Fill Out Your Publix Reimburse Form

The Publix Reimbursement form is an essential tool designed for associates pursuing higher education through Publix's Tuition Reimbursement Program. This initiative supports team members who are enrolled in undergraduate programs, specifically those working toward associate or bachelor’s degrees. To access reimbursement, certain criteria must be met, such as maintaining at least six months of consecutive service and achieving a grade of “C” or better in the relevant class. Associates must submit their completed forms along with necessary documentation, including grade reports and itemized receipts within 45 days of course completion. This ensures that the process runs smoothly and that members receive the financial support they deserve in a timely manner. After submission, updates will be provided through email, and it's vital to follow up if there's no communication within four weeks. The program has specific guidelines regarding eligible majors and payment methods, detailing that grants or scholarships used for tuition are not reimbursable. Tax implications also come into play, as reimbursement amounts are subject to federal and state withholding. This structured support not only encourages personal growth but also reinforces Publix’s commitment to its associates' continuous development.

Publix Reimburse Example

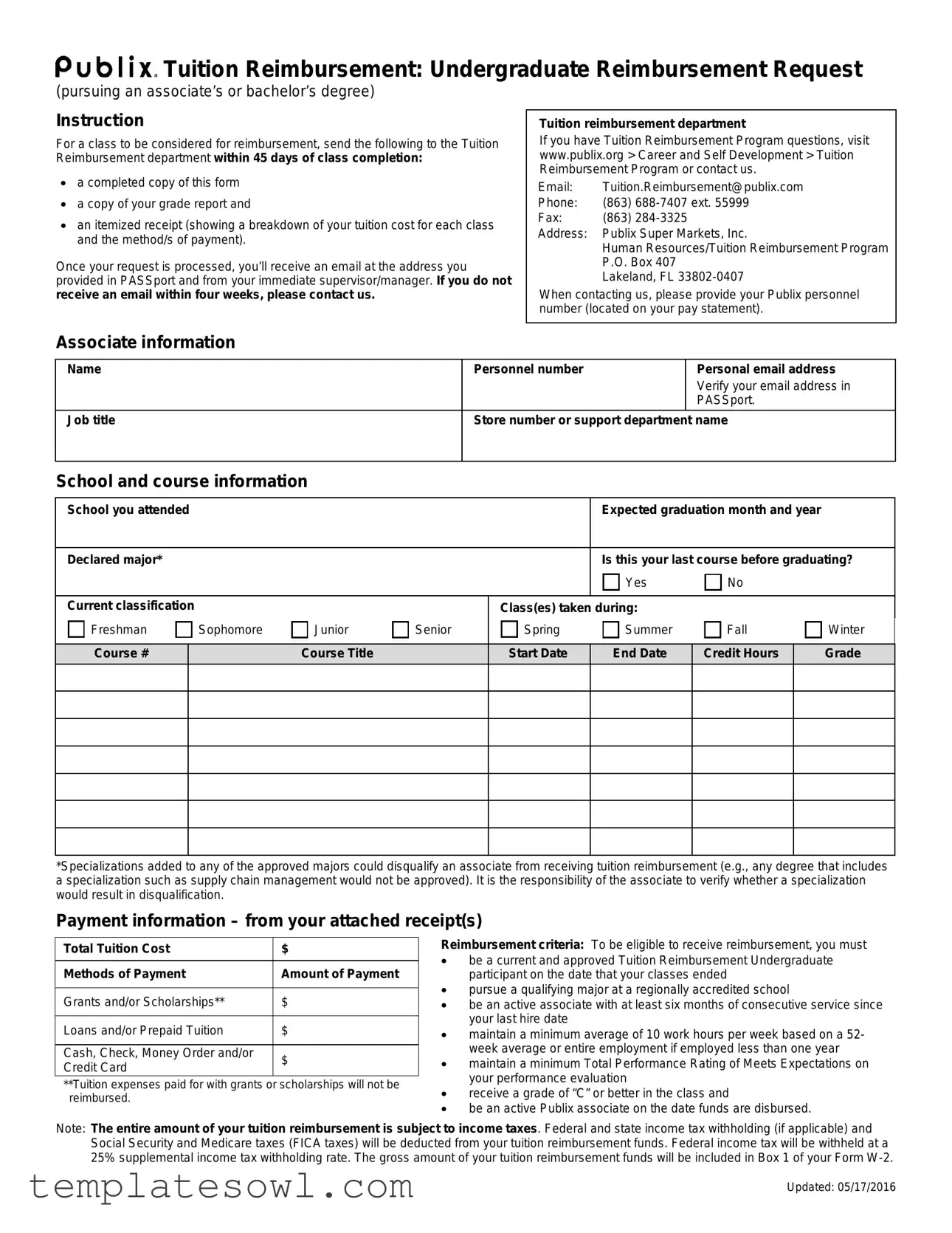

Tuition Reimbursement: Undergraduate Reimbursement Request

Tuition Reimbursement: Undergraduate Reimbursement Request

(pursuing an associate’s or bachelor’s degree)

Instruction

For a class to be considered for reimbursement, send the following to the Tuition Reimbursement department within 45 days of class completion:

•a completed copy of this form

•a copy of your grade report and

•an itemized receipt (showing a breakdown of your tuition cost for each class and the method/s of payment).

Once your request is processed, you’ll receive an email at the address you provided in PASSport and from your immediate supervisor/manager. If you do not receive an email within four weeks, please contact us.

Tuition reimbursement department

If you have Tuition Reimbursement Program questions, visit www.publix.org > Career and Self Development > Tuition Reimbursement Program or contact us.

Email: |

Tuition.Reimbursement@publix.com |

|

Phone: |

(863) |

|

Fax: |

(863) |

|

Address: Publix Super Markets, Inc.

Human Resources/Tuition Reimbursement Program P.O. Box 407

Lakeland, FL

When contacting us, please provide your Publix personnel number (located on your pay statement).

Associate information

Name |

Personnel number |

Personal email address |

|

|

Verify your email address in |

|

|

PASSport. |

Job title |

Store number or support department name |

|

|

|

|

School and course information

School you attended

Declared major*

Expected graduation month and year

Is this your last course before graduating?

YesNo

Current classification |

|

|

|

Class(es) taken during: |

|

|

||

Freshman |

Sophomore |

Junior |

Senior |

Spring |

Summer |

Fall |

Winter |

|

|

|

|

|

|

|

|

|

|

Course # |

|

|

Course Title |

|

Start Date |

End Date |

Credit Hours |

Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Specializations added to any of the approved majors could disqualify an associate from receiving tuition reimbursement (e.g., any degree that includes a specialization such as supply chain management would not be approved). It is the responsibility of the associate to verify whether a specialization would result in disqualification.

Payment information – from your attached receipt(s)

Total Tuition Cost |

$ |

|

|

|

|

Methods of Payment |

Amount of Payment |

|

|

|

|

Grants and/or Scholarships** |

$ |

|

|

|

|

Loans and/or Prepaid Tuition |

$ |

|

|

|

|

Cash, Check, Money Order and/or |

$ |

|

Credit Card |

||

|

**Tuition expenses paid for with grants or scholarships will not be reimbursed.

Reimbursement criteria: To be eligible to receive reimbursement, you must

•be a current and approved Tuition Reimbursement Undergraduate participant on the date that your classes ended

•pursue a qualifying major at a regionally accredited school

•be an active associate with at least six months of consecutive service since your last hire date

•maintain a minimum average of 10 work hours per week based on a 52- week average or entire employment if employed less than one year

•maintain a minimum Total Performance Rating of Meets Expectations on your performance evaluation

•receive a grade of “C” or better in the class and

•be an active Publix associate on the date funds are disbursed.

Note: The entire amount of your tuition reimbursement is subject to income taxes. Federal and state income tax withholding (if applicable) and Social Security and Medicare taxes (FICA taxes) will be deducted from your tuition reimbursement funds. Federal income tax will be withheld at a 25% supplemental income tax withholding rate. The gross amount of your tuition reimbursement funds will be included in Box 1 of your Form

Updated: 05/17/2016

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Criteria | To qualify for reimbursement, associates must be active participants and meet specific requirements, such as having completed at least six months of service since their last hire date. |

| Reimbursement Timeline | Associates must submit their completed form, grade report, and itemized receipt within 45 days of class completion. Timely submissions are crucial for processing. |

| Grade Requirement | A grade of "C" or better must be achieved in the class for reimbursement eligibility. A strong performance can help associates secure financial assistance. |

| Tax Implications | The entire reimbursement amount is subject to income tax withholding. Federal tax is withheld at a 25% rate, and it will be reported on the associate's Form W-2. |

| Funding Restrictions | Tuitions paid through grants or scholarships are not reimbursable. Associates should consider this when applying for financial aid. |

| Contact Information | For questions regarding the Tuition Reimbursement Program, associates can reach out via email at Tuition.Reimbursement@publix.com or call (863) 688-7407 ext. 55999. |

| Forms and Submission | Along with the reimbursement form, associates must include a copy of their grade report and a detailed receipt showing tuition costs, payment methods, and breakdowns. |

| Specialization Limitation | Associates pursuing specializations may inadvertently disqualify themselves from reimbursement. It is their responsibility to verify program eligibility. |

| Processing Notification | Upon processing the request, associates will receive notifications via email. If no communication is received within four weeks, contacting the department is advised. |

Guidelines on Utilizing Publix Reimburse

To successfully fill out the Publix Reimbursement form, follow the steps outlined below. This process is designed to ensure all required information is accurately provided for your tuition reimbursement request.

- Begin by downloading and printing the Publix Reimbursement form.

- Fill in your name, personnel number, and personal email address at the top of the form.

- Check that your email address is correct in PASSport.

- Complete the section for job title and store number or support department name.

- Provide details about the school you attended, your declared major, and expected graduation month and year.

- Indicate whether this is your last course before graduating by selecting Yes or No.

- Choose your current classification from the available options (Freshman, Sophomore, Junior, Senior).

- List the courses taken by providing the course number, title, start date, end date, credit hours, and grade received.

- In the payment information section, input the total tuition cost and itemize all methods of payment with corresponding amounts.

- Attach a copy of your grade report and an itemized receipt showing the breakdown of your tuition costs.

- Submit the completed form along with the required documents to the Tuition Reimbursement department within 45 days of class completion.

After submitting your request, you can expect to receive an email confirmation at the address provided in your PASSport. If you do not receive a response within four weeks, reach out to the Tuition Reimbursement department for assistance.

What You Should Know About This Form

What documents do I need to submit to qualify for tuition reimbursement?

To be considered for tuition reimbursement, you need to submit three key documents to the Tuition Reimbursement department within 45 days of completing your class. These documents include a completed copy of the Publix Tuition Reimbursement form, a copy of your grade report, and an itemized receipt that clearly shows a breakdown of your tuition costs for each class, as well as the payment methods used. Having all of these documents in order will help ensure a smooth reimbursement process.

How long will it take to process my reimbursement request?

After submitting your request, you can expect to receive an email confirmation at the address you provided in PASSport. This email will also come from your immediate supervisor or manager. If you do not receive any communication within four weeks, it is important to reach out to the Tuition Reimbursement department for assistance. Staying proactive is key to ensuring you are kept informed about the status of your request.

What are the eligibility criteria for receiving tuition reimbursement?

To be eligible for tuition reimbursement, several criteria must be met. First, you need to be an active associate with at least six consecutive months of service since your last hire date. You must also be a current participant in the Tuition Reimbursement Program on the date your classes ended and be pursuing a qualifying major at a regionally accredited school. Furthermore, maintaining a minimum average of 10 work hours per week and receiving a grade of "C" or better in your courses are essential conditions. Additionally, you should have a performance evaluation rating of at least "Meets Expectations." Lastly, you must be an active associate on the date the funds are disbursed.

Will I be taxed on my tuition reimbursement funds?

Yes, all tuition reimbursement amounts are subject to income taxes. This means that federal and state income tax withholding will be deducted, along with Social Security and Medicare taxes (often referred to as FICA taxes). Specifically, federal income tax will be withheld at a rate of 25%. When you receive your W-2 form from Publix, the total amount of your tuition reimbursement will be reported in Box 1, reflecting the gross amount you received before taxes.

How can I get in touch with the Tuition Reimbursement department for further questions?

If you have any questions regarding the Tuition Reimbursement Program, there are multiple ways to reach out for assistance. You can visit the Publix career development website at www.publix.org > Career and Self Development > Tuition Reimbursement Program. Alternatively, you can email the department at Tuition.Reimbursement@publix.com or call them at (863) 688-7407, ext. 55999. If you prefer fax communication, you can use (863) 284-3325. Lastly, correspondence can also be sent to Publix Super Markets, Inc. Human Resources/Tuition Reimbursement Program, P.O. Box 407, Lakeland, FL 33802-0407. When contacting them, remember to include your Publix personnel number, which can be found on your pay statement.

Common mistakes

When filling out the Publix Reimbursement form, mistakes can slow down the process or even result in a denial. The following are common errors that individuals often make, which can easily be avoided.

First, not providing a completed copy of the form is a frequent issue. Ensure that every section is filled out accurately. An incomplete form can lead to delays as the Tuition Reimbursement department will need to contact you for the missing information.

Another mistake is failing to include the required documentation. You need to submit your grade report and an itemized receipt along with your form. Without these important documents, your request will be considered incomplete, which may lead to a rejection.

Additionally, many forget to send their submissions within the specified timeframe. You must submit everything within 45 days of class completion. Mark this deadline on your calendar to keep yourself accountable and avoid last-minute scrambles.

Another common oversight involves providing an invalid email address. Double-check the email included in your submission, as this is how you will receive updates about your reimbursement status. An incorrect email can cause you to miss important communications.

Some individuals also neglect to verify whether their degree specialization disqualifies them from receiving reimbursement. For instance, if your major includes a specialization not on the approved list, it could lead to your application being denied. Take the time to research your program thoroughly.

It is important not to overlook a critical eligibility requirement: being a current and approved Tuition Reimbursement participant. If your participation status is not confirmed by the time classes end, you will not qualify for reimbursement. Make sure your status is current.

Many applicants might skip including necessary payment information, such as the method of payment and total amount paid. Be sure to include all payment details from your receipt, as incomplete financial information can lead to questions and further delays.

Lastly, it’s crucial to receive a grade of “C” or better in your courses to qualify for reimbursement. Make sure to check your grades before submitting the form to ensure you meet this requirement. Failing to meet this academic standard can invalidate your request.

By avoiding these common mistakes, you can ensure a smoother application process for your tuition reimbursement at Publix. Taking the extra time to review your submission can save you both time and frustration.

Documents used along the form

When submitting a Publix Reimbursement Form for tuition reimbursement, several additional documents are typically necessary to support the request. Each of these documents plays a crucial role in ensuring that the application process is smooth and efficient. Below is a list of forms and documents often used alongside the Publix Reimbursement Form.

- Grade Report: This document provides evidence of the student's performance in the enrolled course. It must demonstrate that the student received a grade of “C” or better to be eligible for reimbursement.

- Itemized Receipt: An itemized receipt is required to detail the tuition costs incurred for each class. It should break down the tuition fees and specify the method of payment used, substantiating the reimbursement request.

- Job Title Confirmation: This confirmation may be useful in verifying the associate's current job title and its relevance to educational courses taken. It helps confirm eligibility based on the associate's role within the company.

- Employment Verification: A document that confirms the associate’s active employment status. This may include statements regarding employment duration and hours worked, ensuring compliance with the reimbursement criteria.

Including all necessary documents when submitting the Publix Reimbursement Form can enhance the chances of a timely and successful reimbursement process. It's essential to ensure that each document meets the outlined requirements to avoid any delays.

Similar forms

-

Expense Reimbursement Form: Similar to the Publix Reimburse form, the Expense Reimbursement Form allows employees to request reimbursement for business-related expenses. It typically requires details such as the nature of the expense, receipts, and justification for the reimbursement, much like the tuition reimbursement form necessitates documentation of tuition costs and grades.

-

Medical Reimbursement Request: This document is used to claim reimbursements for medical expenses incurred by an employee or their dependents. It often demands receipts and proof of payment. Like the Publix Reimburse form, it emphasizes the need for proper documentation to receive the funds.

-

Relocation Reimbursement Form: This form assists employees who have incurred expenses related to moving for work-related purposes. Similar to the tuition reimbursement process, it requires itemized receipts and a description of expenses, ensuring that workers provide necessary documentation to claim their relocation costs.

-

Professional Development Reimbursement Form: Employees use this document to seek reimbursement for costs associated with professional development activities. Just as with tuition reimbursement, participants must submit receipts, a completed request form, and proof of completion to validate their claims.

Dos and Don'ts

When completing the Publix Reimbursement form, attention to detail is crucial. Below is a list of important do's and don'ts to guide you through the process.

- Do submit your completed form within 45 days of class completion.

- Do include a copy of your grade report along with the form.

- Do attach an itemized receipt detailing your tuition costs and payment methods.

- Do verify your email address in PASSport to ensure you receive notification about your submission.

- Do contact the Tuition Reimbursement department if you don't receive an update within four weeks after submission.

- Don't forget to provide your Publix personnel number; it's essential for processing.

- Don't submit receipts for tuition paid with grants or scholarships, as these will not be reimbursed.

- Don't miss any required information such as your declared major or course details; incomplete forms may delay processing.

- Don't assume your specialization is eligible—check to avoid disqualification.

- Don't ignore the tax implications of your reimbursement; be aware that taxes will be deducted.

Misconceptions

Tuition reimbursement programs can be complicated, leading to various misconceptions. Below is a list detailing some common myths about the Publix Reimbursement form and the reality that dispels them.

-

Misconception 1: All courses are eligible for tuition reimbursement.

In fact, only classes that are part of a qualifying major at a regionally accredited institution are eligible. Additionally, specializations may disqualify an associate from receiving funds.

-

Misconception 2: You can submit the reimbursement form at any time.

The form must be submitted within 45 days of completing the class. Delays could mean losing your chance for reimbursement.

-

Misconception 3: Grants and scholarships will be reimbursed.

This is incorrect. Tuition expenses covered by grants or scholarships are not eligible for reimbursement under the program.

-

Misconception 4: Any grade above a “C” qualifies for reimbursement.

Reimbursement is only available for classes in which you receive a grade of “C” or better. Anything lower will not qualify.

-

Misconception 5: You can remain inactive at work while waiting for reimbursement.

To be eligible, you must be a current active associate at Publix on the date the funds are disbursed. Inactivity can disqualify you.

-

Misconception 6: Reimbursement is not taxable income.

This is false. Tuition reimbursement funds are subject to federal and state income tax withholding, as well as FICA taxes, just like regular income.

-

Misconception 7: You do not need your supervisor’s approval to apply.

Your reimbursement form needs to be processed through your immediate supervisor or manager. They will receive a notification once you submit it.

-

Misconception 8: You can apply for reimbursement for any amount of tuition.

The eligibility for the reimbursement amount is determined by your tuition costs as shown on the itemized receipt. Make sure it is accurate.

-

Misconception 9: You can submit any document for your grade and receipts.

Only a completed reimbursement form, a copy of your grade report, and itemized receipts that detail your tuition costs will be accepted.

-

Misconception 10: There are no deadlines or submission timeframe requirements.

Not true. All submissions must be completed within specified timeframes, and communication within four weeks is essential to ensure eligibility.

Understanding these misconceptions can lead to a smoother experience when applying for tuition reimbursement. Keeping the guidelines in mind will help ensure your request is successful.

Key takeaways

When navigating the Publix Reimbursement form for tuition reimbursement, several important points should be kept in mind to ensure a smooth experience. Here are the key takeaways:

- Submit documentation promptly. All required documents, including the completed form, grade report, and itemized receipt, must be submitted within 45 days after class completion.

- Understand eligibility requirements. To receive reimbursement, participants must be active associates with at least six months of consecutive service and must pursue a qualifying major at a regionally accredited school.

- Maintain communication. You will receive confirmation of your reimbursement request via email. If you do not receive this email within four weeks, it is important to reach out to the Tuition Reimbursement department.

- Be aware of the tax implications. Tuition reimbursement funds are subject to income tax and will be reflected on your Form W-2. Federal income tax will be withheld at a rate of 25%.

- Check for disqualifying specializations. Some specializations may make associates ineligible for reimbursement, so verify beforehand whether your major is affected.

By keeping these takeaways in mind, associates can confidently approach the reimbursement process and ensure all necessary steps are taken carefully.

Browse Other Templates

Indian Bank Nomination Form - The applicants must consent to terms related to tax deductions on deposit interest.

Wedding Party List Template - Specify the dinner arrangement type, whether served or buffet, for planning purposes.

Steak and Shake Jobs - Determine whether you want full-time, part-time, or temporary employment.