Fill Out Your Ps 1164 E Form

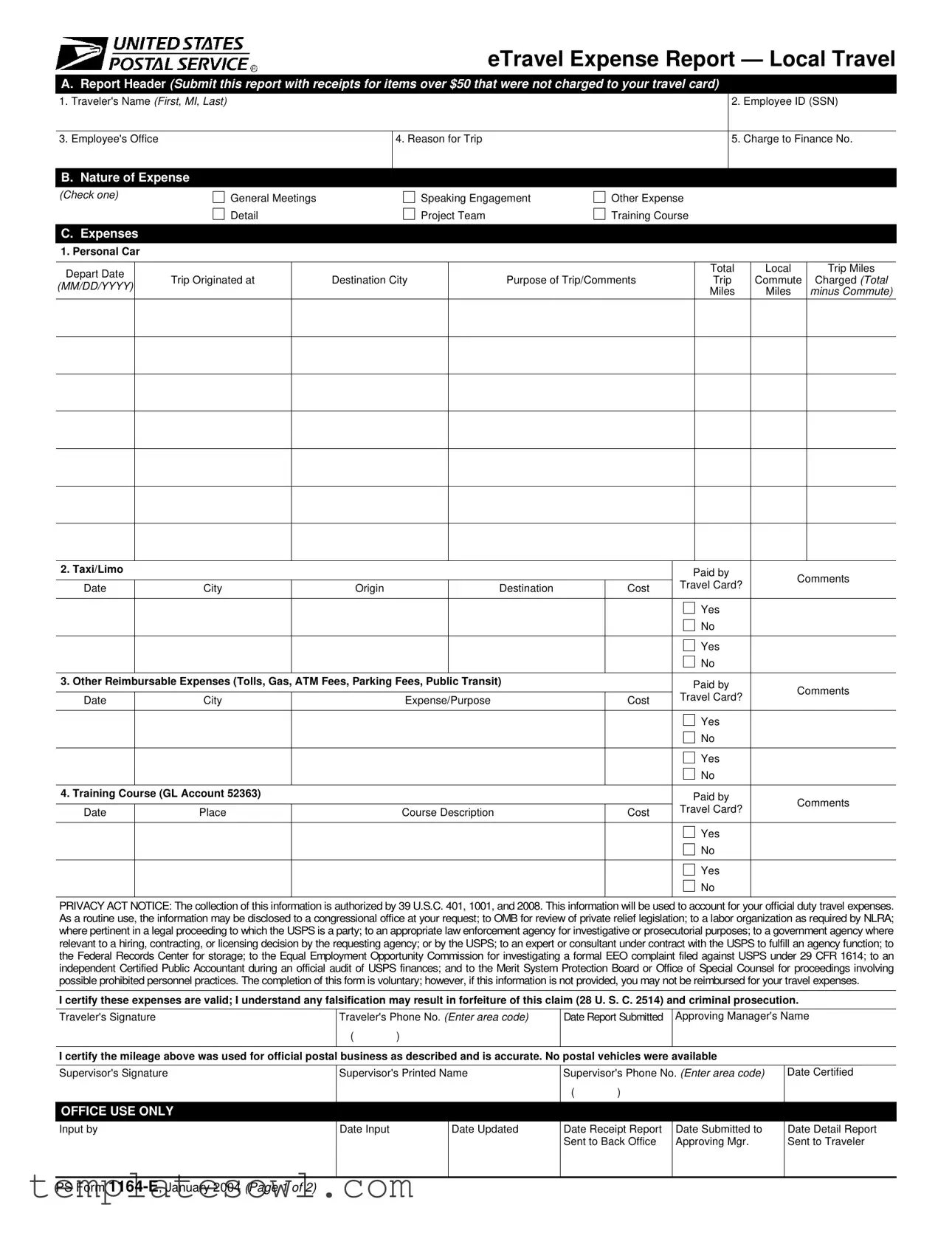

The Ps 1164 E form, known as the eTravel Expense Report, serves a crucial role for employees seeking reimbursement for local travel expenses. Whether you’ve used a personal vehicle, taken a taxi, or incurred other travel-related costs, this form helps you document your journey and associated expenditures accurately. It’s essential to include pertinent information such as your name, employee ID, and the reason for your trip. Each section of the form is designed to capture specific details, from the total miles driven in a personal car to any additional reimbursable expenses like tolls or public transit costs. Notably, receipts are required for items over $50 that weren't charged to your travel card, ensuring transparency and accountability in reporting expenses. The form not only covers transportation costs but also includes provisions for training course fees, expanding its utility beyond traditional travel expenses. Understanding how to properly complete the form is key to facilitating a smooth reimbursement process and adhering to USPS regulations.

Ps 1164 E Example

eTravel Expense Report — Local Travel

A.Report Header (Submit this report with receipts for items over $50 that were not charged to your travel card)

1.Traveler's Name (First, MI, Last)

2. Employee ID (SSN)

3. Employee's Office

4. Reason for Trip

5. Charge to Finance No.

B. Nature of Expense

(Check one)

General Meetings Detail

Speaking Engagement Project Team

Other Expense

Training Course

C.Expenses

1.Personal Car

Depart Date |

|

|

|

Total |

Local |

Trip Miles |

|

Trip Originated at |

Destination City |

Purpose of Trip/Comments |

Trip |

Commute |

Charged (Total |

||

(MM/DD/YYYY) |

|||||||

|

|

|

Miles |

Miles |

minus Commute) |

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Taxi/Limo |

|

|

|

|

|

Paid by |

Comments |

|

|

|

|

|

|

||

Date |

City |

Origin |

|

Destination |

Cost |

Travel Card? |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

3. Other Reimbursable Expenses (Tolls, Gas, ATM Fees, Parking Fees, Public Transit) |

|

Paid by |

Comments |

||||

|

|

|

|

|

|

||

Date |

City |

|

Expense/Purpose |

Cost |

Travel Card? |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

4. Training Course (GL Account 52363) |

|

|

|

|

Paid by |

Comments |

|

|

|

|

|

|

|

||

Date |

Place |

|

Course Description |

Cost |

Travel Card? |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

PRIVACY ACT NOTICE: The collection of this information is authorized by 39 U.S.C. 401, 1001, and 2008. This information will be used to account for your official duty travel expenses. As a routine use, the information may be disclosed to a congressional office at your request; to OMB for review of private relief legislation; to a labor organization as required by NLRA; where pertinent in a legal proceeding to which the USPS is a party; to an appropriate law enforcement agency for investigative or prosecutorial purposes; to a government agency where relevant to a hiring, contracting, or licensing decision by the requesting agency; or by the USPS; to an expert or consultant under contract with the USPS to fulfill an agency function; to the Federal Records Center for storage; to the Equal Employment Opportunity Commission for investigating a formal EEO complaint filed against USPS under 29 CFR 1614; to an independent Certified Public Accountant during an official audit of USPS finances; and to the Merit System Protection Board or Office of Special Counsel for proceedings involving possible prohibited personnel practices. The completion of this form is voluntary; however, if this information is not provided, you may not be reimbursed for your travel expenses.

I certify these expenses are valid; I understand any falsification may result in forfeiture of this claim (28 U. S. C. 2514) and criminal prosecution.

Traveler's Signature

Traveler's Phone No. (Enter area code)

()

Date Report Submitted

Approving Manager's Name

I certify the mileage above was used for official postal business as described and is accurate. No postal vehicles were available

Supervisor's Signature

Supervisor's Printed Name

Supervisor's Phone No. (Enter area code)

()

Date Certified

OFFICE USE ONLY

Input by

Date Input

Date Updated

Date Receipt Report Sent to Back Office

Date Submitted to Approving Mgr.

Date Detail Report Sent to Traveler

PS Form

Instructions for Completing PS Form

A.Report Header

1.Traveler's Name: Print First Name, Middle Initial, and Last Name (to be used in naming convention for expense report).

2.Employee ID: Enter the traveler's Social Security Number.

3.Employee's Office: Enter the name of the Duty Station.

4.Reason for Trip: Briefly describe the reason(s) you traveled, e.g., POS One training, OIC assignment, MPOO meeting.

5.Charge to Finance No.: Enter the finance number to be charged.

B.Nature of Expense

Check one of the boxes listed. Note: Form

C.Expenses

1.Personal Car

a.Depart Date: Enter the first date of travel.

b.Trip Originated at: Enter the location where the trip in your personal car originated, e.g., residence or name of office.

c.Destination City: Enter the location where the trip in your personal car ended.

d.Purpose of the Trip/Comments: Enter the reason for travel and provide information for the approving manager of any special circumstances involved in driving your personal car.

e.Total Trip Miles: Enter the total miles driven to and from the destination.

f.Local Commute Miles: When the trip begins and ends at the traveler's residence, enter the round trip miles from the residence to the official duty station. When the trip begins and ends at the traveler's official duty station, enter zero.

g.Trip Miles Charged: Enter the total trip miles minus the local commute miles. This is your reimbursable miles.

2.Taxi/Limo

a.Date: Enter the date of your taxi/limo ride.

b.City: Enter the city where you rode the taxi/limo.

c.Origin: Enter the location where you were picked up, e.g., hotel, airport, residence, etc.

d.Destination: Enter the location where you were dropped off.

e.Cost: Enter the cost of the ride (may include a tip up to 15%).

f.Paid by Travel Card? Indicate if you paid for the taxi/limo with your government travel card by checking either "Yes" or "No".

g.Comments: List any comments about your taxi/limo expense, if necessary, such as sharing with other USPS employees, etc.

3.Other Reimbursable Expenses

a.Date: Enter the date the other expense occurred.

b.City: Enter the city where the expense occurred.

c.Expense/Purpose: Describe the expense you incurred. Some examples of expenses that should be entered here include tolls, cash advance fees (fees only, not the amount of the cash advance), gas, or parking.

d.Cost: Enter the cost of the expense.

e.Paid by Travel Card? Indicate if you paid for the other expense with your government travel card by checking either "Yes" or "No".

f.Comments: Enter any comments about the expense.

4.Training Course (GL Account 52363) — Tuition Only

a.Date: Enter start date of the course.

b.Place: Enter type of institution where training course was taken, e.g., Facility, University, Other).

c.Course Description: Enter the type of course taken.

d.Cost: Enter tuition paid.

e.Paid by Travel Card? Indicate if you paid for the training expense with your government travel card by checking either "Yes" or "No".

f.Comments: Enter any comments about the expense.

Note: The person entering the expense report must change the general ledger account in the GL Account field of eTravel to training expenses.

Traveler's Signature: The traveler's signature certifies factual presentation of all expense entries and compliance with USPS expense policy.

Phone No.: A phone number where the traveler can be reached if there are questions about your travel expenses.

Date Report Submitted: Enter the date the traveler sent the eTravel Expense Report to the employee for entry into eTravel.

Approving Manager's Name: Enter the name of the manager

to whom the travel report should be submitted. Note: This field must contain a manager's name, not a supervisor's name. Managers who can approve a travel report are defined in Handbook

Supervisor's Signature: Supervisor is station manager or office postmaster. The supervisor's signature certifies that local travel was for official Postal Service ™ business and no Postal Service vehicles were available. In signature block include signature with printed name, phone number, and date certified.

Office Use Only

To be completed by the employee who enters the expense report data into the eTravel system on behalf of the traveler. Once the data is entered into the eTravel system, original form and backup are maintained in the office of the web alias. A copy of the eTravel Detailed Report is sent to the traveler. Any questions from the approving manager will be addressed to the traveler.

Additional Comments

Any questions concerning completion of this form or about travel, should be addressed through the district eTravel coordinator or the employee designated to enter PS Form

After completing this form, forward the form and all receipts for expenses $50 and over that were not charged to your government travel card to the employee designated to enter your PS Form

Resubmit

If the approving manager has any questions regarding the expense report, he or she will contact the traveler directly and resubmit the report to the web alias if necessary. The traveler is responsible for notifying the web alias in writing of any necessary corrections, and authorizing the person entering the expense report to edit the report in the eTravel system. The expense report will then be resubmitted to the approving manager.

PS Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The PS 1164 E form is designed for travelers to report local travel expenses and request reimbursements. |

| Minimum Receipt Requirement | Receipts are required for all items over $50 that are not charged to the travel card. |

| Governing Law | This form complies with the Privacy Act under 39 U.S.C. 401, 1001, and 2008. |

| Certification | Travelers must certify that all expenses are valid and acknowledge that falsification may lead to prosecution. |

| Sections | The form includes sections for the report header, nature of expenses, and detailed expense entries. |

| Manager Approval | The completed form requires approval from a manager, distinct from the traveler's supervisor. |

| Submission Timeline | Travelers must submit the form with all necessary receipts to the designated employee for entry into eTravel promptly. |

Guidelines on Utilizing Ps 1164 E

Follow these guidelines carefully to ensure proper completion of the PS 1164 E form. Gather all required information and receipts before you start. This will help you fill out the form efficiently and accurately.

- Report Header: Start by entering the Traveler's Name (First, MI, Last).

- Provide the Employee ID (Social Security Number).

- Enter the Employee's Office (Duty Station).

- State the Reason for Trip briefly (e.g., training, meeting).

- Input the Charge to Finance No.

- Nature of Expense: Check one box to identify the type of expense.

- Expenses: Begin by filling out the Personal Car section.

- Enter the Depart Date for your trip.

- Record where the trip originated.

- Enter the Destination City.

- Provide the Purpose of the Trip/Comments.

- Calculate and input the Total Trip Miles driven.

- Input Local Commute Miles, entering zero if applicable.

- Calculate the Trip Miles Charged as total miles minus local commute miles.

- Taxi/Limo: Fill in details if you used taxi or limo services.

- Enter the Date of the ride.

- Record the City where the ride took place.

- Input the Origin and Destination of your trip.

- State the Cost of the ride.

- Indicate if paid by Travel Card (Yes/No).

- Add any necessary Comments regarding the ride.

- Other Reimbursable Expenses: List other expenses you incurred.

- Enter the Date of the expense.

- Record the City where the expense occurred.

- Describe the Expense/Purpose.

- Input the Cost of the expense.

- Indicate if paid by Travel Card (Yes/No).

- Provide any relevant Comments.

- Training Course: If applicable, complete this section.

- Provide the Date when the course started.

- Indicate the Place where the course occurred.

- Give the Course Description.

- Input the Cost of tuition paid.

- Indicate if paid by Travel Card (Yes/No).

- Add any relevant Comments.

- Traveler's Signature: Sign and date the form.

- Enter a phone number for questions regarding expenses.

- Input the Date Report Submitted to the employee.

- Approving Manager's Name: Fill in the name of the approving manager.

- Supervisor's Signature: Required signature and additional information.

After completing the form, attach receipts for expenses over $50 that were not charged to your travel card. Forward the form and receipts to the designated employee for processing in the eTravel system. Keep copies of all documents for your records.

What You Should Know About This Form

What is the PS Form 1164 E used for?

The PS Form 1164 E, also known as the eTravel Expense Report, is used to document and request reimbursement for travel expenses incurred during official duties. This form is specifically for local travel and should be submitted with receipts for expenses over $50 that were not charged to a government travel card.

What information do I need to provide on the form?

You will need to fill out several key pieces of information. This includes your name, employee ID, office location, the reason for your trip, and any financial charge numbers. Additionally, you will have to outline the nature of your expenses, including trips using your personal car, taxi or limo expenses, and any other reimbursable costs like tolls or parking fees.

How do I report personal car travel on this form?

When reporting personal car travel, you must provide the departure date, trip origin, destination city, and total miles traveled. You will also need to specify the purpose of the trip and include any local commute miles. This helps to determine the reimbursable mileage amount. Ensure you subtract your local commute miles from the total trip miles for accurate reimbursement.

What if my expenses are less than $50?

If your expenses are less than $50, you should still report them on the form. However, you won't need to submit receipts for these smaller expenses. All expenses reported, even those under $50, should accurately reflect what you spent and why.

Is my personal information protected when using this form?

Yes, your personal information is protected. The form includes a privacy notice that outlines how your information may be used, only for purposes related to travel expense accounting and other authorized disclosures. Completing the form is voluntary, but providing accurate information is necessary for reimbursement.

What happens after I submit the form?

Once submitted, the form will be processed by someone in your office designated to enter the information into the eTravel system. The traveler's signature on the form certifies the expenses are accurate and comply with USPS policies. You will receive a detailed report of your expenses once they are processed, and any questions from the approving manager will be addressed directly to you.

Common mistakes

Filling out the PS 1164 E form can be straightforward, but there are common mistakes that can lead to delays or denials of reimbursement. Understanding these pitfalls can help ensure you receive the funds you're entitled to.

One frequent mistake is not providing a complete Traveler's Name. It's essential to enter the first name, middle initial, and last name correctly. Incomplete or inaccurate names can cause processing issues. Similarly, entering the Employee ID incorrectly can lead to significant problems. This number must be your Social Security Number, so double-check it.

Another area where people stumble is in specifying the Reason for Trip. Vagueness can lead to questions from managers or the finance department. Instead of simple phrases, provide clear and detailed descriptions like “MPOO meeting” or “POS One training.”

In the expenses section, travelers often fail to differentiate between Local Commute Miles and total trip miles. Remember, if your trip starts and ends at an official duty station or residence, calculate the total miles accurately. Miscalculating these numbers can result in reduced reimbursement.

When it comes to taxi or limo expenses, not including a tip can be a common oversight. Tips up to 15% are allowable, so make sure your total costs reflect this. Additionally, travelers might mistakenly check “Yes” or “No” for the Paid by Travel Card section without carefully assessing how the charges were settled.

Many also overlook providing comments related to each expense. This can help clarify any special circumstances or share details about other travelers sharing costs. Lack of sufficient comments may leave room for misunderstanding.

Creatively providing Purpose of Trip/Comments is often neglected. Make sure to specify why the trip was necessary. This helps the approving manager understand the context of the expenses.

Not retaining copies of submitted receipts is another error. You should keep all receipts for any expenses exceeding $50, particularly those that weren't charged on a government travel card. Missing receipts can lead to denied claims.

Finally, remember that signature fields require specific titles. It's common for travelers to mistakenly use a supervisor’s name in the Approving Manager's Name field instead of the appropriate manager's name. Ensure that the manager's signature verifies the report, as per the guidelines.

By taking the time to avoid these mistakes, you can streamline the process of filling out the PS 1164 E form and ensure that you receive timely reimbursements. Check your entries carefully, and don't hesitate to ask for guidance if uncertainties arise.

Documents used along the form

When navigating travel reimbursements, it is essential to understand that various forms and documents may accompany the PS 1164 E form. These documents serve specific purposes and help streamline the process of receiving reimbursement. Below is a list of commonly used forms related to travel expenses.

- PS Form 1164: This form is the standard local travel expense report commonly used for reimbursements. It captures essential travel details, which assist in determining the validity of the claims made.

- Travel Authorization Form: This document outlines the approval for the travel, including specified dates, destination, and purpose. It serves as an official record that the travel was sanctioned by the management.

- Receipts for Expenses: Receipts are crucial for proving that expenses were incurred. For any expense over $50, a receipt must be submitted along with the travel expense report to ensure that reimbursements are processed accurately.

- Employee Travel Itinerary: This itinerary details the traveler's schedule during the trip, including departure and arrival times, modes of transportation, and the specific events or meetings to be attended. It aids in confirming the traveler's activities coincide with claimed expenses.

- Per Diem Request Form: This form is used to claim daily allowances for meals and incidentals while traveling. By submitting this request, employees receive set amounts to cover daily travel costs without needing to provide individual receipts.

- VAT Refund Form: For international travel, this form may be necessary to reclaim Value Added Tax (VAT) incurred on certain purchases. Travelers fill it out to initiate the refund process and ensure compliance with applicable regulations.

- Vehicle Mileage Log: For those using personal vehicles, this log helps record miles driven during travel for reimbursement purposes. It includes details such as the date, destination, and purpose of the trip.

- Training Course Registration Form: If travel is related to attending a training course, this form documents registration and payment details. It can facilitate reimbursement for tuition and associated costs.

- Supervisor Approval Form: This document is needed to certify that the travel incurred was for official business and that no postal vehicles were available during the trip. It must be signed by a supervisor to authenticate the claims.

Understanding and utilizing these forms appropriately can help ensure that travel expenses are reimbursed promptly and accurately. Proper documentation not only safeguards against potential issues but also enhances clarity between employees and their management regarding travel-related financial matters.

Similar forms

- Expense Reimbursement Form: This document seeks reimbursement for expenses incurred during business-related activities. Similar to the Ps 1164 E form, it specifies the type of expenses, requires supporting receipts, and outlines the need for clear documentation of the travel details and purpose.

- Travel Authorization Request: This form is essential for getting approval before embarking on business travel. Like the Ps 1164 E, it captures the traveler’s information, trip details, and reasons for travel. It serves as a precursor to expense reporting, ensuring that the trip was sanctioned beforehand.

- Mileage Reimbursement Tracker: This document records miles driven for work-related purposes. Just as the Ps 1164 E includes mileage calculations for car travel, the mileage tracker details the distances traveled and justifications for work trips, ensuring accurate reimbursement.

- Training Registration Form: Used when attending educational courses, this form captures course details similar to the training section in the Ps 1164 E. Both documents require information about the course, the purpose for attending, and the associated costs, providing a clear path for reimbursement.

- Business Expense Report: This report summarizes various expenses incurred during work assignments. Similar to the Ps 1164 E, it requires clear itemization of expenses and supporting documentation, aimed at ensuring accountability in work-related spending.

Dos and Don'ts

When filling out the PS 1164 E form, it is important to ensure accuracy and clarity. Here is a list of things to do and avoid:

- Do include your full name (First, MI, Last) in the Traveler's Name section.

- Do enter your correct Employee ID, which is your Social Security Number.

- Do provide a specific reason for your trip, detailing the purpose clearly.

- Do indicate the nature of the expense by checking one of the provided boxes.

- Do keep any receipts for expenses over $50 that were not charged to your travel card.

- Do ensure all expenses are clearly stated, including costs for taxis or other transportation.

- Do sign and date the form to certify the accuracy of your entries.

- Do not leave any section of the form incomplete; ensure all necessary information is filled in.

- Do not submit the form without the required receipts for any expenses over $50.

- Do not use the form for personal expenses unrelated to official travel.

- Do not forget to check if you need to charge your expenses to a travel card.

- Do not attempt to falsify any information, as this may lead to serious consequences.

- Do not confuse your supervisor's name with the manager's name; ensure you follow the hierarchy.

- Do not neglect to retain copies of all submitted receipts and the expense report for your records.

Misconceptions

Misconceptions about the PS 1164 E form can lead to confusion and potential issues with reimbursement. Below are ten common myths, along with clarifications.

- The PS 1164 E form is only for travel expenses. In reality, this form can also be used for other approved reimbursements, such as training registration fees.

- You must use a government travel card for all expenses listed. You can indicate if any of the expenses were paid out of pocket. Both options are acceptable.

- This form is optional. While completing the form is voluntary, not submitting the required information can result in unreimbursed expenses.

- All expenses over $50 need to be submitted with receipts. Only the items not charged to your travel card must be accompanied by receipts. If you used your travel card, that requirement does not apply.

- Submitting the form guarantees reimbursement. Even with proper completion, reimbursement is contingent on the validity of the claimed expenses.

- You cannot claim personal car expenses. Personal car usage is eligible for reimbursement, but you must accurately report the mileage and any commuting miles.

- I'm only responsible for my part of the trip expenses. All expenses reported must reflect contributions accurately; if you shared rides or costs, these need to be communicated clearly.

- It's okay to estimate expenses. Accurate receipts or records of expenses must be maintained. Estimates can lead to delays or denials in reimbursement.

- The form doesn’t require signatures. Signatures from both the traveler and the approving manager are essential for validation.

- Only specific personnel can submit the form. Any traveler can submit their PS 1164 E form for reimbursement, but they should follow up with the designated staff for eTravel entry.

Understanding these misconceptions will help ensure a smoother reimbursement process. Clarity about the requirements can lead to successful submissions and avoid unnecessary frustrations.

Key takeaways

Filling out and using the PS 1164 E form can be straightforward if you follow these key takeaways:

- Submit Receipts for Major Expenses: Include all receipts for expenses over $50 that were not charged to your travel card.

- Accurate Reporting: Ensure that personal details, such as the traveler’s name, employee ID, and office, are precise and clear.

- Select the Right Expense Type: Clearly indicate the nature of your expense by checking the relevant box, such as General Meetings or Training Course.

- Document Mileage Correctly: Provide an accurate count of total trip miles, and remember to subtract local commute miles to determine reimbursable miles.

- Keep Track of Taxi or Limo Expenses: For taxi or limo rides, record the date, city, origin, destination, and cost. Specify if a travel card was used.

- Training Course Expenses: When reporting tuition for training, ensure to provide the start date, location, description, and cost clearly.

- Follow-Up on Approval: Once submitted, expect the approving manager to review the expenses. Maintain communication in case any adjustments are needed.

By adhering to these guidelines, you can navigate the process of filling out PS Form 1164 E efficiently and accurately. Proper documentation ensures a smoother reimbursement experience.

Browse Other Templates

Tax Transcript Online - A tracking number is assigned for tracking purposes.

16 Year Old Drivers License Texas - The log serves as an official record for both parents and the Department of Public Safety.

Cup Fund Requirements - Financial assistance from the CUP Fund is intended for urgent situations only.