Fill Out Your Real Estate Closing Checklist Form

Buying or selling a property is a significant undertaking, often filled with various tasks that require careful attention and organization. The Real Estate Closing Checklist form serves as an essential tool in this process, helping all parties stay informed and on track. This comprehensive checklist covers a wide range of tasks including the handling of earnest money, the notification of out-of-state sellers regarding tax implications, and the ordering of property inspections. Additionally, it addresses utility transfers, insurance applications, and the preparation of legal documents such as deeds. Other crucial items include ensuring all conditions of the sale contract are met, reviewing closing statements thoroughly, and managing key handovers. Each of these elements is designed to facilitate a smoother closing process, preventing potential issues that could arise during the final stages of a real estate transaction. In navigating this complex landscape, the checklist not only serves a practical purpose but also promotes transparency and accountability between buyers, sellers, and their respective representatives.

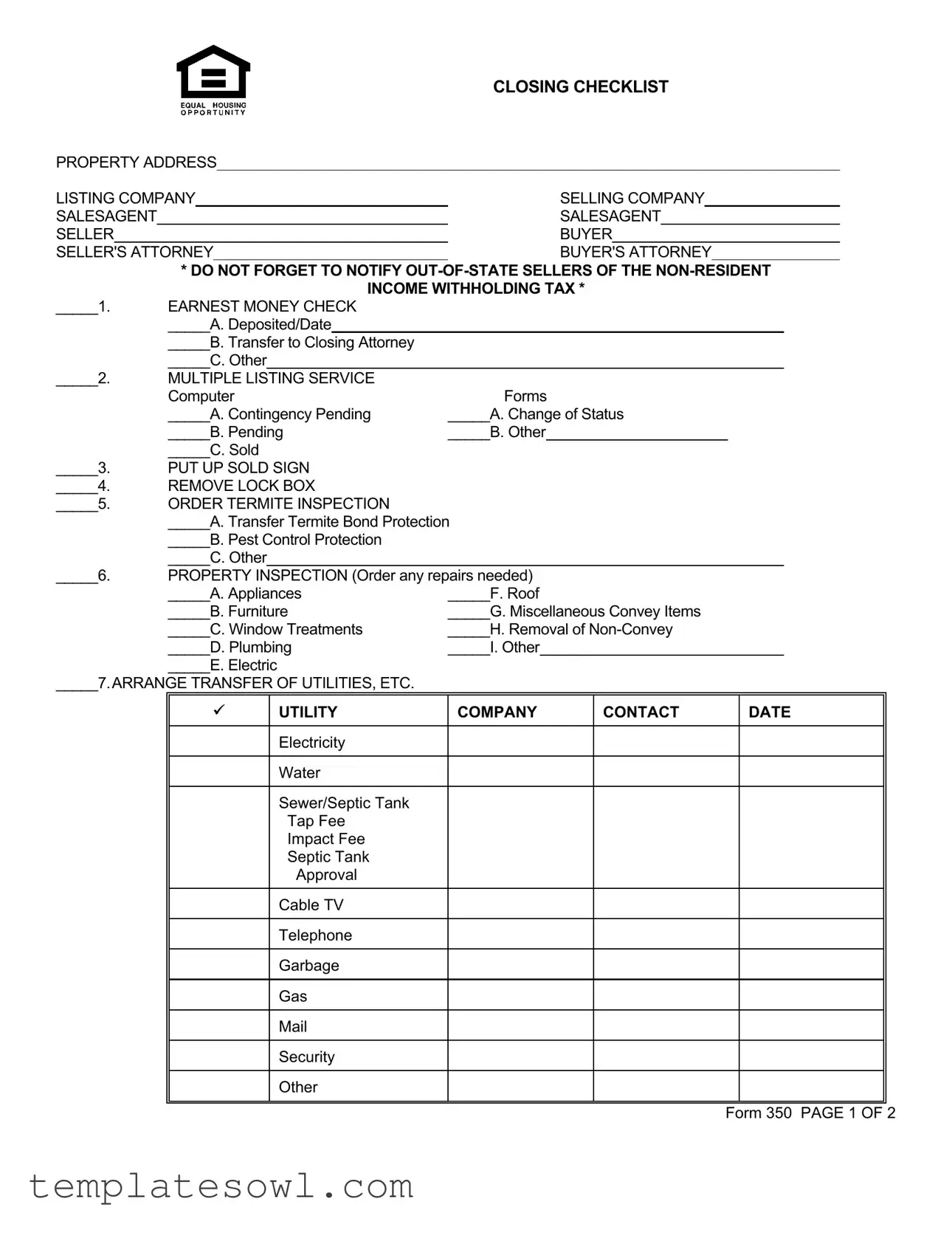

Real Estate Closing Checklist Example

CLOSING CHECKLIST

PROPERTY ADDRESS |

|

|

|

|

|

||||

LISTING COMPANY |

|

SELLING COMPANY |

|||||||

SALESAGENT |

|

SALESAGENT |

|

||||||

SELLER |

|

|

BUYER |

|

|||||

|

|

|

|

|

|

||||

SELLER'S ATTORNEY |

|

BUYER'S ATTORNEY |

|||||||

|

|

|

|

|

|

|

|

|

|

|

* DO NOT FORGET TO NOTIFY |

|||||||

|

|

|

|

INCOME WITHHOLDING TAX * |

||||

_____1. |

EARNEST MONEY CHECK |

|

|

|

|

|||

|

_____A. Deposited/Date |

|

|

|

|

|

||

|

_____B. Transfer to Closing Attorney |

|

|

|

|

|||

|

_____C. Other |

|

|

|

|

|

||

_____2. |

MULTIPLE LISTING SERVICE |

|

|

|

|

|||

|

Computer |

Forms |

||||||

|

_____A. Contingency Pending |

_____A. Change of Status |

||||||

|

_____B. Pending |

_____B. Other |

||||||

|

_____C. Sold |

|

|

|

|

|||

_____3. |

PUT UP SOLD SIGN |

|

|

|

|

|||

_____4. |

REMOVE LOCK BOX |

|

|

|

|

|||

_____5. |

ORDER TERMITE INSPECTION |

|

|

|

|

|||

|

_____A. Transfer Termite Bond Protection |

|||||||

|

_____B. Pest Control Protection |

|

|

|

|

|||

|

_____C. Other |

|

|

|

|

|

||

_____6. |

PROPERTY INSPECTION (Order any repairs needed) |

|||||||

|

_____A. Appliances |

_____F. Roof |

||||||

|

_____B. Furniture |

_____G. Miscellaneous Convey Items |

||||||

|

_____C. Window Treatments |

_____H. Removal of |

||||||

|

_____D. Plumbing |

_____I. Other |

||||||

|

_____E. Electric |

|

|

|

|

|||

_____7.ARRANGE TRANSFER OF UTILITIES, ETC.

|

UTILITY |

COMPANY |

CONTACT |

DATE |

|

|

|

|

|

|

Electricity |

|

|

|

|

|

|

|

|

|

Water |

|

|

|

|

|

|

|

|

|

Sewer/Septic Tank |

|

|

|

|

Tap Fee |

|

|

|

|

Impact Fee |

|

|

|

|

Septic Tank |

|

|

|

|

Approval |

|

|

|

|

|

|

|

|

|

Cable TV |

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

|

|

|

Garbage |

|

|

|

|

|

|

|

|

|

Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security |

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 350 PAGE 1 OF 2

_____8. |

INSURANCE |

|

|

|

|

|

|

|

|||||

|

|

|

|

AGENCY |

|

|

|

|

CONTACT |

DATE |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Flood |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wind, Storm, & Hail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fire (Hazard) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____9. LOAN APPLICATION |

|

|

|

|

|

|

|

||||||

|

|

|

|

COMPANY |

|

PROCESSOR |

DATE |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Assumption |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prorate Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Mortgage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Mortgage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____10. |

ORDER DEED PREPARATION |

|

|

|

|

|

|

|

|||||

|

_____A. Name as it should appear on deed |

|

|

|

|

|

|

|

|

||||

|

_____B. Does Seller want Buyer's Attorney to prepare deed? |

|

|

|

|||||||||

|

_____C. Does Buyer want Title Insurance? |

|

|

|

|

|

|

|

|

||||

_____11. |

ORDER SURVEY |

|

|

|

|

|

|

|

|||||

_____12. |

RENTAL INFORMATION |

|

|

|

|

|

|

|

|||||

|

_____A. Sign Management Agreement/or Withdraw From Rental Program |

|

|

||||||||||

|

_____B. Sign Interest Agreement |

|

|

|

|

|

|

|

|||||

|

_____C. Lock Box Agreement for Buyer |

|

|

|

|

|

|

|

|||||

|

_____D. Refund Lock Box Fee to Seller |

|

|

|

|

|

|

|

|||||

|

_____E. Check with Bookkeeper for Outstanding Bills |

|

|

|

|||||||||

_____13. |

CONDOMINIUMS |

|

|

|

|

|

|

|

|||||

|

_____A. Notify Home Owners Association |

|

|

|

|

|

|

|

|||||

|

_____B. Transfer Name and Address |

|

|

|

|

|

|

|

|||||

|

_____C. Outstanding Balance/Prorated Rents |

|

|

|

|

|

|

|

|||||

|

_____D. Transfer Rent Securities |

|

|

|

|

|

|

|

|||||

_____14. |

REVIEW SALES CONTRACT TO BE SURE ALL CONTINGENCIES HAVE BEEN MET |

||||||||||||

_____15. |

SELLER SIGN LEASE AGREEMENT IF REMAINING IN HOUSE/CONDO |

|

|

||||||||||

_____16. |

CLOSING STATEMENT REVIEW |

|

|

|

|

|

|

|

|||||

|

_____A. Check Addition and Subtraction |

|

|

|

|

|

|

|

|||||

|

_____B. Transfer Rent Securities |

|

|

|

|

|

|

|

|||||

|

_____C. Interest Prorated |

|

|

|

|

|

|

|

|||||

|

_____D. Earnest Money Transferred to Closing Attorney |

|

|

|

|||||||||

|

_____E. Go over Closing Statement with Buyer |

|

|

|

|

|

|

|

|||||

|

_____F. Go over Closing Statement with Seller prior to Closing |

|

|

|

|||||||||

|

_____G. Termite Inspection fee |

|

|

|

|

|

|

|

|||||

|

_____H. Reminder: Signed Agency Disclosure |

|

|

|

|

|

|

|

|||||

_____17. |

KEYS |

|

|

|

|

|

|

|

|||||

|

_____A. Get Keys from Seller |

|

|

|

|

|

|

|

|||||

|

_____B. Give Keys to Buyer |

|

|

|

|

|

|

|

|||||

|

|

|

AFTER THE CLOSING |

|

|

|

|||||||

_____1.THANK YOU LETTERS TO BUYER AND SELLER. PERIODIC FOLLOW UPS ARE NICE! |

|

|

|||||||||||

_____2. |

DISBURSE FUNDS |

|

|

|

|

|

|

|

|||||

|

_____A. Selling Agent |

|

|

|

|

|

|

|

|||||

|

_____B. Listing Agent |

|

|

|

|

|

|

|

|||||

|

_____C. Referral |

|

Date |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The foregoing form is available for use by the entire real estate industry. The use of the form is not intended to identify the user as a REALTOR®. REALTOR® is the registered collective membership mark which may be used only by real estate licensees who are members of the NATIONAL ASSOCIATION OF REALTORS® and who subscribe to its Code of Ethics. Expressly prohibited is the duplication or reproduction of such form or the use of the name "South Carolina Association of REALTORS®" in connection with any written form without the prior written consent of the South Carolina Association of REALTORS®. The foregoing form may not be edited, revised, or changed without the prior written consent of the South Carolina Association of REALTORS®.

© 2002 South Carolina Association of REALTORS®. 01/02

Form 350 PAGE 2 OF 2

Charleston Real Estate Guide Legal Forms

Charleston Real Estate Guide - Legal Forms

©Charleston Real Estate Guide | Things to do in Charleston South Carolina | Charleston SC Real Estate Agent | Neighborhoods in Charleston SC Real Estate Listings Free Charleston SC MLS Listings Hot Sheet | Charleston Real Estate Mortgages | Charleston Relocation Package

About The Charleston Real Estate Market SC Real Estate Forms and Contracts | The Official Charleston Real Estate Forum

Listing Your Home With Prudential Carolina | Charleston SC MLS Listings

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Real Estate Closing Checklist is designed to ensure that all necessary tasks are completed before closing a property transaction. |

| Parties Involved | The form includes sections for the seller, buyer, and their respective attorneys, as well as details about the sales agent. |

| Earnest Money | One of the initial steps involves confirming the deposit and transferring earnest money to the closing attorney. |

| Utility Transfers | Arranging the transfer of utility services is a key task, requiring specific contacts for different utility companies. |

| Legal Compliance | In South Carolina, the checklist must adhere to state rules governing real estate transactions, including notification for non-resident sellers regarding income tax. |

Guidelines on Utilizing Real Estate Closing Checklist

As the closing process approaches, it's time to ensure that every detail is attended to meticulously. Filling out the Real Estate Closing Checklist form helps to confirm that all necessary steps have been completed, safeguarding a smooth transition for all parties involved in the real estate transaction. Below is a step-by-step guide to help you accurately fill out the form.

- Property Address: Write the complete address of the property being sold.

- Listing Company: Enter the name of the real estate agency representing the seller.

- Selling Company: Provide the name of the agency representing the buyer.

- Sales Agent: Include the name of the selling agent.

- Seller: Fill in the name of the property seller.

- Buyer: Write down the name of the buyer.

- Seller's Attorney: Specify the seller's legal representative.

- Buyer's Attorney: Enter the name of the buyer's legal representative.

- * Note: Remember to notify out-of-state sellers about the non-resident income withholding tax.

- Earnest Money Check: Indicate whether it has been deposited and provide the date, then show the transfer to the closing attorney or other relevant information.

- Multiple Listing Service Computer Forms: Confirm all statuses (Contingency Pending, Pending, Sold) have been checked off appropriately.

- Put Up Sold Sign: Mark off once completed.

- Remove Lock Box: Ensure this task is done.

- Order Termite Inspection: Document any related information and protection details.

- Property Inspection: Check off any repairs needed and list items as necessary.

- Arrange Transfer of Utilities: Provide details and contact information for utility companies.

- Insurance Agency: Document the contact information and type(s) of insurance required.

- Loan Application: Enter relevant company and processor details along with loan specifics.

- Order Deed Preparation: Complete all sections regarding the buyer's name, who will prepare it, and if title insurance is desired.

- Order Survey: Confirm if this step has been completed.

- Rental Information: Document any agreements or bookings regarding rentals.

- Condominiums: Include necessary actions related to Homeowners Association notifications and name transfers.

- Review Sales Contract: Make sure that all contingencies have been addressed.

- Seller Sign Lease Agreement: Determine if the seller will remain in the property and has signed accordingly.

- Closing Statement Review: Examine all entries for accuracy based on the agreement.

- Keys: Arrange to collect keys from the seller and hand them over to the buyer post-closing.

- Thank You Letters: Consider sending thank you letters to both buyer and seller, along with periodic follow-up.

- Disburse Funds: Document where and to whom the funds are being allocated after the sale.

What You Should Know About This Form

What is the purpose of the Real Estate Closing Checklist?

The Real Estate Closing Checklist is designed to help both buyers and sellers ensure that all necessary steps have been completed before finalizing the transaction. It includes tasks like ordering inspections, preparing deeds, and transferring utilities, creating a smoother closing experience for everyone involved.

Who should use the Real Estate Closing Checklist?

This checklist should be used by real estate agents, buyers, sellers, and their attorneys. Each party plays a role during the closing process, and utilizing this checklist promotes accountability and ensures that no important tasks are overlooked.

What items are included in the checklist?

The checklist covers a wide range of items, such as handling earnest money, ordering inspections, notifying homeowner associations, and reviewing the sales contract. Each section is itemized to allow for easy completion and tracking of all required tasks.

How do I handle earnest money according to the checklist?

Earnest money is a crucial part of home buying. You should deposit the earnest money check promptly and notify the closing attorney about any transfers related to it. The checklist provides space to document dates and other relevant information concerning the earnest money.

What should I do if I am buying a condominium?

For condominium purchases, specific tasks pertain to homeowners associations. You will need to notify the association, ensure the transfer of names and addresses, manage any outstanding balances, and handle prorated rents. The checklist outlines these steps to ensure everything is in order before closing.

Is there a section for utility transfers?

Yes, there is a dedicated section for arranging the transfer of utilities. It includes space to note utility company contacts and set dates for the transfer of services such as electricity, water, and gas. This ensures all necessary accounts are in the buyer's name at the time of closing.

What is the importance of reviewing the closing statement?

Reviewing the closing statement is vital for both buyers and sellers. It helps confirm that all financial details, including repairs, adjustments, and prorated rents, are accurate. The checklist encourages a thorough review to avoid any surprises on closing day.

What should I do after the closing?

After closing, sending thank you letters to both the buyer and seller is recommended. Maintaining good relations can facilitate future communication or referrals. Additionally, ensure all funds are disbursed to the correct parties to finalize the transaction properly.

Common mistakes

Completing the Real Estate Closing Checklist form can be a detailed process. However, several common mistakes can make this task more challenging. One frequent error is forgetting to notify out-of-state sellers about the non-resident income withholding tax. This crucial step ensures compliance with the tax obligations for sellers who live outside the state.

Another mistake involves the handling of earnest money. Many individuals neglect to verify if the earnest money check has been properly deposited and recorded. Ensuring this check is accurately tracked can prevent potential delays in closing. Additionally, not transferring the funds to the closing attorney in a timely manner can lead to complications during the closing process.

Failing to update the Multiple Listing Service (MLS) status is another common oversight. Sellers often forget to mark the property as "Sold" or change the status to "Pending." This not only affects the visibility of the property but can also mislead potential buyers and real estate agents trying to access current listings.

Moreover, neglecting to arrange for a termite inspection can result in last-minute problems. Not only does this inspection safeguard against unexpected repairs, but it also assures buyers that the property is in good condition. Failing to put up a "Sold" sign or remove the lockbox can confuse interested parties who may still see the property as available, potentially leading to further misunderstandings.

Utility transfers are often overlooked. Without proper arrangement, utilities can remain in the seller's name, creating complications for the new homeowner. Ensuring all utilities are correctly transferred is critical for a smooth transition to ownership.

A common mistake occurs during the review of insurance details. Many overlook to confirm the necessary insurance coverages, such as flood and fire insurance. This could lead to significant liability in the event of unforeseen damages.

In addition, individuals often skip thoroughly reviewing the sales contract for contingencies. This review ensures that all conditions are met before finalizing the sale. Not doing so could lead to issues that arise at closing, potentially delaying the process or costing additional fees.

Finally, failing to conduct a final review of closing statements and the disbursement of funds is another misstep. It is essential to check for proper calculations and ensure that all parties understand the financial aspect of the transaction. Overlooking these elements can lead to disputes and dissatisfaction post-closing.

Documents used along the form

When going through the real estate closing process, various forms and documents are essential to ensure everything runs smoothly. Each document serves a specific purpose, helping both the buyer and seller navigate this significant transaction. Below are some common forms you may encounter alongside the Real Estate Closing Checklist.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies. It is a legally binding contract between the buyer and seller.

- Title Report: A title report confirms the legal ownership of the property. It also reveals any claims or liens against the property, ensuring that the buyer receives clear title at closing.

- Appraisal Report: An appraisal assesses the property's market value. This document is typically required by lenders to ensure that the property is worth the amount being financed.

- Closing Disclosure: This form provides a detailed breakdown of all costs associated with the transaction, including loan terms, closing costs, and cash needed at closing. It helps ensure transparency and allows buyers to review their financial obligations before closing.

- Deed: The deed officially transfers ownership of the property from the seller to the buyer. It includes important information such as the property’s legal description and is signed at closing.

- Power of Attorney: This document allows one person to act on behalf of another, especially if the seller cannot attend the closing. It grants authority to sign necessary documents in the seller's absence.

- Property Condition Disclosure: This form requires the seller to disclose any known issues with the property, including repairs or defects. It protects buyers by ensuring they are aware of potential problems before finalizing the sale.

- Insurance Binder: This document provides proof of insurance coverage for the property, often required before the closing can be completed. It shows the lender that the property is protected from risks.

Understanding each of these documents can be invaluable in ensuring that you are fully prepared for a smooth closing experience. Taking the time to review and ask questions about each form will help alleviate any concerns and promote a successful transaction.

Similar forms

- Purchase Agreement: The Real Estate Closing Checklist is similar to a Purchase Agreement in that both documents serve as essential guides for the buyer and seller during the transaction. While the Purchase Agreement outlines the terms and conditions of the sale, the closing checklist ensures that all necessary tasks and paperwork are completed before the property officially changes hands.

- Title Commitment: Much like the Real Estate Closing Checklist, a Title Commitment provides a roadmap for the closing process. It details what needs to be addressed in order to clear the title of any issues before closing, while the checklist focuses on actions and deadlines related to the transfer of ownership.

- Disclosure Statements: Disclosure statements are required to inform buyers of any known issues with the property. Similar to the closing checklist, these statements aim to protect all parties involved by making sure all pertinent information is communicated clearly before the closing takes place.

- Closing Statement: The Closing Statement, also known as a HUD-1, meticulously details the final transaction costs and disbursements. Like the Real Estate Closing Checklist, it acts as a summary of the closing process, ensuring that all financial aspects are accounted for before the deal is finalized.

Dos and Don'ts

When it comes to filling out the Real Estate Closing Checklist form, being meticulous and organized can save you a lot of headaches. Below are seven important dos and don'ts that can help ensure the process goes smoothly.

- Do: Carefully read each item on the checklist to make sure you understand what is required.

- Do: Confirm the accuracy of all dates and names to prevent any potential confusion.

- Do: Notify out-of-state sellers about the non-resident income withholding tax in a timely manner.

- Do: Arrange for the transfer of utilities well before closing, ensuring services are uninterrupted.

- Do: Review the sales contract to confirm that all contingencies have been met.

- Do: Keep communication open with all parties involved to facilitate a smoother closing process.

- Do: Follow up with a thank-you letter to both the buyer and seller post-closing.

- Don't: Forget to double-check calculations on the closing statement for accuracy.

- Don't: Neglect to consult with the seller’s attorney regarding any deed preparations.

- Don't: Assume that all repairs have been completed without inspecting the property yourself.

- Don't: Delay in the order of necessary inspections, as they can take longer than expected.

- Don't: Skip contacting the Homeowners Association if dealing with condominiums.

- Don't: Overlook the need for title insurance, which can provide peace of mind.

- Don't: Forget to give the keys to the buyer only after closing is finalized.

By adhering to these dos and don'ts, you can foster a more efficient and pleasant real estate closing experience for everyone involved.

Misconceptions

Understanding the Real Estate Closing Checklist can enhance your confidence during a property transaction. Here are five common misconceptions about this essential document.

- It's Just a List of Tasks: Many think the checklist is merely a to-do list. While it does outline tasks to complete, it also ensures legal compliance and smooth transitions for buyers and sellers.

- Only Real Estate Agents Use It: Some believe this checklist is solely for agents. In reality, it benefits all parties involved, including buyers, sellers, and attorneys. Each participant plays a role in ensuring everything goes as planned.

- It Covers Everything: A checklist is comprehensive but may not address unique circumstances for every transaction. Certain properties or situations might require additional steps, so keep that in mind.

- It's a One-Time Use Document: Another misconception is that it's only needed during the closing process. In truth, you can refer back to it for future transactions or as a guideline for potential purchases.

- Missing Items Are Not a Big Deal: Some believe overlooking checklist items is minor. However, missing crucial steps can lead to complications, delays, or even legal issues, so thoroughness is vital.

This checklist serves as a crucial roadmap in navigating real estate closings. Understanding its purpose and proper use can lead to smoother transactions.

Key takeaways

When using the Real Estate Closing Checklist form, keep these key takeaways in mind:

- Start with the Basics: Clearly list property address, involved companies, agents, and attorneys to keep everything organized.

- Earnest Money Matters: Make sure to specify the earnest money check status and confirm its deposit.

- MLS Updates: Change the multiple listing service status to reflect the property's current situation, whether it's pending or sold.

- Visibility: Remember to put up a sold sign and remove any lock boxes to avoid confusion.

- Inspections: Order necessary inspections, including termites and property inspections, to address any repairs before closing.

- Utilities Transfer: Arrange for the transfer of utilities well in advance to ensure a smooth transition for the buyer.

- Insurance Coverage: Contact insurance agencies to confirm that all necessary policies are in place before the closing date.

- Loan Applications: Ensure that all loan application details are in order and that required approvals are received.

- Deed Preparation: Order the deed well ahead of closing, including confirming how names should appear on it.

- Follow Up: After closing, send thank-you letters to both the buyer and seller, and keep in touch for any ongoing concerns.

Browse Other Templates

Dd Form 370 April 2021 - The form addresses the applicant's substance use and its potential impact on performance.

LLC Statutory Agent Withdrawal Form,Statutory Agent Resignation Notice,LLC Agent Departure Document,Arizona Statutory Agent Termination Form,Agent Resignation Filing,LLC Agent Notice of Resignation,Statutory Agent Exit Form,Arizona LLC Statutory Agen - Submissions via fax are permissible, providing flexibility for filings.

Termite Inspection Arizona - This form contributes to maintaining property values by addressing pest issues proactively.