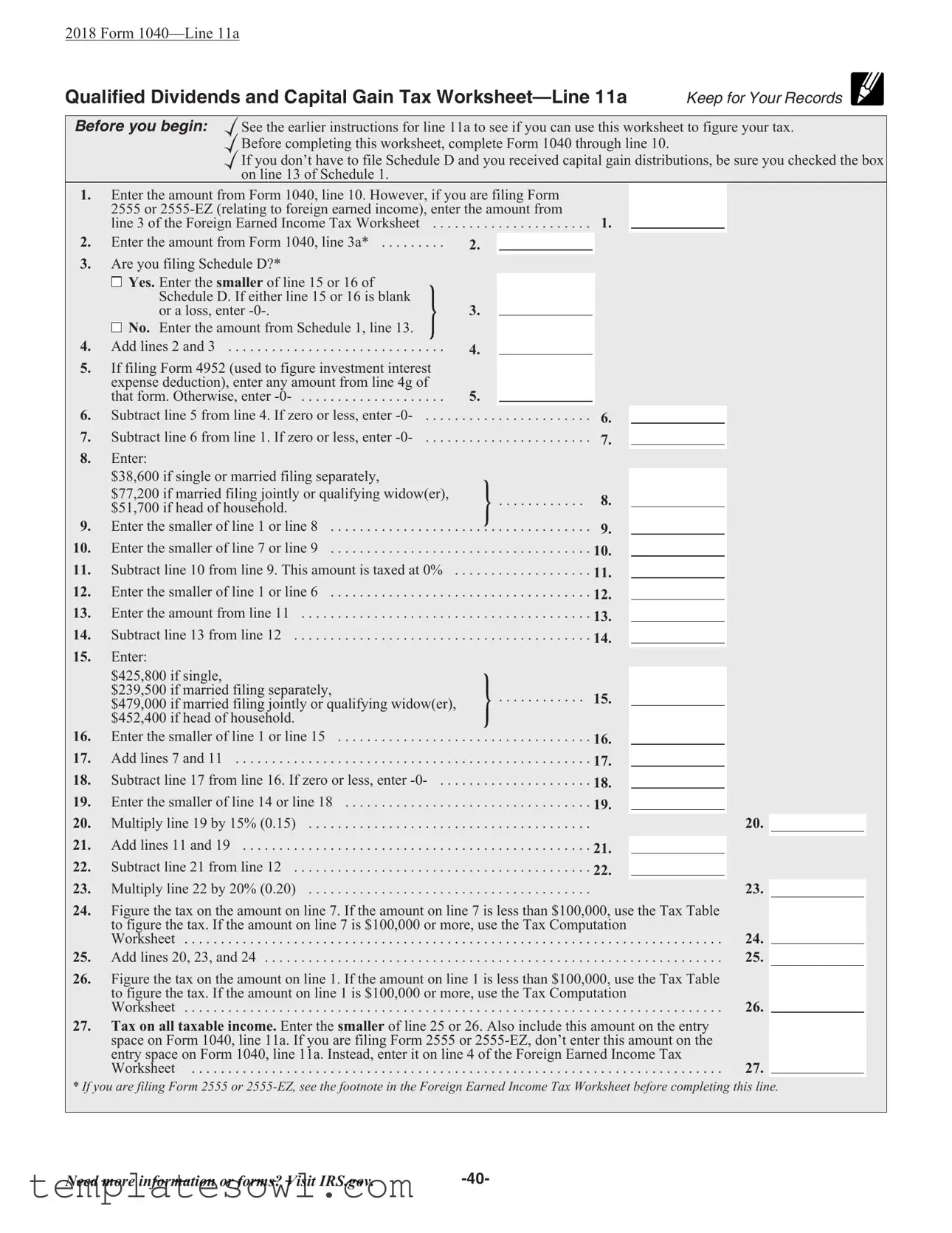

Fill Out Your Qualified Dividends Tax Worksheet Form

The Qualified Dividends Tax Worksheet is an essential tool for taxpayers who need to accurately calculate their taxes on qualified dividends and capital gains. This worksheet plays a significant role in determining the tax rate that applies to these types of income, which can often be taxed at lower rates than ordinary income. Before diving into the calculations, taxpayers must ensure they have completed Form 1040 up to line 10. The form guides users through a series of steps, including entering the necessary amounts from Form 1040 and Schedule D, if applicable. By facilitating the various calculations, such as comparing amounts from different lines and determining thresholds based on filing status, this worksheet ensures that individuals can avoid underpayment or overpayment of taxes. It also includes values that correspond to income limits, enabling filers to see precisely how their income levels affect their tax obligations. Overall, using the Qualified Dividends Tax Worksheet correctly will lead to a clearer understanding of tax liabilities while promoting compliance with tax regulations.

Qualified Dividends Tax Worksheet Example

2018 Form

Qualified Dividends and Capital Gain Tax |

Keep for Your Records |

|

Before you begin: |

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. |

|

|

Before completing this worksheet, complete Form 1040 through line 10. |

|

|

If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box |

|

|

on line 13 of Schedule 1. |

|

1.Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or

line 3 of the Foreign Earned Income Tax Worksheet |

. .1 |

|||||

. . . . . . . . .Enter the amount from Form 1040, line 3a* |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

Are you filing Schedule D?*

Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter

No. Enter the amount from Schedule 1, line 13. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

No. Enter the amount from Schedule 1, line 13. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

|

If filing Form 4952 (used to figure investment interest |

|

|

|

|

|

|

|

|

|

|

|

|

expense deduction), enter any amount from line 4g of |

5. |

|

|

|

|

|

|

|

|

|

|

6. |

that form. Otherwise, enter |

|

|

|

|

|

|

|

|

|

|

|

Subtract line 5 from line 4. If zero or less, enter |

. .6. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

7. |

.Subtract line 6 from line 1. If zero or less, enter |

. . . . . . . . . . . . . . .. .7. |

|

|

|

|

|

|

||||

8. |

Enter: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

$38,600 if single or married filing separately, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$77,200 if married filing jointly or qualifying widow(er), |

8. |

|

|

|

|

|

|

||||

|

$51,700 if head of household. |

|

|

|

|

|

|

|||||

9. |

Enter the smaller of line 1 or line 8 |

. . . . . . . . . . . . . . . . . 9. |

|

|

|

|

|

|

||||

10. |

.Enter the smaller of line 7 or line 9 |

. . . . . . . . . . . . . . . . . 10. |

|

|

|

|

|

|

||||

11. |

.Subtract line 10 from line 9. This amount is taxed at 0% . |

. . . . . . . . . . . . . . . . . 11. |

|

|

|

|

|

|

||||

12. |

.Enter the smaller of line 1 or line 6 |

. . . . . . . . . . . . . . . . . 12. |

|

|

|

|

|

|

||||

13. |

.Enter the amount from line 11 |

. . . . . . . . . . . . . . .. .13. |

|

|

|

|

|

|

||||

14. |

Subtract line 13 from line 12 |

. .14. |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||||

15. |

Enter: |

|

|

|

|

|

|

|

|

|

|

|

|

$425,800 if single, |

|

|

|

|

|

|

|

|

|

|

|

|

$239,500 if married filing separately, |

|

|

. . . . . . . . . . . . |

15. |

|

|

|

|

|

|

|

|

$479,000 if married filing jointly or qualifying widow(er), |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

16. |

$452,400 if head of household. |

|

|

|

|

|

|

|

|

|

|

|

Enter the smaller of line 1 or line 15 |

. . . . . . . . . . . . . . . . . 16. |

|

|

|

|

|

|

|||||

17. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 7 and 11 |

. . . . . . . . . . . . . . . . . 17. |

|

|

|

|

|

|

||||

18. |

.Subtract line 17 from line 16. If zero or less, enter |

. . . . . . . . . . . . . . . . . 18. |

|

|

|

|

|

|

||||

19. |

.Enter the smaller of line 14 or line 18 |

. . . . . . . . . . . . . . .. .19. |

|

|

|

|

|

|

||||

20. |

Multiply line 19 by 15% (0.15) |

|

|

|

|

20. |

|

|

|

|

||

|

|

|

|

|||||||||

21. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 11 and 19 |

. . . . . . . . . . . . . . . . . 21. |

|

|

|

|

|

|

||||

22. |

.Subtract line 21 from line 12 |

. . . . . . . . . . . . . . .. .22. |

|

|

|

|

|

|

||||

23. |

Multiply line 22 by 20% (0.20) |

|

|

|

|

23. |

|

|

|

|

||

|

|

|

|

|

||||||||

24. |

Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table |

|

|

|

|

|

||||||

|

to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation |

|

|

|

|

|||||||

|

Worksheet |

. .24 |

|

|||||||||

25. |

Add lines 20, 23, and 24 |

25. |

|

|

|

|

||||||

|

|

|

||||||||||

26. |

Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table |

|||||||||||

|

to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation |

|||||||||||

|

Worksheet |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26. |

|

|

|

|||||||

27.Tax on all taxable income. Enter the smaller of line 25 or 26. Also include this amount on the entry space on Form 1040, line 11a. If you are filing Form 2555 or

Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.

* If you are filing Form 2555 or

Need more information or forms? Visit IRS.gov. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This worksheet helps taxpayers calculate the tax on qualified dividends and capital gains reported on their federal tax return. |

| Eligibility | Only taxpayers who have qualified dividends or capital gains should use this worksheet, after completing Form 1040 through line 10. |

| Income Thresholds | Income thresholds for taxation vary by filing status: $38,600 for single, $77,200 for married filing jointly, $51,700 for head of household. |

| Investment Interest | If investors use Form 4952 for investment interest expense deductions, this must be factored in while determining qualified income. |

| Tax Rates | The worksheet outlines how to apply different tax rates (0%, 15%, and 20%) depending on the amount of taxable income. |

| Filing Form 2555 | Taxpayers filing Form 2555 or 2555-EZ need to follow specific instructions as this impacts how they report dividends and capital gains. |

| Final Entry | Once calculations are complete, the total tax amount from the worksheet is entered on Form 1040, line 11a, unless filing Form 2555. |

Guidelines on Utilizing Qualified Dividends Tax Worksheet

Once you have thoroughly prepared your income information and calculations for your tax return, it is essential to accurately complete the Qualified Dividends Tax Worksheet. This worksheet will help determine your tax liability related to qualified dividends and capital gains. Follow these steps carefully to ensure that you fill it out correctly.

- Enter the amount from Form 1040, line 10. If applicable, and you are filing Form 2555 or 2555-EZ, use line 3 of the Foreign Earned Income Tax Worksheet instead.

- Enter the amount from Form 1040, line 3a.

- Determine if you are filing Schedule D. If yes, enter the smaller of line 15 or 16 of Schedule D. If either line is empty or a loss, enter -0-. If no, enter the amount from Schedule 1, line 13.

- Add lines 2 and 3 together.

- If you are filing Form 4952, enter the amount from line 4g of that form. If not applicable, enter -0-.

- Subtract line 5 from line 4. If the result is zero or less, enter -0-.

- Subtract line 6 from line 1. If the result is zero or less, enter -0-.

- Enter the threshold amounts based on your filing status: $38,600 for single or married filing separately, $77,200 for married filing jointly or qualifying widow(er), and $51,700 for head of household.

- Enter the smaller of line 1 or line 8.

- Enter the smaller of line 7 or line 9.

- Subtract line 10 from line 9; this amount is taxed at 0%.

- Enter the smaller of line 1 or line 6.

- Enter the amount from line 11.

- Subtract line 13 from line 12.

- Enter the threshold amounts based on your filing status: $425,800 for single, $239,500 for married filing separately, $479,000 for married filing jointly or qualifying widow(er), and $452,400 for head of household.

- Enter the smaller of line 1 or line 15.

- Add lines 7 and 11 together.

- Subtract line 17 from line 16. If the result is zero or less, enter -0-.

- Enter the smaller of line 14 or line 18.

- Multiply line 19 by 15% (0.15).

- Add lines 11 and 19 together.

- Subtract line 21 from line 12.

- Multiply line 22 by 20% (0.20).

- Calculate the tax based on line 7. If line 7 is less than $100,000, use the Tax Table; if $100,000 or more, use the Tax Computation Worksheet.

- Add lines 20, 23, and 24 together.

- Calculate the tax based on line 1. Refer to the same guidelines as for line 24 based on the amount on line 1.

- Enter the smaller of line 25 or line 26 as your total tax on all taxable income. Transfer this amount to Form 1040, line 11a. If filing Form 2555 or 2555-EZ, enter it on line 4 of the Foreign Earned Income Tax Worksheet instead.

What You Should Know About This Form

What is the Qualified Dividends Tax Worksheet?

The Qualified Dividends Tax Worksheet is a calculation tool used to determine the tax on qualified dividends and capital gains for individuals filing their federal tax returns with IRS Form 1040. This worksheet helps identify the correct tax rates that may apply to dividend income, which can be lower than ordinary income tax rates.

Who should use this worksheet?

What information do I need before starting the worksheet?

Before beginning the worksheet, ensure you have completed Form 1040 up to line 10. You may also require information from Schedule D or Schedule 1, specifically lines that pertain to capital gains and dividends received. Having recent tax guidelines can be beneficial as well.

Can this worksheet be used if I’m filing Form 2555 or 2555-EZ?

If you are using Form 2555 or 2555-EZ regarding foreign earned income, you will need to follow specific instructions that deviate slightly from filling out this worksheet. Be sure to check the footnotes related to those forms before proceeding.

How do I know if my dividends are considered qualified?

Qualified dividends typically come from stocks held for a specified period and paid by U.S. corporations or qualifying foreign corporations. The dividends must meet certain criteria as outlined by the IRS. If in doubt, consider reviewing the IRS guidelines or consulting a tax professional.

What are the tax rates on qualified dividends?

Qualified dividends are generally taxed at favorable rates, including 0%, 15%, or 20%, depending on your overall taxable income and filing status. The worksheet helps identify which portion of your income falls under these rates based on the calculations performed.

What do I do if my income is significantly low?

If your taxable income is low enough, you may qualify for the 0% tax rate on a portion or all of your qualified dividends. The worksheet outlines specific thresholds. If your income is below these thresholds, it may reduce your tax burden significantly.

What should I do with the final amount calculated on this worksheet?

The final figure you determine using the Qualified Dividends Tax Worksheet should be entered in the appropriate space on your Form 1040, specifically on line 11a. If you have filed other forms related to foreign income, special instructions will apply.

What if I made a mistake on the worksheet?

Errors occur, and it’s important to correct them before filing your taxes. If you discover a mistake after you have completed the worksheet, recalculate your numbers and ensure adherence to IRS guidelines. Depending on when you discover the error, you may need to file an amended return.

Where can I find more information about this worksheet?

Additional information and instructions can be accessed on the IRS website at IRS.gov. The site offers resources and further clarifications on how to use the Qualified Dividends Tax Worksheet and related filing matters.

Common mistakes

Filling out the Qualified Dividends Tax Worksheet can be tricky. Many individuals make errors that could affect their tax calculations or lead to unnecessary confusion. One common mistake is skipping the review of the instructions on line 11a before beginning. This worksheet is meant for specific situations, and a quick check can save time and hassle later on.

Another frequent error occurs at the beginning of the form. Taxpayers sometimes enter the amount from line 10 of Form 1040 incorrectly. Remember, if you are filing Form 2555 or 2555-EZ for foreign earned income, enter the corresponding line from the Foreign Earned Income Tax Worksheet instead. Mistakes at this initial step can create a cascade of errors throughout the rest of the worksheet.

People also tend to overlook the need to complete Schedule D if they already had capital gains during the tax year. The worksheet requires specific adjustments based on whether you are filing Schedule D or not. Failing to check that box or entering the incorrect amounts from Schedule D can also lead to significant discrepancies in the final tax owed.

Additionally, many individuals neglect to pay attention when calculating the amounts on subsequent lines. For instance, when subtracting line 5 from line 4, a common error is to leave amounts that total zero as blank rather than entering '-0-'. This can lead to issues later when determining tax rates based on these amounts.

Lastly, not checking the deduction limits can cause mistakes, especially when dealing with headers for different filing statuses. Each status has specific incomes to consider, so entering the wrong limit can lead to miscalculations. Always ensure you are entering your information based on your correct filing status to avoid unnecessary complications. Taking the time to double-check each entry can help clarify your tax situation and keep your returns accurate.

Documents used along the form

When preparing your taxes, particularly if you have qualified dividends to report, a handful of additional forms and documents may assist you in navigating the process efficiently. Each of these documents serves a unique purpose and can help clarify your financial situation for the IRS. Below is a list of key forms and documents that often accompany the Qualified Dividends Tax Worksheet.

- Form 1040: This is the standard individual income tax return form used to report your income, claim tax deductions and credits, and calculate your tax liability. Before completing the Qualified Dividends Tax Worksheet, it's essential to fill out this form through line 10.

- Schedule D: If you have sold stocks or mutual funds, Schedule D will help you report capital gains and losses. You will need this form to determine whether you've sold any assets that could affect your qualified dividends.

- Schedule 1: This form is used to report additional income and adjustments to income. If you have capital gain distributions, you'll need to complete Schedule 1 to check the appropriate box.

- Form 4952: If you claim a deduction for investment interest expenses, you'll need Form 4952. This form helps calculate how much of your interest expense can be deducted against your investment income.

- Foreign Earned Income Tax Worksheet: This is required if you're filing Form 2555 or 2555-EZ to report foreign earned income. The worksheet helps you calculate the allowable exclusion amount for income earned abroad.

- Tax Table: If your taxable income is below a certain threshold, you can use the Tax Table to compute your tax liability. This can be particularly useful for determining how much tax you owe on amounts less than $100,000.

- Tax Computation Worksheet: For those with a taxable income of $100,000 or more, this worksheet assists in calculating the tax owed based on your total income.

- Evidence of Dividends Received: Keep any brokerage statements or documentation of dividends received during the tax year. This evidence can help verify the amounts you report on your tax forms.

Familiarity with these forms can simplify your tax filing experience and ensure compliance with IRS requirements. Gathering all relevant documents ahead of time helps make the process smoother and less stressful.

Similar forms

The Qualified Dividends Tax Worksheet is an essential tool for taxpayers who want to calculate their tax liabilities accurately. Several other forms share similarities in structure and purpose. Below is a list of these documents along with a brief explanation of their connections to the Qualified Dividends Tax Worksheet:

- Form 1040: This is the standard individual income tax form used in the United States. The Qualified Dividends Tax Worksheet is typically completed alongside Form 1040, specifically to determine the tax on qualified dividends and capital gains reported on this form.

- Schedule D: Used to report capital gains and losses, Schedule D informs the calculations on the Qualified Dividends Tax Worksheet. It is directly referenced for inputs that help assess the overall tax liability related to dividends and gains.

- Tax Computation Worksheet: This worksheet assists taxpayers in calculating their tax liability on higher income levels, often exceeding $100,000. Both the Tax Computation Worksheet and the Qualified Dividends Tax Worksheet rely on similar income thresholds to determine the applicable tax rates.

- Form 2555: This form is utilized by expatriates to report foreign earned income. Taxpayers who use Form 2555 must refer to specific sections of the Qualified Dividends Tax Worksheet to ensure that their calculations align with foreign income provisions, thereby avoiding complications with U.S. tax laws.

Overall, these forms and worksheets are designed to assist you in navigating various aspects of income taxation. Each serves a unique purpose but ultimately aims to provide clarity and ensure compliance with tax obligations.

Dos and Don'ts

Filling out the Qualified Dividends Tax Worksheet can be straightforward if you keep a few essential tips in mind. Here are some important do's and don'ts to help guide the process:

- Do complete Form 1040 through line 10 before starting the worksheet.

- Do check if you need to file Schedule D, as it affects your calculations.

- Do ensure the amounts you enter are accurate, especially from previous forms.

- Do remember to enter -0- when applicable, like in the case of losses.

- Do read the instructions carefully to see if you're eligible to use this worksheet.

- Don't skip any lines; each step is crucial for calculating your tax.

- Don't ignore the limits based on your filing status, as they impact your tax rate.

- Don't miscalculate your entries; small errors can lead to bigger issues.

- Don't forget to carry over the final amount to Form 1040, line 11a, if applicable.

- Don't rely solely on previous years' figures without confirming they remain the same.

By following these tips, you can navigate the Qualified Dividends Tax Worksheet with greater ease. Staying organized and attentive will aid in accurate reporting and potential savings.

Misconceptions

People often have misunderstandings about the Qualified Dividends Tax Worksheet. Here are some common misconceptions:

- This form is only for high-income earners. Many believe that only those with significant income need to use this worksheet. In reality, anyone who has qualified dividends can benefit from it, regardless of their income level.

- All dividends are taxed the same way. Some think all dividends fall under the same tax rate. However, qualified dividends have more favorable tax rates compared to ordinary dividends.

- You must file Schedule D to use this worksheet. It’s a common myth that Schedule D is mandatory. You can still use the worksheet if you don’t need to file Schedule D and have capital gain distributions.

- The worksheet is only relevant for federal taxes. While this worksheet is a federal form, the results can influence your state tax returns, depending on your state’s tax laws.

- You can skip lines if you get lost. Some people assume they can skip around if they find a particular line confusing. Instead, it’s better to go through the worksheet step by step to avoid mistakes.

- This is a complicated tax form. Many individuals shy away from using the worksheet because they think it is too complex. In truth, it follows a straightforward structure that can be understood with some patience.

- Qualified dividends are the same as capital gains. There’s a misconception that qualified dividends are just capital gains. While they can intersect, qualified dividends are a type of income separate from capital gains.

By clearing up these misconceptions, taxpayers can better understand how the Qualified Dividends Tax Worksheet can apply to their financial situations.

Key takeaways

When filling out the Qualified Dividends Tax Worksheet, it’s essential to keep several key points in mind.

- Complete Form 1040 First: Before diving into the Qualified Dividends Tax Worksheet, make sure that you have completed Form 1040 up to line 10. This step ensures that you’re starting with accurate information.

- Determine if Schedule D is Needed: Understand whether you need to file Schedule D. If you are receiving capital gain distributions and do not need to file Schedule D, be sure to check the appropriate box on Schedule 1.

- Understand Income Thresholds: The worksheet includes specific income thresholds for different filing statuses. For example, the threshold is $38,600 for single filers and $77,200 for married couples filing jointly. Knowing these figures can help you navigate the calculations more effectively.

- Final Tax Calculation: Your final tax calculation will be the smaller amount between line 25 and line 26. Make sure to accurately report this figure on Form 1040, line 11a, as it reflects your overall tax obligation related to qualified dividends.

These takeaways can streamline your experience and ensure that you have all the necessary information to complete the worksheet accurately.

Browse Other Templates

Como Rellenar Formulario Incapacidad Permanente - Each incapacity type must be properly documented to validate the claim.

Child Custody Affidavit Examples - The affidavit includes a section for the parent’s age and birthdate.

Indiana Wh-3 - Failure to comply with filing requirements may result in additional scrutiny from the Indiana Department of Revenue.