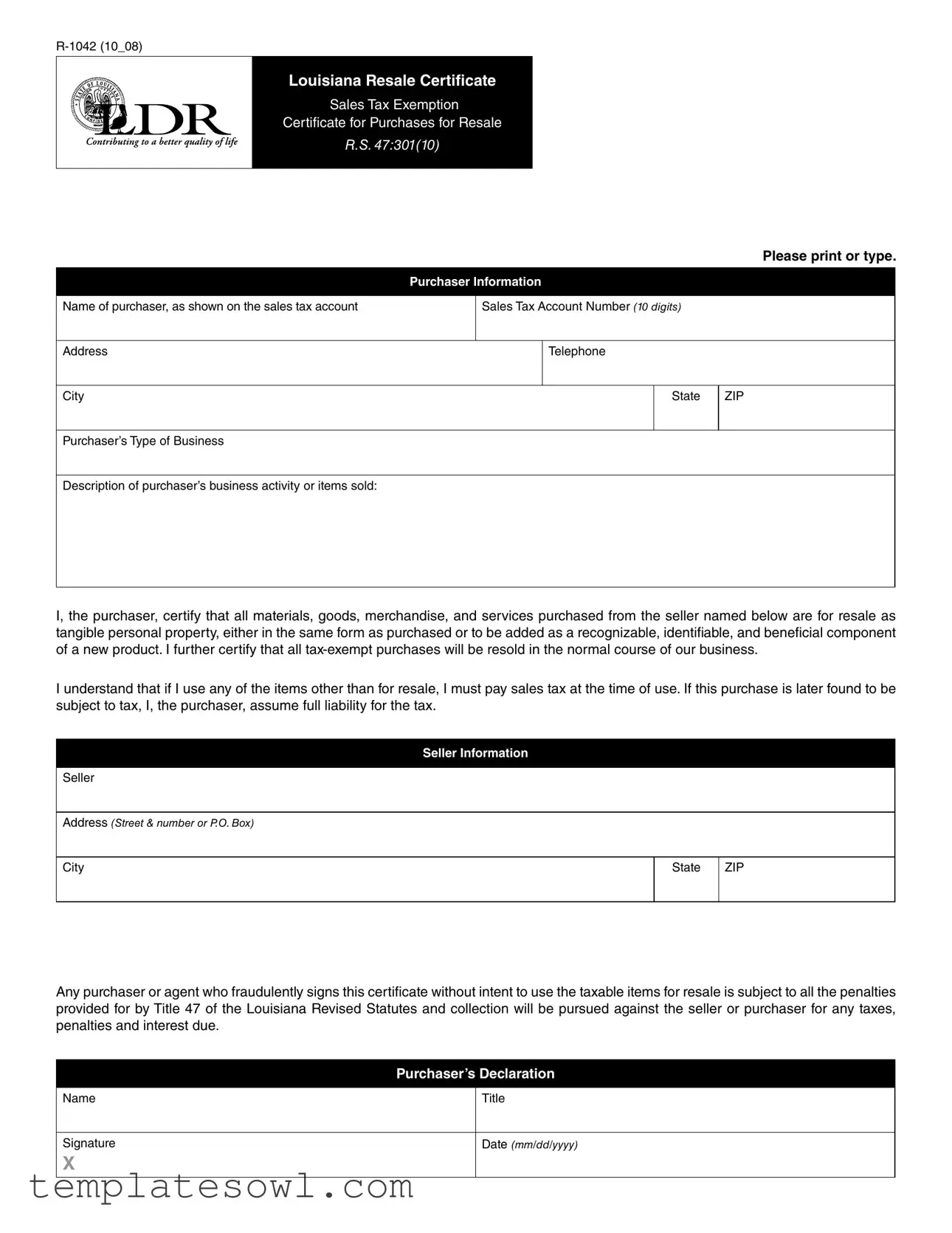

Fill Out Your R 1042 Louisiana Certificate Form

The R 1042 Louisiana Certificate form plays a crucial role in facilitating tax-exempt sales for businesses engaged in retail activities. This form functions as a Resale Certificate or Sales Tax Exemption Certificate, specifically designed for purchases intended for resale. When a purchaser fills out this certificate, they must provide their name, sales tax account number, and contact information, which ensures proper identification and accountability. Additionally, the form requires details about the type of business and the nature of the products sold, underscoring the intent to resell purchased items. By signing this certificate, the purchaser certifies that the acquired goods or services will be sold in their original form or incorporated into a new product, thereby exempting them from paying sales tax at the time of purchase. However, the purchaser must remain aware that any personal use of these items will incur sales tax liability. The form also includes essential seller information, which includes the seller’s address, ensuring that the details of the transaction are fully documented. Notably, any fraudulent use of the R 1042 Certificate can lead to severe penalties, making it imperative for those involved to adhere strictly to the regulations outlined by the Louisiana Revised Statutes. This rigorous approach protects both buyers and sellers while promoting clarity in resale transactions.

R 1042 Louisiana Certificate Example

Louisiana Resale Certificate

Sales Tax Exemption

Certificate for Purchases for Resale

R.S. 47:301(10)

Please print or type.

|

Purchaser Information |

|

|

|

||

|

|

|

|

|

|

|

Name of purchaser, as shown on the sales tax account |

|

Sales Tax Account Number (10 digits) |

|

|||

|

|

|

|

|

|

|

Address |

|

|

Telephone |

|

||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP |

|

|

|

|

|

|

|

Purchaser’s Type of Business

Description of purchaser’s business activity or items sold:

I, the purchaser, certify that all materials, goods, merchandise, and services purchased from the seller named below are for resale as tangible personal property, either in the same form as purchased or to be added as a recognizable, identifiable, and beneficial component of a new product. I further certify that all

I understand that if I use any of the items other than for resale, I must pay sales tax at the time of use. If this purchase is later found to be subject to tax, I, the purchaser, assume full liability for the tax.

Seller Information

Seller

Address (Street & number or P.O. Box)

City

State

ZIP

Any purchaser or agent who fraudulently signs this certificate without intent to use the taxable items for resale is subject to all the penalties provided for by Title 47 of the Louisiana Revised Statutes and collection will be pursued against the seller or purchaser for any taxes, penalties and interest due.

Purchaser’s Declaration

Name

Signature

X

Title

Date (mm/dd/yyyy)

Form Characteristics

| Fact Name | Details |

|---|---|

| Name of the Form | The form is known as R-1042, Louisiana Resale Certificate Sales Tax Exemption Certificate for Purchases for Resale. |

| Governing Law | This form is governed by R.S. 47:301(10) of the Louisiana Revised Statutes. |

| Purchaser Certification | The purchaser certifies that items purchased using this certificate are for resale as tangible personal property. |

| Sales Tax Liability | If items are used other than for resale, the purchaser is responsible for paying sales tax at the time of use. |

| Fraudulent Use Consequence | Individuals who sign this certificate fraudulently may face penalties as specified in Title 47 of the Louisiana Revised Statutes. |

Guidelines on Utilizing R 1042 Louisiana Certificate

The R 1042 Louisiana Certificate form provides a streamlined process for purchasers to certify that their purchases qualify for sales tax exemption due to resale intentions. Completing this form accurately is key to ensuring compliance with state laws regarding sales tax and resale exemptions. Here’s a guide to help you fill out the form correctly.

- Provide Purchaser Information:

- Enter the name of the purchaser as it appears on the sales tax account.

- Input the 10-digit Sales Tax Account Number.

- Fill in the address, including street, city, state, and ZIP code.

- Include the telephone number of the purchaser.

- Specify the type of business.

- Describe the business activity or items sold.

- Certify Resale Intentions:

- Review the declaration to ensure understanding.

- Confirm that all purchases are for resale purposes.

- Understand the liability for any taxes due if purchased items are not resold.

- Provide Seller Information:

- Enter the seller's name and address, including street, city, state, and ZIP code.

- Complete the Purchaser’s Declaration:

- Sign and date the form in the designated area.

- Include the title of the person signing the certificate.

After completing the form, it's essential to keep a copy for your records. Present the R 1042 to the seller to ensure you can make your tax-exempt purchase. Always review the form for accuracy to prevent any compliance issues in the future.

What You Should Know About This Form

What is the R 1042 Louisiana Certificate form?

The R 1042 Louisiana Certificate form is a Sales Tax Exemption Certificate specifically for purchasers seeking to buy materials, goods, and services for resale in Louisiana. It allows businesses to avoid paying sales tax on items that they intend to resell. This form ensures that the purchaser's intent is clearly documented, preventing unnecessary taxation at the point of sale.

Who needs to use the R 1042 form?

Any business or individual who purchases tangible personal property with the intent to resell it must use the R 1042 form. Common examples include retailers, wholesalers, and manufacturers who incorporate these items into their products for sale. It is crucial for businesses to file this certificate to avoid paying sales tax on items meant for resale.

What information is required on the form?

The R 1042 form requires several key pieces of information: the purchaser’s name, sales tax account number, address, telephone number, and a description of their business activities. Additionally, the seller's name and address must be included, allowing for clear identification of the transaction and parties involved.

How does one properly complete the R 1042 form?

To complete the R 1042 form, print or type all required information legibly. Ensure that the purchaser's information is accurate and that the business description clearly aligns with the goods being purchased. After filling out the form, the purchaser must sign and date it, certifying that the items will be used for resale.

What happens if I misuse the R 1042 form?

Misusing the R 1042 form can result in serious consequences. If a purchaser uses the items for anything other than resale, they become liable for paying sales tax on those items. Additionally, there are possible penalties for fraudulently signing the certificate, including fines and interest charges outlined in Title 47 of the Louisiana Revised Statutes.

Do I need to provide the certificate to the seller?

Yes, the completed R 1042 form must be presented to the seller at the time of purchase. This document is proof that the items are intended for resale, and it allows the seller to process the transaction without charging sales tax. It’s important for both the buyer and seller to retain records of this transaction.

Is there a specific format for the Declaration on the R 1042 form?

The Declaration on the R 1042 form includes a signature block where the purchaser must sign, print their name, and provide their title along with the date. This declaration confirms the intent to resell the purchased items, making it a critical part of the form.

Can I use the R 1042 form if I’m purchasing services?

Yes, the R 1042 form can be used for certain services as well, as long as those services are directly related to the resale of tangible personal property. However, it’s valuable to clarify your business relationship with the service provider to ensure compliance with tax regulations.

What should I do if my business address changes?

If your business address changes, you should update your information on the R 1042 form each time you submit it. Accurate address details are crucial, as they are linked to your sales tax account. It's advisable to contact the Louisiana Department of Revenue to ensure that all records are current.

Where can I obtain the R 1042 form?

The R 1042 form can be obtained from the Louisiana Department of Revenue's website or through other official state channels. It is often available as a downloadable PDF, allowing for easy printing and completion before presenting it to vendors.

Common mistakes

Filling out the R 1042 Louisiana Certificate form requires attention to detail. One common mistake is not providing the correct sales tax account number. This 10-digit number must match the account registered with the Louisiana Department of Revenue. An incorrect number can lead to delays or denials in tax-exempt purchases.

Another frequent error involves the section where the purchaser’s name should be indicated. It is crucial that the name of the purchaser matches exactly as it appears on the sales tax account. Discrepancies can lead to issues when validating the exemption.

Addressing the form accurately is vital. Many individuals fail to triple-check their address details. This includes street names, numbers, and ZIP codes. An inaccurate address can create complications in future correspondence or audits.

In addition, the description of the business activity often lacks clarity. Providing a vague or incomplete description of the purchaser’s business activity might result in questions from tax authorities regarding the purpose of the purchases. It is advisable to be specific about what items are being bought for resale.

Another mistake occurs in the declaration section. Some purchasers forget to sign and date the form. A missing signature or date renders the certificate invalid, leading to non-exempt purchases being taxed correctly.

Many people overlook the stipulation regarding the intended use of the purchased items. It is essential to understand that only items meant for resale qualify for tax exemption. If the items are used otherwise, purchasers need to be prepared to pay sales tax.

Moreover, individuals often neglect to consult their legal representatives or tax advisors before filling out the form. This oversight can lead to misunderstandings about exemptions, potentially resulting in complications later on.

Failure to provide up-to-date or accurate information can also be problematic. For example, if there has been a change in business structure or ownership, the purchaser’s type of business must reflect those changes. Outdated information can lead to disputes with tax authorities.

Lastly, some may not familiarize themselves with the penalties for fraudulent use of the certificate. Understanding that any misuse can lead to significant penalties helps purchasers take the process more seriously. Awareness can prevent unintended mistakes and ensure compliance with Louisiana tax regulations.

Documents used along the form

The R 1042 Louisiana Certificate form serves a significant purpose in facilitating tax-exempt purchases for resale. However, it often exists alongside other essential documents that pertain to sales tax exemptions, forms of identification, and record keeping. Below is a list of documents frequently utilized in conjunction with the R 1042 form, along with a brief description for each.

- Louisiana Sales Tax Exemption Certificate: This form allows qualified purchasers to claim exemptions on certain purchases, typically for specific types of goods or services defined by Louisiana law. It confirms eligibility for exemption based on the purchaser's type of business.

- IRS Form W-9: This document is used to request information for the purpose of reporting income to the IRS. It collects the taxpayer identification number (TIN) of the purchaser, which is essential for compliance with tax reporting rules.

- Sales Tax Permit: Issued by the state, this permit is required for businesses making taxable sales. It satisfies legal requirements for collecting sales tax from end consumers.

- Purchase Order: This document outlines the details of the transaction between the purchaser and seller, including product descriptions, quantities, and agreed prices. It provides a record of the purchase agreement.

- Invoice: An invoice is generated by the seller after a sale is made. It details the items sold, pricing, and any taxes collected, serving as a formal request for payment.

- Sales Tax Returns: Businesses typically file these returns periodically to report and remit sales tax collected from purchasers. These documents summarize tax collected over a specific period.

- Resale Certificate from Other States: If a business operates in multiple states, different resale certificates may be necessary. These documents allow purchases made in one state to be recognized for resale in another state without incurring sales tax.

- Business License: This license is required for a business to operate legally. It verifies that the business meets local regulatory requirements and confirms the legitimacy of the operation.

- Supplier Agreements: Such agreements formalize the relationship between a purchaser and seller, detailing terms of sale, pricing, and responsibilities, ensuring both parties are aligned on the expectations of their transaction.

Understanding these documents enhances compliance and streamlines processes related to sales tax exemptions. It is vital for businesses to maintain organized records of these forms to ensure compliance with both state and federal regulations.

Similar forms

-

Sales Tax Exemption Certificate: Similar to the R 1042 form, this certificate allows purchasers to claim exempt status from sales tax on specific items or services. It serves to affirm that the items will not be used for personal or business consumption but will instead be resold or repurposed in a way that qualifies for tax exemption.

-

Resale Certificate: This document is issued to wholesalers or retailers to authorize tax-exempt purchases for items intended for resale. Like the R 1042, it confirms that the buyer will be selling the items rather than using them, thus allowing them to sidestep the initial sales tax on those purchases.

-

Form ST-4 (Massachusetts Resale Certificate): This form serves a similar purpose in Massachusetts, permitting businesses to buy goods tax-free as long as those items are meant for resale. The underlying principle of asserting the intent behind the purchase is the same as with the R 1042 form.

-

California Resale Certificate (BOE-230): In California, this certificate plays a role very much like the R 1042. It allows retailers to buy goods without paying sales tax, provided the items will be resold. Both forms share the requirement of declaration regarding the purchaser’s intent.

-

Texas Sales and Use Tax Resale Certificate: This certificate is used in Texas to exempt purchases made with the intent to resell. Mirroring the R 1042, it shifts the responsibility for taxation onto the eventual consumer rather than the distributor or retailer.

Dos and Don'ts

When filling out the R 1042 Louisiana Certificate form, certain guidelines will help ensure accuracy and compliance. Here are ten important dos and don'ts:

- Do print or type all information clearly to avoid any confusion.

- Do use the purchaser’s legal name as registered with the sales tax account.

- Do include the correct ten-digit sales tax account number.

- Do provide a detailed description of the business activity or items sold.

- Do sign and date the form after filling out all required sections.

- Don't leave any required fields blank; all sections must be completed.

- Don't sign the certificate unless you have the authority to do so.

- Don't use the exemption for items that will not be resold.

- Don't commit fraud; inaccurate information can lead to penalties.

- Don't forget to keep a copy of the completed form for your records.

Following these instructions can help facilitate a smoother process and protect against unnecessary complications down the line.

Misconceptions

The R 1042 Louisiana Certificate is essential for purchasers seeking sales tax exemptions on items purchased for resale. However, several misconceptions can lead to confusion regarding its proper use. Here are four common misconceptions, along with clarifications.

- Misconception 1: The R 1042 form can be used for any purchase.

- Misconception 2: Once the form is completed, it guarantees that purchases are always tax-exempt.

- Misconception 3: Any agent can sign the form on behalf of the purchaser.

- Misconception 4: Using the R 1042 form allows the seller to avoid any responsibility for tax collection.

This is incorrect. The R 1042 form is specifically designed for purchases intended for resale. It cannot be used for items that will be consumed or used in a non-resale manner. If the items are not resold, the purchaser is responsible for paying the sales tax.

While the form indicates a tax-exempt status at the time of purchase for resale, it does not guarantee permanent exemption. If it is later determined that items purchased were not actually for resale, the purchaser is liable for the sales tax due.

This is misleading. Only a duly authorized agent of the purchaser may sign the R 1042 form. It is essential that the person signing has the authority to act on behalf of the business in tax matters, ensuring compliance and reducing risk.

In reality, both the purchaser and the seller hold responsibilities. If the purchaser submits a false declaration or misuses the certificate, the seller may still be held accountable for any taxes owed. The law enforces penalties on both parties involved if misuse occurs.

Key takeaways

Understanding the R 1042 Louisiana Certificate form is essential for any business engaging in resale activities. The following key takeaways provide clarity on filling out and using this document effectively.

- Accurate Information Required: Ensure that all sections—such as the name of the purchaser, sales tax account number, address, and description of business activity—are filled out accurately. This aids in avoiding potential issues with tax authorities.

- Certification of Intent: The purchaser must certify that the items being purchased are intended for resale. This includes the stipulation that any items used outside of resale will incur sales tax obligations.

- Potential for Liability: If items purchased under this certificate are later determined to be subject to sales tax, the purchaser assumes full liability. This highlights the importance of compliance with the intended use outlined in the certificate.

- Penalties for Fraud: The form includes a warning regarding the legal repercussions of improperly signing the certificate. Fraudulent use can result in penalties outlined in Louisiana's tax statutes, affecting both the seller and the purchaser.

- Signature and Date: The document must be signed and dated by the purchaser or authorized agent. This formalizes the declaration and should reflect correct information and intent.

Browse Other Templates

Fannie Mae Form - Interest is charged on the unpaid principal until it is fully paid, ensuring the borrower understands the potential costs involved.

Metlife Annuity - Remaining aware of how repayments apply to your outstanding balances is essential for management.