Fill Out Your Reactivation Of Account Form

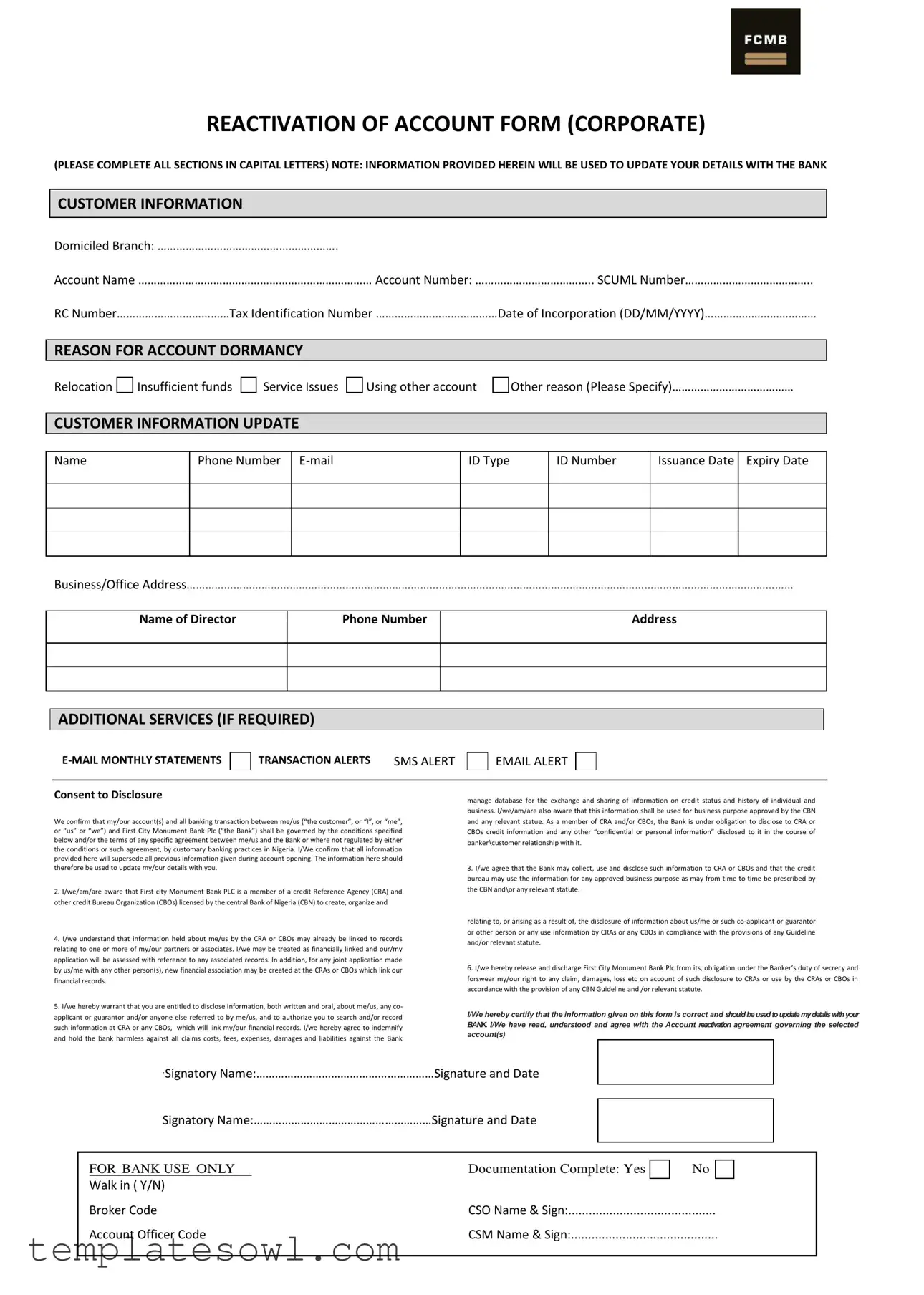

The Reactivation Of Account form is a crucial document designed for corporate customers looking to restore their dormant accounts. This form requires the completion of all sections in capital letters to ensure clarity and accuracy. Information provided will update the customer's details with the bank, and key sections include customer information, reasons for account dormancy, and consent for disclosure of information. Customers must provide specific details such as account name, account number, RC number, and tax identification number, along with a declaration regarding the reason for the account's inactivity. Additional services, if needed, can also be selected at this time.

Furthermore, the form emphasizes the importance of transparency, as it outlines the customer's consent to share information with credit reference agencies and other financial organizations. By filling out the Reactivation Of Account form, customers agree to indemnify the bank against claims associated with the information disclosed. It is essential for applicants to confirm the correctness of the provided data and to understand the implications of reactivating their accounts, particularly concerning their financial associations with other parties.

The final sections of the form are dedicated to bank use, ensuring that proper verification and documentation processes are followed. Customers will need to sign and date the form, certifying that the information is accurate and complete. Overall, this form serves as a comprehensive tool for account reactivation, ensuring that both the bank and the customer are aligned in their understanding and obligations.

Reactivation Of Account Example

REACTIVATION OF ACCOUNT FORM (CORPORATE)

(PLEASE COMPLETE ALL SECTIONS IN CAPITAL LETTERS) NOTE: INFORMATION PROVIDED HEREIN WILL BE USED TO UPDATE YOUR DETAILS WITH THE BANK

CUSTOMER INFORMATION

CUSTOMER INFORMATION

Do i iled Bra h: ………………………………………………….

Account Name ………………………………………………………………… Account Number: ……………………………….. “CUML Nu er…………………………………..

RC Number………………………………Tax Identification Number …………………………………Date of Incorporation DD/MM/YYYY ………………………………

REASON FOR ACCOUNT DORMANCY

REASON FOR ACCOUNT DORMANCY

Relocation |

|

Insufficient funds |

|

Service Issues |

CUSTOMER INFORMATION UPDATE

CUSTOMER INFORMATION UPDATE

Using other account

Other reason (Please “pe ify …………………………………

Name

Phone Number

ID Type

ID Number

Issuance Date Expiry Date

Busi ess/Offi e Address……………………………………………………………………………………………………………………………………………………………………………

NAME OF DIRECTOR

PHONE NUMBER

ADDRESS

ADDITIONAL SERVICES (IF REQUIRED)

ADDITIONAL SERVICES (IF REQUIRED)

TRANSACTION ALERTS SMS ALERT

EMAIL ALERT

CONSENT TO DISCLOSURE

We |

o |

fir |

that |

y/our a ou t s |

a |

d all a |

ki |

g tra |

sa tio |

et ee |

e/us |

the |

usto |

er , or |

I , or e , |

or |

us |

or |

e |

a d First City Mo |

u |

e t Ba |

k |

Pl |

the Ba k |

shall |

e go er |

ed |

y the |

o ditio |

s spe ified |

below and/or the terms of any specific agreement between me/us and the Bank or where not regulated by either the conditions or such agreement, by customary banking practices in Nigeria. I/We confirm that all information provided here will supersede all previous information given during account opening. The information here should therefore be used to update my/our details with you.

2.I/we/am/are aware that First city Monument Bank PLC is a member of a credit Reference Agency (CRA) and other credit Bureau Organization (CBOs) licensed by the central Bank of Nigeria (CBN) to create, organize and

4.I/we understand that information held about me/us by the CRA or CBOs may already be linked to records relating to one or more of my/our partners or associates. I/we may be treated as financially linked and our/my application will be assessed with reference to any associated records. In addition, for any joint application made by us/me with any other person(s), new financial association may be created at the CRAs or CBOs which link our financial records.

5.I/we hereby warrant that you are entitled to disclose information, both written and oral, about me/us, any co- applicant or guarantor and/or anyone else referred to by me/us, and to authorize you to search and/or record such information at CRA or any CBOs, which will link my/our financial records. I/we hereby agree to indemnify and hold the bank harmless against all claims costs, fees, expenses, damages and liabilities against the Bank

manage database for the exchange and sharing of information on credit status and history of individual and business. I/we/am/are also aware that this information shall be used for business purpose approved by the CBN and any relevant statue. As a member of CRA and/or CBOs, the Bank is under obligation to disclose to CRA or

CBOs redit i for atio a d a y other o fide tial or perso al i for atio dis losed to it i the ourse of

banker\customer relationship with it.

3.I/we agree that the Bank may collect, use and disclose such information to CRA or CBOs and that the credit bureau may use the information for any approved business purpose as may from time to time be prescribed by the CBN and\or any relevant statute.

relating to, or arising as a result of, the disclosure of information about us/me or such

6.I/we hereby release and discharge First City Monument Bank Plc from its, obligation u der the Ba ker’s duty of se re y a d forswear my/our right to any claim, damages, loss etc on account of such disclosure to CRAs or use by the CRAs or CBOs in accordance with the provision of any CBN Guideline and /or relevant statute.

I/We hereby certify that the information given on this form is correct and shouldbeused toupdatemydetailswithyour BANK. I/We have read, understood and agree with the Account reactivation agreement governing the selected account(s)

|

`Signatory Na |

e:…………………………………………………Signature and Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“ig atory Na |

e:…………………………………………………Signature and Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR BANK USE ONLY |

|

Documentation Complete: Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

||||

|

Walk in ( Y/N) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broker Code |

|

CSO Name & Sign: |

|

|

|

|

||

|

Account Officer Code |

|

CSM Name & Sign: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Reactivation of Account Form (Corporate) |

| Completion Requirement | All sections must be completed in capital letters. |

| Governing Law | The reactivation process is governed by the regulatory conditions specified by the Central Bank of Nigeria (CBN). |

| Customer Information | Information collected is used to update the customer's account details with the bank. |

| Consent to Disclosure | The bank is authorized to disclose information to Credit Reference Agencies (CRAs) and Credit Bureau Organizations (CBOs). |

| Certification of Information | Applicants must certify that all information provided is accurate and will supersede prior details. |

Guidelines on Utilizing Reactivation Of Account

After completing the Reactivation of Account form, the information will be processed to ensure your account is updated accurately. It's crucial to fill in all sections clearly and accurately. This ensures efficient processing and minimizes delays.

- Fill in your branch information in capital letters.

- Provide your account name and account number.

- Enter your CUML number and RC number, if applicable.

- Input your Tax Identification Number and the date of incorporation (DD/MM/YYYY).

- Select the reason for your account dormancy from the provided options.

- If applicable, specify an additional reason under "Other reason".

- Update your personal information, including your name, phone number, and e-mail ID.

- Provide your type of identification and numbers, including the issuance and expiry dates.

- Enter your business or office address clearly.

- List the name of the director associated with your account, along with their phone number and address.

- Indicate any additional services needed, such as monthly statements or transaction alerts (via SMS or email).

- Agree to the consent to disclosure by confirming your understanding of the terms presented.

- Sign and date the form where indicated, ensuring both signatory names are provided if applicable.

Once submitted, the bank staff will review your form. It is essential to keep a copy for your records and ensure all details are accurate to prevent any potential issues during processing.

What You Should Know About This Form

What is the purpose of the Reactivation of Account form?

The Reactivation of Account form is designed for corporate customers who wish to reactivate their dormant bank accounts. By filling out this form, customers provide necessary information to update their account details and restore access to their banking services.

What information is required to complete the form?

The form requires various details, including your account name, account number, corporate registration number, tax identification number, and date of incorporation. Additionally, you will need to provide a reason for the account's dormancy and your current contact information such as phone number and email address.

What should I do if my account is dormant due to insufficient funds?

If your account is dormant because of insufficient funds, you can note this in the section provided for the reason for dormancy. After reactivation, ensure you deposit sufficient funds to avoid future dormancy issues.

How does the bank use the information provided in the form?

The bank uses the provided information to update your account details in its system. This ensures that your records are current and accurate, which is essential for maintaining your banking relationship.

Can I request additional services while reactivating my account?

Yes, the form allows you to indicate if you would like additional services, such as monthly statements or transaction alerts. Simply check the relevant boxes to request these services as part of your reactivation process.

What if I have recently changed my business address?

You should fill in your current business address directly on the form. Providing the updated address ensures that all communications and statements are sent to the correct location going forward.

Will the bank disclose my information to credit reference agencies?

Yes, as a member of credit reference agencies (CRAs) and credit bureau organizations (CBOs), the bank may disclose your information as necessary. This practice aids in assessing your financial standing in a systematic manner, and it's detailed in the consent section of the form.

How do I sign the form for multiple signatories?

Each signatory must complete and sign the form separately. Ensure all signatories include their names, signatures, and dates where indicated, thereby affirming their consent to the information provided.

What happens after I submit the Reactivation of Account form?

Once submitted, the bank will review the form and any attached documentation. If everything is complete, the account will be reactivated, and you will be notified of your renewed access to banking services.

What if my form is incomplete or missing information?

If your form is incomplete, the bank may contact you for the missing information or documentation. Therefore, it is crucial to double-check that all sections are filled out accurately before submission to avoid delays in the reactivation process.

Common mistakes

Filling out the Reactivation of Account form can be daunting. Many individuals overlook key points that could delay the process or lead to complications. One common mistake involves failing to complete all sections of the form. It is vital to provide information in every required field to avoid rejection. Leaving blank spaces can suggest carelessness or lack of attention to detail.

Another frequent error pertains to the use of improper formatting. The instructions specifically state that information should be completed in capital letters. Ignoring this guideline may not only result in confusion but could also prompt the bank to return the form for corrections. Always remember that attention to instructions can expedite processing.

People often misinterpret the requirement for the Tax Identification Number (TIN). Some may accidentally enter incorrect digits or provide an outdated number. This error needs rectification, as the TIN is crucial for identification and verification purposes. Accuracy in this section is paramount to ensure compliance with tax regulations.

In the reason for account dormancy section, applicants sometimes provide vague descriptions. Simply indicating "other reasons" without a thorough explanation can hinder understanding. It’s essential to be as specific as possible when describing why the account may have been inactive. Clarity here helps the bank assess your situation more effectively.

Contact information errors also commonly occur. Individuals may transpose numbers in the phone number fields or provide outdated email addresses. The bank needs accurate contact information to reach you regarding your application or any further requirements. Double-checking this information can save time later on.

Omitting signature fields is another notable mistake. Users often forget to sign and date the form, assuming that electronic submissions do not require physical signatures. However, a lack of signature can lead to processing delays, as the bank must confirm the validity of the application. Always ensure that all necessary signatures are included before submission.

Overlooking consent to disclose personal information can lead to complications in processing. Some may fail to read this section thoroughly and neglect to provide consent. Not understanding the implications of this consent could prevent the bank from accessing important information that might be vital for the reactivation process.

Another misstep is neglecting to review the reactivation agreement in its entirety. Not taking the time to understand the terms and conditions can lead to confusion about what is being agreed upon. This oversight could hinder expectations regarding account management and services received from the bank.

Lastly, individuals may forget to follow up after submitting the form. Some think that once submitted, the process is entirely out of their hands. However, following up not only shows initiative but helps ensure that your application is being processed. Maintaining communication can clarify any outstanding issues that might need attention.

Documents used along the form

When reactivating an account, several other forms and documents may be needed to ensure a smooth process. Each of these documents serves a specific purpose in updating or validating customer information with the bank. Here’s a look at some commonly required documents:

- Account Verification Form: This document is essential for confirming the identity of the account holder. It often includes personal information like social security numbers and addresses to protect against fraud.

- Identity Verification Documents: These can be government-issued IDs or passports that help verify the customer's identity. They ensure that the individual requesting the reactivation is indeed the authorized account holder.

- Proof of Address: Utility bills, lease agreements, or bank statements are commonly accepted as proof of residence. This information is crucial for maintaining current contact details for communication and updates.

- Authorization Letter: If a third party is acting on behalf of the account holder, this letter grants them permission to access account information. It must be signed by the account holder and clearly outline the scope of authority.

- Compliance Declaration: This is a document stating that the customer agrees to abide by the bank's terms and conditions. By signing this declaration, the account holder acknowledges their understanding of banking regulations and responsibilities.

Gathering the correct forms and documents ensures a hassle-free account reactivation process. Be prepared and make sure all information is current and accurate before submitting your request. This will help expedite your account's reactivation and restore access to your banking services promptly.

Similar forms

- Account Opening Form: Similar to the Reactivation of Account form, the Account Opening Form collects essential information about the account holder. Both forms require identification details and authorization for disclosure of information related to the account.

- Change of Information Form: This document is used when an account holder wants to update contact information or personal details. Like the Reactivation form, it requires specific data and customer consent.

- Account Closure Form: When an account is to be closed, this form gathers final details about the account holder. It emphasizes consent and acknowledgement, similar to the reactivation process.

- Power of Attorney Document: This legal document allows one person to act on behalf of another. Both require signatures and specific identification, ensuring the individual has the authority to manage financial matters.

- Direct Deposit Authorization Form: This form authorizes deposits directly into an account. Like the Reactivation form, it seeks consent and pertinent banking information necessary for processing.

- Loan Application Form: When applying for a loan, a customer provides their financial information to assess eligibility. This parallels the Reactivation form where the bank gathers necessary information to update the client’s records.

- Beneficiary Designation Form: This document allows account holders to specify beneficiaries for their accounts. It requires personal and contact information from the account holder, much like the Reactivation form.

- Credit Card Application Form: Similar to the Reactivation of Account form, it collects personal and financial details to evaluate eligibility for credit, requiring customer consent for information sharing.

- Address Change Notification: This form allows customers to inform the bank about a change in their address. It parallels the Reactivation form in its function of updating customer information in bank records.

- Account Statement Request Form: Customers use this to request copies of their account statements. This form, like the Reactivation form, ensures the bank has updated information for accurate documentation.

Dos and Don'ts

When filling out the Reactivation Of Account form, it is important to follow specific guidelines to ensure a smooth process. Below are key do's and don'ts to comply with:

- Do complete all sections in capital letters to ensure legibility.

- Do provide accurate information, including your Account Name and Account Number.

- Do specify the reason for account dormancy clearly to assist the bank in processing your request.

- Do include your Tax Identification Number and RC Number for verification purposes.

- Don’t leave any sections blank; incomplete forms may delay reactivation.

- Don't use informal language or abbreviations; clarity is key in formal documents.

- Don't forget to sign and date the form at the end, as this confirms your understanding and agreement.

Misconceptions

- Misconception 1: Everyone can reactivate their account easily.

- Misconception 2: The form can be filled out in any way.

- Misconception 3: Dormant accounts are reactivated without checking information.

- Misconception 4: The reasons for dormancy do not matter.

- Misconception 5: All accounts can be reactivated immediately.

- Misconception 6: A single signature is enough for multiple account holders.

- Misconception 7: Providing updated information is not important.

Account reactivation is not automatically granted. It requires specific steps and completion of the Reactivation of Account form. The bank may also need to review the reasons for the account's dormancy.

The Reactivation of Account form must be completed in capital letters. This requirement helps ensure clarity and accuracy in the information provided.

The bank will scrutinize the details provided in the form. It also reviews the account holder’s history and any outstanding issues before reactivation.

Understanding why the account became dormant is critical. Depending on the reason selected, the bank may take different actions during the reactivation process.

Reactivation times can vary. The bank may require additional processing time, especially if they need more information or clarification from the account holder.

If the account has multiple signatories, each individual may need to sign the form for reactivation. This assures all parties are aware of and agree to the changes.

Accurate and current information is crucial for reactivation. The bank will use this information to update records and ensure compliance with necessary regulations.

Key takeaways

Here are some key takeaways regarding the completion and use of the Reactivation Of Account form:

- Complete Every Section: It is crucial to fill out all sections of the form in capital letters. Leaving any section incomplete may delay the reactivation process.

- Provide Accurate Information: Ensure that all personal and account details, such as your account name, number, and tax identification number, are correct. This information will be used to update your records with the bank.

- Specify the Reason for Dormancy: Clearly indicate why the account has been inactive. Reasons may include relocation, insufficient funds, or service issues, among others. Providing this information helps the bank understand your situation better.

- Consent for Disclosure: You must agree to the bank's terms regarding sharing your information with credit reference agencies. Remember, this consent is vital for compliance and to ensure your reactivation request is processed effectively.

Browse Other Templates

How Do I Donate My Body to Science When I Die - Direct contact information is necessary, including phone numbers and addresses.

Anthem 151 Form - Be mindful of deadlines related to submitting your claim adjustments.