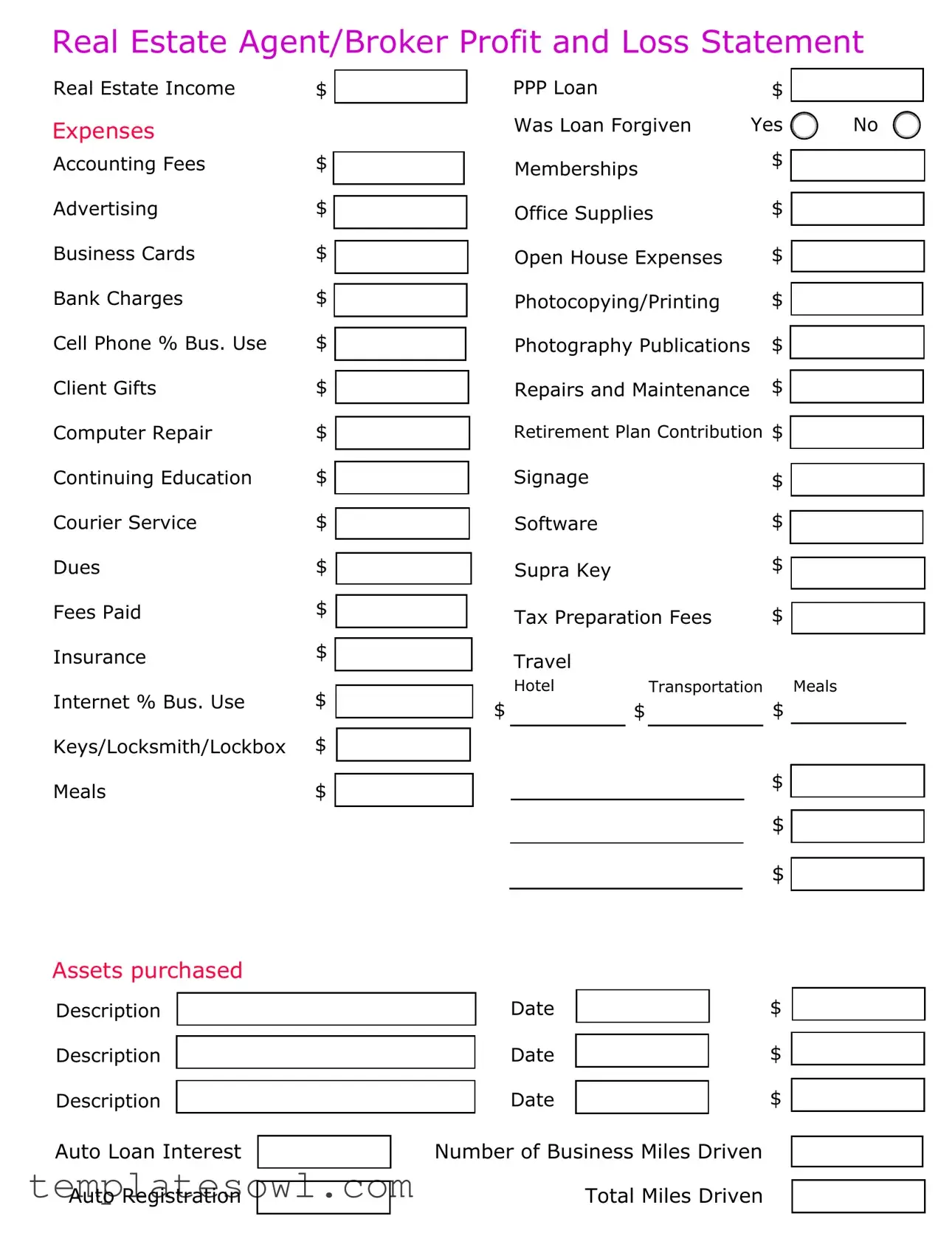

Fill Out Your Real Estate Agent Profit Form

In the dynamic landscape of real estate, understanding financial performance is essential for agents and brokers alike. The Real Estate Agent Profit and Loss Statement provides a comprehensive overview of an agent's income and expenses, allowing for a clearer picture of profitability. This form collects various streams of income, such as commissions from property sales and rental transactions, showcasing the potential earnings that constitute a real estate professional's revenue. On the expense side, agents are required to detail costs associated with their business operations, including accounting fees, advertising expenses, continuing education, and client gifts. Additional expenses capture the nuances of real estate work life, encompassing everything from cell phone and internet use to office supplies and professional dues. Notably, the statement allows agents to input information related to any government assistance received, such as a PPP loan and whether it was forgiven, providing better insight into the financial health of the practice during fluctuating economic times. Agents are also prompted to record their business travel expenses, detailing costs related to hotels and transportation, which further illustrates the investment made into their career. This form is not merely a collection of numbers; it encapsulates the essence of real estate practice and is a crucial tool for evaluating profitability and making informed business decisions.

Real Estate Agent Profit Example

Real Estate Agent/Broker Profit and Loss Statement

Real Estate Income $

Expenses

Accounting Fees |

$ |

Advertising |

$ |

Business Cards |

$ |

Bank Charges |

$ |

Cell Phone % Bus. Use |

$ |

Client Gifts |

$ |

Computer Repair |

$ |

Continuing Education |

$ |

Courier Service |

$ |

Dues |

$ |

Fees Paid |

$ |

Insurance |

$ |

Internet % Bus. Use |

$ |

Keys/Locksmith/Lockbox |

$ |

Meals |

$ |

PPP Loan |

|

$ |

|

|

Was Loan Forgiven |

Yes |

No |

||

Memberships |

|

$ |

|

|

|

|

|||

|

|

|

|

|

Office Supplies |

$ |

|

|

|

|

|

|||

Open House Expenses |

$ |

|

|

|

|

|

|||

Photocopying/Printing |

$ |

|

|

|

|

|

|||

Photography Publications |

$ |

|

|

|

|

|

|||

Repairs and Maintenance |

$ |

|

|

|

|

|

|||

|

|

|||

Retirement Plan Contribution $ |

|

|||

Signage |

|

$ |

|

|

|

|

|

||

|

|

|

||

Software |

|

$ |

|

|

|

|

|

||

|

|

|

||

Supra Key |

|

$ |

|

|

|

|

|

||

|

|

|

||

|

|

|

|

|

Tax Preparation Fees |

$ |

|

|

|

|

|

|||

|

|

|||

Travel |

|

|

|

|

|

|

|

|

|

Hotel |

Transportation |

Meals |

||

$$$

$

$

$

Assets purchased

Description

Description

Description

Auto Loan Interest

Auto Registration

Date |

|

$ |

|

|

|

Date |

|

$ |

|

|

|

Date |

|

$ |

Number of Business Miles Driven

Total Miles Driven

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used by real estate agents and brokers to track income and expenses, helping them assess profitability. |

| Income Section | The form includes a section for reporting various sources of real estate income, providing a comprehensive overview of earnings. |

| Expense Tracking | Agents must document their expenses, such as advertising and office supplies, to calculate net profit accurately. |

| PPP Loan | The form allows agents to report any Paycheck Protection Program loans they received and whether they were forgiven. |

| State-Specific Requirements | Compliance with state-specific regulations may be necessary. In California, for example, the governing law is that agents must follow the California Business and Professions Code. |

| Mileage Tracking | Agents must document business mileage to deduct vehicle expenses appropriately, which helps in tax preparation. |

| Record Keeping | It's important for agents to maintain thorough records of all entries on the form to support their profitability claims during tax audits. |

| Software and Tools | Agents might invest in software for managing finances, which can streamline the process of keeping track of income and expenses. |

Guidelines on Utilizing Real Estate Agent Profit

Completing the Real Estate Agent Profit form is a straightforward process that allows real estate professionals to accurately reflect their income and expenses. This document gathers crucial financial information, helping to present a clear picture of profitability. Follow these steps carefully to ensure that all necessary information is captured effectively.

- Begin by writing your name or the name of your real estate brokerage at the top of the form, as well as the relevant period for which you’re reporting.

- In the **Real Estate Income** section, list all sources of income. Enter the total amount earned during the specified period.

- Move on to the **Expenses** section. This is where you will detail your expenditures.

- For each item listed under expenses, fill in the amount spent. Be diligent in accounting for the following:

- Accounting Fees

- Advertising

- Business Cards

- Bank Charges

- Cell Phone % Business Use

- Client Gifts

- Computer Repair

- Continuing Education

- Courier Service

- Dues

- Fees Paid

- Insurance

- Internet % Business Use

- Keys/Locksmith/Lockbox

- Meals

- PPP Loan and its forgiveness status

- Memberships

- Office Supplies

- Open House Expenses

- Photocopying/Printing

- Photography

- Publications

- Repairs and Maintenance

- Retirement Plan Contribution

- Signage

- Software

- Supra Key

- Tax Preparation Fees

- Travel (including Hotel, Transportation, and Meals)

- For any **Assets purchased**, provide descriptions and relevant amounts next to each item.

- Next, record any **Auto Loan Interest** and **Auto Registration** details along with the corresponding dates.

- Lastly, calculate your total business miles driven and the total miles driven for personal records. Fill these figures in the designated spaces.

What You Should Know About This Form

What is the Real Estate Agent Profit form for?

The Real Estate Agent Profit form is designed to help real estate agents and brokers track their income and expenses. This form serves as a profit and loss statement, allowing you to see how much you earn versus how much you spend in your real estate business. By organizing your financial information in one place, you can gain a clearer understanding of your profitability, which is essential for making informed business decisions.

What types of income should I include on this form?

Include any income that you receive related to your real estate activities. This typically includes commissions from property sales, referral fees, and any other earnings directly linked to your real estate work. It's important to be thorough to accurately reflect your financial situation, so consider every source of income you may have generated over the reporting period.

What expenses are considered deductible on the form?

Many expenses can be classified as deductible. Common examples include advertising costs, office supplies, and fees for business-related services, such as accounting and tax preparation. You may also deduct business-related travel expenses, including transportation, meals, and accommodation. Keeping detailed records of these expenses will help you capture all eligible deductions effectively.

How do I determine the percentage of personal versus business use for expenses like my cell phone and internet?

To determine the percentage of personal versus business use for expenses such as your cell phone and internet, you should monitor your usage patterns. For example, if you find that 60% of your calls are business-related, you would classify 60% of your cell phone bill as a business expense. A similar approach applies to your internet usage. The key is to document your usage to support your calculations in case of an audit.

What should I do if I have not kept receipts or records for my expenses?

If you haven’t kept records or receipts, it’s essential to start tracking your expenses moving forward. For any past expenses, try to reconstruct your records as best as you can by checking bank statements or credit card bills. You can also review emails, calendars, and other relevant documents for clues. However, it’s important to note that good record-keeping practices will help mitigate issues in the future and provide clearer financial insights.

Do I need to include loans and liabilities in my profit form?

The Real Estate Agent Profit form focuses primarily on income and expenses rather than loans and liabilities. However, it may be useful to track items like auto loan interest separately if those expenses were incurred for business purposes. Doing so will provide a fuller picture of your financial situation, especially when understanding cash flow and profitability.

How often should I update my Real Estate Agent Profit form?

It is recommended to update your Real Estate Agent Profit form regularly—ideally monthly or quarterly. Frequent updates help you stay on top of your income and expenses, allowing you to monitor your financial health effectively. By reviewing your profits and losses often, you can make timely adjustments to your business strategies or spending habits, ultimately leading to improved profitability.

Common mistakes

When filling out the Real Estate Agent Profit form, many individuals stumble upon common pitfalls that can affect the accuracy of their financial statements. One major mistake is failing to accurately categorize expenses. For instance, mixing personal and business expenses can lead to misleading figures. It’s crucial to clearly separate these to get an accurate view of profitability.

Another frequent error is neglecting to include all sources of income. Real estate agents may have diverse revenue streams—from sales commissions to referral fees. By not listing every income source, agents risk underestimating their total earnings, which in turn affects financial planning and tax liabilities.

Many people also underestimate their expenses, either by forgetting to include smaller costs or by inaccurately estimating larger ones. Small expenses, like office supplies or business cards, can add up quickly. If they are not accounted for, the overall profit will appear inflated. Being thorough and meticulous in tracking these costs is essential.

The use of percentages can also trip up many agents. For example, when indicating the business use of cell phone and internet services, it’s important to be precise. Rounding numbers or guessing usage percentages can lead to skewed results. Accurate tracking over a month or a year can provide better clarity.

This form also includes sections for PPP loans and loan forgiveness status. Many individuals forget to document whether their PPP loans were forgiven, which can affect the financial picture. This detail is crucial, as it may turn a liability into additional income.

Failure to complete the mileage section correctly is another common misstep. Reporting only total miles driven without specifically noting business miles can lead to an inaccurate representation of vehicle expenses. It’s better to keep a detailed mileage log to ensure nothing is left out.

Budgeting for advertising and marketing is another area where agents often make errors. Whether for social media campaigns or traditional advertising, overlooking these expenses can lead to an unrealistic profit projection. Keeping all advertising receipts and allocating the correct amounts can provide a more accurate picture.

Many agents also overlook the reporting of continuing education expenses. The real estate field constantly evolves, and investing in development is vital. If these costs are not included, the profit outlook might seem healthier than it really is.

Lastly, always remember to check and double-check all entries. A simple typo or miscalculation can ripple through the entire form, leading to incorrect conclusions. Accurate financial information is vital for making informed business decisions.

Documents used along the form

In the world of real estate, various forms and documents complement the Real Estate Agent Profit form. These documents aid agents in managing their finances, tracking expenses, and ensuring compliance with industry regulations. Here’s a brief overview of seven key forms that real estate professionals frequently use alongside their Profit and Loss Statements.

- Listing Agreement: This document outlines the terms between a seller and an agent, including the agent's commission and responsibilities. It formalizes the agent’s authority to market and sell a property.

- Buyer’s Representation Agreement: Similar to the listing agreement, this form establishes the relationship between a buyer and an agent. It details the agent's duties and entitles them to compensation in exchange for their services in finding a property.

- Closing Statement (HUD-1): This document summarizes the financial transaction at closing. It lists all the costs associated with the sale, including fees, taxes, and other expenses, ensuring transparency for both parties.

- Property Disclosure Form: Sellers must complete this form to disclose any known defects or issues with the property. It safeguards buyers by informing them about the property's condition before they make a purchase.

- Real Estate Commission Agreement: This internal document defines how the agent's commission will be calculated and distributed among the involved parties. Clarity on percentage splits and timelines helps avoid disputes later.

- Marketing Plan: This strategic outline details how a property will be marketed to potential buyers. It may include advertising methods, target audiences, and timelines, ensuring a focused approach to selling.

- Expense Report: Agents utilize this form to track everyday expenses related to their business activities. It helps in itemizing costs and assists in reporting accurate profit and loss figures on the Real Estate Agent Profit form.

Understanding these documents not only streamlines the operational aspects of a real estate agency but also plays a vital role in maximizing profitability and minimizing risks. Together with the Real Estate Agent Profit form, they contribute to a well-structured and transparent approach to real estate transactions.

Similar forms

-

Profit and Loss Statement: Just like the Real Estate Agent Profit form, a Profit and Loss Statement provides an overview of income, expenses, and overall profitability during a specific period. It is essential for tracking financial health.

-

Income Statement: This document serves a similar purpose as the Real Estate Agent Profit form. Both outline total revenues and expenses, providing insights into financial performance. They help agents understand where their money goes.

-

Business Expense Report: A Business Expense Report highlights expenses incurred in conducting business. Similar to the Real Estate Agent Profit form, it ensures that all expenses are accounted for, aiding in effective financial management.

-

Cash Flow Statement: This document tracks the flow of cash in and out of a business. Like the Real Estate Agent Profit form, it emphasizes the importance of managing cash effectively to maintain operational stability and growth.

-

Tax Return Schedule C: Schedule C is used by sole proprietors to report income or loss from their business. It closely aligns with the Real Estate Agent Profit form, detailing both income and expenses necessary for tax filing.

-

Budget Planning Worksheet: A Budget Planning Worksheet assists in estimating future income and expenses. Similar to the Real Estate Agent Profit form, it helps agents manage their finances and forecast profitability.

-

Annual Financial Report: This report encompasses a comprehensive overview of a business’s financial performance over a year. Much like the Real Estate Agent Profit form, it presents income, expenses, and net profit, offering a broad perspective on financial health.

Dos and Don'ts

When filling out the Real Estate Agent Profit form, consider these important actions and precautions. This ensures you provide accurate information and avoid potential issues.

- Gather all necessary documentation before starting the form. This includes receipts, bank statements, and records related to your income and expenses.

- Use clear and concise language. Write in straightforward terms to avoid confusion.

- Double-check your calculations for accuracy. Mistakes in numbers can lead to discrepancies.

- Include all relevant income. This should encompass any commissions, fees, or bonuses received.

- Break down your expenses clearly. Detail each cost to provide a comprehensive view of your financial situation.

- Ensure consistency in your reporting period. Use the same time frame for all income and expenses.

- Review for completeness. Make sure all sections are filled out fully before submitting.

Also, here are some actions to avoid:

- Do not omit any income sources. Failing to report earnings can create issues later.

- Avoid using vague terms. Be specific about the items and amounts listed.

- Don’t mix personal expenses with business expenses. Keep them separate for clarity.

- Do not ignore deadlines for submission. Late forms can affect your financial reporting.

- Refrain from providing false information. Honesty is crucial in all financial statements.

- Do not rush through the form. Take your time to ensure all details are correct.

- Avoid assuming you remember figures. Always refer to documented evidence for accuracy.

Misconceptions

Understanding the Real Estate Agent Profit form can be crucial for agents and brokers as they navigate their businesses. However, several misconceptions persist that could lead to confusion. Here are nine common misunderstandings about this important financial document:

- The Profit form only tracks income. Many believe that the form focuses solely on income generated. In reality, it meticulously details both income and expenses, providing a complete overview of profitability.

- All expenses are tax-deductible. While numerous expenses can be deducted, not all are eligible. Personal expenses, for example, do not qualify and can lead to issues if claimed incorrectly.

- Expense categorization is not important. Some agents underestimate the significance of accurately categorizing expenses. Proper categorization helps in identifying which areas of the business are most profitable and where savings can be made.

- The form is only for large brokerages. This form benefits all types of agents and brokers, regardless of their size. Individual agents can also gain valuable insights into their financial health.

- Expenses must be recorded daily. There is a misconception that records need to be updated every day. While regular updates are helpful, it is more important to maintain consistent records, whether weekly or monthly.

- Only direct expenses matter. Many mistakenly focus solely on direct expenses associated with transactions. However, indirect expenses, like advertising or communication costs, can also significantly impact overall profitability.

- This form is only used for tax purposes. While it is certainly valuable for taxation, the Profit form can also assist in business planning and growth assessments.

- All income sources are reported the same way. Agents may think all income streams, like commission or bonuses, are recorded uniformly. Different types of income may need to be categorized separately for clarity.

- The form is difficult to understand. Some agents feel overwhelmed by the document, thinking it’s complex. With clear examples and regular use, understanding it becomes much easier over time.

By addressing these misconceptions, real estate professionals can better harness the power of the Real Estate Agent Profit form to make informed business decisions, ensure compliance, and enhance their overall financial strategies.

Key takeaways

Here are key takeaways regarding the filling out and usage of the Real Estate Agent Profit form:

- The form helps track both income and expenses, which is essential for understanding profitability.

- Real estate income must be reported accurately, including all transactions related to sales and commissions.

- Expenses are categorized for clarity. These categories include advertising, office supplies, and insurance, among others.

- Consider the percentage of personal versus business use for items like cell phone and internet services.

- Notable expenses such as meals, travel, and continuing education can impact overall profit margins.

- Be aware of any loans, such as the PPP loan, and indicate whether they have been forgiven, as this affects financial statements.

- Document assets purchased, including vehicles, and provide details such as loan interest and registration dates.

- The total business miles driven should be reported to accurately assess vehicle-related expenses.

Browse Other Templates

Where Can You Get Tax Forms - Engaging with LITCs can be beneficial for struggling taxpayers.

Tsp 99 Form - If a primary beneficiary predeceases you, the share will be distributed among the remaining beneficiaries.