Fill Out Your Qr 7 Report Form

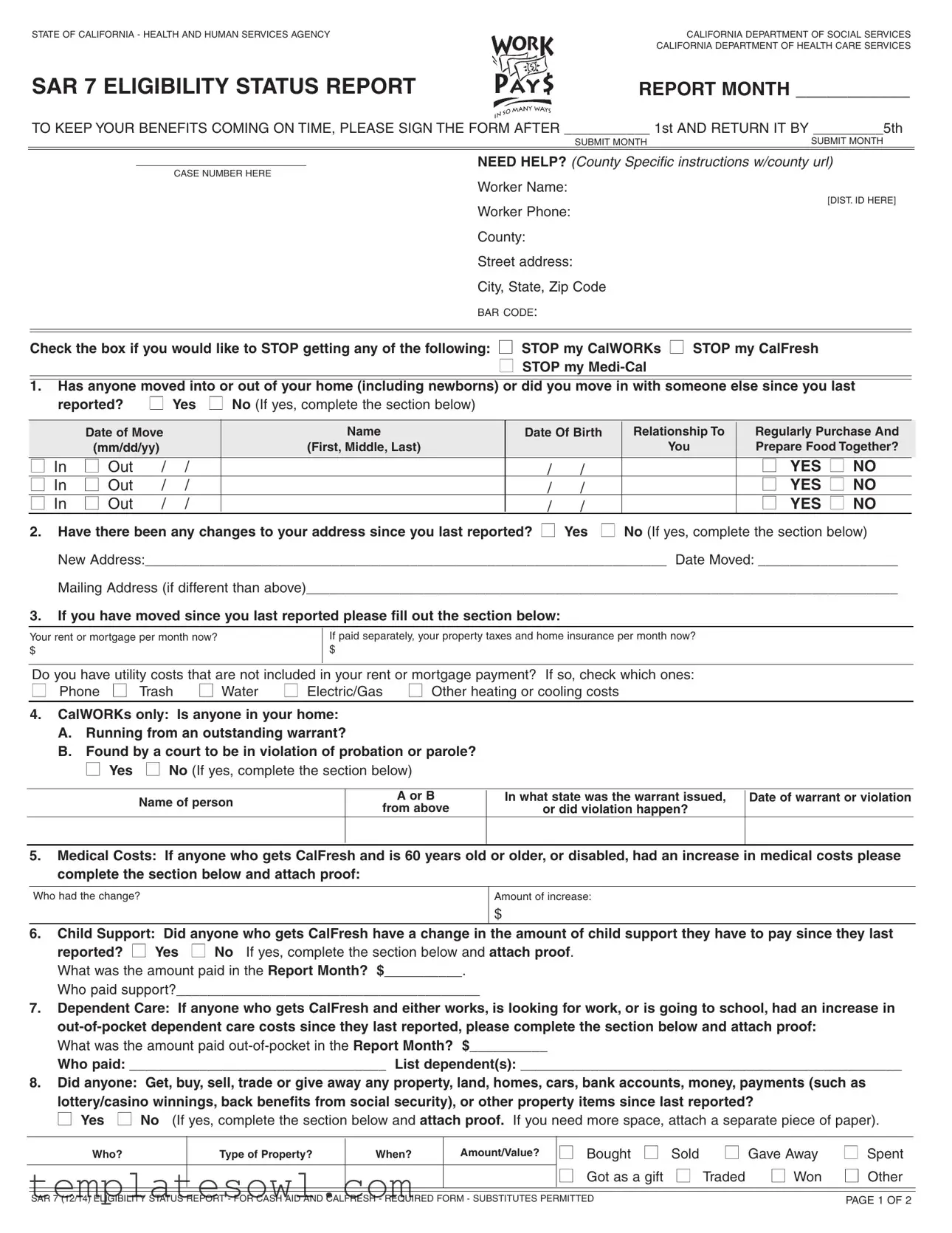

The QR 7 Report form is an essential document for California residents receiving benefits from programs such as CalWORKs, CalFresh, and Medi-Cal. This form serves to update the state on changes in a household’s circumstances that may affect eligibility for these benefits. Recipients must complete a detailed report covering various aspects, including changes in household composition, income, residency status, and specific needs like medical costs or child support obligations. By submitting this form, recipients confirm crucial information related to their living situation and finances, allowing the state to ensure that assistance is provided accurately and fairly. Promptly returning the signed form by the specified deadlines is crucial for uninterrupted benefits. Additional instructions are available based on specific county requirements, ensuring recipients have the necessary guidance to complete the form correctly. This form also includes sections for reporting changes in property ownership, dependent care costs, and any income received in the report month, which collectively shape the assessment of ongoing eligibility for financial assistance programs.

Qr 7 Report Example

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY |

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES |

|

CALIFORNIA DEPARTMENT OF HEALTH CARE SERVICES |

SAR 7 ELIGIBILITY STATUS REPORT

REPORT MONTH ___________

TO KEEP YOUR BENEFITS COMING ON TIME, PLEASE SIGN THE FORM AFTER ___________ 1st AND RETURN IT BY _________5th

SUBMIT MONTHSUBMIT MONTH

NEED HELP? (County Specific instructions w/county url)

CASE NUMBER HERE

Worker Name:

[DIST. ID HERE]

Worker Phone:

County:

Street address:

City, State, Zip Code

BAR CODE:

Check the box if you would like to STOP getting any of the following: ■

■

STOP my CalWORKs ■ STOP my CalFresh STOP my

1.Has anyone moved into or out of your home (including newborns) or did you move in with someone else since you last

reported? |

■ Yes |

■ No (If yes, complete the section below) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

Date of Move |

|

|

Name |

Date Of Birth |

Relationship To |

Regularly Purchase And |

|||

|

(mm/dd/yy) |

|

|

(First, Middle, Last) |

|

|

You |

Prepare Food Together? |

||

■ In |

■ Out |

/ |

/ |

|

|

/ |

/ |

|

■ YES ■ NO |

|

■ In |

■ Out |

/ |

/ |

|

|

/ |

/ |

|

■ YES ■ NO |

|

■ In |

■ Out |

/ |

/ |

|

|

/ |

/ |

|

■ YES ■ NO |

|

2. Have there been any changes to your address since you last reported? ■ Yes ■ No (If yes, complete the section below) New Address:___________________________________________________________________ Date Moved: __________________

Mailing Address (if different than above)____________________________________________________________________________

3.If you have moved since you last reported please fill out the section below:

Your rent or mortgage per month now?

$

If paid separately, your property taxes and home insurance per month now?

$

Do you have utility costs that are not included in your rent or mortgage payment? If so, check which ones:

■ Phone ■ Trash |

■ Water |

■ Electric/Gas |

■ Other heating or cooling costs |

4.CalWORKs only: Is anyone in your home:

A.Running from an outstanding warrant?

B.Found by a court to be in violation of probation or parole?

■ Yes ■ No (If yes, complete the section below)

Name of person

A or B

from above

In what state was the warrant issued,

or did violation happen?

Date of warrant or violation

5.Medical Costs: If anyone who gets CalFresh and is 60 years old or older, or disabled, had an increase in medical costs please complete the section below and attach proof:

Who had the change?

Amount of increase:

$

6.Child Support: Did anyone who gets CalFresh have a change in the amount of child support they have to pay since they last reported? ■ Yes ■ No If yes, complete the section below and attach proof.

What was the amount paid in the Report Month? $__________. Who paid support?_______________________________________

7.Dependent Care: If anyone who gets CalFresh and either works, is looking for work, or is going to school, had an increase in

What was the amount paid

Who paid: _________________________________ List dependent(s): _________________________________________________

8.Did anyone: Get, buy, sell, trade or give away any property, land, homes, cars, bank accounts, money, payments (such as lottery/casino winnings, back benefits from social security), or other property items since last reported?

■ Yes ■ No (If yes, complete the section below and attach proof. If you need more space, attach a separate piece of paper).

Who?

Type of Property?

When?

Amount/Value?

■ |

Bought ■ Sold ■ Gave Away |

■ |

■ |

Got as a gift ■ Traded ■ Won |

■ |

Spent

Other

SAR 7 (12/14) ELIGIBILITY STATUS REPORT - FOR CASH AID AND CALFRESH - REQUIRED FORM - SUBSTITUTES PERMITTED |

PAGE 1 OF 2 |

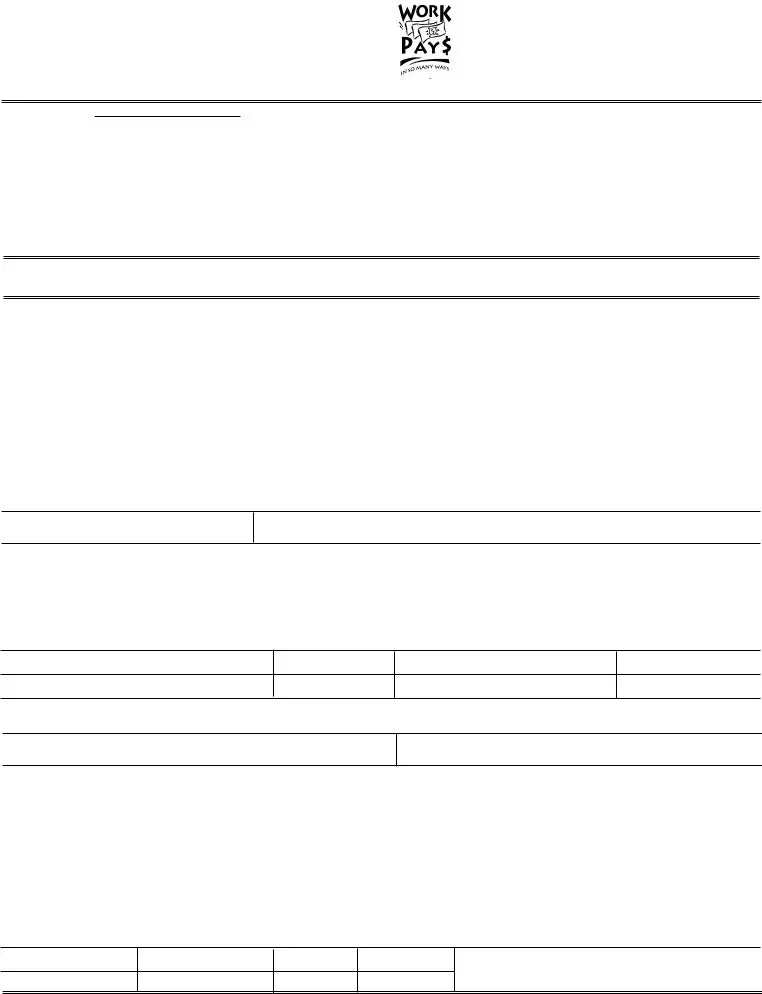

9. Did anyone get income from employment in the Report Month? ■ Yes ■ No (If yes, complete the section below and attach proof). The Report Month is listed at the top of the first page. List each job for each person who works. If you need more space attach a separate piece of paper. Examples include babysitting, salary,

|

|

Job #1 |

|

Job #2 |

|

Job #3 |

|

Name of person who got income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source of income/Employer name: |

|

|

|

|

|||

|

|||||||

How often paid: |

■ Weekly |

■ Biweekly ■ Other |

■ Weekly |

■ Biweekly ■ Other |

■ Weekly |

■ Biweekly ■ Other |

|

■ Monthly |

■ Twice monthly |

■ Monthly |

■ Twice monthly |

■ Monthly |

■ Twice monthly |

||

|

|||||||

|

|

|

|

|

|

|

|

Gross amount of income they got in the |

$ |

|

$ |

|

$ |

|

|

report month: |

|

|

|

||||

DATE(S) RECEIVED: |

DATE(S) RECEIVED: |

DATE(S) RECEIVED: |

|||||

|

|

|

|

|

|

|

|

Hours worked per month: |

|

|

|

|

|

|

|

10. Will there be any changes to your income from employment in the next six months (including income listed in #9)?

■ Yes ■ No (If yes, explain here and attach proof). Examples: Stopping or starting a job; increase or decrease of income; changes in hours; quitting a job or going on strike; change in how often you are paid.

|

|

11. Did anyone get money from any other source in the Report Month: ■ Yes |

■ No (If yes, complete the section below and attach |

|

|||

|

|

proof.) The Report Month is listed at the top of the first page. Examples include: Social Security, Unemployment Compensation, |

|||||

|

|

Veteran’s Benefits, State Disability Insurance (SDI), Child/Spousal Support, Worker’s Compensation, Loans/Gifts, Earned/Unearned |

|||||

|

|

Housing, Utilities, Food, etc. If you no longer get money from a source you previously reported, attach proof. |

|

|

|||

|

|

Name |

Source of income |

|

One time payment or monthly |

How much |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

12. Will there be any changes to money received from any other source in the next six months (including money listed in #11)? ■ No (If yes, explain here and attach proof). Examples of changes: An increase or decrease in income or benefits, or if

you will start or stop getting income or benefits.

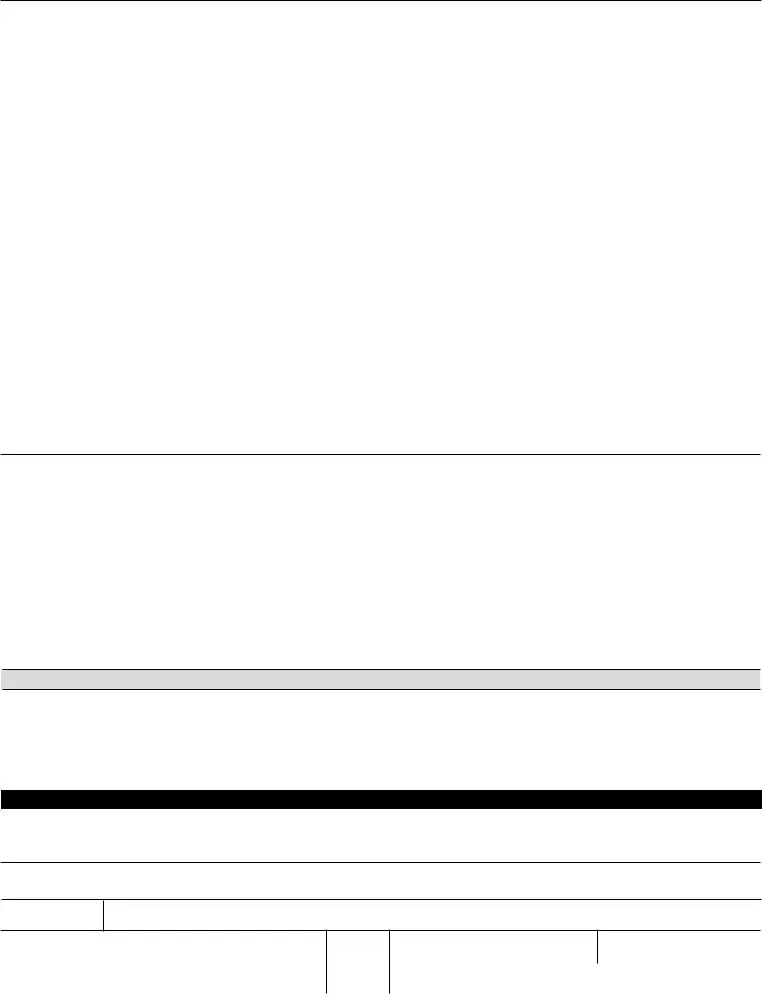

13. CalWORKs only: Have any of the following happened to anyone in your home since you last reported? ■ Yes ■ No (If yes, check below and attach proof):

■Family Change (Married, divorced, separated, entered into a California Registered Domestic Partnership (RDP), have a

■

■

■

■

■

■

■

Job/Employment (Start, stop, quit a job, started a business or went on strike?) Disability (Became disabled or recovered from a disability or major illness?)

Immigration (Citizenship or immigration status change, or got a new card, form, or letter from USCIS (INS)?) Insurance (Started, stopped, or changed health, dental, or life insurance benefits, including MEDICARE?) Custody (Any change in the amount of time you care for/have custody of your children?)

School Attendance

For Age 18 or older student - started or stopped school/college? (You may be able to claim costs for books, school transportation, etc.)

■Someone paid for all of my housing, food, clothing or utility costs. (please explain) _______________________________

■Other_________________________________________

Please read carefully, sign, and date.

By signing this form:

•I understand and certify, under penalty of perjury, that all my answers on this report are correct and complete to the best of my knowledge.

•I understand the penalties for fraud are as follows: I may be sent to prison for up to 20 years and fined up to $250,000. I may have to pay back benefits if I was not eligible to them. The first time I break the rules on purpose I will not be able to get CalFresh for one year; the second time two years; and after the third time I will not be able to get CalFresh again.

•I understand and agree to give copies of all documents needed to complete my

•I understand that in some instances, I may be asked to give consent to the County to make whatever contacts are necessary to determine eligibility.

CERTIFICATION - FRAUD WARNING

I UNDERSTAND THAT: If on purpose I do not report all facts or give wrong facts about my income, property, or family status to get or keep getting aid or benefits, I can be legally prosecuted. I may also be charged with committing a felony if more than $950 in Cash Aid, and/or CalFresh is wrongly paid out as a result of such an action. I have received a copy of the Instructions and Penalties for the SAR 7 Eligibility Status Report for Cash Aid and CalFresh.

YOU MUST SIGN AND DATE THIS REPORT AFTER THE LAST DAY OF THE REPORT MONTH OR IT WILL BE CONSIDERED INCOMPLETE.

I declare under penalty of perjury under the laws of the United States and the State of California that the facts contained in this report are true and correct and complete.

WHO MUST For Cash Aid: You and your aided spouse, registered domestic partner, or the other parent (of

SIGN BELOW: For CalFresh: The head of household, a responsible household member, or the household's authorized representative.

SIGNATURE OR MARK |

DATE SIGNED HOME PHONE |

CONTACT/CELL PHONE |

☛ |

( |

) |

( |

) |

|

|

|

|

|

|

|

SIGNATURE OF SPOUSE, REGISTERED DOMESTIC PARTNER, OR OTHER |

DATE SIGNED SIGNATURE OF WITNESS TO MARK, INTERPRETER, OR OTHER PERSON |

DATE SIGNED |

|||

PARENT OF CASH AIDED CHILD(REN) |

COMPLETING FORM |

|

|

|

|

☛ |

☛ |

|

|

|

|

|

|

|

|

|

|

SAR 7 (12/14) ELIGIBILITY STATUS REPORT - FOR CASH AID AND CALFRESH - REQUIRED FORM - SUBSTITUTES PERMITTED |

PAGE 2 OF 2 |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The SAR 7 Report is governed by California Welfare and Institutions Code Sections 11200 et seq. |

| Purpose | The form is used to determine ongoing eligibility for CalWORKs and CalFresh benefits. |

| Submission Deadline | To ensure uninterrupted benefits, individuals must sign and submit the form by the 5th of the month. |

| Reporting Changes | Beneficiaries must report any changes in household composition, income, or address since the last report. |

| Medical Costs Reporting | Individuals aged 60 or older, or disabled, must report increases in medical costs if they receive CalFresh benefits. |

| Child Support Changes | Changes in child support payments must be reported by recipients of CalFresh. |

| Dependent Care Costs | Increases in out-of-pocket dependent care expenses must also be reported by CalFresh recipients who work or study. |

| Income from Employment | Any income from employment during the report month needs to be listed, including job details and amounts. |

| Consequences of Fraud | Failure to report accurate information may result in severe penalties, including imprisonment and fines. |

Guidelines on Utilizing Qr 7 Report

After completing the QR 7 Report form, ensure that all sections are filled out accurately. This form must be submitted by a designated deadline to continue receiving benefits. Follow these steps to complete the form correctly.

- Fill in the report month at the top of the form.

- Enter your case number, worker’s name, worker’s phone number, county, and your address (street, city, state, and zip code).

- Indicate whether anyone has moved into or out of your home since your last report. If yes, list the names, dates of birth, relationship, and if they prepare food together with you.

- Provide your new address if there have been changes since the last report. Include the date you moved.

- State your monthly rent or mortgage amount and, if applicable, your property taxes and home insurance.

- If you have utility costs not included in your rent or mortgage, check the applicable boxes.

- If applicable, answer whether anyone in your home is running from an outstanding warrant or is in violation of probation/parole. If yes, provide required details.

- For any CalFresh recipients over 60 or disabled, indicate if there was an increase in medical costs and include proof.

- Report any changes in child support amounts. Attach proof if there was a change.

- List any increases in out-of-pocket dependent care costs for CalFresh recipients and provide proof.

- Disclose if anyone got, bought, sold, traded, or gave away any property since the last report. Include details and attach proof if necessary.

- Indicate if anyone received income from employment during the report month and list the jobs. Attach proof if applicable.

- Mention if there will be any changes to employment income in the next six months. If yes, provide details and proof.

- Report any money received from other sources during the report month. Attach proof as necessary.

- Note if there will be changes to other income in the next six months. If yes, provide explanations and attach proof.

- For CalWORKs, indicate any life changes for anyone in your home and attach proof as required.

- Read the certification statement carefully. Sign and date the form after the report month ends.

What You Should Know About This Form

1. What is the purpose of the Qr 7 Report form?

The Qr 7 Report form, officially known as the SAR 7 Eligibility Status Report, serves as a critical tool for recipients of Cash Aid and CalFresh in California. It is designed to help the state determine ongoing eligibility for these benefits. Recipients must provide updated information about any changes in their household circumstances, such as income, residence, and family composition. Timely submission of this form ensures that benefits continue without interruption.

2. When is the Qr 7 Report form due?

To maintain uninterrupted benefits, it is important to submit the Qr 7 Report form promptly. The form must be completed and returned by the 5th of the month following the report month listed at the top of the form. For instance, if the report month is January, the form should be submitted by February 5th. Make sure to sign the form after the last day of the report month, as submission without a signature will be considered incomplete.

3. What should I do if my circumstances have changed since the last report?

If there have been any changes in your household, such as someone moving in or out, a change in income, or a shift in medical expenses, these must be reported on the Qr 7 form. The form includes specific sections to document these changes, including dates, names, and the nature of the changes. It is crucial to attach any necessary proof, such as pay stubs or medical bills, to substantiate the information provided. Failing to report changes can affect eligibility and benefits.

4. How do I submit the Qr 7 Report form?

The Qr 7 Report form can be submitted in multiple ways, depending on your county's requirements. Generally, you can mail it to the designated county office listed on the form or deliver it in person. Some counties may offer an online submission option. Be sure to check county-specific instructions, which can usually be found on the county's official website. Always keep a copy of the submitted form for your records, as this may be necessary for future reference.

Common mistakes

Filling out the Qr 7 Report form can be a straightforward task, but many people make mistakes that can delay their benefits. One common error is forgetting to sign and date the form after the report month. This step is crucial. If you don’t sign it, the form may be considered incomplete, leading to potential delays in processing your benefits.

Another frequent mistake involves neglecting to report anyone who has moved in or out of the household. This includes newborns and other significant changes in living arrangements. If you answer "Yes" to the question about changes in your household but fail to complete the corresponding section, that can raise red flags. Always ensure to provide the necessary details when the answer is affirmative.

People also tend to overlook reporting income changes accurately. It's essential to include any income received during the report month. This includes wages, self-employment earnings, and other forms of income. If you miss or incorrectly report earnings, this may impact your eligibility for benefits. Be diligent and list every source of income.

Failure to attach required proof for claims is another issue. Whether it's changes in child support, dependent care costs, or medical expenses, all claims must be backed up with proper documentation. If you state there’s been a change, but don’t provide evidence, your form might not be accepted, causing further delays.

Finally, misunderstanding the instructions on the form can lead to significant errors. For instance, some people might not realize they need to fill out sections related to changes in health insurance or child custody arrangements. Read through the entire form and instructions carefully to avoid misunderstandings that could jeopardize your assistance.

Documents used along the form

The Qr 7 Report form is an important document in California's social services framework, primarily used to assess eligibility for benefits such as Cash Aid and CalFresh. Alongside this critical form, several additional documents support the application process and help ensure one receives the assistance they need. Below is a list of commonly used forms and documents that often accompany the Qr 7 Report form.

- CA 7 Report Form: Similar to the Qr 7 Report, the CA 7 is another eligibility status report specifically designed for individuals receiving California Work Opportunity and Responsibility to Kids (CalWORKs) benefits. This form gathers pertinent information about income, expenses, and household changes.

- Proof of Income Documentation: This includes documents such as pay stubs, tax returns, or statements from employers that verify an individual's income. Providing accurate proof of income is necessary for determining eligibility and calculating the benefit amount.

- Housing Expense Verification Form: This form is used to report and verify housing expenses, including rent or mortgage payments. It helps the county assess an applicant's financial obligations and overall eligibility for assistance.

- Child Support Verification: If applicable, this document confirms any child support payments made or received. It provides insights into financial contributions towards household expenses and can influence eligibility assessments.

- Medical Expense Verification: For those qualifying for medical cost considerations, this document provides details about any medical expenses incurred by household members. Attachments, such as receipts or bills, may be necessary to support claims of increased medical costs.

Understanding these additional forms can significantly ease the process of applying for assistance. Each document plays a critical role in ensuring that individuals receive the benefits they are entitled to, thereby helping support their families' needs effectively.

Similar forms

The Qr 7 Report form is similar to several other documents used in eligibility reporting and application processes. Here are eight documents that share key features and purposes:

- Annual Renewal Form: This document requires beneficiaries to confirm their eligibility each year, similar to the Qr 7's monthly updates. Both forms ask for detailed information about household composition and income changes.

- SAR 7 Eligibility Status Report: This form serves a similar function, capturing specific changes in a recipient's life that might affect their benefits. It includes questions on income, household members, and expenses, mirroring the Qr 7's essential inquiries.

- Change Report Form: Used when beneficiaries experience changes in circumstances, this form requests information on circumstances that could impact eligibility, just as the Qr 7 prompts users to disclose shifts in household composition or earnings.

- Food Stamp Application: This initial application assesses eligibility for assistance, requiring similar financial and household information as the Qr 7. Both emphasize the importance of accurate reporting of income sources.

- CalWORKs Application: This application form requires applicants to provide detailed information about household income, expenses, and changes, paralleling the detailed requirements of the Qr 7 for ongoing eligibility assessment.

- Income Verification Form: This form is used for income documentation when seeking assistance. Like the Qr 7, it emphasizes the need for verification and may request similar types of income documentation.

- Work Participation Report: Used for tracking work requirements, this report collects data on employment status and income, much like the Qr 7's questions regarding job status and income changes.

- Supplemental Security Income (SSI) Annual Review: This review process gathers data on income and eligibility status annually, similar to the Qr 7's role in assessing monthly eligibility updates for ongoing benefits.

Dos and Don'ts

- Do read the instructions carefully before starting the form.

- Do complete all required sections to ensure your report is accurate.

- Do provide the date you moved, if applicable, and any changes in your household.

- Do double-check for any missing signatures before submitting the form.

- Don't leave any questions unanswered unless they do not apply to you.

- Don't submit the report without signing and dating it after the report month ends.

- Don't forget to attach required proof for any reported changes or income.

Misconceptions

- Misconception 1: The SAR 7 Report form is optional for receiving benefits.

- Misconception 2: Only financial changes need to be reported.

- Misconception 3: This form can be submitted at any time during the reporting month.

- Misconception 4: Only the head of the household needs to sign the form.

- Misconception 5: Changes reported on the form do not need documentation.

This is not true. The SAR 7 Report form is required to maintain eligibility for benefits. Failing to submit it on time can lead to interruptions in the services you receive.

While reporting financial changes is important, the form also requires you to disclose any changes in household composition, address, or medical costs. All relevant information must be provided to ensure accurate eligibility determination.

Submission of the SAR 7 Report form must occur between the 1st and 5th of the month following the report month. Late submissions could delay your benefits.

It’s essential that all individuals listed, such as spouses and other responsible members, also sign when applicable. Their signatures affirm the accuracy of the information provided.

Documentation may be required for various changes, especially in income, property, or medical expenses. Always attach the necessary proof to support any claims made on the form.

Key takeaways

Completing the Qr 7 Report form is crucial for maintaining your benefits from programs like CalWORKs, CalFresh, and Medi-Cal. Here are some key takeaways to consider:

- Timeliness is essential: Submit your form by the 5th of the month following the report month to avoid delays in benefit payments.

- Accurate information is key: Report all changes regarding household composition, income, and expenses. Complete all sections that apply to your situation to ensure your benefits are calculated correctly.

- Documentation can be crucial: Whenever you report changes, especially concerning income or expenses, be prepared to attach proof. This could include pay stubs, bills, or court documents.

- Understand the penalties for fraud: Know that providing false information on the form can lead to serious consequences, including potential criminal charges and loss of benefits. Always review your responses before signing.

Browse Other Templates

Supplemental Consumer Information Form 1103 - Monthly receipts for work performed must also be reported to ensure transparency.

Steer Clear Program State Farm - /Regulatory compliance is essential for drivers who wish to receive the discount.