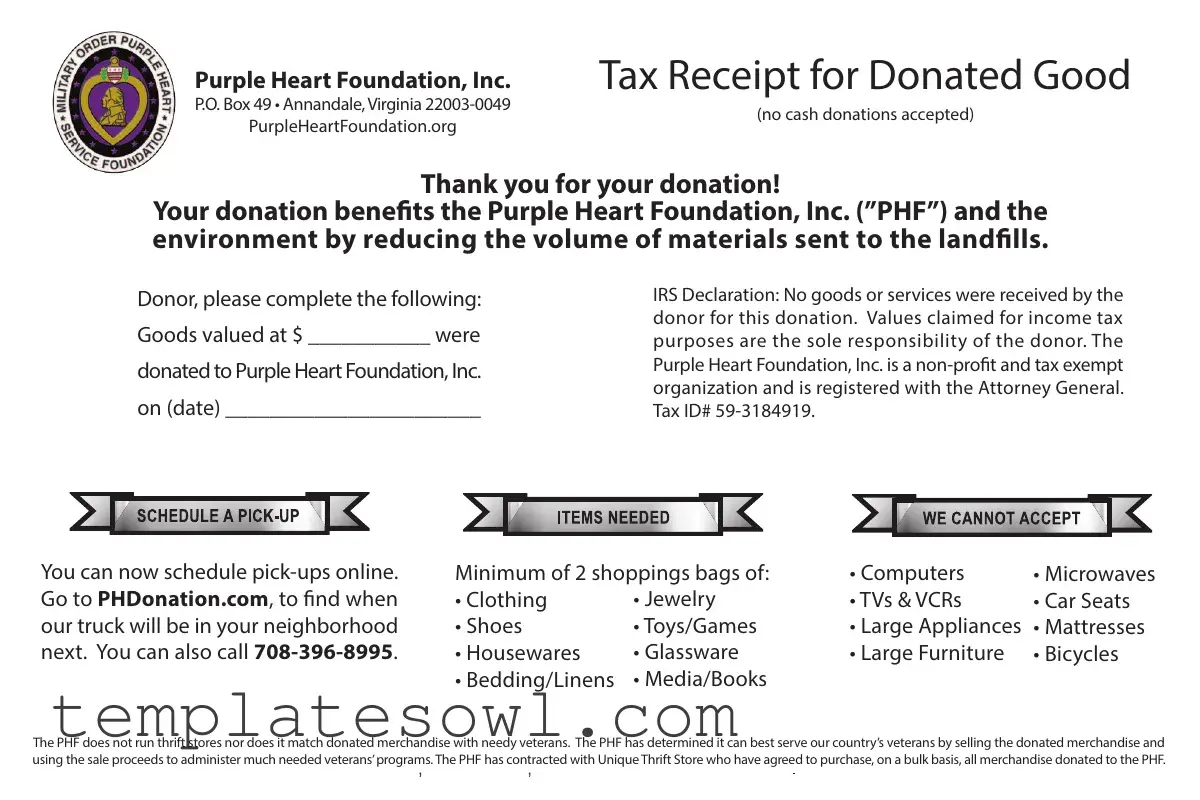

Fill Out Your Purple Heart Tax Receipt Form

The Purple Heart Tax Receipt form is an essential document for individuals who wish to donate goods to the Purple Heart Foundation, Inc. This organization is dedicated to supporting veterans and environmentally friendly practices by accepting various types of donations, from clothing and household goods to large appliances. When completing the form, donors are required to list the approximate value of the items they are donating and provide the date of the contribution. Importantly, the form states that no goods or services were exchanged for the donation, placing the responsibility for the claimed value on the donor. It's worth noting that the Purple Heart Foundation does not operate thrift stores or directly match donated goods with veterans in need. Instead, the organization sells donated items to Unique Thrift Store, which purchases items in bulk. This approach allows the Purple Heart Foundation to fund its veteran programs effectively. The foundation is a registered non-profit organization, ensuring transparency and compliance with tax regulations, and it also provides a Tax ID number for donor reference. Donors can conveniently schedule pickups online or by phone, simplifying the donation process.

Purple Heart Tax Receipt Example

Purple Heart Foundation, Inc. |

Tax Receipt for Donated Good |

|

P.O. Box 49 • Annandale, Virginia |

(no cash donations accepted) |

|

PurpleHeartFoundation.org |

||

|

Thank you for your donation!

Your donation beneurple Heart Foundation, Inc. (”PHF”) and the environment by reducing the volume of materials sent to the land.

Donor, please complete the following:

Goods valued at $ ___________ were

donated to Purple Heart Foundation, Inc.

on (date) _______________________

IRS Declaration: No goods or services were received by the donor for this donation. Values claimed for income tax purposes are the sole responsibility of the donor. The Purple Heart Foundation, Inc. is a

You can now schedule |

Minimum of 2 shoppings bags of: |

• Computers |

• Microwaves |

|

Go to PHDonation.com, to |

• Clothing |

• Jewelry |

• TVs & VCRs |

• Car Seats |

our truck will be in your neighborhood |

• Shoes |

• Toys/Games |

• Large Appliances |

• Mattresses |

next. You can also call |

• Housewares |

• Glassware |

• Large Furniture |

• Bicycles |

|

• Bedding/Linens |

• Media/Books |

|

|

The PHF does not run thrift stores nor does it match donated merchandise with needy veterans. The PHF has determined it can best serve our country’s veterans by selling the donated merchandise and using the sale proceeds to administer much needed veterans’programs. The PHF has contracted with Unique Thrift Store who have agreed to purchase, on a bulk basis, all merchandise donated to the PHF.

Form Characteristics

| Fact | Description |

|---|---|

| Organization | The Purple Heart Foundation, Inc. (PHF) is a nonprofit organization focused on aiding veterans and their families. |

| Tax ID | PHF's Tax ID number is 59-3184919, which is essential for donor record keeping and tax deduction purposes. |

| Goods Donation | Only certain goods can be donated, including clothing, appliances, and furniture. Cash donations are not accepted. |

| IRS Declaration | Donors must declare that no goods or services were received in exchange for their donation, a vital point for tax records. |

| Scheduling Pick-ups | Donors can easily schedule pick-ups online or by calling 708-396-8995, making the donation process convenient. |

| Proceeds Use | The PHF sells the donated items to fund crucial veterans' programs, rather than distributing them directly to individuals. |

Guidelines on Utilizing Purple Heart Tax Receipt

After making a donation to the Purple Heart Foundation, Inc., you will need to complete the Purple Heart Tax Receipt form to document your charitable contribution. This form will assist you in claiming your donation on your tax return, although the value claimed will be your responsibility. Following the steps below will help ensure the form is filled out correctly.

- Obtain the Purple Heart Tax Receipt form. This might be provided in physical form or available for download online.

- Locate the section on the form labeled “Goods valued at $ ___________ were donated to Purple Heart Foundation, Inc. on (date) _______________________.”

- Fill in the dollar amount that you estimate the donated goods are worth where it says “$ ___________”. This should reflect your assessment of the value of the items.

- Next, enter the date you made the donation in the space provided, next to “on (date) _______________________.” This should be the exact date when you donated the items.

- Review the IRS declaration statement. There is a statement that says “No goods or services were received by the donor for this donation.” Make sure it aligns with your experience.

- Understand that it is noted that the values claimed for income tax purposes are your sole responsibility. If you have any questions about determining value, consider consulting tax guidance or a tax professional.

- Write down the Tax ID# 59-3184919 if needed for your records. This is the identification number for the Purple Heart Foundation, Inc.

- Make a copy of the completed receipt for your records before submitting it or storing it with your tax documents.

By following these steps, you can effectively complete the Purple Heart Tax Receipt form and ensure you have the necessary documentation for your tax records. Remember to keep the receipt for your personal records after filling it out.

What You Should Know About This Form

What is the Purple Heart Tax Receipt form?

The Purple Heart Tax Receipt form serves as a documentation for individuals who donate goods to the Purple Heart Foundation, Inc. This form acknowledges your contribution and states that no goods or services were received in return for the donation. It can be important for tax purposes, helping you report your charitable contributions when you file your income tax return.

How do I use the Purple Heart Tax Receipt form?

After donating your items to the Purple Heart Foundation, simply fill out the required information on the tax receipt form. You'll need to specify the total value of the donated goods and the date of the donation. Make sure to keep a copy for your records, as you can use it to claim a deduction when filing taxes.

What types of items can I donate?

The Purple Heart Foundation accepts a variety of items. You are encouraged to donate clothing, shoes, housewares, glassware, large appliances, furniture, media, and toys, among others. Please note that cash donations are not accepted, and a minimum of two shopping bags is required for pick-ups.

Is there a minimum or maximum value for donations?

While there is no maximum value for donations, you must assign a fair market value to the items you donate to ensure accurate reporting. This value is at the discretion of the donor and must be based on the condition and type of the items. The Purple Heart Foundation does not determine these values.

Can I schedule a pick-up for my donated items?

Yes! You can schedule a pick-up online or by calling 708-396-8995. Just visit PHDonation.com to set up a pick-up in your neighborhood. This convenient service makes it easy to donate without having to transport the items yourself.

How does the Purple Heart Foundation use my donations?

The Purple Heart Foundation does not operate thrift stores nor distribute donated items directly to veterans. Instead, your donations are sold, and the proceeds are used to fund programs that support veterans in need. By donating, you're contributing to a cause that directly benefits those who have served the country.

Will my donation impact my taxes?

Your donation can potentially lower your taxable income, as contributions to qualified charitable organizations like the Purple Heart Foundation may be tax-deductible. However, it’s essential to consult with a tax professional or reference IRS guidelines to understand how to best report your donation on your tax return.

Common mistakes

Filling out the Purple Heart Tax Receipt form may seem straightforward, but there are common mistakes that can lead to complications. Understanding these pitfalls can help ensure that your donation process goes smoothly and that you receive the most out of your charitable contribution.

One frequent mistake arises when donors fail to provide an accurate value for their donated goods. The form prompts you to enter the valued amount of items donated. Rounding down or guessing can lead to discrepancies later, especially when claiming deductions on your taxes. It is vital to assess your items fairly and accurately, as the IRS expects you to be truthful about their worth.

Another oversight involves neglecting to include the proper date of the donation. Forgetting to fill in this important detail not only renders the receipt incomplete, but it can also complicate your record-keeping. Establishing a timeline for your donations is essential for documentation, especially in case the IRS requires information during an audit.

Many people also fail to recognize that no goods or services can be accepted in exchange for their donation. It’s essential to read the IRS Declaration on the form carefully. If you mistakenly indicate that you received something in return, it could lead to potential issues with your tax filings and diminish the legitimacy of your charitable giving.

Some donors may overlook the importance of using the correct tax identification number, which is provided on the form. Omitting or miswriting this number could lead to confusion with tax authorities. Ensuring accuracy in this detail can help avoid unnecessary complications and ensure that your donation is correctly documented.

Donors sometimes forget to retain a copy of the completed Purple Heart Tax Receipt form. This receipt serves as your proof of donation and can be necessary when preparing your tax returns. Keeping a record of your charitable contributions for your own files is a smart practice.

Lastly, many people mistakenly assume they can donate cash when, in fact, the Purple Heart Foundation only accepts goods. This misunderstanding can result in frustration. Being aware of the specific items listed on the form and their acceptance criteria will guide you in the donation process and ensure your efforts are properly recognized.

By being mindful of these common mistakes, you can ensure that your experience with the Purple Heart Tax Receipt form is positive and that your contributions are properly recorded. Properly filling out this form helps not just you, but also the valuable programs supporting our veterans.

Documents used along the form

In addition to the Purple Heart Tax Receipt form, various other documents are commonly associated with charitable donations, especially those aimed at tax benefits. Each of these documents serves a unique purpose and may be required for comprehensive record-keeping or tax reporting.

- IRS Form 8283: This form is used by taxpayers who donate property valued over $500. It provides details about the donation and requires the donor's signature, along with a qualified appraisal for items valued above certain thresholds.

- Donation Acknowledgment Letter: Charitable organizations often provide a letter confirming the donation. This letter includes details such as the date of the contribution and a description of the items donated, which helps donors substantiate their claims for charitable deductions.

- Appraisal Report: When donating higher-value items, a formal appraisal is recommended to establish the fair market value. This report must be prepared by a qualified appraiser and is crucial for accurate tax reporting.

- Form 1040 Schedule A: This is part of the individual income tax return that allows taxpayers to itemize deductions, including charitable contributions. Proper reporting of donations on this form can lead to significant tax savings.

- Form 1098-C: For donations of vehicles, this IRS form is often required. It details the vehicle’s value and helps the donor report the correct amount when claiming a deduction.

- State Tax Deduction Form: Some states have their own forms for reporting charitable contributions. These forms vary from one state to another and may have specific requirements for documentation.

- Personal Journal of Donations: Maintaining a ledger or journal documenting each donation can provide a comprehensive overview for tax preparation. This personal record should include dates, item descriptions, and estimated values.

- Power of Attorney (if applicable): If someone else is handling the donation on behalf of the donor, a Power of Attorney may be necessary. This document grants the designated individual the authority to manage the donation process and associated tax filings.

Understanding these forms and documents will facilitate a smoother donation process and ensure that donors can maximize their tax benefits associated with charitable contributions. Proper documentation not only supports personal claims but also enhances the transparency of charitable organizations.

Similar forms

The Purple Heart Tax Receipt form serves a specific function in the realm of charitable donations. However, it shares similarities with several other documents commonly used for similar purposes. Each of these documents facilitates the process of acknowledging donations, providing a record for tax purposes, and ensuring transparency between donors and organizations. Below are four documents that are akin to the Purple Heart Tax Receipt form:

- Charitable Contribution Receipt: This document is provided by a non-profit organization to acknowledge a donor's contribution. Like the Purple Heart Tax Receipt, it specifies the amount and type of donation, and confirms that no goods or services were exchanged in return. This helps ensure clarity for tax deductions.

- IRS Form 8283: Used for non-cash charitable contributions, this form must be filled out by donors who give items of substantial value. It captures information about the donated items, along with their appraised worth. Similar to the Purple Heart form, it emphasizes that donor responsibility regarding valuation is paramount.

- Donation Confirmation Letter: Often sent from non-profit entities to thank donors, this letter confirms the details of the donation. Just like the Purple Heart Tax Receipt, it provides evidence of the goodwill act, reinforces donor engagement, and serves as a record for tax purposes.

- Fair Market Value (FMV) Documentation: This is often required when a donor claims a tax deduction for their contributions. It outlines the FMV of the donated items and verifies their valuation. This is comparable to the Purple Heart Tax Receipt because it places the burden of proof regarding item valuation upon the donor.

Each of these documents plays a crucial role in the charitable donation process, providing both validation for the donor and assurance for the receiving organization.

Dos and Don'ts

When filling out the Purple Heart Tax Receipt form, there are several important actions to take and avoid. Adhering to these guidelines ensures that the process is smooth and effective.

- DO ensure you complete all required fields on the form, including the value of goods donated and the date of donation.

- DO provide an accurate valuation of the items to reflect their fair market value.

- DO keep a copy of the completed form for your records for tax purposes.

- DO remember that no goods or services were received for the donation, as stated on the form.

- DO schedule pick-ups online or call the provided phone number for assistance.

- DON'T include cash donations, as the form is specifically for donated goods.

- DON'T underestimate or exaggerate the value of the donated items, as this could cause discrepancies with the IRS.

Following these do's and don'ts will help ensure compliance with tax regulations and support the work of the Purple Heart Foundation.

Misconceptions

Misconceptions about the Purple Heart Tax Receipt form can lead to confusion for donors. Here are five common misunderstandings:

- All donations are tax-deductible. While many donations are eligible for tax deductions, the Purple Heart Foundation specifically states that the values claimed for tax purposes are the sole responsibility of the donor. It is important for individuals to consult with a tax professional about their particular situation.

- The Purple Heart Foundation operates thrift stores. Some may assume that the Purple Heart Foundation runs thrift stores where donated items are sold. In fact, the foundation has contracted with Unique Thrift Store to handle the sale of donated merchandise on a bulk basis. Thus, they do not operate their own retail locations.

- Donations must be in new condition. Donors may believe that only new items can be donated. However, gently used goods are acceptable. The foundation encourages donations of items like clothing, household goods, and appliances, as long as they are in good condition.

- Donors receive goods or services for their donations. A common misconception is that donors might receive compensation for their contributions. The IRS declaration clearly states that no goods or services were given in exchange for the donation. This condition is crucial for maintaining tax deductibility.

- The Purple Heart Foundation directly helps individual veterans. Some individuals may think that the foundation matches donations with specific veterans in need. However, the organization focuses on selling the donated items and using the proceeds to fund programs that support veterans rather than matching items to individuals.

Key takeaways

When filling out and using the Purple Heart Tax Receipt form, keep these key takeaways in mind:

- Donation Value: Clearly indicate the total value of the goods you are donating. This information is crucial for your tax records.

- Date of Donation: Include the date when the donation is made. This helps establish the timing for tax purposes.

- No Goods or Services Received: The form states that no goods or services were received for the donation. This statement is essential for compliance with IRS regulations.

- Ownership of Value Claims: The responsibility for the value claimed on tax returns lies solely with the donor. Ensure accurate valuation of your donated items.

- Non-Profit Status: The Purple Heart Foundation is a registered non-profit organization. This status may affect your ability to claim donations as tax-deductible.

- Online Pick-up Scheduling: You have the option to schedule your donation pick-up online. This can make the process more convenient for you.

- Donation Limitations: Be aware that the Purple Heart Foundation does not run thrift stores and will not match goods with needy veterans. Understanding this helps set clear expectations.

Browse Other Templates

Va Form 26-1880 - It retains its record for three years after submission.

Vehicle Inspection Pdf - The inspector marks components as either 'OK', 'Needs Repair', or 'Does Not Apply' to streamline the evaluation process.

Mn Vehicle Gift Form - This application must be submitted within ten days of vehicle purchase to avoid complications.