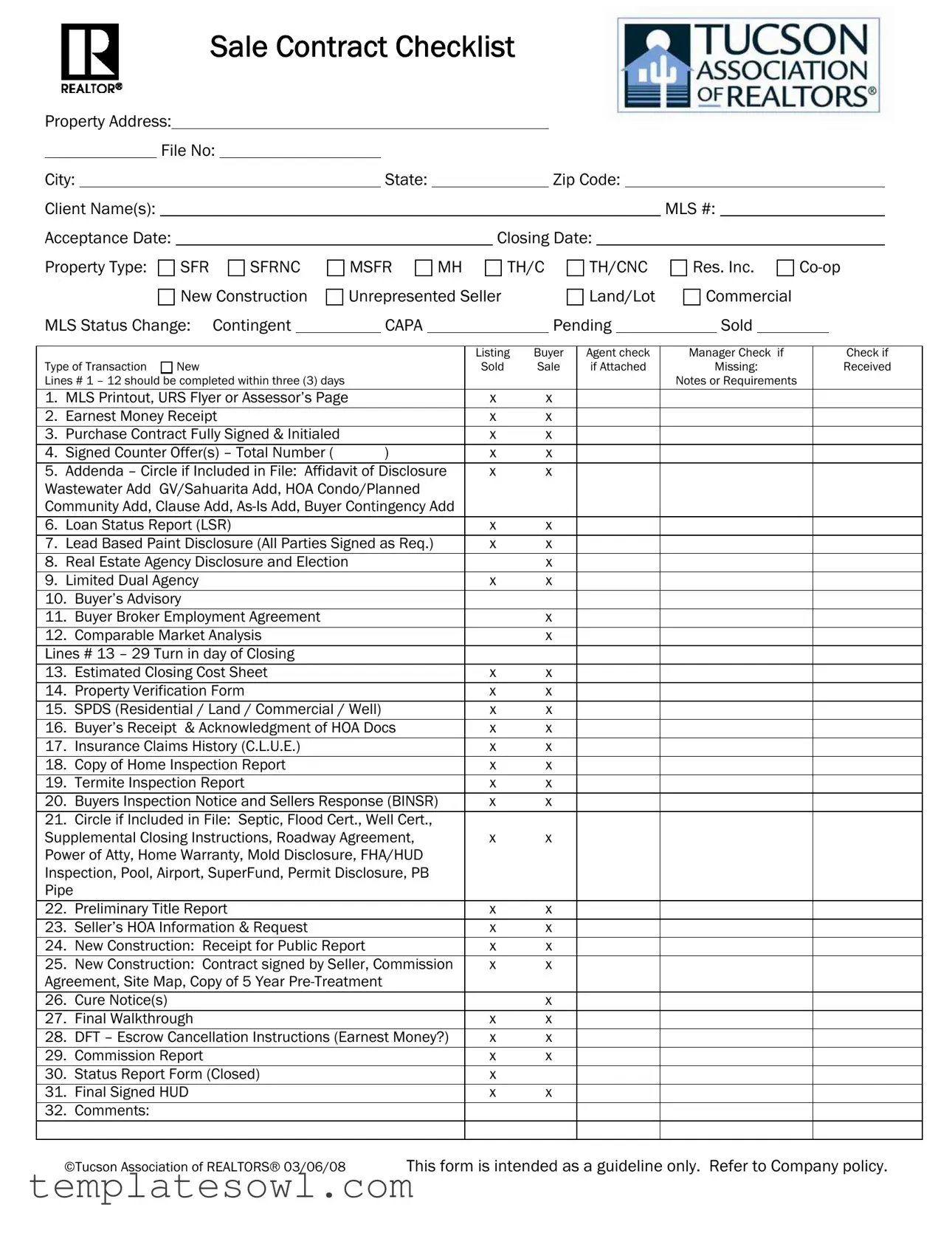

Fill Out Your Real Estate Checklist Form

Navigating the complexities of real estate transactions can be daunting, whether for buyers, sellers, or agents. A key tool that simplifies this process is the Real Estate Checklist form, which helps ensure that all necessary documents and requirements are addressed in a systematic manner. This checklist is designed to cover various aspects of a sale contract, starting from essential property details like address, city, and state to specifics such as the buyer's and seller's information. It outlines types of properties involved—ranging from single-family residences to commercial properties—and details specific transaction types. The form also includes lists of important documents needed at different stages of the transaction, such as earnest money receipts, signed purchase contracts, and various disclosures. Critical deadlines are highlighted, ensuring that necessary documents are completed within specified time frames. Some sections focus on requirements for closing day, emphasizing items like estimated closing cost sheets and property verification forms. Ultimately, this checklist acts as a vital reminder to manage the myriad tasks involved in real estate deals, streamlining the process and reducing the potential for errors or missed opportunities.

Real Estate Checklist Example

Sale Contract Checklist

|

Property Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

File No: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

City: |

|

|

|

|

|

|

|

State: |

|

|

|

|

|

Zip Code: |

|

|

|

|

|

|

|

|

|

|||||||||

|

Client Name(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLS #: |

|

|

|

|

|

||||||

|

Acceptance Date: |

|

|

|

|

|

|

|

|

|

|

|

Closing Date: |

|

|

|

|

|

|

|

|

|

|||||||||||

|

Property Type: |

|

SFR |

|

SFRNC |

MSFR |

MH |

|

TH/C |

TH/CNC |

Res. Inc. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

New Construction |

Unrepresented Seller |

|

|

Land/Lot |

Commercial |

|

|

|

|

||||||||||||||||

|

MLS Status Change: |

Contingent |

|

|

CAPA |

|

|

|

|

|

Pending |

|

|

|

Sold |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Listing |

Buyer |

Agent check |

|

Manager Check if |

|

|

Check if |

|||||||||

|

Type of Transaction |

|

New |

|

|

|

|

|

|

|

|

Sold |

Sale |

if Attached |

|

Missing: |

|

|

Received |

||||||||||||||

|

Lines # 1 – 12 should be completed within three (3) days |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes or Requirements |

|

|

|

|

|||||||||||||

|

1. MLS Printout, URS Flyer or Assessor’s Page |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

2. Earnest Money Receipt |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

3. |

Purchase Contract Fully Signed & Initialed |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

4. |

Signed Counter Offer(s) – Total Number ( |

) |

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

5. |

Addenda – Circle if Included in File: Affidavit of Disclosure |

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Wastewater Add GV/Sahuarita Add, HOA Condo/Planned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Community Add, Clause Add, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

6. Loan Status Report (LSR) |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

7. |

Lead Based Paint Disclosure (All Parties Signed as Req.) |

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

8. |

Real Estate Agency Disclosure and Election |

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

9. Limited Dual Agency |

|

|

|

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

10. |

Buyer’s Advisory |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

11. |

Buyer Broker Employment Agreement |

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

12. |

Comparable Market Analysis |

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Lines # 13 – 29 Turn in day of Closing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

13. |

Estimated Closing Cost Sheet |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

14. |

Property Verification Form |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

15. |

SPDS (Residential / Land / Commercial / Well) |

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

16. |

Buyer’s Receipt & Acknowledgment of HOA Docs |

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

17. |

Insurance Claims History (C.L.U.E.) |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

18. |

Copy of Home Inspection Report |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

19. |

Termite Inspection Report |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

20. |

Buyers Inspection Notice and Sellers Response (BINSR) |

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

21. |

Circle if Included in File: Septic, Flood Cert., Well Cert., |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Supplemental Closing Instructions, Roadway Agreement, |

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Power of Atty, Home Warranty, Mold Disclosure, FHA/HUD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Inspection, Pool, Airport, SuperFund, Permit Disclosure, PB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Pipe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

22. |

Preliminary Title Report |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

23. |

Seller’s HOA Information & Request |

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

24. |

New Construction: Receipt for Public Report |

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

25. |

New Construction: Contract signed by Seller, Commission |

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Agreement, Site Map, Copy of 5 Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

26. |

Cure Notice(s) |

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

27. |

Final Walkthrough |

|

|

|

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

28. |

DFT – Escrow Cancellation Instructions (Earnest Money?) |

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

29. |

Commission Report |

|

|

|

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

30. |

Status Report Form (Closed) |

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

31. |

Final Signed HUD |

|

|

|

|

|

|

|

|

x |

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

32. |

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

©Tucson Association of REALTORS® 03/06/08 |

|

This form is intended as a guideline only. Refer to Company policy. |

|||||||||||||||||||||||||||||

©Tucson Association of REALTORS® 03/06/08 |

This form is intended as a guideline only. Refer to Company policy. |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Real Estate Checklist is designed to ensure all necessary documentation is collected during a real estate transaction. |

| Requirements | Certain documents must be completed and submitted within three days of the sale contract acceptance. |

| Completion Timeline | Lines #1-12 should be provided within three days; Lines #13-29 are due on the closing day. |

| Key Documents | Essential documents include the Purchase Contract, Earnest Money Receipt, and Lead-Based Paint Disclosure. |

| Types of Properties | The checklist accommodates various property types, including residential, commercial, and new construction. |

| MLS Involvement | Real estate listings are tracked through the MLS, affecting the status updates on the checklist. |

| Governance | This checklist adheres to Arizona real estate laws, ensuring compliance with local regulations. |

| Final Documentation | Final documents include the HUD statement and Status Report Form, ensuring all transactions are properly recorded. |

Guidelines on Utilizing Real Estate Checklist

Filling out the Real Estate Checklist form is an essential process for ensuring all necessary documents and information are accounted for during a real estate transaction. Following these steps will help streamline the preparation and submission of required documentation.

- Property Address: Fill in the complete address of the property, including the street number, street name, and any unit number.

- File No: Enter the assigned file number for the property.

- City: Write down the name of the city where the property is located.

- State: Indicate the state where the property can be found.

- Zip Code: Fill in the zip code associated with the property address.

- Client Name(s): List the names of all clients involved in the transaction.

- MLS #: Enter the Multiple Listing Service number for the property.

- Acceptance Date: Specify the date the sale contract was accepted.

- Closing Date: Note the expected closing date for the transaction.

- Property Type: Select the appropriate property type by marking the relevant box.

- MLS Status Change: Check the status of the property: Contingent, Pending, or Sold.

- Buyer Agent Check: Confirm if a buyer's agent is involved.

- Manager Check: Indicate if a manager needs to be notified.

- Type of Transaction: Select the type of transaction (New or Sold) and check if a sale is attached.

- Missing: Identify any missing documents from lines #1-12 and ensure they are received within three days.

For lines #13-32, note that these items should be submitted on the day of closing. Make sure to gather and verify all required documents, including closing cost sheets, inspection reports, and title information. Fill in the checklist accurately to ensure a smooth transaction.

- Estimated Closing Cost Sheet: Prepare and include the estimated closing costs.

- Property Verification Form: Complete the property verification form.

- SPDS: Include the Seller's Property Disclosure Statement (choose appropriate type).

- Buyer’s Receipt & Acknowledgment of HOA Docs: Gather the acknowledgment from the buyer.

- Insurance Claims History (C.L.U.E.): Collect the claims history report.

- Copy of Home Inspection Report: Make sure to have a copy of the home inspection.

- Termite Inspection Report: Acquire the termite inspection report.

- Buyers Inspection Notice and Sellers Response (BINSR): Get the completed BINSR form.

- Included Files: Circle relevant included files like septic, flood certification, and other disclosures.

- Preliminary Title Report: Obtain the preliminary title report.

- Seller’s HOA Information & Request: Gather necessary information regarding the seller’s HOA.

- New Construction Docs: Prepare all documents required for new construction, such as public reports and contracts.

- Cure Notice(s): Document any cure notices issued.

- Final Walkthrough: Confirm the final walkthrough is complete.

- DFT – Escrow Cancellation Instructions: Provide instructions regarding earnest money cancellation.

- Commission Report: Include the commission report in the documentation.

- Status Report Form (Closed): Prepare the status report form indicating the closing status.

- Final Signed HUD: Collect the final signed HUD form.

- Comments: Add any additional comments or notes as needed.

Completing the checklist thoroughly will help ensure that all necessary details are covered and that the transaction proceeds as smoothly as possible.

What You Should Know About This Form

What is the purpose of the Real Estate Checklist form?

The Real Estate Checklist form serves as a comprehensive guide to ensure that all necessary documents and requirements are completed and organized for a property transaction. This form helps both buyers and sellers keep track of essential paperwork, making the closing process smoother and more efficient. It outlines everything from the sale contract to specific disclosures and inspections, providing clarity for all parties involved.

What information do I need to complete the Real Estate Checklist form?

You need to provide various details regarding the property and transaction. This includes the property address, client names, property type, acceptance date, and closing date. Additionally, you will need to specify if the seller is unrepresented and check the applicable MLS status. Completing the checklist involves gathering required documents mentioned in the form, such as the fully signed purchase contract, earnest money receipt, and a loan status report, among others.

How do I know which documents are required on the checklist?

The checklist clearly outlines the documents needed, divided into two sections. Lines 1 to 12 list documents that should be completed within three days. Lines 13 to 29 indicate items due on the day of closing. Each item specifies essential paperwork, including disclosures and inspection reports. You should review these items carefully and ensure that you have everything prepared according to your transaction type.

Is there a deadline for completing the items on the checklist?

Yes, it's crucial to adhere to the specified deadlines. Items listed in lines 1 to 12 must be completed within three days of the acceptance date. Then, items from lines 13 to 29 should be turned in on the day of closing. Meeting these deadlines helps facilitate a successful transaction and prevents delays in the closing process. Be proactive and check off each requirement as you gather the necessary documents.

Common mistakes

Filling out the Real Estate Checklist form can be straightforward, but many individuals encounter common mistakes that can lead to complications. The first mistake often made is failing to complete all mandatory fields. Each section, especially the property address and client name, must be filled in. Incomplete information can delay the processing of your transaction.

Another frequent error is not submitting the required documents promptly. Lines #1 through #12 of the form require documentation that must be provided within three days. Delays in submitting these items can jeopardize the timeline for the sale.

Omitting important documents is also a significant mistake. Many people forget to include the PURCHASE CONTRACT, which needs to be fully signed and initialed by all parties. Without this, your agreement lacks validity, which can lead to disputes or cancellations later on.

Some individuals mistakenly assume that all addenda are optional. However, it's crucial to mark whether addenda such as the Lead Based Paint Disclosure are included. Missing these disclosures can expose you to legal liabilities.

Confusion over transaction type is another potential pitfall. It is essential to accurately check the type of transaction, whether it is a new sale or a resale. Incorrectly identifying the transaction can create complications in the escrow process.

Many wait too long to verify financing details. A Loan Status Report is a necessary component of the checklist, and not providing it promptly can result in delays in closing.

Another common oversight is neglecting to circle if certain documents are included in the file. It is imperative to ensure that the Buyer's Advisory and other necessary disclosures are marked correctly. This lack of attention to detail can complicate the transaction down the line.

One might also overlook the importance of including the Preliminary Title Report with deadlines aligned with the closing schedule. The failure to do this can lead to unforeseen issues regarding property ownership and claims.

During the final checks, not conducting a final walkthrough can lead to surprises after the purchase. It is essential to ensure that everything is in order before finalizing the transaction.

Lastly, failing to gather and turn in the Final Signed HUD can result in significant delays at closing. This document is critical for confirming all financial details and ensuring that the transaction proceeds smoothly.

Documents used along the form

When navigating the complexities of real estate transactions, several essential forms and documents often accompany the Real Estate Checklist form. Each document serves a specific purpose, providing crucial information and protections for all parties involved. Understanding these documents can ensure a smoother process and help address potential issues before they arise.

- Sale Contract: This is the primary agreement that outlines the terms and conditions of the sale, including price, contingencies, and obligations of both the buyer and seller.

- Earnest Money Receipt: This document serves as proof of the buyer's earnest money deposit, showing their commitment to the purchase of the property.

- Title Report: A preliminary title report reveals any liens, encumbrances, or title issues that may affect the property’s ownership, helping to ensure clear title at closing.

- Lead Based Paint Disclosure: This disclosure informs buyers about potential lead hazards in homes built before 1978, ensuring they understand associated risks.

- Property Verification Form: This form allows verification of the property details and condition, ensuring that the information provided is accurate and up-to-date.

- Home Inspection Report: A detailed report prepared by a licensed inspector, it highlights the condition of the home and any necessary repairs that may be needed.

- Buyer's Advisory: This advisory offers buyers important information regarding the home-buying process, including issues to consider and tips for smooth transactions.

- Final Walkthrough Form: This form documents the buyer's final inspection of the property before closing, ensuring that it’s in the agreed-upon condition.

- Commission Report: This report outlines the commission paid to real estate agents and brokers involved in the transaction, ensuring transparency in compensation.

- Closing Disclosure: A crucial document, the Closing Disclosure details all financial aspects of the transaction, including loan terms, closing costs, and other related fees, ensuring that all parties are informed before finalizing the sale.

Reviewing these documents alongside the Real Estate Checklist can significantly enhance understanding and preparation for a successful real estate transaction. Each form plays a role in protecting your interests and ensuring compliance with legal requirements, fostering a smooth closing process.

Similar forms

-

Purchase Agreement: Like the Real Estate Checklist, a purchase agreement outlines the specifics of a real estate transaction, including parties involved, purchase price, and conditions. Both documents must be detailed and clear to avoid misunderstandings.

-

Earnest Money Receipt: This document records the money a buyer puts down to demonstrate their serious intent to purchase a property. Similar to the Real Estate Checklist, it includes crucial information such as the buyer, seller, and property details.

-

Disclosure Statements: Disclosure statements, including lead-based paint disclosures, highlight potential issues with a property. Both the Real Estate Checklist and disclosure statements serve to inform buyers about what they might expect, aiming to create transparency in the transaction.

-

Inspection Reports: Home inspection and termite inspection reports provide significant information regarding the condition of a property. The Real Estate Checklist emphasizes the importance of these reports, helping buyers understand any issues that require attention.

-

Closing Cost Estimate: This document itemizes all expected costs associated with closing a real estate transaction. Just as the Real Estate Checklist helps organize necessary documents for closing, the estimate offers a financial overview, aiding in informed decision-making.

-

Buyer’s Advisory: A buyer’s advisory informs potential buyers about their rights and responsibilities. Similar to the Real Estate Checklist, it serves as a guide, ensuring the buyer understands the process and expectations.

-

Comparative Market Analysis (CMA): The CMA provides insights into property values in a given area. Like the Real Estate Checklist, which can include a section on market comparisons, the CMA assists buyers in evaluating fair purchase prices based on current market conditions.

-

Preliminary Title Report: This report reveals any issues linked to a property's title, including liens or encumbrances. Both the Real Estate Checklist and title report contribute to the due diligence process, ensuring buyers know what they are acquiring.

-

Final Settlement Statement (HUD-1): The final settlement statement summarizes all financial details of a transaction, including costs, credits, and disbursements. It complements the Real Estate Checklist by confirming that all agreed-upon items have been accounted for before closing.

Dos and Don'ts

When filling out the Real Estate Checklist form, there are some important dos and don’ts to keep in mind. This list will help ensure that you complete the form accurately and efficiently.

- Do: Fill out all required fields completely.

- Do: Double-check for accuracy before submitting.

- Do: Attach all necessary documents as indicated in the checklist.

- Do: Use clear and legible handwriting or typed text.

- Do: Keep a copy of the submitted form for your records.

- Don't: Leave any lines blank that are required to be completed.

- Don't: Forget to sign or initial where necessary.

- Don't: Submit the form without confirming all documents are included.

- Don't: Ignore any deadlines for submission, especially those within three days.

Following these guidelines will make the process smoother for everyone involved. Take your time and ensure everything is accurate!

Misconceptions

Misconceptions often cloud understanding, especially in real estate processes. Here are five common misconceptions regarding the Real Estate Checklist form, along with clarifications.

- The checklist is mandatory for all transactions. Many people believe the Real Estate Checklist form must be filled out regardless of the transaction type. In reality, while it is highly recommended for many real estate deals, certain transactions, particularly those involving cash buyers or unique circumstances, may not require strict adherence to this form.

- All parts of the checklist need to be completed immediately. A common assumption is that every section of the checklist should be filled out as soon as the transaction begins. However, the form specifies that some lines only need to be completed three days before closing, allowing time for adjustments throughout the process.

- The checklist ensures a successful closing. Some think that completing this checklist guarantees a successful closing. While it helps organize necessary documents and requirements, a successful closing relies on numerous factors, including communication between parties and adherence to contractual obligations.

- The checklist includes legal advice. Many individuals view the Real Estate Checklist form as a source of legal guidance. It's important to note that this checklist serves as a practical tool for documentation and organization, not a legal document or advice. Buyers and sellers should consult professionals for legal counsel.

- All forms mentioned in the checklist are universally required. There's a misconception that all documents listed on the checklist, like the Lead-Based Paint Disclosure or Termite Inspection Report, are needed for every transaction. In truth, the necessity of each item varies based on the property type and location, which can affect local regulations and requirements.

Understanding these misconceptions can help buyers, sellers, and agents navigate the real estate process more effectively, ensuring they are better prepared for transactions.

Key takeaways

When using the Real Estate Checklist form, it’s essential to ensure that you are thorough and organized. Here are key takeaways to help you navigate the process:

- Timeliness is crucial. Aim to complete lines #1-12 within three days of acceptance to keep the transaction moving smoothly.

- Document verification. Ensure that all required documents, such as the MLS printout and earnest money receipt, are accurately filled out and included.

- Consider contingencies. Be aware of any contingencies specified in the purchase contract and ensure they are clearly documented.

- Maintain clear communication. It's important to keep in touch with all parties involved; this can prevent misunderstandings and delays.

- Organize additional disclosures. Be ready to provide significant documentation such as the Lead-Based Paint Disclosure and applicable HOA documents on the closing day.

- Review the closing costs. Familiarize yourself with the estimated closing cost sheet to avoid surprises at the time of final settlement.

- Inspect thoroughly. Conduct a final walkthrough and review inspection reports to ensure everything is in order before closing.

- Keep a checklist handy. Refer back to the Real Estate Checklist frequently to track your progress and ensure no items are overlooked.

- Document everything. Maintain a comprehensive record of all communications and documents to support a smooth transaction process.

Browse Other Templates

What Is a Proforma Invoice Australia - The Pro Invoice form aids in the efficient flow of goods across borders.

Norka Registration Kerala - Application form dedicated to registering NRK associations abroad.