Fill Out Your Pta Audit Sample Form

The Pta Audit Sample form serves as a crucial tool for ensuring transparency and accountability within Parent-Teacher Associations (PTAs). This comprehensive document not only records essential financial details but also establishes a clear framework for evaluating the financial health of the organization. Key components of the form include introductory information such as the name of the unit, fiscal year, and IRS EIN, along with specific banking details that reflect the PTA’s financial operations. It outlines the membership dues and provides a summary of total members and e-members year-to-date, offering insight into the organization’s growth and engagement. The audit period is explicitly stated, giving context to the financial data being reviewed. Furthermore, the form meticulously tracks balances on hand before and after the audit, breaking down receipts and disbursements that have occurred. Important reconciliations that reflect the bank statement balance as of a certain date, along with deposits not yet credited and uncleared checks, help in pinpointing discrepancies and ensuring accuracy. The auditor’s findings, which may range from completely correct to incorrect, indicate the degree of compliance with established accounting procedures and the overall financial integrity of the PTA. Moreover, a separate audit form is mandated for each bank account, emphasizing the importance of thorough oversight. Upon completion, the form requires signatures from the auditor and the review committee, ensuring that all steps have been undertaken with diligence. Since this process is vital, copies of the audit report are distributed to key PTA officials, maintaining communication and accountability across the organization.

Pta Audit Sample Example

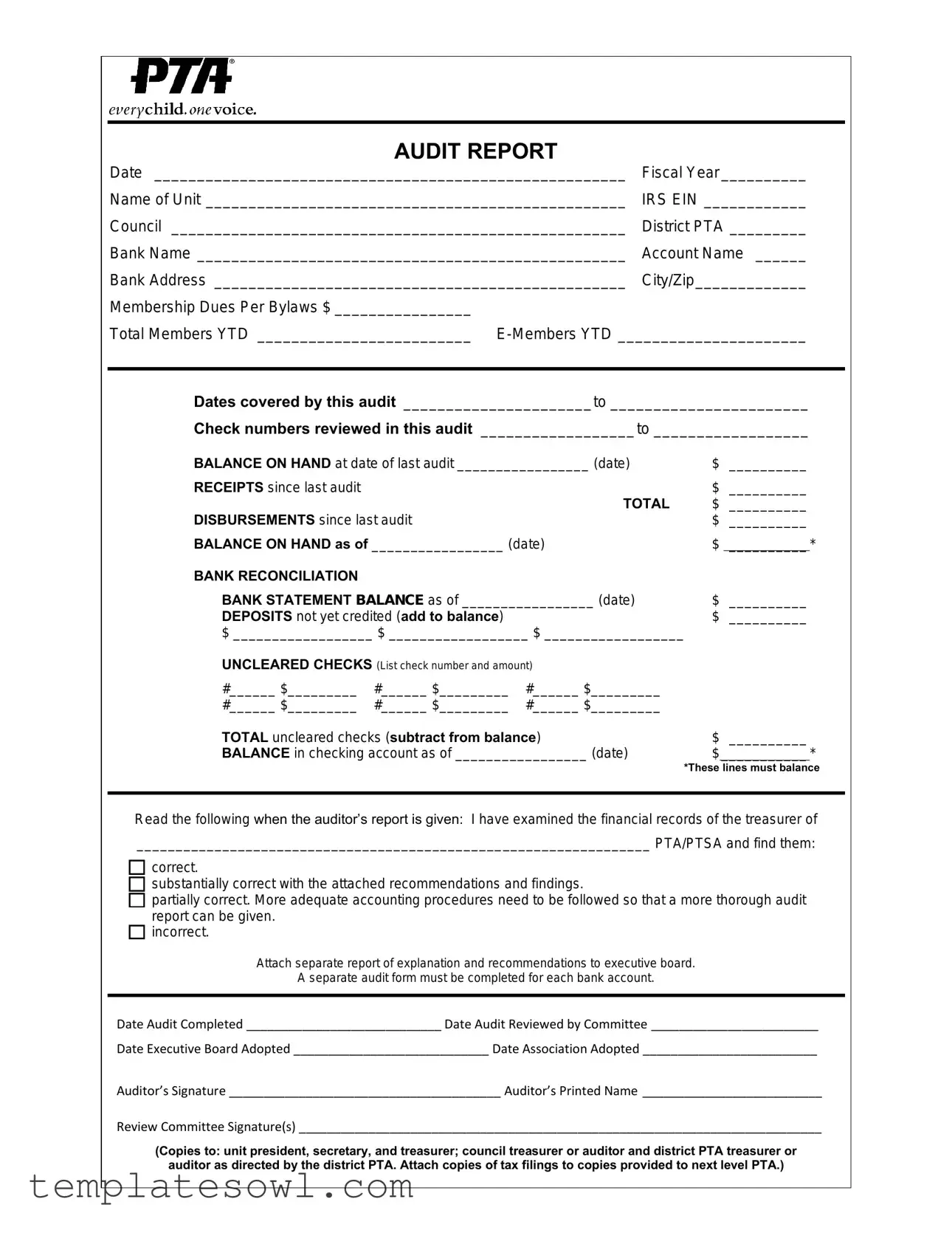

AUDIT REPORT

Date _______________________________________________________ |

Fiscal Year __________ |

Name of Unit _________________________________________________ |

IRS EIN ____________ |

Council _____________________________________________________ |

District PTA _________ |

Bank Name __________________________________________________ |

Account Name ______ |

Bank Address ________________________________________________ |

City/Zip_____________ |

Membership Dues Per Bylaws $ ________________ |

|

Total Members YTD _________________________

Dates covered by this audit ______________________to _______________________

Check numbers reviewed in this audit __________________to __________________

BALANCE ON HAND at date of last audit _________________ (date) |

$ |

__________ |

||

RECEIPTS since last audit |

|

|

$ |

__________ |

|

|

TOTAL |

$ |

__________ |

DISBURSEMENTS since last audit |

|

$ |

__________ |

|

BALANCE ON HAND as of _________________ (date) |

$ |

__________ * |

||

BANK RECONCILIATION |

|

|

|

|

BANK STATEMENT BALANCE as of _________________ (date) |

$ |

__________ |

||

DEPOSITS not yet credited (add to balance) |

|

$ |

__________ |

|

$ __________________ $ __________________ $ __________________ |

|

|

||

UNCLEARED CHECKS (List check number and amount) |

|

|

||

#______ $_________ |

#______ $_________ |

#______ $_________ |

|

|

#______ $_________ |

#______ $_________ |

#______ $_________ |

|

|

TOTAL uncleared checks (subtract from balance) |

$ |

__________ |

BALANCE in checking account as of _________________ (date) |

$ |

___________ * |

|

*These lines must balance |

|

|

|

|

Read the following when the auditor’s report is given: I have examined the financial records of the treasurer of

__________________________________________________________________ PTA/PTSA and find them:

correct.

substantially correct with the attached recommendations and findings.

partially correct. More adequate accounting procedures need to be followed so that a more thorough audit report can be given.

incorrect.

Attach separate report of explanation and recommendations to executive board.

A separate audit form must be completed for each bank account.

Date Audit Completed ____________________________ Date Audit Reviewed by Committee ________________________

Date Executive Board Adopted ____________________________ Date Association Adopted _________________________

Auditor’s Signature _______________________________________ Auditor’s Printed Name __________________________

Review Committee Signature(s) ___________________________________________________________________________

(Copies to: unit president, secretary, and treasurer; council treasurer or auditor and district PTA treasurer or auditor as directed by the district PTA. Attach copies of tax filings to copies provided to next level PTA.)

Form Characteristics

| Fact Name | Description |

|---|---|

| Date of Audit | The audit report begins with a space to enter the date it is conducted. |

| Fiscal Year | Units must specify the fiscal year for which the audit report is being prepared. |

| IRS EIN | The form requires the IRS Employer Identification Number for the unit. |

| Bank Reconciliation | It includes a section for reconciling bank statements, ensuring accuracy in finances. |

| Membership Dues | The form documents membership dues as defined by the unit's bylaws. |

| Audit Scenarios | Auditors must select one of four options to indicate the accuracy of the financial records reviewed. |

| Uncleared Checks | There’s a section to list uncleared checks, which helps track outstanding payments. |

| Date of Last Audit | Users are asked to enter the balance on hand at the date of the last audit. |

| Committee Review | A separate date field indicates when the audit was reviewed by the committee. |

| Copies Distribution | After completion, copies of the audit must be sent to various PTA officials for record-keeping. |

Guidelines on Utilizing Pta Audit Sample

Filling out the PTA Audit Sample form requires careful attention to detail, ensuring that all financial records are accurately documented for accountability. This process involves recording the unit’s financial activities over a specific period and ensuring all numbers balance correctly. Following these steps will help streamline your completion of the form.

- Start by entering the Date of the audit at the top of the form.

- Fill in the Fiscal Year for which the audit is being conducted.

- Write the Name of Unit, ensuring correct spelling and full designation.

- Enter the IRS EIN (Employer Identification Number) assigned to your PTA.

- Document the Council under which your unit operates.

- Specify the District PTA associated with your unit.

- Record the Bank Name, Account Name, and Bank Address along with the relevant City/Zip.

- Fill in the Membership Dues Per Bylaws amount and the Total Members YTD.

- Include the number of E-Members YTD and the audit coverage dates.

- List the Check numbers reviewed in the audit.

- Enter the balance on hand from the date of the last audit.

- Document all Receipts since last audit and note the Total receipts.

- Fill in the amounts for Disbursements since last audit and the Balance on Hand as of the current date.

- Proceed with the Bank Reconciliation section by entering the bank statement balance.

- List any Deposits not yet credited that need to be added to the balance.

- Record all Uncleared Checks, including check numbers and amounts.

- Calculate the total uncleared checks and subtract this amount from the balance.

- Ensure that everything balances as of the date specified.

- Finalize the audit report details, selecting the appropriate finding for the financial records.

- Document the Date Audit Completed and the Date Audit Reviewed by Committee.

- Note the dates for Executive Board and Association Adoption.

- Sign and print the auditor’s name, alongside securing review committee signatures.

Double-check all entries for accuracy and completeness before submitting the form to the necessary parties. Copies should be distributed to the unit president, secretary, and treasurer, among others, as outlined in the instructions.

What You Should Know About This Form

What is the purpose of the PTA Audit Sample form?

The PTA Audit Sample form is designed to ensure financial transparency and accountability for PTA units. It provides a structured way to review and confirm the accuracy of financial records, assess compliance with bylaws, and make recommendations for any improvements needed in financial practices.

Who needs to complete this audit?

This audit should be completed by an appointed auditor, preferably someone who is not part of the financial management team, in order to maintain objectivity. The auditor reviews the financial records of the PTA treasurer and prepares the report based on their findings.

What financial information is required for the audit?

Auditors need a variety of financial data, including dates covered, bank statements, a list of receipts and disbursements since the last audit, and the balance on hand as of the audit date. This information ensures that the audit reflects a complete and accurate picture of the PTA's finances.

How often should the PTA conduct an audit?

It is advisable to conduct an audit at least once a year. After the fiscal year ends, the audit should take place to evaluate the financial activities and confirm that everything balances correctly. This regular oversight helps to ensure financial integrity within the organization.

What happens if the audit finds discrepancies?

If discrepancies are found, the auditor will need to classify their findings as correct, substantially correct, partially correct, or incorrect. Depending on the level of discrepancies identified, the auditor may recommend improved accounting procedures or provide a separate report detailing findings and suggestions for the executive board.

How does the audit report get approved?

After the audit is completed, it is reviewed by a committee. Once approved by the committee, the audit report must be adopted by the executive board and then presented to the PTA association for final approval. Each step ensures that the findings are acknowledged and that any necessary changes are implemented.

Are there copies of the audit report distributed?

Yes, copies of the completed audit report must be shared with several individuals, including the unit president, secretary, and treasurer. Additionally, copies should be sent to the council treasurer or auditor, as well as the district PTA treasurer or auditor, as directed by the district PTA. This distribution helps to maintain transparency at all levels of the organization.

What should auditor's report contain?

The auditor's report should include a statement about the treasurer's financial records and a signature by the auditor. It should also detail any recommendations or findings, especially if the records are not correct or require improved accounting procedures. Overall, the report serves as a critical tool for fostering fiscal responsibility within the PTA.

Common mistakes

The PTA Audit Sample form is an important document that helps ensure transparency and accountability in financial matters. However, many people make common mistakes when filling it out. Recognizing these mistakes can lead to a smoother auditing process.

One frequent error is leaving out vital information. Details like the name of the unit, IRS EIN, or fiscal year may seem minor, but omitting them can complicate the audit. Always double-check that these fields are completed before submission.

Another common oversight is failing to match totals. The section on receipts and disbursements must balance with the overall bank reconciliation. If they don’t, it raises questions and can prolong the auditing process.

Some individuals mistakenly skip the section for uncleared checks. It’s easy to overlook those checks that haven’t cleared yet, but this information is crucial for an accurate financial picture. Not listing them can create discrepancies that confuse auditors.

In many cases, people also forget to obtain the required signatures. The auditor's signature and the review committee's signatures are not just formalities; they confirm that the audit report is accurate. Missing these signatures can render the audit incomplete.

Another mistake is not attaching recommended documentation. It's essential to include tax filings along with the audit form. Without these documents, the audit can face unnecessary delays or even rejection.

Additionally, some individuals do not write the date when the audit was completed or reviewed. This omission might seem small, but it can lead to confusion about the timeline of the financial review, which is essential for effective record-keeping.

Lastly, failing to follow instructions for copies can be a frustration. The notes indicate that copies must go to various committee members. Not distributing these correctly can lead to further issues during organizational reviews.

By being aware of these common mistakes, you can help ensure that the PTA audit process runs smoothly and effectively. A careful and thorough approach to filling out the audit form will benefit everyone involved.

Documents used along the form

The PTA Audit Sample form is a crucial document used for evaluating a PTA's financial health. Several other forms and documents complement this audit to ensure transparency and accountability. Below is a list of related documents often utilized with the PTA Audit Sample form.

- Annual Financial Report: This report summarizes the PTA’s financial activities over the fiscal year. It provides an overview of revenues, expenses, and net assets, ensuring stakeholders understand the PTA's financial position.

- Bank Reconciliation Statement: This statement compares the PTA's financial records with the bank statements. It identifies discrepancies and ensures that the PTA’s recorded financial figures match the bank’s records.

- Meeting Minutes: The official record of discussions and decisions made during PTA meetings. Meeting minutes should reflect any financial endorsements or issues addressed, serving as additional context for the audit.

- Budget Proposal: Proposed financial plans for the upcoming year. This document outlines expected income and planned expenditures, guiding decisions and priorities for the PTA.

- Receipts and Invoices: Detailed records of all financial transactions. These documents serve as proof of purchases and contributions, making them essential for verifying expenditures during the audit.

- Tax Filings: Copies of tax returns filed with the IRS. These documents are relevant for ensuring compliance with federal tax regulations and bolstering the accuracy of financial reports.

- Authorization Forms: Documents that detail permissions granted for expenditures or financial activities within the PTA. These forms help ensure that all transactions are approved and legitimate.

- Conflict of Interest Policy: A document outlining how the PTA handles situations where personal interests may conflict with organizational responsibilities. It promotes ethical behavior and transparency in financial dealings.

These documents work together to create a comprehensive picture of a PTA’s financial standing. Utilizing them alongside the PTA Audit Sample form fosters good governance and keeps the organization accountable to its stakeholders.

Similar forms

The PTA Audit Sample form serves as a tool for financial accountability and transparency. Several other documents share similarities in structure or purpose with this audit form. Here are seven such documents:

- Financial Statement: This document summarizes the financial position of an organization, showing assets, liabilities, and equity. Like the audit form, it emphasizes accuracy and clarity in financial reporting.

- Review Engagement Report: Prepared by an accountant, this report provides an assessment of financial statements. Both documents are used to evaluate financial health and ensure adherence to legal standards.

- Tax Return (Form 990): Nonprofit organizations file this document annually. It outlines income, expenses, and activities, mirroring the audit's focus on financial transparency and compliance.

- Budget Report: This outlines projected income and expenditures for a specific period. Both reports serve to guide financial decision-making and track actual performance against planned budgets.

- Cash Flow Statement: This report details how cash moves in and out of an organization. Similar to the audit form, it assesses financial health by focusing on liquidity and operational efficiency.

- Internal Control Assessment: This document evaluates the processes in place to safeguard assets and ensure accurate reporting. Both the assessment and the audit form aim to identify weaknesses and improve financial practices.

- Expense Report: This outlines incurred costs for reimbursement purposes. Like the audit form, it delineates categories for tracked spending, ensuring all financial activities are accounted for and reviewed.

Each of these documents plays a crucial role in managing finances, fostering accountability, and ensuring compliance with standards and regulations.

Dos and Don'ts

When filling out the PTA Audit Sample form, consider the following recommendations:

- Do: Provide accurate information for each section, ensuring all fields are complete.

- Do: Double-check all calculations, especially totals and balances.

- Do: Include the auditor's signature and printed name for validation.

- Do: Attach all necessary documents, such as tax filings, to the completed form.

- Do: Maintain a copy of the audit for your records and distribute copies as indicated.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any fields blank; every section is important.

- Don't: Forget to list uncleared checks, as this can affect the final balance.

- Don't: Skip the review by the committee; it is essential for accountability.

- Don't: Ignore the recommendations and findings from the audit report.

Misconceptions

- Misconception 1: The PTA Audit Sample form is only for large units.

- Misconception 2: Completing the audit form is optional.

- Misconception 3: Once filled out, the form is final and does not require further action.

- Misconception 4: The audit is solely the responsibility of the treasurer.

- Misconception 5: The form does not need to be updated regularly.

- Misconception 6: The findings of the audit are confidential and shouldn't be shared.

This form can be valuable for any size of PTA unit, regardless of membership numbers or financial complexity. Smaller groups often benefit from structured financial oversight, just as much as larger ones do.

In fact, conducting an audit is a critical aspect of financial accountability. Most PTAs are required to perform audits regularly, making this form essential to maintaining transparency.

After completing the audit, it is necessary for the findings to be reviewed and adopted by the executive board. This process ensures that any recommendations or corrections are acknowledged and acted upon.

While the treasurer plays a key role in maintaining records, the audit process involves the entire committee and must be reviewed by others. Multiple perspectives can enhance accountability and oversight.

Reviewing and potentially updating the audit form is crucial. Changes in banking practices and regulatory requirements may necessitate revisions to ensure it remains relevant and useful.

In reality, the audit results are typically shared with all relevant parties, including the executive board and higher levels of the PTA. Transparency fosters trust and community engagement.

Key takeaways

Filling out and using the PTA Audit Sample form is a critical process for ensuring transparency and accountability in financial matters. Here are some key takeaways to assist in navigating this important task:

- The audit report should be dated accurately to reflect the timeframe of the review.

- Collect all pertinent information, including the name of the unit, the IRS EIN, and the district PTA, before starting.

- Identify the correct fiscal year for which the audit is being conducted to align financial records.

- Note the membership dues as outlined in your bylaws and report total membership figures.

- Thoroughly document any receipts and disbursements since the last audit to maintain a clear financial overview.

- Ensure the bank reconciliations are straightforward and check for uncleared checks to calculate the accurate checking account balance.

- When presenting the auditor's report, provide findings clearly, indicating whether the financial records are correct, substantially correct, partially correct, or incorrect.

- Complete a separate audit form for each bank account to maintain specificity and clarity in reporting.

- Make sure to distribute copies of the completed audit form to the required parties, such as the unit president, secretary, and treasurer, to ensure all stakeholders are informed.

By carefully following these key points, you can help ensure the accuracy and effectiveness of your PTA audit process.

Browse Other Templates

Amerigroup Prior Authorization Form - Patient contact information is also included to facilitate any follow-up necessary during the authorization process.

Board of Veterans' Appeals Docket Number Search - This form must be completed after receiving a Statement of the Case from the VA.

Education Plan Form,Degree Completion Application,Academic Progress Review,AFROTC Academic Plan,Credit Evaluation Form,Student Academic Verification,Curriculum Compliance Checklist,Degree Pathway Documentation,Academic Track Assessment,Course Complet - Each fall term reevaluation includes a designated area for the official’s signature and date.