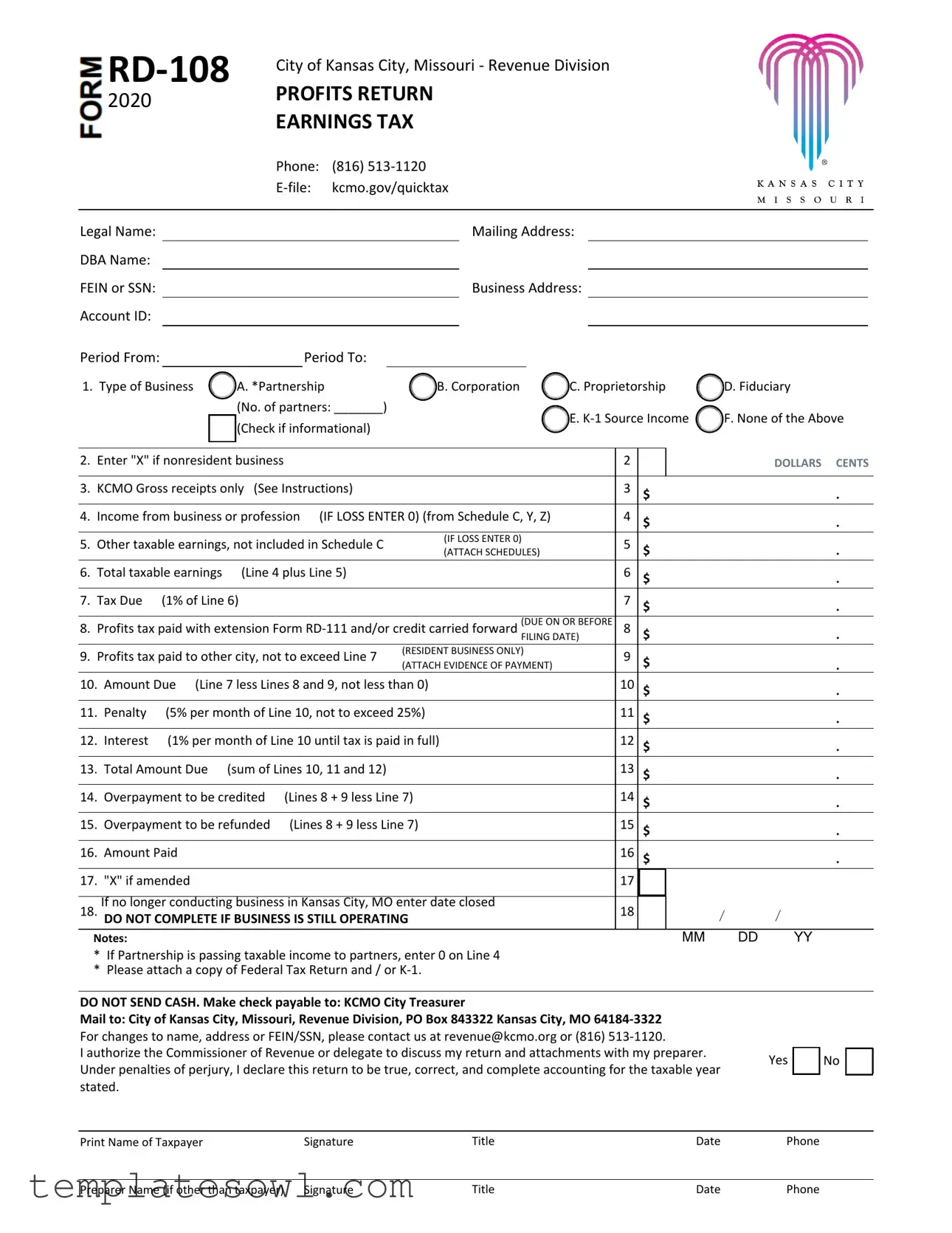

Fill Out Your Rd 108 Form

The RD-108 form is an essential document for businesses operating within Kansas City, Missouri, as it pertains to the city's earnings tax. Each year, residents and nonresidents alike must file this form to report their business profits accurately, ensuring compliance with local tax regulations. The RD-108 requires entering detailed financial information, including gross receipts, net profits, and other taxable earnings. Specific lines on the form guide users through calculating the total taxable earnings, determining the tax due, and identifying any applicable credits or payments made in advance. Additionally, entities such as corporations and partnerships must note their business structure on the form and include relevant schedules, such as Schedule C for profit reporting, to substantiate their taxable income claims. The deadline for submitting the RD-108 typically falls on May 17 of each year, though different timelines apply to businesses that operate on a fiscal basis. Failing to file this form accurately and on time can lead to penalties and interest charges, highlighting the importance of thorough preparation and submission. Moreover, businesses that have ceased operations within the city must also fulfill their filing obligations by indicating the closing date on the form. Ultimately, understanding the requirements and implications of the RD-108 allows business owners to navigate Kansas City's tax landscape with ease and confidence.

Rd 108 Example

City of Kansas City, Missouri - Revenue Division |

||

|

||

2020 |

PROFITS RETURN |

|

|

EARNINGS TAX |

|

|

Phone: |

(816) |

|

kcmo.gov/quicktax |

|

Legal Name:

DBA Name:

FEIN or SSN:

Account ID:

Period From:

1. Type of Business

Period To:

A. *Partnership

(No. of partners: _______)

(Check if informational)

Mailing Address:

Business Address:

B. Corporation |

C. Proprietorship |

D. Fiduciary |

|

E. |

F. None of the Above |

2. |

Enter "X" if nonresident business |

|

|

2 |

|

|

|

DOLLARS CENTS |

|||

|

|

|

|

|

|

|

|

||||

3. |

KCMO Gross receipts only (See Instructions) |

|

3 |

$ |

|

|

. |

||||

4. |

Income from business or profession (IF LOSS ENTER 0) (from Schedule C, Y, Z) |

4 |

$ |

|

|

. |

|||||

5. |

Other taxable earnings, not included in Schedule C |

(IF LOSS ENTER 0) |

5 |

$ |

|

|

. |

||||

(ATTACH SCHEDULES) |

|

|

|||||||||

6. |

Total taxable earnings |

(Line 4 plus Line 5) |

|

6 |

$ |

|

|

. |

|||

7. |

Tax Due |

(1% of Line 6) |

|

|

7 |

$ |

|

|

. |

||

|

|

|

|

|

|

(DUE ON OR BEFORE |

|

$ |

|

|

|

8. |

Profits tax paid with extension Form |

8 |

|

|

. |

||||||

9. |

Profits tax paid to other city, not to exceed Line 7 |

(RESIDENT BUSINESS ONLY) |

9 |

$ |

|

|

. |

||||

(ATTACH EVIDENCE OF PAYMENT) |

|

|

|||||||||

10. |

Amount Due (Line 7 less Lines 8 and 9, not less than 0) |

10 |

$ |

|

|

. |

|||||

11. |

Penalty |

(5% per month of Line 10, not to exceed 25%) |

11 |

$ |

|

|

. |

||||

12. |

Interest |

(1% per month of Line 10 until tax is paid in full) |

12 |

$ |

|

|

. |

||||

13. |

Total Amount Due |

(sum of Lines 10, 11 and 12) |

|

13 |

$ |

|

|

. |

|||

14. |

Overpayment to be credited |

(Lines 8 + 9 less Line 7) |

14 |

$ |

|

|

. |

||||

15. |

Overpayment to be refunded |

(Lines 8 + 9 less Line 7) |

15 |

$ |

|

|

. |

||||

16. |

Amount Paid |

|

|

|

16 |

$ |

|

|

. |

||

17. |

"X" if amended |

|

|

|

17 |

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

18. |

If no longer conducting business in Kansas City, MO enter date closed |

18 |

|

|

/ |

/ |

|||||

DO NOT COMPLETE IF BUSINESS IS STILL OPERATING |

|

|

|||||||||

|

Notes: |

|

|

|

|

|

|

MM |

DD |

YY |

|

*If Partnership is passing taxable income to partners, enter 0 on Line 4

*Please attach a copy of Federal Tax Return and / or

DO NOT SEND CASH. Make check payable to: KCMO City Treasurer

Mail to: City of Kansas City, Missouri, Revenue Division, PO Box 843322 Kansas City, MO

I authorize the Commissioner of Revenue or delegate to discuss my return and attachments with my preparer. Yes Under penalties of perjury, I declare this return to be true, correct, and complete accounting for the taxable year

stated.

No

Print Name of Taxpayer |

Signature |

Title |

Date |

Phone |

Preparer Name (if other than taxpayer) Signature |

Title |

Date |

Phone |

City of Kansas City, Missouri - Revenue Division |

||

|

||

2020 |

PROFITS RETURN |

|

|

EARNINGS TAX |

|

|

Phone: |

(816) |

|

kcmo.gov/quicktax |

|

|

|

|

GENERAL INSTRUCTIONS FOR FILING FORM

1.Who must file:

•Every resident individual who derives income from an unincorporated business, association, profession, or other business activity.

•Every nonresident individual who derives income from an unincorporated business, association, profession, or other business activity within the city.

•Every corporation and partnership conducting business within the city or rendering or performing services within the city.

•

2.Exceptions:

•File Form

•Form

3.When and where to file:

•This return is due on or before May 17 of each year unless your annual accounting period is on a fiscal year basis in which case it is due 105 days from the end of your fiscal year. In the event a corporation or partnership ceases to engage in any business activity in the city, the income from which is taxable in whole or in part, a final return shall be due within 105 days from the date such business activity is terminated. Mail completed returns to the City of Kansas City, Missouri, Revenue Division, PO Box 843322 Kansas City, MO

•Extension

Complete Form

City of Kansas City, Missouri - Revenue Division |

||

|

||

2020 |

PROFITS RETURN |

|

|

EARNINGS TAX |

|

|

Phone: |

(816) |

|

kcmo.gov/quicktax |

|

|

|

|

GENERAL INSTRUCTIONS FOR FILING FORM

Line 1. Indicate type of business.

Line 2. Check if nonresident business (not located in Kansas City, Missouri)

Line 3. Enter gross receipts amount shown on Form

Line 4. Enter total taxable net profit from business or profession shown on

ENTITY, PLEASE NOTE ADDITIONAL INSTRUCTIONS UNDER SCHEDULE Z FOR FILING OPTIONS.

Line 5. Enter any other taxable earnings or profits and ATTACH SCHEDULE showing computation of this amount including partnership income. IF LOSS, ENTER "0".

Line 6. Total taxable earnings (Line 4 plus Line 5).

Line 7. Multiply Line 6 by .01 (1%) and enter on this line.

Line 8. Enter estimated profits tax paid with extension plus any profits tax credits carried forward from prior periods. The balance of the tax is due with the filing of the return together with interest at 12% per annum from the date the return was originally due. If the return is not filed and the balance of the tax due is NOT paid within the period as extended, penalty of 5% per month up to but not exceeding 25% shall be computed in addition to the interest charges. Extension payment must be 90% of the tax due to avoid penalty and interest.

Line 9. Only residents are allowed a credit for earnings tax or income tax paid to another city. This credit is to be applied only to the extent of the tax imposed by Kansas City (1% rate) upon amounts earned in other cities where the tax is paid. The credit may not exceed the amount of tax due on Line 7. ATTACH DOCUMENTATION OF TAX

PAYMENT.

Line 10. Line 7 minus the sum of Lines 8 and 9.

Line 11. If the return is delinquent, compute penalty on the amount in Line 10 from the due date to date of payment at 5% per month or portion thereof and enter on this line.

Line 12. If return is delinquent, compute interest on the amount in Line 10 from the due date to date of payment at .01 (1%) per month or portion thereof and enter on this line.

Line 13. Total amount due (sum of Lines 10, 11 and 12).

Line 14. If the sum of Lines 8 and 9 is greater than Line 7, enter the difference on Line 14 to receive CREDIT;

OR

Line 15. Enter the difference on Line 15 to receive a REFUND. Overpayments of less than $1.00 will not be refunded.

Line 16. Enter amount paid.

Line 17. "X" if this is an amended return.

Line 18. Enter date business stopped operating inside Kansas City, Missouri or closed.

|

|

|

City of Kansas City, Missouri - Revenue Division |

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

2020 |

|

|

|

|

PROFITS RETURN - EARNINGS TAX |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

Schedule C, Y, Z |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Phone: |

(816) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

kcmo.gov/quicktax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

SCHEDULE C - PROFIT (OR LOSS) FROM BUSINESS OR PROFESSION |

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

CENTS |

|||||||||||||

1. |

Gross receipts or gross sales, fees, or commissions less returns and allowances |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||||||||

2. |

Cost of goods sold: |

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

CENTS |

|

|

|

|

|

|

|

|

|

|

|

||

|

A. Inventory at beginning of year |

|

2A |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

B. Purchases |

|

|

|

|

2B |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Wages |

|

|

|

|

2C |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Other costs (attach worksheet) |

|

2D |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

E. Total (Lines 2A through 2D) |

|

|

2E |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

F. Less inventory at end of year |

|

|

2F |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

DOLLARS |

CENTS |

||

|

G. Net cost of goods sold (Line 2E less Line 2F) |

|

|

|

|

|

|

|

|

2G |

|

|

|

|

|

|

|

. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. |

Gross profit (Line 1 less Line 2G) |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

. |

||||

4. |

Other business income (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

. |

|||

5. |

Total business income before deductions (Line 3 plus Line 4) |

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

. |

|||||||||||

6. |

Officer Compensation |

|

|

|

|

|

|

|

|

. |

|

12. Interest |

|

|

|

|

|

|

|

|

12 |

|

|

|

. |

||

7. |

Salaries |

|

|

|

|

|

|

|

|

. |

|

13. Depreciation |

|

|

|

|

|

|

|

13 |

|

|

|

. |

|||

8. |

Repairs & maintenance |

|

|

|

|

|

|

|

|

. |

|

14. Depletion |

|

|

|

|

|

|

|

14 |

|

|

|

. |

|||

9. |

Bad debts |

|

|

|

|

|

|

|

|

. |

|

15. Advertising |

|

|

|

|

|

|

|

15 |

|

|

|

. |

|||

10. Rents |

|

|

|

|

|

|

|

|

. |

|

16. Pension, |

16 |

|

|

|

. |

|||||||||||

11. Taxes (Federal, state and |

|

|

|

|

|

|

|

|

|

|

17. Employee benefit |

|

|

|

|

|

17 |

|

|

|

|

||||||

|

local taxes are NOT deductible) |

|

|

|

|

|

|

|

. |

|

programs |

|

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

18. Other deductions (Special |

18 |

|

|

|

. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

deductions are NOT deductible) |

|

|

|

|||||||||||

19. Total business deductions |

(Line 6 through Line 18) |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

. |

|||||||||

20. Net profit or loss |

(Line 5 less Line 19, enter on Line 4, Form |

|

20 |

|

|

|

|

|

|

|

. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

SCHEDULE Y - BUSINESS ALLOCATION FORMULA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

CENTS |

|||||||||

21. Total net profit (from Schedule C, Line 20) |

|

|

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

A: |

|

|

|

|

|

|

|

|

|

B: |

|

|

C: |

||

|

|

|

|

|

|

|

|

|

|

|

|

Everywhere |

DOLLARS CENTS |

In KCMO |

DOLLARS CENTS B divided by A |

||||||||||||

22. Original cost of real and tangible personal property located |

22 |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

% |

||||||||||

23. Total wages, salaries, commissions, and other |

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|||||||||

|

compensation of all employees |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

24. Gross receipts from sales, work or services performed |

24 |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

. |

% |

||||||||||

25. Total percentage (Line 22C through Line 24C) |

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

% |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

26. Allocation percentage (divide total percentage from Line 25 by the number of percentages used) |

|

26 |

|

|

|

|

|

|

% |

||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

27. Taxable net profit |

(Line 21 multiplied by percentage from Line 26, enter amount on Line 4, |

|

|

27 |

|

|

|

|

|

|

|

||||||||||||||||

Form |

|

|

|

|

|

|

|

|

|

|

. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

SCHEDULE Z - DISTRIBUTIVE SHARES OF |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

LIMITED LIABILITY COMPANIES, AND FIDUCIARIES |

|

|

|

|

|

|

||||||||||||||||

Name and address of each taxpayer |

|

|

|

Distributive |

|

|

|

Social Security or |

|

|

|

Resident |

|

|

|

Taxable Distributive |

|

||||||||||

(attach additional sheets if necessary) |

|

|

|

Percentage |

|

|

|

Federal ID Number |

|

(Yes / No) |

|

Shares Amount |

|

||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

100% |

|

|

|

Total, Enter on Line 4, Form |

|

|

|

|

|

. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

City of Kansas City, Missouri - Revenue Division |

||

|

||

2020 |

PROFITS RETURN - EARNINGS TAX |

|

|

Schedule C, Y, Z |

|

|

Phone: |

(816) |

|

kcmo.gov/quicktax |

|

|

|

|

INSTRUCTIONS FOR COMPLETING SCHEDULES C, Y, Z

THIS FORM MUST BE SUBMITTED WITH FORM

1. Schedule C

From total net profits, deduct profits exempted, excluded, or not earned. The remainder shall be deemed "Net Profits Earned". Exemptions and exclusions are cited in 92.220 RSMo and Section

Common Examples of Income not Earned: capital gains, interest (excluding financial institutions), dividends (excluding financial institutions) and partnerships (KCMO sourced income should be reported on Line 5 on Form

Common Examples of Nondeductible Expenses: capital losses, IRS §179 expense deducted above corporate limitations, qualified retirement/health insurance/life insurance plans paid on behalf of owner(s) of non

Each corporation must file a return. Per Section 1.387(a)(3)(A) of the Earnings and Profits Tax Regulations, consolidated returns will not be accepted. A net loss may not be carried forward or back to another year. A net loss may not be deducted against salaries, wages, or other compensation earned.

Proprietorships, partnerships, and corporations should submit a Balance Sheet and a reconciliation of federal taxable income to city taxable income.

2. Schedule

The business allocation formula is to be used only by:

1.Corporations;

2.Nonresident individuals who derive profits from any unincorporated business, partnership, or association provided that the business activity consists of conducting business or performing services both within and outside the city.

In determining the allocation percentage (Line 26), add the percentage determined and shown on Lines 22, 23, and 24 or the percentages applicable to your business and divide the total by the number of percentages used (calculate to seven digits). A percentage shall not be excluded from the computation merely because the factor is found to be allocable entirely outside the city. A factor and its resulting "0" percentage is excludable only when it does not exist anywhere.

City of Kansas City, Missouri - Revenue Division |

||

|

||

2020 |

PROFITS RETURN - EARNINGS TAX |

|

|

Schedule C, Y, Z |

|

|

Phone: |

(816) |

|

kcmo.gov/quicktax |

|

3. Schedule

Each

Resident

Nonresident

Guaranteed Payments

Payment

Partnerships and other

Option 1: The partnership or

Option 2: The partnership or

File completed Form

City of Kansas City, Missouri, Revenue Division, PO Box 843322 Kansas City, MO

Visit our website at kcmo.gov/kctax for more forms and instructions

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Purpose | The RD-108 form is used for the Profits Return - Earnings Tax in Kansas City, Missouri. |

| Filing Requirement | Both residents and non-residents conducting business in Kansas City must file this form. |

| Tax Rate | The tax on total taxable earnings is 1% of the amount reported on Line 6. |

| Filing Deadline | The form is due on or before May 17 each year, with exceptions for fiscal year filers. |

| Extensions | Taxpayers may request an extension by filing Form RD-111 with estimated tax payment. |

| Supporting Documentation | Taxpayers must attach schedules detailing income and deductions along with the form. |

| Payment Options | Taxpayers can pay taxes electronically or by check payable to the KCMO City Treasurer. |

| Overpayment Refund | If taxes are overpaid, taxpayers can claim a refund or credit on a future return. |

| Contact Information | For assistance, individuals can contact the Revenue Division at (816) 513-1120. |

| Governing Law | This form is governed by Section 92.220 of the Missouri Revised Statutes and City Ordinance Section 68-385. |

Guidelines on Utilizing Rd 108

Completing the RD-108 form requires careful attention to specific details and accurate financial reporting. This form is an essential part of fulfilling local tax obligations. Below is a guide to help you navigate the process of filling it out correctly.

- Begin by entering your legal name and any Doing Business As (DBA) name if applicable.

- Provide your FEIN or SSN and Account ID.

- Fill in the period for which you are filing, indicating the start date in the "Period From" section and the end date in the "Period To" section.

- In Line 1, check the appropriate box to indicate the type of business: Partnership, Corporation, Proprietorship, Fiduciary, K-1 Source Income, or None of the Above. If you're a partnership, note the number of partners.

- If applicable, mark Line 2 to indicate whether your business is a nonresident business.

- On Line 3, enter the total KCMO gross receipts from applicable schedules.

- Record your income from business or profession on Line 4. If there is a loss, enter 0.

- For Line 5, include any other taxable earnings not reported on Schedule C. Again, enter 0 if this is a loss.

- Calculate the total taxable earnings for Line 6 by adding Line 4 and Line 5.

- Determine the tax due for Line 7 by multiplying Line 6 by 1%.

- In Line 8, report any profits tax paid with extension and/or credit carried forward.

- If you're a resident business, input any profits tax paid to another city on Line 9. Attach evidence of payment if necessary.

- Calculate the amount due for Line 10 by taking Line 7 and subtracting Lines 8 and 9, ensuring this amount is not less than 0.

- If the return is late, compute the penalty on Line 11, which is 5% of Line 10 for each month late, up to a maximum of 25%.

- Calculate the interest owed on Line 12 at 1% per month of Line 10 until paid.

- Add Lines 10, 11, and 12 to find the total amount due for Line 13.

- On Line 14, if applicable, indicate any overpayment to be credited.

- On Line 15, determine overpayment to be refunded if relevant.

- On Line 16, enter the total amount paid.

- If you are submitting an amended return, mark Line 17 with an "X."

- If your business has closed, provide the date closed on Line 18.

- Sign and date the form. Make sure to include your phone number and, if applicable, the preparer's name and contact information.

Once completed, ensure to attach any necessary schedules such as the Federal Tax Return or K-1 forms for partnerships. Mail your return to the appropriate address for processing. If you have any concerns or require further clarification about the filing process, do not hesitate to reach out to the contact number provided on the form.

What You Should Know About This Form

1. Who needs to file the RD 108 form?

The RD 108 form must be completed by residents and non-residents who earn income from unincorporated businesses or professions within Kansas City. This includes individual business owners, partnerships, corporations, and their earnings. If you are part of a partnership or limited liability company, K-1 source income is also included in this requirement. Remember, if your earnings come solely from salaries or wages, you should instead use the Wage Earner Return (Form RD-109).

2. When is the RD 108 form due?

The form is due by May 17 each year unless your financial year is a fiscal year, in which case it’s due 105 days after the end of that period. If you’ve closed your business within the year, you must file a final return within 105 days of ceasing operations. Missing the deadline may lead to penalties, so mark your calendar!

3. How do I calculate the tax due on the RD 108 form?

To find out how much tax you owe, you need to first determine your total taxable earnings. This is done by adding your income from business or profession (Line 4) to any other taxable earnings (Line 5). The tax due is 1% of your total taxable earnings (Line 7). Be sure to check for any credits or previously paid taxes that might reduce your overall amount.

4. What if I made a loss for the year?

If your business incurs a loss, you should still file the RD 108 form, but make sure to indicate a zero on Line 4 for income from your business or profession. Additionally, if you have other taxable earnings, report them accurately, also noting losses appropriately. It’s essential to provide a complete picture of your financial activities, even if they were challenging.

5. Can I file for an extension?

You can request an extension by submitting Form RD-111. Make sure to also provide your estimated tax payment by the original due date. An extension grants you an additional six months to file, but be careful—it's only an extension for filing, not for payment. Interest and penalties still apply if the tax due isn’t paid on time.

6. What should I include with my RD 108 submission?

When sending in the RD 108 form, make sure to attach necessary schedules, such as Schedule C for profit or loss and any applicable K-1 forms. You’ll also want to include documentation of any taxes you’ve already paid to avoid duplicate payments or penalties. Being thorough can save you time and headaches later!

7. What if I don’t operate in Kansas City anymore?

If your business has closed, you need to indicate the closing date on Line 18 of the RD 108 form. Do not complete the form if you're still active in Kansas City; instead, continue reporting until your business is officially closed. It's important to file accurately to avoid complications.

Common mistakes

When completing the RD-108 form, individuals often make several common mistakes that can lead to filing issues or delay in processing. One significant error is not indicating the correct type of business in Line 1. This form requires precise information about whether the business is a partnership, corporation, proprietorship, or fiduciary. Failing to mark the appropriate box can cause complications in understanding the tax obligations and could result in an inaccurate assessment of income.

Another frequent mistake involves the calculation of KCMO gross receipts on Line 3. People sometimes overlook the specific instructions regarding what constitutes gross receipts. It is crucial to refer to Schedule C or Schedule Y to accurately report these figures. Any miscalculation or omission can lead to underreporting tax liabilities and penalties.

Many individuals also make errors when reporting their taxable earnings on Lines 4 and 5. This could be due to not attaching the necessary supporting schedules or failing to enter the correct amounts from Schedules C or Y. Additionally, if there are losses, some mistakenly leave the line blank instead of entering "0," which can complicate the tax return process.

Additionally, not providing the required documentation can lead to mistakes. For example, Line 9 requires evidence of any profits tax paid to another city. Without proper attachments, the tax department may not accept the return, resulting in delays and potential penalties.

Finally, neglecting to check the amendment box on Line 17 if the return is amended can cause confusion. If a taxpayer is submitting a revised return, it is crucial to indicate that it is not the original filing. Missing this step could lead to issues with the tax authority recognizing the changes made.

Documents used along the form

Filing the RD-108 form is an essential step for businesses operating in Kansas City, Missouri, to report profits and calculate earnings tax. However, several forms often accompany the RD-108 to ensure completeness and compliance with local regulations. Below is a list of these important documents.

- RD-111 - Extension - Profits Return Earnings Tax: This form allows businesses to request an extension for filing the RD-108 by providing payment of the estimated tax due. An extension can be granted for six months, helping businesses avoid penalties for late submissions.

- RD-109 - Wage Earner Return - Earnings Tax: Used by individuals whose income derives entirely from salaries, wages, or other taxable compensation. This form is crucial for those who do not qualify for the RD-108, ensuring that all relevant earnings tax is reported properly.

- RD-108B - Schedule of Profit (or Loss) from Business or Profession: This schedule details the financial performance of the business, including gross receipts and deductible expenses. It must accompany the RD-108, regardless of whether the business shows a profit or loss.

- Schedule Y - Business Allocation Formula: Applicable for corporations and nonresident individuals, this form calculates how much of the overall business income is taxable within Kansas City. It requires specific financial data to determine the allocation percentage.

- Schedule Z - Distributive Shares of K-1 Source Income: Partnerships and LLCs use this schedule to report the distribution of income to partners. It must be submitted alongside the RD-108, especially if the partnership is passing taxable income to its partners.

Each of these forms plays a vital role in ensuring that your business remains compliant with Kansas City's tax regulations. Review the requirements thoroughly and gather all necessary documentation before your filing date to avoid any complications.

Similar forms

Form RD-109 - Wage Earner Return: This form is used by individuals who solely receive their income from salaries, wages, or commissions. Similar to the RD-108, it deals with Kansas City's earnings tax but is specifically for wage earners rather than businesses. An important distinction is that RD-109 cannot be substituted for RD-108 when profits or business income is involved.

Form RD-111 - Extension for Profits Return: This document allows businesses to request an extension on filing their earnings tax return. Like the RD-108, it requires an estimated tax payment. It acts as a complementary form, enabling filers to meet their deadline despite delays in preparing the main return.

Schedule C - Profit or Loss from Business or Profession: This schedule accompanies the RD-108 and provides detailed information about gross receipts and net profit. Both documents are essential for calculating taxable earnings for businesses operating within Kansas City.

Schedule Y - Business Allocation Formula: Similar to Schedule C, Schedule Y helps businesses determine what portion of their profits is taxable in Kansas City versus other locations. This allocation is necessary for businesses operating out of multiple jurisdictions.

Schedule Z - Distributive Shares of K-1 Source Income: This schedule is used by partnerships and LLCs to report distributions to partners. It shares common ground with the RD-108 as both documents aim to accurately report income generated by a business entity, ensuring partnership incomes are taxed appropriately.

Form 1065 - U.S. Return of Partnership Income: This federal form is filed by partnerships to report income, deductions, and credits. Both the form 1065 and RD-108 require comprehensive financial data and facilitate compliance with respective tax obligations at both federal and local levels.

Form 1120 - U.S. Corporation Income Tax Return: Corporations file this federal form to report their income and tax liability. Similar to the RD-108, it assesses earnings that are attributable to a taxable entity, providing a layer of accountability for business profits.

Form 941 - Employer's Quarterly Federal Tax Return: Although primarily for payroll, it tracks federal income taxes withheld from employee wages. Like the RD-108, it represents a form of tax accountability, albeit focused on employment-related income compared to business profits.

Dos and Don'ts

When filling out the RD-108 form for the City of Kansas City, Missouri, it is essential to approach the task with care and diligence. Below is a list of six critical dos and don'ts to consider when completing this important document.

- Do provide accurate financial figures. Ensure that the gross receipts and other earnings are correctly calculated and reported, as inaccuracies could lead to penalties.

- Do check the appropriate box for your business type. Select whether you are a corporation, partnership, or another entity type as this determines how taxes will be assessed.

- Do attach required schedules. If you have partnership income or additional taxable earnings, make sure to include the necessary documentation that supports your claims.

- Don't ignore the filing deadlines. The form must be submitted no later than May 17 unless you are on a fiscal deadline, in which case the deadline shifts to 105 days after your fiscal year's end.

- Don't forget to sign and date the form. Failing to do so could result in your tax return being considered invalid or incomplete.

- Don't send cash as payment. Instead, pay by check or through approved electronic means to ensure your payment is processed correctly.

Misconceptions

Misconceptions surrounding the RD-108 form can lead to confusion for many individuals and businesses alike. Here are five common misunderstandings, along with clarifications to help ensure accurate filing and compliance.

- The RD-108 is exclusively for corporations. This form is applicable not only to corporations but also to partnerships, sole proprietorships, and fiduciaries. Any resident or nonresident individual engaged in business within Kansas City must file this return if they earn income.

- Losses cannot be reported on the RD-108. While individuals experiencing a loss may not report a negative amount, they are instructed to enter "0" on specific lines if there is no income to report. This practice ensures that the form is completed correctly, even in the absence of profits.

- Extension requests provide automatic relief from payment deadlines. It is important to note that filing an extension does not delay the requirement for payment. An extension may provide additional time for filing the return, but it necessitates the payment of estimated tax due to avoid penalties and interest.

- Only residents can claim credits for taxes paid to other cities. While credits are, in fact, available only to resident businesses, this misconception often leads nonresidents to overlook their obligation to file the RD-108 even when conducting business in Kansas City. Nonresidents must still report and pay taxes on income earned within the city.

- Providing a copy of the federal tax return is optional. Attaching a copy of the federal tax return or K-1 documentation is a requirement for accurate processing of the RD-108. This information supports the calculations provided on the form, ensuring compliance with city tax regulations.

Understanding these misconceptions can help navigate the complexities of tax filings more effectively. Each taxpayer's diligence plays a crucial role in honoring civic responsibilities and contributing to the community.

Key takeaways

Filling out and utilizing the RD-108 form requires attention to detail and adherence to specific guidelines. Consider the following key takeaways:

- The RD-108 form is for reporting profits for earnings tax in Kansas City, Missouri.

- Both resident and nonresident businesses must file if they derive income within the city.

- Corporations, partnerships, and proprietorships are included in the obligation to file.

- The due date for filing is typically May 17 annually unless on a fiscal year basis.

- If you need additional time, submit Form RD-111 along with estimated tax payment to obtain a six-month extension.

- Be sure to indicate the type of business in Line 1, as it directly affects reporting requirements.

- Gross receipts should appear on Line 3; this requires accurate records from supporting schedules.

- If no income was generated or there is a loss, ensure to enter "0" where applicable.

- Payment documentation is vital for claiming tax credits in Line 9 if tax was paid to another city.

- When applicable, attach any necessary schedules, including federal returns and K-1 forms.

Using these guidelines can contribute to a smoother filing process and help avoid potential penalties or confusion.

Browse Other Templates

Cdph 612 - Home health aide training programs should prioritize timely submission of the CDPH 183.

Cold Chain Management - Providing a backup contact ensures smooth operations in emergencies.

Safeway Jobs Near Me - This application is for non-California residents only.