Fill Out Your Raiser Statement Inspection Form

When navigating the world of professional fundraising in New York, understanding the Raiser Statement Inspection form is essential. This document, officially known as Form CHAR037, facilitates transparency and accountability between professional fundraisers and charitable organizations. It consists of multiple parts that identify the contracting fundraisers and the associated charitable entities. Additionally, key details about the contract period, campaign dates, and the nature of the statement—whether it is an interim or closing statement—are thoroughly outlined. The form also ensures that both parties certify their information under penalty of perjury, solidifying the legitimacy of the reported data. Furthermore, it includes sections dedicated to the financial specifics of the fundraising campaign, detailing revenue sources, expenses, and the distribution of funds. Clarity is emphasized through requirements for descriptions of solicitation methods and information about any subcontractors involved in the fundraising process. With the Raiser Statement Inspection form, both fundraisers and charities can maintain their integrity while serving their communities.

Raiser Statement Inspection Example

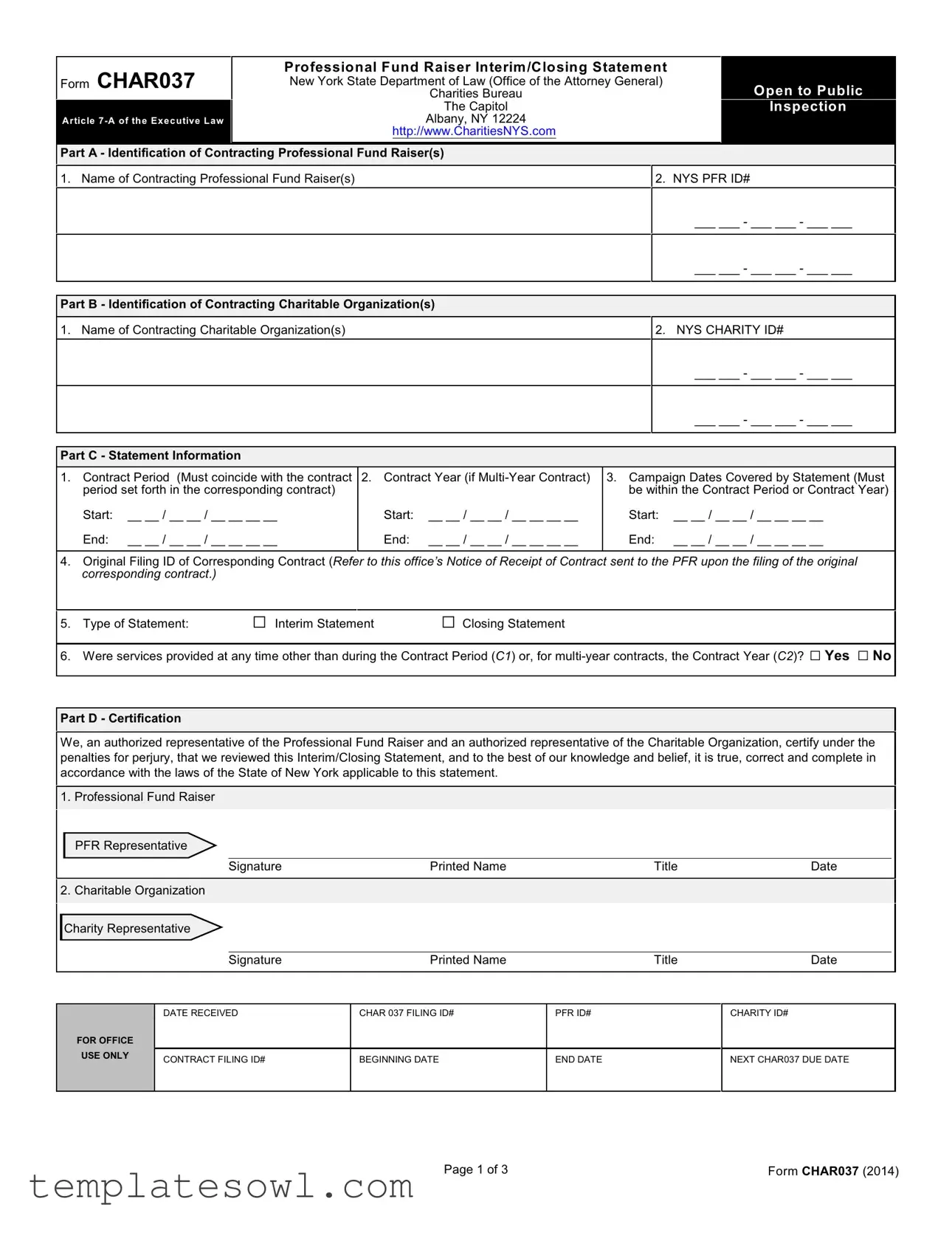

Professional Fund Raiser Interim/Closing Statement

Form CHAR037 |

New York State Department of Law (Office of the Attorney General) |

Open to Public |

|

|

Charities Bureau |

||

|

|

The Capitol |

Inspection |

Article |

|

Albany, NY 12224 |

|

|

|

http://www.CharitiesNYS.com |

|

Part A - Identification of Contracting Professional Fund Raiser(s) |

|

||

1. Name of Contracting Professional Fund Raiser(s) |

2. |

NYS PFR ID# |

|

|

|

|

___ ___ - ___ ___ - ___ ___ |

|

|

|

___ ___ - ___ ___ - ___ ___ |

Part B - Identification of Contracting Charitable Organization(s) |

|

||

1. Name of Contracting Charitable Organization(s) |

2. |

NYS CHARITY ID# |

|

|

|

|

___ ___ - ___ ___ - ___ ___ |

|

|

|

___ ___ - ___ ___ - ___ ___ |

Part C - Statement Information |

|

|

|

|

|

1. Contract Period (Must coincide with the contract 2. |

Contract Year (if |

3. Campaign Dates Covered by Statement (Must |

|||

period set forth in the corresponding contract) |

|

|

be within the Contract Period or Contract Year) |

||

Start: |

__ __ / __ __ / __ __ __ __ |

Start: |

__ __ / __ __ / __ __ __ __ |

Start: |

__ __ / __ __ / __ __ __ __ |

End: |

__ __ / __ __ / __ __ __ __ |

End: |

__ __ / __ __ / __ __ __ __ |

End: |

__ __ / __ __ / __ __ __ __ |

4.Original Filing ID of Corresponding Contract (Refer to this office’s Notice of Receipt of Contract sent to the PFR upon the filing of the original corresponding contract.)

5. Type of Statement: |

G Interim Statement |

G Closing Statement |

6. Were services provided at any time other than during the Contract Period (C1) or, for

Part D - Certification

Part D - Certification

We, an authorized representative of the Professional Fund Raiser and an authorized representative of the Charitable Organization, certify under the penalties for perjury, that we reviewed this Interim/Closing Statement, and to the best of our knowledge and belief, it is true, correct and complete in accordance with the laws of the State of New York applicable to this statement.

1. Professional Fund Raiser

1. Professional Fund Raiser

PFR Representative

Signature |

Printed Name |

Title |

Date |

2. Charitable Organization

2. Charitable Organization

Charity Representative

|

Signature |

Printed Name |

|

Title |

Date |

|

DATE RECEIVED |

CHAR 037 FILING ID# |

PFR ID# |

|

CHARITY ID# |

FOR OFFICE |

|

|

|

|

|

USE ONLY |

CONTRACT FILING ID# |

BEGINNING DATE |

END DATE |

|

NEXT CHAR037 DUE DATE |

|

|

Page 1 of 3 |

Form CHAR037 (2014) |

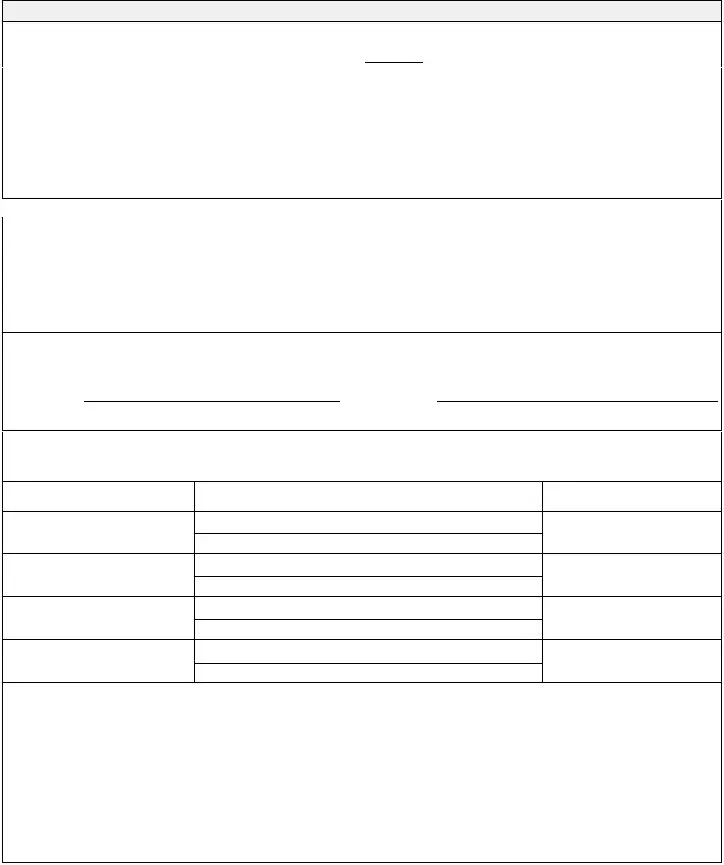

Part E - Activity and Conduct |

|

|

|

1. Specify the methods of solicitation (Column A) and the types of contributions solicited (Column B). (Check all that apply.) |

|

||

COLUMN A |

|

COLUMN B |

|

Telemarketing |

G |

Monetary Contributions |

G |

Direct Mail |

G |

Donation of New or Used Goods |

G |

Door to Door |

G |

Tickets to a Dinner/Gala/Other Special Event |

G |

Electronic Media (TV, Radio) |

G |

Ads in a Publication/Magazine |

G |

Print Media |

G |

Purchase of a Product |

G |

Internet |

G |

Grants |

G |

G |

Volunteers |

G |

|

Other (please describe): |

G |

Other (please describe): |

G |

2. Did this campaign involve the solicitation of persons in New York State only, the solicitation of persons in New York State and other states or the solicitation of persons only in other states?

2. Did this campaign involve the solicitation of persons in New York State only, the solicitation of persons in New York State and other states or the solicitation of persons only in other states?

(Complete only Columns I and II in Part F - Financial Report (page 3)) (Complete all Columns in Part F - Financial Report (page 3))

(Do not complete Part F - Financial Report (page 3), but provide below an explanation as to why the corresponding contract was filed with the Charities Bureau.)

Explanation:

3.Within five days of receipt, were all contributions received from solicitation activity under this contract deposited in a bank account under the exclusive control of the charitable organization listed above?.................G Yes* G No* G Not Applicable (PFR had no access to contributions)

*If “Yes” or “No”, complete account information below:

Bank Name: |

Bank Address: |

Account Name: |

|

4. Did the professional fund raiser subcontract any contractual services to an third party during the specified Contract Period or, if a

contract, the Contract Year? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . G Yes* G No |

*If “Yes,” provide each subcontractor’s name, NY PFR ID#, address and telephone number. |

|

|

Subcontractor Name & NYS PFR ID# |

Subcontractor Address (Number and street, Room/Suite, |

Subcontractor Phone Number |

|

City or town, state or country and ZIP+ 4) |

|

5. Has the professional fund raiser provided all contractual services and has the charitable organization received all contractual monetary payments required by the contract? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . G Yes G No*

*If “No,” provide an explanation:

Page 2 of 3 |

Form CHAR037 (2014) |

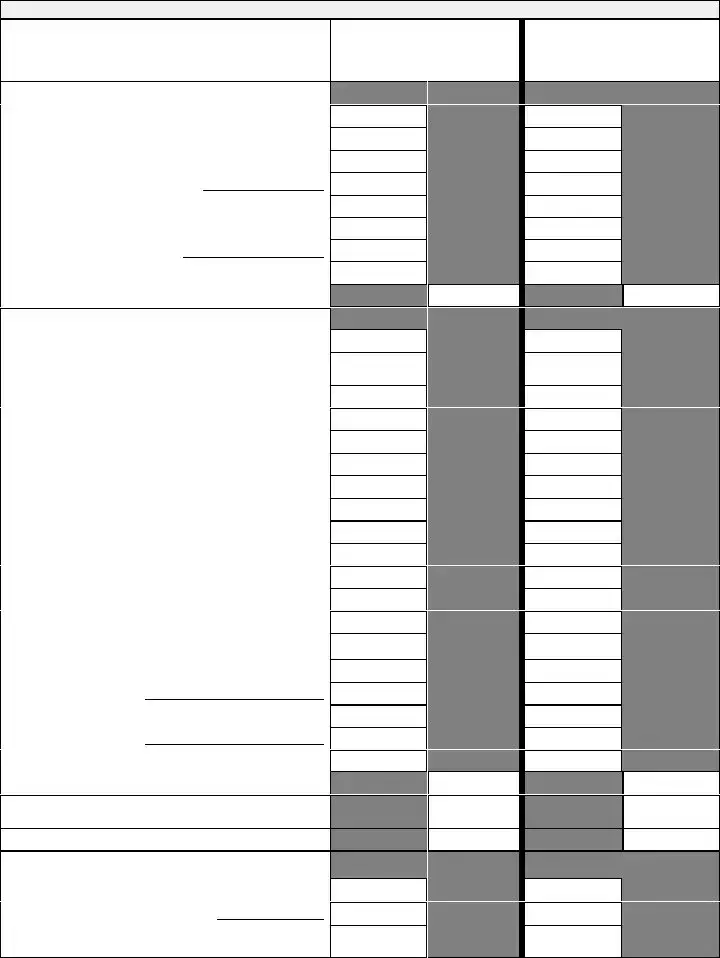

Part F - Financial Report

If the campaign involved only the solicitation of persons in New York State, complete Columns I and II. If the campaign involved the solicitation of persons in New York State and other states, complete Columns I, II, III and IV.

1. GROSS REVENUE

New York |

|

|

All States |

Column I |

Column II |

Column III |

Column IV |

a. |

Monetary Contributions Solicited By PFR |

|

$ |

|

|

$ |

|

b. |

Advertisement Sales |

|

$ |

|

|

$ |

|

c. |

Entertainment Sales/Admission Charges |

|

$ |

|

|

$ |

|

d. |

Other Product Sales (Identify Product: |

) |

$ |

|

|

$ |

|

e. |

Monetary Contributions Solicited By PFR Recruited Volunteers |

|

$ |

|

|

$ |

|

f. |

Other Revenue Source (Describe: |

) |

$ |

|

|

$ |

|

g. |

Other Revenue Source (Describe: |

) |

$ |

|

|

$ |

|

h. |

Other Revenue Source (Describe: |

) |

$ |

|

|

$ |

|

i. |

TOTAL GROSS REVENUE (Add lines #1a through #1h) . . . . |

|

|

$ |

|

$ |

|

2. |

EXPENSES |

|

|

|

|

|

|

a. |

PFR’s Remuneration/Fee |

|

$ |

|

|

$ |

|

b. |

Salaries & Benefits For Professional Solicitors, |

|

$ |

|

|

$ |

|

|

Office Manager, Other PFR Employees |

|

|

|

|

||

c. |

Subcontractor’s Fee (Identify Subcontractor(s) in Part E4) |

|

$ |

|

|

$ |

|

d. |

Permits, Licenses, Registration Fees, Etc |

|

$ |

|

|

$ |

|

e. |

Office Rent, Office Utilities, Office Insurance |

|

$ |

|

|

$ |

|

f. |

Office Supplies, Other Office Expenses |

|

$ |

|

|

$ |

|

g. |

Computer/Data Processing Service Fees |

|

$ |

|

|

$ |

|

h. |

Telephone |

|

$ |

|

|

$ |

|

i. |

Printing |

|

$ |

|

|

$ |

|

j. |

Advertising |

|

$ |

|

|

$ |

|

k. |

List Rentals |

|

$ |

|

|

$ |

|

l. |

Postage & Shipping |

|

$ |

|

|

$ |

|

m. |

Show/Event Fee |

|

$ |

|

|

$ |

|

n. |

Show/Event Facilities Rental Fee & Insurance |

|

$ |

|

|

$ |

|

o. |

Cost of Merchandise For Resale |

|

$ |

|

|

$ |

|

p. |

Other Expense (Describe: |

) |

$ |

|

|

$ |

|

q. |

Other Expense (Describe: |

) |

$ |

|

|

$ |

|

r. |

Other Expense (Describe: |

) |

$ |

|

|

$ |

|

s. |

Other Expense (Describe: |

) |

$ |

|

|

$ |

|

t. |

TOTAL EXPENSES (Add lines #2a through #2s) |

|

|

$( |

) |

$( |

) |

3. |

NET AMOUNT RETAINED BY THE CHARITY |

|

|

$ |

|

$ |

|

|

(Subtract line #2t from line #1i) |

|

|

|

|

||

4. |

ADDITIONAL GUARANTEED MONIES PAID TO THE CHARITY |

|

$ |

|

$ |

|

|

5. |

MISCELLANEOUS |

|

|

|

|

|

|

a. |

Uncollected Pledges as of the Date of this Report |

|

$ |

|

|

$ |

|

b. |

) |

$ |

|

|

$ |

|

|

c.Professional Fund Raiser’s Profit/Loss (Optional)

(not the same as line #2a) |

$ |

$ |

|

Page 3 of 3 |

Form CHAR037 (2014) |

New York State Departm ent of Law (Office of the Attorney General) Charities Bureau

Instructions for Form CHAR037 (Professional Fund Raiser Interim/Closing Statement)

and Summary of Filing Requirements for Professional Fund Raiser Interim/Closing Statements

http://www.CharitiesNYS.com

Important Notice: These Instructions and Summary are intended to provide assistance in completing Form CHAR037. Also included is information on the filing requirements relating to Professional Fund Raiser Interim/Closing Statements. For additional information on registration and filing requirements pursuant to the Executive Law, registrants and potential registrants are encouraged to familiarize themselves with

I.General Instructions in Completing Form CHAR037

A.Type or print in ink the responses to all items on pages 1 - 3 of Form CHAR037. Enter "NA" for any item that is not applicable.

B.In all instances "PFR Representative" or an “authorized representative of the Professional Fund Raiser” shall mean an owner, partner, director, officer, manager or key employee of the contracting PFR.

C.In all instances "Charity Representative" or an “authorized representative of the Charitable Organization” shall mean an officer, director or key employee of the contracting Charity.

D.The Financial Report (Part F, page 3) must report, on an accrual basis, all revenues received by or on behalf of the charitable organization(s) and all expenses incurred by the professional fund raiser(s) and the charitable organization(s) as a result of services provided during the specified contract period or contract year (if a

II.PFR and Charity Certification

An authorized representative of the Professional Fund Raiser and an authorized representative of the Charitable Organization must certify to all statements made in Form CHAR037. The signatures on Form CHAR037, Part D must be accompanied by each signatory’s printed name, title and the date signed.

III.Amendments to Form CHAR037

A Professional Fund Raiser should file an amended CHAR037 whenever there is a material change to the information provided on a previously filed interim/closing statement, including changes in revenue and expense figures. All Parts (A - F) on an amended Form CHAR037 must be completed. Additionally, the word “AMENDED” must be placed at the top of page 1, Form CHAR037.

IV. |

Form CHAR037 Due Dates |

|

A closing statement is due within 90 days after the termination of a contract. For a contract whose term is longer than one year, |

|

an interim statement must be filed within 15 months of the execution of the contract and annually thereafter. |

V.Mailing Instructions

All completed Form CHAR037 should be mailed to the following address:

New York State Department of Law (Office of the Attorney General) Charities Bureau

The Capitol Albany, NY 12224

VI. |

Additional Charities Bureau Contact Information |

|

|

Telephone: |

(518) |

|

Charities.Fundraising@ag.ny.gov |

|

Instructions for Form CHAR037/CHAR037 Summary (2014) |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Identification | This is the Professional Fund Raiser Interim/Closing Statement, known as Form CHAR037. |

| Governing Law | The form is governed by Article 7-A of the Executive Law of New York. |

| Filing Deadline | A closing statement must be submitted within 90 days after contract termination. |

| Certification Requirement | Both the Professional Fund Raiser and the Charitable Organization must certify the statement under penalties for perjury. |

| Campaign Dates | The activities reported must align with the contract period specified in the form. |

Guidelines on Utilizing Raiser Statement Inspection

Completing the Raiser Statement Inspection form is a crucial step in fulfilling legal requirements for professional fundraising activities in New York State. To ensure an accurate and timely submission, follow the steps outlined below. Each section of the form requires specific information, and attention to detail is vital to avoid delays.

- Part A - Identification of Contracting Professional Fund Raiser(s):

- Enter the name of the contracting professional fund raiser(s).

- Provide the NYS PFR ID#, entering the digits in the correct format.

- Part B - Identification of Contracting Charitable Organization(s):

- Write the name of the contracting charitable organization(s).

- Fill in the NYS CHARITY ID# using the correct format.

- Part C - Statement Information:

- Specify the contract period, ensuring that the start and end dates match the original agreement.

- For multi-year contracts, provide the contract year dates.

- Indicate the campaign dates covered by this statement, ensuring they are within the contract period.

- Fill in the original filing ID from the contract receipt notice.

- Select the type of statement: Interim or Closing.

- Answer whether services were provided outside of the specified contract times.

- Part D - Certification:

- Both representatives must sign, providing their printed names, titles, and dates.

- Part E - Activity and Conduct:

- List the methods of solicitation and contributions solicited, checking all that apply.

- Specify the geographic scope of solicitation—New York only, New York and other states, or other states only.

- Confirm whether all contributions were deposited in a bank account controlled by the charity.

- Indicate if any services were subcontracted during the contract period.

- Answer whether all services were provided and payments received as per the contract.

- Part F - Financial Report:

- Fill in the revenue and expense totals according to the type of solicitation.

- Attach any additional schedules for itemized income and expenses, if necessary.

After completing the form, review each section for accuracy. Ensure that all required signatures are in place before mailing the form to the New York State Department of Law at the specified address. It’s important to adhere to the filing deadlines to avoid penalties. For any questions or assistance, consider reaching out to the Charities Bureau via phone or email.

What You Should Know About This Form

What is the Raiser Statement Inspection form?

The Raiser Statement Inspection form, officially known as Form CHAR037, is a reporting document required by the New York State Department of Law. It is used by professional fundraisers to provide details about their fundraising activities and the financial results of those activities on behalf of charitable organizations. The form aims to ensure accountability and transparency in fundraising efforts.

Who needs to complete this form?

Both professional fundraisers and the contracting charitable organizations must complete this form. An authorized representative from each entity must review, sign, and certify the accuracy of the information provided. This includes reporting on solicitations, contributions received, and financial disclosures relevant to the fundraising campaign.

What information is required on the form?

The form requests various pieces of information, including the names and identification numbers of the professional fundraiser and the charitable organization, contract periods, campaign dates, types of statements (interim or closing), and detailed financial reports. It covers gross revenue, expenses, and net amounts retained by the charity, ensuring comprehensive accountability.

How often must the Raiser Statement Inspection form be submitted?

The submission frequency depends on the type of contract. A closing statement is due within 90 days of contract termination. For contracts longer than one year, an interim statement must be filed within 15 months of execution and annually thereafter. This timing ensures that the fundraising activities are regularly reported and regulated.

Are there penalties for not submitting the form?

Failure to submit the Raiser Statement Inspection form on time can lead to penalties imposed by the New York State Department of Law. This can include fines, and it may impact the ability of the professional fundraiser or charitable organization to conduct future fundraising activities. Compliance is essential to maintain good standing under New York law.

What should be done if the information changes after submission?

If there are material changes to the information previously submitted on the Raiser Statement Inspection form, an amended form must be filed. This includes changes in revenue and expense figures. Each section of the amended form needs to be fully completed, and the word “AMENDED” should be noted at the top of the first page.

Where can I find more information or assistance regarding the form?

Additional information, including detailed instructions and filing requirements for the Raiser Statement Inspection form, can be found on the New York State Department of Law website. For specific inquiries, individuals can reach out via telephone at (518) 486-9797 or through email at Charities.Fundraising@ag.ny.gov.

Common mistakes

Completing the Raiser Statement Inspection form can be intricate, and there are several common mistakes that people often make. Learning to avoid these errors can ensure a smoother filing process and help meet compliance requirements.

One significant mistake is failing to align dates appropriately. Individuals sometimes do not match the contract period with the campaign dates. The form asks for specific date ranges that must correlate with what is stated in the corresponding contract. When these dates do not match, it can lead to delays or rejections in processing the statement.

Another frequent error involves the careless listing of representatives’ information. It is essential to ensure that both the Professional Fund Raiser and the Charitable Organization provide accurate and complete names, signatures, titles, and dates. Omitting any of this information can result in the form being returned for correction, which can cause a backlog in your reporting obligations.

Some people mistakenly leave certain fields blank, thinking that they are optional. However, specific sections require answers, even if the answer is "not applicable." Omitting to fill these out can imply incomplete information and may violate the filing requirements, ultimately leading to complications.

In addition, individuals may not properly understand how to report the financial figures correctly. The financial report section expects all income and expenses to be documented on an accrual basis. Misreporting these figures, or failing to provide detailed descriptions for specific income sources and expenses, can present a misleading financial picture of the fundraising efforts.

People also often check the wrong box concerning the type of statement being submitted. Misidentifying whether it is an interim or closing statement can lead to confusion and may prevent the applicable rules and regulations from being followed. Each type of statement serves a different purpose and is subject to different deadlines and requirements.

Lastly, it's crucial not to overlook the importance of signatures. Each submitted form requires the signature of an authorized representative. Without these signatures, the form is considered incomplete. Ensure that both representatives from the Professional Fund Raiser and the Charitable Organization carefully sign and date the form before submission.

By paying attention to these common errors while filling out the Raiser Statement Inspection form, individuals can help ensure their filings are accurate and compliant with the requirements set forth by the New York State Department of Law. Careful review and attention to detail can significantly ease the process of fundraising reporting.

Documents used along the form

The Raiser Statement Inspection form plays a critical role in ensuring transparency and accountability in fundraising efforts within New York State. However, a collection of additional documents often accompanies this form to provide further context and facilitate compliance with state regulations. Each of these documents serves a purpose that contributes to the overall integrity of fundraising activities. Below is a list of frequently used forms and documents alongside the Raiser Statement Inspection form.

- Charitable Organization Registration Form: This document registers a charitable organization with the state. It typically requires information about the organization’s mission, structure, and financials, ensuring that it meets legal requirements to operate as a charity in New York.

- Professional Fundraiser Contract: This contract outlines the agreement between the charitable organization and the professional fundraiser. It includes details about the scope of work, compensation, and responsibilities, clarifying the expectations from both parties involved.

- Campaign Financial Report: This report details the financial results of a fundraising campaign. It includes comprehensive information about revenues, expenses, and net proceeds, allowing stakeholders to assess the financial effectiveness of the campaign.

- Contribution Report: This document provides a summary of the contributions received during a specific period. It identifies donors, amounts contributed, and the mediums through which the contributions were made, assisting in evaluating donor engagement.

- Solicitation Disclosure Form: Required by law, this form outlines the methods used to solicit donations and where funds are directed. It aims to inform potential donors about how their contributions will be utilized and the fundraising process.

- Subcontractor Agreement: If the professional fundraiser hires subcontractors, this agreement outlines the terms under which these third parties will operate. It includes details about the services to be provided, compensation, and compliance expectations.

- Tax Exempt Status Confirmation: Charitable organizations often need to provide proof of their tax-exempt status under IRS regulations. This documentation verifies that the organization qualifies for tax deductions for donors, enhancing attractiveness for potential contributions.

- Annual Financial Statement: An annual financial statement offers a comprehensive overview of the charitable organization’s financial health. This document typically includes income statements, balance sheets, and cash flow statements, providing valuable insights to donors about the organization’s sustainability.

- Donor Acknowledgment Letters: These letters serve as receipts for donors, acknowledging their contributions. They detail the amount donated and specify that the contribution will be used for charitable purposes, providing essential documentation for tax purposes.

Incorporating these additional documents strengthens the fundraising process, ensuring compliance with state regulations while fostering trust between charitable organizations and their supporters. Together, they create a more robust framework for overseeing and reporting fundraising activities, allowing both fundraisers and donors to operate with clarity and confidence.

Similar forms

The Raiser Statement Inspection form shares similarities with several other documents commonly used in fundraising and charitable operations. Below is a list of those documents, highlighting their respective similarities:

- Contractual Agreement: Like the Raiser Statement, a contractual agreement outlines the terms and obligations between a professional fund raiser and a charitable organization. Both documents include identification of the parties involved and details regarding the duration and specifics of the agreement.

- Financial Statements: Financial statements provide a summary of revenues and expenses, similar to the financial reporting section in the Raiser Statement. Both documents require transparency regarding financial activities during a specified period.

- Solicitation Report: A solicitation report details methods used for fundraising activities and their outcomes, akin to the methods of solicitation outlined in the Raiser Statement. This ensures proper documentation of the fundraising process.

- Annual Report: An annual report presents a summary of an organization’s financial health and activities over the year. This is similar to the Raiser Statement as both provide information on fundraising campaigns and their effectiveness in generating funds.

- IRS Form 990: IRS Form 990 is filed by tax-exempt organizations to report their income, expenses, and activities. Like the Raiser Statement, this form requires accuracy and certification of the information reported to ensure compliance with regulations.

- Grant Proposal: A grant proposal outlines the funding needs, project goals, and expected outcomes of a fundraising campaign. Both documents contain sections that emphasize the necessity of clear objectives and accountability for funds raised.

Dos and Don'ts

When filling out the Raiser Statement Inspection form, there are important dos and don’ts to keep in mind to ensure accuracy and compliance.

- Do type or print clearly using ink to prevent any misunderstandings.

- Don't leave any sections blank; mark "NA" for items that do not apply.

- Do ensure that the contract period matches the details provided in your original contract.

- Don't complete the form with incomplete financial data; ensure all revenues and expenses are included.

- Do seek assistance if you're unsure about any section to avoid mistakes.

- Don't forget to include signatures from authorized representatives of both the professional fund raiser and the charitable organization.

- Do keep a copy of the completed form for your records after submission.

Following these guidelines can help facilitate a smoother process and ensure compliance with New York State laws.

Misconceptions

Understanding the Raiser Statement Inspection form is crucial for both professional fundraisers and charitable organizations. However, some misconceptions can lead to confusion or misinterpretation of the requirements. Here are four common misconceptions:

- The form is only for large organizations. Many believe that only large charities need to complete this form. In reality, any professional fundraiser working with a charitable organization in New York must file the Raiser Statement regardless of the organization's size.

- Completion of the form is optional. Some might think that if they do not consider their activities significant, they can skip filing the form. This is incorrect. Filing is mandatory and must adhere to the state regulations to ensure accountability and transparency.

- You can file the form anytime. A common misunderstanding is regarding deadlines. The closing statement, for instance, has specific due dates, such as within 90 days after a contract ends. Failure to meet deadlines can lead to penalties.

- Only financial information is required. Many assume that the form focuses solely on financial aspects. While the financial report is important, other sections covering the identification of parties and certification also hold significant value in the overarching compliance requirements.

By addressing these misconceptions, fundraisers and charities can better navigate the requirements set forth by the New York State Department of Law.

Key takeaways

When dealing with the Raiser Statement Inspection form, here are some key points to remember:

- Understand the Structure: The form has distinct sections for identifying both the professional fund raiser and the charitable organization. Complete these parts accurately to avoid any processing delays.

- Be Timely: It’s essential to submit a closing statement within 90 days after your contract ends. If your contract lasts over one year, remember that interim statements are required periodically.

- Certification is Key: An authorized representative from both the fund raiser and the charitable organization must sign the form. Your signatures confirm the statements are true and complete, so double-check everything before sending.

- Financial Reporting Matters: Report all revenues and expenses on an accrual basis. Missing information can lead to compliance issues, so include all income sources and expenditures properly.

Browse Other Templates

Dl 44 Form for Minors - The DMV DL 142 form is used to request the cancellation or surrender of a driver's license or identification card in California.

Washington State Cps Laws - Mandated reporters must provide their contact details as part of the submission.