuat ke atas mana- mana data peribadi yang dipegang oleh PAMB. Permohonan tersebut boleh dibuat di Pusat Perkhidmatan Pelanggan PAMB; dan

FORM ID 110010

Prudential Assurance Malaysia Berhad |

|

Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. |

Version / Versi 06/2019 |

Customer Service Hotline: |

Page/ Mukasurat 2/3 |

Policy/Insurance Certificate Number/ Nombor Polisi/Sijil Insurans

4.This Data Privacy Declaration can be revised from time to time, of which the notice of any such revision can be given on PAMB’s corporate website or by

such other means of communication deemed suitable by PAMB./ Pengakuan Data Peribadi ini boleh diubah dari semasa ke semasa, yang mana notis untuk sebarang pengubahan boleh diberi melalui laman korporat PAMB atau

I/We understand and agree that unless a longer period of document retention is required by law or PAMB’s internal policies, PAMB will only retain the original physical documents submitted to PAMB for 6 months from the date PAMB received that document. PAMB shall not be held liable for disposal of

such documents. Therefore, if I/we want the original physical document to be returned, I/we will have to submit the request to PAMB in the form PAMB decides within 3 months from the date PAMB first received that document./ Saya/Kami memahami dan bersetuju bahawa melainkan

Note: In the event of any ambiguity between the English and Bahasa Melayu version, the English version shall prevail and be given effect to.

Nota: Sekiranya terdapat

Signature of Assured/Assignee(if any)/Insured Member Tandatangan Pemunya Polisi/Penerima Hak (jika ada)/ Ahli Yang Diinsuranskan

Name/ Nama:

NRIC/Passport No./ No. Kad Pengenalan/Pasport:

Signature of Trustee(s) (if any)/ Tandatangan Pemegang Amanah (jika ada)

Name/ Nama:

NRIC/Passport No./ No. Kad Pengenalan/Pasport:

PART 4: STATEMENT OF WITNESS / BAHAGIAN 4: KENYATAAN SAKSI

I hereby certify the above signature(s) was/were made in |

my |

presence and that |

to |

my |

own |

personal |

knowledge |

it |

is the |

||||

signature(s) of the Life Assured/Assured/Spouse/Parent/Legal Guardian/Joint |

Parent/Assignee/Trustee(s)/Insured Member under the |

Policy/Insured |

|||||||||||

Certificate mentioned |

as above./ Saya dengan ini |

mengesahkan |

bahawa |

tandatangan |

di |

atas |

dibuat |

di hadapan saya |

dan |

setakat |

|||

yang |

saya ketahui |

tandatangan tersebut ialah |

tandatangan Hayat |

Yang |

Diinsuranskan/Pemunya |

Polisi/Pasangan/Ibu |

bapa/Penjaga |

Sah/Ibu |

|||||

bapa |

Bersama/Penerima Hak/Pemegang Amanah/Ahli Yang Diinsuranskan di bawah Polisi/Sijil Insurans yang disebutkan di atas. |

|

|

|

|||||||||

Note: The witness must be completed by an authorized Quality Agent, Quality Leader, Branch Head, Customer Service Representative or Bank

Representative of PAMB; or Commissioner for Oath or Notary Public./ Nota: Saksi mestilah seorang Ejen Berkualiti, Pemimpin Agensi, Ketua Cawangan, Wakil Khidmat Pelanggan atau Wakil Bank Kepada PAMB; Pesuruhjaya Sumpah atau Notari Awam.

Witness’s Name/ Nama Saksi:

NRIC/Passport No./ No. Kad Pengenalan/Pasport:

Signature of Witness / Tandatangan Saksi

PART 5: TERMS & CONDITIONS / BAHAGIAN 5: TERMA‐TERMA & SYARAT‐SYARAT

A. Application/Permohonan

1.Copy of identity card or passport of the Assured/Assignee/Insured Member (where applicable) must be enclosed./ Salinan kad pengenalan atau pasport Pemunya Polisi/Penerima Hak/Ahli Yang Diinsuranskan (di mana terpakai) mesti disertakan.

2.Only the original form duly completed by Assured/Assignee (if any)/Insured Member shall be acceptable./ Cuma salinan asal yang diisi oleh Pemunya Polisi/Penerima Hak (jika ada)/Ahli Yang Diinsuranskan akan diterima.

3.Consent from Trustee(s) is required./ Kebenaran dari Pemegang Amanah adalahdikehendaki.

B.Application For Surrender/ Permohonan Untuk Serahan

1.The surrender value will be determined in accordance with the Policy/Insurance Certificate and other such documentation required by PAMB to prove the title of the person claiming payment./ Nilai serahan akan ditentukan menurut Polisi/Sijil Insurans tersebut dan dokumen lain yang dikehendaki oleh PAMB bagi mengesahkan hak milik individu yang menuntutbayaran.

2.The surrender value payable is subject to the surrender charge, redemption cost, tax penalty or any other charges provided under the Policy/Insurance Certificate (where applicable) (collectively refered to as the “Surrender Related Charges”) and any of the Surrender Related Charges can be varied from time to time./ Nilai serahan yang perlu dibayar adalah tertakluk kepada caj serahan, kos penebusan, penalti cukai atau apa apa caj lain yang diberikan di bawah Polisi/ Sijil Insurans (di mana terpakai), (secara kolektif dirujuk sebagai "Caj Tentang Serahan) dan

3.No reinstatement is allowed./ Pengembalian semula tidak dibenarkan.

4.The Surrender Value is referring to the amount provided under the Policy/Insurance Certificate, less any amount owed to PAMB including but not limited to the Surrender Related Charges./ Nilai Serahan merujuk kepada amaun yang diperuntukkan di bawah Polisi/Sijil Insurans, yang mana amaun tersebut akan ditolak dengan sebarang amaun yang terhutang kepada PAMB termasuk tetapi tidak terhad kepada Caj Tentang Serahan.

5.The Policy/Insurance Certificate and any premium payment facility will be terminated upon surrender./ Polisi/Sijil Insurans dan sebarang kemudahan pembayaran premium akan ditamatkan setelah serahan.

6.PAMB will only process this Application after the completion of any prior request for

FORM ID 110010

Prudential Assurance Malaysia Berhad |

|

Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. |

Version / Versi 06/2019 |

Customer Service Hotline: |

Page/ Mukasurat 3/3 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Application Requirement | The Prudential Surrender form must be completed using dark black ink only. |

| Surrender Value Notification | The applicant acknowledges that they have received information regarding the estimated surrender value and total indebtedness of the policy. |

| Bank Account Details | Direct credit arrangements require the applicant to provide their bank account details, including the bank's name and account number. |

| Indemnity Clause | The application contains an indemnity clause, protecting Prudential from claims arising from errors in the provided bank account details. |

| Data Privacy | Disclosure of personal data is allowed to third parties for processing the application and other related functions. |

| Witness Requirement | A witness, such as a bank representative or authorized agent, must certify the signatures on the form. |

| Governing Law | The surrender form is governed under applicable Malaysian insurance laws, particularly Prudential Assurance Malaysia Berhad policies. |

Guidelines on Utilizing Prudential Surrender

Filling out the Prudential Surrender form is a straightforward process that requires careful attention to detail. Once the form is correctly completed and submitted, Prudential will process your application and notify you of the outcome. Below are the steps to follow in order to complete the form properly.

- Use a dark black ink pen to fill out the form.

- Begin by entering your Policy/Certificate Number at the top of the form.

- Next, provide the Assured/Master Policyholder’s full name.

- Fill in the Application Date to indicate when you are submitting the form.

- Enter the Life Assured/Insured Member’s Name as it appears on the policy.

- Provide details for the Agent/Bank, including the Prudential Assurance Malaysia representative’s code, name, and contact number.

- Move to PART 1: Select the type of service requested by ticking the appropriate box for either Investment-Linked Plan, Traditional Plan, Universal Life Plan, or Credit Life Plan.

- Read and acknowledge the information in items 1 and 2, ensuring you have received the estimated surrender value and total indebtedness if applicable.

- In PART 2, fill out your Bank Account Details only if you are applying for Direct Credit Facility. Include your Bank Name, Account Holder's Name, Account Type, and Account Number.

- In PART 3, review and check the boxes for the statements regarding your understanding and acceptance of the terms and conditions. Sign where appropriate.

- If applicable, provide information in PART 4 for the Statement of Witness by entering the witness's name, NRIC/Passport number, and signature. Make sure the witness is an authorized individual per the instructions.

- Finally, ensure that you attach a copy of your identity card or passport and that any necessary consents from trustees are included.

Upon submission, the Prudential team will evaluate your application. Stay alert for their notification regarding the status of your surrender request.

What You Should Know About This Form

What is the Prudential Surrender form used for?

The Prudential Surrender form is used for policyholders who wish to surrender their insurance policy or certificate. By completing this form, the policyholder authorizes Prudential Assurance Malaysia Berhad to process the surrender request and to pay out the surrender value. This requests a full release of the company’s liability under the policy in question.

How do I complete the Prudential Surrender form?

When filling out the form, use dark black ink only. Clearly provide your policy or certificate number, the name of the policyholder, and the relevant account details for payouts. Ensure that all required sections are completed, including any checkboxes for the type of service and acknowledgments. Make sure to sign the form and include any necessary identification documents as specified.

What fees or charges might apply when I surrender my policy?

When surrendering your policy, various fees may be deducted from the surrender value. These can include surrender charges, redemption costs, tax penalties, or any other charges outlined in your policy. It's essential to review these details in your policy documents to understand the total amount you will receive.

How can I ensure that my surrender request is processed in a timely manner?

For quick processing, submit the completed form along with any required documents to Prudential Assurance Malaysia Berhad promptly. Additionally, make sure all information is accurate, and respond to any requests from Prudential for further documentation. Delays may occur if any part of the application is incomplete or incorrect.

What happens after I submit the Prudential Surrender form?

After submitting the form, Prudential Assurance Malaysia Berhad will review your request. The surrender will take effect only once it is accepted and confirmed by the company. You will receive a notification once the process is complete, along with the details about the surrender value being credited to your designated bank account.

Common mistakes

Many people encounter issues while filling out the Prudential Surrender form. One of the most frequent mistakes is using the wrong ink color. The instructions clearly specify to use DARK BLACK ink only. Ignoring this advice can lead to delays or even rejection of your application.

Another common error involves skipping important sections. Each part of the form must be completed diligently. Failing to provide required details, such as the Policy/Certificate Number or the correct Bank Account Details, may result in processing delays. The form explicitly states the necessity of filling in these sections thoroughly.

Individuals often overlook the need for signatures. A signature is required from the assured, as well as from any trustees if applicable. Omitting these crucial signatures can void the application, forcing you to start the process over again.

Misunderstanding the financial aspects is another mistake many applicants make. Some assume they know their surrender value without confirming it with Prudential. It’s essential to check the estimated surrender value and understand any outstanding debts linked to the policy. Being uninformed could lead to unexpected deductions from the amount you anticipate receiving.

Lastly, submitting a photocopy of the form instead of the original version can derail everything. The application must be the original form duly filled out and signed. Submitting anything less than that means Prudential will not accept your request. Taking these steps seriously can save you time and ensure a smoother process.

Documents used along the form

When completing a Prudential Surrender form, there are often additional documents that may be needed to ensure a smooth processing of your application. Below is a list of ten common forms and documents that accompany this surrender process, each serving a specific purpose.

- Policy Document: This is the original insurance policy that outlines the terms, coverage, and benefits. Having this document is essential to verify the details associated with your policy.

- Identification Documents: Typically, a photocopy of your identity card or passport will be required. This helps establish your identity as the policyholder or beneficiary.

- Bank Account Details Form: If you’re choosing to receive the surrender value via direct bank transfer, you'll need to fill out this form, providing your bank account details for payment processing.

- Trustee Consent Form: If your policy has a designated trustee, their consent is necessary. This document confirms that the trustee is aware of and agrees to the surrender of the policy.

- Claim Form (if applicable): In some cases where the surrender is requested due to the death of the insured, a claim form may be necessary to process the payout to beneficiaries.

- Proof of Indebtedness: If there are any outstanding loans or debts against the policy, you may need to submit documentation reflecting the total indebtedness. This ensures all outstanding balances are settled.

- Data Privacy Consent Form: This form allows the company to process your personal data in accordance with privacy laws, ensuring your information is handled appropriately.

- Withdrawal Request Letter: A formal letter requesting the surrender can accompany your form. This gives added clarity and can express any specific instructions you wish for Prudential to follow regarding the surrender.

- Financial Statements (if applicable): Depending on the type of policy, Prudential may ask for recent financial statements to assess your current financial situation, especially for investment-linked policies.

- Witness Statement: A witness may be required to confirm the authenticity of your signature on the surrender form. This adds an extra layer of security to the process.

Each of these documents plays a vital role in the surrender process, helping to confirm identity, verify policy details, and ensure compliance with Prudential’s requirements. Preparing these in advance can significantly streamline your application and lead to a quicker resolution.

Similar forms

- Withdrawal Form: Similar to the Prudential Surrender form, a withdrawal form allows policyholders to take out a portion of their investment or savings. It similarly requires proper identification and acknowledgment of the consequences of the withdrawal.

- Change of Beneficiary Form: This document is used to alter the designated beneficiary on an insurance policy. Like the surrender form, it needs clear consent from the policy owner and often requires a witness signature.

- Policy Loan Request Form: This form enables policyholders to borrow against their policy’s cash value. It shares the requirement of understanding the impacts of the loan on the policy’s value and future benefits, similar to a surrender request.

- Address Change Form: Used to update contact information, this form must be filled out by the policyholder and often includes declarations of understanding similar to those found in the surrender form.

- Claims Form: This document is used to initiate a claim for benefits under an insurance policy. Both forms require the accuracy of information provided, and they may necessitate supporting documents to process the claim or surrender.

- Investment Policy Cancellation Form: This allows the policyholder to cancel their investment policy. Both forms require acknowledgment of termination consequences and may include similar declarations regarding the accuracy of the personal information provided.

Dos and Don'ts

When filling out the Prudential Surrender form, certain practices can significantly affect the processing of your application. Here is a list of do's and don'ts:

- Do: Use DARK BLACK ink only, as instructed.

- Do: Read the entire form carefully before starting the application.

- Do: Ensure all required fields, especially personal and policy information, are filled completely.

- Do: Check your bank account details if applying for direct credit.

- Don't: Submit a photocopy of the form; only the original form is accepted.

- Don't: Leave any fields blank, as missing information may delay processing.

- Don't: Forget to include a copy of your identity card or passport, if applicable.

- Don't: Assume that verbal confirmations suffice; written consent is required where noted.

Misconceptions

- Misconception 1: The Prudential Surrender form can be completed using any color of ink.

- Misconception 2: Once the form is submitted, the surrender is immediate.

- Misconception 3: The surrender value is always the full amount paid into the policy.

- Misconception 4: Completing the form is a straightforward process without needing assistance.

- Misconception 5: You do not need to provide any identification when submitting the form.

- Misconception 6: The application can be submitted without prior obligations being cleared.

- Misconception 7: Surrender charges are fixed and will not change.

- Misconception 8: The surrender form does not require any witness signature.

- Misconception 9: The applicant can change their bank account details at any time without following specific instructions.

- Misconception 10: The Prudential Assurance will maintain submitted documents indefinitely.

In truth, it is specified that the form must be completed in DARK BLACK ink only.

This is incorrect. The application does not take effect until it has been accepted and acknowledged by Prudential Assurance.

That is not accurate. The surrender value may be less than the total premiums paid due to charges and penalties outlined in the policy.

Assistance may be required, especially in understanding terms and conditions, which can be complex.

In fact, a copy of the identity card or passport of the assured or assignee is required as per the instructions.

It is mentioned that all prior requests for top-up and premium payments must be completed before processing the surrender application.

In reality, surrender charges can vary over time, as noted in the terms of the policy.

This is misleading. A witness's signature is indeed a necessary part of the application process.

Account details can only be updated under specific conditions, as outlined in the form.

Contrary to this belief, PAMB retains documents for only six months after receipt, unless otherwise required by law.

Key takeaways

- Complete with Dark Black Ink: It is essential to fill out the Prudential Surrender form using only dark black ink. This ensures legibility and helps avoid potential processing delays.

- Tick Appropriate Boxes: Throughout the form, be sure to tick the boxes that apply to your situation. This clarifies your intentions and requests.

- Provide Accurate Policy Information: Include the correct policy or certificate number, and the names of the master policyholder and life assured. Mistakes here can lead to confusion or rejected applications.

- Include Bank Account Details: If requesting direct credit of the surrender value, accurately fill in your bank details as they appear on your bank statements. Incorrect information may delay your payment.

- Understand Surrender Terms: Familiarize yourself with the terms and conditions regarding the surrender value. This amount may be affected by various charges and debts associated with the policy.

- Be Aware of Processing Time: The application will only be processed after prior requests for top-ups and premium payments have been completed. Planning ahead can minimize delays.

- Signatures Required: Make sure to include the necessary signatures, whether for the assured, assignee, or trustee. Each must be clearly signed to validate the application.

- Witness Certification: The signatures of the assured must be witnessed. The witness must be an authorized representative or legal entity to ensure legitimacy.

- Data Privacy Declaration: Acknowledge and agree to how Prudential will handle any personal data. Understanding this helps ensure compliance and protect your rights.

Browse Other Templates

Documents Needed for a Va Loan - First-time homebuyer status helps determine eligibility for specific loan programs.

Roll Over Ira - You can complete this form to ensure the correct amount of state tax is withheld from your IRA payments.